by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are giving back gains after a surprisingly strong jobs report. In college athletics news, Caitlin Clark, the Iowa star, secured her second straight Player of the Year award. Today’s Comment discusses why the Fed’s tolerance for inflation might be higher than investors anticipate, analyzes the surprising strength of US banks following the one-year mark of the Silicon Valley Bank collapse, and delves into the resilience of European equities despite a stagnant European economy. As usual, our report includes a roundup of international and domestic economic releases.

Not 2%, But Close Enough: The S&P 500 trimmed gains after a Fed president downplayed rate cuts, but signs suggest a Fed policy shift might still be coming.

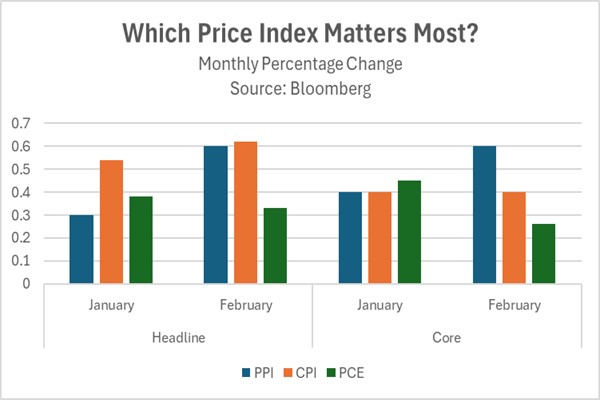

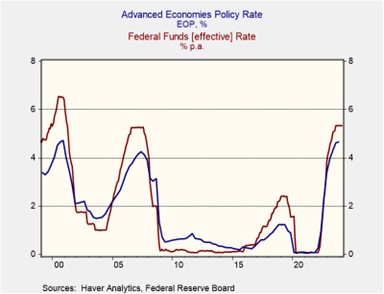

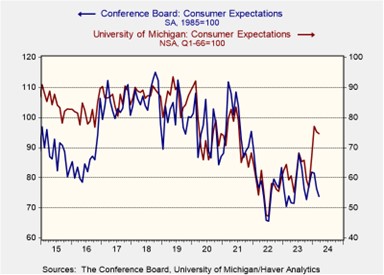

- The Federal Reserve’s monetary policy stance is in flux. In a recent LinkedIn event, Neel Kashkari, president of the Minneapolis Fed, admitted his prior projection of two rate cuts in 2024 might need to be revised. Wary of inflation proving more persistent than anticipated, Kashkari signaled a possibility that the Fed may not cut rates at all this year. This shift follows hotter-than-expected inflation data in January and February, impacting both consumer and producer prices. However, Loretta Mester, president of the Cleveland Fed, remains optimistic, believing inflation will cool enough to allow for a rate cut as planned.

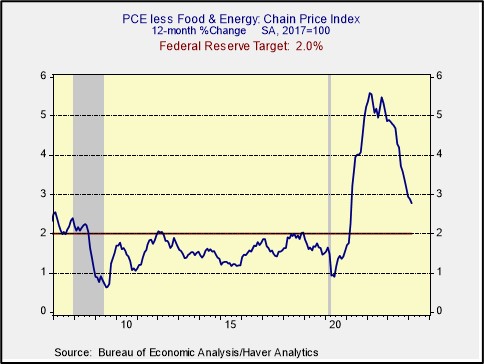

- The threshold for a rate cut may be lower than most investors realize. The latest FOMC projections showed that the committee expects three rate cuts and inflation to fall to 2.5% by year-end. This suggests policymakers may be comfortable with a slower-than-expected pace of inflation reduction as long as the progress is consistent. Even so, the conflicting inflation data may complicate their decision. In February, the Consumer Price Index (CPI), a common inflation gauge, rose 3.8% from the prior year, while the Fed’s preferred measure, the Personal Consumption Expenditures (PCE) price index, currently sits at 2.8%.

- The timing of any policy easing could hinge on which inflation indicator policymakers prioritize, or even if they consider both. Despite policymakers preferring to use core PCE as their tool to evaluate inflation, they have been known to react to changes in core CPI. This is evident in their recent references to persistent inflation, primarily based on the month-to-month change in the CPI data in March, which overshadowed a noticeable deceleration in core PCE. If they prioritize the CPI, they might hold rates for longer than expected. Conversely, if they focus on the PCE price index, they could be open to a rate cut as early as June.

Slow Moving Train: More than a year after the Silicon Valley Bank collapse, the financial system shows signs of recovery, though some skepticism lingers around regional banks.

- This week, Federal Reserve Vice Chair of Supervision Michael Barr sought to reassure the public about the financial system’s health, while acknowledging potential risks in commercial real estate. At a National Community Reinvestment Coalition event, he declared banks to be “sound” and “resilient,” highlighting improved liquidity. However, he balanced this optimism by acknowledging “pockets of risk” due to firms holding “significant unrealized losses” on their books and having a high concentration of commercial real estate. Instead of an immediate crisis, Barr likened the situation to a “slow-moving train” with potential problems surfacing over several years.

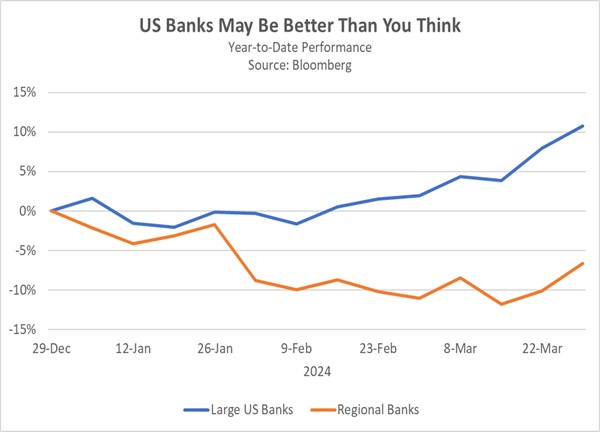

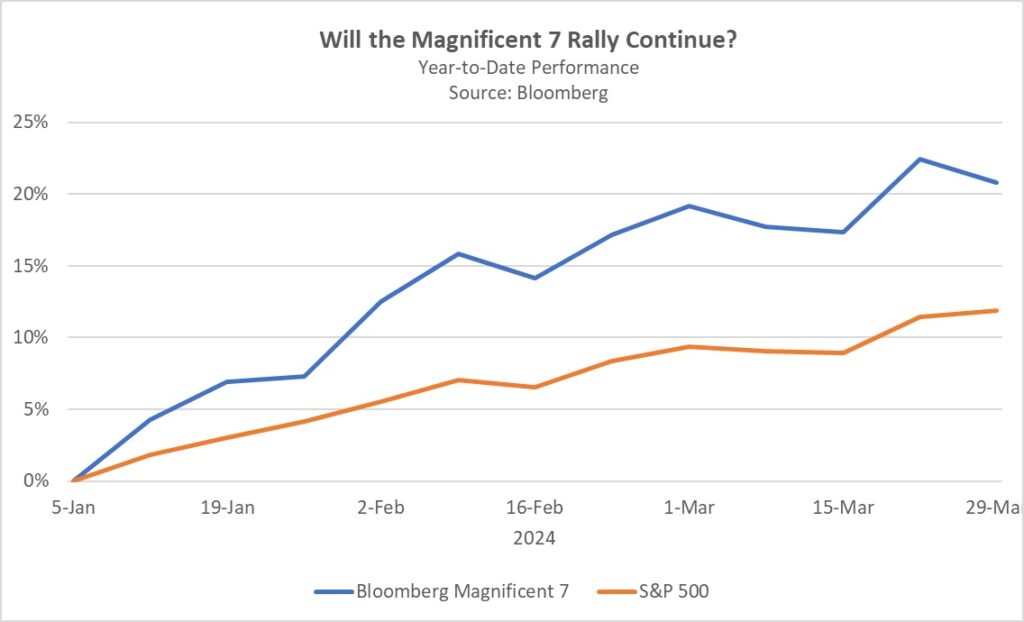

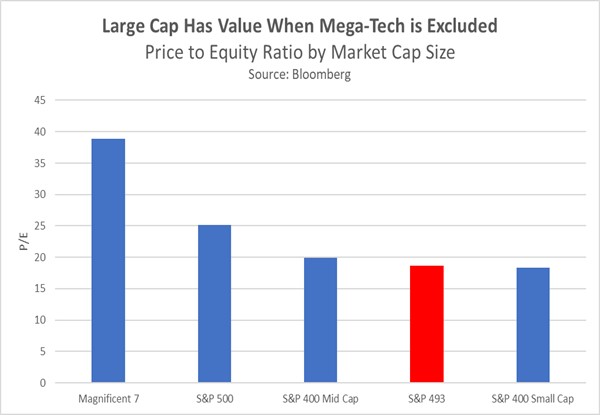

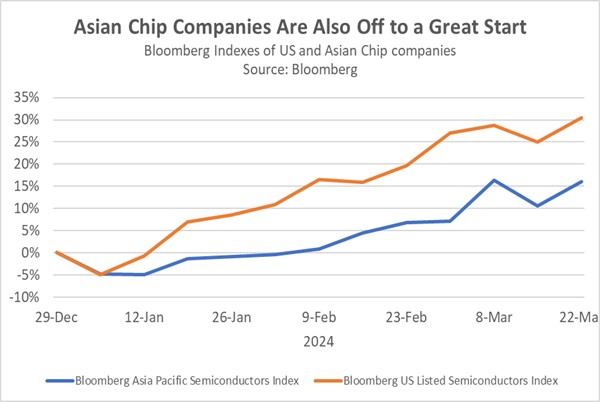

- Despite lingering concerns about the health of the banking system, US banks have surprised analysts with a strong start to 2024. Large-cap bank stocks have surged 11% year-to-date according to a UBS index, significantly outperforming the S&P 500’s gain of just 8.5% over the same period. This robust performance can be attributed to two key factors. First, large banks capitalized on opportunities last year by acquiring struggling but profitable regional banks, which has bolstered their earnings. Second, net interest income has remained healthy due to the Federal Reserve’s decision to keep interest rates elevated.

- Large banks have thrived this year, but regional banks remain a cloud of concern for investors. The KBW regional bank index is currently in negative territory, reflecting investor wariness of smaller banks due to anxieties about their commercial real estate exposure. The recent misstep at New York Community Bank further fueled these apprehensions. Still, it’s important to note that the closure of the Fed’s Bank Term Funding Program hasn’t triggered signs of an imminent regional banking crisis. If this situation continues, it will further add to optimism that the economy may avoid a downturn this year.

Silver Lining in Europe: European equities are showcasing resilience amidst prevailing economic headwinds and Germany’s weakened state.

- The STOXX Europe 600 (SXXP) has soared to new highs in 2024, fueled by a strong performance from large-cap stocks, particularly in banking and car manufacturing. The banking sector has witnessed its best showing in six years, surging 34% year-over-year. This rise is attributed to the banks’ ability to maintain financial health and capitalize on recent interest rate hikes by the European Central Bank (ECB). The recent shift by automakers away from electric vehicles due to perceived slowing demand, though, has also found favor with investors worried about declining profit margins and potentially lower sales.

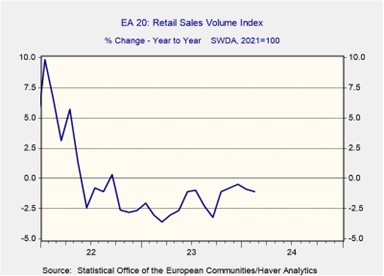

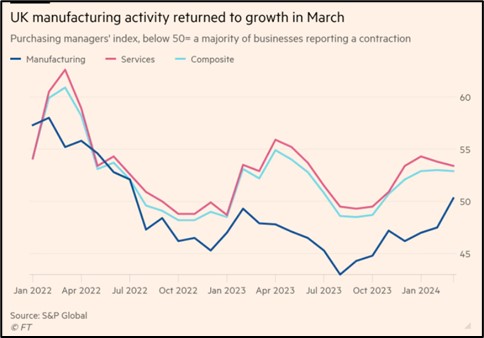

- Despite a strong stock market performance, the eurozone economy faces ongoing challenges. The region narrowly averted a recession, technically defined as two consecutive quarters of economic decline. Recent data paints a concerning picture, with retail sales dropping 0.5% in February and the March purchasing managers’ index indicating a further contraction in construction activity. Germany, a key eurozone player, appears particularly vulnerable. Its manufacturing sector, a traditional engine of growth, continues to drag. German industrial orders rose a meager 0.2% in February, far below expectations of 0.8%.

- The strong stock market performance may be short-lived if economic conditions continue to deteriorate. Downturns historically lead to credit tightening, making it harder for companies to borrow and potentially hindering their ability to remain profitable. However, the ECB’s planned interest rate cut in June could help ease the situation by making credit more affordable. In the current economic climate of uncertainty, European blue-chip stocks could be a viable option for investors seeking a safe haven. These companies are resilient to major financial fluctuations, while also maintaining relatively attractive valuations compared with their US peers.

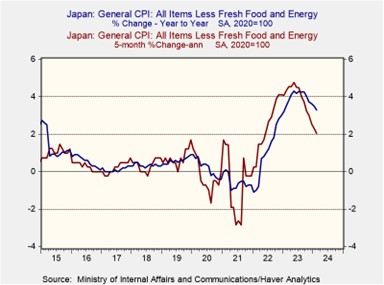

Other News: Bank of Japan Governor Kazuo Ueda signaled a possible rate hike in the second half of the year; the comment led the yen to strengthen against the dollar. Argentinian President Javier Milei seemed to retract his commitment to distancing the country from China by indicating that Beijing still wields considerable influence in South America. Treasury Secretary Janet Yellen has underscored the impracticality of the United States severing ties with China, solidifying a persistent trend of simmering tensions between the world’s two largest economies.