Author: Amanda Ahne

Bi-Weekly Geopolitical Report – The Great AI Race: A Sputnik Moment for the 21st Century (September 15, 2025)

by Thomas Wash | PDF

On his first full day in office, President Trump convened a group of prominent tech leaders in what he characterized as an effort to secure the United States’ technological future. This meeting launched the largest artificial intelligence infrastructure initiative in US history, named Stargate Project. The strategy forged a major public-private partnership with firms such as OpenAI, SoftBank, and Oracle, creating a joint venture with a fund that will exceed $500 billion over the next four years in order to cement US global dominance in artificial intelligence (AI).

This initiative placed the US at the forefront of a struggle with China that transcends a mere contest for technological supremacy; it is a fundamental clash of economic systems. While both are engaged in industrial state policy, China employs a state-guided, top-down model, using its bureaucracy to steer markets toward national objectives. In contrast, the American industrial approach is decentralized and industry-led, relying on private enterprise to drive innovation and growth.

The outcome of this contest will do more than anoint a global technology leader. It will also determine the dominant economic framework of the 21st century, which could not only profoundly reshape the world economy but also the architecture of the global financial system. Thus, much like Sputnik, this isn’t just about a single technological achievement; rather, the future of the global order could be at stake. In this report, we discuss the AI race between the US and China and what it means for markets going forward.

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Daily Comment (September 12, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with an analysis of OpenAI’s pivotal shift from a non-profit structure and its broader implications for the AI sector rally. We then explore the market’s optimistic anticipation of potential rate cuts at the upcoming Federal Reserve meeting. Our discussion extends to the latest round of US-China trade negotiations in Madrid and the notable warming of relations between the US and India.

OpenAI Goes Public: The AI company is restructuring its relationship with parent company Microsoft, moving toward a more traditional for-profit model. It will gain greater control over a new public benefit corporation, allowing it to balance generating profits for shareholders with its public-benefit mission. This shift away from its unconventional structure comes as market focus intensifies on AI companies .

- In recent months, the market’s reliance on tech companies for growth has accelerated. A prime example is the “Magnificent 7,” which, despite initially dragging on the broader S&P 500 Index this year, has since surged and now outperforms the combined growth of the other 493 companies.

- This pattern echoes the “safety trade” observed in 2023 and 2024, wherein investors flocked to established tech giants for capital appreciation. This strategy was driven by the companies’ robust earnings power, which provided a haven during a period of significant economic uncertainty caused by concerns over high interest rates and persistent inflation.

- Much of the hype around these companies has come from the optimism that they will become monopolies within their sector and generate substantial future returns. However, there are signs that this may not happen.

- Although some firms, such as Adobe, have shown that AI can boost profits, evidence suggests its practical impact remains limited. An MIT study revealed that a mere 5% of AI implementations have yielded significant returns or productivity gains — a finding supported by census data indicating that AI adoption rates among large companies have begun to fall.

- While we believe the AI momentum trade may still have legs, adding some exposure to value stocks could be a beneficial portfolio addition. During the equity sell-off earlier this year, value stocks outperformed their growth counterparts, suggesting they could act as a shock absorber if AI sentiment were to unexpectedly reverse.

Rate Cut Optimism: Equities rallied on Thursday as fresh economic data bolstered investor confidence that the Federal Reserve remains on track to cut rates next week. The rally occurred despite a key labor market report showing initial jobless claims jumping to their highest level in nearly four years, signaling continued softening. Furthermore, the latest inflation reading rose precisely in line with forecasts, reassuring markets that price pressures remain within expected bounds.

- Although this data all but guarantees a rate cut at the next meeting, it also raises serious questions about what follows. The primary headwind for future cuts is somewhat elevated inflation, with the monthly increases in July and August marking the highest in two years. Conversely, the startling jump in jobless claims may be less sinister than it appears; it could simply be a seasonal anomaly exacerbated by the unusual clustering of holiday weekends, which notoriously distort the data.

- The mixed economic data will likely fuel vigorous debate among FOMC members as significant concerns over persistent inflation remain. Several Fed officials — including voting members like St. Louis Fed President Alberto Musalem, Kansas City Fed President Jeffrey Schmid, and Chicago Fed President Austan Goolsbee — have already expressed reluctance to cut rates, citing inflationary pressures exacerbated by recent tariffs.

- The upcoming FOMC meeting will be pivotal for the sustainability of the current market rally. Markets have currently priced in 75 basis points of rate cuts for this year, with an expectation that the Fed will start with a 50-basis point cut next week. Consequently, the updated “dots plot” will be scrutinized as it outlines the projected path of future policy rates. A signal of aggressive easing is likely to buoy risk assets, while any suggestion of a moderate approach to easing could dampen investor risk appetite.

Brazil President’s Sentence: A Brazilian Supreme Court justice has sentenced former President Jair Bolsonaro to 27 years in prison for his role in plotting a coup after his 2022 election defeat. The ruling is poised to strain relations with the United States, where some lawmakers have called the arrest politically motivated. Prior to the sentencing, the US had imposed 50% tariffs on Brazilian steel, and Secretary of State Marco Rubio suggested further trade penalties could follow.

US and China Meet in Madrid: The US and China will meet in Madrid next week for talks on trade and TikTok. This follows the White House’s decision to extend the deadline for a trade agreement until November 10. The discussions will offer insight into the progress made over the past month, with both sides seeking concessions. While we do not expect a full resolution, the apparent unwillingness of either side to escalate tensions going into the meeting is a positive signal for markets.

ECB Holds Rates Steady: The European Central Bank decided to hold rates steady at its latest meeting, expressing optimism that growth and inflation remain broadly consistent with its goals. The bank revised its annual growth outlook upward by 30%, while acknowledging upcoming headwinds. Conversely, it revised its inflation forecast downward to 1.9% for the year. This strong outlook will likely boost the euro against the dollar but may act as a headwind for US investors holding European equities.

US and Poland Disagree: Polish Prime Minister Donald Tusk has rejected the White House’s assertion that a recent Russian incursion into Polish airspace was unintentional. This disagreement coincides with Poland’s request for additional military assistance to defend against future Russian provocations. The US willingness to give Russia the benefit of the doubt may suggest a hesitancy to getting more deeply involved in European security. The incident provides more evidence that the EU needs to shore up its own defenses amid the lack of US assurances.

US and India: Washington and New Delhi are close to finalizing a trade agreement, according to the White House. It also stated that the US views India as one of its most important strategic trade partners as it seeks to shape a future economic order. Simultaneously, the US is reportedly advocating for G-7 nations to impose tariffs on India due to its support for Russia’s invasion of Ukraine. This announcement aligns with the US employing a “carrot-and-stick” approach to encourage India to distance itself from China.

Daily Comment (September 11, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins by examining the White House’s push for a greater share of university patent revenue and the underlying ideological shift this move represents. We then analyze the latest Producer Price Index report and its implications for monetary policy. The discussion will also cover Mexico’s new tariffs on goods from China and other Asian countries, as well as French President Macron’s choice for a new prime minister. We also include a summary of key global economic and domestic data releases.

Industrial Policy: The White House is arguing that it is entitled to a share of the revenue that universities generate from patents developed through federally funded research. During an interview with Axios, Commerce Secretary Howard Lutnick stated that the government should recoup its investment and “participate” in the returns, noting that many universities profit by licensing this research to companies that provided no initial funding. Secretary Lutnick also suggested that this revenue could be used to support Social Security and other public programs.

- This move is consistent with a broader pattern of recent economic policies, such as mandating revenue-sharing from chip sales to China, acquiring a direct stake in Intel, and securing a “golden share” in US Steel (a veto power over key decisions) as a condition for approving its acquisition by Nippon Steel.

- The government’s move to seek payments from companies and organizations appears to be a significant ideological shift away from the “Washington Consensus,” which favored a light-touch approach. This new direction may reflect a preference for state-aligned monopolies that can serve a dual purpose: coordinating policy efforts and generating government revenue.

- This change will likely favor larger companies over smaller ones. Their significant economies of scale give them the financial strength to absorb increased costs that would be a challenge for smaller competitors. Large technology and manufacturing firms are well-positioned to benefit, given their ability to provide solutions for both consumer and military markets. We are entering an era where collaboration between companies and governments is becoming essential for addressing complex challenges.

PPI: Producer prices experienced an unexpected decline in August, signaling that firms are encountering resistance to price increases. The headline Producer Price Index (PPI) reversed from a 0.7% gain in July to a 0.1% decline the following month. Core PPI, which excludes food and energy prices, also fell by 0.1%. A sharp slowdown in trade services was the primary driver behind the decline in overall price pressures. In fact, when excluding trade services, core PPI rose by 0.3%.

- The trade services component of PPI, a key measure of wholesale and retail margins, is essential for monitoring how tariffs are being absorbed by the economy. The index recorded its sharpest one-month decline since July, indicating that businesses are either accepting lower profits or are being forced to reduce prices amid weakening demand.

- This decline, particularly in trade services, can also be a sign that the effects of previous tariff-driven inflation are beginning to wane as businesses and supply chains adapt to the new pricing environment. The contraction in wholesale margins serves as a reliable forward-looking indicator for consumer prices.

- A weak PPI report suggests that companies are struggling to pass tariff costs on to consumers, which may have implications for profit margins. This development bolsters expectations for a Fed rate cut at the upcoming meeting next week. If price pressures continue to abate, we anticipate the Fed will shift its focus away from fighting inflation toward protecting the labor market.

Miran’s Confirmation: The Senate Banking Committee advanced Stephen Miran’s nomination on Wednesday, paving the way for him to participate in the next Federal Open Market Committee (FOMC) meeting. To meet this timeline, the full Senate must confirm his nomination by Monday. If confirmed before the FOMC begins its two-day meeting on Tuesday, Miran is expected to push for a rate cut, likely an aggressive one, probably 50 bps or more.

Mexico Plans Tariffs: The Mexican government has announced a tariff increase of up to 50% on imports from China and other Asian nations. This protectionist measure is a strategic move to safeguard domestic industries ahead of upcoming talks for the North America Free Trade Agreement (now known as USMCA). Since the US is expected to push for a more unified trade policy among the North American bloc, this action by Mexico signals its willingness to align with US concerns about Chinese imports, a point we highlighted in last year’s outlook.

Poland Seeks Assistance: On Wednesday, Poland requested more allied air defense systems and counter-drone technology to protect against new incursions from Russia. The request follows 19 instances where Russian drones crossed into Polish territory and were subsequently shot down by Polish forces. While the conflict did not escalate, this marks the first direct military engagement between NATO and Russian forces since the war in Ukraine began. Although full-scale war is unlikely, the risk of escalation is now elevated.

Political Violence: Popular conservative activist and influencer Charlie Kirk was assassinated during a speaking event at Utah Valley University. The attack underscores the dangerously growing polarization in US politics. An increasingly hostile political environment is likely to fuel further civil unrest, with direct market effects including eroding trust in public institutions. This trend could trigger significant market volatility if investors begin to fear a fundamental weakening of the nation’s political stability.

New French PM: French President Emmanuel Macron has appointed Sébastien Lecornu as the new prime minister. The two share a close relationship, with Macron previously relying on him to negotiate delicate situations, such as the release of hostages held by Hamas. Lecornu maintains connections across the political spectrum, and it is hoped that he will leverage this to finally pass a budget. Nevertheless, France’s complicated political situation continues to fuel uncertainty in the bond market.

Daily Comment (September 10, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with the recent downward payroll revisions and explains our sustained optimism regarding the market’s resilience. We then examine escalating tensions in the Middle East, the surge in AI-driven market enthusiasm, and the potential for a collaborative US-EU effort to hold India and China accountable for supporting Russia during the war in Ukraine. Finally, we provide a summary of key economic data releases to offer a comprehensive view of the current global financial landscape.

Payroll Revisions: A major government revision revealed that US employers hired 911,000 fewer workers in the 12 months leading up to March 2025 than was previously reported. This represents the largest downward revision in payrolls on record, indicating the economy actually added an average of just 74,000 jobs per month in 2024 — roughly half of the initially reported 147,000. This data suggests the labor market was significantly weaker than understood, a revelation that will likely add urgency to the Federal Reserve’s deliberations on interest rate cuts.

- The critical question raised by this data is whether the economy is sliding into a recession or merely experiencing a period of weakening growth. Currently, we lean toward a more optimistic interpretation that while economic momentum has undoubtedly slowed in recent months, it remains underpinned by resilient household consumption and robust investment spending, particularly within the technology sector.

- That said, even if our assessment is incorrect, this is not a time for complacency. History shows that markets can rise during a recession, particularly in the absence of a major shock. For example, the US recession technically began in December 2007, but the equity market did not fully capitulate until the collapse of Lehman Brothers in September 2008. Without such a defining crisis, it is unclear whether that period would have been perceived as a deep recession or merely a prolonged economic slowdown.

- This dynamic contrasts sharply with the March 2023 collapse of Silicon Valley Bank. A swift and coordinated regulatory response successfully contained the crisis and averted a broader contagion. Consequently, the S&P 500 rallied and went on to gain over 26% for the year. Therefore, we are watching for a similar catalytic event before materially changing our outlook. In the meantime, we continue to emphasize the importance of including value in portfolios as a way to balance risk.

Israel-Qatar: In a significant escalation of regional tensions, Qatari Prime Minister Sheikh Mohammed bin Abdulrahman al-Thani has called for a regional response against Israel following an attack in Doha that targeted Hamas leadership. This move comes just one week after Qatar warned that a potential Israeli takeover of the West Bank could jeopardize the Abraham Accords, the foundational agreements for Israel’s normalization with several Middle Eastern states.

- Although the White House was briefed on the incident, it has expressed clear frustration with Israel’s assertiveness. A cornerstone of US strategy to de-escalate tensions in the Middle East is the normalization of relations between Israel and the Gulf states. By executing a strike on the sovereign territory of a key regional partner without its consent, Israel risks causing those same Gulf nations to reconsider their decision to establish ties, thereby undermining a central US diplomatic achievement.

- While we expect cooler heads to prevail between Israel and regional Arab states, the risk of a broader conflict remains elevated. Following the attack, natural gas prices initially spiked but quickly reversed course, closing lower for the day. This market response suggests that investors are currently discounting the probability of a wider regional war. Nevertheless, we are monitoring the situation closely, as a significant escalation could trigger a flight to safety, particularly into assets like gold.

Tariff Case: The Supreme Court has agreed to fast-track a hearing to determine whether President Trump possesses the authority to implement tariffs without congressional approval. The court has consolidated two separate cases on the dispute: one involving an appeal of a federal ruling that found the president lacked such authority and another brought by two educational toy companies arguing that the tariffs violate the International Economic Powers Act.

- We do not believe this will stop the White House from issuing tariffs, as it retains other legal tools at its disposal to impose tariffs under certain circumstances.

- Nevertheless, the bond market is monitoring the situation closely. A ruling against the administration could force the return of collected tariff revenue, an outcome that would further weaken the US fiscal situation.

AI Optimism: Oracle Corporation’s stock surged to a record high following its earnings release, driven by an exceptionally aggressive outlook for its cloud business. This occurred despite the company missing its earnings per share (EPS) target. Investor enthusiasm was primarily fueled by a stunning increase in bookings (a measure of future revenue), which reached $455 billion for the quarter. The company also anticipates significant new contracts with other clients, potentially pushing its total future contractual obligations over $500 billion.

- This optimism is likely to provide a tailwind for the broader technology sector, underscoring the market’s robust faith in the long-term AI narrative.

- That said, the market response does show that investors are prioritizing future growth over current performance.

FOMC: A federal judge has granted a temporary restraining order blocking President Trump from firing Federal Reserve Governor Lisa Cook. The federal court ruling grants Governor Cook the ability to remain on the Federal Open Market Committee (FOMC) and participate in the upcoming policy meeting, where officials will determine whether they will cut rates. However, regardless of the lower court’s decision, the ultimate authority to fire a Fed governor will almost certainly be decided by the Supreme Court.

New Tariffs: The White House is pressuring the EU to impose a 100% tariff on goods from China and India. This aggressive push is based on the two countries’ continued support for Russia in the Ukraine war. The US has also stated its willingness to match any tariffs the EU implements, aiming to create a united front and force a swift end to the conflict. This move is part of an ongoing effort by the US to secure greater assistance from the EU in its foreign policy goals.

Daily Comment (September 9, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with news of a potentially fundamental change in US defense strategy that could have large implications for the country’s foreign relations, economy, and financial markets. We next review several other international and US developments with the potential to affect the financial markets today, including the latest on the search for new prime ministers in Japan and France and a sobering report on how long it may take US firms to see a positive return on their current investments in artificial intelligence.

US Defense Strategy: New reporting says the Pentagon’s draft defense strategy would prioritize domestic missions, homeland defense, and protection of the Americas region over preparing to fight major foreign rivals such as China and Russia. Although the strategy could still be revised, it appears that the current version is calling for the US to end its traditional role as the global hegemon and instead focus on being a regional hegemon, probably relying on the Pacific and Atlantic Oceans and the US nuclear arsenal to deter longer-range threats.

- The apparent strategy change is surprising because the document is being developed by Under Secretary of Defense for Policy Elbridge Colby, who has long advocated for the US to focus its military on the potential threat from China. Like other Republican China hawks, Colby has argued for shifting military resources from Europe and the Middle East to the Asia-Pacific, not to the Americas.

- If the strategy shift is finalized, a key question is what it means for future US defense spending and the economic and financial prospects of the defense industry. As we’ve noted before, isolationist sentiment in parts of the administration’s political base could force eventual defense spending cuts, even as new military technologies lead to smaller orders for major, expensive weapon systems such as aircraft carriers and bombers.

- At the same time, we think that the prospect of the US pulling back from its foreign defense commitments will continue to prompt foreign nations to hike their own spending. Some of those new orders will likely go to major US defense contractors, but the bulk will likely go to foreign defense firms.

- That validates our longstanding expectation that European and Asian defense firms could be especially well placed to enjoy increased sales, bigger profits, and higher stock prices than their US counterparts.

Japan: Yesterday, Toshimitsu Motegi, the former secretary-general of the ruling Liberal Democratic Party, became the first Japanese politician to say he will contend to replace Prime Minister Ishiba as head of the LDP and the government following his resignation on Sunday. Several other top politicians are also expected to throw their hats into the ring in the coming days, including the investor favorite, free-market advocate and former Economic Security Minister Sanae Takaichi.

China: On the sidelines of the Munich Auto Show yesterday, the executive vice-president of Chinese electric-vehicle giant BYD said about 100 of the country’s carmakers would have to be pushed out of business for the industry to stabilize. The statement comes as Beijing starts taking top-down steps to rein in the country’s growing problem with excessive industrial capacity and debilitating price wars in many industries. However, some observers believe that even putting 100 carmakers out of business would leave China with too many auto firms.

Indonesia: Following last month’s widespread protests against government corruption and lawmaker privileges, President Prabowo Subianto yesterday fired longtime Finance Minister Sri Mulyani Indrawati. The firing of the respected finance official suggests the president may be considering looser fiscal spending to curry favor with voters. Reflecting the threat to financial discipline, Indonesia’s benchmark stock index fell approximately 1.8% today, while the rupiah has weakened about 1.0% against the US dollar.

European Union: ASML, the Dutch maker of semiconductor manufacturing equipment, has announced that it will invest 1.3 billion EUR ($1.5 billion) in the French artificial intelligence start-up Mistral to help foster its “strategic technology.” As the US and China battle for the lead in AI technology and development, leaving other major countries in their dust, the ASML-Mistral deal illustrates how European countries are scrambling to catch up, or at least avoid falling into irrelevance.

France: As previewed in our Comment yesterday, Prime Minister Bayrou did lose yesterday’s no-confidence vote in parliament, with 364 of the 577 lawmakers voting against him. President Macron today will accept Bayrou’s resignation and may announce a nominee to replace him. Even so, whoever accepts the poisoned chalice to try to become the next prime minister will face the same challenges of a fractured parliament and strong resistance to economic reform, which will likely weigh on French asset values and push bond yields higher.

US Labor Force: According to the Department of Education, high schoolers’ average math and reading scores in the National Assessment of Educational Progress for 2024 fell to their lowest levels on record. The share of 12th graders rated as “proficient” or above also declined, to just 22% in math and 35% in reading. Such abysmally low levels of proficiency have long been seen as an Achilles heel for the US that will leave companies without the educated workers they need to reindustrialize and compete globally in high technology and the sciences.

US Artificial Intelligence: Julie Sweet, CEO of consulting giant Accenture, said in an interview with Axios that it will probably take several years for US companies to really see a positive return on their AI investments. According to Sweet, that’s because it will take time for firms to retrain their workforces and revamp their operations to make full use of the technology. The statement is consistent with other recent studies and commentaries that have warned that the payoff from AI may be further in the future, creating some risk of a pullback in AI-related stocks.

Daily Comment (September 8, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with yet another production hike from a key group of oil producers, which will likely help keep a lid on global energy costs and help offset the impact of other types of rising prices. We next review several other international and US developments with the potential to affect the financial markets today, including the resignation of Japan’s prime minister and a surge in US corporate bond issuance now that it seems clear the Federal Reserve will cut interest rates later this month.

Global Oil Supply: A subset of the Organization of the Petroleum Exporting Nations and its Russia-led partners yesterday said they’ll boost their collective oil production by 137,000 barrels per day starting in October, marking the latest in a string of increases. With economic growth slowing, the small output hike is expected to help keep the global economy well supplied with oil and will likely hold down energy prices. The countries hiking production include Saudi Arabia, Russia, Iraq, the United Arab Emirates, Kuwait, Kazakhstan, Algeria, and Oman.

Japan: Prime Minister Ishiba yesterday said he will resign, finally succumbing to pressure from within his Liberal Democratic Party (LDP) to take responsibility for its loss in the July parliamentary elections. The decision came one day before the LDP was to hold an early leadership election, which Ishiba could well have lost. The party will now probably select a successor for Ishiba in October. In the meantime, Japanese security and economic policy will likely be on hold, but Japanese stock prices have surged to a new record high on optimism about any Ishiba successor.

- Potential successors for Ishiba include Agriculture Minister Shinjirō Koizumi, the son of former Prime Minister Junichiro Koizumi, who in 2001-2006 laid much of the groundwork for Japan’s eventual economic resurgence.

- Other possible successors include Chief Cabinet Secretary Yoshimasa Hayashi, a moderate and the protégé of former Prime Minister Kishida, and the ultraconservative former Economic Security Minister Sanae Takaichi.

China: The Chinese Communist Party announced on Friday that Yi Huiman, chairman of the China Securities Regulatory Commission (CSRC) from 2019 to 2024, is being investigated for “severe breaches of discipline.” That makes Yi the latest Chinese stock market regulator to come under a cloud because of corruption, incompetence, or both. The streak of probes highlights the challenge General Secretary Xi faces as he tries to transform China into a “financial superpower” and make its stock market more attractive to domestic and foreign investors.

Taiwan: New reports say the Taiwanese military is making rapid progress on a Ukraine-inspired “high-low” attack drone strategy to deter a potential invasion by China. For the top end of the force, the Taiwanese have modified a low-cost, legacy training missile into a loitering strike drone with a range of 1,000 km, enough to hit cites such as Beijing and Shanghai. For the low end, they are also developing cheap, expendable, AI-enabled drones that can be used to swarm the invading Chinese.

- Many foreign military observers have decried Taiwan’s weak preparations to resist a Chinese takeover, citing problems such as big purchases of the wrong types of weapons to insufficient troop training. However, Ukraine’s success in blunting Russia’s invasion has evidently provided a potentially viable roadmap for how Taiwan could deter China.

- The development also offers further evidence of how AI-enabled drones and drone swarms continue to change the nature of warfare. This could potentially upend the current balance of power among national militaries and possibly create enticing new investment opportunities in defense industry.

France: Prime Minister Bayrou today faces a no-confidence vote in parliament over his unpopular deficit-cutting proposal, and he is widely expected to be toppled. That would force President Macron to name his fifth prime minister in the last two years. It would also further paralyze the fractured French parliament and make it even harder to push through reforms to straighten out the country’s finances. As a result, French government bond yields have now risen to their highest level since the eurozone debt crisis more than a decade ago.

United Kingdom: An interesting article in the Wall Street Journal today suggests the UK and its surging bond yields could be the “canary in the coal mine” regarding investor concerns about growing debt costs in major developed countries. The analysis points to a risk that rising debt and slow economic growth in countries such as the US and France could also undermine investor confidence and drive longer-term bond yields even higher over time.

Argentina: In an election yesterday, the opposition Peronists won approximately 47.0% of the vote in the major province of Buenos Aires, while President Milei’s libertarian La Libertad Avanza party won 33.9%. The lopsided win for the opposition was far worse than expected, setting the stage for Milei’s party to suffer major losses in the midterm elections in October 2026. That possibility could prompt Milei to water down some of his anti-statist, pro-capitalist economic policies over the coming year.

US Immigration Policy: In an interview with Axios, US Citizenship and Immigration Services Director Joseph Edlow said he plans to significantly toughen the civics test used to vet foreign nationals applying to become citizens, arguing the current citizenship process is too easy. Edlow also revealed that he has revoked some citizenship approvals granted previously and planned to “denaturalize” more people going forward. Edlow’s statements illustrate how new US policies don’t just involve cutting illegal immigration, but also involve rolling back legal entry.

- Reducing legal and illegal immigration has the potential to create labor shortages in certain industries, thereby weighing on economic growth, at least in the near term.

- On the other hand, as US labor demand weakens and firms start to lay off more workers, pushing out the immigrant workers could create opportunities for native-born employees who lose their jobs. In turn, that could limit any associated rise in the unemployment rate.

US Bond Market: With the Fed set to cut its benchmark interest rate later this month, reports indicate companies are rushing to issue corporate bonds and take advantage of investor demand for higher yielding obligations. For the month to date, firms have issued some $56.4 billion of investment-grade bonds and $9.6 billion in junk bonds, for the strongest such period since early March. Investor demand for the obligations has driven the spread between corporate yields and US Treasury yields down to their lowest level in two years.

US Health Insurance Market: New analysis by Mercer indicates health insurers are on track to hike premiums for corporate health plans by about 6.5% in 2026, marking the biggest jump in 15 years. A separate report says that people who buy their health insurance on government exchanges will see their premiums jump about 18.0%. The big hikes are likely to buoy the consumer price index and keep inflation uncomfortably high.

Asset Allocation Bi-Weekly – The Cap-Weighted and Equal-Weighted S&P 500 (September 8, 2025)

by Patrick Fearon-Hernandez, CFA | PDF

There are many ways to describe the strong performance in large cap US stock prices this year. You could simply call it a bull market, with the S&P 500 total return index up 31.2% since its low in early April and up 11.5% year-to-date. The strong buying pressure could even be called a “euphoria.” With continued gains, it would be no surprise if some observers started referring to it as a return to the type of “irrational exuberance” seen in the 1990s. In any case, the market is exhibiting strong momentum, especially in the growthy sectors such as Information Technology and Communication Services. Indeed, investors now widely understand that the lion’s share of the uptrend this year has come from just a few stocks within those sectors, i.e., the Magnificent 7. A key question is whether these trends will continue. And to the extent that there is a risk of these trends reversing, is there a good way to hedge the associated downside risk?

The growth of index investing in recent decades is probably one reason for the outperformance of large cap growth stocks like the Mag 7. Many individual and institutional investors simply channel their US large cap stock investments into funds tracking the S&P 500 Index, where each holding is weighted by the stock’s total market capitalization. Funds channeled into this version of the S&P 500 go disproportionately to those stocks with big market caps, especially the Mag 7, helping them appreciate even more. But there is also a version of the S&P 500 in which the allocation to each stock is an equal 0.2% — the S&P 500 Equal Weight Index. In this methodology, stocks with smaller capitalizations and more “value” characteristics have a higher representation than they do in the capitalization-weighted version. If we compare the performance of the cap-weighted S&P 500 to that of its equal-weighted counterpart, we can get a sense of the relative advantages or disadvantages of each index during different market scenarios.

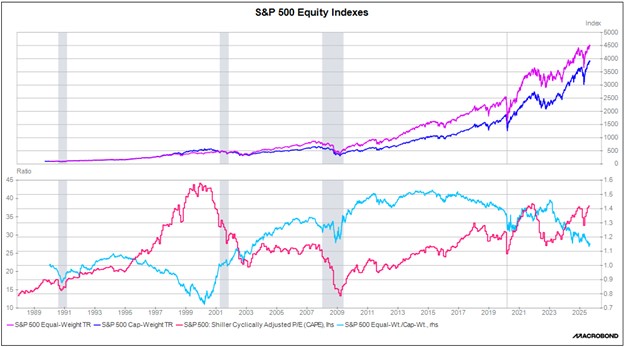

In the upper panel of the following chart, we show the S&P 500’s total return index in both its cap-weighted and equal-weighted forms, with each based to 100 in January 1990. The figure shows that over the last 35 years, the equal-weighted variation of the S&P 500 has produced a meaningfully higher total return than the market cap-weighted one. (Consistent with finance theory, the higher return for the equal-weighted index also comes with a higher standard deviation.)

Importantly, the relative performance of the two indexes changes over time. In the bottom panel of the chart, the light blue line shows the relative performance of the equal-weighted index to that of the version weighted by market cap. We have also included the Case-Shiller cyclically adjusted price/earnings ratio as a measure of average stock valuation.

In the bottom panel, the long downtrends in the blue line from 1995 to 2000 and from 2015 to the present coincide with periods of intense market enthusiasm, strong momentum in big, popular growth stocks, and lagging performance in relatively smaller, less growthy stocks. These periods generally happen when investors are pouring funds into the market and driving up valuations. In these periods, including the present, it can be tempting for investors to just focus on the large cap growth stocks driving the market. However, the chart clearly shows that when market enthusiasm eventually reverses and investors pull out of the market, the relative advantage of the equal-weight index snaps back sharply. This reflects the sudden sell-off in trending, growthy, highly weighted stocks during such periods. In sum, the bottom panel illustrates how concentration risk increases in long, strong bull markets. This tends to set the stage for sharp portfolio declines when markets go into reverse, even for investors who think they are well diversified because they are invested in the cap-weighted S&P 500.

The lesson from this discussion is that while fast-rising large cap growth stocks like the Mag 7 may still have some momentum left, investors should also consider broad diversification with meaningful exposure to undervalued and overlooked stocks, which could have the potential for solid, longer-run returns.