by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently weighing the possibility of a government shutdown. In sports news, Real Madrid secured a victory over cross-town rivals Atlético Madrid and advanced to the quarterfinals of the Champions League. Today’s Comment will delve into the bond market’s subdued reaction to the latest CPI report, explore why Senate Democrats are engaging in a high-stakes standoff over the stopgap funding bill, and cover other key market-related news. As always, the report includes a summary of domestic and international economic data releases.

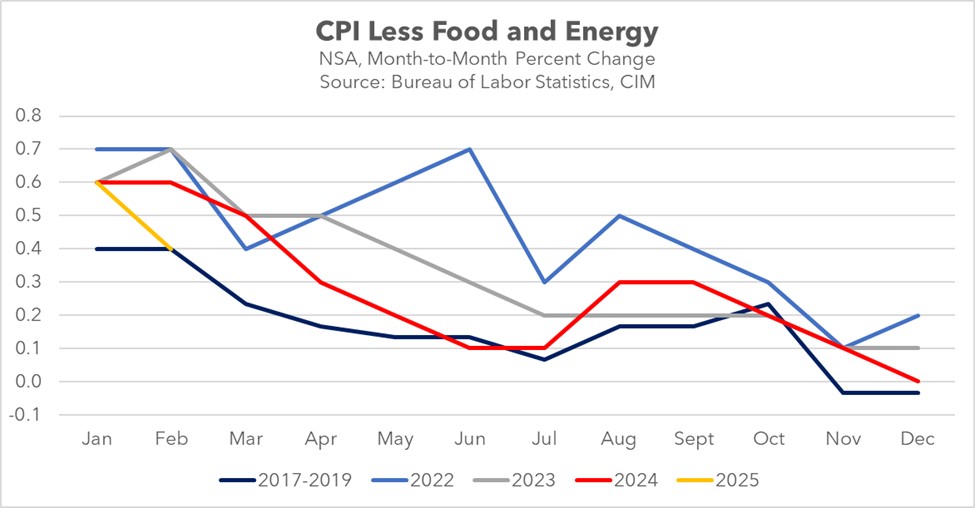

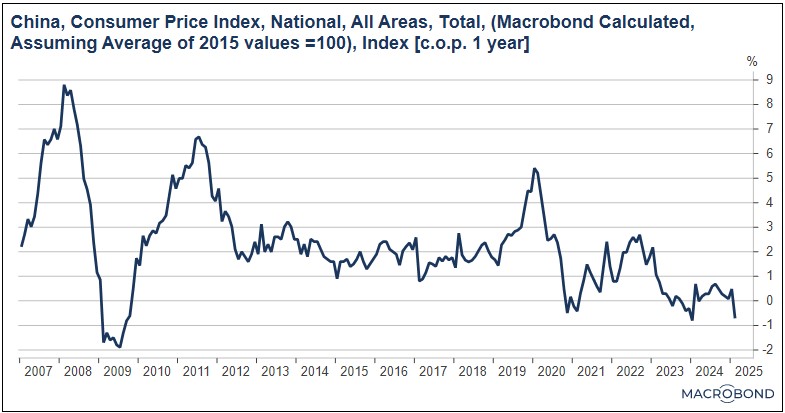

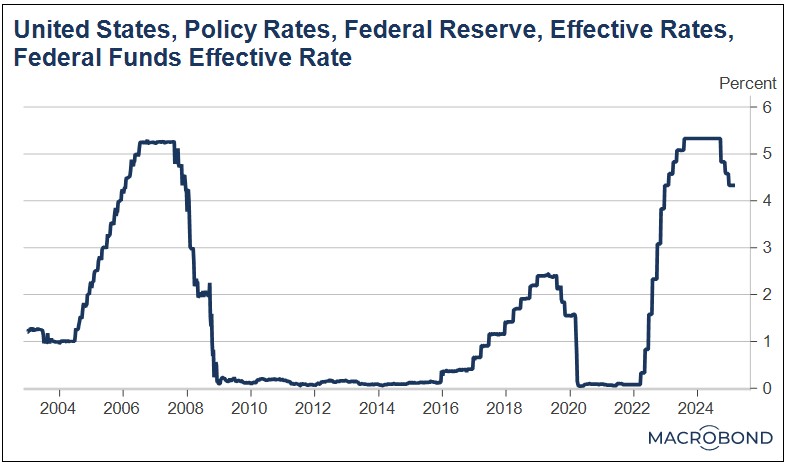

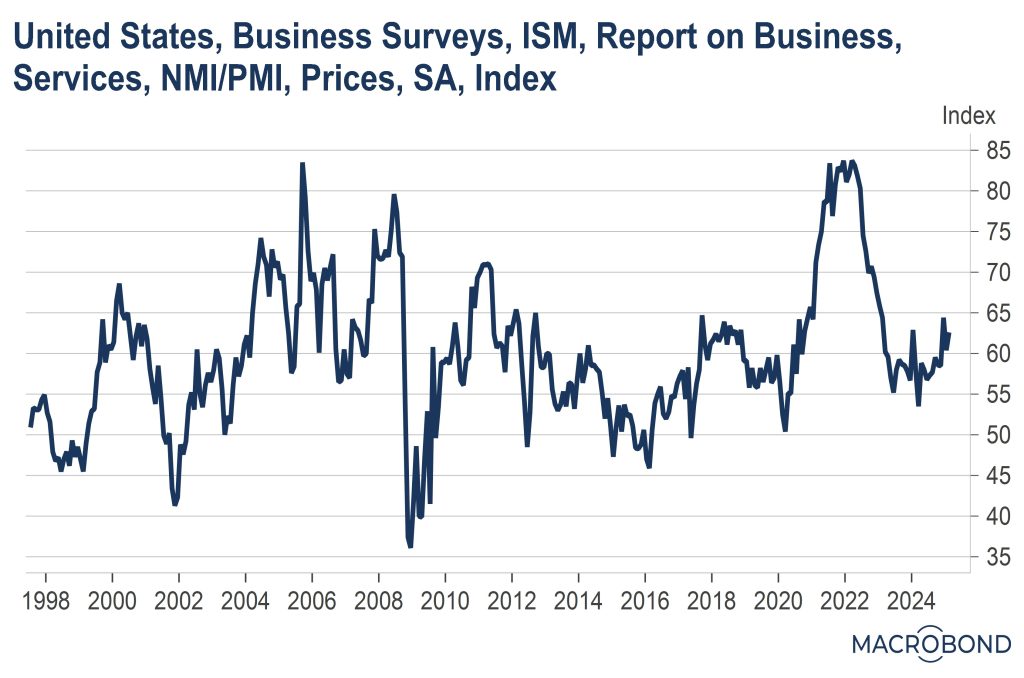

CPI Down, Market Shrugs: While the Bureau of Labor Statistics Consumer Price Index (CPI) indicated a better-than-expected inflation reading for February, the bond market’s muted response is signaling ongoing investor apprehension regarding tariffs.

- Annual inflation in February surprised to the downside, declining from 3.0% to 2.8%, while core inflation also slowed, dropping from 3.3% to 3.1%. Both figures came in below expectations, as headline inflation was forecast to fall to 2.9% and core inflation was projected to ease to 3.2%. The moderation was driven by cooling shelter costs and declines in the prices of airfare and gasoline. Although egg prices surged 58% year-over-year, they had a negligible overall impact on the index.

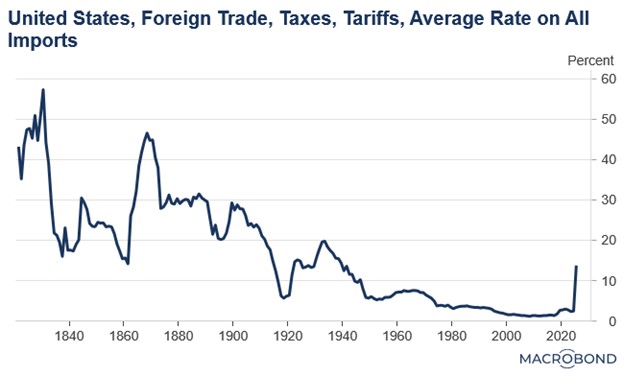

- Despite the positive inflation news, concerns over tariffs took center stage. On Wednesday, the US imposed tariffs on steel and aluminum products, a move expected to significantly impact automakers and homebuilders. Furthermore, the prospect of additional tariffs, set to take effect on April 2, raises the risk of renewed price pressures in the near future.

- Despite inflation posting its strongest two-month start since the pandemic, the potential disruption from tariffs has led many investors to refrain from concluding that the fight against inflation will end anytime soon. The 10-year Treasury yield ended the day roughly 3 basis points higher, reflecting growing skepticism that inflation will reach the 2% target this year.

- One area we will be closely monitoring during the trade war is the labor market. We anticipate that firms may attempt to offset profit losses caused by tariffs by reducing their workforce. Such a move could help exert downward pressure on inflation. However, if the labor market remains tight or tightens further due to tariffs, inflation is likely to stay stubbornly elevated.

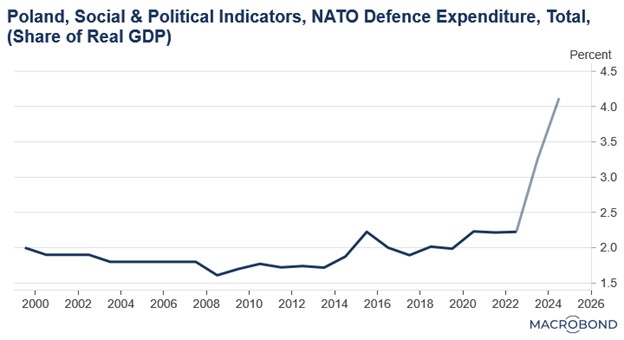

Polish Nuclear Power? Polish President Andrzej Duda has proposed that the US station nuclear warheads in Poland, reflecting growing global interest in nuclear arsenals amid perceived US reluctance to provide security guarantees.

- Duda believes that President Trump should consider relocating US nuclear warheads currently stored in Western Europe or the United States to Poland as a strategic deterrent against Russian aggression. His proposal aims to revive discussions around nuclear sharing, a dialogue initiated during the previous administration. This initiative comes at a critical juncture, as Eastern European nations seek enhanced security measures to counter potential threats from Russia.

- While it is unclear whether Trump will entertain such a proposal, the idea highlights the deepening anxieties among Eastern European nations regarding the potential fallout from the ongoing Russia-Ukraine conflict. Duda’s remarks align with his recent push to increase Poland’s military spending to a minimum of 4% of GDP, reflecting a broader effort to strengthen regional security and deterrence capabilities in response to heightened geopolitical tensions.

- Poland’s proposal to request nuclear weapons from the US highlights a growing trend among nations seeking to fill the security void left by America’s apparent reduction in global military engagement. While such a move would be politically untenable in most countries, it reflects a broader strategy for self-preservation, as possessing nuclear capabilities could deter potential invasions and eliminate the prospect of unconditional surrender in the face of aggression.

- This trend may extend beyond Europe, as regions like the Middle East also seek nuclear capabilities for security. A US military pullback could spur nuclear proliferation, risking a global arms race. For investors, this instability could boost commodities, as demand for safe-haven assets like gold and raw materials often rises amid geopolitical uncertainty.

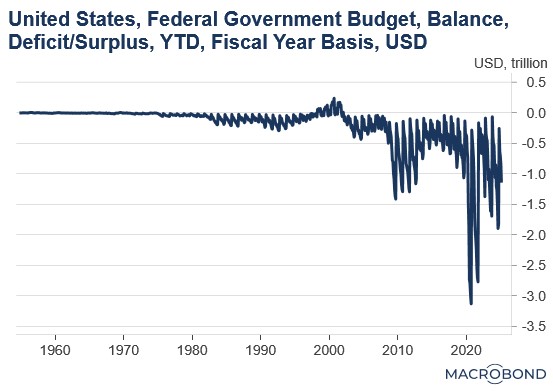

On Second Thought: While it was widely anticipated that Senate Democrats would approve the stopgap measure to fund the government for the next six months, the group ultimately failed to support the legislation. This unexpected setback has significantly increased the likelihood of a government shutdown over the weekend.

- Senate Democrats are advocating for a short-term 30-day stopgap bill, prioritizing their push for specific legislative measures over the longer-term funding proposal put forward by their counterparts. Their refusal to support the extended bill heightens the risk of a government shutdown, which could be averted only if they reconsider their stance before the critical Friday deadline.

- The ongoing standoff between Democrats and Republicans underscores the deepening partisan divide, as both sides struggle to find common ground on reducing the government deficit. In the first five months of fiscal year 2025, government spending soared to a record $1.147 trillion, including $307 billion from President Trump’s first month in office.

- This mounting fiscal challenge underscores the pressing need for bipartisan cooperation, yet the persistent deadlock casts doubt on the government’s ability to effectively address its escalating financial obligations. While Democrats currently oppose the measure, there remains a possibility that they could ultimately support it in order to avert the political fallout and economic disruption that would accompany a government shutdown.

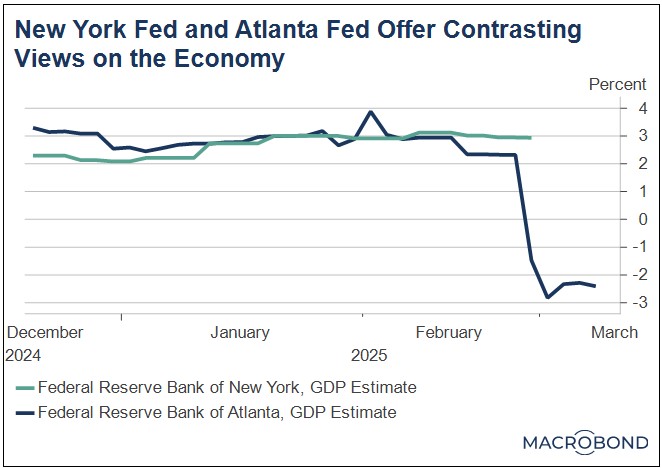

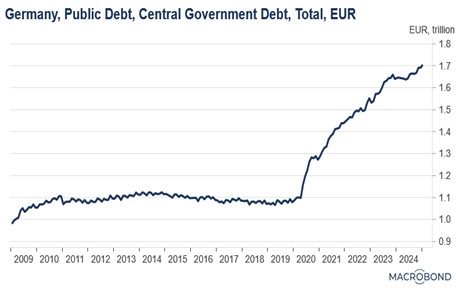

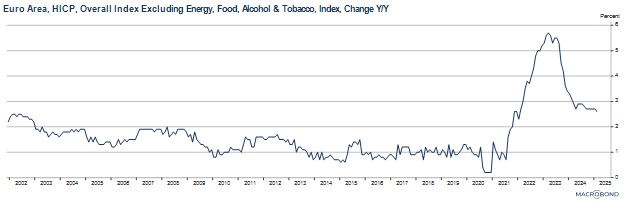

Europe’s Borrowing Costs: As EU countries move to significantly increase military spending, the resulting pressure on government budgets is driving up bond yields, compelling the bloc to explore drastic measures to prevent debt from escalating into a long-term economic challenge.

- The potential downgrade by Fitch Ratings has pushed France’s 30-year government bond yields to their highest levels in 14 years, as investors react to heightened fiscal concerns. Last month, the ratings agency warned that France might scale back its planned fiscal consolidation following the passage of its budget. These concerns have only intensified since the government pledged to increase defense spending, further straining its financial outlook and raising questions about its long-term debt sustainability.

- France is not alone in facing fiscal pressures, as Germany is also experiencing a sharp rise in long-term bond yields amid plans to significantly increase spending. The yield on Germany’s 10-year bund has surged the most in a single week since 1990, following efforts to revise the country’s budget rules to accommodate higher defense expenditures.

- One of the key developments to monitor as these countries aim to strengthen their defense capabilities is the potential shift toward a more integrated fiscal union. Recently, Italy has proposed the creation of a European guarantee mechanism, which would enhance the marketability of bonds issued by countries seeking to increase debt to fund defense initiatives. This implicit backing could make European bonds more attractive to foreign bondholders.