Author: Amanda Ahne

Bi-Weekly Geopolitical Report – The Changing Face of War (April 22, 2024)

by Daniel Ortwerth, CFA | PDF

If the United States were at war with another great power, would we know it? How would we know it? These questions might seem absurd but consider that the US has not fought a war against a major world power since 1945. Meanwhile, when the US has engaged in conflicts against weaker and regional powers since World War II, the beginnings and endings of the conflicts have tended to be blurred. Technology has advanced in ways unimaginable to the 1945 mind. This has changed the nature of life, and it has also changed the face of war. In this report, we consider how the contours of that face have changed over time, what it takes to recognize war in the 21st century, and whether the US and its allies might already be at war with China and its allies.

By addressing key elements of technological advancement and geopolitical evolution, we explore how 80 years have changed the face of war. We consider aspects of war that have not and never will change as well as what has changed, and we drive to the bottom line for investors. In our view, that bottom line has remained constant through time as war is expensive, citizens pay the price, and that price largely manifests itself in the form of higher inflation and long-term interest rates. Will the US ever go to war again with another major power in a way that we can recognize? Will we know it when we are there? These questions are harder to answer than ever before, but investors can still prepare.

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Daily Comment (April 22, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with a discussion of the big foreign aid bill passed by the House of Representatives over the weekend. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including an analysis of why Japan and South Korea are agitating for a weaker dollar and some observations on where US bond yields go from here.

United States-Ukraine-Israel-China: The House of Representatives approved a package of bills on Saturday that will provide a total of $95 billion in military and other aid to Ukraine, Israel, and Taiwan, even though a majority of Republicans opposed the $60 billion or so destined to Ukraine to help it fend off Russia’s invasion. The Senate is poised to give final legislative approval to the package in the coming days, after which President Biden is expected to sign it into law.

- Here at Confluence, we have long noted how US voters have become increasingly resistant to supporting the country’s traditional role as global hegemon, with the enormous fiscal, economic, and social costs. We believe that resistance is a key reason why right-wing populists such as Donald Trump have gained power in recent years.

- Nevertheless, it is not set in stone that US voters will ultimately support a full pullback from US leadership in global affairs. The vote over the weekend is an example of how, when faced with the threat of authoritarian powers abroad, politicians could well line up behind renewed US engagement, higher US defense spending, and a stronger commitment to US military power.

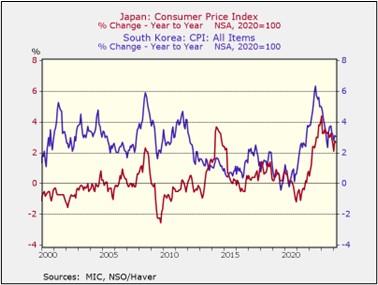

United States-Japan-South Korea: New analysis suggests Friday’s joint statement on currency rates by the US, Japan, and South Korea stemmed from Japanese and Korean concerns about consumer price inflation. As strong economic growth and the prospect of continued high interest rates in the US buoy the dollar, the yen (JPY) and won (KRW) have depreciated sharply. In turn, Japanese and Korean purchases of dollar-denominated goods have become more expensive, broadly pushing up price pressures in each country.

- Since the end of 2022, the yen has lost 14.8% of its value versus the greenback. Meanwhile, the Korean currency has weakened 8.3% against the dollar.

- The statement, which acknowledged that Tokyo and Seoul have serious concerns about their currencies, could signal a future coordinated effort to weaken the dollar and allow the yen and won to rise again. At any rate, it suggests the Biden administration has given the two allies a green light to intervene in the currency markets to boost their currencies.

Chinese Monetary Policy: The People’s Bank of China today said the country’s major banks have kept their prime lending rates unchanged this week, as widely expected after the central bank kept the interest rate on its medium-term lending facility unchanged last week. The banks’ one-year prime rate remains at 3.45%, while their five-year rate remains at 3.95%. Because of continued modest economic growth, some economists still expect the PBOC to cut rates further, but policymakers continue to resist broad, aggressive stimulus measures.

Chinese Military: State media on Friday said General Secretary Xi has ordered the biggest reorganization of the People’s Liberation Army since 2015. Under the change, the Strategic Support Force will be split up, with its space and cyberspace forces becoming new, standalone services and its remaining elements becoming a new Information Support Force.

- One likely reason for the change is to hasten the development and improve the operational efficiency of China’s key space warfare and cyberspace capabilities. If successful, the reorganization could help make those forces even more formidable threats to the US and the rest of its geopolitical bloc.

- Another likely reason for the reorganization is to stamp out corruption. Over the last year, several high-ranking military officials in the sprawling Strategic Rocket Force and defense industry were removed from their posts, apparently for procurement-related corruption that would have made them susceptible to recruitment by foreign intelligence agencies. Breaking up the Strategic Support Force could help increase control over its elements and reduce the opportunity for bribery, graft, espionage, and the like.

Iran-Israel: The Israeli military finally launched its retaliation on Friday for Iran’s direct missile and drone attack on Israel on April 13, striking a military base near the central Iranian city of Natanz. Details over the weekend showed the strike apparently used one missile and multiple drones to destroy an Iranian air defense radar near some of Iran’s key nuclear program sites. The limited nature of the strike and Iran’s muted response suggest the risk of escalation has diminished, but it’s clear Israel was signaling it can attack Iran by air if it so chooses in the future.

Canada: Bank of Canada Governor Macklem has given an optimistic assessment that consumer price inflation in Canada is now “closer to normal” and that the March data was a further “step in the right direction.” According to the report last week, March consumer prices were up 2.9% from the same month one year earlier. Macklem’s statement is being read as further evidence that the central bank will begin cutting interest rates as early as June.

US Bond Market: With the big rise in US bond yields over the last month, which has lifted the yield on the10-year Treasury note to 4.62% so far today, investors are increasingly wondering whether the benchmark yield could re-test the 5.00% level reached last October. Given the strength in US economic growth and sticky consumer price inflation, that’s possible. However, we note that Fed policymakers are behaving as if 5.00% is an informal ceiling that, if touched, would spur efforts to try to talk down yields or take other actions to push them lower.

- In other words, if the 10-year Treasury yield hits 5.00%, bond yields may not go much higher in the near term.

- Indeed, that level could potentially be a buying opportunity since Fed policymakers may then push yields lower again.

US Labor Market: The United Auto Workers said late Friday that 73% of the workers at a VW auto factory in Tennessee have voted to join the union, marking the UAW’s first success in organizing a non-Detroit Three assembly plant and its first major success in the South. The victory illustrates how labor shortages have boosted popular support for unions to a six-decade high and given workers increased leverage versus employers.

Daily Comment (April 19, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are off to a great start following optimism that tensions in the Middle East might be easing. On the lighter side, NHL fans rejoice — the playoffs begin this Sunday! Today’s Comment examines the potential effects of rising interest rates on repo markets, explores signs of a slowdown in semiconductor demand, and discusses the growing anxiety among central banks outside the US regarding the resurgent strength of the dollar. As usual, our report concludes with a summary of domestic and international data releases.

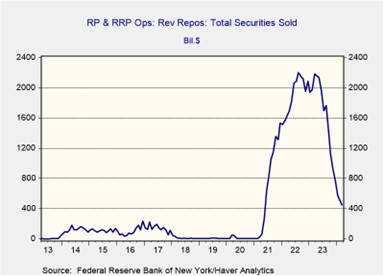

Another Repo-calypse? The recent rise in Treasury yields has led to concerns about a squeeze in the short-term lending market.

- Recent hawkish comments from Federal Reserve officials have driven yields upwards on the 10-year US Treasury bond. While New York Fed President John Williams signaled a cautious approach by suggesting rate cuts are improbable in the near term, he didn’t entirely rule out the possibility of future hikes. Atlanta Fed President Raphael Bostic later offered a contrasting view, indicating that a rate cut in the final quarter is still a possibility. These remarks have further bolstered the market’s perception that interest rates may stay elevated for a longer period than previously expected.

- The recent rise in interest rates has sparked concerns about a potential yield curve steepening, which could lead to funding stress. Higher interest rates incentivize investors to shift their funds towards higher-yielding, safer assets, such as the short-term Treasurys the government is issuing to meet its funding needs. This shift has consequently absorbed much of the excess liquidity, leading to a decline in the use of the reverse repo (RRP) facility, which has fallen to its lowest level since 2021, and is currently at $433 billion. Moreover, a sustained decline in RRP usage could lead to an excess reserve problem, potentially posing systemic risks in the financial system.

- The 2019 repo crisis serves as a stark reminder that disruptions in the short-term wholesale market can be a warning sign of an impending recession, even though they don’t directly cause one. Notably, each of the last four recessions was preceded by such disruptions. As the usage of the RRP continues to decline, we could see an increase in bond volatility. This, in turn, could raise the likelihood of a market correction. At this time there is no evidence of any sign of trouble, but investors could seek protection in commodities if conditions worsen unexpectedly.

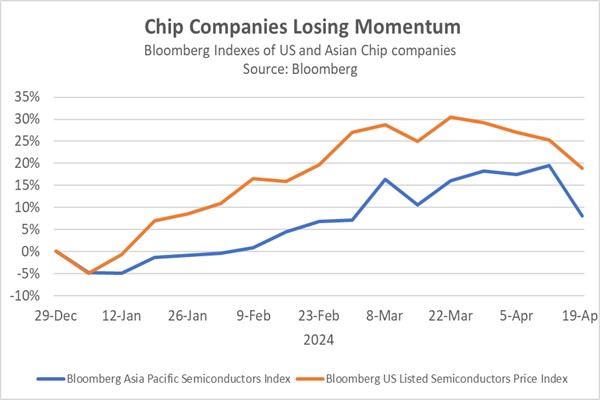

Chip Hype Fades: Semiconductor stocks are slumping amid growing concerns about future demand, particularly for consumer goods.

- On Thursday, Taiwan Semiconductor Manufacturing Company (TSMC) the world’s largest chipmaker, cut its 2024 chip market outlook due to a slowdown in the purchasing of smartphones and PCs. Excluding memory chips, they now expect the semiconductor market to grow around 10% this year. This revision highlights a widening gap between chipmakers supplying consumer electronics and those focused on AI-related services. The decline in Apple’s consumer products, exemplified by weak iPhone sales in China, contrasts sharply with Microsoft’s projected strong revenue growth in cloud computing, which fuels its AI efforts. This trend highlights the growing divide between hardware-focused companies and those leveraging cloud services for AI.

- The uncertain macroeconomic and geopolitical climate is likely to exacerbate the weakness in chip demand. While the US has shown some resilience this year, the global outlook remains precarious. The European Union and UK are struggling to stimulate economic growth, and China’s slowdown continues to be a drag on the world’s economy. This will likely disproportionately impact chip companies compared to other sectors due to their greater reliance on global markets. This lack of optimism is likely why Dutch chip equipment maker ASML posted lower-than-expected orders, as chipmakers are hesitant to ramp up production.

- TSMC’s earnings report underscores the waning enthusiasm for tech stocks in this volatile market. Rising interest rates, driven by the Fed’s tighter monetary policy, are prompting investors to seek alternative assets with higher yields than US Treasurys. This shift could trigger a sell-off in AI-related companies like Nvidia, particularly if earnings disappoint. Investors are increasingly questioning the sustainability of the AI boom. Even the “Magnificent Seven” tech giants, which started the year strong, may be forced to relinquish some of those gains in the coming weeks. Nevertheless, this doesn’t negate the potential value proposition of stocks beyond the traditional tech players.

The Super Greenback: Fueled by hawkish rhetoric from Federal Reserve officials and robust US economic growth, the dollar’s surge against its peers has sparked international concern.

- The Bloomberg Dollar Spot Index has climbed to its highest level since October 2023, putting pressure on economies reliant on dollar-denominated imports. South Korea and Japan recently met with the US to address the issue. Their worries stem from currency depreciation, with the yen (JPY) trading around 154 per dollar and the won (KRW) nearing 1400 per dollar earlier this week. Both countries fear a stronger dollar could exacerbate inflationary pressures. While no immediate policy coordination was agreed upon, the group has committed to “close consultation.”

- A strengthening dollar is prompting central banks to reassess their policies. The People’s Bank of China has threatened currency intervention to deter speculative bets against the yuan (CNY). The Bank of Japan is also considering intervention and a potential interest rate hike later this year to curb the yen’s depreciation. In Europe, the European Central Bank (ECB), which previously anticipated a rate cut in June, may be forced to reconsider its dovish stance. Similarly, Sweden’s Riksbank has hinted that its potential rate cut in May might be jeopardized.

- The strong dollar and tightening global monetary policy have become key drivers of international markets in 2024, creating headwinds for many countries. While the global economic climate remains improved compared to last year, the outlook has somewhat dimmed. Interest rates are likely to stay higher than initially anticipated, potentially weighing on international equities, especially if the Fed maintains its hawkish stance. However, central bank interventions could mitigate some of these challenges by injecting more liquidity into the market, potentially offering some resistance to the dollar’s appreciation and supporting foreign equities.

In Other News: Israel launched a limited counterstrike against Iran on Friday. Tehran downplayed the retaliation, calling it insufficient, but the measured response may help prevent further escalation. The US Congress is nearing a vote on approving aid for allies, including Ukraine and Israel. In a separate development, Apple removed WhatsApp and Threads from its App Store in China due to pressure from Beijing. These issues highlight the growing geopolitical tension in the world.

Daily Comment (April 18, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are surging as investors await another round of earnings reports today. Meanwhile, Real Madrid, after dethroning Champions League champion Manchester City, now gear up for their semi-final clash against Bayern Munich. Today’s Comment explores how the Federal Reserve’s shifting sentiment has impacted market expectations for interest rate cuts, why nuclear power is considered a potential solution to the energy constraints of artificial intelligence, and how the debate over military aid to various countries contributes to global uncertainty.

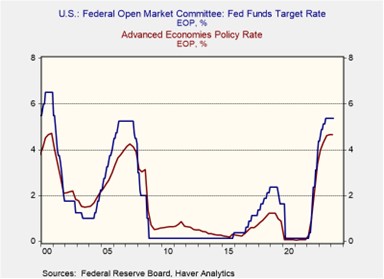

Powell Pivot: Markets have regained composure following Federal Reserve Chair Jerome Powell’s hawkish shift toward a restrictive-for-longer monetary stance.

- Investors drove the decline, seeking to capitalize on the highest Treasury yields of the year. The strong demand for the 20-year bond auction, which yielded 4.818% (2 basis points lower than the pre-auction yield), fueled optimism. However, despite exceeding expectations, the auction resulted in the second-highest Treasury yield since the 10-year tenor’s reintroduction in 2020. Additionally, the bond yields for the two-year Treasury fell below 5%, while the bond volatility declined after it hit its highest level since January in a sign that investors are still hopeful of rate cuts this year.

- Investor expectations for Federal Reserve interest rate cuts have undergone a dramatic shift in the last several months. Initially, markets anticipated up to seven cuts this year, fueled by the Fed’s confidence in controlling inflation and concerns about a slowing job market (evidenced by declining job openings and payroll figures). However, recent data has dashed hopes of an imminent slowdown. Inflation data reveals persistent price pressures, particularly in wage-sensitive sectors. As a result, policymakers have grown reluctant to cut rates anytime soon, as they fear such a move could undermine their credibility in fighting inflation.

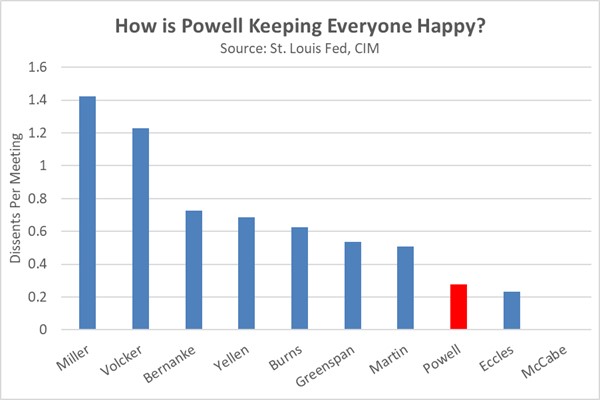

- Federal Reserve Chair Jerome Powell’s recent shift to a more hawkish stance is likely a reflection of his cautious decision-making approach. Powell prioritizes consensus among policymakers before taking action, which has resulted in one of the lowest dissent rates in Fed history during his tenure. Over the last few weeks, members have offered a range of opinions about the inflation trajectory. Some dismiss the recent data as a blip, while others voice concerns about a new trend of stickiness. However, employment has been an area of agreement. If jobs slow considerably in the coming months, policymakers may be open to a rate cut, but until then, expect “higher for longer” to be a major theme going forward.

AI Energy Problem: The future may belong to artificial intelligence (AI) but addressing its ever-increasing energy demands is a critical challenge.

- The AI boom is raising concerns for the overall economy. A representative from UK semiconductor company ARM predicts that AI could consume more electricity than India, the world’s most populous country, by 2030. This surge is driven by companies training increasingly complex AI systems with ever-larger datasets. The energy constraint has become a significant roadblock to AI development, potentially surpassing chip shortages as the top concern among tech companies. While these firms have made strides in efficiency with custom chips, these solutions may only offer up to 15% energy savings in data centers.

- Nuclear power is emerging as a promising solution. Energy Secretary Jennifer Granholm recently announced the Department of Energy’s support for using small-scale nuclear plants to power AI and data centers. This groundbreaking approach brought together tech giants to explore the deployment of compact, on-site nuclear reactors utilizing nuclear fission. This initiative seamlessly aligns with the Biden administration’s focus on modernizing infrastructure, prioritizing a shift towards cleaner energy sources. The forthcoming rejuvenation of the Holtec Palisades facility serves as a testament to this commitment and could herald the resurgence of similar plants nationwide.

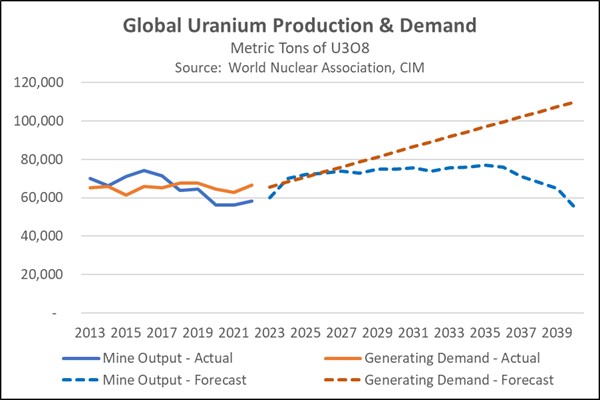

- Nuclear energy, currently supplying 20% of the nation’s power, is poised for a resurgence as the US divests from fossil fuels. Analysts predict a uranium supply crunch due to surging demand, especially with more countries adopting nuclear power. This scarcity is likely to make uranium a strategic investment, potentially granting uranium companies leverage in pricing. The recent 80% price increase over a year reflects this optimism in the nuclear sector, particularly for miners. This momentum is expected to continue as navigating the regulatory hurdles for uranium production is a slow process for many countries.

Military Aid Dispute: Despite edging closer to approving funding for military efforts abroad, persistent political wrangling among lawmakers raises concerns about future efforts.

- On Wednesday, House Speaker Mike Johnson (R-LA) informed fellow party members of his decision to schedule a crucial vote on foreign aid packages earmarked for Ukraine and Israel, set to take place this Saturday. The announcement comes amid simmering tensions within the leader’s own party. Some members are pushing for more funds to address domestic issues like border security, while others are wary of ballooning the deficit. This internal rift makes securing bipartisan support crucial, particularly as pockets of strong opposition have solidified within the party itself.

- While aid can provide much-needed support to these countries, it’s unlikely to be a cure-all for the long shadow cast by surging geopolitical tensions. The situation in Ukraine has taken a drastic turn for the worse in recent weeks. Anxieties mount as the country struggles to repel Russian advances due to a critical lack of anti-missile defenses, exemplified by Tuesday’s loss of a key power plant. Meanwhile, the specter of wider conflict looms as Israel weighs a response to Iran’s weekend attack, with Tehran threatening further escalation in the event of another military strike.

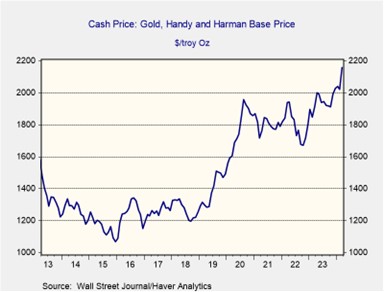

- Escalating geopolitical flashpoints exacerbate global uncertainty, sending investors scrambling for hedges against potential supply chain disruptions in a wider war. This uncertainty fuels a surge in gold prices, as the precious metal reclaims its safe-haven status. The preference for safe-havens is likely to persist, with long-term Treasury yields expected to remain volatile. The US’s growing debt burden adds to this volatility, as investors grapple with the government’s ability to manage it. Our analysis suggests that growing threats from the Russia-China-Iran alliance will necessitate increased US security spending, further limiting its ability to control spending in the coming years.

In Other News: A group of conservative economists is advocating for a 17% flat income tax and maintaining the cap on SALT deductions. This plan comes as the presumed Republican presidential nominee is likely to consider ways to reduce taxes. Weight loss drug Ozempic is unexpectedly linked to increased fertility rates in users. This raises concerns about potential unintended consequences of the medication. Japan and Korea are working with the US to weaken the rise of the dollar.

Keller Quarterly (April 2024)

Letter to Investors | PDF

“What could go wrong?” When that question is uttered with confidence, wise folks immediately brace themselves for calamity. It is an oddity of the stock market that the more quickly a stock ascends in price, the less often people seem to worry about what could go wrong. Rising stock prices have a way of anesthetizing investors against concern that “something could go wrong.”

There’s nothing wrong with the question, but it matters whether it’s voiced with hubris or humility. In our view, an investor needs to critically inquire as to what can go wrong before ever committing capital to an investment. This is where risk management starts. Most investors, however, tend to begin their work with the question, “How much money can I make?” But we have found that worrying about risk is even more important. That’s because while the price of every security has an expected return built into the price (an earnings yield and rate of growth for a stock and a yield to maturity for a bond), the actual return depends on the probability that return is actually realized.

That probability is the answer to the question, “What can go wrong?” Good investors obsess over that question, whether the subject is an individual stock or the construction of an entire portfolio. We know that if we correctly understand the risks, we will better understand the probability that our return expectations will be realized. We can’t predict the future (no one can), so it’s a matter of doing our best to put the probabilities in our favor. That’s where correct analysis of risk comes in.

Our analysts, strategists, and portfolio management teams spend more time on risk management than on any other pursuit. This activity doesn’t guarantee against downside risk, of course. This is a “batting average” business, and the goal is not to eliminate risk, which is impossible, but to not knowingly accept unreasonable risk relative to the returns we expect. I have always thought that if we manage the downside appropriately, the upside will take care of itself.

Last quarter I referred to a book that over 40 years ago profoundly affected how I thought about investing: Benjamin Graham’s The Intelligent Investor. In 2003, Jason Zweig issued an excellent revision and commentary on that classic which, if possible, made the original even better. In that edition is this insightful observation:

The longer a bull market lasts, the more severely investors will be afflicted with amnesia; after five years or so, many people no longer believe that bear markets are even possible. All those who forget are doomed to be reminded; and, in the stock market, recovered memories are always unpleasant.

Even though the stock market has seen some sharp selloffs in the last five years, it seems to me we are living in such a time as Mr. Zweig describes. While the Fed has the overnight rate at over 5% today, memories of extraordinary monetary support (0% interest rates for most of the last 16 years plus Quantitative Easing or bond-buying) have convinced investors that they won’t be abandoned by the authorities. Then add a new productivity enhancer like Artificial Intelligence (AI) and the market had all it needed to take valuations to new highs. But there’s no such thing as a risk-free market.

This is an environment where a long-term investor needs to consider the probabilities of what can go wrong. Is there a cost to weighing risk carefully? Of course, there is no free lunch. It means not chasing “hopes and dreams” stocks that others are, where the prospects of big gains are paired with big risks. The market today seems to be more excited about future gains than the possibility of loss. The wisest saying in the investment business is to “be cautious when others are bold and bold when others are cautious.” We are a bit cautious these days but are prepared to be bold when the opportunities present themselves.

We appreciate your confidence in us.

Gratefully,

Mark A. Keller, CFA

CEO and Chief Investment Officer

Daily Comment (April 17, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with the latest on the potential for a broader, more intense war in the Middle East. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including downgraded debt rating outlooks for Chinese banks and a statement by Federal Reserve Chair Powell that confirms the central bank is less likely to cut US interest rates in the near term.

Iran-Israel: As the Israeli government continues to consider how and when it will retaliate for Iran’s direct missile and drone attack over the weekend, the Iranian government and military are reportedly preparing for an assault. Iranian and Iran-backed Hezbollah militants in Syria are being dispersed, while the Iranian air force is preparing for an attack on Iran itself. The Iranian navy will also escort commercial ships in the Red Sea. The moves illustrate how the war between Israel and Hamas could still broaden and escalate into a disruptive regional conflict.

- US and European officials continue to put strong pressure on Israel not to retaliate or at least to avoid any major retaliation.

- In a sign that the US and European messages may be getting through, the Israeli government has reportedly assured Arab countries in the region that its response to Iran’s attack wouldn’t endanger their security and would likely be limited in scope.

- Nevertheless, investor concern about a broader war has driven the VIX stock volatility index to its highest level since last October.

Chinese Stock Market Regulation: The China Securities and Regulatory Commission has clarified that its recent rule updates designed to make stocks more inviting for investors won’t be applied to smaller companies. The clarification comes after investors raised concerns that the new rules would discourage small companies from listing and force others to abandon their current listing. The CSRC’s move is another example of Chinese regulators clamping down on a sector, only to backtrack after going too far or scaring off investors.

- According to the CSRC, its new policy to flag companies for unsatisfactory dividends will mostly target healthy, profitable firms that pay no dividends at all or relatively small dividends over several years.

- The agency also emphasized that the “special treatment” tag applied to such firms would not necessarily be grounds for delisting.

Chinese Banking Industry: Just days after cutting the outlook for China’s sovereign debt rating, Fitch has cut the outlook for China’s major state-owned banks from stable to negative, citing China’s slowing economic growth and the government’s more limited ability to support the institutions as fiscal challenges increase.

United States-China: President Biden today will propose more than tripling a key tariff on imports of Chinese steel and aluminum. The move will lift the tariff to 25% from its current level of 7.5%. Moreover, the higher rate would be in addition to the Trump administration’s tariffs of 25% on Chinese steel and 10% on Chinese aluminum, which Biden has kept in place. The resulting total tariffs of 50% on steel and 35% on aluminum are sure to further worsen US-China trade tensions and will probably invite some kind of trade retaliation from Beijing.

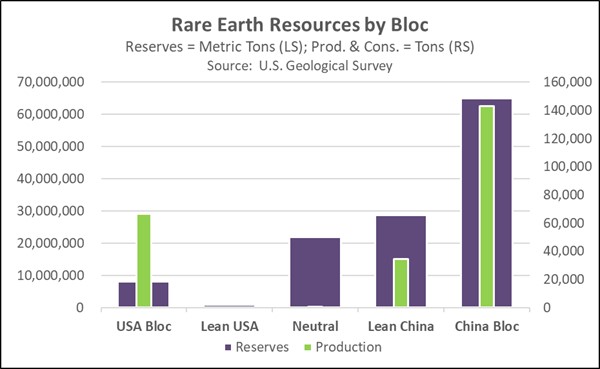

United States-Australia: Just weeks after rare-earth mining firms Lynas of Australia and MP Minerals of the US came to an impasse in their merger bid, Australian mining billionaire Gina Rinehart has amassed at least 5% of the shares in each company, raising expectations that she will serve as kingmaker to facilitate the link-up.

- China and its geopolitical bloc currently account for the vast majority of proven reserves, production, and refining capacity for rare earths, which are critical to the more electrified economy of the future.

- The Lynas-MP Minerals merger is seen as one potential way to help boost Western production of rare earths and establish a more secure supply chain for the minerals.

US Monetary Policy: At an event yesterday, Fed Chair Powell gave the strongest hint yet that the central bank expects to hold interest rates “higher for longer” because of continued high consumer price inflation. According to Powell, “Given the strength of the labor market . . . and progress on inflation so far, it’s appropriate to allow restrictive policy further time to work and let the data and the evolving outlook guide us.” The statement is consistent with our view that investors have been too aggressive in expecting near-term rate cuts.

US Labor Market: The United Auto Workers today will begin a unionization vote at a Volkswagen car plant in Tennessee, marking a key step in the union’s effort to organize workers at foreign-owned factories outside the more union-friendly areas in Michigan. Results of the vote are expected by the end of the week. With the vote, the UAW is trying to capitalize on the increased leverage workers have during today’s labor shortages and the union’s recent success in boosting pay at “Detroit Three” automakers.

US Military: Six months into the federal fiscal year, the Army and Air Force have reported improved recruiting results compared with the previous year. The improvement reflects a number of new programs and policy changes, such as remedial training for low-scoring applicants and relaxed standards for drug use and tattoos. However, the Navy continues to lag its recruiting goals, leaving it undermanned in both at-sea positions and on-land billets.

- After years of falling short of recruiting goals, Army Secretary Christine Wormuth says her service is now about 5,000 contracts ahead of where it was at the same point last year. She also said the Army is on track to meet its goal of 55,000 new recruits for the whole fiscal year, in large part because of a new, 90-day soldier prep course that helps low-scoring applicants meet the Army’s academic and fitness standards.

- In the Air Force, recruiting has been strong enough for the service to hike its goal for the year to 27,100, compared with its original goal of 25,900. According to service officials, the improvement mostly reflects easier tattoo rules, bonus increases, and expanded efforts to recruit lawful permanent residents.

Daily Comment (April 16, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an examination of China’s latest economic growth, which will have a big impact on global markets. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including new signs that the Russian military is regaining momentum in its invasion of Ukraine and a major new antitrust suit being prepared in the US.

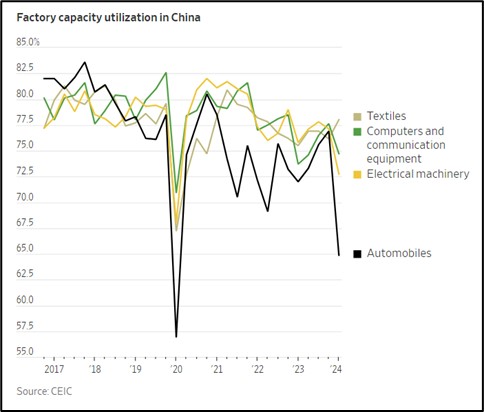

China: After stripping out price changes, first-quarter gross domestic product was up 5.3% from the same period one year earlier, beating expectations and accelerating slightly from the 5.2% rise in the year ended in the fourth quarter of 2023. However, the country’s growth is looking increasingly lopsided. In the year to the first quarter, most of the economic expansion came from corporate investment, industrial production, and exports, while consumer spending and housing investment remained tepid.

- The data is consistent with official plans to encourage massive new investment in higher-technology production, such as electric vehicles, batteries, and solar panels to make up for the weakness in consumption and the steep correction in residential building. The problem is that domestic demand isn’t strong enough to absorb all that new production, so Chinese firms are increasingly dumping excess output at fire-sale prices on the world market, further stoking trade frictions.

- So long as the government refuses to stimulate consumption spending or allow another spurt of housing investment, and so long as Western countries keep clamping down on Chinese dumping, the strategy will likely lead to further excess capacity in the economy. Indeed, other data today showed Chinese industrial capacity utilization falling in March to just 73.6%. Excluding the pandemic period, that was the lowest since 2016.

Japan: The yen depreciated further yesterday, closing at 154.37 per dollar, its lowest level since 1990. Given the Japanese government’s recent warnings that it will intervene in the currency markets if the currency weakens much further, the likelihood of intervention has probably risen sharply.

- More broadly, last week’s unsettling report on US price inflation and yesterday’s report of strong US retail sales have pushed foreign stock markets sharply lower today.

- Since the data adds to concerns that the Federal Reserve may be even more reluctant to cut US interest rates, the dollar has surged against a number of currencies and forced foreign investors to consider a prolonged period in which capital will be drawn to the US and out of Europe and Asia.

Iran-Israel: The Israeli war cabinet today continues deliberating whether or how to respond to Iran’s big missile and drone attack against Israel over the weekend. As discussed in our Comment yesterday, domestic political dynamics are likely to push the Israeli government to launch some kind of response. The key question is how big and destructive such a response could be. A bigger response would raise the risk of a significant expansion of the current war between Israel and Hamas and threaten Middle Eastern energy supplies.

Russia-Ukraine: As warmer weather returns and dries out the ground, making it easier for Russia’s armored vehicles to maneuver, the Ukrainian military says Russian forces are now attacking more intensively along the front lines. Kyiv has rushed forces to try to plug the gaps in the line, but residents of front-line cities and towns are fleeing, and it is looking increasingly like the Russians could gain new offensive momentum and re-seize significant territory across Ukraine.

- To the extent that the Russians retake territory in Ukraine, it will have negative security implications for Western Europe. In such a scenario, the Europeans would likely have even more incentive to try to coalesce politically and boost their defense spending.

- If the Russians conquer huge new swaths of Ukrainian territory, it could also have an important political implication in the US, as the Democrats would likely pin the blame on those Republicans who have blocked further US military aid to Kyiv in recent months.

US Antitrust Regulation: The Justice Department is reportedly preparing to file an antitrust suit against concert promoter and ticket vendor Live Nation, alleging it has leveraged its dominance in a way that undermines competition for ticketing live events. The company has long been criticized for exorbitant ticket fees and poor customer service. In any case, the potential suit is another example of the Biden administration’s effort to toughen antitrust enforcement, which creates increased regulatory risk for investors.

US Energy Industry: In a little reported development last week, the Biden administration has announced an increase in the royalties paid and bonds posted to drill for oil on federal land. Royalties paid to the government will rise from 12.50% to 16.67%, marking their first increase since 1920. Bonds posted will rise from $10,000 to $150,000, for their first increase since 1960.

- The industry naturally has complained that the moves will weigh on domestic energy exploration and production. However, it’s important to remember that only about 10% of US oil output comes from federal land.

- In all likelihood, Biden’s move aims to placate supporters on the left wing of the Democratic Party, many of whom have been disappointed by his energy policies.

US Electric Vehicle Industry: Premium EV maker Tesla yesterday said it is laying off more than 10% of its workforce to deal with the worldwide slowdown in demand for fully electric cars. In response, Tesla’s stock price fell some 5.6%, bringing its year-to-date loss to more than 33.0%. Tesla’s layoffs and stock decline illustrate the sharp reversal in fortune for EV makers since last year — a trend that could get even worse as Chinese producers look to dump their excess production on world markets at fire sale prices.

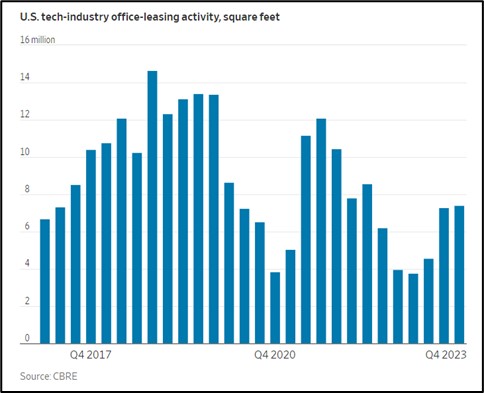

US Commercial Real Estate Industry: New data shows that technology firms have sharply curtailed their purchases and leases of office space in coastal markets, despite strong demand for the companies’ products. The drop-off in technology office demand marks yet another blow to the commercial real estate industry. The trend has reportedly boosted sublease listing, driven down lease rates and building values, and hurt office owners.