by the Asset Allocation Committee | PDF

- The likelihood of recession has declined during our three-year forecast period, as such we increased equity exposure.

- We anticipate below-trend economic growth due to persistent trade and fiscal policy ambiguity weighing on business investment, as well as consumer and investor confidence.

- Domestic equity exposure includes large and mid-caps, with an even-weighted value-growth tilt.

- We added to international developed equities which are supported by a weakening US dollar and attractive relative valuations.

- Gold and Treasurys remain in the portfolios as strategic allocations to help dampen volatility.

ECONOMIC VIEWPOINTS

The economy is expected to avoid a recession over the next three years, supported by the fiscal policy backdrop, including tax cut extensions and industrial policy initiatives. Despite continued uncertainty surrounding trade policy, there is a growing expectation that the administration will stop short of destabilizing the economy or the markets. Although potential for a policy error remains elevated, continued fiscal support and the prospect of easier monetary policy are expected to support risk markets. While recession risks have receded, the economic expansion will likely be restrained until trade policies are finalized and their resultant impact on businesses and consumers are known.

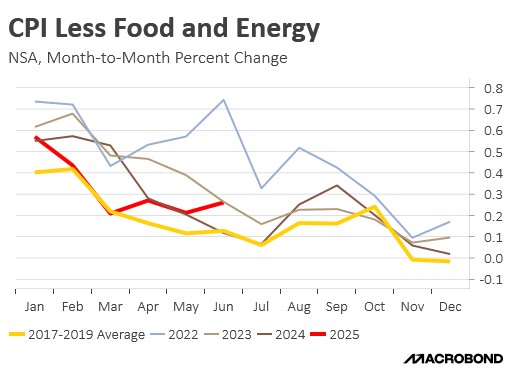

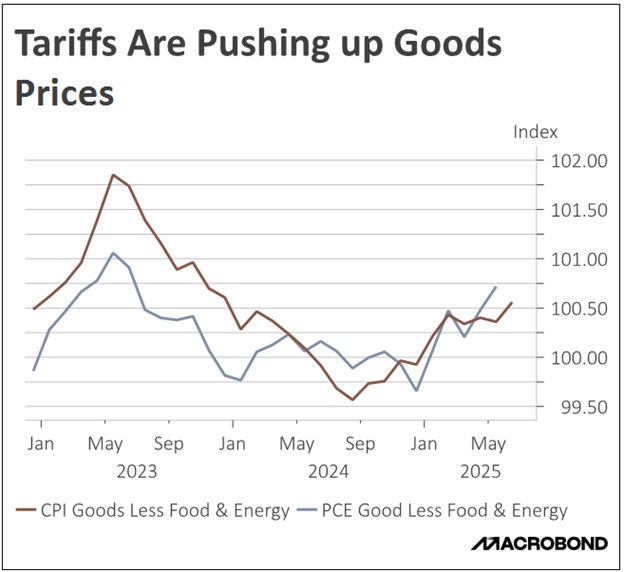

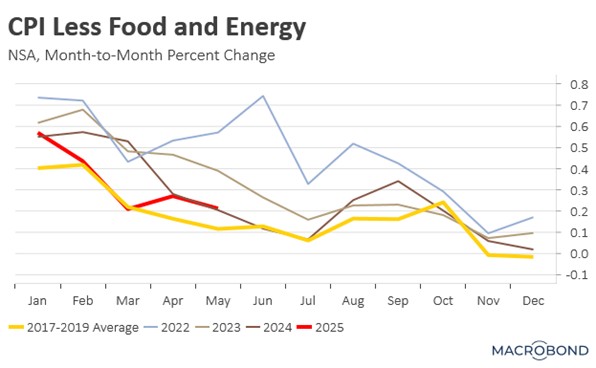

Inflation is expected to moderate within a 2–3% range; however, tariff policies, global supply chain realignment, and persistent wage pressures are likely to keep inflation uneven. In the interim, under Chair Powell, the federal funds rate is likely to remain relatively stable. With a change in Fed leadership anticipated in May 2026, we expect a gradual decline in rates over the next three years.

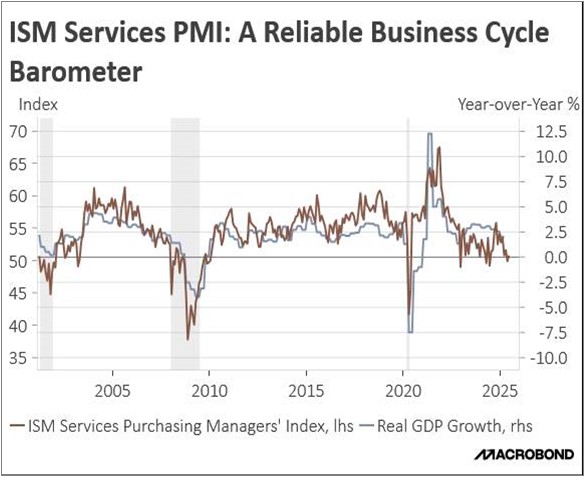

Recent indicators point to continued, albeit slowing, economic growth. The ISM Services PMI (in brown on the chart), which comprises the majority of US economic activity, remains above the critical 50 level, signaling ongoing expansion in the services sector. However, the level does not reflect robust growth. This moderation is also mirrored in real GDP growth (in blue), which has softened but remains in positive territory, reinforcing our base case for a soft landing. While the Q1 real GDP declined 0.5% quarter-over-quarter, real year-over-year GDP grew 2.0%, indicating a slowing rate of expansion.

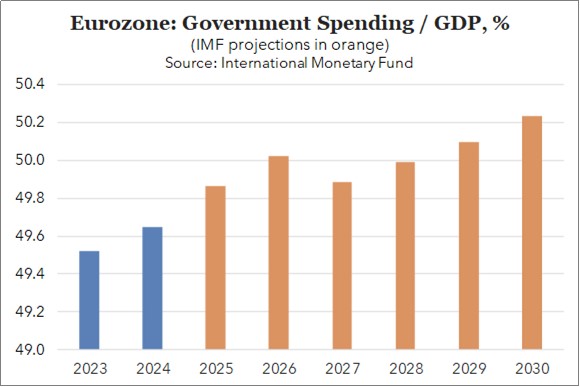

The US shift toward more protectionist trade policy has accelerated global diversification, prompting investors to allocate capital toward regions with independent growth prospects. Europe stands to benefit, supported by substantial fiscal initiatives, including increased defense spending and the Recovery and Resilience Facility, which are driving investment into defense, infrastructure, and strategic manufacturing. Easing regulations in Europe around fiscal stimulus have enabled policy actions that were previously considered politically or structurally unlikely, creating a more supportive environment for investment.

This chart highlights a projected rise in eurozone government spending as a share of GDP, with IMF forecasts (in orange) indicating a steady upward trend through 2030. This increase reflects expanded fiscal commitments to support growth. However, the scale of bond issuance required to fund these initiatives raises questions about long-term debt sustainability. Yield levels and market appetite will remain key indicators to watch. A failure to maintain fiscal discipline could reintroduce fragmentation risks within the eurozone.

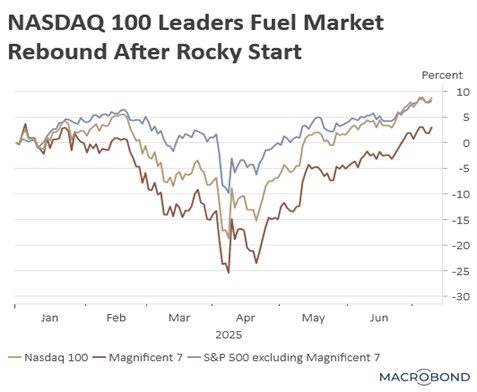

STOCK MARKET OUTLOOK

Lower recession risk prompted us to rebalance our growth-value tilt to 50/50 to capture upside while managing valuation risk. The recently passed “One Big Beautiful Bill” includes significant provisions for immediate R&D expensing and capital investment incentives, designed to stimulate innovation and bolster long-term industrial competitiveness. This should further support domestic equities. Large cap equities should continue to benefit from passive flows, while mid-cap equities offer valuation expansion potential. We continue to hold dividend-focused ETFs in the large and mid-cap allocations as dividends become more important as volatility rises. In sector weights, we maintain the exposure to advanced military technologies given continued geopolitical tensions. With the reduced likelihood of recession, we exited the Consumer Staples overweight position. We remain void of small cap stocks. US small cap equities may face stronger headwinds as a result of tariff policies due to potentially higher costs of capital, tighter financial conditions, and margin compression due to limited pricing power.

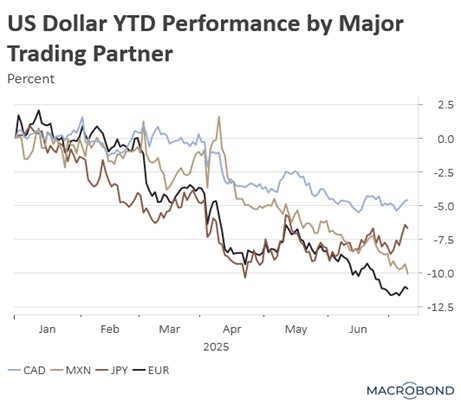

We expect the US dollar to weaken as a result of both policy shifts and macroeconomic factors, enhancing the return potential of foreign assets for US-based investors. We increased the allocation to foreign developed markets as valuations remain attractive, with Europe particularly well-positioned to benefit from its gradually improving growth outlook. Within international developed equities, we maintain a broad-based index and added a Europe-focused allocation and an international developed small cap value equity position. International developed small cap value stocks may outperform amid global trade realignment as they’re less exposed to cross-border disruptions and benefit directly from regional fiscal stimulus. With high allocations to industrials and materials, they are well-positioned for infrastructure and defense spending. Valuation and profitability screens further enhance return potential in this segment. At the same time, we exited the Swiss franc currency ETF in favor of more attractive opportunities in general European equities.

BOND MARKET OUTLOOK

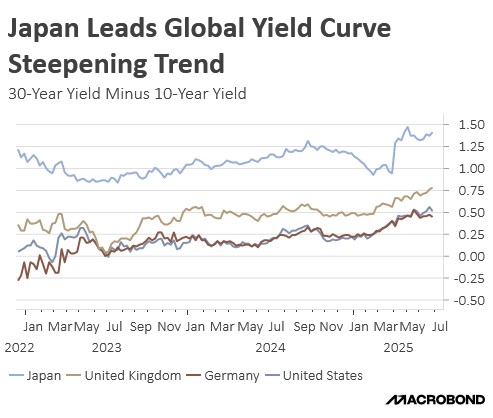

In the near-term, we expect the federal funds rate to remain relatively stable, while inflation stays above the Fed’s longstanding 2% target due to tariff-induced pressures. Beyond that, we foresee a gradual decline in rates over the next three years, following a change in leadership at the Federal Reserve in early 2026. As a result, we anticipate an upward-sloping yield curve to reemerge, shaped by a few Fed rate cuts and a normalization of intermediate-term rates relative to long rates. Importantly, we believe rates will continue to be in excess of inflation, offering continued real returns for fixed income investors.

We hold a barbell duration strategy — balancing shorter maturities with longer-dated exposures to capture attractive yields, while managing interest rate sensitivity. Credit markets are expected to experience some spread widening from currently tight levels over the forecast period, though we do not anticipate a spike that is normally associated with a default cycle. A key driver of the widening will be the substantial corporate refinancing needs that must be addressed before the end of the forecast period. Within the fixed income allocation, we continue to emphasize US Treasurys and mortgage-backed securities (MBS). Many MBS loans were originated during the low-rate environment. Because these loans remain well below current mortgage rates, seasoned MBS prepayment speeds are very low, limiting duration extension risk. At the same time, discounted prices on seasoned MBS provide potential upside if interest rates move lower.

For income-seeking strategies, we have added modest exposure to speculative grade bonds, focusing exclusively on higher-quality BB-rated credits. These positions offer attractive yields with less sensitivity to economic softness than lower-rated speculative bonds.

OTHER MARKETS

We maintain gold exposure across all strategies. Persistent central bank accumulation highlights gold’s relevance as both a reserve asset and an inflation hedge. Rising geopolitical tensions, along with global efforts to diversify away from US dollar dependence, are expected to sustain demand, reinforcing gold’s strategic value in a diversified, risk-aware asset allocation framework.