Author: Amanda Ahne

Daily Comment (February 12, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are reacting to the latest inflation figures this morning. On the sports front, Real Madrid narrowly defeated Manchester City in the first leg of their highly anticipated playoff series. Today’s Comment will cover the increasing influence of AI, Fed Chairman Powell’s testimony before Congress, and other key market developments. We’ll also provide our regular roundup of the latest international and domestic economic data releases.

US AI vs Everyone Else: Vice President JD Vance declined to sign a declaration aimed at ensuring AI remains “safe, secure, and trustworthy.” Instead, he asserted that the United States is committed to leading AI development and governance, and aims to set global standards and rules. While acknowledging the importance of international collaboration, Vance emphasized the US’s ambition to become the global hub for AI manufacturing and innovation.

- Vance’s emphasis on the US taking the lead in shaping AI rules seems to be a deliberate response to the EU’s Digital Markets Act and Digital Services Act, which aim to create a more balanced competitive landscape between EU and US tech companies. The administration has made it clear that it will aggressively oppose any measures perceived as discriminatory against US firms operating abroad.

- Furthermore, his remarks suggest that the EU should take a subordinate role to the US in the global technology landscape — a stance that risks deepening tensions and complicating transatlantic cooperation. This approach appears to directly conflict with the EU’s ambitions to cultivate and strengthen its own domestic tech industry.

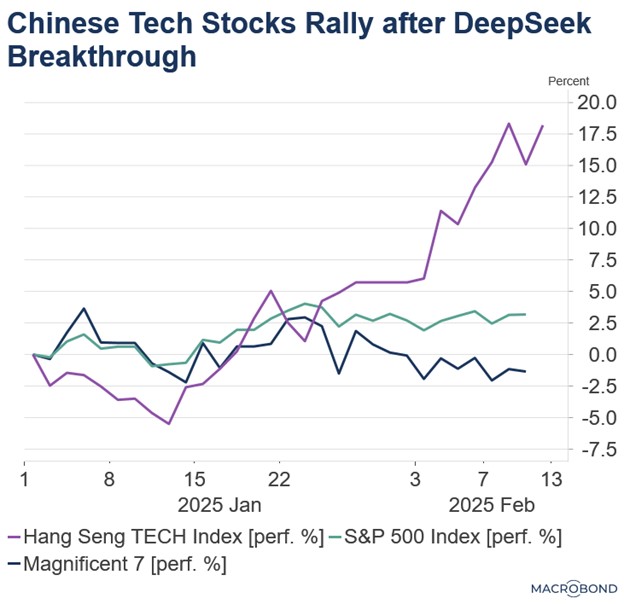

- Vance’s message comes at a pivotal moment as China continues to demonstrate its rising competitiveness in the AI sector. The recent breakthrough by DeepSeek, reportedly achieved with just $6 million and less sophisticated chips, has sent shockwaves through financial markets. This has prompted investors to increasingly turn their attention to Chinese tech companies, while casting doubt on the ability of their US counterparts to meet lofty valuations.

- Since the release of DeepSeek, Chinese stocks have surged, as investors view the breakthrough as a catalyst for revitalizing the sector and injecting new energy into the country’s equity markets. While the Magnificent 7 stocks are trading below their year-start levels, the Hang Seng TECH Index, which tracks leading Chinese tech companies, has climbed nearly 20% year-to-date, underscoring the shifting momentum in global markets.

- The recent rally in Chinese tech stocks faces significant headwinds. China’s economic challenges, often summarized as the five Ds — weak consumer demand, excess capacity and high debt, unfavorable demographics, economic disincentives stemming from Communist Party market interventions, and Western decoupling — pose substantial risks.

- Moreover, the US’s ability to sustain its relationship with Western allies will likely play a pivotal role in preserving its dominance in the tech sector as it looks to counter China. However, it is increasingly evident that the EU and the US could emerge as competitors in this space in the near future, potentially reshaping the dynamics of global technological leadership.

Powell Goes to Washington: Fed Chair Jerome Powell held the first of his two meetings with Congress on Wednesday. Markets showed little reaction to his testimony, as he provided no new insights into the future path of monetary policy. However, the hearing underscored the growing tension between the two parties as they continued to clash over the Department of Government Efficiency (DOGE) and how to address the budget.

- On monetary policy, Fed Chair Powell largely echoed the sentiment of his fellow colleagues stating the Fed is in no rush to cut interest rates but warned that the neutral rate was likely meaningfully higher than it was prior to the pandemic. When pushed to give his thoughts on the inflationary impact of tariffs, he resisted, and only stated that a rise in inflation was a possible outcome of new trade restrictions.

- Fiscal policy was also a key topic of discussion. Fed Chair Powell urged lawmakers to rein in spending, emphasizing that current levels are on an unsustainable trajectory. Additionally, he addressed Elon Musk’s recent cost-cutting efforts at DOGE, noting that the Treasury system remains secure from any breaches and clarifying that the group has no access to its systems. Furthermore, Powell suggested that the Fed may not require staff reductions but rather hires to effectively fulfill its responsibilities.

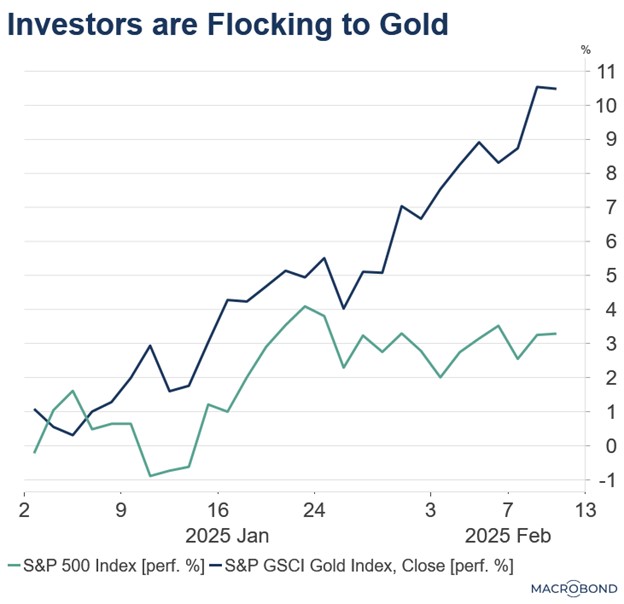

- Investors have driven up 10-year yields in recent weeks as they react to the ongoing debate over fiscal and monetary policy. The market is increasingly pricing in the risks of higher debt and inflation, which could limit the Federal Reserve’s policy options down the road. A continued rise in the yield is likely to raise borrowing costs for households and firms as well as be a source of headwinds for equities.

- Precious metals may offer a hedge against current economic uncertainty. Gold has seen a strong start to the year, rising 11.0% year-to-date and outpacing the S&P 500’s 3.0% gain over the same period. This preference for gold comes as investors and institutions become skeptical of the dollar’s use as a reserve asset. This trend could be further fueled by escalating trade tensions, which could weaken the dollar’s position as a reserve currency.

UK Growth Concerns: British Chancellor Rachel Reeves is facing mounting pressure after a watchdog downgraded its UK GDP growth forecast. Reeves had previously cited strong economic growth as a key rationale for avoiding harsh budget cuts, but the revised outlook has cast doubt on that justification.

- Reeves is scheduled to deliver her update on the budget on March 26. If growth does not meet the fiscal rules, she will be forced to make spending cuts to public services or welfare in order to balance the books.

- Thursday’s monthly UK GDP report is expected to offer valuable insights into the trajectory of the economy. If the data reveals strong growth in December, we anticipate a rally in UK bonds and equities, reflecting renewed investor confidence.

Ukraine War Update: While details of the negotiations between the US, Russia, and Ukraine to end the war remain undisclosed, it is evident that discussions are ongoing. In a recent development, a wrongfully detained teacher has been released from Russia, marking a potentially significant step amid the broader diplomatic efforts.

- Russia has intensified its attacks on Kyiv even as negotiations continue, signaling a dual strategy of military pressure and diplomacy. However, signs of economic fragility are emerging, particularly as borrowing costs rise and financial strain deepens. Meanwhile, Ukraine remains steadfast in the holding of its occupied territories, aiming to leverage them for potential negotiation swaps in the ongoing conflict.

- The likelihood of a ceasefire in the conflict has grown, but its impact on markets will largely hinge on whether Russia receives sanctions relief. This remains an open question, particularly given the Trump administration’s focus on bolstering US energy companies, which could complicate any decision to ease economic pressure on Moscow.

Daily Comment (February 11, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with the latest vague promise by the Chinese government to boost consumer spending and spur economic growth. We next review several other international and US developments with the potential to affect the financial markets today, including a planned move by the European Union to make its fiscal policy more flexible and supportive of growth and the latest US import tariffs announced by the White House.

China: At a meeting yesterday, the State Council again said it would prioritize raising consumers’ income and consumption spending to spur economic growth. However, as in the past, the officials gave no details, which suggests the government remains ideologically opposed to a major new stimulus program. Some new spending programs are likely to be unveiled at the March legislative meetings, but we don’t expect them to be aggressive enough to overcome China’s increasingly difficult structural barriers to growth.

European Union: The European Commission is reportedly planning a major revamp of its next multi-year common budget, which begins in 2028. The plan would consolidate the dozens of different spending programs in the current budget to just three funds. The first would operate similar to a block grant, giving recipient countries wide flexibility in how to use the funds. The second would provide money for competitiveness and investment, while the third would provide funding for administration, foreign policy, and defense.

- The proposed structure is apparently how the Commission plans to get around the member countries’ disagreements over new challenges, such as common debt financing and increased defense spending.

- However, the plan is not yet set in stone, and it is still not certain if it will ultimately be approved.

France: Illustrating how trade tensions can crimp exports, industry association data shows that French wine and spirit shipments abroad fell approximately 4% in 2024 to 15.56 billion EUR ($16.04 billion). Exports to the US grew, especially for wine, but the overall total was held down by weak shipments to other countries. Importantly, shipments to China were down because of an antidumping probe that Beijing launched to retaliate for the EU’s dumping probe into Chinese electric vehicles.

US Monetary Policy: Federal Reserve Chair Powell starts his semi-annual testimony to Congress today with an appearance before the Senate Committee on Banking, Housing, and Urban Affairs at 10:00 AM ET. Naturally, investors will be looking for any clues on the future path of interest rates and how many rate cuts there might be in 2025. We will also be looking for how the Fed is thinking about the new administration’s tariffs and other economic policies. Powell will also appear at the House Committee on Financial Services tomorrow.

US Fiscal Policy: The federal judge who issued the January 31 restraining order against the Trump administration’s effort to freeze federal spending on diversity and other programs yesterday issued a new order demanding that the administration implement the first order. The new order responds to a suit by 22 states and the District of Columbia alleging that the administration has not yet unfrozen the affected funds.

- Another report by the Washington Post yesterday said some farmers are not receiving funds promised under the Biden administration’s Inflation Reduction Act, despite Trump’s assurances that his spending freezes would not affect individuals.

- The developments provide further evidence that the Trump administration intends to be aggressive about withholding even outlays approved by Congress. That increases the risk of an eventual constitutional crisis over presidential and Congressional powers.

- In addition, if the administration impounds large amounts of the federal budget, the sudden fiscal contraction could spark an economic slowdown or even recession. If government contractors, employees, or other firms or individuals sense that federal payments can no longer be taken for granted, they are likely to slow their spending. In turn, that could weigh on economic activity, boost bond values, and hurt stocks.

US Trade Policy: As expected, President Trump last night ordered tariffs on all US imports of steel and aluminum, including finished metal products, to be effective in early March. The new duties will be on top of the 25% levies on Canada and Mexico that are currently paused, the new 10% tariffs on goods from China, and the president’s upcoming reciprocal duties on other nations. As we noted in our Comment yesterday, the blanket nature of the steel and aluminum tariffs suggests the administration may not be inclined to offer exemptions to them.

- In response, the European Union today said it would respond to the new US tariffs with “firm and proportionate countermeasures.”

- EU member states have already approved retaliatory tariffs of up to 50% on 4.8 billion EUR ($4.96 billion) of US imports and could quickly take a final vote to impose them. The products affected could include bourbon whiskey, Harley-Davidson motorcycles, motorboats, and some US-produced steel and aluminum.

US Labor Market: In its March cover story, The Atlantic magazine highlights how high housing prices, mortgage rates, and other factors have sharply reduced many US residents’ ability to move to other locations to take advantage of better job opportunities. The article calls the fall in labor mobility the US’s “single most important social change of the past half century.” It also claims that only the affluent and well-educated seem exempt from the phenomenon.

- If affluence and a good education really have become the requirement for labor mobility, the phenomenon would probably help explain the rise of populism in the US over the last couple of decades.

- If the situation is not improved, it would also suggest that many stagnating states and communities could continue to struggle, holding back economic growth and fueling even more resentment toward elites, politicians, and government in general.

Bi-Weekly Geopolitical Report – Middle Eastern Stock Markets: An Overview (February 10, 2025)

by Daniel Ortwerth, CFA | PDF

All the attention paid to the strong performance of United States stock markets in recent years can easily distract us from what might be happening in other markets around the world. A quick review of global stock markets reveals that one region, the Middle East, has seen its market capitalization grow more rapidly over the last 10 years than any other region, including the US. This prompts an investigation into the reasons. Should investors give more consideration to the Middle East, or might there be other factors at play that explain the growth without necessarily translating into investable opportunities?

This report begins with a review of the global stock market, categorized by region and country. We next take a closer look at the fastest growing Middle Eastern markets, and we finish with considerations about the potential future for Middle Eastern stocks. As always, we conclude the report with investment implications.

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Bi-Weekly Geopolitical Podcast – #60 “Middle Eastern Stock Markets: An Overview” (Posted 2/10/25)

Daily Comment (February 10, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with news that the Russian intelligence services are trying to take advantage of the job buyouts currently being offered to employees of the US intelligence community. The situation highlights the risk that the personnel turnover could affect the US’s ability to counter rival countries such as China and Russia. We next review several other international and US developments with the potential to affect the financial markets today, including Chinese preparations to target US tech firms to retaliate for the Trump administration’s tariffs and the administration’s preparations for a range of new tariffs this week.

Russia-United States: Just days after the Trump administration extended its job buyout offer to workers at the Central Intelligence Agency and other US intelligence organizations, Russia’s Foreign Intelligence Service, the main successor to the KGB, released a video parodying the chaos in the US government and inviting US intelligence professionals to sell their secrets to Russia. The offer highlights the potential threat to US national security from the administration’s aggressive effort to push workers out of the government.

- On a related note, the new leaders at the CIA last week used an unclassified email to respond to a White House request for the names of all employees hired over the last two years. The request from the White House appears to be a part of the administration’s effort to shrink the federal workforce and root out any employees at odds with its goals.

- Virtually all unclassified communications with the White House are monitored by the Chinese, Russians, and other US adversaries. For the newly hired employees, the CIA only sent first names and first initial of their last names, but the Chinese and Russians will be able to triangulate that information with other data in their possession and identify the vast majority of the new workers.

- Since the CIA in recent years has rapidly ramped up its intelligence effort against China, many of the compromised workers were probably China-focused. They will now almost certainly be targeted by the Chinese intelligence services. Some will be targeted merely for surveillance; others will be pressured to become double agents. The incident will almost certainly undermine US national security versus China in the coming years.

- Of course, China and Russia also continue to aggressively court US officials outside the intelligence community. For example, a former senior advisor to the Federal Reserve was recently arrested for selling confidential US financial information to Chinese intelligence. China could have used the information to manipulate US markets.

Germany: Friedrich Merz, the center-right CDU party’s nominee for chancellor in this month’s election and the current leader in polls, said last night that he is open to easing Germany’s strict “debt brake” limits on fiscal deficits to help pay for a higher defense budget. However, he insisted that easing the debt brake would only come after all possible cuts in the government’s nonmilitary spending and strong efforts to boost the country’s economic growth. The prospect of eased fiscal rules would likely be positive for the German economy and stocks.

France: Ahead of his “AI Action Summit” in Paris this week, President Macron has announced 109 billion EUR ($112 billion) in new artificial-intelligence investments in the coming years, most of which will be carried out by private companies. The total apparently includes the 50-billion EUR ($51.5 billion) investment in new data centers that the United Arab Emirates announced last week. The French total is smaller than the Trump administration’s $500-billion “Stargate” AI plan, but it is big enough to show that Europe may finally be ramping up its effort as it tries to catch up with the US and China.

China: In another sign of how rapidly China is building on its success with artificial intelligence, Chinese firms such as Lenovo are already deploying the low-cost DeepSeek AI model into products such as personal computers, robots, and electric vehicles. The development will likely feed into concerns that AI companies in the US are now lagging, which, if true, could weigh on their stock valuations.

China-United States: According to the Wall Street Journal today, Chinese officials are compiling a list of US technology firms that they could target with antitrust probes and other measures to retaliate for the Trump administration’s tariffs and other policies opposed by Beijing. Besides Nvidia and Google, which are already being investigated, the report says the Chinese are preparing to target Apple, Broadcom, Synopsys, and others.

- China’s strategy apparently aims to leverage President Trump’s political reliance on Silicon Valley technology executives, who have become perhaps the most important members of Trump’s governing coalition.

- If Beijing does clamp down on more US tech firms, a key question is whether the tech leaders around Trump could convince him to reverse his tariffs and soften his approach to protect their interests.

- The extent to which Trump’s “tech bros” can influence him will likely help determine how exposed US tech firms — and their stocks — are to Chinese pressure.

United States-China: President Trump on Friday signed an order delaying the application of US tariffs on Chinese imports considered “de minimis,” i.e., valued under $800. The delay will be welcomed by China, but it does not constitute a softening of the Trump administration’s general trade policies toward the country. Rather, the delay is strictly to allow the Commerce Department time to develop the procedures and systems needed to apply tariffs to such small shipments.

United States-Japan: Fresh off his summit with President Trump in Washington, Japanese Prime Minister Ishiba yesterday said Trump didn’t press him to either raise Japan’s defense spending or cut its auto exports to the US.

- Under previous US pressure, the Japanese government already plans to double its military budget to 2% of gross domestic product.

- By declaring his satisfaction with that effort instead of demanding Tokyo reach the defense burden of 5% that he wants for the US’s allies in Europe, and by avoiding any sharp demands on trade, Trump may be signaling that he will prioritize the US-Japan relationship.

- If so, it would mean that Japan’s political and economic landscape will be spared the disruptions Trump is imposing on other key countries. A relatively hands-off policy by Trump would likely be positive for Japan’s economy and stock market.

US Trade Policy: President Trump over the weekend said he would announce tariffs on additional countries on Tuesday or Wednesday of this week. According to Trump, the “reciprocal” tariffs in this batch will aim to match the tariffs that the targeted countries have imposed on US products. Possible targets for the new tariffs include the European Union, India, Vietnam, and Brazil.

- Trump also announced that he will impose 25% tariffs on steel and aluminum imports.

- The announcements suggest that the administration may keep rolling out new tariff plans for some time. If so, the continued uncertainty could start to weigh more heavily on global stock markets.

US Fiscal Policy: In an interview aired during the Super Bowl’s pregame show yesterday, President Trump said he would soon ask Elon Musk and his Department of Government Efficiency to investigate wasteful and fraudulent spending at the Department of Education and then at the Department of Defense. The statement suggests that those two departments will be the next to face dramatic cutbacks potentially affecting thousands of workers and contractors.

- According to Trump, the Musk effort will find and end “hundreds of billions” of dollars of waste and fraud at the Defense Department. Of course, Musk has already frozen a lot of other government outlays, but because the defense budget is so big and affects the country so broadly, sizable spending cuts there could disrupt and slow economic activity in a much more noticeable way, not to mention that it could also reduce the military’s ability to respond to a national security threat.

- More broadly, government spending is an important source of demand for the economy, so if Musk is able to cut outlays enough, the sudden fiscal contraction could potentially produce a recession and weigh on the financial markets, at least temporarily.

Daily Comment (February 7, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently digesting the latest employment data, while in sports news, the NBA trade deadline officially passed. Today’s commentary will cover the latest developments in Trump’s tax plan, explore why investors are growing increasingly concerned about the spending levels of tech companies, and provide updates on other market-related news. As always, the report will also include a summary of key international and domestic data releases.

Tax Policy: The Trump administration has provided some insights into its strategy for fulfilling the president’s campaign tax promises. However, it remains uncertain whether the Republican Party will rally behind a legislative measure before the impending expiration of the tax cuts at the end of the year.

- The president has indicated his intention to eliminate tax breaks for carried interest, a loophole highly favored by private equity fund managers. He also proposed removing special tax breaks for billionaire sports team owners, which currently allow them to deduct expenses related to team purchases over a 15-year period.

- The elimination of these tax breaks is aimed at funding the president’s proposed expansion of state and local tax deductions, as well as introducing new tax incentives for products manufactured in America. Additionally, there is speculation that Republicans may consider ending the tax exemption for state and local government debt.

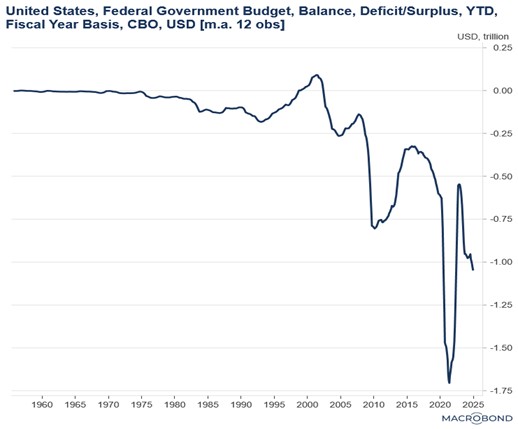

- These cuts could lead to major savings but not enough to offset increases in spending. Repealing the carried interest tax provision, estimated to cost $12 billion over 10 years, would primarily impact private equity funds. Meanwhile, state and local tax exemptions represented $27 billion in forgone tax revenue in 2022. The potential tax savings from targeting sports team ownership is less certain, as closing this loophole could decrease the frequency of team sales.

- While the savings help offset the cost of the president’s new tax plan, which includes eliminating taxes on tips, overtime pay, and Social Security, as well as lowering the corporate tax rate, additional funding will still be needed to prevent the plan from increasing the deficit. The latest estimate shows that his plan would add over $4 trillion to the deficit within the decade.

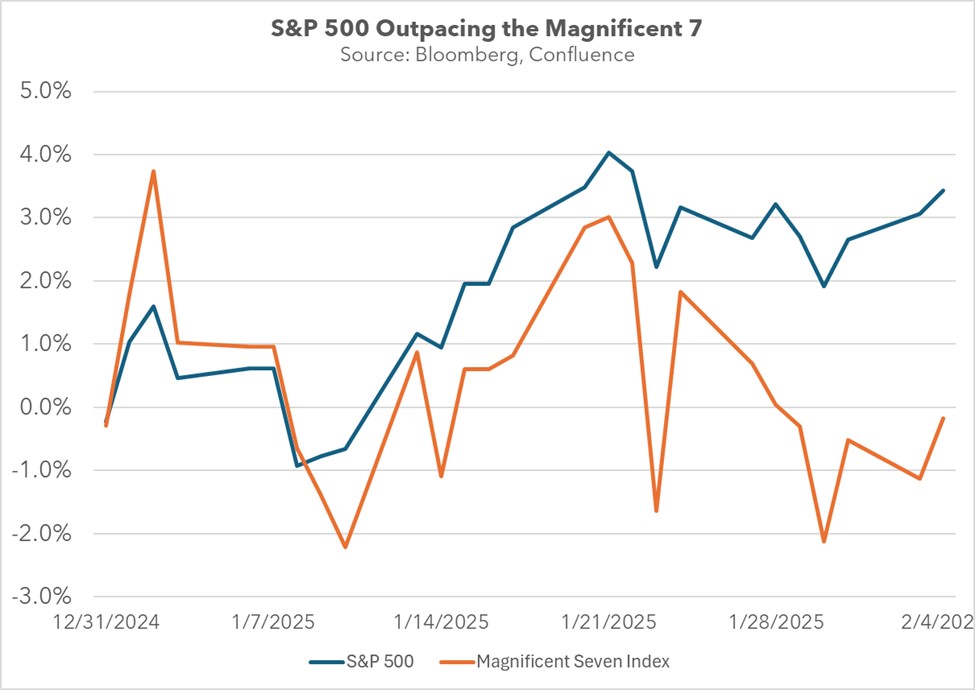

Big Tech Ramps Up Spending: Nearly two weeks after the release of DeepSeek’s latest update sent shockwaves through financial markets, Silicon Valley tech companies are facing mounting pressure to enhance profitability and validate their sky-high valuations. This week, three companies have come under intense scrutiny as investors closely watch whether they can meet heightened expectations.

- Amazon reported better-than-expected fourth quarter earnings and sales on Thursday but offered a weak outlook for the coming period. This pessimism stemmed largely from unfavorable exchange rate fluctuations, as a stronger dollar typically weighs on foreign revenues. Despite the cautious outlook, Amazon plans to increase capital expenditures to $100 billion in 2025, up from $83 billion the previous year.

- Two other companies that reported earnings this week also announced plans to ramp up AI spending. Alphabet, Google’s parent company, revealed that it intends to increase its capital expenditures from $57.5 billion to $75 billion. Similarly, Microsoft indicated it could spend up to $80 billion on AI data centers in the coming period.

- The focus on spending has intensified amid growing concerns that tech companies are diverting capital toward expanding AI capabilities at the expense of rewarding shareholders. These concerns were further amplified by the release of the Chinese-made DeepSeek, which was reportedly developed at a fraction of the cost and at a significantly faster pace compared to US tech companies, while still delivering comparable results.

- Growing skepticism about the already elevated valuations of mega cap tech stocks has begun to weigh on their performance this year, with the so-called Magnificent 7 underperforming the S&P 500 year-to-date. As a result, we anticipate that earnings and profitability will likely play an increasingly critical role in determining the trajectory of tech stocks for the remainder of the year.

The Indo-Pacific Seeks Assurances: The Trump administration is scheduled to meet with Asian leaders in the coming days to discuss ongoing security and economic relationships. In his first few days in office, President Trump has adopted a more assertive stance in advancing his trade agenda, signaling a shift toward a relatively expansionist foreign policy.

- President Trump is set to meet with Japanese Prime Minister Shigeru Ishiba on Friday. During the discussions, Japan is expected to commit to purchasing more American weapons and energy, investing in artificial intelligence, and sharing a greater portion of the defense burden. Japan’s ability (as an export-oriented economy) to avoid a trade war with the US will likely provide support to its equity markets.

- On the same day, US Secretary of Defense Pete Hegseth is scheduled to meet with his Australian counterpart, Richard Marles. Ahead of the meeting, Australia made its first $500 million payment to the US as part of the AUKUS nuclear submarine deal. This payment is expected to foster goodwill, as the two leaders are likely to focus on strengthening the ongoing relationship between their nations, which are already aligned through both the QUAD and AUKUS alliances.

US Policy Close to Neutral? As the Federal Reserve prepares to review its first inflation data of the year, concerns are emerging that views within the Federal Open Market Committee (FOMC) are beginning to diverge. While some members believe the central bank could cut rates this year, others remain more skeptical.

- Dallas Fed President Lorie Logan suggested that the Federal Reserve may be nearing a neutral interest rate, the point at which monetary policy is neither stimulative nor restrictive. Her comments follow similar observations from several other policymakers.

- As we have mentioned in previous reports, inflation in the first few reports of the year will likely play a major role as to whether the Fed is actually making progress toward its 2% inflation target.

Daily Comment (February 6, 2025)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Markets are closely watching the latest developments from the Trump administration. In sports news, the Golden State Warriors made headlines by acquiring Miami Heat guard Jimmy Butler in a major trade. Today’s commentary will focus on the Trump administration’s shift toward targeting longer-term interest rates, Canada’s planned response to new US tariffs, and other market-moving headlines. As always, we’ll also provide a roundup of key domestic and international data releases.

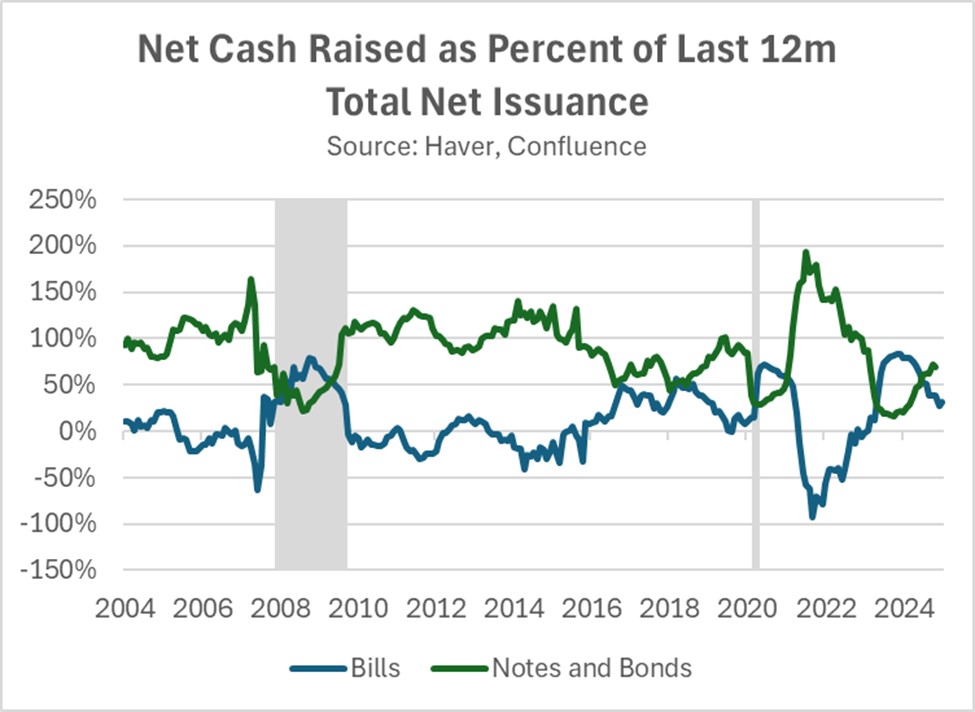

Ten-Year Yield Rates Take Center Stage: US Treasury Secretary Scott Bessent reaffirmed his support for the Federal Reserve’s independence on Wednesday, stating that the current administration has no intention of interfering with Fed policy. Instead, the Treasury plans to leverage its issuance strategy to target long-term interest rates, which play a more direct role in shaping borrowing costs for American households.

- His announcement comes amid growing concerns from several Federal Reserve officials about the potential inflationary impact of tariffs. Chicago Fed President Austan Goolsbee recently added his voice to the debate, cautioning that the risks to supply chains from trade policy should not be overlooked. His hesitation is particularly noteworthy given his past support for the Fed’s easing measures, signaling a shift in perspective as policymakers weigh the broader economic implications of trade restrictions.

- Prior to Secretary Bessent’s remarks, the Treasury Department unveiled its quarterly refunding plans, revealing that it would maintain the debt management strategy established by its predecessor, Janet Yellen. The Treasury confirmed it will continue shifting issuance away from longer-term securities, a move expected to alleviate upward pressure on 10- and 30-year Treasury yields.

- Over the next three months, the Treasury plans to utilize Treasury bills to manage fluctuations in its borrowing needs. This decision marks a notable shift for Secretary Scott Bessent, who had previously criticized the strategy, warning that it could undermine the Federal Reserve’s efforts to curb inflation.

- Additionally, the Treasury’s forward guidance indicated that borrowing needs would keep auction sizes unchanged for at least the next several quarters. However, this decision has been met with some skepticism, as the Treasury Borrowing Advisory Committee — a group of external advisors including dealers, fund managers, and other market participants — has warned that auction sizes may need to adjust depending on the trajectory of monetary and fiscal policy, and the broader economic outlook.

- With the Treasury now prioritizing the reduction of long-term interest rates, this shift is likely to be bullish not only for fixed-income securities but also for equities, particularly small-cap stocks. Lower long-term rates typically reduce borrowing costs and support higher valuations across asset classes. However, this move also underscores the need for the Treasury to maintain a focus on cost reduction to ensure it can sustainably fund future spending initiatives.

Canada Fights Back? Canadian sentiment toward the US has soured following the imposition of tariffs on Canadian exports and controversial remarks suggesting Canada could become the 51st state. This shift in relations has prompted many Canadians to push for a stronger response from their government.

- Nearly 82% of Canadians support implementing an export tax on oil if the US follows through with its threat to impose tariffs. This measure has gained traction as Canadian lawmakers aim to pressure the US by increasing energy costs for American consumers and businesses. Other goods being considered for export taxes include uranium and potash.

- The threat arises as the US president has opted to exclude oil from the tariffs he plans to impose on Canadian goods. It’s important to note that a tariff is essentially an import tax, typically paid by the consumer, though in some cases, the cost may be shared with the supplier. Conversely, an export tariff is paid by the supplier to ship goods abroad, though this cost can also be passed on to the consumer under certain circumstances.

- The key difference between export and import tariffs lies in their impact on supply and sales. Import tariffs, or taxes, are intended to make foreign goods more expensive compared to their American counterparts, thereby reducing their sales. This, in turn, typically leads to higher prices for consumers. On the other hand, export tariffs discourage the sale of domestic goods abroad, increase domestic supply and, as a result, lower prices.

- Export taxes on Canadian goods could provide a modest boost to Canada’s economy but are unlikely to prevent a recession. Conversely, reduced US imports of oil may lead to some price increases domestically, but the effect should be minimal and would not disrupt the overall economic outlook.

End of Ukraine War? The Trump administration is set to unveil its long-awaited plan to resolve the Ukraine war next week at the Munich Security Conference. The announcement will coincide with the three-year anniversary of the conflict’s onset. The plan is expected to facilitate increased access to Russian energy in global markets.

- While specific details of the proposal have not been revealed, it is expected to include a freeze on the conflict, potentially allowing Russian forces to remain in occupied territories. The plan may also provide Ukraine with security guarantees against future Russian aggression, alongside provisions for new elections following a ceasefire.

- That said, there still appears to be room for negotiation between Russia and Ukraine. Moscow believes it holds enough territorial leverage to extract concessions from Kyiv, while Kyiv views its control over parts of the Kursk region as a potential bargaining chip.

- One consistent pattern we’ve observed with this administration is its reluctance to make deals without securing benefits for the United States. President Trump has expressed interest in gaining access to Ukraine’s rare earth minerals and has hinted at ensuring that Europe maintains its energy ties with the US. Consequently, any potential sanctions relief for Russia is likely to come with significant conditions attached.

Bank of England Lowers Rate: The UK central bank lowered its benchmark interest rate for the first time this year, reducing it from 4.75% to 4.50%, amid growing concerns about the economy’s weakening strength. While the decision was widely anticipated, the downgrade in the economic outlook has dampened sentiment toward the British pound (GBP).

- While the Monetary Policy Committee unanimously agreed on the need for a rate cut, two members dissented, pushing for a larger decrease. Interestingly, even Catherine Mann, typically a policy hawk, advocated for a 50 basis point reduction, which would have brought the rate down to 4.25%.

- The committee signaled its openness to further rate cuts to stave off a recession. Despite a recent uptick in inflation, they anticipate it will be transitory. This apparent disregard for rising prices suggests a shift in the central bank’s priority from price stability to economic stabilization.

The Case for Hard Assets: An Update (First Quarter 2025)

by Patrick Fearon-Hernandez, Bill O’Grady, Mark Keller, and Joe Hanzlik | PDF

Background and Summary

Secular markets are defined as long-term trends in an asset. There are both secular bear and bull markets. In most markets, there are also cyclical bull and bear markets, often tied to the business cycle, and in some markets, there are seasonal bull and bear markets that are usually tied to annual production or consumption cycles. For example, a secular bull market in bonds is characterized by falling inflation expectations that trigger steady declines in interest rates. A secular bear market in bonds is caused by the opposite condition ― rising inflation expectations that drive interest rates consistently higher. In comparison, a cyclical bull market in bonds is often related to the business cycle and monetary policy.

In general, secular cycles tend to last a long time. Using bonds as an example, we are likely concluding a four-decade secular bull market, which encompassed several cyclical markets as well. The length tends to be tied to specific characteristics of each market.

Commodity markets have secular cycles as well. Commodity demand is mostly a function of economic and population growth, whereas commodity supply comes from agriculture, ranching, mining, and drilling. As the chart on the next page shows, commodity producers are likely to face a serious secular headwind as capitalist economies tend to persistently improve their efficiency in producing finished goods from raw commodities. Commodity production is also subject to steady improvement in productivity.