by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

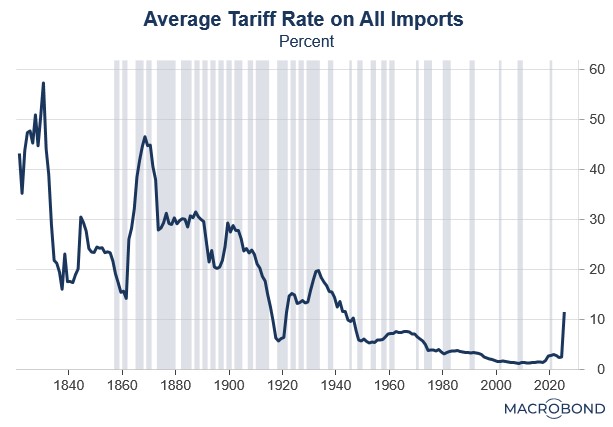

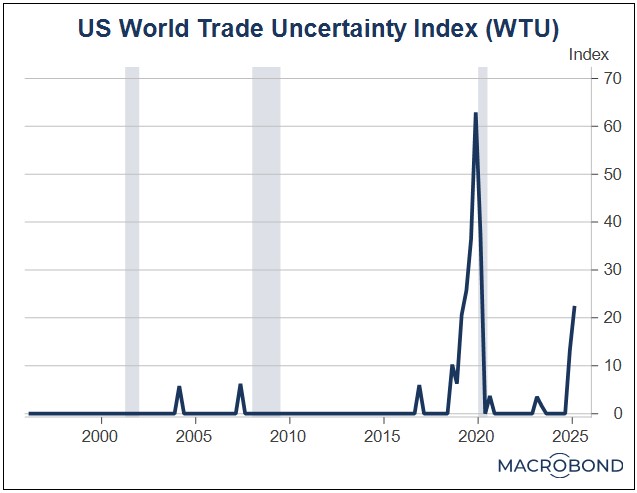

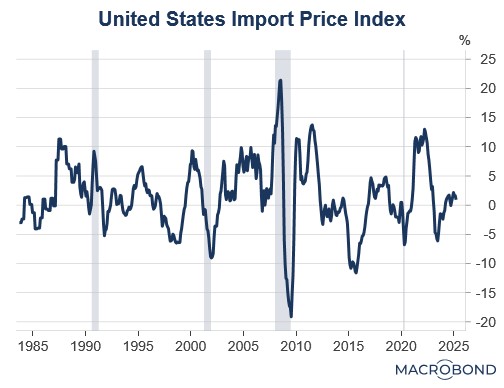

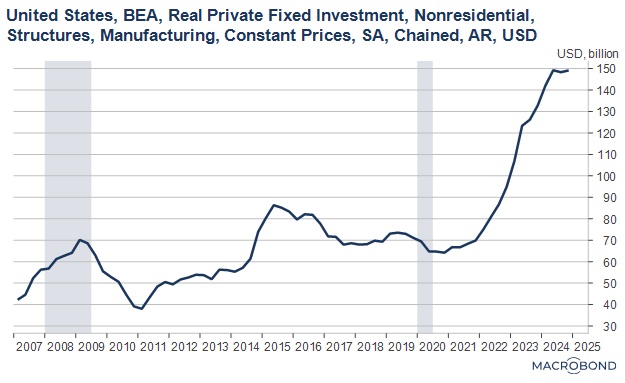

Our Comment today opens with reports suggesting President Trump’s import tariffs may finally show up in the trade and economic data starting this week. Firm evidence of falling imports and potential shortages would have the potential to further undermine market confidence. We next review several other international and US developments with the potential to affect the financial markets today, including an increasing risk of military conflict between India and Pakistan and Trump’s suggestion that he may pursue new tax cuts to offset the impact of his tariffs.

United States-China: New data published late last week showed that US-China trade is finally starting to fall sharply in response to the Trump administration’s stiff tariffs against Beijing. Figures from the Department of Agriculture show that US net exports of soybeans in the week of April 11 to 17 were down about 50% from the previous week and 25% below their four-week moving average. Net exports of pork were also down sharply. Meanwhile, Port of Los Angeles Executive Director Pete Seroka said he expects a 35% drop in Chinese import volumes within two weeks.

- According to Seroka, “essentially all shipments out of China for major retailers and manufacturers [have] ceased.”

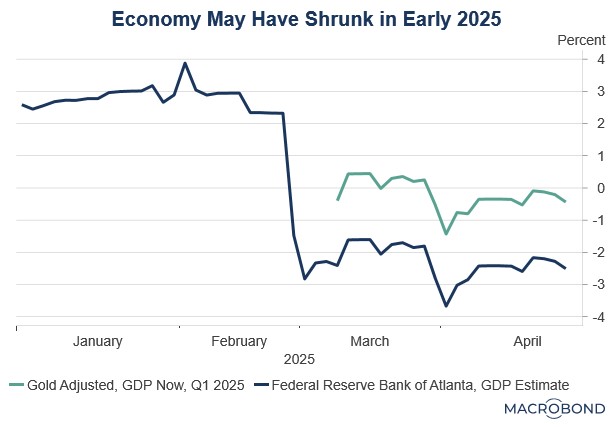

- Until now, there have been few signs of outright declines in trade operations or economic activity, even though there is plenty of survey data showing that consumers and firms are becoming much more pessimistic. The relatively stable activity data probably reflects factors such as front-running shipments to get ahead of the tariffs, the difficulty of canceling shipping schedules quickly, and the overall momentum of the US economy.

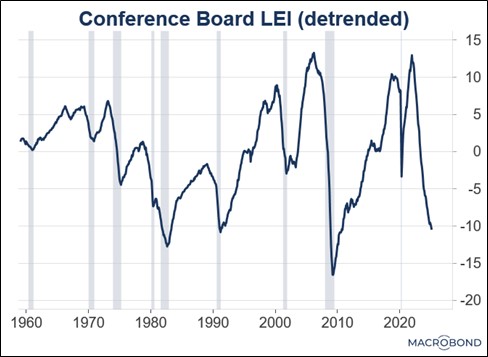

- Looking forward, observers are increasingly expecting to see disruptions in trade and output by early summer. It would be no surprise if negative data starts to roll in starting as early as this week. If so, it would likely increase over the coming months. We still don’t think a recession is a certainty, but the weakening activity will probably raise the risk of a broader economic contraction.

- In any case, any incoming data that appears to confirm a sharp contraction in trade or general economic activity could potentially spark a new sell-off in risk assets, especially US stocks.

China-Philippines: The Chinese coast guard on Saturday released photos showing it had seized a tiny reef in the South China Sea that is claimed not only by China but also by the Philippines, Vietnam, and Taiwan. Most concerning, the reef is located just kilometers from a Philippine naval outpost in the Spratly Islands. The move is only the latest example of Chinese territorial aggressiveness in the area. If that aggressiveness heats up further, the result will likely be more global tensions, a risk of conflict, and further risks to the global financial markets.

China: Despite being sanctioned by the US, technology giant Huawei is reportedly preparing to test a new computer chip designed to be a substitute for Nvidia’s powerful H100, which is popular for training artificial intelligence models. The new chip, the Ascend 910D, is apparently competitive with the H100 in computing power, but it less power-efficient. Still, Huawei’s success with the chip so far is a reminder that China may be catching up to the US in advanced information technology, potentially threatening big US tech firms and their stocks.

India-Pakistan: After last week’s terrorist attack that killed 26 in the Kashmir region, Indian Prime Minister Modi has reportedly called dozens of global leaders in an apparent effort to prepare them for a retaliatory attack on Pakistan. Indian police have also launched large-scale arrests in Kashmir, while Hindu nationalists have unleashed mass anti-Muslim protests across India. Any military conflict between the two nuclear powers could prompt a global security concern and add to the current downward pressure on risk assets.

South Korea: The center-left opposition party, the Democratic People’s Party, yesterday picked Lee Jae-myung as its candidate for the snap presidential election on June 3. In the latest polls tracking public support for the candidates, Lee and the DPP currently have a double-digit lead over the conservative People’s Power Party, which has been rocked by scandal. If Lee ultimately wins the election, South Korean policy could shift toward closer relations with China and cooler relations with the US, while economic policy could shift into a more statist direction.

Germany: Incoming Chancellor Friedrich Merz has reportedly chosen Katherina Reiche, a high-level executive with German energy group Eon, to lead the economy ministry. The move is a sign that Merz may prioritize energy supply as a key part of his program to revitalize German industry and spur economic growth. The nomination of Reiche comes as Merz’s center-right CDU party has signed a coalition deal with the center-left Social Democratic Party to form a government.

Spain: The country today was hit by an enormous electricity blackout affecting approximately 10 gigawatts of demand. The blackout has also extended to parts of Portugal and France. The loss of electricity has disrupted a wide range of economic activity in the affected areas, including airline and train operations, factory production, communications, and office work. However, it is not yet clear whether the blackout will have lasting negative impacts on economic output or the Spanish financial markets.

Canada: Parliamentary elections are being held today, with the main contenders being the ruling center-left Liberal Party under Prime Minister Mark Carney and the opposition center-right Conservative Party under Pierre Poilievre. The latest opinion polls suggest the Liberals will win a modest majority, keeping them in power, after Poilievre lost a massive advantage after being tagged for being in line with US President Trump.

US Fiscal Policy: In a social media post yesterday, President Trump suggested he will push for a new income-tax cut for individuals making less than $200,000 per year to offset the impact of his import tariffs. His post suggested any revenue loss from the new tax cuts would be made up by tariff revenues. However, the likely drop in trade because of the tariffs and any tariff reductions negotiated with foreign countries would probably keep overall tariff revenues relatively modest.

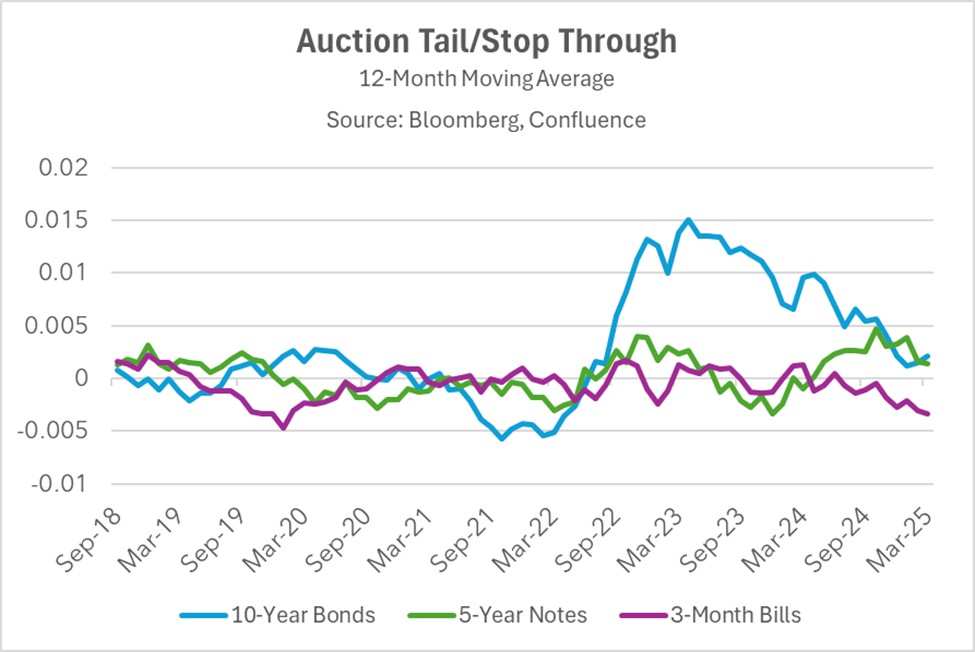

- The suggestion of further tax cuts therefore could add to concerns about the federal budget deficit and debt levels. If so, the recent US capital flight and backup in Treasury yields could worsen.

- So far today, bond prices have weakened, driving up yields. The yield on the benchmark 10-year Treasury note has risen to 4.292% as of this writing.

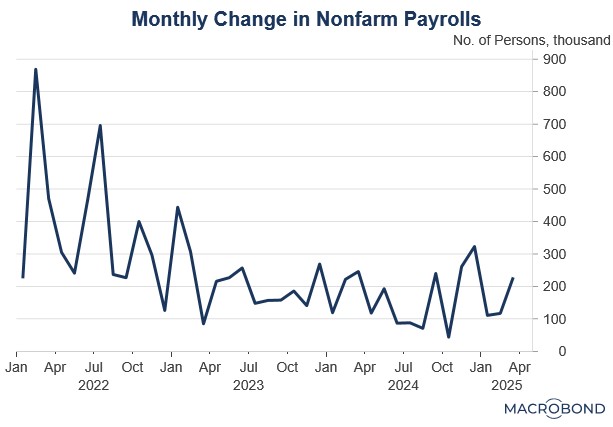

US Corporate Sector: A review of recent earnings reports and other corporate statements by the Wall Street Journal shows that US companies in multiple industries are slashing costs to help pay for President Trump’s big tariff increases, which are essentially a tax on importers. The article notes that firms are still generally reluctant to lay off their own workers, but they are tightening their spending on consultants and contractors — a move that has often preceded layoffs and weaker economic growth in the past.