by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a quick overview of President Trump’s move to oust Federal Reserve Governor Lisa Cook. We next review several other international and US developments with the potential to affect the financial markets today, including the French government’s risky call for a confidence vote in September and new evidence that artificial intelligence is weighing on the US labor market.

US Monetary Policy: In a letter posted to social media last night, President Trump informed Federal Reserve board member Lisa Cook that he was immediately firing her for cause, citing allegations by Federal Housing Finance Agency Director Bill Pulte that she claimed two different properties as her “primary residence” in nearly simultaneous mortgage applications in 2021.

- Cook is likely to contest her firing in the courts. Nevertheless, if the firing stands, the president would be able to take a large step toward quickly reshaping the Fed policy board to his liking.

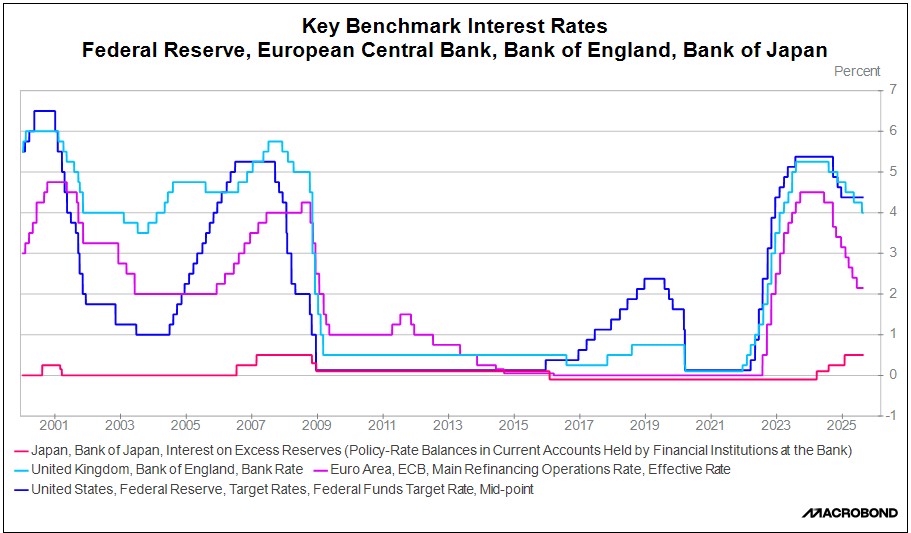

- If so, the Fed may start accelerating its interest-rate cuts relatively soon, helping bring US interest rate policy in line with the recent cuts from other major central banks, such as the European Central Bank and the Bank of England. That would probably give a boost to small-cap stocks, REITs, dividend payers, and cyclical equities.

- At the same time, the loss of Fed independence would likely be taken poorly by many investors, as it could portend excessively loose monetary policy and higher price inflation in the future. That could eventually push up longer-term bond yields and cap the positive impact on stocks.

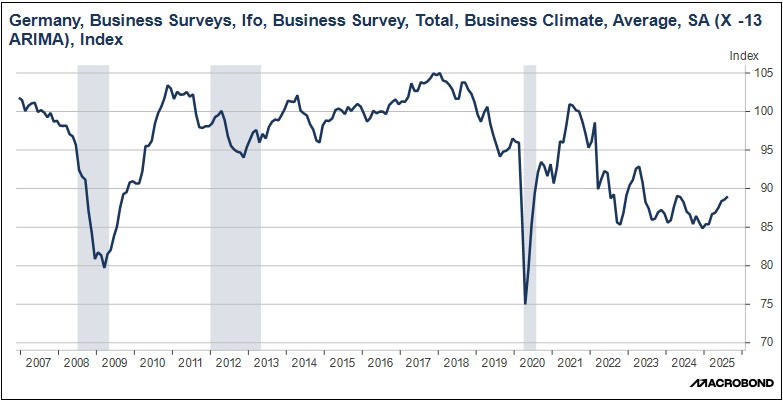

France: Prime Minister Bayrou yesterday called a confidence vote on his government for September 8, in hopes that it will help push his deficit-cutting budget proposal through the divided parliament. However, the vote could also prompt the government’s downfall, paralyze policymaking, and/or usher in a right-wing populist government. French stocks and bonds are therefore selling off sharply for the second straight day.

United Kingdom: The leader of the populist Reform UK party, Nigel Farage, said in a major policy speech today that if his party comes to power, it will seek to take the UK out of the European Convention on Human Rights and start mass deportations of asylum seekers. Since Reform UK has been leading both the Conservatives and the Labour party in opinion polls, the statement suggests any future Reform UK government would enact a tough anti-immigration policy similar to that of the US government.

Russia-Ukraine Conflict: New reports say Ukraine’s stepped-up drone strikes on Russia oil refineries have led to gasoline shortages, rationing, and price spikes in some regions. The jump in gasoline prices comes just as Ukrainian attacks on Russia’s airports and railroads have forced more of the country’s citizens to travel by auto. There is no sign that the hardships will force Russia to scale back its war against Ukraine, but the situation does suggest potential political problems for President Putin down the line.

United States-China: President Trump yesterday said he is prepared to allow 600,000 students from China to study in the US each year, more than double the current quota. The statement came one day after the Chinese Embassy in Washington warned that students should be wary about intrusive immigration checks when arriving through Houston. The new quota of 600,000 student visas could be a negotiating offer to help achieve a new US-China trade deal, reflecting the administration’s new-found appreciation for China’s strong leverage in the negotiations.

US Trade Policy-Digital Services: In a social media post last night, President Trump warned that he will impose “substantial additional Tariffs” and restrict US advanced technology exports to any country “with Digital Taxes, Legislation, Rules, or Regulations,” which he said are discriminatory against US tech firms. Separately, reports say the White House is mulling the imposition of visa restrictions and other sanctions on EU officials enforcing such rules.

- The president’s warning comes despite previous indications that the new US-EU trade deal didn’t touch Europe’s digital services tax or other technology regulations.

- Therefore, it will likely rekindle investor concerns about the unpredictability of policy changes coming from the administration.

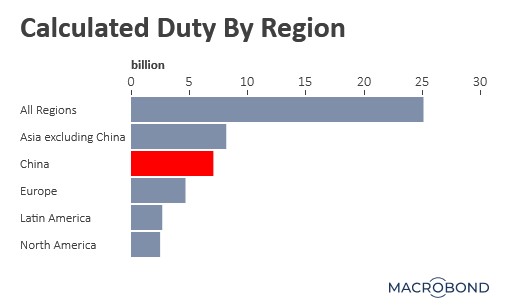

US Trade Policy-Lumber and Wood Products: The White House yesterday clarified that furniture is included in its probe of dumped lumber, wood, and derivative products, which was announced March 1. The clarification followed a statement by President Trump on Friday that the investigation would soon lead to unspecified tariffs on imported furniture. In response, furniture importers such as Wayfair and Williams-Sonoma experienced sharp drops in their share prices yesterday.

US Labor Market: New research from Bank of America shows that workers who switched jobs in the last year are now seeing no better wage growth than workers who stayed in their positions. For both cohorts, average wages are now up 4.3% from a year ago. As recently as early 2023, job switchers’ wages were up almost 8.0% year-over-year, while job stayers’ wages were up only about 5.5%. The changed dynamics are additional evidence of weaker labor demand, which could help ensure the Fed cuts interest rates in September.

- Separately, three Stanford economists today released a study showing “clear” evidence that artificial intelligence is crimping the demand for young workers in particular fields.

- Based on anonymized data related to millions of employees at tens of thousands of firms, the research finds that younger workers now make up a much smaller share of total employment in heavily AI-exposed occupations, such as software development. That is consistent with other recent reports suggesting firms are cutting their hiring of younger workers with college degrees.