by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with an examination of President Trump’s recent tariff announcement. We will then turn to other key stories shaping the market, including our thoughts on a potential meeting between President Trump and Russian President Vladimir Putin, an update on the president’s search for a new chair and governor to reshape the Federal Reserve, and recent changes to 401(k) retirement plans. We will conclude by assessing other major international and domestic developments impacting financial markets.

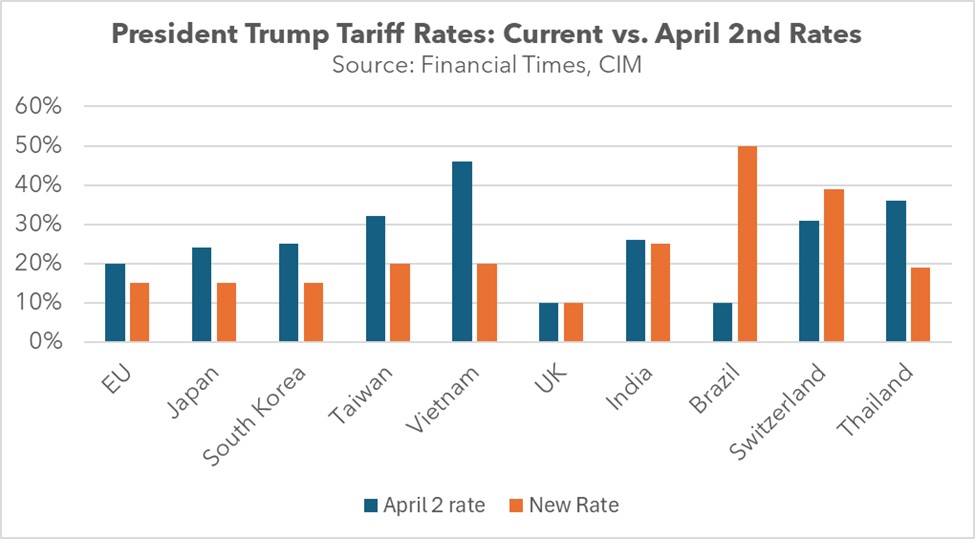

Trump Tariffs: President Trump has announced plans to impose a 100% tariff on all imported chips and semiconductors, with an important exception. The tariffs will not apply to companies that have committed to or are actively increasing their semiconductor manufacturing presence within the United States. This policy highlights a key aspect of the Trump administration’s trade strategy: using tariffs as a powerful incentive to drive both foreign and domestic companies to expand their production capabilities in the US.

- The president’s decision to expand carve-outs will likely bolster market confidence, as these tariffs are now expected to be less disruptive than initially feared. Furthermore, this decision indicates that the administration may be shifting toward a policy model that favors companies focused on strengthening US industrial capacity.

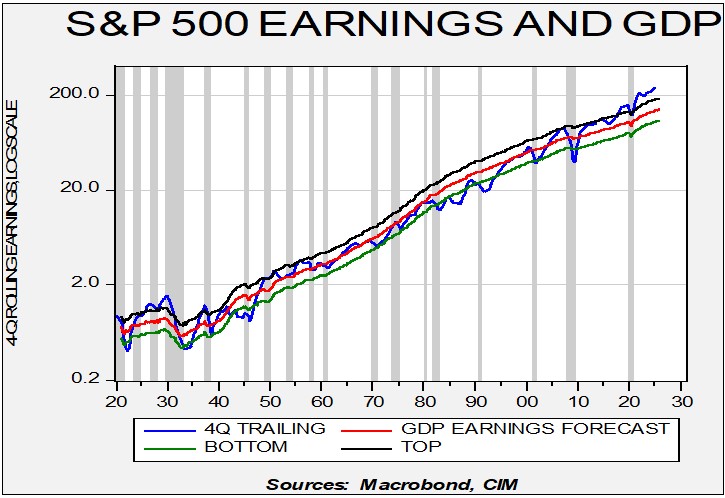

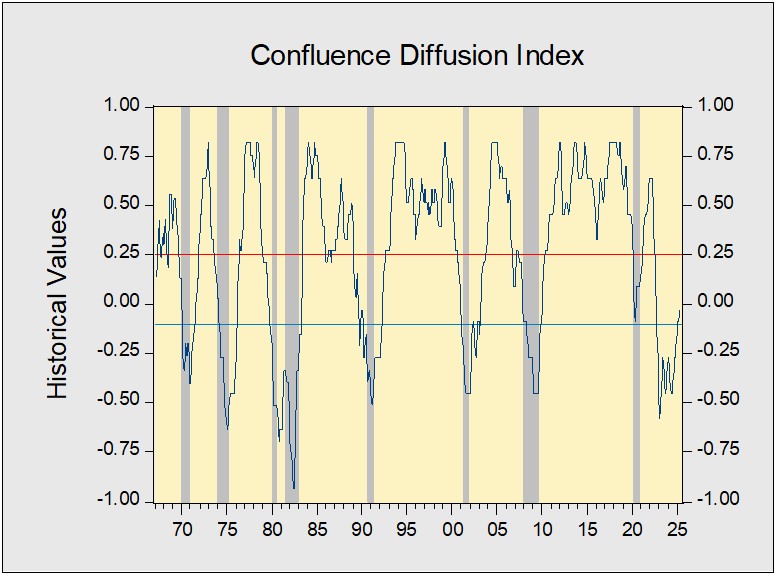

- That said, we continue to assess the potential economic impact of these tariffs. While we remain cautiously optimistic that the economy can absorb the shocks, we are closely monitoring consumer spending and corporate earnings to gauge how businesses and households are adjusting.

Putin-Trump Meeting: The White House announced that Russian President Vladimir Putin and President Trump may hold a meeting as early as next week. This decision to hold talks follows President Trump’s recent threats to impose secondary sanctions on countries like India and China that purchase Russian goods. The administration hopes the meeting will lead to greater progress in ending the war in Ukraine.

- Trump is pushing for an end to the conflict in Ukraine, citing a desire to reduce US funding for conflicts without direct involvement. The conflict’s resolution would likely restore stability to the European continent, potentially boosting regional equities. It could also lead to Russian energy returning to the market, which may put downward pressure on commodity prices.

- We will be paying close attention to how Europe navigates the end of the conflict. If Europe seeks rapprochement with Russia, it could provide another significant boost to the region’s equities, given its proximity and ongoing need for more energy. While many in the region have pushed back against trusting Russia, it is possible that sentiment could shift, especially as Europe looks to reduce its dependency on the US.

Temporary Fed Governor: President Trump may appoint a temporary official to fill the vacant Fed governor seat. The position became open after Adriana Kugler resigned early, even though her term was set to expire in January. This temporary appointment could calm fears of a “shadow Fed chair” and simultaneously increase pressure on Chair Powell to cut rates at the upcoming meeting. That said, the two leading contenders to take over the Fed are Kevin Warsh and Kevin Hassett.

Saving Social Security: There is a bipartisan effort underway to improve the solvency of Social Security. Senators Bill Cassidy (R-LA) and Tim Kaine (D-VA) are spearheading a proposal to create a $1.5 trillion investment fund over the next five years, which would then be given 70 years to grow. This plan marks the second major proposal in recent years that considers investing in financial markets to help fund future benefits. It follows a similar concept to the “Trump accounts” that were included in the One Big Beautiful Bill Act.

Japan Auction Success: The country’s sale of 30-year bonds was met with solid demand, with a bid-to-cover ratio consistent with its yearly average. This strong showing is likely to reaffirm confidence in the demand for its long-term debt, despite political uncertainty and concerns over increased stimulus spending. However, this robust interest is likely the result of low issuance, as the country has been shifting toward selling lower-duration debt to finance its spending.

Bank of England Cuts: The central bank lowered its policy rate by 25 basis points to 4.00% on Thursday. While the rate cut was widely anticipated, the decision was contentious and required a second vote after one member switched their stance from advocating for a deeper cut to supporting the 25 bps reduction, while other policymakers maintained their hold positions. This hesitancy suggests that while monetary policy is on a downward trajectory, the easing cycle is likely to proceed more gradually when compared to some of its peers.

China Crackdown: In an effort to curb bureaucracy, Beijing has mandated that officials reduce the frequency of meetings and limit official documents to 5,000 words. The move aims to allow the government to focus on supporting the economy, which is grappling with a weakening trade environment and a property slump. The policy follows a recent warning from Chinese President Xi Jinping to local governments about over-investing in AI and electric vehicles, which may signal a new anti-corruption investigation into those areas.

401K Gets a Boost: President Trump will sign an executive order enabling alternative assets in retirement accounts, directing the Labor Department to review ERISA guidelines on private equity, real estate, and cryptocurrency investments. The move could unlock trillions in retirement funds for non-traditional assets while raising questions about risk exposure for 401(k) participants.