Author: Amanda Ahne

Daily Comment (February 25, 2026)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with reports of new mass protests in Iran that could potentially help spur the US to launch its expected attack on the country. We next review several other international and US developments that could affect the financial markets today, including the nomination of two dovish academics to the Bank of Japan’s policy board and growing concerns in Germany and Canada that their new defense budget hikes will disproportionately benefit large, incumbent defense suppliers.

Iran: Anti-regime protestors and pro-government militias clashed on college campuses across the nation yesterday for a fourth consecutive day. The protests haven’t spread beyond campuses so far, but if they do, there would be a heightened risk of a violent crackdown by the government like the one in early January that killed some 7,000 civilians. In turn, such a crackdown could spur the US administration to launch its long-awaited attack against Iran, potentially sparking political disintegration or an economically disruptive war across the region.

Japan: Prime Minister Takaichi today nominated two dovish academics for positions on the Bank of Japan’s nine-member monetary policy committee, following through with her intention to push through more stimulative monetary and fiscal policies. In response, the yen has weakened some 0.5% to 156.61 per dollar ($0.00639). If concerns about overly dovish monetary policy take hold in Japan, the yen could weaken further, potentially boosting consumer price inflation and drawing the ire of the US.

Thailand: Today, the Bank of Thailand unexpectedly cut its benchmark short-term interest rate from 1.25% to 1.00%, reflecting the country’s persistently weak economic growth and low price inflation. Since the pandemic, the Thai economy has been weighed down by high household debt, weak consumption, and a slow tourism recovery. While the central bank has cut rates to help address those issues, it has also called on the government to take more proactive steps in fiscal, regulatory, and industrial policy to address the problem.

Germany: According to the Financial Times, Chancellor Merz and his government are probing the way major defense firms such as Rheinmetall benefit disproportionately from Germany’s increased military budget. The government reportedly wants to ensure that the hundreds of billions of euros in new defense funds also reach start-ups focused on unmanned systems and military applications for AI and quantum technology.

- We have long believed that changing geopolitics will give a boost to European defense stocks, and that has been borne out over the last few years.

- If the Merz government’s initiative leads to major procurement policy changes, it could remove some of the opportunity for big, incumbent defense firms in Germany and the broader European Union. Over time, however, it could also help spawn a new class of smaller, more agile, and more innovative firms that could eventually list shares.

Canada: The German-style concern about concentrated military spending is also now playing out in Canada. While the government intends to boost its defense budget to 5.0% of gross domestic product by 2035 and channel at least 70% of the total into Canadian defense firms, smaller companies are warning that a risk-averse Ottawa might channel the bulk of increased defense funding to well-established players such as Bombardier or continue with legacy US military providers such as Lockheed Martin.

US Politics: In his State of the Union speech last night, President Trump focused on painting a positive picture of the US economy, while offering several initiatives to address the cost of living. For example, he reiterated his intention to impose limits on investors buying large numbers of homes, and he announced a plan to shield consumers from electricity price hikes caused by AI data centers. He also floated a plan to give citizens without access to a retirement savings plan at work the opportunity to invest in the retirement plan for federal workers.

- Of course, a major goal of the speech would have been to bolster Republican chances ahead of the mid-term Congressional elections in November.

- With public opinion polls showing widespread dissatisfaction with the current economy, it is not yet clear whether the rosy picture painted by the president will do much to help Republican prospects when it is time to vote. As of right now, the polls continue to suggest the Republicans will at least lose their majority in the House of Representatives.

US Artificial Intelligence Industry: AI firm Anthropic, which has touted its strict guardrails on its models, yesterday said it will relax its core safety policy to stay competitive with other AI labs. The move may mean the firm will cave to the Pentagon’s demand for free rein to use Anthropic’s well-regarded Claude model. More broadly, it also signals that competitive pressures may also push other AI firms to loosen their safety standards, increasing the risk of dangerous results from the use of their models.

Daily Comment (February 24, 2026)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a review of two key factors behind yesterday’s stock sell-off: a report highlighting inaccurate accounting related to data centers and another report suggesting artificial intelligence will lead to massive economic dislocations. We next review several other international and US developments that could affect the financial markets today, including the first corporate lawsuit demanding a rebate for its tariffs paid and more China-Japan tensions.

US Technology Industry: Credit rater Moody’s yesterday warned that a gap in US accounting rules is allowing big technology firms to conceal tens of billions of dollars of potential liabilities for their AI data centers. The problem stems from the firms’ use of special-purpose, off-budget vehicles that don’t require a full accounting of the potential costs of failing to renew a data center lease. The report was one major reason for the downdraft in US stock prices yesterday.

- The report also illustrates the increasingly opaque financial accounting that is helping to support hyperscalers’ stock prices even as they pump billions of dollars into new data center projects.

- In turn, the funky accounting is likely to be taken as one more sign that the sector is in an investment bubble. However, even if it is, it would be very difficult to predict when the bubble might definitively pop.

US Artificial Intelligence Industry: Another factor in yesterday’s market action was a dire report by Citrini Research that warned of massive economic disruption as artificial intelligence begins to outstrip human capabilities. According to the report, “For the entirety of modern economic history, human intelligence has been the scarce input . . . We are now experiencing the unwind of that premium.” Because of this, the report said the repricing of human knowledge will drive down asset values across a wide range of industries.

- Separately, Meta today announced that it has agreed to buy six gigawatts’ worth of AI computing power from chipmaker Advanced Micro Devices, in a deal valued at more than $100 billion that could result in Meta owning as much as 10% of AMD’s stock.

- The deal is only the latest transaction that has raised concerns about daisy-chain financing and excess capital investment related to AI. While such deal announcements initially were taken well by investors, sentiment has shifted, and the Meta-AMD deal could well weigh on technology shares today.

US Trade Policy: Responding to last week’s Supreme Court decision invalidating much of President Trump’s tariff policy, FedEx yesterday became the first US company to sue for a rebate of the tariffs it has paid. According to trade experts, the federal government could now potentially be on the hook for some $160 billion in rebates. We suspect that many firms will sue the federal government for rebates, potentially leading to cash windfalls but also signaling the start of long, complex, and expensive legal cases.

- The administration today began applying its temporary, blanket replacement tariffs at a rate of just 10%, as Trump initially announced, after key trading partners pushed back against his later vow to hike the rate to 15%. However, administration officials say the president still intends to raise the blanket tariff to 15% in the near future.

- Separately, the Wall Street Journal reports today that the administration is considering imposing national-security based tariffs on half a dozen key industries in order to help offset the impact of the court decision. The new tariffs being considered could cover industries such as large-scale batteries, cast iron and iron fittings, plastic piping, industrial chemicals, and power grid and telecom equipment

European Union-United States: In another response to the US administration’s loss of its main trade cudgel, the European Parliament yesterday suspended work on two pieces of legislation needed to implement the US-EU trade deal tentatively agreed to last year. EU officials said US policymaking is now in too much flux to set anything in stone. The move is likely to anger the US administration and lead to retaliation, which naturally could weigh on EU asset values.

United States-Iran: The Wall Street Journal said yesterday afternoon that Chairman of the Joint Chiefs of Staff Gen. Dan Cane and other senior Pentagon leaders have warned President Trump and his administration that a prolonged attack on Iran would carry significant risks, such as US and allied casualties, depleted air defenses, and an overtaxed force. Since Gen. Cane is reportedly trusted by the president, the news means there is possibly less of a chance of the attack going forward. If it doesn’t materialize, one obvious result would likely be a retreat in global oil prices.

China-Japan: The Chinese government today widened its ban on the export of critical minerals and other key goods to Japan, adding 20 major Japanese companies to the blacklist. The prohibited exports include rare earths used in motors and magnets, machine tools, batteries, and semiconductor-making equipment. Affected companies include Mitsubishi Heavy Industries, IHI, and NEC.

- The move is the latest in a long series of actions Beijing has taken to punish Prime Minister Takaichi for her statement last autumn that a Chinese blockade of Taiwan would require a military response from Japan.

- The export ban could cause considerable disruptions for the affected companies, highlighting the importance of geopolitical risk as China becomes more aggressive on the world stage.

Bi-Weekly Geopolitical Report – The Great Chinese Purge (February 23, 2026)

by Patrick Fearon-Hernandez, CFA | PDF

One defining feature of the world today is the large share of the global population living under political systems that are authoritarian or moving in that direction. With 1.405 billion people, or about 18% of the global population total, China is the best example of that. Still, we suspect that many people in the West don’t appreciate how authoritarian the country is or how this structure can affect investment prospects both within China and around the world. After all, the end of the Cold War in 1991 allowed many in the West to adopt the pleasant notion that Communist dictatorship was a thing of the past. The great Chinese economic opening and reform program of the last four decades also helped obscure what was happening on the ground from Tibet to Hong Kong.

Now, under General Secretary Xi, a long program of purges in the Chinese military and defense industry has come to a head, driving home just how authoritarian the country has become again. In this report, we examine the purges and their potentially large implications for whether China launches a military seizure of Taiwan and discuss the likelihood that China can remain stable in the event that Xi dies or is incapacitated. As always, we wrap up with a discussion of the ramifications for investors.

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Daily Comment (February 23, 2026)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with an update on the US’s evolving foreign trade policy now that the Supreme Court has invalidated much of the administration’s tariffs. We next review several other international and US developments that could affect the financial markets today, including moves that will likely boost Japan’s defense industry and a spike in violence in Mexico after its government killed a major drug lord.

US Tariff Policy: Responding to the Supreme Court’s decision on Friday invalidating the import tariffs that President Trump had based on an emergency law, the president on Saturday said he will impose a blanket 10% tariff on all countries based on a different law that would allow them to stay in place for 150 days, effective Tuesday. He later said he would raise that tariff to 15%. For some countries that would actually be higher than the rate they had previously negotiated with the US.

- We had long argued that if the Supreme Court ruled against the original tariffs, the administration would pivot to other legal justifications for them. The new legal basis isn’t as advantageous as the one initially used, but the administration is still likely to use it to its maximum effect.

- As a result, we expect that trade policy uncertainty will increase again, especially since the court ruling now raises a question about rebates of the previous tariffs and the validity of foreign countries’ investment pledges to the US.

- Indeed, the renewed trade uncertainty appears to be weighing on global equity prices so far today.

US Nuclear Energy Industry: In a weekend interview with the Financial Times, the CEO of enriched uranium firm Centrus Energy warned that the US nuclear energy industry will face a shortage of the fuel when new sanctions outlaw sourcing it from Russia beginning in 2028. The CEO, Amir Vexler, said his firm is racing to build new enrichment capacity but may not be able to keep up with the demand from planned reactor installations or restarts.

- Vexler’s warning is consistent with our view that increased demand for nuclear energy around the world is likely to put upward pressure on uranium prices at different stages of the fuel’s supply chain. That alone should support robust pricing for uranium going forward.

- In addition, investors should keep in mind that China’s effort to rapidly build up its arsenal of nuclear weapons will also demand a significant chunk of global uranium mine output. That will likely put added upward pressure on uranium prices.

US Airline Industry: The Department of Homeland Security yesterday said it would suspend the TSA PreCheck and Global Entry expedited security programs at US airports due to the partial government shutdown, but later backtracked and said only Global Entry would be suspended. On top of the blizzard that has already canceled or delayed hundreds of flights in the Northeast, the news points to painful, if temporary, disruptions for the US airline industry in the coming weeks.

Japan: The ruling Liberal Democratic Party at the weekend approved a draft law that would scrap the current rules limiting Japan’s defense equipment exports and allow lethal arms shipments. The party is expected to present the draft bill to the government as early as this week. Prime Minister Takaichi can then use her supermajority in parliament to push it into law. In our view, the legislation is likely to spur the development of an important new industry for Japan, potentially helping improve economic growth and boost stock market opportunities.

- Under Japan’s current rules, defense equipment exports are limited to five categories: rescue, transportation, vigilance, surveillance, and minesweeping.

- The proposed rules would assign defense equipment to two categories: arms such as tanks and howitzers, and non-arms equipment such as bulletproof vests. The National Security Council, attended by the prime minister and relevant ministers, would have the authority to approve or disapprove arms exports.

China: New satellite photos analyzed by Janes show that China has launched the first of its next-generation Sui-class attack submarines. The photos show that the nuclear-powered Type 095 sub exhibits advanced acoustic stealth and strike technologies, such as an X-tail rudder configuration and pump-jet propulsion. The new sub illustrates how China continues to rapidly build and improve its armed forces in an effort to dominate at least the Indo-Pacific region and force the US into economic and geopolitical retreat.

Mexico: Under pressure from the US, the Mexican military yesterday killed the country’s top drug lord, Nemesio “Mencho” Oseguera. In response, his Jalisco New Generation Cartel has begun lashing out with a series of attacks on civilian and government targets. It isn’t clear whether the cartel will continue trying to get revenge against President Scheinbaum for her cooperation with the US, or whether it will devolve into an intra-cartel power struggle. Either way, the resulting violence could be a headwind for Mexican stocks in the near term.

United States-Israel-Middle East: In a weekend interview, the US Ambassador to Israel, Mike Huckabee, said Israel has a right to seize vast swaths of land from “the Wadi of Egypt” to the Euphrates, based on the biblical verse in which God granted it to the descendants of Abraham. Huckabee later backtracked, but the statement raises concerns that the US could be working to extend Israeli sovereignty beyond its borders. If so, the policy would likely portend renewed tensions or even war between Israel and the rest of the Middle East in the coming years.

United States-Iceland-European Union: Even though the US administration’s push to take over Greenland has cooled a bit recently, the government in neighboring Iceland is reportedly considering a vote to restart EU membership talks as early as August in order to bolster its security. The move illustrates how the US’s new, more forward-leaning foreign policy is forcing dramatic realignments between countries around the world.

Daily Comment (February 20, 2026)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with an analysis of the US pressure campaign on Iran, then examines the growing concerns surrounding private credit firms. We next explore signs of a “New Monroe Doctrine” emerging in South America and discuss speculation over the ECB president’s potential departure. We also include a summary of key economic data from the US and global markets.

Iran Pressure: While talks between the US and Iran over Tehran’s nuclear program are ongoing, the stakes for reaching a deal are rising. President Donald Trump warned on Thursday that Iran has “10 to 15 days” to agree to terms on its nuclear program, sharpening the diplomatic deadline. Adding further fuel to tensions, Washington has ordered its largest military buildup in the Middle East since the Iraq war, a move widely seen as preparation for potential action if diplomacy fails. The heightened military posture has increased the risk of open conflict.

- The latest US moves appear aimed at signaling to Iran that it has limited leverage at the negotiating table. The renewed talks are reportedly centered on Iran’s ballistic missile program, which Tehran sees as essential to its regional power projection, but which neighbors view as a serious security threat. Iran has indicated that it is unwilling to give up these capabilities, yet Washington seems intent on testing whether that position can be softened.

- That said, it remains unclear what level of force the US is prepared to employ against Iran. Reports suggest the administration may be favoring a limited strike as a catalyst to advance diplomatic talks, an initial attack could occur within days that would likely target military and government sites. Should that prove insufficient, the strategy could escalate into a broader campaign aimed at regime change.

- The threat of a potential conflict has already drawn international involvement. Russia has vowed to respond to any new US strikes against Iran, while both Moscow and Beijing have initiated joint military exercises with Tehran. These maneuvers, aimed at ensuring operational readiness, signal that both powers could provide strategic support should a full-scale conflict with the US erupt.

- While we remain cautiously optimistic that a full-scale conflict can be avoided, the margin for miscalculation remains high. Although Iran lacks the leverage to dictate terms, the US has little appetite for a repeat of the Iraq War — a scenario that could mirror the chaos of a potential regime collapse in Tehran. Given this backdrop, we believe rising geopolitical uncertainty will provide a significant tailwind for commodity prices and precious metals.

Private Credit Concerns: Financial stability concerns around private credit have intensified following fresh restrictions at a major debt fund. On Wednesday, Blue Owl permanently restricted withdrawals from its retail-focused private credit vehicle, underscoring mounting anxiety over weakening consumer loan performance and significant exposure to software companies seen as vulnerable to AI-driven disruption. Despite the recent scrutiny, there is little evidence so far that private credit funds are being forced into large write downs on their assets.

- That said, there is likely to be growing concern about the broader private credit market, increasing the odds that it becomes a target for tighter oversight. Recent commentary from Senator Elizabeth Warren and other lawmakers has emphasized the need for stronger safeguards around complex non-bank lending, while recent Fed meeting minutes flagged vulnerabilities in the “opaque” private credit sector and its exposure to higher risk borrowers.

- For now, we assess the risk of a private credit bubble triggering broad market turmoil as low. Yet, we doubt this is the last we will hear of underlying vulnerabilities, given the trajectory of consumer credit delinquencies and the structural threat AI poses to established players. Although we expect any fallout to be limited in scope, we believe increased international exposure could serve as a useful hedge against potential vulnerabilities in the US and technology sectors.

New Monroe Doctrine: President Santiago Peña of Paraguay has emerged as a supportive voice for US policy in South America. He characterized US actions regarding Venezuela as a necessary, if imperfect, step toward restoring democracy and expressed confidence in the country’s democratic prospects. Peña has also backed US stances on Israel and anti-cartel operations. These statements support our thesis that the United States is actively seeking to solidify its regional footprint and counter China’s deepening influence.

Lagarde to Stay? ECB President Christine Lagarde has pushed back against speculation that she could step down before her term expires in 2027, telling the Wall Street Journal that her baseline is to serve out her full mandate. While she stopped short of categorically ruling out an early exit, her comments suggest no decision has been taken to leave ahead of schedule. Any premature departure would give EU leaders a chance to install a successor who is likely to focus on preserving the integrity of the currency bloc while reaffirming the ECB’s commitment to price stability.

Daily Comment (February 19, 2026)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment opens with analysis of the latest Federal Reserve meeting minutes. We then turn to the upcoming Supreme Court ruling on tariffs, followed by updates on Iran, the US administration’s efforts to circumvent EU content restrictions, and the IMF’s push for China to reduce state subsidies. We also include a summary of key economic data from the US and global markets.

FOMC Pivot? Federal Reserve officials signaled openness to a rate hike following their latest meeting. Minutes from the discussion revealed concern that tariffs may have contributed to the recent rise in core goods prices. While some officials expressed optimism that these pressures could ease, most participants cautioned that progress toward the inflation target is likely to be slower and more uneven than previously anticipated. This caution has led some policymakers to consider further rate increases if inflation remains elevated for longer than expected.

- The decision to raise rates reflects the Federal Reserve’s growing confidence in the broader economy and its effort to closely monitor evolving conditions. Officials noted that, although hiring remains soft, there are emerging signs that the labor market may be stabilizing. They also expressed confidence in the economy’s underlying resilience, adding that productivity could strengthen further as more firms adopt artificial intelligence technologies.

- Although a few participants raised the possibility of increasing the federal funds target range, there was little evidence that a move is imminent. Most officials emphasized that policy is not on a preset course, favoring a steady approach at current levels. However, the more hawkish members advocated for language that recognizes a “two-sided” policy path, leaving the door open to additional rate hikes if inflation remains above target.

- The Fed meeting minutes suggest that policymakers view the current federal funds target as being within the range of estimates of the neutral rate, giving them flexibility to take their time before deciding on further rate cuts. The minutes also indicate that officials are paying closer attention to financial stability, with several members highlighting vulnerabilities in private credit markets and in the debt financing of AI-related infrastructure as areas that warrant ongoing monitoring.

- While the minutes indicate that the FOMC is unlikely to cut rates anytime soon and remains noncommittal about the timing of any potential easing, markets appear to expect the first cut as early as June, with two reductions currently priced in for the year. Whether the market’s expectations prove accurate will likely influence the dollar’s performance, as much of its recent depreciation has been driven by widening interest rate differentials with other major economies.

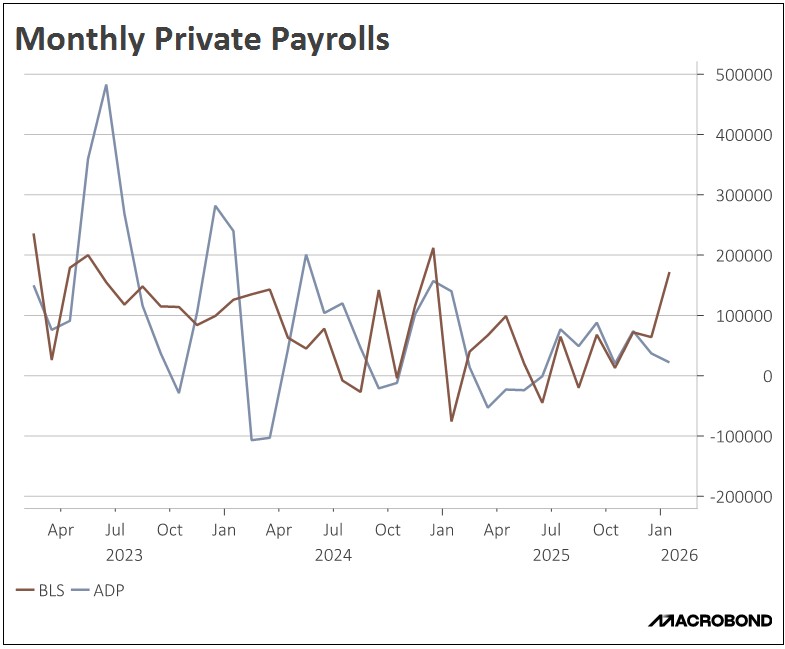

- At this point, we tend to side with the market’s view that the central bank is likely to cut rates more than the minutes suggest. For one, there are increasing signs that inflation is steadily moving toward the Fed’s 2% target. Additionally, while the latest BLS payroll report continues to show labor market strength, the ADP private payroll data points to emerging weaknesses. Taken together, these factors support our view that the Federal Reserve’s rate-cutting cycle still has room to run.

Supreme Court Tariffs: The US Supreme Court is expected to come out with a new set of rulings starting Friday focused on tariffs. Justices are set to give rulings on Friday, Monday, and Tuesday, which could potentially rule on whether or not the White House has the authority to impose tariffs without congressional approval. The impact of the ruling could potentially overturn tariffs that were previously imposed by the government and could lead to uncertainty regarding trade policy.

- There is growing speculation that the Supreme Court may ultimately curb the White House’s ability to impose tariffs unilaterally under emergency powers. During oral arguments, conservative-leaning Justice Neil Gorsuch warned that the White House interpretation would create a “one-way ratchet” of authority from Congress to the president. He cautioned that allowing such broad tariff powers could effectively leave the president with near‑unchecked authority in this area.

- The potential overturning of these tariffs would be a setback for the White House’s trade agenda, though it is unlikely to be a fatal one. The legal challenge at hand centers on the president’s use of the International Emergency Economic Powers Act (IEEPA) to enact his “reciprocal tariffs.” However, this represents just one pillar of his trade policy, which has also relied on Section 232 for national security tariffs and Section 338 to counter discrimination against US commerce.

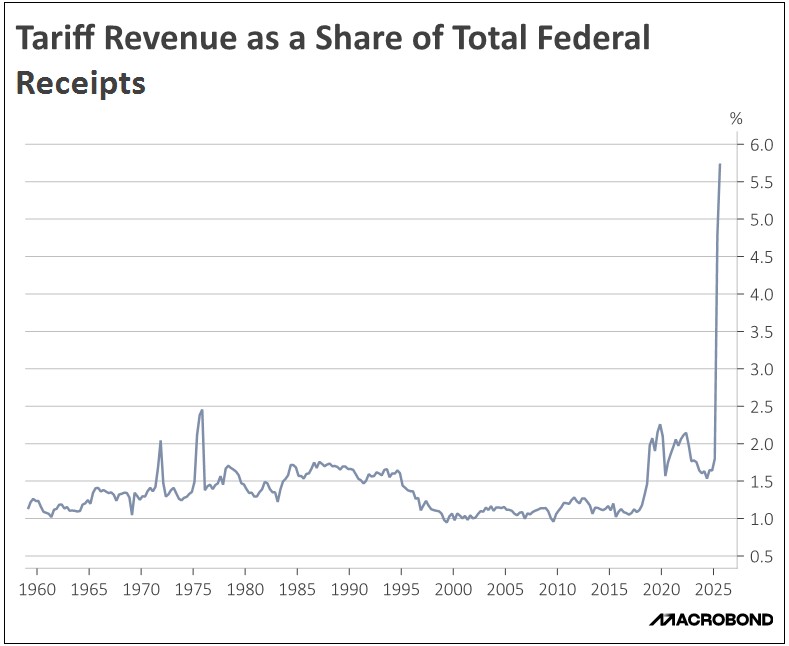

- However, the most significant challenge will likely concern how the government handles tariff revenues if those measures are ultimately ruled illegal. Numerous firms have already sued the government seeking refunds of duties paid under the contested tariffs, should they be invalidated. In addition, the loss of this revenue stream is likely to exacerbate concerns about the fiscal deficit, as tariffs have effectively functioned as an alternative source of federal income.

- Rolling back these tariffs would provide meaningful relief to the sectors most affected, particularly Consumer Staples and Consumer Discretionary, where margins have been under sustained pressure. This potential shift reinforces the case for diversification beyond AI‑related companies, as areas previously hurt by trade uncertainty may stand to benefit from greater clarity on policy direction.

Iran Conflict: Tensions between Tehran and Washington, which had previously appeared to be easing around potential nuclear talks, now seem to have stalled. Recent rhetoric has hardened on both sides, with Ayatollah Khamenei reportedly warning that Iran is prepared to target US ships and Washington responding by stepping up its military deployments in the region. While some of this brinkmanship likely reflects strategic posturing, the probability of miscalculation and a broader conflict has clearly risen.

Circumvent EU: The US appears to be taking steps that could undermine its allied governments in the EU. The White House is reportedly developing an online portal designed to allow users to bypass EU content restrictions, including those targeting material deemed by the bloc to be harmful — such as hate speech and terrorist-related content. The move comes as the US seeks to support the electoral appeal of right-wing parties in Europe. This development is likely to further strain transatlantic relations and could accelerate the EU shift toward strategic autonomy.

IMF Callout China: The International Monetary Fund has urged China to cut its industrial subsidies to 2% of GDP, roughly half of current levels. The organization criticized the excessive use of subsidies, warning that they may create spillover effects across the broader economy and contribute to China’s heavy reliance on exports. The IMF’s recommendation comes amid growing pressure from Western nations, particularly the United States, which argues that China’s industrial policies have created unfair market outcomes.

Confluence of Ideas – #47 “Reviewing the Asset Allocation Rebalance: Q1 2026” (Posted 2/18/26)

Daily Comment (February 18, 2026)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment opens with our take on the EU’s efforts to safeguard its institutions from the far right. We then examine the escalating fight over data centers heading into the midterm elections. Next, we discuss how software companies are working to calm AI fears, signs of progress in Iran-US talks, and a possible tax on social media platforms. We close with a summary of key economic data from the US and global markets.

Far Right Fear: As Europe braces for a potential surge in far‑right influence, attention is increasingly turning to the guardians of its institutions. In a bid to shield the euro’s credibility from future populist governments, policymakers are reportedly weighing leadership changes at the European Central Bank and other key institutions. This kind of defensive maneuvering speaks to a deeper anxiety that the bloc’s political cohesion is eroding, casting fresh doubt over the single currency’s long‑term trajectory.

- A key sign of this preparation is the rumored early departure of ECB President Christine Lagarde. Although her term does not officially end until April 2027, there is growing speculation that she could step down sooner, allowing European leaders to install a firmly pro‑EU successor ahead of France’s national elections next year. While no timetable has been announced, expectations are coalescing around a possible exit as early as this summer.

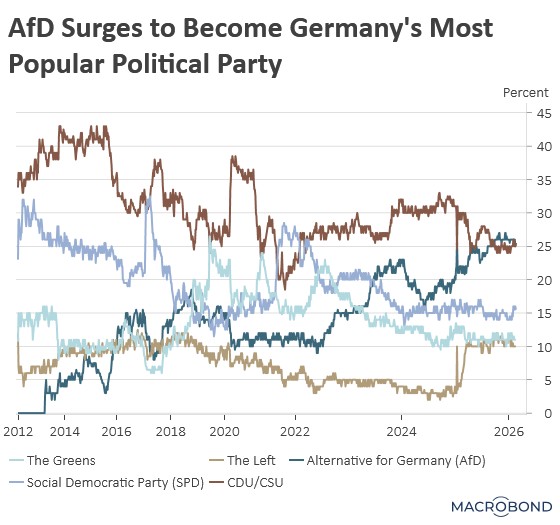

- Her anticipated resignation comes amid mounting discontent with incumbent lawmakers, whose popularity has deteriorated across the European Union, particularly in France and Germany. The French prime minister’s approval rating has fallen to historic lows, while support for Germany’s ruling CDU/CSU has eroded as voters gravitate toward ascendant populist parties such as the AfD and the Left Party, raising the prospect that movements once seen as fringe could move firmly into the European mainstream in the years ahead.

- The mounting fears have led to a push to help make changes to central banks within countries as well. French Central Bank Governor François Villeroy de Galhau is already looking to step down before his term ends in October 2027. While Klaas Knot, the former Dutch central bank chief, is considered a frontrunner for ECB president, Bundesbank President Joachim Nagel is also a top contender, which is a scenario that would allow German Chancellor Friedrich Merz to appoint Nagel’s successor.

- The push to insulate the ECB from rising populist influence should help underpin the euro’s relatively strong performance against the dollar, for now. That could change, however, if right‑wing governments gain enough power to reshape the bank’s structure or dilute its price‑stability mandate — moves that would likely damage the ECB’s credibility and, over time, weigh on the currency.

Data Center Fight: As the midterm elections draw nearer, the rapid expansion of AI infrastructure is coming under heightened political scrutiny. A recent Politico/Public First survey found that nearly half of respondents believe data center development will emerge as a key campaign issue, reflecting growing public concern over the environmental and physical footprint of these facilities. While lawmakers tout such infrastructure as critical to “winning the AI race,” local communities are increasingly pushing back against the real-world costs of hosting it.

- According to the survey, more respondents favor data center construction than oppose it, provided there is no negative impact on their utility costs. Specifically, 37% of respondents supported it, 28% opposed it, and 28% remained undecided. However, a majority of those who initially backed construction stated they would reverse their position if the development resulted in a monthly bill increase of $25 or more.

- The rise of data center corridors follows a surge in infrastructure spending pledged by major tech companies. Currently, the highest concentrations are in Virginia, Texas, and California — states that have become primary targets for investment and are likely to serve as crucial battlegrounds for policy and voter influence.

- To prevent policy reversals, tech companies have begun engaging more directly in the political arena. The super PAC Leading the Future plans to invest heavily in election outcomes to ensure project continuity. Simultaneously, firms like Anthropic are taking proactive measures, such as pledging to cover electricity costs and grid upgrades to shield local communities from the infrastructure’s secondary impacts

- The upcoming midterm elections will likely provide significant insight into the direction of AI development as the industry pushes to expand capacity. While AI-related stocks maintain strong momentum and command a major share of the S&P 500, we believe overlooked sectors offer superior value. This is driven not only by a comparative lack of political risk but also by more attractive valuations.

AI Uncertainty: The market continues to grapple with growing uncertainty over how AI will ultimately affect corporate earnings. In response, a handful of software companies, including cybersecurity firm McAfee, have released earnings ahead of schedule to reassure investors and lenders that their businesses remain resilient to the newly deployed AI tools. Executives have stressed that they are still generating solid demand even as AI systems become more capable of replicating elements of the services and workflows they provide.

Iran Deal Progress: The two sides appear to be edging closer to a deal, even though key issues remain unresolved. Officials in Tehran say they have agreed with Washington on the broad guiding principles of an accord, signaling that a pathway to de‑escalation exists despite the absence of a finalized text. At the same time, Vice President JD Vance has highlighted remaining roadblocks, suggesting the US is still pressing for additional concessions. Any meaningful easing of tensions would likely reduce pressure on commodity prices.

Social Media Tax: Illinois is weighing a proposal to tax social media companies operating within the state. Under the plan, these platforms would pay a monthly fee based on the number of users whose data they collect, and they would be prohibited from passing the cost on to users. The measure is expected to generate roughly $200 million annually, helping to address the state’s budget shortfall. This proposed tax reinforces our long-standing view that investors should diversify into other sectors to reduce concentration risk.