Author: Amanda Ahne

Daily Comment (October 13, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with the latest dramatic policy announcements on US-China relations, which drove stock prices sharply lower on Friday before a reversal gave stocks a boost this morning. We next review several other international and US developments with the potential to affect the financial markets today, including a big new investment in US defense firms, mineral producers, and artificial-intelligence firms by JPMorgan and a growing chance that the long ruling Liberal Democratic Party could lose power in Japan.

United States-China: There was a sudden rekindling of US-China tensions on Friday, when President Trump said he would impose an additional 100% tariff on US imports from China, restrict critical US exports, and possibly cancel his summit with General Secretary Xi this month. However, Trump and Vice President Vance both made more conciliatory statements over the weekend. The renewed trade tensions had weighed heavily on global stock and cryptocurrency assets on Friday, but the more conciliatory statements have boosted asset values so far today.

- The initial move by Trump on Friday was in response to Beijing’s decision to further tighten its curbs on Chinese exports of critical minerals and the technology to mine and process them, which we described in our Comment last week.

- The renewed US export curbs apparently would have included critical software and aircraft parts. That’s a reminder that US producers of those items could face reduced sales in China if the trade dispute worsens again.

- Months ago, the reciprocal US and Chinese export controls of critical products helped prompt a truce in the US-China trade war. All the same, the experience during the spring has taught each side where its economic leverage really lies. Despite China’s huge reliance on exports to the US, perhaps the key takeaway is that Beijing has developed important leverage against Washington with its control of critical minerals and its ability to shut its domestic market to US goods ranging from soybeans to semiconductors.

- Coupled with China’s growing military, technological, and diplomatic strength, its newly realized economic strength raises the likelihood that the US will have to back down and accept a long-term compromise such as the one we described in our Comment last week, i.e., US acquiescence in a Chines takeover of Taiwan and a cut in US import tariffs in exchange for more Chinese investment in the US. Indeed, the White House’s reversal at the weekend helps confirm that this is a possibility.

- In the short-to-medium term, such a deal would likely be positive for US and Chinese stocks, as it would remove an important geopolitical risk. By allowing China to increase its global influence, however, such a deal would likely be negative for US economic and financial prospects in the long run.

US Defense Industry: JPMorgan Chase today said it will directly invest $10 billion of its own capital over the next 10 years in a range of companies deemed critical to US national security and economic resiliency. The targeted firms are expected to include defense contractors, mineral producers, and artificial-intelligence firms. According to the bank, its investments will facilitate a total of $1.5 trillion in additional capital for the firms.

- We think the program also underscores our longstanding belief that rising Great Power competition will spur stronger defense spending and programs for economic resiliency across the globe, although we continue to believe that the threat from Russia will make the trend more pronounced in Europe.

- JPMorgan is probably also responding to the US administration’s penchant for taking direct stakes in critical companies, which has often sharply boosted their share prices.

US Critical Minerals Industry: The Pentagon’s Defense Logistics Agency has said it’s looking to buy up to $1 billion of critical minerals to add to the US’s national security stockpile as it seeks to reduce China’s ability to crimp US defense production by withholding supplies. Some of the targeted minerals have not previously been stockpiled. The program could give a boost to many mining and mineral processing firms.

US Economy: In its latest regular survey of economists, the Wall Street Journal found that the respondents have ratcheted up their forecasts of near-term US economic growth, with an average expectation that fourth-quarter gross domestic product will be up 1.7% from a year earlier, compared with a forecast of just 1.0% in July. However, they maintained their forecast of 1.9% growth for 2026. The increased growth forecasts generally reflect looser monetary and fiscal policy combined with reduced policy uncertainty.

- Despite expecting less Federal Reserve independence and improved growth, the economists have lowered their forecasts for consumer price inflation.

- In part, that reflects their expectation for a much softer labor market and a modest rise in unemployment.

Netherlands-China: In a sign of continued Europe-China tensions, the Dutch government said it has taken control of Netherlands-based semiconductor company Nexperia from its Chinese owner to keep Europe from losing “technological knowledge and capabilities” necessary for its economic security. According to Dutch officials, the move was taken after the government picked up “signals of serious governance shortcomings and actions within Nexperia.”

- Nexperia’s Chinese owner, Wingtech Technology, suggested the Dutch move resulted from the US’s recent blacklisting of several Chinese firms, including Wingtech, along with their subsidiaries. Nexperia evidently could have been subject to US sanctions, raising the risk that Wingtech would bring its operations back to China.

- In any case, the incident is the latest evidence of how countries are working feverishly to secure their critical supply chains and shore up their domestic industrial and technological capabilities. These moves will create both risks and opportunities for investors.

Japan: The centrist Komeito party is talking with several smaller opposition parties about backing Yuichiro Tamaki, leader of the Democratic People’s Party, in the upcoming Diet vote for a new prime minister. Komeito quit its long role as junior partner to the ruling Liberal Democratic Party only on Friday, so the sudden coalescing of opposition parties against the LDP is a shock to Japan’s political system. It also raises doubts as to whether the LDP’s new chief, the conservative, pro-market Sanae Takaichi, will really become the new prime minister as expected.

- Optimism that Takaichi would again implement the stimulative “Abenomics” policies of former Prime Minister Abe had given a big boost to Japanese stock prices in recent weeks. Now that Komeito has pulled out of the ruling coalition and is talking with other parties about supporting a rival candidate, investors are much less certain about Takaichi’s ascension.

- As a result, Japanese stock values have pulled back over the last few days. If Takaichi’s future becomes even more uncertain, Japanese stocks could soften further.

France: Late Friday, President Macron again nominated Sébastien Lecornu to be prime minister, just days after Lecornu resigned from his first stint in the position after only a month. Macron’s decision has been widely criticized as a sign that the president is running out of options for his government. Popular opinion also increasingly criticizes Macron for refusing to respect the people’s rejection of his plan for fiscal tightening to cut France’s rising debt. The political chaos in France is likely to continue weighing on French and European asset values.

Pakistan-Afghanistan: The Pakistani and Afghan armed forces have engaged in a series of border skirmishes in recent days, culminating in dozens of deaths on each side over the weekend. The fighting has sparked concerns that the violence could lead to a broader conflict between the two countries, whose governments have become increasingly hostile to each other in recent months over Islamabad’s accusation that Afghanistan is harboring anti-Pakistani militants on its side of the border.

Daily Comment (October 10, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with an in-depth analysis of US intervention in the Argentine currency market. We then examine the latest strategic moves by the US and China ahead of pivotal trade talks. Our coverage continues with a discussion of the accounting controversy surrounding First Brands and explores the potential for a capital markets union in the EU. We also provide a summary of key economic indicators from the US and global markets.

US Intervenes: The United States has taken exceptional steps to stabilize Argentina’s economy, with Treasury Secretary Scott Bessent announcing a $20 billion currency swap and direct support for the peso (ARS). The intervention is a clear signal of support for President Javier Milei amid market turmoil ahead of the October 26 legislative elections. Bessent defended the policy by declaring Argentina’s free-market reforms to be of “systemic importance” to the US and promising to do “whatever exceptional measures are warranted” to ensure their success.

- This marks the first attempt to prop up a foreign currency since the 1995 financial support package for Mexico (known as the “Tequila Crisis”). While the bailout for Mexico was primarily justified as an effort to prevent a systemic financial crisis from impacting the US economy and its regional interests (like NAFTA), the measures for Argentina appear less focused on systemic risk and more overtly aimed at ensuring the viability of the current administration’s specific economic reform agenda.

- The move is a significant demonstration of US influence aimed at countering China’s deep economic ties in Latin America. China has cemented its role as a key financial partner through its currency swap line with Argentina and by increasingly becoming a major buyer of regional agricultural exports to diversify its sourcing from the US.

- Another strategic benefit of the US financial package is currency stabilization, which prevents a peso collapse that would otherwise sharply reduce the export price of Argentine goods, thereby safeguarding the global price competitiveness of US agricultural producers.

- The efficacy of the currency intervention in preventing a financial collapse is debatable, but the move signifies the US’s willingness to deploy its financial tools for geopolitical ends. This strategic use of the dollar as a lever of hegemony could undermine the dollar’s perceived credibility and neutrality. As a result, market participants may become more inclined to seek stability and diversification in other currencies, presenting a structural resistance to the dollar’s continued strength.

Trade Tensions Escalate: The US and China are continuing to escalate tensions ahead of their next meeting through a series of reciprocal economic measures. In a significant move, US senators have endorsed a bill to prohibit federal funding from reaching Chinese firms and to bar American investment from key Chinese industries. Simultaneously, Beijing has retaliated by launching an anti-trust probe into the American chipmaker Qualcomm and imposing new fees on US vessels using Chinese ports.

- We interpret these maneuvers as strategic posturing in advance of trade negotiations scheduled for later this month, suggesting no imminent setback. Both the Congressional move to ban funding and the Chinese probes into US firms are likely performative acts. Furthermore, the fees levied on US vessels at Chinese ports are a direct, reciprocal response to American charges on Chinese-built ships, reflecting China’s clear intent to counter the US push for increased use of domestically manufactured vessels.

- We remain optimistic that talks between the US and China will culminate in a significant grand bargain, one that should yield benefits for both markets. Our premise is that the agreement must improve the trade relationship, particularly in technology, by granting China greater access to advanced chips in exchange for US access to critical minerals. Crucially, we anticipate that substantial Chinese investment into the US economy will be a major component of the final agreement.

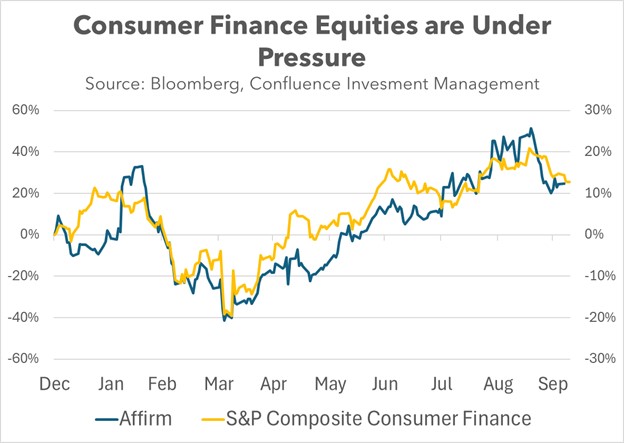

First Brands: The auto parts giant is facing a formal investigation by the Department of Justice following its bankruptcy filing amid concerns over accounting irregularities. The crisis centers on approximately $2.3 billion in undisclosed off-balance-sheet financing, a debt structure that concealed the true scale of the company’s liabilities. The failure has amplified concerns regarding the credit quality of borrowers across the private credit space, potentially casting a wider net of scrutiny on the loan portfolios of major consumer finance firms, such as Affirm.

Finally, More Data! The US government is recalling furloughed employees to ensure the release of the Consumer Price Index (CPI) report. Although the report was originally scheduled for October 15, it is now expected by the end of the month. This data is critical as it determines the cost-of-living adjustment (COLA) for Social Security. It is also vital for Federal Reserve policy; a strong inflation reading could lead the Fed to keep interest rates unchanged at its October 29 meeting.

Japan Coalition Collapse: Coalition talks between Japan’s Liberal Democratic Party (LDP) and its junior partner, Komeito, collapsed on Friday, complicating efforts to form a new government. This breakdown poses a significant challenge for new LDP leader Sanae Takaichi, who must now secure a partner to become prime minister. The difficulty in forming a stable government raises fresh concerns about political instability in a country that has had four prime ministers since Shinzo Abe stepped down in 2020.

EU Capital Markets: Germany has signaled its willingness to grant European financial regulators more authority, a significant move indicating the EU is advancing toward a capital markets union (CMU). This policy shift is expected to enhance the competitiveness of European markets against global rivals like the US and China. The CMU concept, championed by former ECB chief Mario Draghi, aims to deepen and integrate the bloc’s capital markets, potentially making European equities and investment opportunities more attractive to global investors.

Shutdown Prolonged: The political standoff over federal funding has dragged the US government into its second week of shutdown, with no resolution in sight. The core legislative fight centers on the demand by Senate Democrats to permanently extend the enhanced Affordable Care Act (ACA) tax credits as part of any stopgap funding bill. Republicans have so far refused to negotiate policy matters while the government is closed. So far, shutdown troubles have not impacted equity markets.

Daily Comment (October 9, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with a deep dive into the new ceasefire agreement between Israel and Hamas. Next, we turn to the global economic stage and break down the latest maneuvers from the US and China ahead of critical trade negotiations. From there, we decode the revealing Fed minutes that have markets buzzing and investigate fresh signs of an escalation in tensions between NATO and Russia. We also provide a summary of key economic indicators from the US and global markets.

Hamas and Israel Deal: Israel and Hamas are reportedly set to agree on a ceasefire on Thursday. The plan centers on the release of all hostages, a withdrawal of Israeli forces from the front lines, and a substantial increase in humanitarian aid to the war-torn territory. Although the deal will face some resistance from hardliners within the Israeli government, Prime Minister Netanyahu is expected to get it approved easily. The news led to a drop in global oil prices and a rally across US and international equity markets.

- The agreement was achieved after the White House successfully mediated an outline for a 21-point peace plan among all negotiating parties, though the document has yet to be formally finalized. While the full details remain pending, the plan is widely anticipated to leverage and expand upon the framework of the Abraham Accords, aiming for broader normalization and reengagement between Israel and its Middle Eastern allies.

- This political shift is expected to facilitate the long-planned US “pivot” by freeing up resources and attention currently committed to the Middle East. With the immediate conflict addressed, Washington can intensify its focus on China, which it designates as the main strategic threat. Crucially, a stable Middle East will enable the US to be able to strengthen alliances more readily and mitigate Chinese influence across the region.

- The broader agreement is likely to ease market anxieties regarding Middle Eastern supply chain stability. A key focus is the Strait of Hormuz, a critical chokepoint that has seen attacks escalate due to regional hostilities. By reducing this security threat, the pact should help keep oil prices in check and prevent volatility in global shipping rates.

China Crackdown: The US and China escalated their trade war with dueling security-related actions this week. Beijing imposed stringent new export controls on critical minerals, requiring authorization for any goods containing even trace amounts. Concurrently, Washington sanctioned a network of Chinese firms for allegedly supplying components to Iran’s military and its proxies. The tit-for-tat measures, justified by both sides on national security grounds, cast a shadow over upcoming bilateral trade talks.

- China’s decision to restrict exports of critical minerals is a strategic response to US controls on advanced semiconductors. By targeting goods with even trace amounts of these materials, Beijing is mirroring the US “foreign direct product rule,” effectively using its own strategic resource as a counterweight by adopting a key tactic from the American regulatory playbook.

- Additionally, the US sanctions on Chinese firms serve as a form of pressure, aiming to secure Beijing’s cooperation in restraining its allies. While these recent measures primarily target Iran, their underlying goal is to enlist China’s help in persuading Tehran to cease backing groups hostile to Israel. This tactic reflects a broader US strategy of seeking foreign policy coordination, as Washington has also repeatedly urged Beijing to end its support for Russia to help end the war in Ukraine.

- While the recent tit-for-tat actions by Beijing and Washington have undoubtedly raised tensions, they may also be setting the stage for more comprehensive negotiations. We believe these talks are likely to extend beyond trade to encompass critical issues of technology and foreign policy. A resulting “grand bargain” between the two powers, should it materialize, could provide a significant boost to US equities.

Fed Noncommittal: Federal Reserve officials were hesitant to cut interest rates at the last Federal Open Market Committee (FOMC) meeting, according to the recently released minutes, suggesting a potential division within the committee. The minutes indicate that while many members saw the labor market softening, significant concern over elevated inflation persisted. A few officials even suggested that tariffs were hindering the path to the Fed’s 2% inflation target, though this view was met with some internal pushback.

- The Federal Reserve’s lack of policy certainty likely stems from the conflicting signals within its dual mandate. While some officials acknowledge the cooling of the labor market, the persistently low unemployment rate suggests that economic conditions have not deteriorated sufficiently to warrant an aggressive policy shift.

- Although inflation has ticked slightly higher, several committee members believe this increase was less than anticipated and project that price pressures will ease in the coming months, complicating the decision on whether to prioritize employment or price stability.

- The latest FOMC minutes confirm that members have retained the option for at least one final rate cut before the year ends. Our view is that the upcoming September labor market data — currently delayed by the shutdown — will be the critical pivot point. A report showing a marked deceleration in hiring will provide the necessary evidence for officials to proceed with easing monetary policy at the October 29 meeting.

NATO Escalation: The Western military alliance is debating a shift toward a more forceful deterrent strategy against Russian provocation. Recent discussions have focused on potential escalations, including deploying armed drones along the Russian border and authorizing pilots to shoot down Russian aircraft. This proposed reinforcement is designed to counter what the alliance now describes as Russian “hybrid warfare.” Such measures, however, are likely to significantly raise the risk of direct conflict as both sides test the new boundaries of engagement.

EU Port Strikes: Twin strikes by lashers — workers who secure and unload ships — at the key European hubs of Rotterdam and Antwerp-Bruges is escalating existing supply chain chaos. The industrial action, driven by demands for a 7% wage hike, comes immediately after recent storms had already strained port capacity. A prolonged stoppage at these critical gateways threatens to severely impede international trade and trigger adverse ripple effects across global commerce.

Finland-US Ties: The United States and Finland are set to sign a defense cooperation agreement focused on icebreaker vessels, reflecting the Arctic’s growing strategic importance. The deal will facilitate joint work on ships capable of navigating ice-covered waters, a capability essential for maintaining access and presence in the region. This move signals the US’s increased commitment to asserting control and ensuring freedom of navigation in the increasingly contested Arctic seas.

Daily Comment (October 8, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with an analysis regarding new concerns about AI profitability, following the reported leak of internal documents from Oracle. We then assess a strategic pivot in global trade, as the EU considers more protectionist measures to counter US economic policy. We also examine the recent surge in gold prices and evaluate spillover risks from the First Brand bankruptcy. As always, we conclude by providing a summary of key economic indicators from the US and global markets.

AI Concerns: Fears that Oracle may be unable to hit profit targets following its sizable Nvidia chip order triggered a massive AI-related sell-off. The core concern, fueled by leaked internal documents, is that profit margins in Oracle’s cloud computing business are lower than anticipated from the chips it currently leases from Nvidia. The reports raise doubts about Oracle’s $40 billion commitment to purchase Nvidia chips earlier this year to support data centers, reportedly for OpenAI.

- Following the report, Oracle shares plunged as much as 7.1% as investors scrambled to gauge the implications for the broader technology sector. The report, citing internal documents, revealed that Oracle’s Nvidia-powered server rentals generated approximately $900 million in revenue but yielded a gross profit of only $125 million. Even more concerning was the fact that the company incurred losses on smaller, less utilized quantities of chips.

- The revelations are likely to put a spotlight on chipmakers, underscoring their sensitivity to customer purchasing decisions. Since only a few companies can afford this cutting-edge technology, chipmakers face significant risk from potential pullbacks, prompting them to actively diversify their client base. This pressure was immediately evident when, on the same day the Oracle report broke, Nvidia announced a chip deal with Elon Musk’s xAI.

- Despite widespread skepticism regarding a potential bubble in the AI sector, these companies’ affiliation with the US government through the Stargate Project could sustain investor confidence. However, any concerns about the long-term commercial viability of these ambitious technologies could trigger a significant market correction. Consequently, we recommend investors maintain a well-diversified portfolio, utilizing exposure to value-oriented assets as a strategic hedge against a potential AI bubble.

EU Pushback: The EU is adopting an assertive trade posture on two fronts. First, it has raised concerns over new US demands perceived as an effort to compel regulatory concessions. Second, it is advancing a plan to cap steel imports and slapping a 50% tariff on any country that exceeds the quota — a measure that has already provoked a sharp response from the UK. Together, these developments illustrate the bloc’s strategic pivot in order to navigate a more protectionist global trade landscape.

- Despite a lack of public details, the US has consistently pressured the EU to overhaul its regulations across several critical sectors, including digital and technology rules, corporate compliance, and climate-related policy. While the EU has opened the door for discussions, it has characterized the US proposals as “maximalist” and has vowed to resist significant changes.

- The EU’s decision to resist trade pressures and impose new tariffs demonstrates a strategic play to assert both its independence and its trade power. This move has particularly impacted the UK steel industry, which sends over 80% of its exports to the bloc. The blow is especially sharp as the UK is still waiting for the US to lower its own steel tariffs from 25% to 0%.

- The EU’s assertive new trade posture is a double-edged sword: it shields vulnerable domestic industries from US pressure but risks provoking retaliatory actions. While a compromise remains possible as the European Parliament debates its response, a failure to reach an agreement could trigger an escalation. In such a scenario, the US would likely impose higher tariffs, forcing the EU to reciprocate with defensive measures of its own.

Gold Price: Gold prices soared to a record $4,000 an ounce on Tuesday as investors sought safety amid political and economic uncertainty. The rally was driven by a looming US government shutdown and a broader market shift away from the 10-year Treasury note. Investor skepticism toward US debt is growing due to concerns over rising national debt and higher inflation expectations.

First Brand: The demise of First Brand, a critical auto supplier, has exposed concentrated financial vulnerabilities among its creditors. The fallout underscores substantial exposure at several institutions, including a UBS fund with a highly concentrated 30% position and an estimated $500 million in total exposure for the firm. Jefferies is confronting an even larger estimated exposure of $715 million, with Blackstone and Onset Financial also having some exposure. This incident, while isolated, serves as a clear indicator of stress in the financial system.

France Stalemate: A breakthrough on France’s national budget appears imminent, with outgoing Prime Minister Sébastien Lecornu expressing confidence that a deal can be finalized ahead of the December 31 cutoff, notwithstanding remaining policy disputes. Following his announcement, a French legislator proposed withdrawing the controversial increase in the retirement age as a critical concession for parliamentary approval. The forthcoming budgetary resolution is anticipated to reduce market pressure on French sovereign bonds.

Shutdown Standoff: As the government shutdown enters its second week, the White House is considering withholding back pay from furloughed workers. This move would intensify the financial strain on federal employees, who have already gone without one paycheck. There is now concern that the threat of lost wages could compel essential staff — who are currently working unpaid — to walk off the job. Such an action would cripple vital government services and potentially weigh on market sentiment and investor confidence.

Daily Comment (October 7, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with news of another US government investment in a key critical minerals company. We next review several other international and US developments with the potential to affect the financial markets today, including signs that the Trump administration may be ready to negotiate with Democrats in Congress to end the federal government shutdown and expectations that the European Union will impose its own big, new tariffs on imported steel today.

US Private Property Policy: The White House yesterday said it will take a 10% stake in Canadian critical minerals firm Trilogy Minerals in return for approving a controversial road infrastructure project in Alaska. The road project will allow access to remote mineral resources sought by the company. In response to the news, shares in Trilogy tripled in value, mimicking the stock surges in other recent deals where the federal government has taken partial ownership of firms.

- It’s becoming obvious that a profitable near-term strategy for investors is to purchase private-sector enterprises that are in good graces with the administration, in which case they are likely to receive special treatment in terms of regulatory relief, contracts, or state investment and other support.

- Of course, the long-term risk is that mass “state ownership of the means of production” could lead to unprofitable decisions, high costs, and less economic efficiency.

US Fiscal Policy: President Trump late yesterday hinted that Republicans in Congress are in talks with Democrats over healthcare subsidies to potentially reach a funding compromise and end the ongoing federal government shutdown. Democratic leaders said no such talks are taking place, which suggests the president’s statement may have been a smokescreen or just a hint that he wants to discuss such a deal. Nevertheless, Trump also said he would like to see a deal on healthcare, pointing toward a potential path toward a funding deal and an end to the shutdown.

US Tariff Policy: In a social media post yesterday, President Trump said he will impose a 25% tariff on imports of medium and heavy trucks starting November 1. The announcement came just a day before Trump’s scheduled meeting with the prime minister of Canada, which would be heavily affected by the new truck tariffs. In the past, Trump has sometimes exempted Canadian and Mexican imports compliant with the USMCA trade deal, but his post yesterday made no mention of such an exemption.

US Artificial Intelligence Industry: In the latest AI-related tech deal, private AI model developer Anthropic is in talks to include its Claude model in IBM’s latest integrated developer environment, or IDE. If completed, the deal would make Claude available to software engineers using IBM’s tools at large businesses for tasks such as modernizing code or building proprietary AI agents. In pre-market trading so far today, IBM’s share price has risen about 4.6%.

US Energy Industry: Research by energy consulting firm Wood Mackenzie shows US firms plan to invest $50 billion in new and expanded pipelines in the next five years to cash in on booming natural gas demand and deregulation under President Trump. That amounts to some 8,800 miles of new pipelines aimed at removing bottlenecks that have arisen because of booming production, meeting record liquefied natural gas exports, and fueling electricity generation for data centers. Midstream firms involved in the boom include Kinder Morgan and Enbridge.

US Auto Industry: Novelis, which produces some 40% of the sheet aluminum used by US auto manufacturers, has announced that one of its major plants in New York has been knocked offline until early next year because of a fire three weeks ago. The shutdown is expected to disrupt production for major automakers. Reports suggest Ford is especially at risk, as its profit-driving F-150 pickup is particularly dependent on aluminum from the shuttered plant. Other automakers that could be affected include Toyota, Hyundai, Volkswagen, and Stellantis.

European Union-United Kingdom: According to the Financial Times, the EU today plans to impose a 50% tariff on all imported steel. All steel-exporting countries would face the tariff above quotas set at 2013 levels. If fully implemented, the protectionist tariff would likely be devastating for the UK, which currently sends some 80% of its steel exports to the EU. In response, trade association UK Steel warned that many of the UK’s remaining steel firms could go extinct unless the British government imposes its own protectionist tariffs.

Germany: The German government has recently granted domestic arms makers a string of “direct award” contracts with no public tenders, such as a 390-million EUR ($455 million) contract to Rheinmetall to develop anti-drone lasers. The direct-award contracts have sparked complaints by foreign defense contractors and members of parliament who say the deals could be wasteful. Another key takeaway is that Berlin may be prioritizing the development of its own defense technology to reduce its reliance on foreign suppliers, potentially including US defense firms.

Japan: Now that the ruling Liberal Democratic Party has selected conservative Sanae Takaichi as its new leader, putting her in position to become prime minister and push economic policy back toward stimulative “Abenomics,” one of her key advisors has said the Bank of Japan shouldn’t hike interest rates as expected this month. The statement by influential advisor Etsurō Honda suggests the central bank’s next rate hike might be delayed, which helps explain why the yen (JPY) has weakened further today, falling about 0.4% to 150.80 per dollar ($0.0066).

New Zealand: The Reserve Bank of New Zealand has established a new body with enormous powers to ensure financial stability and address prudential issues for banks. The central bank’s new Financial Policy Committee will set debt-to-income and loan-to-value ratios for banks, so it will also have enormous power over the country’s housing sector.

Confluence Mailbag – #4 “Dollar Dynamics and the Future of Fed Independence” (Posted 10/7/25)

Daily Comment (October 6, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with the latest market-moving deal in the US artificial intelligence industry. We next review several other international and US developments with the potential to affect the financial markets today, including the outlines of a potential US-China trade deal, prospects for a new, market-friendly prime minister in Japan, and the latest on the US government shutdown.

US Artificial Intelligence Industry: Artificial intelligence developer OpenAI and chip designer Advanced Micro Devices (AMD) this morning announced a deal under which Open AI will equip its data centers with gigawatts worth of AMD chips, leading to tens of billions of dollars in new revenue for AMD over the next five years. OpenAI will also get warrants for up to 160 million AMD shares (roughly 10% of the firm) at 1 cent per share, if OpenAI hits certain targets and AMD’s stock price rises.

- The requirement for AMD’s stock to rise doesn’t look like a problem, as its shares are trading approximately 25% richer as of this writing.

- The deal is the latest in a string of AI-related linkups that have further fueled the excitement over AI’s prospects. However, concerns are also rising about excessive exuberance and daisy-chain deals that could ultimately lack economic substance.

China-United States: Bloomberg reported over the weekend that Beijing is pressing the Trump administration to lower national security restrictions on Chinese investment in the US to resolve the current US-China trade war. The proposed deal would involve Chinese firms investing up to $1 trillion in new factories and other industrial facilities in the US. It would also require the US to lower its tariffs on Chinese inputs used in the Chinese-owned facilities built under the deal.

- Other reporting suggests that China is also seeking a commitment from the US to oppose Taiwanese independence under the deal. Such a move would be a fundamental change to the US’s traditional policy of “strategic ambiguity,” under which it doesn’t say how it would respond to a Chinese effort to take control of the island.

- Such a deal might be hard for the US administration to swallow, given that it would likely generate strong opposition from domestic China hawks and could be seen by the public as capitulation to Beijing. It would also pose the risk that massive Chinese investment would allow Beijing to eventually dominate the US economy.

- Still, such a deal could have some positive economic benefits as well. For example, it would likely reduce the risk of a costly, destabilizing war. It could also allow the administration to cut its high tariffs against China and thereby reduce the risk of higher consumer price inflation. It could spur faster re-industrialization in the US. Also, producing more Chinese goods in the US could help rebalance bilateral trade and re-channel Chinese investment from Treasurys into fixed investment.

- If announced, the deal could be a headwind for gold, at least temporarily, while faster US re-industrialization would likely be positive for other commodities. US defense stocks would likely fall in value, but European defense equities would probably be less affected. In any case, such a deal would likely be positive for the broader US and Chinese stock markets.

China-Mexico-United States: Late on Friday, Beijing issued a strong condemnation of Mexico’s 11 on-going anti-dumping investigations against Chinese imports, which it said were masterminded by the US to help crimp China’s economic growth. Importantly, the statement also implicitly threatened to retaliate against Mexico if the probes lead to new tariffs against Chinese goods. Of course, various reports say the US is trying to enlist other countries to constrict Chinese exports. This incident shows how third-party countries can be caught in the crossfire.

Japan: The ruling Liberal Democratic Party on Saturday chose former Economic Security Minister Sanae Takaichi as its new leader, virtually guaranteeing the arch conservative will become Japan’s next prime minister due to the recent resignation of incumbent Shigeru Ishiba. If the Diet approves her as expected, Takaichi would serve out the remainder of Ishiba’s term, which ends in September 2027. Her policies are expected to include being tough on China, supporting big increases in the defense budget, and promoting faster economic growth.

- The prospect that Takaichi would win and return Japan to the pro-market economic policies of former Prime Minister Shinzo Abe has helped boost the country’s stock prices in recent weeks, even though the LDP’s lack of a majority in either house of parliament will make it hard to push through new reforms.

- So far today, Japanese stock prices have surged approximately 4.8%, while the yen (JPY) has weakened about 1.7% to 149.94 per dollar ($0.0067).

Philippines: New reports say the wave of coup rumors that have risen in recent weeks in conjunction with mass anti-corruption protests can be traced to loyalists and influencers aligned with former President Rodrigo Duterte, the chief political rival of incumbent President Ferdinand Marcos, Jr. The coup rumors, claims of foreign interference, and accusations of military disloyalty are increasingly seen as destabilizing, and may potentially set the stage for major disruption in a key US ally and major Asia-Pacific economy.

France: Prime Minister Lecornu resigned today after less than a month in office and less than one day after presenting his proposed government. Lecornu’s departure, driven by difficulties in pushing a vital deficit-cutting budget through parliament, makes him the fourth French prime minister to resign in the last year and the shortest-serving prime minister in the Fifth Republic. Since the move is further evidence of the political chaos in one of the European Union’s biggest economies, the news is weighing heavily today on the euro and on EU stocks and bonds.

Czech Republic: In parliamentary elections at the weekend, the Ano party of right-wing billionaire and former prime minister Andrej Babiš came in first, allowing Babiš to try to form a government and become prime minister again. Although the Ano party supports Czech membership in the North Atlantic Treaty Organization, it is more skeptical of the European Union and wants to reduce the country’s aid to Ukraine while it pursues more conservative economic policies. The result could be reduced aid to Kyiv and more friendly relations with Russia.

US Fiscal Policy: The federal government shutdown appears set to continue in the coming days, as Republican and Democratic leaders look committed to their budget positions, meaning Senate votes on a new funding bill continue to fail due to lack of the 60 votes needed for it to pass. However, President Trump is still holding in reserve his threat to use the shutdown to implement mass firings of federal employees — a move that could substantially worsen the economic impact of the shutdown.

US Labor Market: In a little-noticed development amid the federal shutdown, some 100,000 federal employees who had taken the administration’s deferred buyout deal earlier this year dropped off the federal payroll as of October 1. Another 55,000 or so will go off the payroll in the coming weeks. The newly unemployed workers are expected to add to the increased softness in the US labor market, raising the risk of a near-term economic slowdown despite expectations for faster growth in 2026.

Global Oil Market: The Organization of the Petroleum Exporting Countries and its Russia-led partners said eight of their members will boost their oil output by a modest 137,000 barrels per day starting November 1. The move, led by Saudi Arabia, will likely help keep the global oil market well supplied and keep a lid on prices in the near term, especially if slowing economic growth weighs on demand.