by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with our analysis of why the Federal Reserve’s balance sheet may now be more critical than its rate decision. We then examine the surge in tech deals as a potential signal of a longer-term trend. Additional topics will include the growing corporate focus on efficiency-driven earnings, progress in US-China trade talks, and a possible setback in the Israel-Gaza truce. We also provide a summary of key international and domestic data releases.

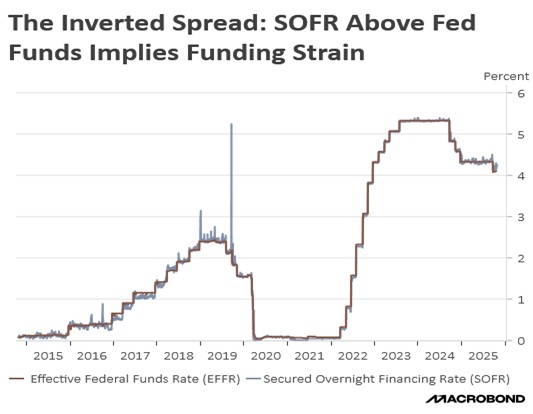

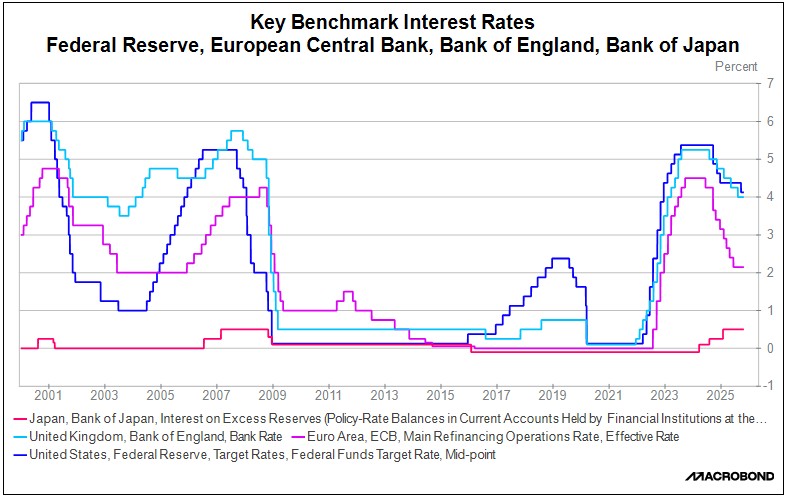

Fed Meeting Primer: While rate cuts have dominated headlines, the market’s focus appears to be shifting to the Fed’s quantitative tightening. A severe liquidity crunch is underway, fueled by a perfect storm of factors: interbank rates breaching the Fed’s target, the Treasury’s rapid refilling of its General Account, and the depletion of the reverse repo facility (RRP). This aggressive drain on system-wide cash is driving up funding costs and threatens to become the primary headwind, structurally undermining the supportive liquidity environment that has powered the recent equity rally.

- The Fed’s signal to conclude quantitative tightening (QT) aligns with its goal of preempting liquidity stress. A key preparatory dynamic has been the drawdown of the RRP. As the Fed’s overnight repurchase agreement rate became less attractive, investors were incentivized to deploy cash into higher-yielding private markets. This process naturally drains liquidity from the RRP and, by doing so, helps the Fed identify the true, underlying level of demand for bank reserves within the system.

- Furthermore, the Fed had already begun to slow the pace of its balance sheet reduction in April. This deliberate slowdown is intended to extend the tightening cycle, allowing reserves to gradually decline from “abundant” to “ample” levels. The central bank’s objective is to execute this transition smoothly to avoid the kind of market disruptions that characterized the September 2019 repo crisis.

- Foreshadowing the current market stress, Fed Chair Jerome Powell had already signaled earlier this month that the central bank was looking to end its quantitative tightening program, which is likely to reduce much of the funding stress and could potentially pave the way for more rate cuts.

- It’s important to note that even with the tightening of liquidity, market stability has held up comparatively well. This resilience is a result of the Fed’s creation of robust liquidity backstops, encouraging banks to increase reliance on the standing repo facility (SRF) and, to a lesser extent, the discount window for immediate funding. As long as there is no abrupt loss of confidence triggering systemic bank runs, we expect the market impact to remain manageable.

Tech Boost: The AI merger and partnership trend continues to affirm the tech rally’s staying power in the equity market. The most notable deal on Monday was OpenAI’s restructuring, which granted Microsoft a 24% stake in the company. This move will make the company more attractive to investors as it shifts to a for-profit entity. Additionally, Nvidia announced a 2.9% equity stake in Nokia, a deal valued near $1 billion. Recent high-profile deals underscore a new era of resource consolidation and strategic alignment across the tech industry.

- These strategic investments have become critical for tech firms aiming to accelerate growth and secure essential resources. They are primarily driven by the need to quickly improve operational synergies and gain rapid access to proprietary technology and specialized talent.

- Through its strategic partnership with OpenAI, Microsoft has secured a pathway to advancements in artificial general intelligence (AGI) — a transformative step beyond current AI. In a similar vein, NVIDIA’s collaboration with Nokia positions it at the forefront of next-generation wireless technology by involving it in the development of 6G cellular services.

- This flurry of activity is driven by the White House’s agenda to spur AI-driven reindustrialization and build a robust US industrial ecosystem. While this initiative fosters unprecedented collaboration, the inherent structure of the AI sector means it simultaneously risks accelerating market concentration, likely cementing the dominance of a few key technology giants.

- We believe tech stocks maintain significant momentum, a trend likely to persist through 2026. Deal-making is expected to shift into higher gear, fueled by tax incentives such as the interest rate deduction provision from the landmark bill passed in July. Although concerns of an AI bubble are valid, we see little evidence suggesting it will burst in the near term.

Jobs and Earnings: The trend of corporate workforce reduction continues as executives prioritize profitability. This week, UPS beat earnings forecasts, crediting its recent layoffs for boosting margins, while Amazon announced further job cuts to drive efficiency through restructuring and AI. These moves confirm our thesis that in an era of sustained pressure from tariffs and rising costs, aggressive headcount reduction has become a primary corporate strategy for stabilizing and growing earnings.

US Al Alliance: The United States and South Korea are expected to finalize an agreement to strengthen their collaboration in key technologies, including artificial intelligence, quantum computing, and 6G. The deal will establish aligned export controls and reduce regulatory burdens for tech companies. This move reinforces our view that the US is seeking to supplement traditional trade relationships with strategic technology alliances as a primary means of maintaining its global leadership.

US-China Trade: In a sign of easing tensions between Washington and Beijing, China has purchased its first cargoes of soybeans this year, indicating a potential recovery in bilateral trade flows. This move follows President Trump’s announcement that he would allow China to have access to Nvidia’s advanced Blackwell chips. These developments reinforce our view that the two sides are moving toward a broader “grand bargain” agreement, a prospect that is likely to provide crucial support to the market.

Canada Looks for Friends: Canadian Prime Minister Mark Carney is following through on his promise to reduce Canada’s economic dependency on the United States by strengthening ties with Asia. During the ASEAN conference in Malaysia, he pursued a free trade agreement between Canada and the 11-nation bloc. This push comes as Canada faces mounting job losses resulting from a trade dispute with the US, which imposed 10% tariffs after the province of Ontario released an anti-tariff advertisement in American markets.

Israel and Gaza: The ceasefire between Israel and Hamas has been severely tested in recent days. On Tuesday, Israeli Prime Minister Netanyahu ordered strikes on Gaza, accusing Hamas of violating the agreement by attacking Israeli soldiers. Although tensions have since cooled, significant concerns remain that the truce may collapse. A renewed escalation in the region could exert upward pressure on global oil prices.