by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment opens with an analysis of mounting concerns over a potential market pullback. We then examine how a wave of new AI partnerships continues to provide crucial market momentum. Our coverage further extends to government initiatives in the energy and commodities sector, conflicting signals from Fed officials on December rate cuts, and a notable shift in sentiment among UK youth regarding welfare benefits. We also include a summary of key international and domestic data releases.

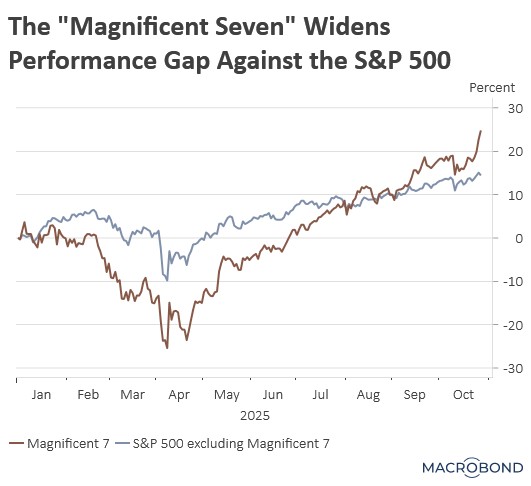

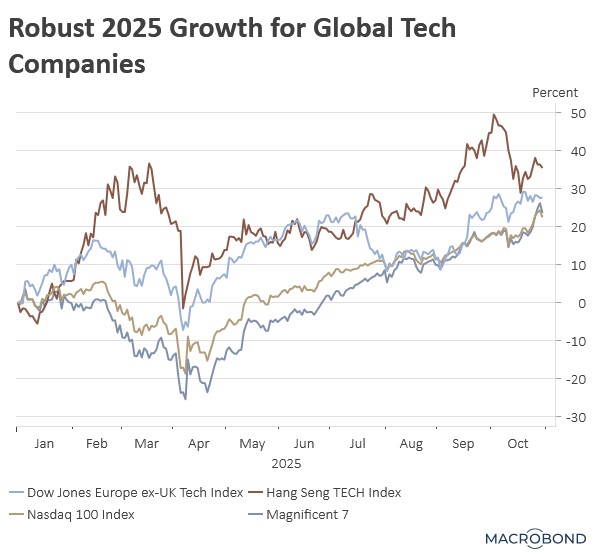

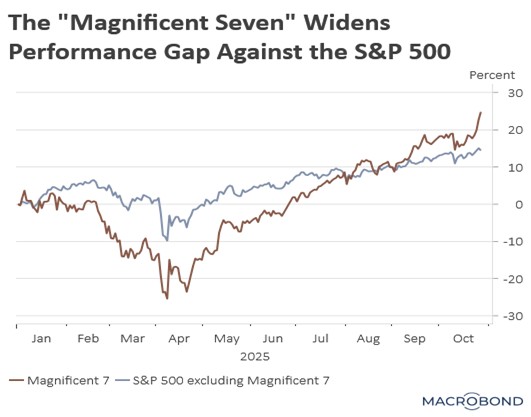

Pullback Concerns: Wall Street leaders, such as David Solomon and Ted Pick, foresee a “healthy” market correction within the next 12-24 months, citing a dangerous divergence between valuation and fundamentals. While corporate earnings are robust, they are being vastly outpaced by exuberant price appreciation. This has created a clear schism where, on one side, there is analytical caution dictated by financial models, while on the other, there is a market psychology driven by unwavering faith in tech’s secular growth.

- Palantir appears to be driving today’s market narrative by serving as a prime example of the current tension in tech. Despite reporting robust earnings and providing strong forward guidance, its stock has declined. This counterintuitive sell-off highlights investor apprehension that a 175% year-to-date rally — and the resulting P/E ratio of 688.49 — has created a valuation that its underlying business performance cannot support, leading to renewed concerns of a sector-wide bubble.

- Historical precedent suggests this weakness is temporary. The Magnificent 7 have a track record of weathering periods of skepticism and early-year underperformance, consistently rallying to fuel broader market gains. In our view, the current negative sentiment mirrors these past episodes and is unlikely to derail the sector’s near-term trajectory.

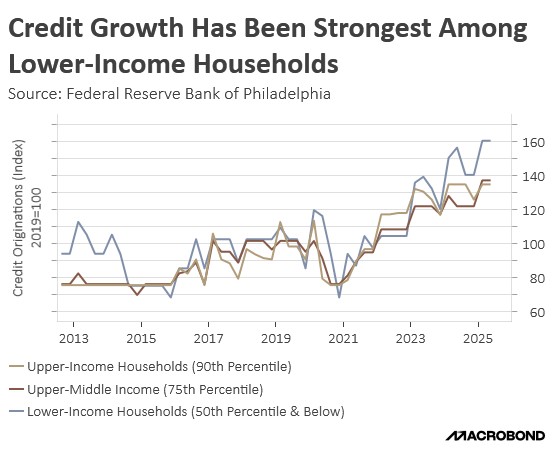

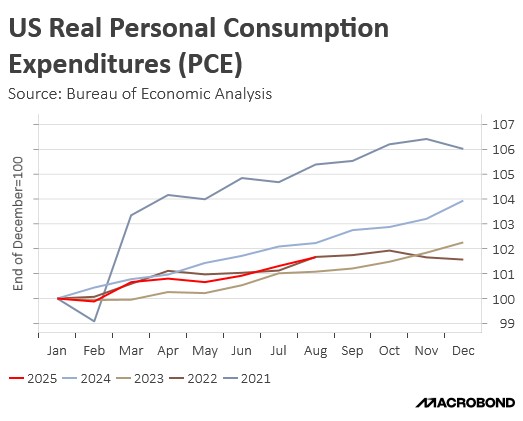

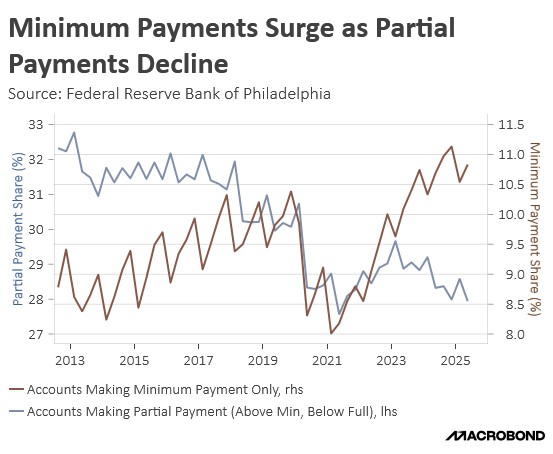

- The case for sustained equity strength is compelling and rooted in a US economy that is demonstrating solid growth. Key data indicates twin engines of growth including unwavering household demand and a landmark acceleration in AI capital expenditure. Meanwhile, a labor market that is normalizing rather than weakening provides crucial stability. Given this combination of persistent demand and transformative investment, we anticipate further market appreciation, albeit at a potentially more selective and moderate pace.

AI Partnerships: The market is paying a lot of attention to the growing interconnectedness of tech companies. On Monday, Amazon Web Services (AWS) announced a multi-year, $38 billion agreement with OpenAI to provide it with massive cloud computing resources. The landmark deal is expected to significantly bolster confidence in AWS’s cloud computing infrastructure as it competes aggressively against rivals like Microsoft, Alphabet (Google), Oracle, and CoreWeave, all of whom are securing similar contracts to power the AI boom.

- Following the announcement, Amazon’s stock surged, a trend mirrored across the broader Magnificent 7 as investors continue to pour money into AI. The primary source of investor confidence is the robust and growing supply chains these firms are building, coupled with significant revenue diversification. This reassures the market that these companies have multiple avenues to justify their lofty valuations.

- Specifically, this move signifies that OpenAI is diversifying its cloud infrastructure beyond Microsoft, a strategic shift as it operates more like a for-profit company rather than a non-profit. Simultaneously, Amazon has solidified its status as a major AI player by securing OpenAI as a client, adding to AWS’s existing partnership with OpenAI’s rival, Anthropic.

- We anticipate a continued flow of strategic deals over the next few months as major tech companies aim to diversify both their revenue streams and supply chains. This proactive diversification is crucial for building resilient AI infrastructure and significantly reducing reliance on any single vendor. While we acknowledge that current tech valuations are elevated, we maintain that companies with strong balance sheets should see sustained momentum.

Government Investments: The White House has announced a series of new funding initiatives aimed at boosting US competitiveness in the commodities and energy sectors. On Monday, President Trump unveiled $100 million in funding for coal-related initiatives, although the specific source of the funds was not clarified. Additionally, the administration has committed $750 million to rare earth startups, a move that will involve the government taking equity stakes in the companies. These actions underscore the government’s growing role in the economy.

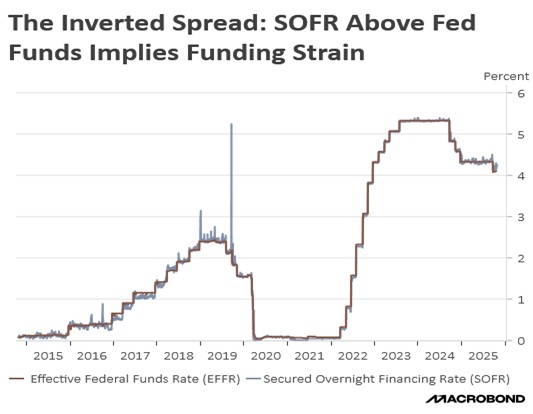

Rate Cut Doubt? Signals from Federal Reserve officials have cast doubt on the likelihood of a rate cut in December, revealing a split in their policy priorities. Chicago Fed President Austan Goolsbee emphasized that his dominant worry is persistent inflation, overshadowing labor market considerations. Meanwhile, Fed Governor Lisa Cook suggested her unease is more focused on the labor market’s health. This divergence creates a lack of clear guidance, which is expected to temper enthusiasm for risk assets as investors prefer the certainty of a dovish pivot.

US-China Trade Relations: In a sign of easing trade tensions, the US and China are moving toward normalizing relations. Chinese officials are expected to resume sales of rare earth metals to the US, while the White House has signaled a greater openness to allowing chip exports to China. These reciprocal gestures are likely to bolster confidence that the trade relationship will not be abruptly severed, even as the risk of future disputes remains. This should offer some support to the broader market.

EU Restraint: The European Union is considering measures to tighten its membership process, aiming to prevent the admission of what it might see as “Trojan horses.” The proposed plan would place new entrants on a probationary period before granting full membership, ensuring they do not backslide on democratic principles after joining. This measure is designed to prevent a repeat of situations like that of Hungary, which, after joining the bloc, subsequently cracked down on free speech.

UK Sentiment Shift: As the UK’s ruling Labour Party prepares to push through more tax hikes, polls show a growing number of young voters are expressing support for a crackdown on crime and benefits. This sentiment highlights the public’s growing dissatisfaction with the government as it struggles to manage the nation’s rising debt. The discontent appears to be fueling a rise in popularity for the Reform UK and Green parties, a sign that the traditional political duopoly is starting to lose favor.

Note: Due to the federal government shutdown, we were unable to update the Business Cycle Report this month. The report will return as soon as we are able to once again access government data.