Author: Amanda Ahne

Daily Comment (July 15, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with further evidence that President Trump has soured on Russia and President Putin, creating a risk of greater US-Russia tensions. We next review several other international and US developments with the potential to affect the financial markets today, including surprisingly strong economic growth in China in the second quarter and new pressure on Federal Reserve Chair Powell to resign.

United States-Ukraine-Russia: In perhaps the most surprising sign of President Trump’s recent souring on Russian President Putin, the Financial Times today reports that Trump has privately encouraged Ukrainian President Zelensky to step up deep military strikes on Russian territory. According to the report, Trump has even asked Zelensky whether Ukraine could hit Moscow and St. Petersburg if the US provided long-range weapons. Indeed, the report says Trump encouraged Zelensky to do so.

- Sources cited in the report say Trump wants to “make them [Russians] feel the pain” and force the Kremlin to the negotiating table to end its war against Ukraine. Of course, the risk is that Ukrainian attacks on Moscow or St. Petersburg using US weapons could prompt Putin to retaliate against the US.

- The news comes just a day after Trump threatened to impose severe tariffs on Russia and its trading partners if Putin doesn’t come to the negotiating table to end his war against Ukraine within 50 days.

- Domestically, Trump’s apparent new antagonism toward Russia will likely exacerbate the growing schism between him and his more isolationist political base. Many in the “Make America Great Again” camp are already angered by recent Trump actions, such as his decision to join Israel’s attacks on Iran and his government’s report that Jeffrey Epstein died by suicide and left no “client list” of compromised officials.

European Union-United States: EU officials yesterday published a list of US goods on which they say they will impose tariffs if Washington and Brussels can’t soon agree on a trade deal. The tariffs would be imposed if President Trump slaps his threatened 30% import tariff on the EU on August 1. After Trump issued his latest tariff threat, EU officials had said they wouldn’t immediately retaliate. However, the new list raises the risk that any failure in the negotiations could lead to a spiral of tariffs and counter-tariffs between the two economies.

United States-China: Semiconductor giant Nvidia today said it has been assured by the Trump administration that it will soon be allowed to sell its H20 artificial-intelligence chip to China again. The firm still won’t be allowed to sell its most advanced AI chips in China on concerns about that country gaining military or technological superiority over the US. Still, reports say Beijing sees today’s news as a concession in the ongoing US-China trade talks, which could help facilitate a deal. The news is also driving Nvidia’s stock price sharply higher so far today.

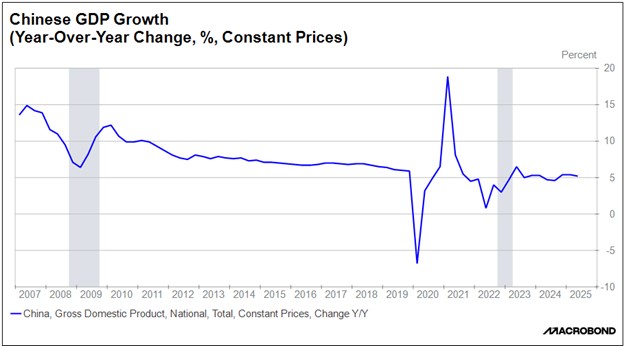

China: Official data today showed second-quarter gross domestic product was up 5.2% from the same period one year earlier, slightly beating expectations. The annual growth rate in the second quarter was still a bit weaker than in the previous two periods, but it still pointed to unexpected resilience in the face of the US-China trade war. In turn, that suggests Beijing could still hit its goal to have the economy grow 5.0% for all of 2025.

Japan: The yield on 10-year Japanese government bonds (JGB) today rose to the highest level since 2009, closing at 1.58%. The jump in JGB yields appears to reflect investor concerns that the ruling Liberal Democratic Party (LDP) will lose its majority in the upper house of parliament in Sunday’s elections. If the LDP does lose its majority, it might have to make fiscal concessions to smaller parties to form a coalition, and those concessions could blow out the deficit and drive Japanese debt even higher.

US Politics: Former New York Governor Andrew Cuomo yesterday said he will run as an independent in the upcoming election for mayor of New York City. The move comes after Cuomo lost in the Democratic Party primary election to avowed socialist Zohran Mamdani. Many moderate Democrats around the country fear that a Mamdani victory in the general election could paint their party as too liberal, so Cuomo and a number of other Democrats are running in the election as independents.

US Monetary Policy: To force out Fed Chair Powell before his term is up in May and replace him with someone more apt to cut interest rates, officials in the Trump administration have started to accuse Powell of malfeasance related to what press reports say are “renovations” at the central bank’s headquarters in Washington. However, as this author can attest after seeing the site many times over the last year, the project isn’t a mere renovation, but a major teardown and reconstruction of the north half the building.

- Such a major project often suffers from major cost overruns as unexpected reconstruction issues arise. That suggests that the attacks on Powell may be unfounded.

- If so, the attacks could set a bad precedence in which presidents would be free to conjure up legal reasons to sack a Fed chair, undermining the central bank’s independence and setting the stage for overly loose monetary policy and higher inflation.

US Drone Industry: The Commerce Department yesterday said it has launched national security probes into foreign drones and a raw material used for chips and solar panels. The investigation into unmanned aircraft systems would focus on the US’s dependency on foreign drones and whether foreign countries (such as China) could hurt US national security by suddenly cutting off supplies. The investigations could well lead to new import tariffs on foreign drones to help spur the development of the US drone industry, which is widely seen as lagging.

US Food Prices: As announced in April, the US yesterday officially exited a nearly 30-year old trade agreement with Mexico and slapped a 20.91% antidumping tariff on tomatoes from south of the border. Some economists have predicted that the move will boost prices for tomatoes and tomato products by as much as 10% in the near term. However, that expectation may be wrong, given that the US imports few fresh tomatoes during the summer (when tomatoes can be grown even in Maine), and processing tomatoes come largely from California.

Bi-Weekly Geopolitical Report – Mid-Year Geopolitical Outlook: Searching for the Endgames (July 14, 2025)

by the Confluence Macroeconomic Team | PDF

As the first half of 2025 draws to a close, we typically update our geopolitical outlook for the remainder of the year. This report is less a series of predictions as it is a list of potential geopolitical issues that we believe will dominate the international landscape for the rest of 2025. The report is not designed to be exhaustive. Rather, it focuses on the “big picture” conditions that we think will affect policy and markets going forward. Our issues are listed in order of importance.

Issue #1: US-China Tensions Remain

Issue #2: Russian-Ukraine War Continues

Issue #3: Fallout From Israel-Iran War

Issue #4: US Mulls Capital Controls

Issue #5: Prospects for Lasting Economic Change in Europe

Issue #6: AI Investing Gets Second Wind

The podcast episode for this particular edition will be posted under the Confluence of Ideas series later in the week.

Daily Comment (July 14, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a discussion of how a key Pentagon official is roiling relations between the US and its allies. We next review several other international and US developments with the potential to affect the financial markets today, including President Trump’s latest major tariff announcement (against the European Union and Mexico) and a modestly more optimistic poll of economists by the Wall Street Journal.

United States-Japan-China: A Saturday report said US Undersecretary of Defense for Policy Elbridge Colby has been pressuring Japanese and Australian officials to clarify how they would respond if the US went to war against China over Taiwan. The pressure has irked Tokyo and Canberra because it is being seen as an effort to make them commit to specific future actions to aid the US, even though the US itself officially maintains a policy of “strategic ambiguity” on whether it would help defend Taiwan from Chinese aggression.

- Colby is strongly focused on shifting US defense resources away from Europe and the Middle East and toward the Asia-Pacific region to deter China there. His disruptive pressure on Tokyo and Canberra regarding a Taiwan contingency is only the latest example of his penchant for pushing policies far beyond what the White House wants, sometimes forcing President Trump to override him.

- For example, Colby has also “gone off the reservation” by pushing the US’s allies in Asia to hike their defense spending to the same 5%-of-GDP standard asked of its NATO allies. He has also launched a review of the AUKUS defense deal in which the US and the UK will help Australia acquire nuclear-powered submarines. More recently, he was evidently instrumental in the Defense Department’s temporary cutoff of arms transfers to Ukraine before Trump overruled him last week.

United States-European Union-Mexico: President Trump on Saturday revealed that he plans to impose 30% tariffs on the EU and Mexico starting August 1, separate from his 50% levies on steel and aluminum imports and his 25% tariff on auto imports. EU and Mexican officials said they would continue to negotiate until the deadline in an effort to reach broad trade deals with lower tariffs. Nevertheless, since the EU and Mexico are among the top trading partners for the US, the latest Trump tariff threats could potentially weigh on financial markets on Monday.

Germany: Research from the Bundesbank today shows German GDP would have grown 50% more from 2021 to 2024 if its export industries hadn’t been held back by problems such as labor shortages and bureaucracy. The report says those challenges have kept German exports from rising in line with demand in key markets, leading to a loss of market share. The report may add to the growing fervor for deregulation, industrial policy, and other market-friendly reforms in Germany and the broader EU.

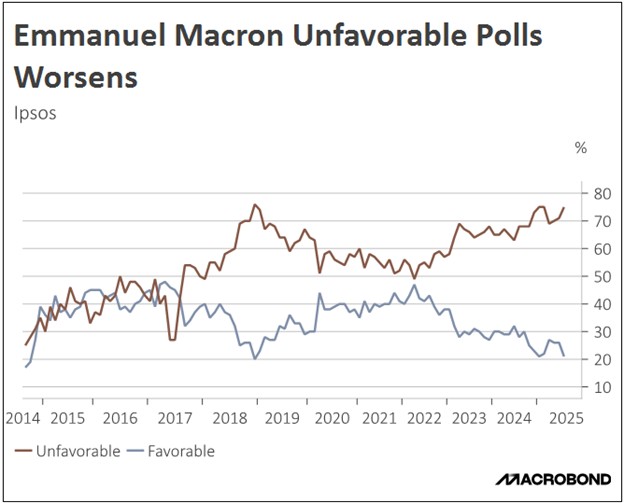

France: In his annual speech to the armed forces on the eve of the Bastille Day national holiday, President Macron said yesterday that his government will hike its defense spending to the equivalent of $74.8 billion by 2027, about double the defense budget when Macron became president in 2017. French defense spending is still only equal to about 2% of the country’s gross domestic product, but Macron argued that with growing threats and an uncertain US commitment, European militaries must become more formidable in their own right.

US Military: Reports say the country’s newest aircraft carrier, which was due to be delivered to the US Navy this month, will now be delayed by two years until March 2027. The delay of the USS John F. Kennedy mostly reflects challenges in perfecting and integrating new technologies, as well as supply-chain and labor-force issues. Given the upcoming retirement of the 50-year-old USS Nimitz, the delayed delivery of the USS John F. Kennedy would leave the US temporarily with just 10 operating carriers even as China continues to expand its carrier fleet.

US Defense Industry: As cheap, expendable drones become essential weapons in modern warfare, Defense Secretary Hegseth last week signed an order designed to rapidly scale up the US military’s procurement of unmanned aerial systems. The memo loosens restrictions on the military’s drone procurement programs and encourages the purchase of commercial drones that can be used for military purposes. Nevertheless, a lack of pure-play drone makers in the public equity markets continues to make it hard for investors to benefit from the move.

US Critical Minerals Industry: Several mining firms are reportedly in talks with defense giant Lockheed Martin to exploit two seabed mine licenses for critical minerals that Lockheed owns in the eastern Pacific Ocean. The firm has owned the licenses since the early 1980s but has never used them. The possible use of the licenses underscores the US rush to develop its own critical-mineral resources and end its dependency on China. It also suggests Lockheed could have an unexpected new revenue stream, but the firm hasn’t said how big that stream could be.

US Economic Growth: In the Wall Street Journal’s latest quarterly poll, economists expect fourth-quarter GDP to be up 1.0% year-over-year, slightly better than the 0.8% gain, which was forecast last quarter but still only half what they expected at the beginning of the year. The economists now put the probability of a US recession in the next year at 33%, down from 45% last quarter but still higher than the 22% chance seen in January. In perhaps the best aspect of the report, they see GDP growth rebounding to 1.9% in 2026.

Daily Comment (July 11, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is focused squarely on new tariff developments. Today’s Comment will give our thoughts on President Trump’s latest trade threats. We’ll also explain the escalating US stance on Russia, focusing on the proposed “Sanctioning Russia Act of 2025.” The report will also cover other market-moving news and key domestic and international economic data releases.

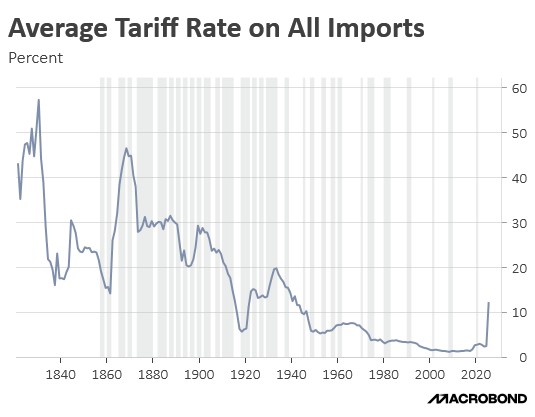

Tariff Broadening: The president continues to broaden his trade fight, threatening higher tariffs for countries and materials.

- President Trump has threatened to impose steep tariff hikes, raising duties on most trading partners to 15–20%. This follows an earlier warning of a potential 35% levy on Canadian goods not covered by the USMCA. Additionally, the existing 50% tariff on copper is expected to be expanded to include semi-finished products. The president also signaled a willingness to escalate tariffs further if deemed necessary.

- This escalation in trade tensions coincides with the administration’s push to secure negotiated agreements before the August 1 deadline, when the president is expected to formalize new tariff rates. The president faces mounting pressure to deliver concrete trade deals after his controversial decision to extend negotiations beyond the original July 9 cutoff date.

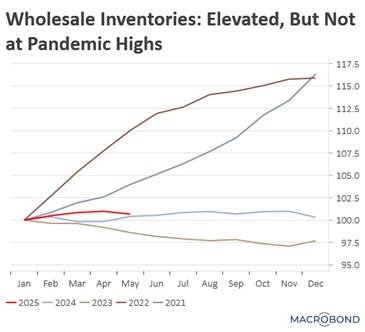

- While markets have largely priced in the “Trump Always Chickens Out” (TACO) trade, growing evidence suggests that the president faces mounting pressure to deliver on trade deals. Many businesses have so far avoided passing higher costs on to consumers, having stockpiled inventories ahead of potential tariffs in anticipation of more favorable terms that could prevent sharp price hikes.

- The primary challenge for firms will be navigating new tariffs if they remain in place at current levels or increase after August 1, while also attempting to replenish inventories. Current stock levels sit modestly above figures from a year ago but elevated costs could drive them lower. We anticipate businesses may offset these pressures through price increases, production cuts, or potential workforce reductions.

- That said, the president has consistently employed a pattern of Friday market warnings followed by Monday resolutions — a tactic we’ve dubbed FAME (Friday Alarm, Monday Excitement). Historically, he uses end-of-week volatility to amplify pressure, only to announce negotiated deals at week’s start. If this pattern holds, we may see another round of agreements announced Monday.

Tough on Russia: President Trump is expected to make a major statement on Monday about Russia as he pushes to end the war in Ukraine.

- The president has grown increasingly frustrated with the Kremlin’s persistent obstruction of peace negotiations with Ukraine. This frustration comes amid reports that Russia has adopted an uncompromising stance in talks, with the Trump administration dismissing Moscow’s demands as unrealistic. In response to Russia’s intensified aerial attacks on Ukrainian cities, the White House has authorized new missile shipments to strengthen Ukraine’s defensive capabilities.

- President Trump’s forthcoming policy announcement coincides with rising bipartisan pressure to take stronger action against Russia. This sentiment is reflected in new Senate legislation, the Sanctioning Russia Act of 2025, which would impose unprecedented 500% tariffs on nations purchasing sanctioned Russian goods. The bill, introduced by Senators Lindsey Graham (R-SC) and Richard Blumenthal (D-CT), would specifically target countries like India and China.

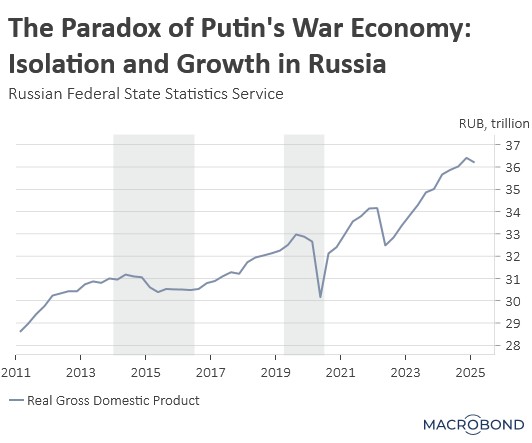

- Russia’s war persistence stems largely from domestic political calculus, as leaders look to maintain the appearance of control while avoiding any perception of defeat. After three years of devastating conflict, the war has paradoxically boosted military-dependent industries while leaving Russia increasingly isolated, making a settlement without tangible gains politically risky for the Kremlin.

- We anticipate a negotiated settlement in the coming months, likely extracting further Ukrainian concessions while offering tentative discussions on restoring European ties. The outcome hinges on Russia’s need for face-saving terms against Ukraine’s sovereignty demands, with Western support remaining the decisive factor.

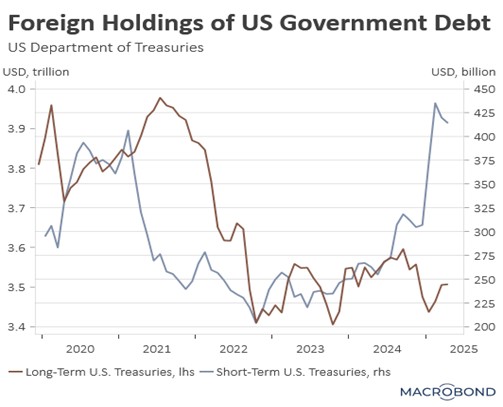

Treasury Auction Success: There has been strong demand for long-dated securities; however, global-debt burden remains a problem.

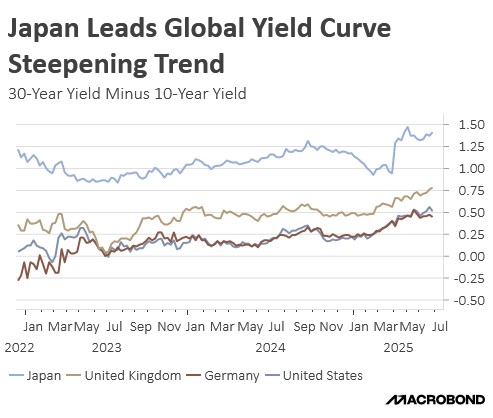

- The US Treasury’s $22 billion 30-year bond auction cleared at a high yield of 4.889%, closely aligning with the pre-auction “when-issued” rate. The solid bid-to-cover ratio of 2.38 demonstrated healthy investor appetite, a significant test following last week’s passage of expansive fiscal legislation. This outcome suggests that the market remains capable of absorbing the increase in long-dated supply, at least for now.

- Sovereign bond issuance is drawing intense scrutiny as governments ramp up fiscal stimulus worldwide. Facing upward pressure on long-term yields, many central banks, including the US Treasury and the Bank of Japan, are strategically shifting issuance toward shorter maturities to alleviate yield curve strain.

- While increased sovereign debt issuance may provide short-term economic stimulus, it risks tightening global financial conditions through upward pressure on interest rates. This tension could compel central banks to deploy unconventional measures, including rate cuts or renewed quantitative easing, as they navigate the dual challenges of supporting growth while preserving debt sustainability.

ECB Under Pressure: As US lawmakers push for additional fiscal cuts this year, European governments are urging their central banks to maintain accommodative monetary policies.

- While the ECB has cut rates three times this year, French Prime Minister François Bayrou is pushing for more accommodative monetary policy to shore up the economy. This comes as European nations face the dual challenge of a slowing economic environment, growing budget deficits, and the need to adjust to an increasingly protectionist and less dependable US ally.

- This rare criticism coincides with US lawmakers’ efforts to pressure Fed Chair Jerome Powell for an interest rate cut at the upcoming meeting. They argue a cut would help offset the rising budget deficit and promote domestic growth. Adding to this, Ohio Senator Bernie Moreno has reportedly initiated efforts to garner GOP backing for Powell’s resignation.

- The imperative to lower interest rates in the face of burgeoning budget deficits will likely compel the market, particularly foreign investors, to favor shorter-duration government securities. This diminished appetite for longer-dated bonds could consequently exacerbate interest rate volatility.

Daily Comment (July 10, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is focused on the latest trade updates. Today’s Comment will dive into the newly released Federal Reserve meeting minutes. We’ll also explore what Nvidia’s impressive surge reveals about the increasing influence of technology on equity performance. Plus, we’ll cover other breaking market news. As always, you’ll find a comprehensive summary of recent international and domestic data releases in the report.

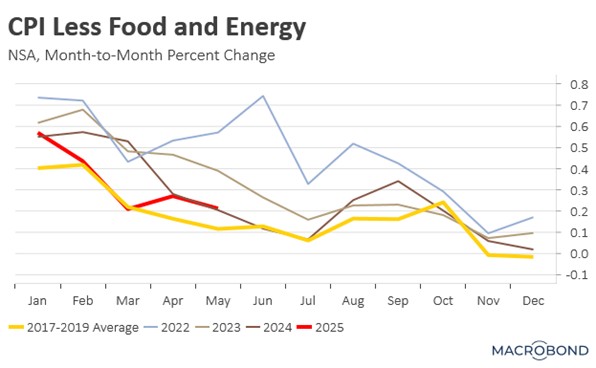

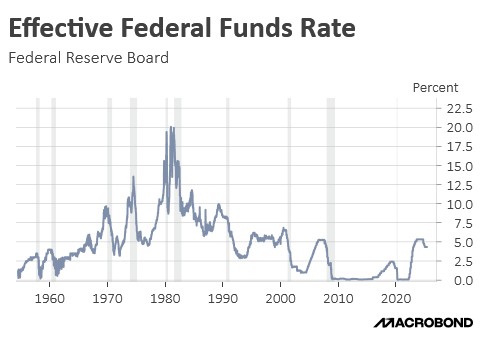

A Divided Fed: FOMC members continue to favor a wait-and-see approach on rate cuts, despite their differing views on the long-term inflationary impact of tariffs.

- The minutes from the June 17-18 meeting revealed that while most committee members believed tariffs would remain a long-term inflationary challenge, a significant contingent argued that the effects might be temporary. The disagreement centered largely on firms’ ability to pass price increases on to consumers. Skeptics of sustained inflation questioned whether businesses had sufficient pricing power, whereas proponents doubted whether profit margins could absorb higher input costs without raising prices.

- The discussion also revealed divisions over how tariffs were affecting the labor market. While the committee agreed that labor conditions remained strong, several officials noted that some firms had paused hiring due to trade policy uncertainty. Others pointed to tighter immigration enforcement as a growing constraint on labor supply. The overall view is that labor demand could soften over the next few months.

- In short, the meeting minutes suggested that Fed officials were prioritizing inflation over labor market concerns, a sign that the committee may be adopting a more hawkish stance. This heightened focus on inflation stems partly from uncertainty over whether current data fully reflects the tariffs’ impact on prices. Recently, Minneapolis Fed President Neel Kashkari warned that the effects could be delayed, citing firms’ reluctance to raise prices, high inventory levels, and even efforts to bypass tariffs altogether.

- Although two Fed officials, Fed Governors Christopher Waller and Michelle Bowman, have expressed support for a July rate cut, most committee members appear unconvinced unless a labor supply shock materializes. That said, September may be a more likely candidate for action. Historically, summer months tend to produce softer inflation readings, and if the trend of tame inflation readings hold, it could reinforce the view that tariff-related price pressures remain contained.

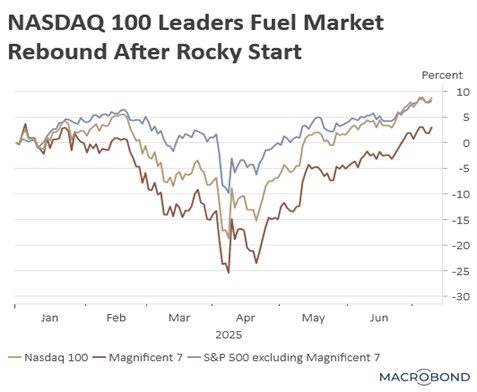

Nvidia Sets Record: The chipmaker has become the first $4 trillion company as investors pour into the tech sector, betting on its resilience amid easing trade policy concerns.

- The sharp increase reflects growing investor confidence that AI spending will remain robust. The stock overcame earlier concerns following the release of China’s language model, DeepSeek, which demonstrated comparable performance to some US models despite using less advanced chips. Additionally, reduced fears of a severe trade war — and its potential impact on capital spending — provided further support. As a result, the stock rebounded 74% from its 2025 low in April.

- Nvidia’s meteoric rise underscores the market’s fixation on companies driving the AI revolution. That enthusiasm is no longer confined to the Magnificent 7 tech giants, as investors increasingly turn to smaller, more agile tech firms with higher growth potential. This shift is already showing up in market performance. While the NASDAQ 100 continues to outperform the S&P 500 this year, only three members of the Magnificent 7 have kept pace, with most now trailing the broader index.

- While the surge in technology stocks (including Nvidia) has been remarkable, we believe it represents a key market vulnerability. Earnings reports in the coming weeks will serve as a critical test of the rally’s sustainability. As long as tech companies demonstrate sales growth, investor enthusiasm will likely persist. However, any signs of softening demand could trigger a pullback, potentially undermining market sentiment.

More Tariff News: President Trump issued a series of tariff letters to emerging markets, notifying them of increased rates and pressing for additional requirements.

- The president issued eight additional letters to countries, notifying them of updated tariff rates targeting emerging market economies. Of these, only two nations, the Philippines and Brunei, faced increases, with rates rising by 1% and 3%, respectively. The remaining countries saw their tariffs either hold steady or drop by as much as 25%. The adjustments dealt a blow to hopes that country-specific rates would fall uniformly to 10% across the board.

- The president escalated tensions with Brazil by threatening to impose tariffs of up to 50%, citing political disputes between the two nations. The warning specifically referenced Brazil’s treatment of former President Jair Bolsonaro and its government’s crackdown on social media platforms accused of spreading election misinformation. The announcement immediately rattled markets, triggering a sell-off of Brazilian equities, while President Lula da Silva vowed retaliatory measures in response.

- The president’s treatment of emerging market economies suggests a broader shift in US strategy from benevolent hegemony toward a more malevolent approach. His willingness to impose harsh tariffs on countries with limited import capacity implies they may be viewed as a form of tribute. Furthermore, his targeting of Brazil reinforces the perception that tariffs are being weaponized to influence foreign policy, signaling a departure from cooperative engagement in favor of coercive economic leverage.

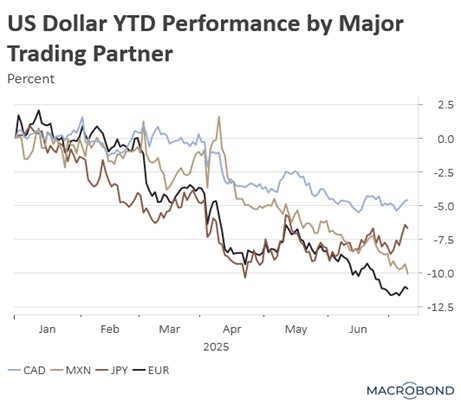

- If our assessment is correct, this is likely to further damage global perceptions of the United States, potentially weakening confidence in holding the US dollar. Recent surveys indicate a notable shift in international sentiment, with more countries now favoring China over the US — a stark reversal from just a year ago. Data from Morning Consult and Nira Data reveals that not only does the US trail China in global favorability but it has also fallen into net-negative territory, while China maintains a positive image.

Canary in the Coal Mine: There are some warning signs that the economy may be heading toward a slowdown.

- Amazon Prime Day’s opening sales fell sharply short of expectations, with preliminary data showing a 41% year-over-year decline in purchases. The event — traditionally a bellwether for consumer demand — has long served as a key indicator of household spending trends. While the drop may partly reflect Prime Day’s extension from two days to four, the weak start will likely fuel concerns about consumers tightening their budgets amid economic uncertainty.

- Additionally, WPP, the world’s largest advertising agency, reported a sharp decline in ad spending during the first half of the year and expects the trend to persist through the second half. While some losses may stem from the disruptive impact of AI on the industry, WPP has primarily blamed the slowdown on deteriorating macroeconomic conditions. Advertising budgets are often among the first cuts businesses make when bracing for an economic downturn.

- While we maintain optimism about the economy’s resilience in the coming quarters, we are closely monitoring for any shifts in the business cycle. Currently, economic conditions remain favorable and should continue to support equity markets. However, as new signals emerge, we may recommend investors adjust their risk exposure accordingly.

Daily Comment (July 9, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are actively assessing the latest trade developments. Today’s Comment will delve into the president’s evolving trade strategy, particularly as he considers new tariffs. We’ll also examine the reasons behind calls for Fed Chair Powell’s resignation and other key market-moving news. As always, the report concludes with a comprehensive summary of the latest domestic and international data releases.

From Countries to Sectors: Despite agreeing to push back the tariff deadline from July to August, President Trump has intensified his trade war measures, suggesting prolonged trade uncertainty.

- The president announced that he does not plan to extend the deadline further for country-specific tariffs set to expire on August 1. Although he expects trade deals to be finalized in the coming days, he still intends to ramp up tariffs, even for countries that are likely to agree on a framework in the near future. He specifically targeted the EU, accusing it of unfairly fining and taxing US technology firms, and threatened unilateral tariffs in response.

- Furthermore, the president appears to be shifting his focus from country-wide tariffs to specific sectors. He has announced plans to impose a 50% tariff on copper by the August 1 deadline, followed by 200% tariffs on foreign-made pharmaceuticals a year later. The threat has already driven COMEX copper prices to a record high, while also weighing on the stocks of drugmakers.

- The shift from country-specific tariffs to sector-specific tariffs may represent a long-term strategy for the president as he seeks to use tariffs to balance the dual objectives of generating revenue and incentivizing the reshoring of manufacturing. We expect he may lower broad, country-wide tariffs to maintain trade flows while imposing sharply higher tariffs on strategic sectors, effectively implementing a restrictive trade policy where it matters most.

- The overall impact of tariffs on equities remains uncertain, as investors have largely begun tuning out the president’s trade actions. However, this dynamic could shift if the next round of earnings reports reveals squeezed corporate margins. We believe the sustainability of the S&P 500’s rally will likely depend on companies’ ability to either absorb higher costs or pass them along to consumers.

Powell Resignation? President Trump called for Federal Reserve Chair Jerome Powell to resign if allegations that he misled Congress prove to be true.

- Fed Chair Powell faces accusations of misleading Congress regarding reports of extensive renovations to the Fed’s headquarters. When questioned about claims that the central bank was undergoing a “lavish overhaul,” Powell dismissed the reports as inaccurate. However, a New York Post report revealed the renovation costs had ballooned to $2.5 billion, a 32% increase from the initial $1.9 billion estimate, with many of these upgrades documented in official filings that contradict Powell’s testimony.

- The accusation is likely to fuel speculation that the president is attempting to oust Powell. He has consistently pressured Fed Chair Powell to resign, criticizing his refusal to cut interest rates over what the president deems to be unfounded concerns that tariffs could exacerbate inflation. Although the president has limited authority to dismiss a sitting Fed chair, he retains the power to do so if justified cause exists.

- According to The Wall Street Journal, two leading contenders are in line to succeed Powell if he is removed. The first is Kevin Hassett, the president’s director of the National Economic Council and former chair of the Council of Economic Advisers. The second is Kevin Warsh, a former Fed governor who was previously a runner-up for the role during the president’s last attempt to fill the position. The president is expected to value loyalty over qualifications.

- Yet, market reactions could upend those expectations. When President Jimmy Carter accepted Fed Chair William Miller’s resignation, markets plunged into chaos after Vice Chair Frederick Schultz, a prominent Democratic donor, was named interim Fed chair. The intense backlash, fueled by fears that Schultz would be too politically beholden to the president, ultimately led Carter to appoint market approved Paul Volcker, even against the advice of some of his own advisors.

- One name that could emerge as a consensus pick, and would likely soothe market concerns, is Fed Governor Christopher Waller. His research focusing on job openings as a key indicator of labor market tightness gives him a unique advantage, providing a data-driven framework to justify potential rate cuts. Moreover, his selection would extend a longstanding tradition of elevating sitting Fed governors, a pattern unbroken since the days of Paul Volcker.

RN Under Fire: France’s far-right movement is confronting intensified scrutiny as the ruling party grapples with eroding popularity.

- French authorities have raided the headquarters of the far-right National Rally party (RN) as part of an investigation into alleged misuse of EU parliamentary funds to finance political campaigns. The operation comes amid ongoing scrutiny of the party’s finances, including a recent conviction against its leader, Marine Le Pen, for embezzling EU funds — a ruling she is currently appealing.

- The crackdown coincides with French President Emmanuel Macron regaining the authority to call snap elections, a power he last exercised a year ago in a failed attempt to curb the far-right’s rising influence. This time, however, Macron appears far less inclined to take such a risk, particularly as his approval ratings have plummeted to near-record lows.

- We believe the crackdown on the far right may inadvertently boost support for the National Rally. Such an outcome could rattle European equities, as it raises the risk of a renewed push for “Frexit,” potentially destabilizing the EU itself. Moreover, markets may get a preview of how populist leaders would navigate increasingly strained US-Europe trade relations.

Daily Comment (July 8, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with the latest chapter in President Trump’s tariff war with other countries, including big new tariffs on major trading partners including Japan and South Korea. We next review several other international and US developments with the potential to affect the financial markets today, including a decision by Trump to resume arms exports to Ukraine and a new executive order that will further weigh on the US green energy industry.

US Tariff Policy: As he promised, President Trump announced major tariff hikes yesterday for multiple countries that have failed to strike trade deals with the US during the 90-day pause that runs out tomorrow. The threatened new tariffs, which will take effect on August 1, include levies of 25% for Japan and South Korea, 30% for South Africa, and 40% for Laos and Myanmar. The high rates reignited concerns about trade wars and economic disruptions, driving risk asset values sharply lower yesterday.

United States-Ukraine-Russia: President Trump yesterday said the US will resume sending weapons to Ukraine to help it defend against Russian attacks. The turnaround follows public and private complaints by Trump that the Kremlin refuses to give up its maximalist territorial and political demands against Ukraine. In Trump’s words, “I’m disappointed, frankly, that President Putin hasn’t stopped.”

- As we and other observers have noted previously, it’s been unclear why Trump has long been so deferential to Putin and supportive of Russia, despite the country’s authoritarian political system and threats to US interests. Trump’s new statements suggest he may be reassessing the nature of Putin’s Russia and could potentially adopt a more mainstream view of the regime.

- As we noted in our Comment yesterday, Trump’s experience with trade negotiations since Inauguration Day also appears to have been a learning experience for him, highlighting the limits of US economic leverage and his own negotiating skill. Going forward, such learnings in geopolitics and economics could subtly shift Trump’s foreign policy toward something more akin to traditional US approaches, even if his rhetoric remains just as aggressive.

North Atlantic Treaty Organization: The Financial Times yesterday carried an article showing how the Dutch port of Rotterdam and the Belgian port of Antwerp are preparing for a potential war with Russia. The efforts are focused on identifying and reserving the port facilities that would be needed to move large amounts of military cargo from the US, the UK, and Canada onto the Continent in wartime. The planning is further evidence that Europe has gotten serious about rebuilding its defenses in the face of Russian aggression and uncertain US support.

Germany: The Ministry of Defense is reportedly mulling a massive 25-billion EUR ($29.3 billion) program to buy thousands of new armored vehicles and tanks to help outfit seven new combat brigades that Berlin has promised to add to the North Atlantic Treaty Organization’s defense capability over the coming decade. The plan would include up to 2,500 GTK Boxer infantry fighting vehicles and as many as 1,000 Leopard 2 main battle tanks, all of which would boost sales by top German defense industry firms, such as Rheinmetall.

United Kingdom: Prime Minister Starmer’s office yesterday declined to rule out tax increases on the rich to help fill the hole in public finances after parliamentary backbenchers in Starmer’s center-left Labour Party last week forced him to retreat on his planned welfare cuts. Analysts are now increasingly expecting Chancellor of the Exchequer Reeves to announce such tax hikes in her autumn budget statement. Expectations of higher taxes on the wealthy could further exacerbate the recent modest retreat in British stock values.

Japan-Philippines: New reports say Tokyo is mulling the transfer of one or more of its six Abukuma-class naval destroyers to the Philippines. If a deal is struck, it would mark Japan’s first transfer of a complete weapon system in decades. Pacifist legal restrictions had barred such transfers for many years, but the contemplated new deal shows how Tokyo is gradually dropping those limits as it tries to bolster its allies’ ability to help defend against Chinese aggression.

China: Little noticed amid the global news of war and trade disputes recently, General Secretary Xi and other top officials have launched a broad campaign against what they call “involution,” meaning excessive price competition arising from excess capacity and production. Excess supply, weak domestic demand, and now greater export barriers have put the country’s producer price inflation in negative territory since late 2022, putting many firms out of business and creating the risk of social disruption.

Australia: The Reserve Bank of Australia today voted 6-3 to keep its benchmark short-term interest rate steady at 3.85%, dashing expectations for a 25-basis point cut to 3.60%. In its policy statement, the RBA said conditions are sufficiently stable and that it can take more time to assess whether consumer price inflation remains on track to fall to the central bank’s 2.5% target. In response, the Australian dollar has appreciated 0.8% so far today, reaching $0.6544.

US Clean Energy Industry: After his “big, beautiful” tax-and-spending bill signed into law last week curtailed the Biden tax credits for green energy projects, President Trump yesterday signed an executive order tightening the standards that wind and solar farms must meet to be eligible for the remaining credits. While the law said facilities had to be “under construction” within the next 12 months to be eligible, the order says a “substantial portion” of the facility must be completed by the deadline. In response to the news, green energy stocks are trading lower today.

US Air Travel Industry: In a move that is sure to spark calls for a national day of celebration, the Transportation Security Administration is reportedly planning to end the rule that most airline passengers take their shoes off for screening before boarding a flight. The requirement is apparently the top complaint that travelers have with TSA. Passengers above the age of 75 and 12 or under are already exempt, as are those in TSA’s PreCheck program.

Daily Comment (July 7, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with more evidence of growing friction between the European Union and China. We next review several other international and US developments that could affect the financial markets today, including plans for an unexpectedly large output boost by a key group of oil exporters and news of another major US tech company succumbing to Trump administration pressure for lower prices on its services to the federal government.

European Union-China-Russia: New reports say Beijing wants to cancel the second half of a two-day summit with EU officials scheduled for later this month in China. The souring Chinese mood on the summit provides added evidence that the short-lived EU-China rapprochement has now run its course. As we have argued before, Brussels and Beijing had hoped that the rapprochement would insulate them from President Trump’s trade policy pressures, but the effort has faltered due to the two sides’ own economic and political frictions.

- One key political dispute between Brussels and Beijing is China’s continued support for Russia in its invasion of Ukraine.

- Signaling that Beijing won’t back down on that issue, Trade Minister Wang Yi said on a trip to Europe this week that China doesn’t want Russia to lose its war against Ukraine because if it did, the US could shift its diplomatic and military energy toward the broad Asia-Pacific region and China. Wang insisted Beijing isn’t helping Russia militarily or financially, but at the very least, it is providing the Kremlin with political support and dual-use goods with both military and civilian uses.

- Separately, China implemented its threatened import tariffs against EU brandy on Friday. Those tariffs are widely seen as retaliation for the EU’s own various anti-dumping tariffs and investigations against Chinese imports.

US Tariff Policy: President Trump on Friday said he would send his “take-it-or-leave-it” tariff rate offers to 12 countries on Monday, although he declined to name the countries or the offered rates. The unilateral offers would come just two days before Trump’s July 9 deadline for trade deals to be completed before his big “reciprocal” tariffs snap back into place. Trump also threatened to impose an additional 10% duty on imports from the BRICS countries, which have called for policies to reduce the dominance of the dollar in world markets.

- Resorting to the take-it-or-leave-it approach suggests that Trump now sees that his boast to strike dozens of trade deals over the 90-day suspension period was overly ambitious. As we and other observers noted at the time the reciprocal tariffs were suspended and the dozens of trade negotiations kicked off, history has shown that trade deals typically require many months or even years of detailed talks.

- An important question now is what Trump may have learned from his inability to push through all the trade deals he promised. His inability to force the EU, Japan, China, and India to quickly capitulate could give Trump a better sense of the US’s relative economic power. That could change Trump’s calculus in future disputes and/or force him to take a broader view of the US’s “cards” in future negotiations.

Global Oil Market: Saudi Arabia, Russia, the United Arab Emirates, and five other members of the “OPEC+” group of major oil exporters on Saturday said they will collectively boost output by 548,000 barrels per day starting in August. The group has been gradually reversing its output cut of 2.2 million bpd from two years ago, but the announced production increase for next month was bigger than expected. The increase will raise concerns about excess supply and potentially cap or push down global oil prices in the second half of 2025.

China: The Chinese government has reportedly been buying up huge amounts of nickel to boost its state reserves amid growing trade tensions with the US. According to the reports, Beijing has bought up to 100,000 tons of the metal since December, essentially doubling its reserves as it seeks to ensure supplies for the production of stainless steel, electric-vehicle batteries, and other products. The report underscores Beijing’s strategy to secure its supplies of key minerals and leverage those minerals, such as rare earths, where it has a near monopoly on global production.

South Korea: At the behest of the newly installed center-left president, Lee Jae-myung, the National Assembly has approved new fiscal stimulus measures valued at about $20 billion. The new measures include cash handouts and coupons for citizens to spur private consumption, financial aid for troubled households or small businesses, and new investments in infrastructure for AI. The aim is to arrest a worsening slowdown in economic growth, but by our calculations, the new spending will only amount to about 1.1% of last year’s gross domestic product.

US Politics: On Saturday, Tesla CEO and former Trump ally Elon Musk said he’s formed a new “America Party” aimed at slashing government spending and reining in the national debt. It’s not clear how much Musk will really focus on the new party, but with his vast financial resources, he and the party could affect the 2026 mid-term elections, where he’s vowed to challenge the Republican lawmakers who voted for Trump’s deficit-expanding “big, beautiful” budget bill. Fearing retaliation by Trump, investors have driven Tesla shares sharply lower so far today.

US Fiscal Policy: The Wall Street Journal today says Oracle has agreed to give the federal government a 75% discount on its database and analytics software licenses through November, as well as a “substantial” discount on its cloud services. That makes Oracle the latest tech firm to succumb to Trump administration pressure for lower prices. That administration initiative has been much quieter than the “Department of Government Efficiency” effort to shed government workers, but it has notched some significant successes.

US Treasury Market: The Financial Times today reports that crypto companies and investors are rapidly buying up tokenized versions of money market and US Treasury mutual funds. Total assets held in tokenized Treasury products have reportedly jumped to $7.4 billion, up 80% so far this year. The surge in part reflects the interest of crypto traders, who find the funds a better place to park funds than stablecoins. Other investors like the product as an easy-to-trade form of collateral in crypto derivatives transactions.

US Venture Capital Industry: New data from PitchBook shows that fully 64% of all US venture capital investments in the first half of 2025 went to artificial-intelligence firms. Globally, 53% of all venture investment in the period went to AI. Even more striking, these investments have been extremely concentrated, with one-third of US investments going to just five firms in the first half. The figures underscore how investors of all stripes continue to expect extraordinary returns from AI in the future.