by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with an overview of current dynamics in both the US stock market and the commercial office market. We next review other international and US developments that could affect the financial markets today, including a conciliatory speech by US Secretary of State Rubio at the Munich Security Conference over the long weekend and signs that Japanese Prime Minister Takaichi isn’t resisting further interest-rate hikes by the Bank of Japan.

US Stock Market: As of this writing, stock index futures are pointing to another sizable price decline in technology shares today, with many trading down more than 1%. One apparent factor is a new Bank of America survey showing that the share of major fund managers who believe companies are currently over-investing is now at a record high. The survey results will feed into growing concerns about a bubble in investment related to artificial intelligence. As a result, investors will likely continue to rotate into value sectors such as Consumer Staples.

US Commercial Office Market: According to new data from Trepp, the delinquency rate for office loans in commercial mortgage-backed securities climbed to a record 12.34% in January. As lenders increasingly conclude that today’s lower office demand is permanent, the data suggests they are abandoning their “extend and pretend” strategy that artificially held down delinquency figures over the last couple of years.

- All the same, the debt on some property types, including industrial buildings and grocery-anchored retail centers, continues to perform well, as those building benefit from steadier demand and more resilient cash flows.

- In any case, the high office delinquencies serve as a reminder that some sectors of the economy are facing increased stress, even if overall economic growth surprises to the upside.

US Financial Regulation: In a speech yesterday, Fed Vice Chair for Supervision Bowman said the central bank will adjust its rules to encourage banks to get more involved in mortgage origination and servicing, potentially reversing some of the migration of mortgage activity to non-banks over the past 15 years. The move is designed to boost the supply of mortgages and bring down mortgage costs. This adjustment would be on top of the administration’s broader action to deregulate the banking sector, which is expected to boost bank profits and stock values.

US Fiscal Policy: Congress on Friday failed to meet a deadline to pass a full-year funding bill for the Department of Homeland Security, leaving the agency in a technical shutdown. However, most of the department’s functions, such as the Transportation Security Administration’s security screenings at airports, will continue with workers being unpaid. For now at least, the limited governmental shutdown is expected to have little if any significant impact on the economy or financial markets.

US-European Security Policy: At the Munich Security Conference over the weekend, US Secretary of State Rubio delivered a relatively conciliatory speech aimed at assuring European leaders that Washington has no intention of abandoning them. The speech was reportedly a relief after the much more hard-hitting speech of Vice President Vance last year, but reports say many European leaders are still skeptical of US intentions given that Rubio also brought up several criticisms of Europe that Vance had made.

- At one level, Rubio’s relatively warm speech may simply reflect his personality versus that of Vance. Historically, Rubio has been much more supportive of traditional US foreign policy. Since other officials in the US administration remain much more hawkish, and since the Europeans can’t “unsee” US moves to date (such as the threat to take over Greenland), we suspect the Europeans will continue looking to rearm, boost economic growth, and fend for themselves.

- As we have argued in the past, adopting more stimulative economic policies and boosting defense spending will likely be positive for European stocks going forward, especially in the defense sector.

- All the same, we have also argued in the past that pushing the Europeans to fend for themselves is a risk, given that the effort will weaken US influence over the Europeans and spur them to take actions potentially at odds with US interests.

- For example, European leaders at the Munich conference openly discussed how they are starting to discuss developing an independent European nuclear arsenal. This is consistent with our view that the evolving US foreign policy could well spark a new, global nuclear arms race (which, incidentally, would likely be positive for uranium prices).

European Union-China: The European Commission has drafted new legislation to protect its key manufacturing industries from low-priced Chinese goods. One change would require electric vehicles to consist of at least 70% EU content to be eligible for public subsidies. Under another rule, at least 25% of products made from aluminum and 30% of plastics used for windows and doors in the construction sector must be manufactured in the EU to qualify for public subsidies or benefit from public contracts. The laws are likely to worsen EU-China trade tensions.

China: Late Friday, the Wall Street Journal carried an interesting article showing that Chinese state-owned companies have been actively selling down their positions in high-flying technology stocks. According to the article, the sales reflect government pressure to help prevent any destabilizing bubble in the stocks but allow for a “slow bull” market. The effort could potentially keep Chinese tech stocks looking attractive even if prices for US tech shares falter more substantially.

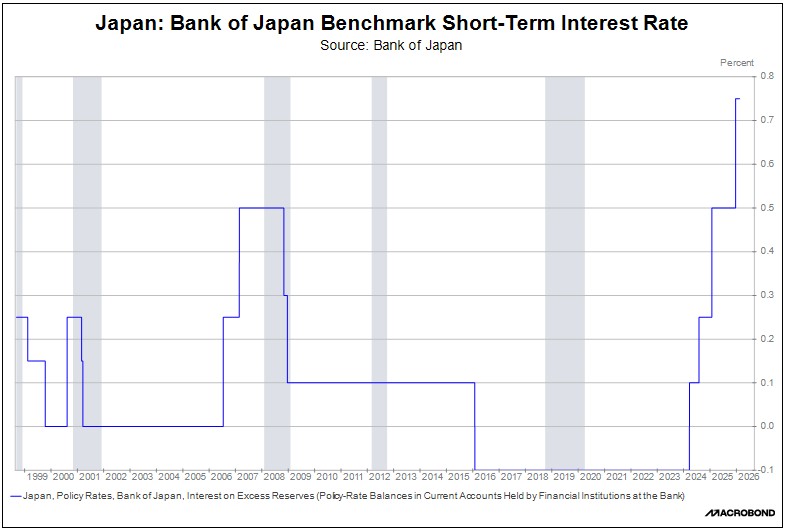

Japan: Prime Minister Takaichi and Bank of Japan Governor Ueda met briefly yesterday to discuss the country’s general economic and monetary situation, but Ueda later insisted to reporters that the prime minister didn’t make any particular request regarding monetary policy, just as she refrained from broaching the topic of interest rates in their initial meeting in November. If true, that suggests Takaichi is satisfied with the slow pace of BOJ rate hikes and implies that investors should expect more of the same so long as the Japanese economy continues on its current path.

- Separately, data yesterday showed Japanese gross domestic product grew at an annualized rate of just 0.2% in the fourth quarter of 2025, little more than one-tenth the expected growth rate. Since Japanese GDP contracted at a rate of 2.3% in the third quarter, the data suggests the economy barely avoided the conventional definition of recession in the second half of the year.

- All the same, Japanese GDP in full-year 2025 rose a healthy 1.1%, marking its best annual growth since 2022.

United Kingdom: In data released today, the national unemployment rate in the three months ended in December rose to a five-year high of 5.2%, up from 5.1% in the previous three-month period. Youth unemployment rose to 16.1%, the highest in more than a decade. The figures reflect the on-going slowdown in British economic growth, which is now widely expected to push the Bank of England to cut interest rates again as soon as March. In response, the pound has continued its recent depreciation, falling 0.7% so far today to $1.3539 per dollar.