by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment opens by analyzing the market’s growing anticipation of a rate cut at the upcoming FOMC meeting. We then pivot to critical global developments, including rising discontent within the EU Parliament over the US trade deal, the bond market’s concerns regarding the potential rollback of tariffs, and signals that China may intervene to cool its overheated equity market. We conclude with a briefing on other key factors influencing the global financial landscape.

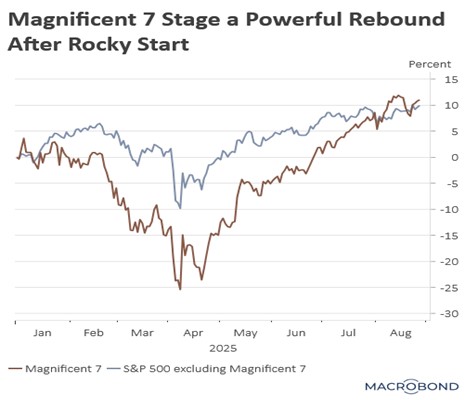

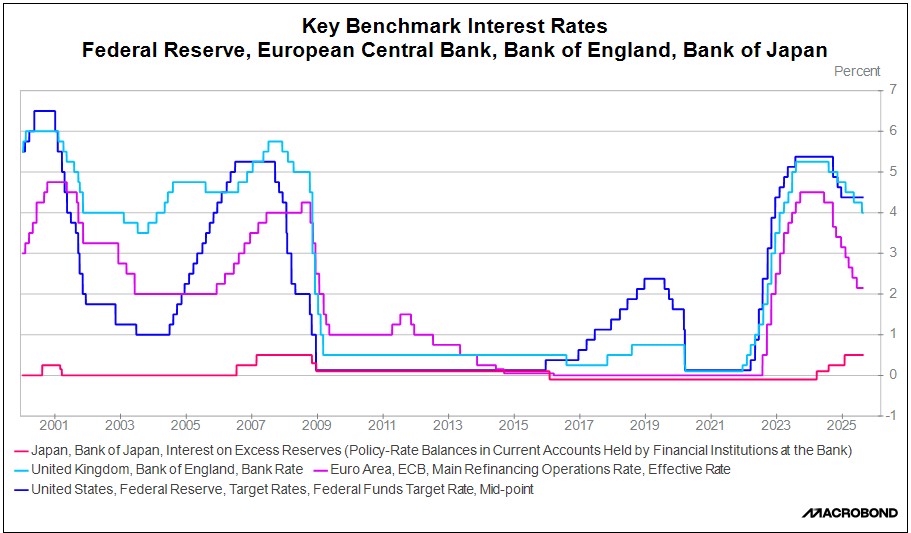

Rate Cut Optimism: Equities received a boost on Wednesday as economic data and recent statements from Fed officials have fueled expectations of an interest rate cut, boosting market confidence. This shift in focus reflects the market’s pivot from trade policy concerns, such as tariffs, to the potential for monetary policy to stimulate investor and consumer sentiment. This is a direct reaction to the belief that a rate cut can more immediately and broadly impact economic activity and offset headwinds from tariffs.

- The latest JOLTS report signifies a cooling labor market, with unemployed workers now outnumbering job openings for the first time since 2021. This hiring slowdown aligns with unemployment insurance data, which shows modest initial claims but a steady rise in continuing claims. Together, these metrics suggest a cautious “slow-hire, slow-fire” environment where firms are neither aggressively recruiting nor conducting large-scale layoffs, opting instead to maintain their current workforce size.

- Furthermore, signs of economic pessimism are emerging. The Federal Reserve’s latest Beige Book reported stagnant or slightly negative economic activity across most districts. The primary concern cited was flat-to-declining consumer spending, as household wages failed to keep pace with rising prices. Notably, the report indicated that inflation pressures were now being felt more acutely by firms than by consumers.

- In response to this weakening trend, Fed Governor Christopher Waller has signaled openness to multiple rate cuts, while Atlanta Fed President Raphael Bostic and St. Louis Fed President Alberto Musalem have both advocated for at least one, possibly as soon as this fall.

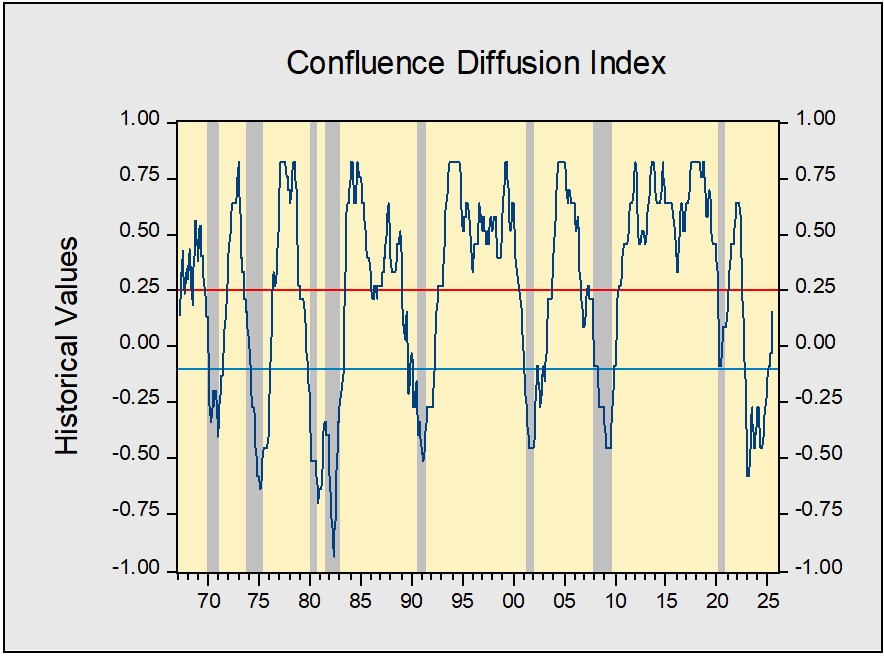

- We maintain our view that the Federal Reserve perceives current inflationary impacts as transitory and will favor its maximum employment objective. Consequently, we anticipate impending rate cuts. Given the economy’s resilient position, further bolstered by increasingly clear trade policy, these cuts should provide a broad lift to equity markets. We expect this tailwind to benefit risk-sensitive assets most prominently, while also providing support to established large-cap names.

EU Friction: Opposition to the proposed EU-US trade deal is broadening within the European Parliament, with parties across the spectrum demanding changes like a sunset clause. While the deal is still expected to pass, its current criticism — from the left’s claim of “capitulation” to the far-right’s charge of weakness — highlights a lack of political enthusiasm. That said, time will tell if the White House is open to making more concessions.

More US Troops in Poland?: The US is considering increasing its troop presence in Poland to help secure the country’s defense. This decision follows meetings between the White House and Polish leaders to discuss assurances of support, likely anticipating a wind-down of Russia’s war in Ukraine. Notably, these assurances may be driven by Poland’s aggressive pursuit of its defense spending targets, signaling that the US is more willing to bolster nations that commit to developing their own military capabilities.

Tariff Fight: The White House has asked the Supreme Court to intervene to maintain a broad set of tariffs that a lower court ruled illegal. This move underscores the crucial importance of this revenue stream for debt reduction, particularly during a period of heightened fiscal spending. Consequently, a ruling against the government could introduce fresh volatility and contribute to ongoing turmoil in the bond market.

China Stock Rally? Chinese regulators are growing concerned about the resurgence in domestic equities. Much of this rise in valuations appears to be driven by speculation from retail investors and hedge funds, rather than a fundamental rebound in economic activity. These investors, seeking higher returns from abroad, have been drawn to the market by relatively lower interest rates elsewhere. This has led to speculation that regulators may intervene to cool the rally to prevent a speculative bubble from forming.

Macron Under Pressure: French President Emmanuel Macron will resist calls for a snap election if his prime minister loses a no-confidence vote next week, an outcome that is widely expected. The potential appointment of a fifth prime minister since 2024 could be interpreted as a sign of declining confidence in his leadership. Macron’s hesitation to call for new elections stems from the political pressure he faces to implement unpopular budget cuts, as he works to stabilize the country’s finances.

Abraham Accords: The United Arab Emirates has warned the White House that Israel’s planned annexation of the West Bank could jeopardize the Abraham Accords. This marks a new diplomatic phase, as the UAE, a key participant to the accords, has linked its future cooperation to Israel’s policies toward Palestinians. This warning, which follows renewed Israeli statements on annexation, suggests that Israel’s actions could undermine US relationships with its allies, potentially creating an opening for rivals such as China.

Silicon Valley to Capitol Hill: A consortium of top tech executives will meet at the White House for an AI summit, reflecting the sector’s deep integration into US efforts to maintain a competitive edge against China. This gathering is the latest example of a broader, enduring shift towards public-private cooperation, which is moving away from an adversarial dynamic and toward a collaborative model for tackling complex issues. We believe companies that support national security goals will be well-positioned to thrive in this new era of cooperation.