by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are breathing a sigh of relief as tensions in the Middle East show signs of easing, helping stabilize risk sentiment. In today’s Comment, we’ll break down the key takeaways from Fed Chair Jerome Powell’s first day of congressional testimony, analyze the latest drop in consumer confidence, and cover other market-moving headlines you need to know. As always, we’ll wrap up with a snapshot of today’s most important domestic and international data releases.

Powell Speaks: Fed Chair Powell addressed markets regarding the timeline for interest rate cuts but stopped short of offering any clear signals on when the first reduction might occur.

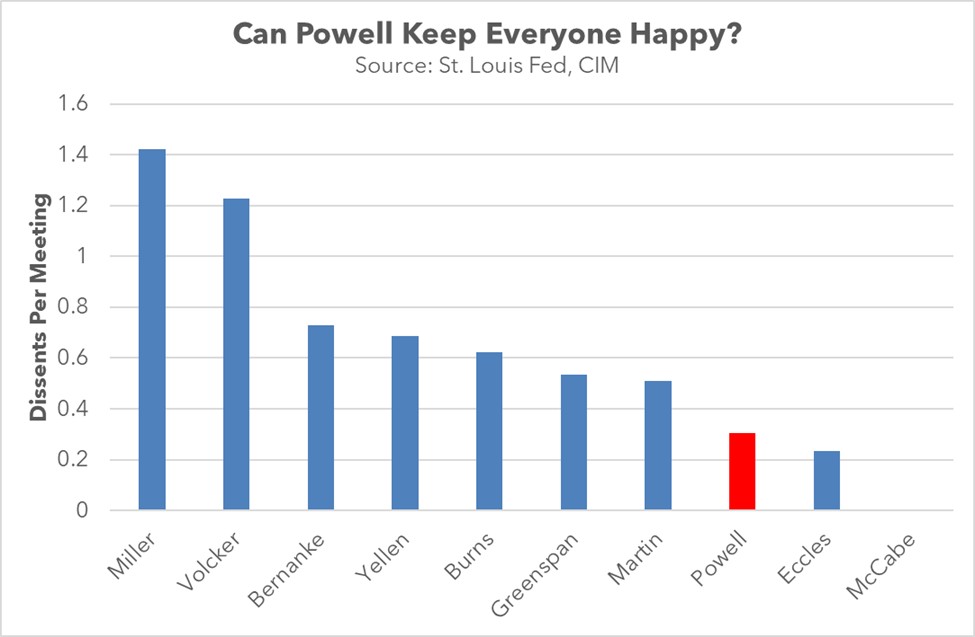

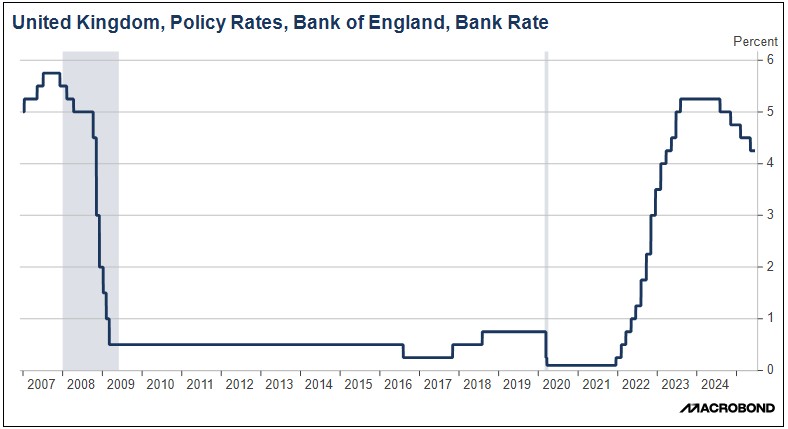

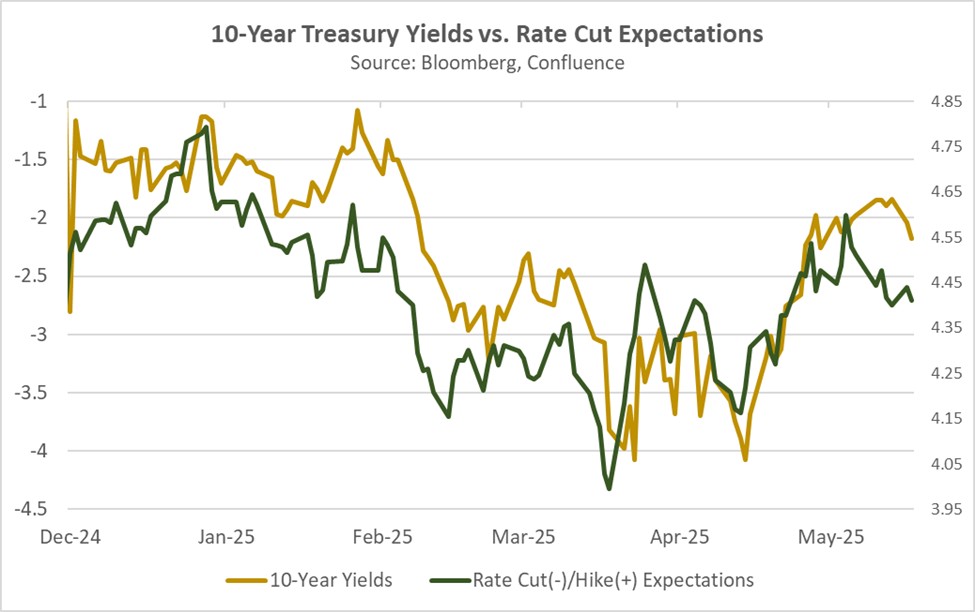

- During his congressional testimony, Fed Chair Powell pushed back against calls for an immediate rate cut but left the door open to potential easing in September. He stressed that the central bank would first need to evaluate June and July inflation data before considering any policy adjustments later this year. His remarks follow recent criticism from the president, who has accused the Fed of lagging behind other major central banks in lowering interest rates.

- The decision to cut rates appears to have deepened divisions within the FOMC, as Fed officials grapple with how to interpret inflation data amid recent tariff impacts. As highlighted in Tuesday’s report, Fed Governor Waller has advocated a data-dependent approach, arguing the central bank should act on incoming figures rather than wait for full confirmation. Meanwhile, Kansas City Fed President Jeffrey Schmid has endorsed Chair Powell’s more cautious “wait-and-see” stance.

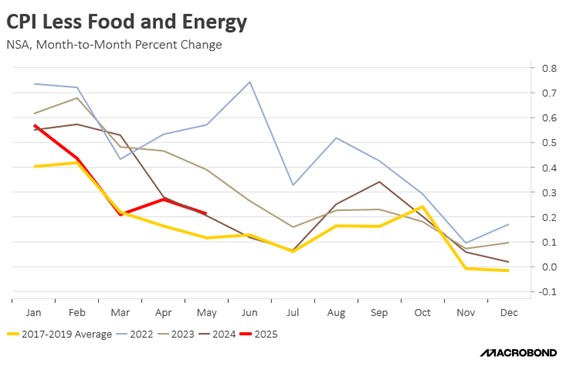

- Despite the Fed’s ongoing debate over whether to cut rates now or later, its hesitancy to act without confirmation has been a consistent pattern. In 2024, even though the Fed ultimately cut rates by 100 basis points, it initially resisted calls for earlier reductions. This cautious approach stems partly from inflation’s seasonal patterns, as historically, price growth slows most during summer months. If incoming data aligns with this trend, the Fed will likely conclude inflation is converging toward its target.

- The key factor we’re monitoring closely is data quality. Over the past three months, the proportion of inflation components derived from estimates rather than actual measurements has surged from 10% to 30%. This increase suggests we may see significant revisions later this year. While we maintain confidence in the overall accuracy of these figures, the growing reliance on estimates could prompt the Fed to exercise additional caution before implementing its first rate cut of the year.

Confidence Slips: While inflation expectations have eased, households are now worried that tariffs could hurt their job prospects.

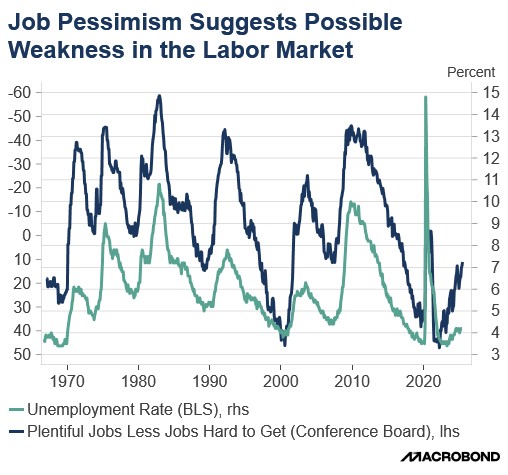

- Consumer confidence unexpectedly declined in June amid growing household concerns about the potential impact of tariffs on employment. The Conference Board’s index dropped to 93.0 from 98.4 in May, significantly missing economists’ consensus forecast of 100. The deterioration was primarily driven by the present situation component, which fell to its lowest level this year, while the expectations index declined further below the 80-point threshold typically indicative of impending recession.

- A closer examination reveals a nuanced shift in consumer sentiment. Respondents reported easing inflation concerns and growing confidence in equity markets. Yet this optimism is tempered by emerging labor market anxieties, with fewer consumers perceiving abundant job availability compared to early 2024. The survey also detected early warning signs of deteriorating household perceptions regarding business conditions.

- The divergence between labor market expectations and equity market performance reflects how financial markets have discounted uncertainty while households remain cautious. This suggests that despite the stock market rebound, consumers are maintaining vigilance against potential economic volatility.

- There’s often a disconnect between consumer sentiment and actual spending behavior. While declining confidence surveys might suggest economic pessimism, most hard indicators still point to continued expansion. That said, the weakening outlook does signal potential caution among households, who may begin restraining discretionary spending in coming months. This divergence warrants attention but doesn’t yet justify significant concern.

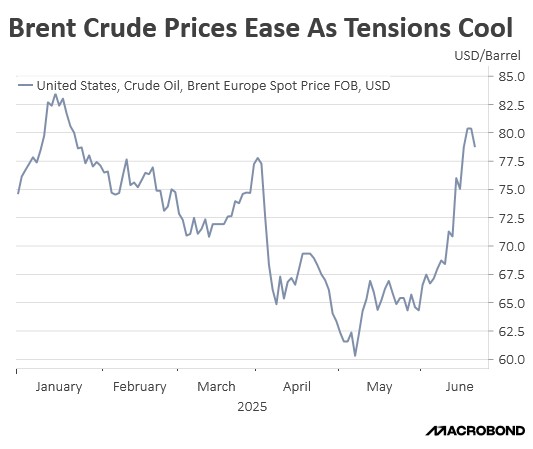

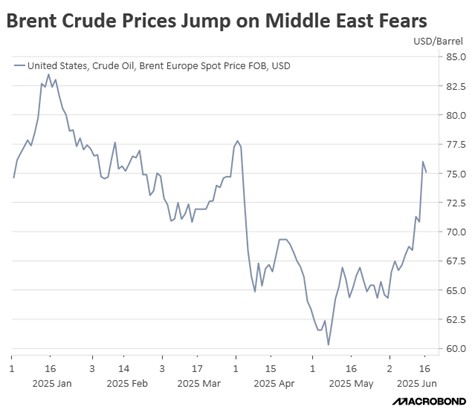

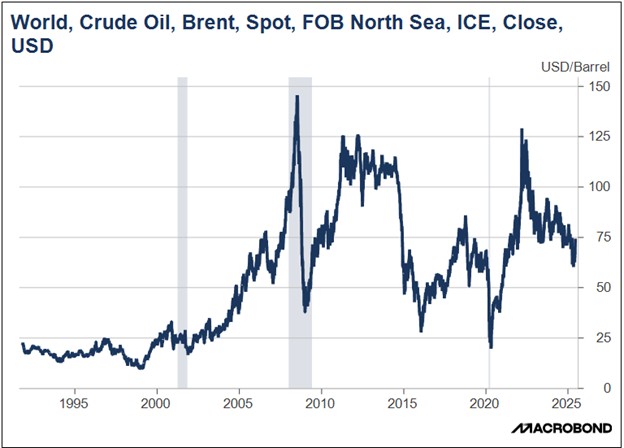

Damaged, Not Destroyed: New information has surfaced concerning the US bombing of an Iranian facility, indicating remaining persistent risks that were perhaps not entirely diffused.

- A recently leaked intelligence report suggests that the impact from the US strike on Iran’s nuclear program was limited, estimating a setback of only a few months. This assessment directly contradicts the president’s assertion that the Iranian nuclear facility was “obliterated” and fuels concerns about the conflict escalating. Defense Secretary Pete Hegseth acknowledged the report’s existence but stated that the intelligence community had “low confidence” in its accuracy.

- Despite these tensions, diplomatic progress appears underway as Iran and Washington have agreed to resume negotiations regarding Tehran’s nuclear program. The White House’s Middle East envoy Steve Witkoff confirmed preliminary discussions are promising, with both sides working toward a comprehensive peace agreement. In a conciliatory gesture, the US has eased sanctions on Chinese vessels involved in Iranian oil purchases, signaling a potential openness to economic concessions.

- The primary challenge facing both parties will be determining a path forward. Israeli intelligence operatives who surveyed the Fordow enrichment facility reported mixed operational results, with one source characterizing the outcome as “really not good.” The assessment noted troubling signs that Iran may have relocated enriched uranium prior to the strike, while the operational status of many centrifuges remains uncertain.

- While the president has recently warned that the US would conduct additional strikes if Iran resumes its nuclear enrichment program, we view this as an unlikely near-term outcome given ongoing negotiations. However, should another strike occur, markets would likely focus less on the military action itself and more on whether Washington intends to pursue regime change — a scenario that currently appears off the table, suggesting limited market volatility for now.

Populist Takeover: The New York mayoral race provided more evidence of a shift in sentiment concerning the established norms.

- In a surprising upset, 33-year-old democratic socialist Zohran Mamdani defeated former New York Governor Andrew Cuomo for the Democratic nomination. A relative unknown, Mamdani built a winning coalition across Queens, Brooklyn, and Manhattan, even making inroads in the Bronx, where Cuomo had believed his support was strongest. Mamdani’s victory signals a potential shift within the Democratic Party as it seeks to rebrand itself as more progressive and grassroots oriented.

- This election underscores a broader erosion of traditional politicians’ ability to maintain power through conventional means. Voters are increasingly rejecting the Washington Consensus that has shaped policy for the past three decades, demanding more disruptive leadership instead. President Trump’s populist ascent exemplifies this shift, reflecting a growing appetite for leaders willing to challenge established norms and institutions.

- Broadly speaking, shifts in sentiment can be viewed through the lens of the equality-efficiency trade-off, a concept famously articulated by economist Arthur Okun. He argued that an inherent tension exists between maintaining robust productivity and ensuring that no segments of society are left behind. While policies promoting greater equality may lead to inefficiencies due to disincentives for production or misallocation of capital, a sole focus on efficiency can exacerbate wealth and income inequality.

- We have experienced a prolonged era of policymaking that prioritized productivity over social welfare, fueling aggregate wealth but exacerbating income inequality in the process. The dynamics of the New York mayoral race appear to reflect a broader shift away from this efficiency-driven paradigm, which could introduce greater uncertainty into markets. In such an environment — where monetary policy and inflation are likely to remain volatile — we believe active investing will outperform passive in the long term.