Author: Amanda Ahne

Daily Comment (October 17, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment opens with a deep dive into emerging credit quality concerns that could signal vulnerability within the financial system. We then pivot to US diplomacy, assessing the latest efforts to broker a resolution in Ukraine. Our coverage also unpacks two key energy and trade updates: the extended tariff exemptions for automakers and the revived debate over the Keystone Pipeline. We also include a summary of key economic indicators from US and global markets.

More Credit Concerns: New concerns of financial stress have emerged. Western Alliance and Zions Bancorporation disclosed instances of fraud within their loan portfolios, specifically where non-defaulted borrowers improperly accessed funds. The primary concern centers on the insufficient level of collateral used to back these loans. While the direct exposure reported by the banks appears limited, there are broader market concerns that these institutions may not be alone in carrying a significant amount of poorly collateralized or “bad” loans.

- Equity markets sold off after two regional banks disclosed lending irregularities and fraud within their portfolios. This news amplified market fears that the collapse of subprime auto lender Tricolor and the bankruptcy of auto-parts supplier First Brands — both involving allegations of double-pledging collateral and missing funds — may be revealing wider systemic vulnerabilities in the credit market’s underwriting and monitoring standards.

- This renewed market anxiety is likely to draw intense scrutiny toward the private credit sector, which has significantly expanded its lending activity in recent years. This spotlight intensified following comments from J.P. Morgan CEO Jamie Dimon, who likened the sector’s risk exposure to finding “cockroaches” after the fallout from the auto lender and other distressed firms. Additionally, there have been signs that investors may be trying to limit their exposure to these funds.

- The turmoil in credit markets may be contributing to liquidity strains within the financial system. The surge in banks using the Standing Repo Facility (SRF) is indicative of funding stress. This activity could prompt the central bank to intervene, which should stabilize the situation relatively quickly assuming there isn’t a broader solvency issue at play.

- While we acknowledge some signs of credit stress in the market, we remain confident that there are no signs of an immediate financial market blow-up. We suspect the Federal Reserve will act decisively to provide liquidity when trouble emerges, which would be favorable for equities. Moreover, tightening credit conditions may encourage the central bank to ease policy more aggressively over the next few months.

Ukraine Focus: With one major geopolitical issue receding, the White House has now focused its attention on ending the conflict in Ukraine. President Trump is reportedly expected to meet with Vladimir Putin within the next two weeks in Budapest to discuss potential conditions for a peace settlement. Meanwhile, Ukrainian President Volodymyr Zelensky will continue to lobby the US for additional Tomahawk missiles when the two sides meet on Friday in order to inflict more damage on Russian forces.

- The upcoming peace talks coincide with the US becoming more open to Ukraine using its weapons to strike Russian oil refineries. Since August, Ukraine has launched more than two dozen strikes on these refineries, which has not only hindered Russia’s ability to export oil but has also led to domestic fuel shortages in certain regions of the country.

- That said, the White House views the continuation of military aid to Ukraine as a critical source of diplomatic leverage, as the US aims to conclude the conflict as peacefully as possible. Consequently, the president’s meeting with Ukrainian officials is intended to strengthen this negotiating position ahead of potential talks with Russia in the coming weeks.

- The biggest unknown remains Russia’s true willingness to negotiate. For President Putin, a key constraint is the need to secure enough territory to claim an unquestionable victory in Ukraine. Furthermore, a significant portion of the Russian economy has become heavily dependent on the war effort, creating a powerful internal incentive to prolong the conflict rather than end it.

- We remain optimistic that the conflict is moving toward an end, given the White House’s clear motivation to secure a resolution. We suspect an agreement could be reached within weeks, especially if Russia begins to fear the potential loss of its recent territorial gains. An end to the conflict would likely be bearish for oil prices but bullish for European equities.

Tariff Exemptions: US automakers are set to receive significant tariff relief on imported auto parts. The Commerce Department has announced a five-year extension of the import adjustment offset. This arrangement allows carmakers that assemble and sell complete vehicles in the US to mitigate the 25% tariff by claiming a credit of up to 3.75% of the vehicle’s value. This policy adjustment highlights the White House’s willingness to modify tariff policy to mitigate some of the economic strain on domestic manufacturing.

European Single Market: German Chancellor Friedrich Merz has called for the establishment of a unified capital market within the European Union. This strategic push is aimed at making it easier for European companies to finance themselves domestically, reducing their over-reliance on US capital markets. The initiative represents a long-term effort to boost the attractiveness and liquidity of European stocks for both domestic and foreign investment.

Keystone Pipeline: The US and Canada are reportedly in preliminary discussions to revive the Keystone Pipeline development. These talks are part of a broader negotiation where the US is seeking greater energy supply in exchange for easing existing tariffs on Canadian steel and aluminum. Both countries appear open to restarting the project, which, if completed, would help alleviate energy supply pressures.

Government Shutdown Pain: The economic fallout from the government shutdown is accelerating. The aviation sector is already experiencing significant disruptions, with flight delays and cancellations mounting as air traffic controllers work without pay. More alarmingly, the USDA warns that vital nutrition programs like WIC and SNAP are at severe risk of exhausting their funds. While short-term economic damage may be contained, the cumulative costs and systemic risks are poised to spike with each passing day.

Homebuilders Optimistic: The NAHB Housing Market Index (HMI) rose to its highest level in six months, reaching a reading of 37, a five-point increase over the previous month. This surge was primarily driven by the market’s expectations of easier monetary policy, which promises both more accessible project financing and improved consumer demand via greater housing affordability. However, the index remains significantly below the critical breakeven point of 50, suggesting that homebuilders still harbor substantial reservations about initiating new projects.

Daily Comment (October 16, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with Treasury Secretary Bessent’s analysis of China’s export restrictions and his recommendations for bolstering the US negotiating position ahead of trade talks. We then provide an overview of the Federal Reserve’s Beige Book, followed by an examination of the sustained momentum in the AI sector, easing US-India trade tensions, and the outcome of the no-confidence vote in France. We also include a summary of key economic indicators from US and global markets.

Bessent on China: The US is strategically calibrating its leverage ahead of crucial trade talks with China scheduled for the end of the month. On Wednesday, Treasury Secretary Scott Bessent adopted a noticeably conciliatory stance, offering to extend the current trade truce — a pause on tariffs — beyond the 90-day deadline. The major condition: China must lift its restrictions on rare earth exports. While markets welcomed the unexpected concession, the explicit linkage reveals how vital China’s mineral supply is for sustaining the recent stock market rally.

- The strategic importance of rare earth elements has become a major concern for the White House as it seeks leverage in trade talks. To address this, Secretary Bessent has suggested that China’s failure to remove export controls may lead to retaliation, including coordinated action between the EU and the US to counter Chinese dominance. Furthermore, Bessent has floated proposals for a more assertive industrial policy, which could include the US government taking stakes in strategically important companies.

- The vulnerability of US technology due to its reliance on external sources for critical minerals has become a central challenge in diplomatic discussions, potentially weakening the US negotiating position. This geopolitical anxiety is reflected in the consistent market sensitivity observed in the NASDAQ throughout the escalation of these talks.

- Although we anticipate the talks will continue as planned, there is growing risk of a US withdrawal. Strategically, this move would be aimed at recalibrating the US negotiating position to secure greater leverage. The continued export ban of Chinese rare earth elements would likely exert downward pressure on US tech stocks. On the other hand, tangible progress toward an agreement would almost certainly trigger a market rally.

Fed Beige Book: In a worrying sign of broad economic stagnation, a recent Federal Reserve survey found that US economic activity showed little change over the past six weeks. This overall flatness, however, masks significant regional disparities. While some districts reported slight-to-modest growth, five saw no growth, and four noted a slight decline in activity, highlighting pockets of notable economic strain. In the absence of comprehensive government data, this report serves as a crucial substitute for gauging the economy’s underlying trends.

- According to the report, consumer spending growth is being propelled primarily by high-income households, even as lower- and middle-income groups contend with financial pressure from increased tariffs. This divergence is evident in spending patterns as high-income consumers are increasing expenditure on luxury accommodations, whereas those in lower income brackets are relying on discounts and promotions to manage the price pressures.

- While this report may not fully reflect upcoming economic data, as the latest Atlanta GDPNow model suggests, it does indicate that market sentiment remains weighed down by economic uncertainty. This dynamic is not necessarily negative, as investors in recent years have consistently used large cap tech equities and gold as safe havens during uncertain periods. We expect this investment trend to persist, barring an unforeseen economic shock, which we consider unlikely in the coming weeks.

AI Momentum: In a strong signal that the AI capital expenditure cycle still has considerable momentum, chipmaking giant TSMC has raised its revenue outlook. As the world’s largest semiconductor foundry, this upgraded guidance reflects TSMC’s confidence that its corporate clients will continue spending heavily to build out their AI infrastructure. This bullish move is likely to bolster confidence across the tech sector, which has been facing growing concerns about the sustainability of its recent gains.

US-India Agreement: India and the US have improved their trade relations following an agreement for India to end its purchases of Russian oil. The White House announced that India will cease buying Russian crude at a future date but did not specify a timeline or confirm whether the US will become the replacement supplier. This agreement likely paves the way for reduced trade tensions, which had escalated after the US imposed secondary tariffs and immigration crackdowns affecting sectors with a high concentration of Indian workers.

Farm Bailout: The White House is developing a bailout plan to assist farmers facing severe financial pressure from rising trade tensions, which have caused declining sales and increased costs for essential inputs like fertilizer and equipment. While the government shutdown has complicated the rollout of these funds, the administration appears determined to provide relief. This support is critical as failure to do so could have significant ripple effects across the economy, potentially leading to reduced agricultural supply and higher food prices nationwide.

No Confidence Avoided: French Prime Minister Sébastien Lecornu has survived a no-confidence vote. He managed to secure the necessary support from the Socialist party by agreeing to delay the contentious 2023 pension reforms until after the 2027 elections. This political compromise is expected to pave the way for the approval of a budget that has strained the government and weighed on France’s credit quality. The government hopes this will help it avoid another credit rating downgrade, which could trigger forced selling of its sovereign debt.

Private Credit Concerns: JPMorgan Chase CEO Jamie Dimon sparked an uproar by suggesting there may be more “cockroaches” hidden within the private credit market. His comment has intensified scrutiny of the sector, which is already facing pressure from the collapse of Tricolor, the bankruptcy of First Brands, and rising delinquencies on subprime loans. While there are no immediate signs of systemic trouble, concerns are mounting that further pain may emerge. However, we suspect the broader financial system is likely to be insulated from a significant fallout.

Daily Comment (October 15, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with the latest escalation in US-China trade tensions. We then analyze shifting monetary policy expectations and the market’s growing conviction for an imminent rate cut. Our coverage continues with an examination of sustained AI infrastructure investment, potential regulatory moves against AI chatbots, and emerging signals that Putin may be facing pressure to end the war in Ukraine. We also provide a summary of key economic indicators from the US and global markets.

US-China Trade Tensions: In another tit-for-tat move, the United States has threatened to ban all imports of Chinese cooking oil in response to China’s pause of US soybean purchases — an act the White House has described as “economically hostile.” This escalation underscores heightened trade tensions as both sides position themselves ahead of the upcoming Asia-Pacific Economic Cooperation (APEC) summit, scheduled for October 31 to November 1. The White House has expressed uncertainty about its attendance, further complicating the prospect for dialogue.

- The market’s attention on US-China trade negotiations is intensely focused on the technology sector, which faces a dual vulnerability: deep supply chain reliance on China for production and China’s critical importance as a foreign sales market. This dependence on both the supply and demand sides exacerbates the risk during trade conflicts, despite companies increasingly taking steps to diversify their manufacturing and sourcing away from China.

- The escalating trade and technological conflict between the US and China, which has been underscored by disputes over rare earth minerals, export restrictions, and critical maritime shipping, is forcing a dramatic expansion in the scope of their bilateral discussions. Consequently, these high-stakes negotiations are now inevitably dominated by core geopolitical flashpoints, including the rising military tensions in the Taiwan Strait and Beijing’s sustained strategic support for Russia amidst the ongoing Ukraine conflict.

- While tensions are escalating between the two sides, we remain optimistic that there will be a grand bargain of sorts. In our view, a larger deal will likely include some form of Chinese investment in US manufacturing and purchases of US agricultural products, in exchange for more favorable trade terms and more access to US technology.

Powell Opens the Door? Federal Reserve Chair Jerome Powell has signaled a potential interest rate cut as early at the next FOMC meeting this month, citing a notable cooling in the labor market. In a speech to the National Association for Business Economics, he indicated that the ongoing decline in job openings could foreshadow a rise in unemployment. These remarks suggest that the Fed, despite navigating with limited recent data, may be shifting its priority toward upholding the maximum employment side of its dual mandate, even as concerns about price stability persist.

- With the government’s official jobs report delayed or unavailable, private data validates Federal Reserve concerns over the weakening labor market. The latest ADP National Employment Report for September showed that private employers cut 32,000 jobs, marking the sharpest decline in months. This deceleration is mirrored by surveys of consumer sentiment from the University of Michigan and the Conference Board, which show that households remain pessimistic about their job prospects.

- That said, inflation is also likely to be a key topic, as several FOMC members have signaled concern over recent increases. Over the last two weeks, both Dallas Fed President Lorie Logan and Fed Governor Michael Barr have emphasized that inflation remains a top priority. Consequently, the upcoming September CPI report, scheduled for release on October 24, will be critical in shaping their perspective.

- So far, momentum appears to be building for another rate cut at the October 28-29 FOMC meeting, driven by growing concern among Fed officials about the labor market. We anticipate a 25bps cut, after which the Fed will likely adopt a “wait-and-see” stance. While market pricing, per the CME FedWatch Tool, suggests a 93% probability of a further 25bps cut in December, this remains contingent on clear, continued signs of a cooling labor market.

More AI News: A wave of mega-deals is propelling the tech industry, driven by soaring capital expenditures for massive data centers. On Thursday, Nscale’s agreement to build a Microsoft data center using Nvidia’s AI chips highlighted this trend. The ripple effect was immediately evident in the supply chain, with ASML — a critical maker of chipmaking equipment — reporting a sharp jump in new orders. Ultimately, the market sees these deals as the core engine powering the tech sector’s ride on the AI wave.

US to Leave Argentina? Argentine President Javier Milei visited the White House on Tuesday to finalize a crucial $20 billion US currency swap line, a lifeline intended to stabilize the Argentine peso. However, President Trump explicitly conditioned this support, directly linking its continuation to the electoral success of Milei’s coalition in the upcoming October 26 legislative elections. This direct intervention introduces a significant risk of market turmoil, as a poor showing for the ruling party could now trigger an immediate withdrawal of US financial backing.

AI Chatbot Restrictions: Missouri Senator Josh Hawley has introduced a bill to ban the use of AI chatbots for minors. The legislation reflects growing political scrutiny of tech companies as AI becomes more omnipresent. The bill has gained traction amid concerns about the negative impact of chatbots on the mental health of teenagers who confide in them. While this specific restriction is unlikely to dampen the current market rally in AI, it signals initial political pushback against the largely unregulated technology.

Aluminum Import Limits: The US Aluminum Association has publicly called for increased trade restrictions on imported scrap metal to protect domestic markets. Key measures proposed include a complete ban on the import of used beverage containers from outside North America and stricter controls on “mill ready” scrap metal shipments. Additionally, the Association is advocating for enhanced tracking of the aluminum scrap flow and stronger enforcement mechanisms for existing trade regulations.

French Pension Reforms: French Prime Minister Sébastien Lecornu has proposed suspending controversial pension reforms, including raising the retirement age from 62 to 64, until after the 2027 presidential election. This concession comes ahead of a no-confidence vote, as the reform has been a major obstacle to passing the national budget. While Lecornu’s proposal has eased tensions, opposition parties are pushing for the complete abandonment of the reforms to secure the budget’s approval.

Moscow Plot: Russian authorities have accused Mikhail Khodorkovsky, a former Russian oligarch and once the country’s richest man, of conspiring to overthrow the government. The Federal Security Service (FSB) alleges that Khodorkovsky and others are planning a coup to remove Vladimir Putin from power. This action appears to be part of a larger effort to intimidate domestic critics of the war in Ukraine and could signal that Putin’s power may be under threat. We suspect that internal political division in the Kremlin could pave the way for peace talks with the US and Ukraine.

Daily Comment (October 14, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with yet another blow-up in the US-China trade war, with Beijing imposing sanctions on South Korean firms that allegedly assisted a US probe into the Chinese shipping industry. We next review several other international and US developments with the potential to affect the financial markets today, including another big artificial-intelligence deal and the first new record in silver prices since 1980.

United States-China: Beijing added five subsidiaries of South Korean shipbuilder Hanwha Ocean to its sanctions list overnight for allegedly helping a US investigation into China’s shipping industry. Because of the action, Chinese individuals and entities will now be banned from working with the Hanwha firms. More importantly, the Chinese action is being seen as another provocative move in the US-China trade war. The news has therefore sparked a new sell-off in equity markets, setting the stage for a decline in the US market at its open.

- One concerning aspect of Beijing’s move against Hanwha Ocean is that it signals China’s willingness to punish US allies and their companies for supporting US geopolitical and military goals. That raises the prospect that US-China tensions will broaden.

- Indeed, in a Financial Times interview yesterday, US Treasury Secretary Bessent slammed China’s recent moves in the trade war, saying, “they want to pull everybody else down with them.” The statement detracted mightily from Bessent’s encouraging statement in another venue yesterday that President Trump and General Secretary Xi still plan to meet later this month, despite the sudden rekindling of US-China trade tensions over the last week.

United States-Netherlands-China: New reports say the Dutch government’s recent seizure of Chinese-owned, Netherlands-based semiconductor firm Nexperia arose after the US warned that it wouldn’t remove the company from its sanctions list as long as its Chinese chief executive remained in control. That means Nexperia could have been left to “wither on the vine,” depriving the Netherlands of an important technology company. The news shows how third-party countries and their companies are increasingly being caught in the trade crossfire between the US and China.

US Artificial Intelligence Industry: In the latest big AI deal, OpenAI and Broadcom said they are working jointly to develop and deploy 10 gigawatts of custom AI processors and related computing systems. The firms didn’t release financial details, but sources said the deal will result in billions of dollars of new revenues for Broadcom, boosting its stock price dramatically.

- Along with OpenAI’s recent deals to buy chips from Nvidia and Advanced Micro Devices, it appears the company has sealed commitments to buy 26 gigawatts of chips in the coming few years, worth hundreds of billions of dollars.

- As large as that amount is, sources say OpenAI plans to buy a total of 250 gigawatts of chips by 2033, for a total commitment of about $10 trillion. If its actual purchases are anywhere near that goal, it suggests chip designers and manufacturers still have plenty of AI business in front of them.

- Of course, OpenAI’s rising purchase commitments and firms’ vast AI investments are also raising the risk of wasted resources and over-extension. The AI frenzy is therefore looking more risky, although there are few signs of problems in the near term.

Global Precious Metals Market: Prices for near silver futures yesterday surged to $50.13 per ounce, up almost 7% on the day and 85% for the year-to-date. The action brought silver prices to their first record high since 1980. Silver prices typically move in the same direction as gold prices, though with a lag and greater volatility, like a skier to a motorboat. Given the recent surge in gold prices, the jump in silver is no surprise, and silver prices could well continue to rise in the near term.

US Auto Industry: General Motors today said it will cut its electric-vehicle manufacturing capacity and take a $1.6-billion charge against it as demand falls in response to reduced government subsidies and regulatory requirements. While companies across the industry look forward to reduced regulatory burdens under the new US administration, the charge is a reminder that policy changes could also generate at least short-term adjustment costs that could affect stock and bond prices.

German Defense Industry: Defense firm Thyssenkrupp said it will spin off its Marine Systems warship business on Monday, when the shipbuilder has its initial public offering on the Frankfurt stock exchange. Thyssenkrupp will retain a 51% stake in the company, while the rest will be floated to the public.

- The IPO shows that Thyssenkrupp is trying to take advantage of the continuing frenzy for European defense stocks.

- As we’ve noted many times before, growing concern about Russian territorial aggression and questions about US defense commitments continue to spur European countries to boost their defense spending, creating new opportunities for European defense firms.

German Labor Policy: The government of center-right Chancellor Merz reportedly plans to introduce a measure that would allow German pensioners to work and earn up to 2,000 EUR ($2313) a month tax-free. The new “active pension” plan is designed to address the country’s severe labor shortages as birth rates continue to fall, and European governments clamp down on immigration. However, it’s not clear whether the new program will be effective enough to boost German companies’ growth prospects.

Russia-NATO: Officials at the North Atlantic Treaty Organization say the Russian navy has sharply reduced its presence in the Mediterranean Sea in recent months, likely because of resource constraints amid the continued fighting in Ukraine and a need to put more focus on the Arctic and Baltic Seas. Despite widespread concern about Russian territorial designs on Central and Western Europe, the development suggests the threat is not necessarily acute, at least as long as Russian forces remain bogged down in their invasion of Ukraine.

Bi-Weekly Geopolitical Report – Why the US Is Offering to Bail Out Argentina (October 13, 2025)

by Patrick Fearon-Hernandez, CFA | PDF

Argentina currently finds itself at a critical juncture. After a multi-decade period marked by economic instability, hyperinflation, and political dysfunction, the country is undergoing a radical transformation under President Javier Milei. His libertarian administration has implemented sweeping reforms aimed at stabilizing the economy, slashing government spending, and embracing cryptocurrency and dollarization. Yet, the path has been anything but smooth. Amid rising poverty, political backlash, and a collapsing Argentine peso, the United States under President Donald Trump has stepped in to offer a $20 billion bailout. The proposed bailout has sparked intense debate over its motivations, implications, and effectiveness. In this report, we review the current situation in Argentina and show that the US bailout of the country likely reflects a new prioritization of regional relations and political affinity. As always, we will also discuss the investment implications.

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Bi-Weekly Geopolitical Podcast – #75 “Why the US Is Offering to Bail Out Argentina” (Posted 10/10/25)

Daily Comment (October 13, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with the latest dramatic policy announcements on US-China relations, which drove stock prices sharply lower on Friday before a reversal gave stocks a boost this morning. We next review several other international and US developments with the potential to affect the financial markets today, including a big new investment in US defense firms, mineral producers, and artificial-intelligence firms by JPMorgan and a growing chance that the long ruling Liberal Democratic Party could lose power in Japan.

United States-China: There was a sudden rekindling of US-China tensions on Friday, when President Trump said he would impose an additional 100% tariff on US imports from China, restrict critical US exports, and possibly cancel his summit with General Secretary Xi this month. However, Trump and Vice President Vance both made more conciliatory statements over the weekend. The renewed trade tensions had weighed heavily on global stock and cryptocurrency assets on Friday, but the more conciliatory statements have boosted asset values so far today.

- The initial move by Trump on Friday was in response to Beijing’s decision to further tighten its curbs on Chinese exports of critical minerals and the technology to mine and process them, which we described in our Comment last week.

- The renewed US export curbs apparently would have included critical software and aircraft parts. That’s a reminder that US producers of those items could face reduced sales in China if the trade dispute worsens again.

- Months ago, the reciprocal US and Chinese export controls of critical products helped prompt a truce in the US-China trade war. All the same, the experience during the spring has taught each side where its economic leverage really lies. Despite China’s huge reliance on exports to the US, perhaps the key takeaway is that Beijing has developed important leverage against Washington with its control of critical minerals and its ability to shut its domestic market to US goods ranging from soybeans to semiconductors.

- Coupled with China’s growing military, technological, and diplomatic strength, its newly realized economic strength raises the likelihood that the US will have to back down and accept a long-term compromise such as the one we described in our Comment last week, i.e., US acquiescence in a Chines takeover of Taiwan and a cut in US import tariffs in exchange for more Chinese investment in the US. Indeed, the White House’s reversal at the weekend helps confirm that this is a possibility.

- In the short-to-medium term, such a deal would likely be positive for US and Chinese stocks, as it would remove an important geopolitical risk. By allowing China to increase its global influence, however, such a deal would likely be negative for US economic and financial prospects in the long run.

US Defense Industry: JPMorgan Chase today said it will directly invest $10 billion of its own capital over the next 10 years in a range of companies deemed critical to US national security and economic resiliency. The targeted firms are expected to include defense contractors, mineral producers, and artificial-intelligence firms. According to the bank, its investments will facilitate a total of $1.5 trillion in additional capital for the firms.

- We think the program also underscores our longstanding belief that rising Great Power competition will spur stronger defense spending and programs for economic resiliency across the globe, although we continue to believe that the threat from Russia will make the trend more pronounced in Europe.

- JPMorgan is probably also responding to the US administration’s penchant for taking direct stakes in critical companies, which has often sharply boosted their share prices.

US Critical Minerals Industry: The Pentagon’s Defense Logistics Agency has said it’s looking to buy up to $1 billion of critical minerals to add to the US’s national security stockpile as it seeks to reduce China’s ability to crimp US defense production by withholding supplies. Some of the targeted minerals have not previously been stockpiled. The program could give a boost to many mining and mineral processing firms.

US Economy: In its latest regular survey of economists, the Wall Street Journal found that the respondents have ratcheted up their forecasts of near-term US economic growth, with an average expectation that fourth-quarter gross domestic product will be up 1.7% from a year earlier, compared with a forecast of just 1.0% in July. However, they maintained their forecast of 1.9% growth for 2026. The increased growth forecasts generally reflect looser monetary and fiscal policy combined with reduced policy uncertainty.

- Despite expecting less Federal Reserve independence and improved growth, the economists have lowered their forecasts for consumer price inflation.

- In part, that reflects their expectation for a much softer labor market and a modest rise in unemployment.

Netherlands-China: In a sign of continued Europe-China tensions, the Dutch government said it has taken control of Netherlands-based semiconductor company Nexperia from its Chinese owner to keep Europe from losing “technological knowledge and capabilities” necessary for its economic security. According to Dutch officials, the move was taken after the government picked up “signals of serious governance shortcomings and actions within Nexperia.”

- Nexperia’s Chinese owner, Wingtech Technology, suggested the Dutch move resulted from the US’s recent blacklisting of several Chinese firms, including Wingtech, along with their subsidiaries. Nexperia evidently could have been subject to US sanctions, raising the risk that Wingtech would bring its operations back to China.

- In any case, the incident is the latest evidence of how countries are working feverishly to secure their critical supply chains and shore up their domestic industrial and technological capabilities. These moves will create both risks and opportunities for investors.

Japan: The centrist Komeito party is talking with several smaller opposition parties about backing Yuichiro Tamaki, leader of the Democratic People’s Party, in the upcoming Diet vote for a new prime minister. Komeito quit its long role as junior partner to the ruling Liberal Democratic Party only on Friday, so the sudden coalescing of opposition parties against the LDP is a shock to Japan’s political system. It also raises doubts as to whether the LDP’s new chief, the conservative, pro-market Sanae Takaichi, will really become the new prime minister as expected.

- Optimism that Takaichi would again implement the stimulative “Abenomics” policies of former Prime Minister Abe had given a big boost to Japanese stock prices in recent weeks. Now that Komeito has pulled out of the ruling coalition and is talking with other parties about supporting a rival candidate, investors are much less certain about Takaichi’s ascension.

- As a result, Japanese stock values have pulled back over the last few days. If Takaichi’s future becomes even more uncertain, Japanese stocks could soften further.

France: Late Friday, President Macron again nominated Sébastien Lecornu to be prime minister, just days after Lecornu resigned from his first stint in the position after only a month. Macron’s decision has been widely criticized as a sign that the president is running out of options for his government. Popular opinion also increasingly criticizes Macron for refusing to respect the people’s rejection of his plan for fiscal tightening to cut France’s rising debt. The political chaos in France is likely to continue weighing on French and European asset values.

Pakistan-Afghanistan: The Pakistani and Afghan armed forces have engaged in a series of border skirmishes in recent days, culminating in dozens of deaths on each side over the weekend. The fighting has sparked concerns that the violence could lead to a broader conflict between the two countries, whose governments have become increasingly hostile to each other in recent months over Islamabad’s accusation that Afghanistan is harboring anti-Pakistani militants on its side of the border.

Daily Comment (October 10, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with an in-depth analysis of US intervention in the Argentine currency market. We then examine the latest strategic moves by the US and China ahead of pivotal trade talks. Our coverage continues with a discussion of the accounting controversy surrounding First Brands and explores the potential for a capital markets union in the EU. We also provide a summary of key economic indicators from the US and global markets.

US Intervenes: The United States has taken exceptional steps to stabilize Argentina’s economy, with Treasury Secretary Scott Bessent announcing a $20 billion currency swap and direct support for the peso (ARS). The intervention is a clear signal of support for President Javier Milei amid market turmoil ahead of the October 26 legislative elections. Bessent defended the policy by declaring Argentina’s free-market reforms to be of “systemic importance” to the US and promising to do “whatever exceptional measures are warranted” to ensure their success.

- This marks the first attempt to prop up a foreign currency since the 1995 financial support package for Mexico (known as the “Tequila Crisis”). While the bailout for Mexico was primarily justified as an effort to prevent a systemic financial crisis from impacting the US economy and its regional interests (like NAFTA), the measures for Argentina appear less focused on systemic risk and more overtly aimed at ensuring the viability of the current administration’s specific economic reform agenda.

- The move is a significant demonstration of US influence aimed at countering China’s deep economic ties in Latin America. China has cemented its role as a key financial partner through its currency swap line with Argentina and by increasingly becoming a major buyer of regional agricultural exports to diversify its sourcing from the US.

- Another strategic benefit of the US financial package is currency stabilization, which prevents a peso collapse that would otherwise sharply reduce the export price of Argentine goods, thereby safeguarding the global price competitiveness of US agricultural producers.

- The efficacy of the currency intervention in preventing a financial collapse is debatable, but the move signifies the US’s willingness to deploy its financial tools for geopolitical ends. This strategic use of the dollar as a lever of hegemony could undermine the dollar’s perceived credibility and neutrality. As a result, market participants may become more inclined to seek stability and diversification in other currencies, presenting a structural resistance to the dollar’s continued strength.

Trade Tensions Escalate: The US and China are continuing to escalate tensions ahead of their next meeting through a series of reciprocal economic measures. In a significant move, US senators have endorsed a bill to prohibit federal funding from reaching Chinese firms and to bar American investment from key Chinese industries. Simultaneously, Beijing has retaliated by launching an anti-trust probe into the American chipmaker Qualcomm and imposing new fees on US vessels using Chinese ports.

- We interpret these maneuvers as strategic posturing in advance of trade negotiations scheduled for later this month, suggesting no imminent setback. Both the Congressional move to ban funding and the Chinese probes into US firms are likely performative acts. Furthermore, the fees levied on US vessels at Chinese ports are a direct, reciprocal response to American charges on Chinese-built ships, reflecting China’s clear intent to counter the US push for increased use of domestically manufactured vessels.

- We remain optimistic that talks between the US and China will culminate in a significant grand bargain, one that should yield benefits for both markets. Our premise is that the agreement must improve the trade relationship, particularly in technology, by granting China greater access to advanced chips in exchange for US access to critical minerals. Crucially, we anticipate that substantial Chinese investment into the US economy will be a major component of the final agreement.

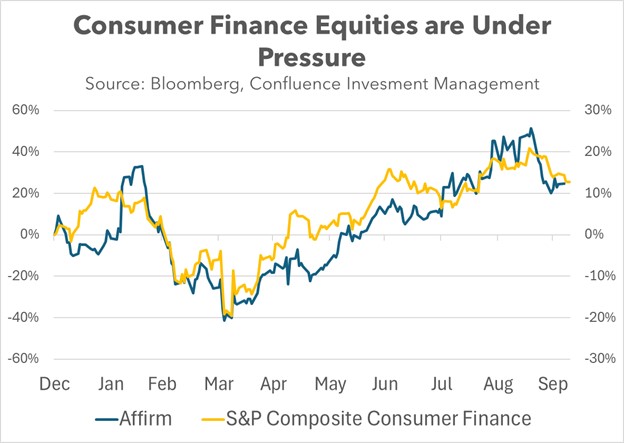

First Brands: The auto parts giant is facing a formal investigation by the Department of Justice following its bankruptcy filing amid concerns over accounting irregularities. The crisis centers on approximately $2.3 billion in undisclosed off-balance-sheet financing, a debt structure that concealed the true scale of the company’s liabilities. The failure has amplified concerns regarding the credit quality of borrowers across the private credit space, potentially casting a wider net of scrutiny on the loan portfolios of major consumer finance firms, such as Affirm.

Finally, More Data! The US government is recalling furloughed employees to ensure the release of the Consumer Price Index (CPI) report. Although the report was originally scheduled for October 15, it is now expected by the end of the month. This data is critical as it determines the cost-of-living adjustment (COLA) for Social Security. It is also vital for Federal Reserve policy; a strong inflation reading could lead the Fed to keep interest rates unchanged at its October 29 meeting.

Japan Coalition Collapse: Coalition talks between Japan’s Liberal Democratic Party (LDP) and its junior partner, Komeito, collapsed on Friday, complicating efforts to form a new government. This breakdown poses a significant challenge for new LDP leader Sanae Takaichi, who must now secure a partner to become prime minister. The difficulty in forming a stable government raises fresh concerns about political instability in a country that has had four prime ministers since Shinzo Abe stepped down in 2020.

EU Capital Markets: Germany has signaled its willingness to grant European financial regulators more authority, a significant move indicating the EU is advancing toward a capital markets union (CMU). This policy shift is expected to enhance the competitiveness of European markets against global rivals like the US and China. The CMU concept, championed by former ECB chief Mario Draghi, aims to deepen and integrate the bloc’s capital markets, potentially making European equities and investment opportunities more attractive to global investors.

Shutdown Prolonged: The political standoff over federal funding has dragged the US government into its second week of shutdown, with no resolution in sight. The core legislative fight centers on the demand by Senate Democrats to permanently extend the enhanced Affordable Care Act (ACA) tax credits as part of any stopgap funding bill. Republicans have so far refused to negotiate policy matters while the government is closed. So far, shutdown troubles have not impacted equity markets.