Author: Amanda Ahne

Bi-Weekly Geopolitical Report – China’s Rising Power and the Implications for US Hegemony (October 27, 2025)

by Patrick Fearon-Hernandez, CFA | PDF

In a recent report, we noted that the world is now transitioning away from its 30-year era of Globalization, when the United States mostly embraced its traditional role as global hegemon, i.e., the big, dominant country that provides international security, ensures relative order, and issues the reserve currency. Our previous report showed that the world is now entering a new era of Global Fracturing or, potentially, Chinese Hegemony. In this report, we take a deeper dive into the current US-China balance of power. We show that in all key aspects of power — military, diplomatic, technological, and economic — the balance appears to be shifting noticeably in favor of China. As this monumental shift in international relations becomes more obvious, US leaders and voters are increasingly struggling to decide whether they want to cede hegemony to the Chinese, defend it, or reform it into something that is more “America First.” Whatever they decide, the US role as global hegemon is changing as China’s relative strength increases. We conclude our report by discussing the investment implications of this change.

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Daily Comment (October 27, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with news that US and Chinese officials have struck a “framework” trade deal that President Trump and General Secretary Xi can approve when they meet later this week. Since the deal should help ease US-Chinese tensions, the news has given a big boost to global stock prices so far this morning. We next review several other international and US developments that could affect the financial markets today, including a big midterm election win for Argentina’s libertarian president and new fears that avian flu could boost US price inflation.

United States-China: US Treasury Secretary Bessent and Chinese Vice Premier He said they struck a preliminary trade deal at their latest talks in Kuala Lumpur over the weekend. If so, having the outline of a US-China trade deal could help de-escalate tensions, potentially giving a boost to global risk assets. If President Trump and General Secretary Xi sign off on the deal when they meet on Thursday, officials from both countries would then work to flesh out the details, likely leading to a detailed, final agreement sometime in the coming months.

- Speaking about the preliminary deal in a television interview on Sunday, Bessent said he thought “the threat of the [added]100% tariff [on Chinese imports] has gone away, as has the threat of the immediate imposition of the Chinese initiating a worldwide [rare earths] export control regime.”

- Bessent also hinted that China would commit to restarting large-scale imports of US soybeans. According to Bessent, US soybean farmers are going to be “extremely happy with this deal for this year and for the coming years.”

- We have been arguing that a broad deal that defuses US-China tensions would likely be especially positive for US and Chinese stocks. As of this writing, Chinese stock prices have risen more than 1.0%, while premarket trading suggests US stock prices will rise by more than 0.8%.

United States-Thailand-Malaysia-Cambodia: On the first day of his weeklong trip to Asia, President Trump yesterday said he had struck deals with Thailand, Malaysia, and Cambodia under which they will cooperate with the US on export controls, sanctions and access to critical minerals. However, the deals evidently do not reduce the 19% import tariffs that the Trump administration has already imposed on the countries.

- The deals appear aimed at least in part to weaken China’s ability to leverage its near monopoly on critical minerals and other trade advantages.

- All the same, it’s not clear if the new deals were helpful in reaching the US-China framework deal mentioned above.

United States-Canada: President Trump on Saturday said he’ll impose an additional 10% tariff on imports from Canada to punish it for US television ads placed by the province of Ontario that featured anti-tariff audio by President Reagan. Current US tariffs haven’t been applied to Canadian goods compliant with the US-Mexico-Canada trade deal, so about 85% of Canadian imports are duty-free, with the rest subject to the administration’s new tariff of 35%. It isn’t yet clear whether the new 10% tariff will apply even to USMCA-compliant imports.

Argentina: In legislative elections yesterday, preliminary results show President Milei’s libertarian Liberty Advances party came in first with 40.8% of the vote, beating the Peronist opposition alliance with 31.7%. The results should help calm fears of a Peronist resurgence, which sparked a run on the peso last month and prompted the US to offer a bailout centered on a $20-billion currency swap facility. Reflecting renewed confidence that Milei can keep pushing through his reforms, Argentina stock, bond, and currency values are surging so far today.

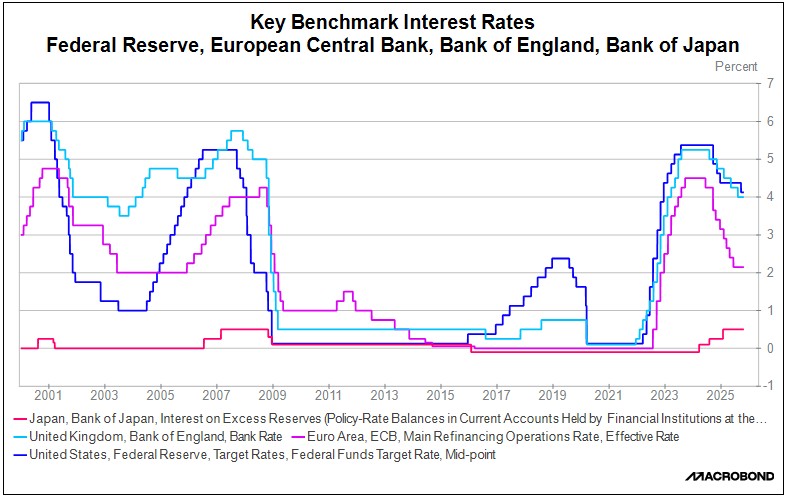

US Monetary Policy: The Federal Reserve tomorrow begins its latest two-day policy meeting, with the decision due on Wednesday at 2:00 PM ET. Based on interest-rate futures prices, investors are nearly unanimous in expecting the policymakers to cut their benchmark fed funds rate by 25 basis points to a range of 3.75% to 4.00%. Investors will also be looking for confirmation that the officials will keep loosening policy in the coming months, as we expect, during the policy statement and Chair Powell’s post-decision news conference.

US Consumer Price Inflation: Agriculture and public health officials say avian influenza is surging in commercial flocks and herds this fall, raising the prospect of renewed tight supplies and higher prices for eggs and other farm products. Wholesale turkey prices are reportedly already up 40% year-over-year, just a month before the Thanksgiving holiday. An additional risk this time around is that the US Department of Agriculture may be understaffed to respond to the crisis if the flu continues to spread.

Eurozone: In contrast with the Fed, the European Central Bank’s policy committee is widely expected to hold its benchmark interest rate unchanged at 2.0% when it meets later this week. That would mark the third straight meeting at which the ECB held its benchmark rate steady, reflecting ECB chief Lagarde’s desire to keep rates on hold for an extended period now that the institution has struck a balance between modest economic growth and lower price inflation.

Italy: Prime Minister Meloni’s plan for a 13.5-billion EUR ($15.7 billion) bridge to connect the Italian mainland to Sicily appears to be hitting a legal roadblock after a court questioned whether the mothballed project — which held its first tender in 2005 — can be restarted without a new tender. If Meloni can pull off the project, it is expected to provide a significant boost to Italy’s economy. Since the bridge could also conceivably aid military mobilization, Rome has also floated it as a boost to Italy’s defense spending to help appease US demands.

Japan: As investors, we all fear bear markets. But what about real bears? Because of factors ranging from its declining population to climate change, Japan is suffering from a spate of bear attacks, with a record nine people killed by the animals so far this year, including one killed and four injured just on Friday. We don’t know about you, but we’ll take the occasional bear market in stocks over a bear mauling any day of the week!

Daily Comment (October 24, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment opens with a discussion about the deepening trade dispute between the US and Canada. Then, we break down what’s at stake as the US and China head back to the negotiating table. Also in today’s report: Washington’s push to maintain calm in Israel, the EU takes aim at an American tech giant, and France debates a new wealth tax. Plus, we’ll give you a quick update on all the key economic data you need to know including the latest CPI data.

Canadian Trade Tensions: The White House has announced the termination of trade talks with Canada, justifying the decision by citing the need to maintain tariffs for economic and national security reasons. This move is widely seen as a direct response to a Canadian advertising campaign that aired last week. The ads, which appeared in several US markets and on social media, invoked the voice and legacy of Ronald Reagan to challenge the tariffs and sway American public opinion.

- The trade standoff between the US and Canada is redefining their relationship following the imposition of tariffs at the start of 2025. The United States has placed tariffs on a number of Canadian goods, specifically targeting the steel and auto industries. In response, Canadian Prime Minister Mark Carney has declared that the country will seek to double its non-US exports, stating that Canada can no longer rely on its southern neighbor as a dependable trade partner.

- This ongoing friction between the two neighbors arises as the US, Canada, and Mexico are in the process of renegotiating the USMCA trade agreement. A key suspected goal of this renegotiation is to forge a unified North American front against China and other trade rivals to protect domestic industries. From this perspective, the White House likely viewed the Canadian ad campaign as undermining that very objective, prompting the decision to terminate talks.

- Although the recent US-Canada dispute represents a setback, we suspect both sides will eventually return to the negotiating table, as significant mutual interests remain at stake. Canada’s economy avoided a recession in recent quarters, and lawmakers are likely to seek ways to build on that momentum. Concurrently, the United States has an incentive to reduce economic uncertainty heading into next year’s midterm elections.

- This response establishes a precedent, signaling the administration’s intent to aggressively counter foreign attempts to influence domestic policy and elections. We should expect a more confrontational stance from the White House, particularly if it believes rival nations are using the midterms to sabotage its policy agenda. Consequently, markets should brace for episodic volatility stemming from trade policy tensions, though these are unlikely to derail the broader market trend.

US-China Trade Truce? On Friday, the US and China are scheduled to hold talks in Malaysia during the ASEAN Summit. The discussions are expected to pave the way for a broader meeting between President Trump and President Xi Jinping at the APEC Summit next Thursday. In advance of these talks, the White House has indicated it may extend the deadline for certain tariff exemptions as a goodwill gesture. Markets have reacted positively to the news, reflecting optimism that the extension could help build momentum toward a more comprehensive trade agreement.

- While the administration’s public focus is on tangible trade outcomes with China — such as an improved agreement, curbing the fentanyl trade, and ending restrictions on rare earth elements — its strategy appears to be driven by broader, unstated geopolitical ambitions.

- One key objective is to enlist China’s help in restraining some of its allies, namely Russia and Iran. The United States hopes Beijing can use its influence to discourage both countries from engaging in hostile actions against US allies and partners, particularly Russia’s ongoing war in Ukraine and Iran’s nuclear ambitions, which are viewed as a direct threat to Israel.

- In exchange for cooperation, China is likely to demand significant concessions from the United States. These would almost certainly include a reversal of the US stance on recognizing Taiwan’s sovereignty and a removal of curbs on technology exports to China.

- We believe the coming week or so will be important for setting market direction. Greater clarity on US-China trade relations should boost confidence and offer support for equities. While we do not anticipate a major deal being finalized in this short timeframe, we suspect there should be measurable progress toward a larger agreement, possibly materializing in early 2026.

Vance Goes to Israel: A White House visit to Israel to oversee the next phase of its peace initiative has been complicated by diplomatic tensions. Vice President Vance sparked controversy by calling a vote to annex the West Bank “stupid,” while the administration has expressed frustration over Israel’s airstrikes and restrictions on humanitarian aid, even as it acknowledges Hamas’s provocations. While we believe the US presence is easing regional tensions, we are closely watching to see whether Washington may be drawn into a deeper role.

EU vs Silicon Valley: The EU has accused Meta of failing to adequately police illegal content on its platforms, signaling a potential fine for violations of the Digital Services Act. This move is likely to provoke a response from the White House, which has previously criticized the EU for unfairly targeting US tech companies with hefty fines. Any retaliatory action by Meta could, in turn, prompt a reaction from Washington, escalating transatlantic trade tensions.

US Arms Race: The United States is taking steps to enhance its weapons capabilities to maintain military dominance against China. On Thursday, the Pentagon agreed to a defense contract with startup Castelion to develop hypersonic missiles. These weapons, which can maneuver while traveling at speeds several times that of sound, are designed to broaden US striking power and modernize its artillery arsenal. This partnership is a key part of a broader initiative to field this game-changing technology.

France Wealth Tax: The French Socialist Party is threatening to topple the government if the prime minister does not include a wealth tax in his budget proposal. The party is a crucial voting bloc, having just sustained the government in a recent no-confidence vote. While the bill is expected to affect only approximately 1,800 households with assets exceeding $100 million, critics warn it could prompt an exodus of wealthy individuals from the country. This debate exemplifies the profound political challenges involved in passing the national budget.

Turkish Courts Intervene: A Turkish court’s dismissal of a case against the main opposition CHP has removed an immediate threat to its leader, Özgür Özel. While this decision spurred a rally in Turkish markets, the underlying political climate remains fraught. The recent conviction of Istanbul Mayor and presidential frontrunner Ekrem İmamoğlu on corruption charges underscores why, despite this legal reprieve, Turkey’s political risk profile remains elevated.

Daily Comment (October 23, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment section opens with an unraveling of the reasons behind the market’s recent breather. This is followed by a crucial look at US monetary policy, specifically analyzing how scant jobs data could constrain the Federal Reserve’s next interest rate decision. We also discuss a major quantum technology breakthrough, the latest in the US-China trade escalation, and North Korea’s weapons advancements. Finally, we provide a concise summary of the day’s essential US and global economic indicators.

Rally Cools: While many companies reported strong earnings, high-profile disappointments from several key players raised red flags. Tesla, for instance, saw record vehicle sales undermined by shrinking profit margins, fueling doubts about its adaptability in a less EV-friendly environment. Similarly, Netflix fell short of earnings targets, largely attributed to a regulatory dispute in Brazil, while Texas Instruments dampened sentiment with a pessimistic forward outlook.

- The market’s narrow focus reflects heightened anxiety over a lack of economic data due to the government shutdown, which has severely hampered the ability to assess the economy’s health. This is particularly concerning amid rising fears about consumer strain and a potential credit crunch. Auto loan troubles at firms like First Brand and Tricolor, coupled with mounting fears that small lenders are carrying a significant amount of bad debt on their books, has largely driven this anxiety.

- Investor confidence in the economy has been heavily reliant on the remarkable resilience of the consumer. Against all odds, consumer spending has consistently defied recessionary warnings, weathering several significant scares over the past three years — from the collapse of Silicon Valley Bank in 2023 to the triggering of the Sahm Rule in 2024 and the ongoing pressures of this year’s trade war.

- Thursday’s market action reflects a market in search of its next catalyst due to the lack of government data. We attribute the recent dip in sentiment to routine profit-taking following several strong quarters and view it as a temporary consolidation. We expect a more definitive market direction to emerge after the upcoming US-China trade talks and the Fed’s policy meeting. We believe that these two catalysts will ultimately provide a supportive backdrop for equities.

Central Bank Data: The Federal Reserve is now operating with a reduced level of vital information following a dispute that led private payroll processor ADP to halt its data sharing. ADP, which tracks payroll for approximately 20% of the US labor force, provided a crucial, high-frequency gauge of the job market. This data loss is particularly challenging now, as the government’s official labor reports are unavailable due to the shutdown, severely complicating the Fed’s ability to accurately assess the job market.

- The dispute stems from comments made by Fed Governor Chris Waller, who cited preliminary ADP estimates — before their public release — to justify his cautious outlook on the economy. This unusual disclosure inadvertently raised concerns (later debunked) that ADP was sharing proprietary client-level information, prompting the company to terminate the data feed.

- This data shortfall arrives at a critical juncture, amplifying a deep policy split among Fed officials regarding their dual mandate. One faction is advocating for accommodative policies to counteract persistent signs of labor market weakness. The opposing group, however, argues that rising price pressures — exacerbated by the effect of tariffs flowing through the economy — demand a cautious stance to prevent fueling inflation, making rate cuts ill-advised at this time.

- The absence of reliable ADP data, which has historically tracked the long-run employment trend despite short-term differences from monthly government figures, makes resolving the Fed’s internal policy debate considerably more difficult. However, clarity is expected tomorrow with the release of the Consumer Price Index (CPI) report. A softer-than-expected inflation reading would likely pave the way for the Fed to pursue another rate cut at its October 28-29 meeting.

Quantum Leaps: Alphabet, Google’s parent company, has announced a quantum computing breakthrough: It has successfully executed a novel algorithm on its “Willow” chip that outperformed the world’s leading classical supercomputers by a staggering 13,000%. This milestone bolsters the conviction that practical quantum technology could be within reach in five years, with near-term applications expected to revolutionize drug discovery and materials science. The achievement also reinforces the US’s dominant technological lead over China.

New US Curbs: The White House is threatening to impose extensive new curbs on software exports to China, a powerful countermeasure to Beijing’s recent restrictions on rare earth elements. This policy debate intensifies trade friction ahead of the preparatory trade talks scheduled for Friday in Malaysia, which precede the anticipated meeting between President Trump and President Xi Jinping in South Korea. Despite trade tensions, we remain optimistic that the two sides will come to an agreement.

Russia Sanctions: Following a recent breakdown in talks with Moscow, the White House is significantly escalating sanctions against Russian oil companies. The US is directly targeting oil giants Rosneft and Lukoil, which together account for 5% of global output. This move has contributed to a broader increase in oil prices. The sanctions are intended to cripple Russia’s ability to finance its war efforts and pressure the Kremlin back to the negotiating table.

US Drug Clash: The United States is intensifying its efforts against organizations it designates as narco-terrorists, extending its operational reach from the Caribbean into the Pacific. This new, more hawkish posture was demonstrated by two recent US military strikes on suspected narcotics vessels. While the current justification is disrupting the drug trade, this escalation in military force could set a precedent for armed intervention for other purposes in the future.

North Korea Weapons: North Korea has announced the successful test of a new hypersonic weapon, signaling significant advances in its weapons technology. These missiles are designed to travel at such high speeds that they are virtually undetectable by current missile defense systems, making them extremely difficult to intercept. The announcement comes as world leaders prepare to gather in South Korea for the APEC conference, a timing that underscores North Korea’s intent to project strength and military prowess to its rivals.

Daily Comment (October 22, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment section opens with a deep dive into the recent drop in gold prices and its stark implications for US-China trade tensions. We then explore the potential pathway to persuading Russia to end the war in Ukraine. Closer to home, a strong earnings season and a landmark AI deal could signal robust market momentum, while in the EU, there is mounting pressure to recalibrate climate strategy. As always, we include a summary of key economic indicators from US and global markets.

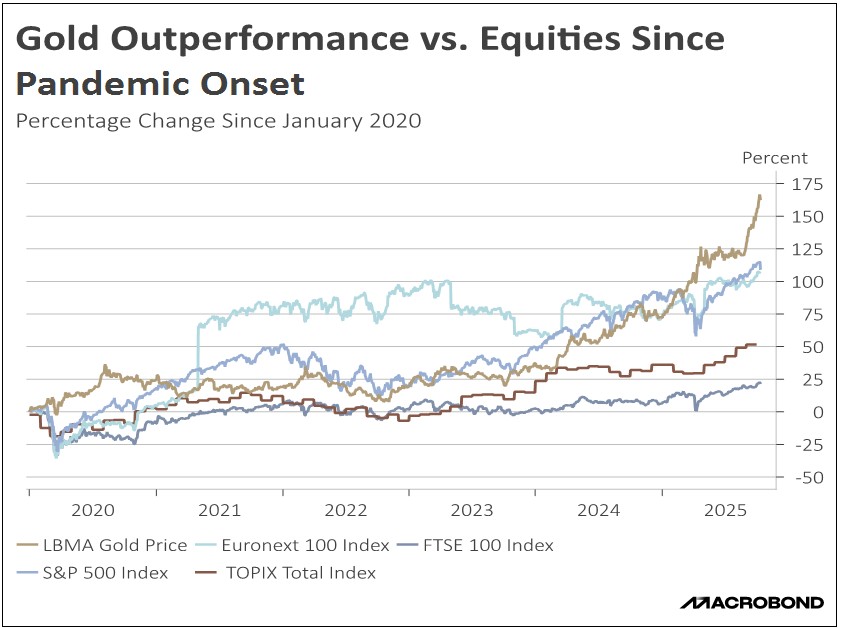

Gold Retreat: Precious metals, including gold and silver, sold off as the de-escalation of US-China trade tensions reduced the appeal of safe-haven assets. This decline was amplified by the post-Diwali lull in Indian demand and widespread concern that the metals were overbought, triggering significant profit-taking. While the retreat from gold and silver signals investors are shifting away from safe havens, the lack of a corresponding surge in equities suggests lingering investor caution.

- The market’s hesitation to embrace riskier assets reflects a standoff-ish posture as investors await for more details about US-China trade negotiations. This hesitation persists despite the White House’s upbeat remarks on Tuesday, expressing confidence in reaching a “fantastic deal.” Yet, skepticism lingers, with no meeting date set and the President Trump implying he will only attend if the talks show real promise of progress.

- The White House has indicated that it will seek a deal that includes provisions on rare earth exports, measures to curb the flow of fentanyl, and the resumption of US soybean purchases. In exchange, Washington could offer tariff relief. There has also been speculation that the US could soften its stance on Taiwan, particularly after the president suggested that Beijing is not currently inclined to pursue an invasion.

- We continue to anticipate a meeting between the two sides at the upcoming ASEAN Summit in Malaysia, ahead of the crucial November 1 tariff deadline. Our base case projects a minimal consensus with a commitment to extend negotiations supported by reciprocal minor concessions. Failure to achieve even this minimal step toward de-escalation, however, would likely serve as a negative catalyst, prompting immediate short-term profit taking across various market sectors.

- That said, a successful meeting yielding a “grand bargain” between the world’s two largest economies would be a highly positive event for markets. We believe this agreement would center on Chinese assurances regarding rare earth exports and a commitment to major purchases of American agricultural products. This outcome would provide a significant boost to both Chinese and US equities, with technology stocks and the US agricultural sector poised for the greatest immediate sectoral benefits.

No Putin Meeting: A high-stakes meeting with Russian President Vladimir Putin in Budapest is now off the table, the White House has confirmed. The decision to halt talks comes after Russia offered no reassurances regarding an end to its invasion of Ukraine, leading the US to conclude that the discussion would be unproductive. This cancellation follows reports of internal US debates, including a recent reversal on sending Tomahawk missiles to Ukraine and rumors of possibly pressing Kyiv for more territorial concessions to secure a deal.

- Two structural factors entrench the conflict’s persistence: a strategic imperative for Putin to obtain a definable victory that legitimizes the invasion’s staggering costs, and the Russian economy’s absorption of war-related production as a key driver of growth. Therefore, the war may be prolonged, as its continuation is directly tied to fulfilling these core strategic and economic objectives.

- While the path to ending the war is challenging, the US retains significant leverage. In addition to sanctions relief, a potent bargaining chip is the unsold, frozen Russian state assets, which could be used as a strategic tool in negotiations. Furthermore, Moscow may be incentivized by the potential for a diplomatic off-ramp, specifically the opportunity to re-establish a closer relationship with the US and secure a pathway for re-engagement with the European Union.

- Recent overtures point to potential avenues for de-escalation. For instance, Moscow has recently floated the idea of an Arctic tunnel connecting Russia and the US across the Bering Strait. On the European side, some speculation persists that the conclusion of the conflict could lead to a significant policy shift in Germany. This includes the possibility that a future German government might reconsider the Nord Stream 2 gas pipeline project.

- While the suspension of talks suggests a pushback on the immediate ceasefire timeline, we maintain an optimistic view that the conflict could be resolved by early 2026, if not sooner. A definitive end to hostilities is expected to be a strong catalyst for European equities. Conversely, the anticipated full resumption of Russian energy (oil, gas, and coal) flows to international markets would likely create significant downward pressure on global commodity prices.

Earnings Season: With only a fraction of S&P 500 companies having reported, the earnings beat rate (the percentage of companies surpassing consensus EPS estimates) this quarter is the highest in over four years. This outcome defies even high initial expectations and suggests better-than-anticipated corporate fundamentals. The primary pillars supporting this profit strength are robust consumer spending, expansive investment in AI technology and infrastructure, and the flow-through effects of ongoing federal deficit spending.

US-India Trade Deal: A pending US-India trade agreement aims to dramatically lower tariffs on Indian goods, cutting them from around 50% to 15-16%. The deal is part of a broader strategic bargain. In return for this tariff relief, India will reduce its reliance on Russian oil and increase imports of American non-GMO corn and soymeal. Successfully concluding this pact would mark a significant diplomatic achievement for the White House, demonstrating its capacity to broker deals that advance both economic and foreign policy objectives.

EU Under Pressure: The United States and Qatar have joined forces to pressure the European Union to revise its proposed climate regulations. The push comes as EU lawmakers debate legislation that would fine companies up to 5% of their global revenue for supply chain practices that harm the environment or violate human rights. Washington has warned that the measure could undermine economic growth and jeopardize the trade agreement reached with the EU in July.

Anthropic and Google: A major rival to OpenAI is negotiating a deal with Google for its cloud computing services. The agreement would grant Anthropic access to Google’s Tensor Processing Units (TPUs), which are specifically designed for machine learning workloads. This move comes as one of its largest suppliers, Amazon, is contending with outages of its cloud services. The deal reinforces an industry trend of heavy spending to build AI supply chain resiliency, while also highlighting the intensifying competition for dominance in AI infrastructure.

Japan Stimulus: Newly appointed Japanese Prime Minister Sanae Takaichi is proposing a targeted economic package to counter rising inflation. The proposal, which aims to mitigate rising costs of living, is believed to center on direct subsidies for winter energy bills and grants to local governments. Deliberately avoiding the broad stimulus spending that has unnerved financial markets, Takaichi’s strategy emphasizes targeted expenditures. However, key questions regarding the package’s total cost and financing have yet to be clarified.

Daily Comment (October 21, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with confirmation that the Japanese parliament has formally approved Sanae Takaichi as Japan’s first female prime minister. We next review several other international and US developments with the potential to affect the financial markets today, including a big corporate finance scandal in emerging-market darling Vietnam that has sharply pushed down its stock prices and an adjustment to the US administration’s new $100,000 fee for H1-B visas that will greatly limit its impact on the labor market.

Japan: As we flagged in our Comment yesterday, the Diet today has confirmed the ruling Liberal Democratic Party’s leader, conservative Sanae Takaichi, as the country’s first female prime minister. Takaichi is expected to push for strong ties with the US, a bigger defense budget, deregulation, and a return to stimulative “Abenomics” policies. However, her new coalition partner, the right-wing Nippon Ishin no Kai (Japan Innovation Party), is expected to resist overly loose fiscal and monetary policies and push idiosyncratic policies such as decentralization.

- Takaichi immediately named her cabinet, including Japan’s first female finance minister. In an effort to help unify the LDP, she also named several of her rivals in the recent party leadership race to positions in the government.

- Reflecting investor excitement and optimism about Takaichi, Japanese stock price indexes yesterday rose to a new record high, although they more recently have given up some of their gains.

Vietnam: The country’s main stock price index plunged 5.5% yesterday after a Friday report by government inspectors noted multiple irregularities in $17 billion of corporate bond issues from 2015 to 2023. The investigators also referred Novaland, one of Vietnam’s biggest property developers, to police for a criminal investigation. The scandal is a major fly in the ointment given that FTSE Russell lifted Vietnam from “frontier” status to “emerging market” just this month. Before yesterday, the main stock price index had been up 25% in dollars for the year-to-date.

United States-Australia: President Trump and Australian Prime Minister Albanese yesterday signed a deal designed to cut US dependence on Chinese critical minerals. Under the deal, the US and Australia will both invest $1 billion to develop Australian mines and processing facilities for unspecified critical minerals, while also supporting billions of dollars of private investments into the sector. The deal also involves minimum purchase prices for the mineral products to help incentivize the investments — a move that has helped spark intense investor interest in the sector.

- Trump also confirmed his support for the AUKUS submarine deal, under which the US and the UK are helping Australia develop a fleet of nuclear-powered submarines to bolster its defenses against China.

- The AUKUS deal is seen as a critical project to leverage Australia’s geographic location near China, but critics have worried that it will strain the beleaguered US shipbuilding industry, which is struggling to deliver submarines to the US Navy on schedule.

US Labor Market: US Citizenship and Immigration Services yesterday said the White House’s new $100,000 fee for H1-B visa applications would only apply to those seeking initial visas from outside the country. That’s likely to sharply narrow the impact of the new fee and allow many current visa holders who are already working or studying in the US to remain. The narrower policy probably stemmed at least in part from lobbying by companies worried that they would be left without qualified workers in technology and other fields.

European Union: The European Commission’s top health official, Olivér Várhelyi of Hungary, is under increasing pressure to resign over accusations that he helped the Hungarian government run a network of spies at EU institutions in Brussels. If the accusations are correct, they highlight just how bad the tensions have become between the EU and Hungary’s right-wing populist leader, Prime Minister Viktor Orbán, who is pushing against a number of EU initiatives in areas such as rule of law and relations with Russia.

Germany: In a sign of what could be coming for US and British investors, Deutsche Bank and other retail financial institutions in Germany have begun offering private equity funds to small investors. For example, Deutsche’s fund only has a 10,000 EUR ($11,600) minimum investment and merely requires that clients hold at least 200,000 EUR ($232,200) in assets with the bank. The US and UK are also working to change their retirement finance rules to allow everyday investors to invest in private equity, largely reflecting private equity firms’ difficulty in raising new capital.

United Kingdom: New data shows net borrowing by the UK government in the first half of the fiscal year (April through September) totaled 99.8 billion GBP ($133 billion), a record high excluding the pandemic year of 2020. Borrowing in the first half was 7.2 billion GBP ($9.6 billion) more than forecast and 11.5 billion GBP ($15.4 billion) higher than in the same period in 2024. The heavy borrowing reportedly reflects tepid economic growth and high costs. The burgeoning debt creates further pressure for the government to impose new taxes during its budget review in November.

Argentina: Despite the US Treasury buying some $400 million of Argentine pesos (ARS) since October 9 and offering a $20-billion swap line, the currency has continued to depreciate and yesterday fell 1% to a new record low of 1,477 per dollar. The continued decline in the peso suggests the unusual US intervention in support of the currency is so far proving ineffective. The peso, therefore, could keep weakening up until Argentina’s midterm elections on October 26, when libertarian President Milei is likely to fall short of earlier expectations for big legislative gains.

Daily Comment (October 20, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with news that Japan’s ruling party has struck a coalition deal that will allow conservative and investor favorite Sanae Takaichi to become the new prime minister. We next review several other international and US developments with the potential to affect the financial markets today, including a slowdown in Chinese economic growth and news of a major internet outage at Amazon Web Services that we suspect could be Chinese retaliation for US cyberattacks.

Japan: Reports yesterday said the ruling Liberal Democratic Party and upstart right-wing party Nippon Ishin no Kai (Japan Innovation Party) have broadly agreed to form a coalition government, setting the stage for Sanae Takaichi, the conservative leader of the LDP, to be voted in as Japan’s new prime minister tomorrow. Ishin will reportedly support Takaichi for prime minister but won’t have any cabinet positions in her government, Nevertheless, Takaichi’s stimulative economic proposals, which have made her an investor favorite, may have to be watered down to keep Ishin’s support.

China-United States: Amazon Web Services (AWS) early today suffered a major technology issue that disrupted internet services to thousands of major US companies, including Facebook, Venmo, and United Airlines. AWS hasn’t tied the outage to a cyberattack, but we note that the outage came just days after Beijing accused the US of launching cyberattacks against its National Time Service Center. According to AWS, the disruptions occurred in its data centers in northern Virginia, near Washington, suggesting China may have launched the attack to send a message.

- China’s National Time Service Center is affiliated with the Chinese Academy of Sciences and is responsible for generating and distributing China’s standard time.

- The NTSC also provides highly precise timing services for the country’s communications, finance, power, transport, mapping and defense sectors. Therefore, if the US really did attack the NTSC, it would represent a major threat to many of China’s key national systems and industries.

- By launching a retaliatory attack against AWS in northern Virginia, which is not only on the doorstep of Washington, DC, but also home to the Central Intelligence Agency, China could be sending a strong message that it will strike back against any US cyberattacks. Of course, this would add to the current US-China tensions over trade and could even more the current trade talks between the two countries harder.

China-Netherlands: After the Dutch government recently seized control of China-owned semiconductor firm Nexperia in response to US sanctions on the company, as we detailed in our Comment last week, reports over the weekend said Nexperia’s China unit told its workers to ignore directives from the company’s Netherlands-based managers. The move suggests China will fight back against the Dutch seizure. It also suggests that the US’s new, broader sanctions against China could mean that other firms in third-party countries could be caught in the crossfire.

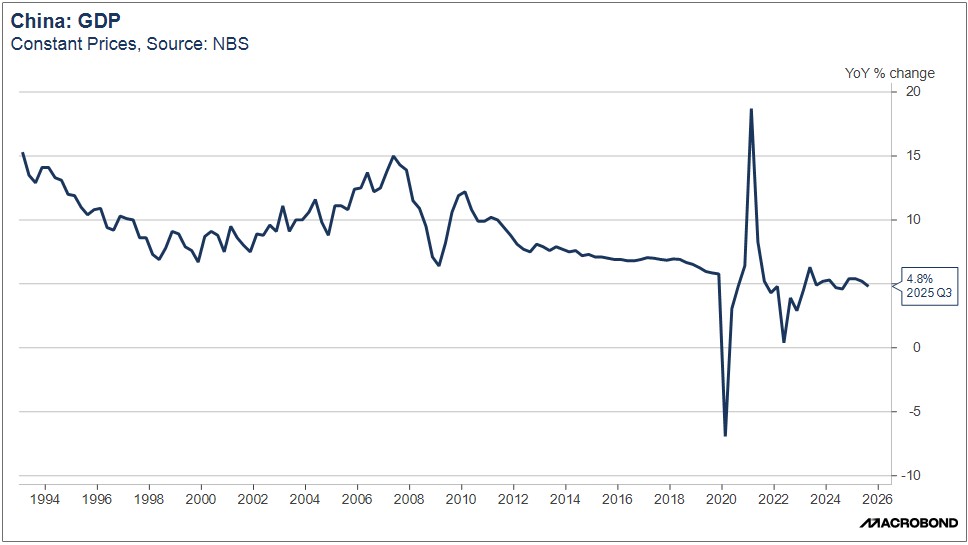

Chinese Economy: According to newly released official data, Chinese gross domestic product in the third quarter was up just 4.8% from the same period one year earlier, slowing from the 5.2% increase in the year to the second quarter. The report suggested that the slowdown stemmed mostly from weaker consumer spending and slower investment, despite government stimulus programs. All the same, the average growth rate over the first three quarters of 2025 stood at 5.2%, staying on track to meet the government’s target of about 5.0% for the year.

Chinese Digital Currencies: The People’s Bank of China and the Cyberspace Administration of China have reportedly told several Chinese technology companies not to move forward with their plans to issue stablecoins under a new Hong Kong program. The affected firms include Alibaba-backed Ant Group and ecommerce group JD.com.

- The regulators evidently believe the tech firms are moving too fast to develop what would essentially be their own currencies, which would compete with the PBOC’s plan to issue its own digital currency.

- The move suggests stablecoins will face higher barriers in China than they are likely to face in the US. In turn, that highlights how the world is increasingly bifurcating between US and Chinese developments.

France: Wealth managers, bankers, and lawyers told the Financial Times that wealthy French citizens concerned about the fractured politics in their country have been shifting large amounts of their investments to Luxembourg annuities and safe-haven assets in Switzerland. Even though Prime Minister Lecornu survived a no-confidence vote in parliament last week by watering down President Macron’s signature pension reform, the government’s position remains tenuous, suggesting further capital flight and continued headwinds for French stocks and bonds.

Russia-Ukraine Conflict: A Ukrainian intelligence report based on captured Russian documents shows that the Kremlin’s forces suffered 281,550 casualties in the first eight months of 2025, or an average of 1,159 per day. The casualty count consisted of 158,529 wounded (652 per day), 86,744 killed (357 per day), and 36,277 missing or captured (150 per day). The figures suggest that Russia continues to lose enormous numbers of troops for only limited territorial gains, raising questions about President Putin’s willingness or ability to keep fighting so hard.

- Throughout the modern era of projectile warfare, the ratio of wounded to killed in battle has been remarkably steady at around 3 or 4 to 1. Defense economics nerds (like myself) typically attribute that ratio to the fact that only 20% to 25% of the surface of the human body covers vital organs. Arrows, bullets, or shrapnel striking the body at random are therefore several times more likely to merely wound rather than kill.

- If Russia’s data is correct, the country’s ratio of wounded to killed this year is only 1.83:1, suggesting a much higher-than-expected share of soldiers who were killed. That’s especially striking since modern body armor worn over the vital organs of the torso would suggest a smaller proportion of troops should be killed. It’s not clear why Russia’s ratio seems out of whack, but it could speak to the Russian military’s reputation for callousness toward its own troops and its willingness to use them as “cannon fodder.”

Canada: In an interview with the Financial Times, Industry Minister Mélanie Joly said her new industrial strategy to create jobs and attract more foreign investment would include steps to get Canadian pension funds to invest more of their portfolios at home. According to Joly, the moves are part of a new embrace of “economic nationalism,” which aim to reverse the longstanding trend of Canadian institutions investing less and less in Canada itself. We suspect the moves would create only very marginal headwinds for US stocks or the greenback.

Bolivia: In elections yesterday, centrist Senator Rodrigo Paz won the presidency with about 55% of the vote, ending two decades of rule by the socialists. Paz reportedly appealed to voters by promising stronger ties with the US and more investment in the country’s lithium mining sector. If Paz is successful in rebuilding Bolivia’s ties with the US, it would mark a stark turnaround from the socialists’ courting of US adversaries, such as China, Iran, and Venezuela.

Asset Allocation Bi-Weekly – The Debasement Hedge: A Tale of Two Safeties (October 20, 2025)

by Thomas Wash | PDF

The surge of gold past the $4,000-per-ounce level in October marks a definitive pivot in market behavior. Unlike past rallies driven by stock market fear, the current move is distinctly characterized by a structural rotation away from sovereign debt and toward tangible assets. This is not a simple risk-off move. Instead, investors are executing a sophisticated dual strategy of maintaining a critical allocation to equity momentum while actively using gold as the premier defense against systemic threats, specifically fiat currency debasement and sovereign debt risk.

This strategic pivot is rooted in three primary policy-driven anxieties: massive sovereign debt issuance, persistent inflationary pressures, and the weaponization of the US dollar. The extraordinary fiscal stimulus unleashed during the pandemic, while cushioning the immediate economic shock, led to an unprecedented accumulation of public debt and entrenched higher inflation. Together, these developments have eroded confidence in fiscal governance, as is evidenced by rising government borrowing costs and mounting concerns over long-term debt sustainability.

Confidence deteriorated further after Russia’s invasion of Ukraine. The coordinated Western move to weaponize the dollar as a financial sanction tool undermined its perceived neutrality as the global reserve asset. The episode crystallized a new risk that access to the dollar system could be constrained by geopolitics. In response, many central banks — particularly in emerging markets — have accelerated gold accumulation as a reserve diversification strategy, signaling a gradual but consequential retreat from pure fiat dependency.

Yet the flight to safety has not been uniform. Equities, especially high-quality large cap stocks, have also benefited from safe-haven inflows. Investors are directing capital into US technology giants for their robust earnings power and balance sheets, and into European pharmaceutical and defense firms for their resilience and defensive characteristics. This reflects a redefinition of safety as select equities are viewed not merely as growth vehicles but as durable stores of value capable of navigating structural volatility.

The relative performance of equities versus gold reveals this nuanced dynamic. When measured in gold terms, European equities briefly outperformed in 2021, a trend reversed by the war in Ukraine. US equities have since maintained steadier ground buoyed by comparatively stronger growth, though their relative strength has softened amid tariff-related tensions. Since 2020, US and European equities have traded largely in line in gold terms, suggesting that gold’s continued dominance will hinge on currency dynamics. A bullish dollar would likely favor US equities, while a bearish dollar could tilt the advantage toward Europe.

Gold’s historic rally thus signals more than inflation hedging — it also represents a crisis of confidence in the traditional financial order. Yet, the simultaneous preference for resilient equities underscores an important nuance: investors are not abandoning growth but recalibrating their definition of safety. Gold and select large cap stocks now operate as complementary safe havens, with the former guarding against systemic and currency risks, while the latter preserves value through corporate strength and adaptability.

Ultimately, the long-term interplay between these two pillars will serve as a barometer of market confidence. Gold will remain the preferred store of value as long as fiscal fragility and geopolitical instability persist. Conversely, a sustained stabilization of the US dollar coupled with credible fiscal consolidation could reignite a stronger rotation toward equities. Until that shift materializes, gold’s record valuation reflects a market structurally repositioned for a more volatile and less predictable financial era.