Author: Amanda Ahne

Bi-Weekly Geopolitical Report – Trump and the Political Economy of Alliances (January 27, 2025)

by Patrick Fearon-Hernandez, CFA | PDF

Now that President Trump is back in office, we think investors are about to see major changes in how the United States deals with the rest of the world. Trump, Treasury Secretary Bessent, and other key officials have signaled they will push to dramatically shift US policies on national security, foreign affairs, and international trade and capital flows. They haven’t necessarily laid out specific, detailed plans. However, based on their initial statements, it’s clear that they aim to reverse the traditional US approach to global hegemony and force US allies to shoulder more of the cost of allied security and prosperity.

In other words, Trump and his aides want to revamp the “political economy of alliance,” not only in formal military alliances such as the North Atlantic Treaty Organization (NATO), but also in the broader US-led geopolitical and economic bloc. At the same time, the China-led bloc is changing its internal relations. In this report, we show how the Trump/Bessent plan could cut costs for the US but at the risk of reducing its influence or hurting the cohesion of the US bloc. At the same time, the China bloc is moving toward greater cohesion and increased power. We wrap up with the implications for investors.

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Daily Comment (January 27, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a discussion of today’s rout in global technology stocks. We next review several other international and US developments with the potential to affect the financial markets today, including more data pointing to sluggish economic growth in China and President Trump’s short-lived tariff hikes against Colombia over the weekend.

Global Technology Stocks: The West’s recently high-flying technology stocks related to artificial intelligence, such as Nvidia and Google, are taking a beating today on news that Chinese firm DeepSeek has developed a powerful AI model that calls into question their investments in the space. In an X post on Friday, well-known Silicon Valley venture capitalist Marc Andreessen went so far as to proclaim, “DeepSeek R1 is one of the most amazing and impressive breakthroughs I’ve ever seen.”

- Importantly, DeepSeek was apparently able to produce its model without having access to the most advanced AI chips from US firms such as Nvidia. Washington has banned selling those chips to China to prevent it from surpassing the US in military and technological capabilities. It now appears that the ban has done little to slow China’s progress in AI.

- In fact, DeepSeek has apparently been able to develop its powerful model for just a small fraction of the cost to develop major AI models in the West.

- Of course, some of DeepSeek’s cost advantage probably reflects subsidies from the Chinese government. Nevertheless, the firm’s success suggests that the enormous AI investments made by the likes of Nvidia, Microsoft, Google, and Meta may be misguided or unjustified.

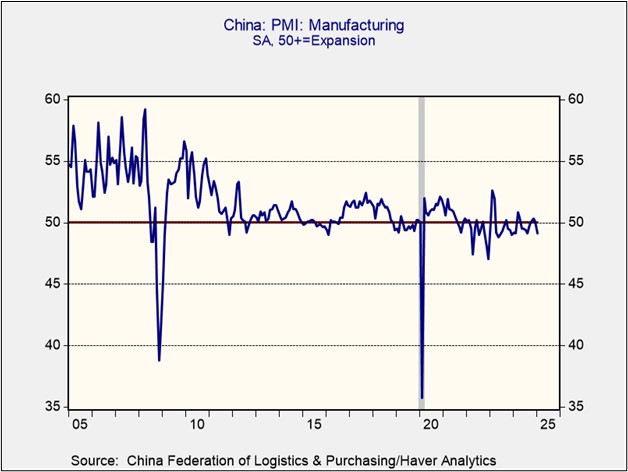

China: The official purchasing managers’ index for manufacturing fell to a seasonally adjusted 49.1 in January, short of expectations and below the 50.1 reading in December. Like all major PMIs, the Chinese one is designed so that readings over 50 indicate expanding activity. The reading for January suggests Chinese factory activity is now contracting again after three straight months of modest expansions. The data underscores the continued slowdown in Chinese economic growth due to problems such as excess capacity and high debts.

India-China: In a potential new source of tension over the coming years, the Indian government has voiced its concerns about a major new hydroelectric dam that China plans to build on the Yarlung Tsangpo River in Tibet, upstream from India. The proposed dam would be three times bigger than China’s Three Gorges dam, which is currently the world’s largest hydroelectric facility. New Delhi fears that the dam will lead to water shortages in India, or even floods if it is ever damaged in an earthquake.

Lithuania-Estonia: Officials in both Lithuania and Estonia have become the latest to endorse President Trump’s demand that the non-US members of the North Atlantic Treaty Organization hike their defense spending to at least 5% of gross domestic product. At those levels, countries such as Poland, Lithuania, and Estonia would be spending well above the US defense burden of about 3% of GDP. The spending hikes could have a major impact on those countries’ fiscal policies and help validate our positive view on non-US defense stocks.

United States-European Union: US electric-vehicle firm Tesla’s Shanghai subsidiary has sued the EU over the anti-dumping tariffs the bloc imposed on Chinese-made EVs late last year. Since Tesla is controlled by “first buddy” Elon Musk, it’s possible that the US government might ultimately side with Tesla and put pressure on the EU to drop its tariffs. Such a move could further threaten the EU’s domestic auto production and weaken the general EU economy.

United States-Denmark-Greenland: According to European diplomats briefed on the matter, a call last week between President Trump and Danish Prime Minister Frederiksen went very badly, with Trump insisting that the US should acquire the autonomous Danish island of Greenland and Frederiksen insisting it isn’t for sale. The “horrendous” tenor of the call has sparked concern in European capitals that Trump is seeking to forcibly expand US territory at their expense, much as Imperialist Russia did in the 1800s and Nazi Germany did in the 1900s.

- Our analysis suggests that the strategic and economic assets offered by Greenland are minimal compared with the potential fracturing of the US alliance system if Trump and his officials continue to strongarm Denmark for a sale of Greenland.

- Although Greenland has deposits of several important mineral resources, the ability to exploit those resources is constrained by factors such as the island’s harsh climate, limited infrastructure, and tiny available workforce.

United States-Colombia: To retaliate for the Colombian government’s refusal to accept US military deportation flights, President Trump yesterday announced 25% tariffs on all imports from Colombia and threatened to double them to 50% in one week. Trump also ordered financial sanctions on Colombia and imposed a travel ban and revoked the visas of Colombian government officials. By the end of the day, however, the White House said Colombia had agreed to all of the president’s terms and the tariffs and sanctions would be held in reserve.

- After a week in which the financial markets were encouraged by the lack of any new tariffs from the Trump administration, it now seems clear that he was perhaps just waiting for the right chance to make an example of a country, even if it’s a traditional ally such as Colombia. Even though the Colombia tariff hikes were ultimately canceled, they could well rekindle broader tariff concerns and weigh on the markets on Monday.

- Colombia’s top exports to the US include crude oil, coffee, and flowers. Given that flowers have such a short shelf life and are shipped shortly before they’re needed, the Colombia tariffs could have produced big price increases for Valentine’s Day roses in the US if they had not been rescinded.

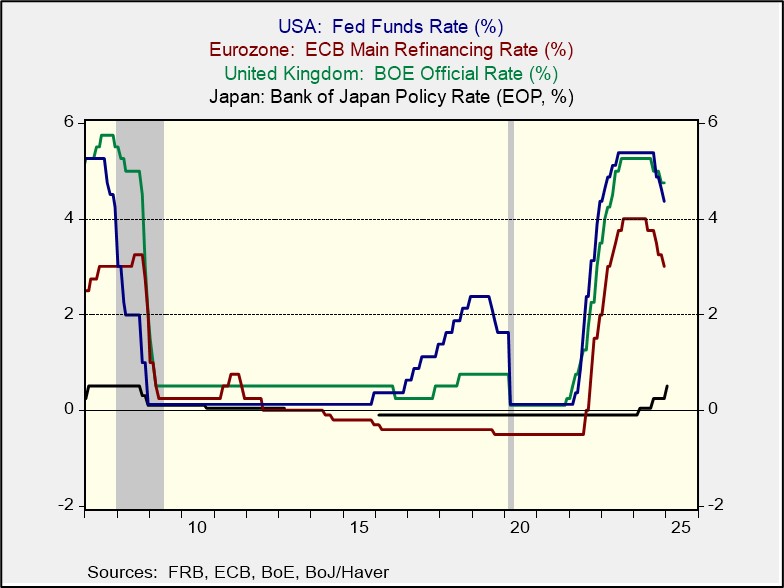

US Monetary Policy: The Federal Reserve holds its latest policy meeting this week, with its decision due on Wednesday at 2:00 PM ET. The policymakers are widely expected to hold their benchmark fed funds interest rate unchanged at its current range of 4.25% to 4.50%. That would make Fed Chair Powell’s post-meeting news conference even more important, as investors will be looking for more guidance on the future path of rates.

US Immigration Policy: The Justice Department yesterday said it had begun a multiagency immigration enforcement operation in Chicago, although the number of arrests so far is uncertain. Meanwhile, Illinois Gov. JB Pritzker said his state would cooperate with federal authorities in deporting undocumented immigrants convicted of crimes or with pending deportation orders, but he said state law enforcement would not take part in targeted raids or profile people in the state who might be without documents.

- Similar to the situation with import tariffs, the Trump administration’s inaction on illegal immigrants in its first week may have created a false sense of security and complacency among immigrant communities and those who employ them.

- The Chicago crackdown on immigrants therefore may rekindle concerns that Trump’s immigration policies will exacerbate today’s labor shortages, especially in sectors such as construction and hospitality.

Daily Comment (January 24, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with new, market-driving statements by President Trump regarding global energy supplies and US tariff policy. We next review several other international and US developments with the potential to affect the financial markets today, including new signs that Europe is taking steps to protect itself from China’s predatory economic policy and new pressure on the Federal Reserve from Trump to cut US interest rates.

United States-World Economic Forum: Yesterday, in his video speech to the WEF in Davos, Switzerland, President Trump urged Saudi Arabia and the other members of the Organization of the Oil Exporting Countries to boost oil production and bring down prices, claiming the price cuts would reduce consumer price inflation and allow interest rates to fall. He also reiterated his invitation for foreign firms to invest in the US and take advantage of its low tax rates, but he warned that foreign manufacturers would be subject to import tariffs.

- Taken together, Trump’s statements on oil prices, inflation, and import tariffs help confirm that he is looking for lower energy prices to offset some of the inflationary impact of some of his other policies, such as higher tariffs.

- Even if that is Trump’s strategy, however, it’s important to remember that the plan may not work. Given that so many of Trump’s policies run the risk of higher price pressures, any lowering of energy prices may merely slow the resulting price inflation, rather than bringing overall prices down.

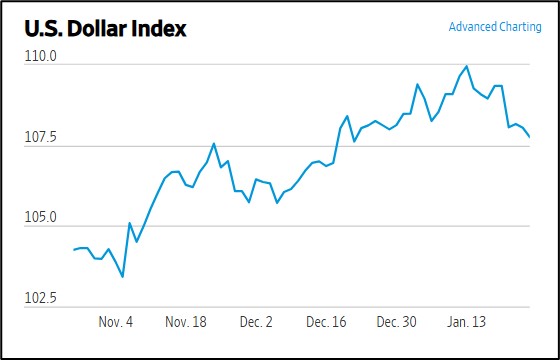

United States-China: Despite reiterating his willingness to hike tariffs in his WEF speech, President Trump said in an interview released last night that he would “rather not” have to impose them against China. Coupled with the lack of any specific new tariffs imposed since Trump was inaugurated on Monday, the statement has increased the market’s uncertainty regarding tariff policy, pushing the dollar lower against most major currencies today and giving a boost to some foreign stock markets.

- As of this writing, the US Dollar Index is down approximately 0.3% to 107.71.

- The index is now down 2.1% from mid-January.

European Union-China: Teresa Ribera, executive vice president of the European Commission, has revealed to the Financial Times that Brussels is considering an EU-wide subsidy for consumers to buy electric vehicles. The subsidy would aim to help EU automakers survive the onslaught of super-cheap EV imports from China. If it is ultimately approved and implemented, the subsidy program would be yet another sign of the protectionism and industrial policy being implemented around the world.

Germany-China: Friedrich Merz, chief of the center-right Christian Democratic Union and leading candidate for chancellor in February’s elections, warned that German firms investing in China shouldn’t expect government help if those investments go sour. The warning comes as German manufacturers desperate for growth are increasingly building factories in China, even though China’s predatory industrial policies are essentially aimed at putting them out of business on their home turf.

- The statement by Merz suggests that he would support further economic decoupling from China if he becomes chancellor as expected.

- The statement therefore signals that the potential policies of Europe’s rising right-wing leaders will likely lead to more global fracturing going forward, which we think will tend to boost consumer price inflation and interest rates in the future.

Eurozone: On a panel during the last day of the WEF in Davos, European Central Bank Chief Lagarde said Europeans are too pessimistic and should be more confident about their economic prospects. According to Lagarde, one thing that would help boost the European economy would be to keep more of its highly skilled workers and capital from going abroad. On the same panel, BlackRock CEO Larry Fink said there is not only too much pessimism in Europe, but that it was also probably time to be investing back into the Continent.

- In our view, Lagarde and Fink probably have a point regarding the extreme pessimism that many investors feel toward Europe these days. The Continent retains an enormous amount of wealth, income, human capital, and economic potential. The question is whether the European economy is finally turning the corner to a new round of strong growth, which may be a necessary catalyst for renewed investor optimism.

- In any case, even though Europe continues to face challenges ranging from disrupted energy supplies and high energy prices to a fractured financial system, high regulation, and poor demographics, we think opportunistic investors can still find attractive opportunities in certain sectors and among the Continent’s many well-run, innovative firms with strong world market shares.

Italy: Monte dei Paschi di Siena, widely recognized as the world’s oldest bank, has announced an unsolicited bid worth nearly $14 billion for fellow Italian lender Mediobanca. The combined firms would make up Italy’s third-largest bank by assets. Along with recent takeover bids by Italian lender UniCredit, the proposed takeover has once again raised investor hopes for a consolidation of the fractured banking system in Italy, and in the broader European Union.

Japan: The Bank of Japan today hiked its benchmark short-term interest rate to 0.50%, boosting it from 0.25% previously and marking the third rate hike in less than a year. In a post-decision press conference, BOJ Governor Ueda said his policymakers had become more confident that a rate hike would help them keep consumer price inflation to their target of 2.0% over the medium term, while they saw no unexpected developments from the new Trump administration that would make them change their tightening course.

- Despite the rate hike and the dollar’s pullback against many other currencies so far today, the yen (JPY) has weakened about 0.2% to 156.32 per dollar ($0.0064).

- Even though the BOJ’s recent hikes have helped close the rate gap with other central banks, the yen today remains near its weakest level since 1990.

US Monetary Policy: With the Fed widely expected to hold its benchmark interest rate at a relatively high 4.25% to 4.50% next week, President Trump yesterday claimed he understands interest rates “much better” than the central bankers and would pressure them to cut interest rates “a lot.” The statement confirms that Trump is ready to strongarm Fed Chair Powell into cutting rates and trample on the Fed’s traditional independence, even if the policymakers think Trump’s policies will push up consumer price inflation.

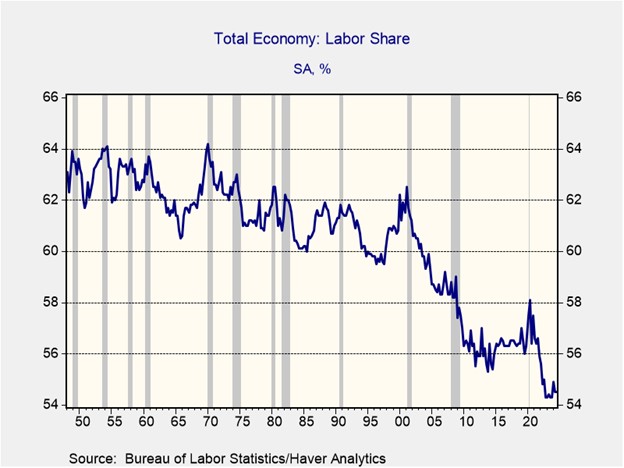

- Trump’s rhetoric illustrates why many investors have been wary of the increasingly powerful right-wing populist politicians in the US and Europe.

- Some investors worry that right-wing populist politicians will cut taxes and hike outlays on workers, expanding national budget deficits. However, they are also concerned that these politicians will push for excessively loose monetary policy, which will raise the risk of resurgent inflation.

US Fires: Even as firefighters were finally making progress on the major blazes elsewhere in Los Angeles County, new fires have broken out in the northern part of the jurisdiction and are now being fanned by strong winds. The Hughes fire near Santa Clarita has exploded to almost 10,400 acres, sparking thousands more evacuation orders. The new Sepulveda fire has broken out just two miles from the perimeter of the Palisades fire that has already destroyed some 23,000 acres and thousands of structures.

Keller Quarterly (January 2025)

Letter to Investors | PDF

Here we are in 2025. I must admit that, growing up in the 1960s, I couldn’t even imagine what 2025 would be like. If I had tried, I probably would have had some science fiction-like expectation — that I’d be commuting to work in a flying car, that I’d have robots doing the dishes and walking the dog, and that we’d be planning a vacation on Mars. In other words, I’d be living in the world of The Jetsons. It turns out that the world of 2025 is pretty much like the world of 1965, except that I have virtually an infinite number of channels on my TV (instead of five) and a cordless telephone in my pocket that I can use anywhere. We are still not on Mars (perhaps getting closer), and I have to walk my dog the old-fashioned way (I do have a little robot that will vacuum the floor, though not all that well). And my car works remarkably like the cars my dad had in the ‘60s (I have not gone EV).

It is true that I do my job very differently today. Typewriters and correction fluid have given way to personal computers. My slide rule is now an antique, replaced by computers and electronic calculators (even on that phone). And the worksheets that I produced using accounting paper and pencils in 1979 are now created and maintained on spreadsheet programs on computers. In fact, we can store millions of bits of data on offsite “cloud” storage devices that years ago would have required a warehouse full of boxes. Those of us in the so-called knowledge businesses work very differently than we used to, making us much more productive. But to be successful, we still have to make good decisions, and those require wisdom, something that is still not easily acquired.

Today, Wall Street is agog with the prospective boon that artificial intelligence (AI) might bestow. This latest technological advancement promises to solve the wisdom shortage. A machine that learns from history, much faster than humans can, will supposedly make better decisions than people can. Perhaps, but perhaps not. When I watched men walk on the moon 55 years ago, I thought that I’d be visiting there by now. It doesn’t look likely that I’ll be doing that in my lifetime. When I took my first airplane ride in 1966 (a Lockheed L-188 Electra, a beautiful turboprop), I figured that by now I’d be travelling at supersonic speeds, flying from St. Louis to New York in about 30 minutes. That also hasn’t happened yet.

Technology tends to move forward in fits and starts. It scoots along at blazing speed for a spell, then slows down substantially. Investors, however, compress all that innovation into the present and value the most innovative businesses as if the future is now. AI stocks are the latest iteration of this trend. The sad fact is that Wall Street almost always gets far too optimistic far too quickly and then capitalizes those companies in new technologies at valuations that are far too hopeful.

As a young financial analyst in the early days of personal computers, I saw hundreds of young companies rise up in that industry and raise money seemingly overnight. Remember Compaq, Osborne, Kaypro, and Gateway computer companies? Apple and Dell were survivors; the vast majority were not. Personal computers turned out to be every bit as revolutionary as we thought they’d be, and even more so! It’s just that not very many companies survived to enjoy that growth.

In the first 20 years of the last century, almost 2,000 companies were formed to manufacture automobiles. By the mid-1920s, there were only about 300 left. By the late 1940s, 90% of all cars in the US were made by three companies. The creative destruction of capitalism is a wonderous thing. It creates magnificent things at great efficiency, but lots of capital is destroyed along the way. Yet, in every age, optimistic investors think that they hold the “winning lottery ticket”: a share in the company that will win the day. Perhaps. The new technology eventually produces the wonders we expect, but it usually occurs much later than expected and at the cost of lots of capital incinerated along the way.

We at Confluence love innovation and growth too, we just are not interested in gambling on who the winners and losers will be in the early days of investor excitement. As has often been noted, the leading edge of technology is also the bleeding edge. It’s usually better to wait a while and see who will win the competition, even if you end up paying more than if you got in at the “ground floor.” Or, alternatively, invest in some of the major companies who are themselves making investments in the new space. Chances are that they will see better investment opportunities than public investors ever will.

Everyone loves to hear stories about the guy who bought $1,000 worth of stock in a new technology that turned into $1 million. But did he do that without also losing a ton of money in other high-risk investments? It’s the risk side of the investment ledger that investors need to devote more attention. It should be the goal of all intelligent investors to produce excellent results on the return side of the ledger without exposing their funds to excessive risk. Our analysts, strategists, and portfolio management teams spend more time on risk management than on any other pursuit. I have always thought that if we manage the downside appropriately, the upside will take care of itself.

We appreciate your confidence in us and wish you all the best in this New Year.

Gratefully,

Mark A. Keller, CFA

CEO and Chief Investment Officer

Daily Comment (January 23, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently awaiting President Trump’s remarks at Davos. In sports news, Aryna Sabalenka is one step closer to becoming the first woman since 1999 to win three consecutive Australian Opens. Today’s Comment will discuss Argentina’s unwillingness to take sides in the US-China rivalry, explain why tariffs are forcing firms to consider relocating, and provide the latest developments in the war in Ukraine. As usual the report will conclude with a summary of domestic and international data releases.

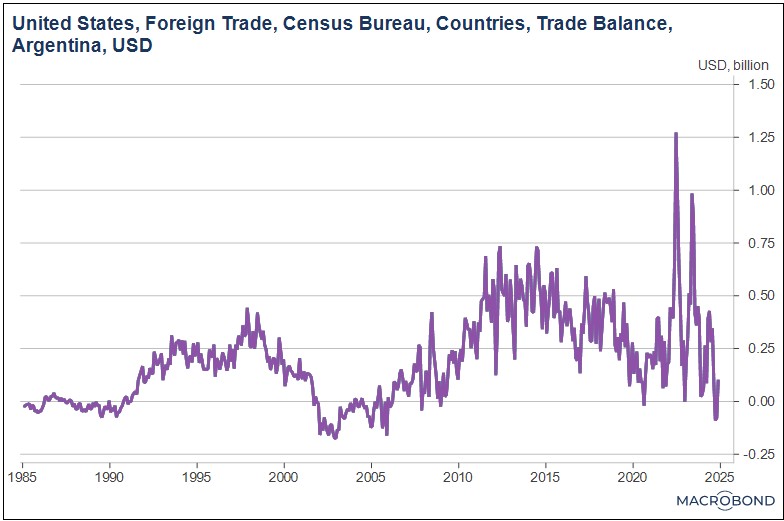

Argentina Has Options: Argentine President Javier Milei has explored the possibility of establishing trade deals with both the United States and China. This decision reflects his broader strategy to revitalize the economy during a challenging period.

- During an interview at the World Economic Forum in Davos, Milei hinted that his administration might be exploring a bilateral trade agreement with the United States. He even suggested a potential willingness to withdraw from the South American trade bloc, Mercosur, in order to secure a favorable deal with the US, if needed. However, he expressed confidence that existing mechanisms within the Mercosur trade arrangement would enable his country to maintain relationships with both trading partners.

- Furthermore, he appears to have significantly altered his stance on engaging with China. After previously characterizing Beijing as a group of assassins, he now believes that China is a valuable trading partner, and he has expressed a desire to cultivate a deeper relationship with the world’s second-largest economy. Milei and his team are expected to travel to China soon to discuss improving commercial ties.

- The Argentinian president’s willingness to engage with both China and the United States likely reflects a desire to maintain strategic autonomy, despite shared interests with the latter. This reluctance to fully align with the US may stem from concerns about potential economic disruptions caused by proposed flat tariffs, as well as the perception of the US as an exporting rival.

- Since taking office, Milei has focused on expanding Argentine exports, particularly in grains, oil, and gas — sectors where the country directly competes with the United States — as a strategy for economic growth. Last year saw the nation achieve a record trade surplus, largely attributed to strong energy exports, while simultaneously reducing its trade deficit with the US.

- Millie’s decision to engage with China signals how US trade threats may be driving other nations toward closer ties with Beijing, potentially creating a counterweight to American influence. This could compel the US to moderate its approach towards less security-dependent nations, potentially making these countries more attractive as investment destinations for those seeking to mitigate trade war risks.

Tariffs Headaches: Confronted with the looming threat of new tariffs, US companies in China are scrambling to explore all viable alternatives. A key concern is the relocation of operations with many reluctant to reshore to the US, raising the specter of renewed supply chain difficulties and potentially reigniting inflationary pressures.

- Nearly 30% of companies are considering relocation, according to a survey conducted by the American Chamber of Commerce in China. While the overall majority of firms plan on keeping their operations at their current location, the trend is showing that firms have started to take steps to hedge against rising trade tensions.

- That said, for most firms, the preferred destination for relocating operations appears to be other countries in Asia, rather than the US or its Northern American partners. Among respondents who plan to move operations, 38% indicated Asia as their preferred destination, with many companies specifically considering countries like Vietnam and the Philippines.

- The reluctance of firms to relocate from Asia to the US, despite policy incentives to do so, stems primarily from concerns about higher labor costs and difficulties in retaining skilled workers. This is particularly pronounced for labor-intensive industries such as wiring and optical fiber cable manufacturing, which often require specialized expertise.

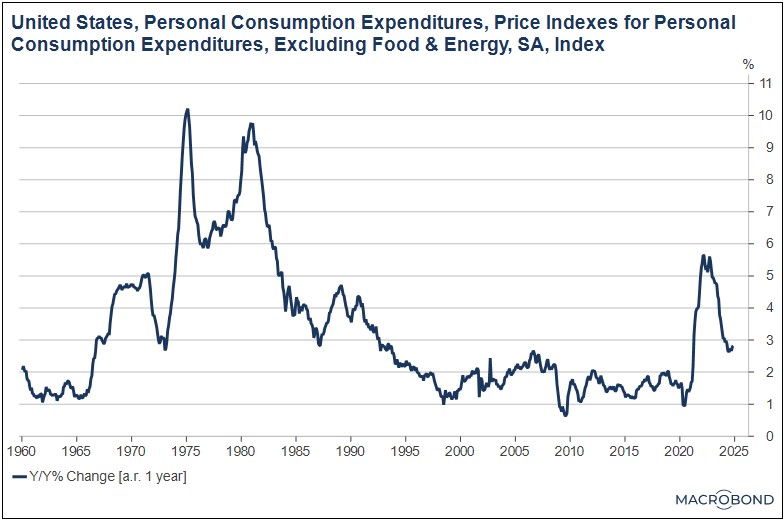

- As a result, proposed tariffs on goods from Mexico and Canada pose a significant threat to the US economy by disrupting supply chains and dampening consumer demand. Deutsche Bank research estimates that the 25% tariffs implemented on February 1 could increase the core PCE price index by 80 basis points, assuming a 50% cost pass-through to consumers. This figure rises to 110 basis points if 75% of costs are passed through.

- If Deutsche Bank’s research proves accurate, it could hinder the Federal Reserve’s efforts to lower interest rates further this year, potentially keeping rates elevated. However, the inflationary impact of these tariffs may be transitory, which could mean the pause could be somewhat limited.

Ukraine-Russia Deal: The US president has demanded that Vladimir Putin quickly agree to a deal to end the war in Ukraine or face tariffs, taxes, or more sanctions. Trump’s threat comes as he is expected to talk to the Russian president later this week to discuss the war.

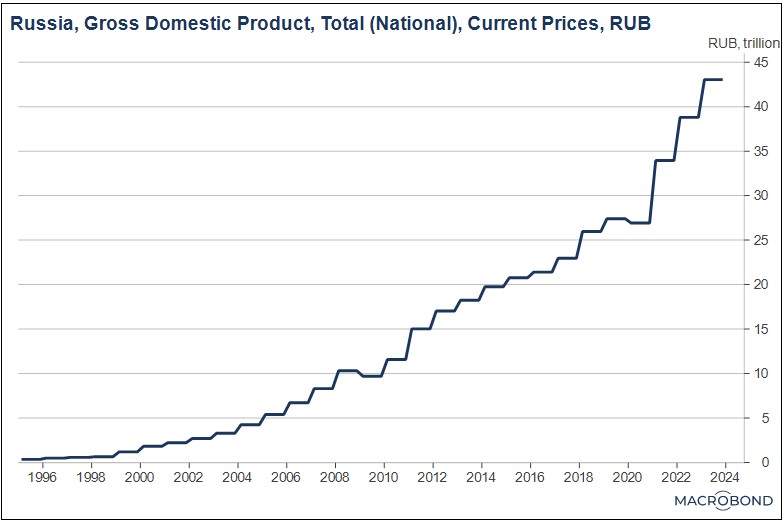

- Trump remains confident that Zelensky is open to negotiations but questions whether Putin is genuinely committed to ending the conflict. Earlier this week, he uncharacteristically criticized Putin, accusing him of destroying Russia by refusing to make a deal. His remarks come amid growing concerns that Russia has prolonged the conflict with support from North Korean troops.

- Moscow responded to Trump’s remarks by expressing interest in meeting with the US for discussions while downplaying the president’s threats as nothing new. Although some within the Kremlin reportedly support continuing the war, sources suggest that Putin believes the war’s objectives have been achieved, indicating that Moscow may be open to a deal.

- The possible end of the war comes at a time when the Russian economy is facing increasing distress, with concerns that the war effort may be leading to some distortion. To mitigate fears of a possibly worsening economic outlook, Russian officials have suggested the rest of the world is also facing some form of economic difficulties.

- A potential peace agreement ending the war would likely be met with enthusiasm by financial markets, as a ceasefire could significantly reduce geopolitical tensions. Commodity prices, particularly energy, are expected to be the most immediate beneficiaries. The prospect of lifting sanctions on Russian oil and gas exports would likely exert downward pressure on energy prices.

Daily Comment (January 22, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are paying close attention to the new president. In sports, Ichiro Suzuki, CC Sabathia, and Bill Wagner were inducted into the National Baseball Hall of Fame. Today’s Comment covers Trump’s first few days in office, including his threats of higher taxes on foreign nationals, tariffs on US allies, and the White House’s push for AI. We’ll also review key domestic and international data releases and other market-moving developments.

Trump 2.0 Begins: President Trump has offered more details on his plans to deal with the rest of the world. These proposed changes include potential taxes on foreign multinational corporations and new tariffs. The announcements positively impacted the stock market, notably boosting equities of small and mid-cap companies, and also contributing to a rise in long-term bond prices.

- The 47th US president has criticized other nations for imposing so-called “extraterritorial taxes” on American companies. Trump argues that Western countries are unfairly targeting US businesses and has vowed to retaliate by doubling taxes on foreign nationals and companies. He referenced a 90-year-old provision in Section 831 of the US tax code that permits retaliatory taxes on foreign entities.

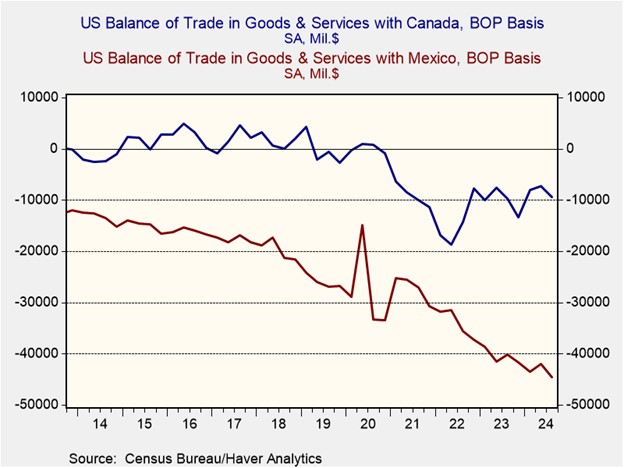

- Regarding tariffs, the president avoided a blanket tax on imports from all nations, instead threatening targeted tariffs specifically against countries involved in the fentanyl trade. He said he would add a 25% tariff to all goods from Mexico and Canada if they don’t take action to stop the flow of illegal immigrants and illicit drugs. Additionally, he also mentioned a modest 10% tariff on Chinese goods for China’s role in the drug trade. This new tariff would start on February 1.

- This shift toward a more assertive stance with US allies likely reflects the president’s efforts to solidify a transition from a benevolent global leader to a more transactional one. Consequently, the US may be less inclined to offer preferential trade terms to its allies and could potentially reassess its security commitments.

- American allies have signaled a willingness to collaborate with the US on certain issues but have also warned of potential pushback. Mexican President Claudia Sheinbaum affirmed her intent to work with the US while emphasizing her commitment to defending Mexico’s sovereignty. Canadian Prime Minister Justin Trudeau stated that Canada would respond decisively to any unfair tariffs.

- The president’s more assertive approach towards US allies may initially have a positive impact on equity and bond yields, provided his rhetoric remains largely posturing and does not provoke significant retaliation. However, in the long term, this isolationist trajectory could negatively impact the US economy. While equities may remain relatively resilient, a prolonged period of increased geopolitical tension and economic decoupling could ultimately trigger a bear market in bonds.

AI Taking Next Steps: The administration’s plans to boost AI infrastructure investment to $500 billion and relax regulations have been met with enthusiasm from the tech industry. However, growing apprehension is evident among other groups concerned about the potential consequences of this rapid advancement.

- On Monday, the president took several actions aimed at accelerating AI development. He signed an executive order that would relax safety and transparency regulations for AI systems. Additionally, he announced a public-private partnership with Softbank, OpenAI, and Oracle Corporation to develop advanced AI technologies. Finally, he signed another executive order authorizing the release of federal land for the construction of data centers.

- Furthermore, the president has expressed a willingness to facilitate increased energy access for these companies to support their growing data center needs. While not explicitly mentioning nuclear power, he indicated an openness to exploring options that allow these firms to generate their own energy solutions.

- NIMBY (not in my backyard) opposition had previously hindered AI development, as several communities have resisted their local governments’ efforts to permit the construction of data centers within their area.

- Additionally, concerns about job displacement due to technological advancements are growing. On Tuesday, Kevin Weil, Chief Product Officer at OpenAI, warned of the imminent arrival of AI agents. These sophisticated AI systems will be capable of performing complex tasks, potentially automating many white-collar jobs.

- While AI is poised to play an increasingly significant role in the economy, its development and deployment are likely to become increasingly politicized in the coming years. Although the president currently appears supportive of the tech industry, we anticipate that the sector is still under threat of higher political scrutiny.

Energy Deregulation Hopes: As anticipated, the president withdrew the United States from the Paris Climate Accords and declared a national energy emergency. This policy shift has fueled optimism among some that increased energy production will lead to lower energy and input costs.

- The president has expressed a desire to increase domestic oil and gas production, aiming to bolster US manufacturing. To this end, he signed an executive order that would ease environmental regulations, facilitating the construction of new energy production facilities and enabling drilling in previously protected areas.

- While the president has prioritized oil and gas production, other sectors also anticipate benefiting from his deregulatory agenda. Rio Tinto, a major copper mining company, has expressed optimism that the administration will approve its plans to expand copper mining operations in Arizona. The company aims to supply 25% of the country’s growing demand for copper.

Panama Canal Takeover: The United States’ desire to reclaim control of the Panama Canal is raising international concerns.

- Earlier today, the Panamanian president dismissed anxieties that the US might attempt a forceful takeover. Additionally, Russia has also publicly stated its interest in ensuring the canal’s continued neutral status.

- The ongoing dispute over the Panama Canal, a vital conduit for global trade, is likely to fuel concerns about potential disruptions to supply chains and an escalation of geopolitical tensions. Therefore, we will be closely monitoring this evolving situation.

Daily Comment (January 21, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a sampling of the key executive orders President Trump issued immediately after being inaugurated to his new term in office yesterday. We next review several other international and US developments with the potential to affect the financial markets today, including a potential decision by Indonesia to cut nickel output amid slumping global prices and new data showing surging foreign investment in the US.

US Politics: President Trump was inaugurated to his new term in office yesterday, dominating the news media around the world. Importantly, he also hit the ground running, signing multiple executive orders aimed at putting into place his agenda regarding international relations, the economy, and other areas. Of course, many of the actions will be challenged in court, but for now, we think it’s useful to highlight a sampling of the ones that could be important for the economy and financial markets. Key orders:

- Directed federal agencies to begin an investigation into international trade practices, including persistent trade deficits and unfair currency practices, and to examine the flows of migrants and drugs from Canada, China, and Mexico to the US. (Even though Trump’s orders didn’t include new tariffs, such investigations could help set the stage for tariffs in the coming weeks or months.)

- Launched a full review of the US industrial and manufacturing base to assess whether further national security-related tariffs are warranted.

- Declared a national energy emergency (the first in US history), which could unlock new powers to suspend certain environmental rules or expedite permitting of certain mining projects.

- Rolled back energy-efficiency regulations for dishwashers, shower heads, and gas stoves.

- Froze federal hiring, except for members of the military or “positions related to immigration enforcement, national security, or public safety.”

- Restored a category of federal workers known as Schedule F, which would lack the same job protections enjoyed by career civil servants.

- Ended the federal government’s remote work policies and ordered workers back to their offices full time.

- Barred asylum for migrants newly arriving at the southern border.

- Prohibited federal employees from issuing citizenship documents to the children of illegal immigrants, despite the birthright citizenship provisions of the 14th

- Withdrew the US from the Paris Agreement on climate change, eliminating the country’s obligations to take action against global warming.

Global Politics: Whether by coincidence or not, the World Economic Forum’s annual conference in Davos, Switzerland, kicked off yesterday. As usual, the list of attendees included a who’s who of global elites, including powerful politicians, business leaders, economists, and commentators. President Trump is due to address the forum via video on Thursday.

Global Pharmaceutical Industry: Researchers following 215,000 US military veterans who have diabetes and use the popular new GLP-1 weight-loss drugs found they were significantly less likely to develop Alzheimer’s and about 40 other diseases, compared with those taking other diabetes medicines. The data could be a new shot in the arm (sorry for the pun) for firms such as Novo Nordisk, maker of Ozempic, and Eli Lilly, maker of Mounjaro, since investors have recently begun to worry about future growth and government support for those drugs.

Indonesia: The government is reportedly mulling a cap on nickel ore production to boost prices amid a global slump. Even though the government has taken strong steps to boost the country’s nickel industry in recent years, global demand has been falling as the demand for electric vehicles falters. Global nickel prices have declined some 40% over the last two years.

Taiwan: The opposition-controlled legislature today froze large portions of the country’s defense budget, throwing a wrench into President Lai’s effort to strengthen the island’s defenses amid concerns about a potential Chinese takeover attempt. According to the China-friendly Kuomintang opposition party, the defense spending is “wasteful,” even though it only amounts to less than 2.5% of Taiwan’s gross domestic product. The funding freeze is likely to draw anger from the new US administration, which wants other countries to boost their military spending.

United States-China: The US law aiming to force Chinese-owned social media app TikTok to either sell itself or shut down went into effect over the weekend, but only temporarily. By Sunday, the app was back in service after President Trump promised to issue an executive order giving the firm more time to separate from its Chinese owner. The reprieve is likely to be taken positively by Beijing.

US Investment Environment: New research by the Financial Times shows the US has become the world’s biggest recipient of foreign direct investment, accounting for 14.4% of the world’s total in the year to November. The research shows that the US is now drawing in several times more investment that China. The US economic industries luring the most investment include real estate, software and information technology services, and industrial equipment. As we’ve noted before, strong capital flows into the US go far toward explaining the strong dollar.

US Semiconductor Industry: Taiwan Semiconductor Manufacturing Corp. late last week said it has begun commercial production of advanced semiconductors at its new, multibillion-dollar campus in Phoenix. That marks the first time 4-nanometer chips (the kind used in smartphones and other popular electronics) have been manufactured on US soil. Importantly, the firm also said that yields at the Phoenix fab are already comparable to those at its famous plants in Taiwan.

- As a reminder, the Biden administration strong-armed TSMC into developing its new $65-billion campus in Phoenix to help secure the US’s access to cutting-edge computer chips. Some 10% of the facility’s cost was subsidized by the CHIPS and Science Act of 2022.

- However, officials close to President Trump have criticized the CHIPS and Science Act, making unclear whether the government will continue to subsidize advanced chip manufacturing in the US going forward.

US Energy Industry: The Wall Street Journal today carries an interesting article showing that major oil and gas companies are considering getting into the power-generation business. The firms reportedly want to take advantage of the surging demand for electricity, especially for data centers running artificial-intelligence models. The energy firms are considered well-placed to build off-grid, gas-fired generating plants to supply those data facilities.

Asset Allocation Bi-Weekly – Magnificent 7 to the Rescue! (January 21, 2025)

by the Asset Allocation Committee | PDF

The traditional role of Treasurys as a safe-haven asset has eroded. For example, Treasury prices fell in the last quarter of 2024 despite escalating geopolitical tensions in the Middle East, concerns about global economic growth, and heightened political uncertainty in developed nations. This weakening in the demand for Treasurys was largely driven by investor anxieties over the future rate of inflation and the widening budget deficit. For many market participants, concerns about the outlook for Treasurys have fueled a resurgence of interest in the Magnificent 7 as a target for safe-haven flows.

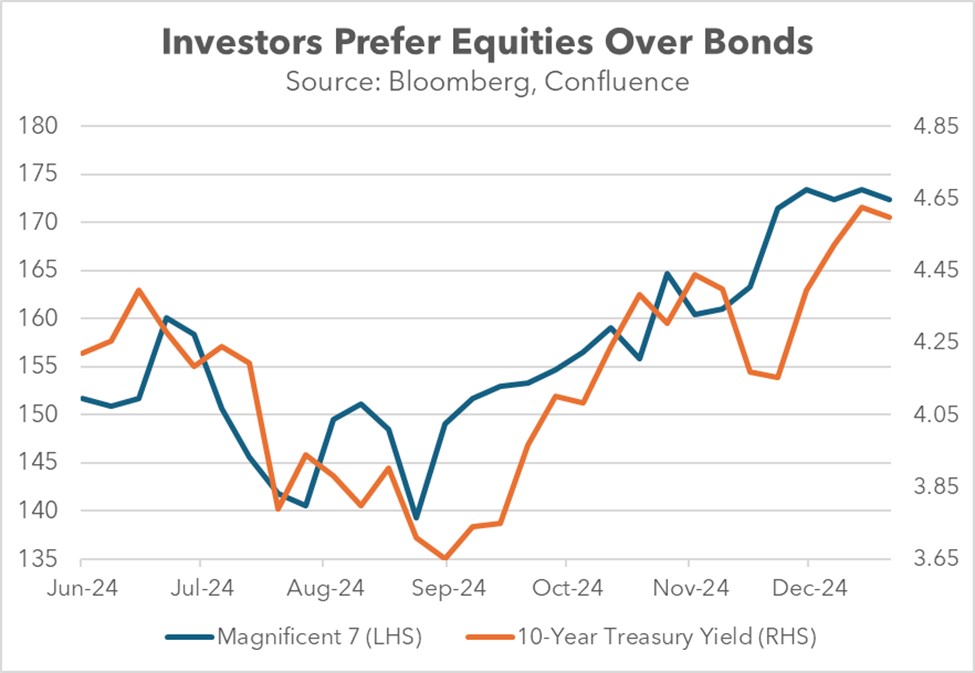

This shift in preference was partly driven by expectations surrounding the incoming administration. Leading up to the election, investors began divesting from US government bonds and purchasing mega-cap tech stocks. This shift reflected growing optimism for a pickup in economic growth and declining confidence in the Federal Reserve’s ability to cut interest rates. Consequently, from September to December, the yield on the 10-year Treasury note surged nearly 100 basis points, while the Magnificent 7 stocks surged almost 24%.

The unraveling began when the Federal Reserve initiated a series of rate cuts last fall. Despite the Fed lowering interest rates by 100 basis points across its final three meetings, the 10-year Treasury yield surged by a comparable amount instead of declining. This divergence stemmed from policymakers’ reluctance to commit to further monetary easing, particularly as the economy showed signs of accelerating. The presence of two dissenting votes during these meetings further reinforced concerns that the central bank may be hesitant to loosen policy.

The Fed’s unwillingness to commit to aggressive rate cuts has led investors to turn to equities. Growing optimism about economic growth propelled the S&P 500 above 6,000 for the first time ever. The change in investor sentiment was further reinforced by growing confidence from the outcome of the November election, which is widely expected to favor policies that will bolster corporate earnings and consumer demand.

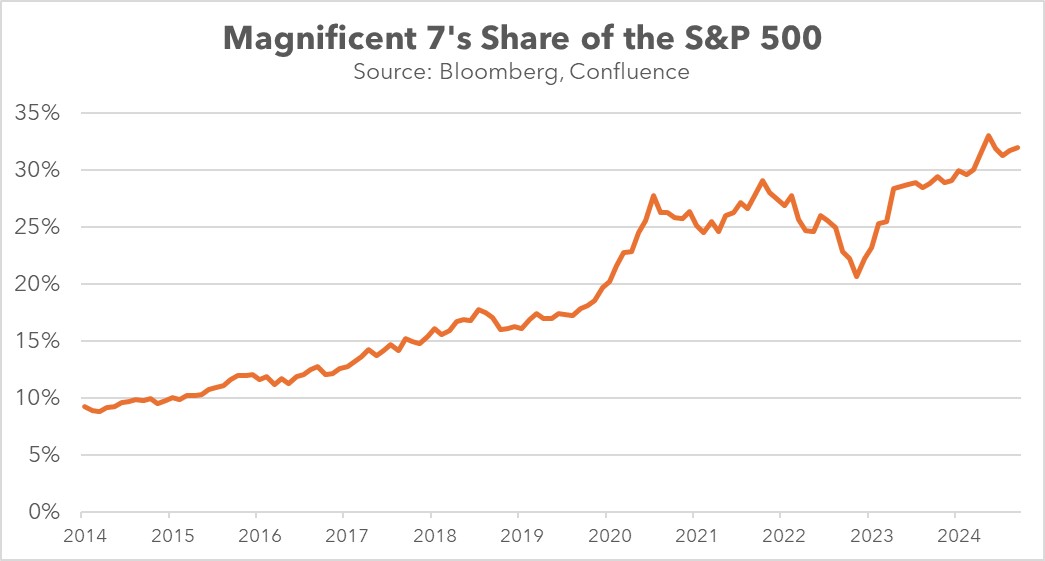

Specifically, investors gravitated toward the Magnificent 7, a cohort of tech giants perceived as capable of generating robust earnings and rewarding shareholders even in a high interest rate environment. This group, which makes up more than a third of the S&P 500’s market capitalization, is projected to significantly outperform the broader index in Q4 earnings, with an estimated 20.7% growth compared to the S&P 500’s overall projected growth of 11.9%.

While stock-price appreciation has been a strong motivator, investor preference for the Magnificent 7 has been further solidified by the companies’ intent to increase shareholder returns. Last year witnessed some notable examples, including Meta and Alphabet issuing their first dividends, Apple executing a massive $110 billion stock buyback, and Nvidia announcing a stock split. The potential for these companies to produce robust earnings growth, coupled with the prospect of lower corporate tax rates, would further enhance their ability to return capital to shareholders.

Looking forward over the coming year and beyond, uncertainty about the future trajectory of interest rates and the fiscal outlook will likely continue to weigh on bond values. Some safe-haven buying may therefore shift to gold and other precious metals, while others could shift to large, stable, dividend-paying value stocks. Still, it wouldn’t be a surprise if many investors favor large cap growth companies because of their strong track record of consistent earnings growth and demonstrated commitment to shareholder returns. However, we think that investors trying to use large cap growth stocks as a safe haven should remember that they are currently very richly valued and could be at risk for correction at some point. Investors should remain mindful of their true risk tolerance before using growth stocks like the Magnificent 7 for safe-haven purposes.