Author: Amanda Ahne

Daily Comment (May 19, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with some issues related to President Trump’s big trip to the Gulf region last week. Specifically, trade deals completed during the trip have raised concern about advanced artificial-intelligence technology from the US leaking to China via the Gulf. We next review several other international and US developments with the potential to affect the financial markets today, including the Moody’s downgrade of US Treasury debt and a slew of important elections in Europe.

United States-Saudi Arabia-UAE-China: As President Trump returned on Saturday from his trip to the Gulf states, Congressional leaders and security analysts are sounding alarms over the billions of dollars of deals he signed to give US artificial-intelligence resources to Saudi Arabia and the United Arab Emirates. Since Saudi Arabia and the UAE have increasingly close ties to China, fears are growing that they would let China gain access to advanced AI chips provided by US firms, thereby helping China advance its own AI capabilities.

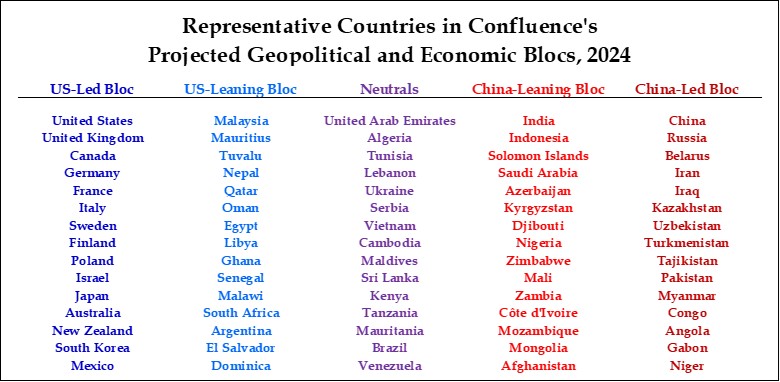

- Despite decades of US security ties with the Gulf states, our analysis of global fracturing puts Saudi Arabia in the “Leaning China” bloc and the UAE is in the “Neutral” bloc. Indeed, both countries have actively sought to play the US and China against each other, suggesting they might be lax in controlling any Chinese access to US technologies.

- The administration’s willingness to give the Gulf countries access to US technology is especially striking given that many in Trump’s right-wing base remain suspicious about Saudi Arabia’s role in the 9/11 terrorist attacks. Therefore, it would not be a surprise if Trump faces political pushback from his own base because of the deals.

- Although the announced deals appear to be quite lucrative for US firms such as Nvidia, it remains to be seen whether they will be fully implemented in the face of any domestic US political pushback.

United States-United Kingdom-China: Data released late Friday confirmed that Japan remains the biggest foreign holder of US Treasury securities, but the UK has now surpassed China to take second place. The data shows that China has continued to whittle down its exposure to US securities, bringing its total holdings down to approximately $765 billion, only about half its holdings in 2011. The data also shows that China has continued to shorten the average maturity of its US Treasury holdings, likely to ensure it can unload those holdings quickly if necessary.

- Chinese officials are likely to be motivated mostly by concerns about geopolitical tensions and security threats related to the US.

- They are likely less motivated by concerns about US fiscal health, despite Friday’s US debt rating downgrade by Moody’s, which is discussed further below.

China: April industrial production was up just 6.1% from the same month one year earlier, decelerating from the 7.1% rise in the year to March. Meanwhile, fixed-asset investment in January through April was up just 4.0% on the year, after an annual rise of 4.2% in January through March. The figures confirm that China’s economy softened considerably at the recent peak of President Trump’s trade war. However, China’s producers will now likely get at least a temporary reprieve as foreign importers rush to take advantage of the current tariff pause.

Australia: Mining firm Lynas Rare Earths said it is now producing dysprosium oxide at its refinery in Malaysia, making it the world’s first commercial producer of heavy rare earths outside of China. The firm also expects to start commercial production of terbium in June. The announcement shows how global concern about China’s stranglehold on rare earths has prompted state-supported investment in alternative sources of the minerals, which are critical for many technologies related to green energy, information processing, and defense.

- Besides its Malaysian refinery, Lynas has a $258-million contract with the US government to build a rare earths refinery in Texas. The company sources its rare earth ore from its mine in Western Australia.

- The new rare earth mines and refineries outside China are still only producing a small amount of the world’s needs. However, if investment in them continues as we expect, they may well eventually break China’s near monopoly on rare earth supplies.

European Union-United Kingdom: Leaders from the EU and the UK today signed a trade and security deal that aims to reverse some of the effects of Brexit and better bind their economies in the face of rising geopolitical threats from Russia and more antagonism from the US. Besides easing EU-UK trade flows, the deal will let British defense firms bid for rearmament programs under the EU’s new 150 billion EUR ($169 billion) defense fund. British defense stocks are therefore likely to get a boost, just as defense stocks on the Continent have been boosted.

Eurozone: Pierre Wunsch, the head of Belgium’s central bank and a member of the European Central Bank’s policy board, said in an interview with the Financial Times that the economic disruptions from the US’s big tariff hikes could require the ECB to cut its benchmark interest rate to less than 2.00%, implying at least two more 25-basis-point cuts. The statement will likely prompt further strength in eurozone bond buying.

Portugal: In parliamentary elections yesterday, the center-right Democratic Alliance of Prime Minister Montenegro came in first with 32.1% of the vote, while the center-left Socialist Party came in second with 22.6%. Importantly, the far-right Chega party saw its support surge to 22.6% as well, putting it in a tie with the Socialists. Montenegro is now expected to form a new coalition government of centrist parties, but Chega’s new-found political strength will likely push Portuguese immigration, security, and other policies to the right.

Poland: In the first round of Poland’s presidential election yesterday, it appears that the winner was Rafał Trzaskowski, the liberal mayor of Warsaw and a member of Prime Minister Tusk’s center-left Civic Platform party. Ballot counting so far suggests Trzaskowski received 30.8% of the vote. In second place was Karol Nawrocki, backed by the hard-right Law and Justice party, who took 29.1%. The two will now face off in the final round of voting on June 1.

- Since the current Law and Justice president has thwarted many of Prime Minister Tusk’s reform initiatives, a win by Trzaskowski in the second round would let Tusk accelerate his efforts to reverse the illiberal right-wing policies passed by the previous government.

- More broadly, Trzaskowski’s surprising victory underscores how right-wing nationalist politicians in some countries have been undermined by the global reaction against President Trump’s aggressive right-wing policies in the US.

- Nevertheless, it’s important to note that the third- and fourth-place winners in the vote were right-wing parties. That suggests Nawrocki could still win the presidency and continue the pushback against Prime Minister Tusk’s policies.

Romania: In the second and final round of Romania’s presidential election on Sunday, the winner was Nicuşor Dan, the centrist mayor of Bucharest, with about 54% of the vote. Dan unexpectedly beat the right-wing nationalist George Simion, who had styled himself after President Trump but only received 46% of the vote. As in the recent elections in Poland, Canada, and Australia, the results suggest that at least some right-wing nationalist politicians who ally themselves to President Trump may now be at a disadvantage in much of the developed world.

- Importantly, Simion had been preparing his supporters to protest a potential loss in the days before the vote. Any significant “Stop the Steal” effort by Simion could potentially spark political instability or paralysis in Romania.

- At the same time, if Dan is confirmed as the winner, it would avoid the risk of Romania becoming another eastern EU country supporting authoritarian Russia and opposing further support for Ukraine as it fights off the Russian invasion.

United States-Russia: President Trump this morning is scheduled to have a phone call with President Putin to discuss ways to stop Russia’s invasion of Ukraine. We suspect that Putin will continue to ostensibly signal openness to Trump’s desire for a quick end to the war, but with impossible demands on Ukraine that would reveal his true intent to keep fighting. If so, a key question is whether Trump would finally recognize the Kremlin’s culpability in the invasion and swing US support back toward Ukraine.

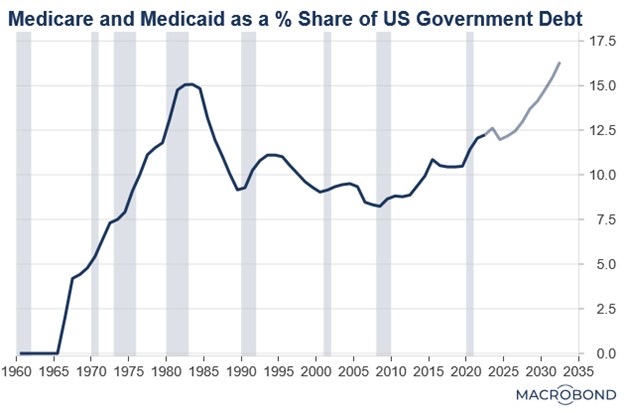

US Fiscal Policy: Late Friday afternoon, Moody’s cut its rating of US debt to Aa1, becoming the last of the major credit rating firms to remove the country’s top-tier assessment. According to the firm, the rating cut reflects the failure of Congress and successive administrations to agree on ways to reverse the US’s big fiscal deficits and rising interest costs. Now that Moody’s has cut its assessment of US debt, it also shifted its outlook to “stable” from “negative,” meaning it doesn’t foresee a further downgrade in the near future.

- Moody’s rating cut will likely factor into the Republicans’ on-going effort to pass its big tax-and-spending bill through Congress, mostly by giving ammunition to the fiscal hawks looking for more spending cuts and resisting certain tax changes. Officials in the Trump administration also slammed the Moody’s decision for not reflecting their promise to tighten fiscal policy going forward.

- Republicans in the House were successful in pushing the tax-and-spending bill through the Budget Committee last night, but its future on the House floor and in the Senate is uncertain. Budget analysts project that tax cuts and spending increases in the bill would offset its spending cuts and expand the US budget deficit by a cumulative $3 trillion over the coming decade.

- All the same, it isn’t clear that the downgrade will have much practical effect in the near term. As we’ve written previously, the administration’s dramatic and erratic tariff war and other policies had already raised concerns about US economic performance, debt sustainability, and financial market stability, sparking at least some measure of capital flight from the US.

- So far today, US bond values have only slipped marginally, pushing the yield on the benchmark 10-year Treasury note up to 4.558%. The dollar has been affected more dramatically, with the US dollar index falling about 0.9%.

US Tariff Policy: After retail giant Walmart warned last week that the administration’s import tariff hikes would force it to raise prices, President Trump on Saturday lashed out at the firm and said it should “eat the cost” of the imposts. The statement underscores the risk that companies will come under both market pressure and political pressure to accept lower profit margins as a result of the tariffs. Indeed, as we have written, incoming economic data suggests the tariffs are already pushing down profit margins for many firms.

- Separately, Treasury Secretary Bessent yesterday warned that any country that isn’t negotiating “in good faith” over its trade relationship with the US will face a snap back to the full, ultra-high tariffs outlined by Trump in his “Liberation Day” announcement.

- Bessent’s statement is a reminder that investors shouldn’t be lulled into complacency by Trump’s decision to pause his high “reciprocal” tariffs for 90 days until early July. For some countries, the tariffs could well snap back to the initial high levels, at least temporarily. In other words, uncertainty about US trade policy has not gone away.

Asset Allocation Bi-Weekly – White House vs. The Fed: The Looming Battle for US Monetary Policy (May 19, 2025)

by Thomas Wash | PDF

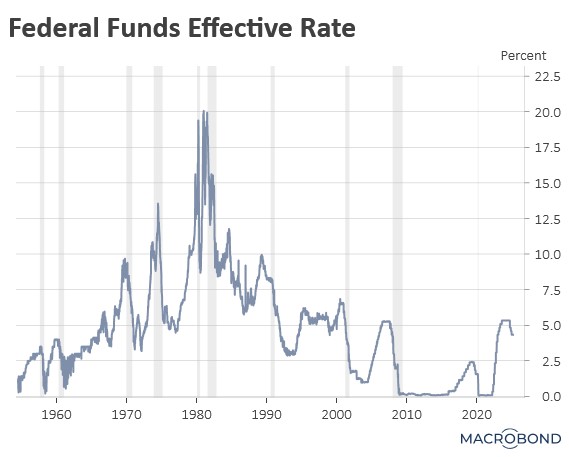

The Federal Reserve’s independence faces its most serious challenge in decades as the Trump White House escalates its criticism of central bank policy. This brewing confrontation echoes historic tensions — most notably the 1951 clash between President Truman and Fed policymakers over yield caps that ultimately led to the Treasury-Fed Accord. Today, the battle lines are being redrawn as the administration pushes for more accommodative monetary policy while it looks to shield the economy from its own trade war.

The widening policy gap between the Fed and its global peers has been highlighted in recent months. While the European Central Bank, Bank of England, and the People’s Bank of China have all lowered their benchmark short-term interest rates to combat slowing growth, the Fed has held its benchmark rate steady — a decision repeatedly criticized by the White House. This policy divergence is further strained by the Fed’s quantitative tightening program, which Treasury Secretary Bessent argues complicates the issuance of longer-term government securities.

The debate has now moved beyond short-term policy disagreements to fundamental questions about the Fed’s role and independence. Former Fed Governor Kevin Warsh, widely seen as the leading candidate to replace Chair Powell when his term ends in 2026, has emerged as a vocal critic of the central bank’s current direction. His critique focuses on two key concerns: first, that the Fed has strayed beyond its core mandate by engaging in issues like climate change policy and diversity, equity, and inclusion; and second, that its operational approach — particularly the frequency of public commentary by FOMC members — has created unnecessary market uncertainty.

Market participants are closely watching several potential flashpoints. The administration has reportedly considered accelerating the leadership transition by nominating Powell’s successor well before his term concludes, a move that could allow markets to price in policy changes gradually. Warsh’s combination of Republican credentials, Fed experience, and Treasury background makes him the probable choice, although some investors question how his well-documented hawkish views might align with the administration’s apparent preference for easier monetary policy.

The stakes for investors are significant. Any perception of compromised Fed independence could trigger a reassessment of risk premiums across asset classes. Treasury yields may face upward pressure, particularly at the long end of the curve, while the dollar could weaken if markets question the central bank’s commitment to price stability. In other words, concerns about reduced Fed independence could exacerbate the budding US capital flight that we discussed in our recent Asset Allocation Bi-Weekly from May 5, 2025. Perhaps most critically, the Fed’s ability to serve as a stabilizing force during future economic downturns could be diminished if political considerations are seen to influence its decision making.

As this drama unfolds, market participants would be wise to monitor three key developments: the timing and nature of any leadership transition, changes to the Fed’s communication strategy, and, most importantly, whether the central bank can maintain its operational independence while navigating increasingly choppy political waters. The outcome of this power struggle will shape monetary policy and market dynamics for years to come.

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Daily Comment (May 16, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are closely tracking the president’s latest trade announcement. In sports, the Carolina Hurricanes secured a victory against the Washington Capitals, advancing to the Eastern Conference Finals. Today’s Comment will discuss the administration’s recalibrating of its trade strategy, Friday’s stronger-than-expected economic data that still contained worrying signals, and other market news. As always, we’ll conclude with a summary of major domestic and international economic data releases.

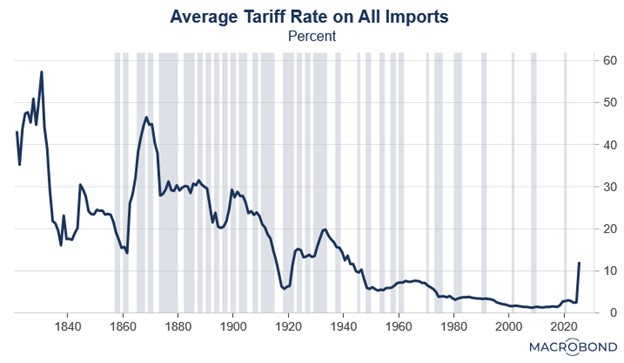

Trump Rethinks Tariffs: The president has stated that he plans to set new tariff rates for countries due to the difficulty in securing deals with individual nations.

- The president has announced a shift away from previously set tariff rates, directing Commerce Secretary Howard Lutnick to notify trading partners of new requirements for doing business with the US. The move follows a series of deals by the Trump administration to lower tariffs from the levels set on April 2. It remains unclear whether this approach will involve eliminating some tariffs in favor of a more direct business tax or simply reducing overall tariff rates.

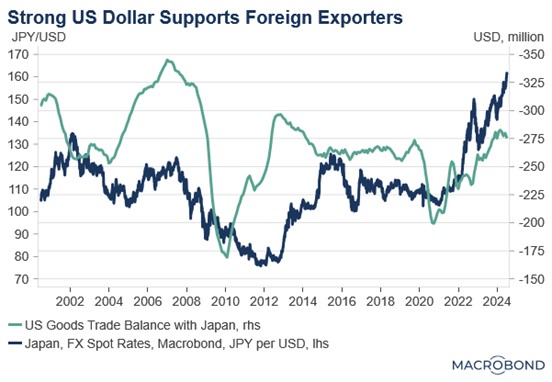

- The president’s policy shift coincided with US-Japan trade negotiations held the same day. Reports suggested the discussions might have expanded beyond trade to include currency exchange rates. However, negotiations reached an impasse when Japanese officials demanded the complete elimination of the 25% auto tariff as a prerequisite for any agreement, a condition the Trump administration ultimately rejected.

- However, his decision to reconsider tariffs offers stronger support for the “Trump put” hypothesis than market observers initially anticipated. This theory posits that the president is more likely to prioritize market performance over long-term policy goals, implying that any significant market downturn would prompt intervention to restore upward momentum.

- A notable trend in this trade war is the increasing influence of public sentiment. President Trump’s trade policies have fueled recession concerns, weakening his domestic approval ratings. At the same time, foreign leaders negotiating with the US face growing political pressure to hold firm in talks to avoid appearing overly conciliatory.

- In short, the political reality of the trade war has complicated negotiations. Many Americans now fear recession and rising inflation, while foreign voters increasingly resent US economic dominance. Faced with these pressures, the administration may need to recalibrate its approach — at least until it secures passage of its tax bill.

- We expect the current market rally to persist barring any unexpected tariff escalations. Investors have largely priced in the April 2 tariffs as the likely peak, with markets now anticipating potential reductions. This baseline scenario, if correct, would mitigate recession concerns and continue supporting equity valuations. However, any deviation from this expectation — particularly new tariff measures — could quickly reverse recent gains.

Mixed Data: The latest retail sales and PPI figures paint a mixed picture of the impact of tariffs, yet recent forecasts still point to strong GDP growth in Q2.

- While overall spending appears to be holding, there are subtle signs of weakness. Retail sales unexpectedly edged up 0.1% in April, defying forecasts of stagnation, as consumers ramped up auto purchases ahead of looming tariffs. But the headline gain masked underlying weakness as the retail sales control group (which excludes autos, gasoline, and building materials and directly feeds into GDP calculations) fell 0.2%, sharply missing expectations of a 0.3% rise.

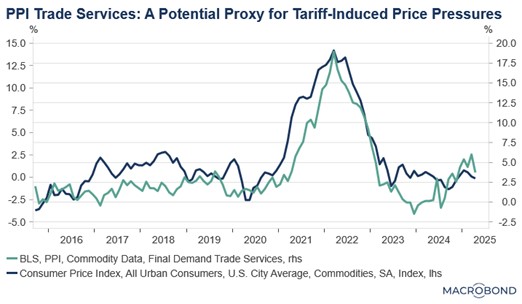

- April’s producer price index also painted a confusing picture of the economy. Defying expectations of a 0.2% gain, the headline PPI instead fell 0.5% month-over-month, a decline that reflects both moderating price pressures and businesses absorbing tariff costs. Most notably, the PPI trade services component, our key barometer for tariff impact, plummeted 1.6%, providing compelling evidence that trade intermediaries are bearing the heaviest burden from recent protectionist measures.

- Taken together, this data suggests the initial impact of tariffs on spending and prices may be less severe than anticipated. This could be attributed to firms strategically maintaining low prices to gain market share while competitors navigate adjustments. However, the sustainability of this trend remains uncertain. Even a major low-cost retailer like Walmart has indicated a willingness to raise prices in response to tariffs.

- Nevertheless, we believe this data reinforces the likelihood of a longer runway before a potential recession than many anticipate, which should support equities if this trend persists. The Atlanta Fed’s latest GDPNow forecast indicates a projected 2.5% growth rate for the second quarter, suggesting economic rebound. In essence, while tariffs are undoubtedly impacting the economy, their effects have not yet been significant enough to derail the economy’s current trajectory.

Putin Says No Deal: The Russian leader’s no-show for a planned meeting in Turkey aimed at securing a truce with his Ukrainian counterpart will delay a peace deal.

- The highly anticipated meeting between the leaders of the two warring nations did not unfold as planned. Originally intended to bring both sides together to finalize an agreement, the day descended into chaos instead. Putin sent a lower-level delegation instead of attending in person, and the groups landed in different cities, making face-to-face discussions nearly impossible. Although talks are expected to resume today, hopes for a final agreement remain slim.

- Putin’s lack of cooperation suggests he remains confident in his dominant position at the negotiating table. Reports indicate he is pushing for discussions based on the 2022 Istanbul draft agreements, terms initially proposed as Russian forces prepared to invade Ukraine. Those demands included drastic reductions in Ukraine’s military capabilities, strict limits on its armaments, and significant concessions on sovereignty — conditions that are almost certain to be rejected.

- The US maintains its mediation efforts between the warring parties, seeking to facilitate a rapid end to hostilities. President Trump has indicated he’s prepared for direct talks with Putin in hopes of altering Russia’s position. However, with key leaders absent from negotiations and no framework for finalizing terms, expectations remain low that the upcoming diplomatic meetings will produce substantive results.

- We remain optimistic that ongoing negotiations will ultimately produce an agreement between the two parties. Putin’s decision to abstain from attending appears primarily designed to demonstrate Russia’s dominant position in the talks. However, he likely understands that sanctions relief remains contingent upon reaching an arrangement. Consequently, we anticipate a settlement before year’s end that should provide support for European equities while exerting downward pressure on energy prices.

Fed Officials Reflect: The Fed is looking to change the framework that it uses to guide its policy decisions.

- Yesterday, Federal Reserve officials convened for the first day of their two-day conference to evaluate current monetary policy strategies. The discussions are part of the central bank’s regular framework review, ensuring its policy tools remain aligned with the Fed’s dual mandate of price stability and maximum employment. A key focus of this review will be evaluating how the pandemic has influenced the Fed’s policy decisions.

- The central debate focused on the Fed’s decision to prioritize maximum employment over inflation control, even as labor markets showed clear signs of tightening. Most notably, the strategy of tolerating above-target inflation to compensate for previous periods of persistently low inflation has emerged as a key area requiring revision in the upcoming policy framework.

- Additionally, discussions have emerged regarding current economic conditions and their implications for monetary policy. Fed Chair Powell has indicated that he anticipates persistent supply shocks and elevated long-term yields, signaling the central bank’s overall reluctance to return to the pre-pandemic normal of near zero interest rates. This shift means that bonds yields are likely to stay elevated.

Bi-Weekly Geopolitical Podcast – #66 “Update on the US-China Military Balance of Power” (Posted 5/16/25)

Daily Comment (May 15, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently focused on analyzing the latest slew of economic data. In sports news, fans are celebrating as the Minnesota Timberwolves secured their spot in the NBA Western Conference Finals. In today’s Comment, we’ll examine the sources of the market’s growing optimism, the underappreciated strategic depth behind Trump’s negotiation tactics, and other notable market developments. We’ll conclude with our regular roundup of international and domestic data releases.

Market Optimism: The initial shock from the tariffs appears to be fading, with the market increasingly reflecting a risk-on sentiment.

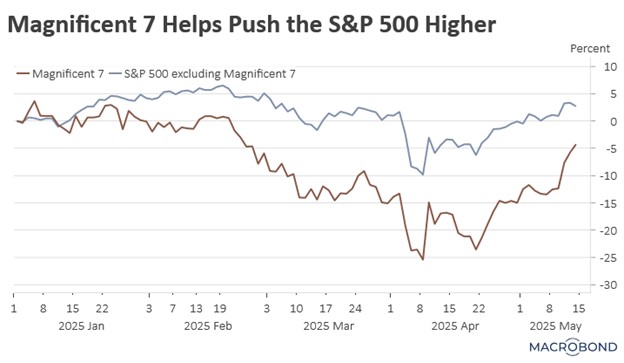

- Since the president’s controversial Liberation Day announcement, which imposed steep tariffs on key trading partners, the S&P 500 has not only fully recovered its initial losses but has now climbed above its 200-day moving average. This rebound reflects improving market sentiment, as investors grow increasingly confident that the administration may adopt a more flexible approach than initially feared when the tariffs were introduced.

- Following progress in trade negotiations with the UK and China, the US announced on Thursday that additional countries have shown willingness to engage on some of the president’s key trade concerns. On Thursday, he revealed that India is considering eliminating all tariffs on US goods. Meanwhile, there have also been discussions suggesting that EU officials are increasingly confident about reaching a deal with the Trump administration.

- Following progress in trade talks, we have seen investors return to the momentum trade that drove the S&P 500 higher in 2023 and 2024. Notably, investors have rushed back into AI-related firms amid optimism that demand for new technology will fuel strong earnings growth over the coming years. The most significant gainers have been Tesla and Nvidia, which both have surged roughly 23% since April 2.

- Investors increasingly believe the president will adopt a more pragmatic approach to tariffs moving forward — a shift many interpret as a sign that the worst may be over. As a result, markets have begun pricing in the prospect of future trade progress, which could significantly benefit US firms. While it is still too early to confirm whether this optimism is justified, sentiment is likely to hold as long as the administration signals no further escalation in tariffs beyond current levels.

- Consequently, we believe it may be prudent to begin cautiously testing the market, particularly by targeting companies with minimal supply chain risks and strong earnings potential. These firms are likely to show the most upside risk as long as the economy continues to grow. That said, there are still risks that are hard to quantify; therefore, a wait and see approach is still the safest.

Trump’s Strategy: While the president’s trade policies may appear volatile, there may be more strategy at play than many realize.

- His decision to impose steep tariffs on fentanyl-related imports from allies and China caught markets by surprise. At the time, many had underestimated his willingness to escalate a trade war due to the impact it would have on equities. As a result, the tariff led to an immediate market sell-off. This move put other countries on notice that he meant business but also forced companies to stockpile goods and brace for further disruptions.

- Next, he imposed sky-high tariffs on nearly all major trade partners, redefining a “trade cheat” not as a country exploiting the system, but simply as any nation running a surplus with the US. By pushing tariffs to extreme levels, he reshaped market expectations of how high tariffs could go, while reinforcing his broader goal of fundamentally restructuring US trade relationships.

- Then, in a tactical pivot, he slashed tariffs to a flat 10% — still triple pre-trade war levels but significantly below his initial demands. This triggered another round of inventory hoarding while boosting government tariff revenues and showcasing their viability as a fiscal tool. More importantly, it delivered an unambiguous warning to trade partners that access to the US market now comes with strings attached.

- Meanwhile, China’s tariffs were maintained at effectively prohibitive levels, compelling Chinese exporters to divert goods to alternative markets. This deliberate oversupply strategy served a dual purpose as it demonstrated the disruptive consequences of Chinese export dominance while creating economic incentives for other countries to align with US efforts to restrain China’s trade practices.

- The US strategically reduced Chinese tariffs to triple the standard rate applied to other nations in a calibrated move that maintained China’s status as the primary trade-policy target. This triggered two key effects: (1) an immediate surge in imports as companies raced to rebuild inventories, boosting tariff revenues; and (2) sustained pressure on US firms to accelerate supply chain diversification away from Chinese manufacturing hubs.

- While this breakdown omits many nuances and certain events, the key takeaway is clear: The president’s tactics, though unorthodox, serve deliberate goals. The trade war is unlikely to end soon, but the volatility itself has secondary benefits such as generating revenue through inventory surges, which could sustain growth longer than many realize. While the ultimate outcome of these policy shifts remains uncertain, there are strong indications of a broader, calculated strategy at work.

Tax Bill Gets Uncomfortable: Republican lawmakers are expected to have a tax bill by July; however, there still seems to be a lot of disagreement over the details.

- Republican lawmakers from high-tax states are set to gain a significant tax concession, with a proposed bill raising the State and Local Tax (SALT) deduction cap to $80,000. This compromise follows threats from several Republicans to block extensions of Trump-era tax cuts unless the deduction — capped at $10,000 since 2017 — was increased. The negotiated change, if enacted, would represent a notable win for moderates in high tax states.

- The House has advanced a bill that would impose steep cuts to Medicaid. Key provisions include imposing work requirements (with specific exemptions) for childless adults aged 19 to 64, eliminating states’ ability to tax healthcare providers for Medicaid funding, and penalizing states offering Medicare access to individuals without legal status. While some conservative lawmakers have expressed concerns about these changes to social programs, it remains unclear whether they have sufficient votes to block the bill.

- The proposed increase in the SALT deduction cap, combined with spending restrictions on Medicaid, will likely result in a narrow passage in the House but spark a more contentious debate in the Senate. While the legislation is still expected to pass, further amendments may be introduced to mitigate its political fallout. That said, the bill’s enactment would likely be supportive for equities.

Trump Deregulation Push: The White House is set to start rolling back bank rules in a win for the financial industry.

- Regulators are expected to lower capital requirements for banks in a move that could affect their lending capacity. Specifically, they plan to reduce the supplementary leverage ratio (SLR), a rule mandating that large banks maintain a minimum level of high-quality capital relative to their leverage. This ratio acts as a buffer against liquidity shortages during periods of financial stress.

- The financial industry has consistently opposed the rule, arguing that its capital requirements not only constrain lending to households but also discourage banks from acting as stabilizers in the Treasury market. By including Treasury securities in the leverage ratio calculation, the rule limits banks’ ability to absorb shocks during periods of bond market stress — a weakness starkly exposed during last month’s volatility.

- The easing of financial regulations is expected to provide a meaningful boost to economic activity. By reducing capital constraints on banks, the policy shift should expand credit availability, enabling households to secure financing more easily and supporting a rebound in consumer spending. This rule change should help support the broader economy.

Daily Comment (May 14, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Financial markets are still in a good mood following the latest deals from the Trump administration. In sports news, fans are celebrating the Indiana Pacers’ victory over the Cleveland Cavaliers that secured their spot in the Eastern Conference Finals. Today’s Comment will examine the latest inflation data, important tax policy developments, and other market-moving news. As always, our report will provide comprehensive summaries of both domestic and international economic data releases.

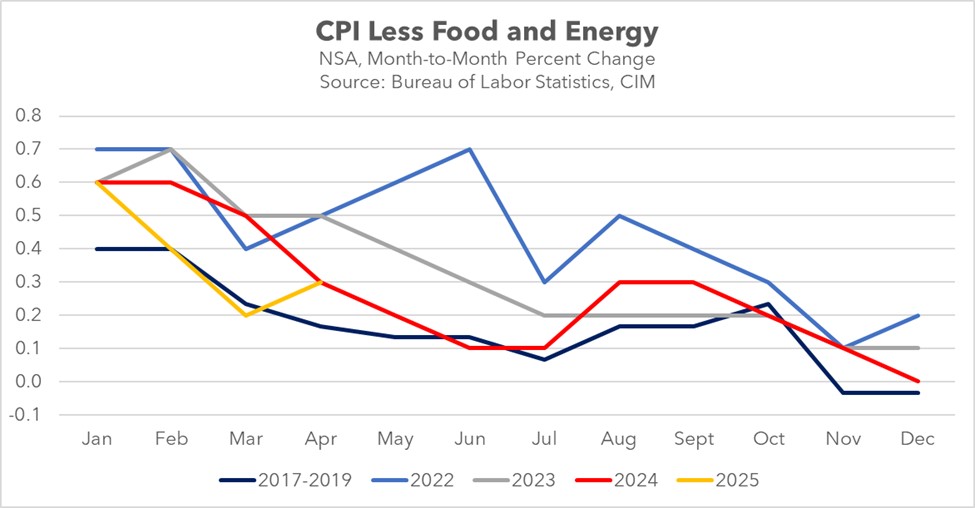

Where’s the Tariff? Inflation was softer than expected, signaling a continued downward trend in underlying price pressures that began before the tariffs took effect.

- Overall, US consumer prices increased by 2.3% year-over-year, down slightly from the previous month’s 2.4% and well below the 3.0% reading at the start of the year. The decline was driven by a sharp 11.5% drop in energy prices compared to the prior year, along with a monthly decrease in food costs. Excluding food and energy, Core CPI held steady at 2.8% for the month.

- The most encouraging aspect of the report is the continued downward trend in services inflation, signaling a return to normalization. The year-over-year change in the index has declined for six consecutive months, with the deceleration primarily driven by shelter costs — a key inflationary driver. This moderation in shelter prices has played a major role in bringing overall inflation closer to the 2% target.

- However, there are early signs that tariff pass-through is beginning to influence inflation, albeit modestly. As the chart below illustrates, the latest CPI reading pushed inflation above its pre-pandemic trend, roughly matching the previous year’s monthly increase. Much of this uptick stemmed from key goods likely affected by tariff-related cost pressures. Notably, price indexes for appliances, recreational goods, and educational commodities all accelerated compared to the previous month.

- The April CPI report offers some reassurance that the feared inflationary surge may not be as severe as initially expected. As we’ve noted in previous commentaries, these tariffs are unfolding alongside a broader disinflationary trend, particularly in shelter costs, which should help restrain an increase in the overall index for the year. That said, the full impact of inflationary pressures may not materialize until mid-to-late summer. Therefore, investors can remain cautiously optimistic regarding inflation.

More Tax Details: The latest estimate for the House Republicans’ tax bill falls within the range projected by lawmakers, clearing the way for additional adjustments to the bill.

- According to the Joint Committee on Taxation, the GOP’s latest budget proposal is projected to increase the deficit by $3.7 trillion over the next decade. This figure reflects $5.8 trillion in proposed new tax spending, partially counteracted by $1.9 trillion in savings achieved through the reversal of clean energy incentives. With this projected deficit increase remaining below the House Ways and Means Committee’s $4.5 trillion benchmark, the possibility of additional tax reductions is being explored.

- Expanding the SALT deduction has emerged as the most likely concession. Several lawmakers have signaled they would support the tax bill only if the deduction is raised from the current $30,000 cap. They contend that opposing the bill outright could lead to a full repeal of the cap, so they are pushing for a larger deduction as an incentive to vote in favor. While negotiations over a potential increase continue, House Speaker Mike Johnson has indicated that a deal could be reached by Wednesday.

- The additional fiscal flexibility could also facilitate a partial reversal of eligibility restrictions for food and health assistance programs. Republican legislators have expressed concerns that these limitations might alienate key constituents who supported Trump’s 2024 presidential victory. This newfound budgetary margin may enable lawmakers to relax certain provisions, potentially averting significant political backlash.

- Although the bill has not yet reached its final form, it is still anticipated to deliver significant stimulus to the broader economy. This economic boost could help mitigate much of the anticipated impact from rising tariffs. We expect businesses may view the bill’s provisions as an incentive to increase investment activity. Consequently, the legislation could provide meaningful support to equity markets in the second half of the year when the tariff impact becomes clearer.

Strengthening US-Gulf Relations: On the first day of his Middle East diplomatic tour, President Trump strengthened strategic partnerships with key Arab leaders, marking a significant step in countering China’s growing influence in the region.

- During his diplomatic visit, the president focused on strengthening economic and security partnerships across the Middle East. The trip yielded significant results, including Saudi Arabia’s commitment to invest more than $1 trillion in the US. A landmark agreement was also reached to enable Nvidia and Advanced Micro Devices (AMD) to supply critical semiconductor chips for several countries in the Middle East, bolstering the region’s artificial intelligence capabilities.

- Additionally, President Trump aims to address long-standing regional conflicts through diplomatic engagement. His administration has announced plans to lift sanctions against Syria’s government and remains open to negotiations with Iran regarding its nuclear program. Furthermore, he is scheduled to meet with Qatari leaders on Wednesday to discuss strengthening bilateral security cooperation.

- The president’s actions appear to be part of a broader strategy to counter China’s expanding influence in the region. Over the past five years, China has significantly deepened its trade and investment ties across the Middle East as part of its effort to reduce economic reliance on the US. This expansion has included major advancements in digital technology, with Arab nations playing an increasingly important role in Beijing’s Digital Silk Road Initiative.

- The administration’s sanctions relief and technology agreements appear strategically designed to counter China’s regional influence by disrupting its economic momentum and isolating it technologically. The Trump administration is reportedly preparing to implement new trade rules that would require partner nations to limit technology transfers to China. If effectively executed, this strategy could substantially weaken Beijing’s ability to compete with American dominance in AI.

A New Plaza Accord: Speculation is growing that the Trump administration may pressure Asian nations to allow their currencies to appreciate to bring down the value of the US dollar.

- The Trump administration has reportedly engaged in preliminary discussions with South Korea regarding currency policy. These talks coincide with upcoming bilateral trade negotiations aimed at averting potential tariffs on Korean exports. While no formal agreements have been confirmed, market reaction to the reports has already triggered appreciation in the Korean won.

- A potential appreciation of Asian currencies could reinforce market expectations that the administration favors a weaker dollar policy to prevent tariff circumvention. While this approach would increase costs for foreign imports, it might also create conditions for either reduced tariff rates or at least an avoidance of additional increases beyond those implemented on April 2.

Confluence of Ideas – #42 “Reviewing the Asset Allocation Rebalance: Q2 2025” (Posted 5/14/25)

Daily Comment (May 13, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with an added US concession in the tariff war between Washington and Beijing, which will likely help de-escalate tensions between the two sides. We next review several other international and US developments that could affect the financial markets today, including an incendiary accusation by Poland that Russia was responsible for an arson fire last year that destroyed Warsaw’s biggest shopping mall (pun intended) and new signs that US lawmakers will gut many green-tech tax incentives, including for buying electric vehicles.

United States-China: After yesterday’s market euphoria over the news that the US and China had agreed to temporarily slash most of their tariffs on each other, the Trump administration last night clarified that it would also cut the US “de minimis” tariff on low-value parcels from China. Applied to packages with a retail value below $800, the de minimis tariff will now be cut to 54% from 120%. An optional $100 payment will be unchanged, rather than rising to $200. The move marks a further de-escalation in the US-China tariff war.

- The clarification will benefit Chinese retailers offering cheap goods directly to US consumers, such as Shein and Temu.

- Importantly, some low-end US retailers could also benefit, as they often rely on small shipments from China that qualify as de minimis parcels.

Russia-United States-Ukraine: President Trump yesterday told reporters that he might attend the planned Russia-Ukraine peace talks scheduled for Thursday in Turkey. The idea was quickly endorsed by Ukrainian President Zelensky, but we have seen no official response from Russian President Putin so far. Indeed, it’s still unclear whether Putin plans to attend. In any case, if Trump is serious about attending, it could set the stage for a potentially volatile, unpredictable meeting, which in itself could discourage Putin from participating.

Russia-Poland: Nearly a year after the largest shopping center in Warsaw burned to the ground, Polish Prime Minister Tusk said it is now confirmed that the fire was set by saboteurs working for the Russian intelligence services. The incident marks the latest instance of Russian destabilization efforts in the European Union. Those actions are likely to keep EU countries focused on rebuilding their militaries, which in turn will likely keep boosting EU defense firms and their stock prices.

Germany: Showing the extent to which populist nationalism and far-right authoritarianism have progressed in some Western democracies, the German government today banned the separatist organization “Kingdom of Germany” and confiscated its assets. Kingdom of Germany members have their own nominal king, reject Germany’s democratic institutions, and claim to rule a small enclave of about 2.4 acres near Wittenberg.

- Berlin’s move against Kingdom of Germany comes just days after it also declared the populist Alternative for Germany party to be a “rightwing extremist” organization, despite the party’s success in winning about one-fifth of the votes in the February federal elections. The designation gives the government the right to monitor the AfD more closely, including by tapping its communications.

- The designation has also sparked public debate over whether to ban the AfD outright. In a survey published over the weekend, some 53% of respondents favored such a ban.

United Kingdom: As firms dealt with an increase in national insurance contributions last month, April payroll employment fell by a seasonally adjusted 33,000, after a drop of 47,000 in March. The report also showed that average hourly earnings in the three months ended in March rose just 5.6% from the same period one year earlier, matching expectations but slowing from the annual rise of 5.9% in the three months ended in February. Weaker hiring but still-high wage growth is expected to keep the Bank of England cautious about cutting interest rates.

US Price Inflation: Late last week, economists at the Federal Reserve published a paper describing a new method to estimate the real-time impact of import tariffs on consumer price inflation. Looking at individual categories of personal consumption expenditures, the tariffs implemented for each category, the prevalence of imports in each category, and assumptions about pass-through from tariffs to consumer prices, the analysis estimates that President Trump’s tariffs this year have already boosted core consumer prices by 0.1%.

US Drug Industry: After hinting on Sunday that he would sign an order aggressively cutting US drug prices to “most favored nation” levels, the measure that President Trump signed yesterday only directed the Department of Health and Human Services to assist any drug company that wants to establish a direct-to-consumer purchasing program. The order threatened aggressive action against the drug firms if they don’t voluntarily cut their prices, but that was less stringent than feared. As a result, pharmaceutical stocks yesterday generally rose.

US Green Technology Industry: As we continue to process the draft budget bill presented by Republicans in the House, we note that one set of provisions would end a range of subsidies for green technology. For example, the proposal would end the $7,500 tax credit for buyers of new electric vehicles by the end of 2027 — despite the recent strong support for President Trump by Tesla chief executive Elon Musk. However, it’s important to remember that the bill at this point remains just a proposal, so it’s far too soon to know whether the provisions will become law.