by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with a few observations on yesterday’s rout in Western technology stocks related to artificial intelligence. We next review several other international and US developments with the potential to affect the financial markets today, including signs that China’s property slump is starting to weaken even its strongest developers and a White House order last night that could potentially disrupt federal payments to a wide range of businesses and nonprofits.

Global Technology Stock Sell-Off: Yesterday’s sell-off in Western artificial-intelligence stocks erased some $589 billion of Nvidia’s market value alone. The previously high-flying stock closed down about 17% for the day, and other AI-related firms closed down almost as much. As a reminder, the sell-off was sparked by a realization that Chinese AI firm DeepSeek was able to produce a top AI model without expensive Nvidia chips and far more cheaply than Western firms have been able to create competing models.

- Since AI stocks had gotten so richly valued, they were probably susceptible to a correction at the sign of any bad news. As we’ve written recently, investors had even begun looking at the Magnificent 7 as a sort of safe haven. The reality is that stock prices can be volatile, and while it can be tempting to chase the momentum plays, keeping diversified can be a safer approach.

- Looking forward, it’s probably too early to gauge exactly how DeepSeek or other Chinese AI models could affect the US firms. As the US-China “AI race” heats up, there is a chance that the US government will limit access to Chinese tools for national security purposes. That could leave America’s AI-related firms in pole position to serve the US geopolitical bloc and maybe even beyond, while keeping them out of the China bloc.

- At the same time, even if the US and Chinese AI markets are walled off from each other, investors should remember that increased competition within the US bloc’s market could weigh on profits as the market develops. There are also positive trends in other sectors of the US economy. That’s a key reason why we think investors shouldn’t forget the importance of diversification and the potential for better future performance from smaller cap stocks and value stocks.

United States-China: After years of saying it didn’t have enough data to say whether the COVID pandemic occurred naturally or from a lab leak in China, the Central Intelligence Agency has released an updated assessment saying it now favors the lab-leak theory, although with only a low level of confidence. The reassessment, ordered by former President Biden last year and released by the new CIA director last week, will likely exacerbate US-China tensions and encourage further economic decoupling between the US and Chinese economies.

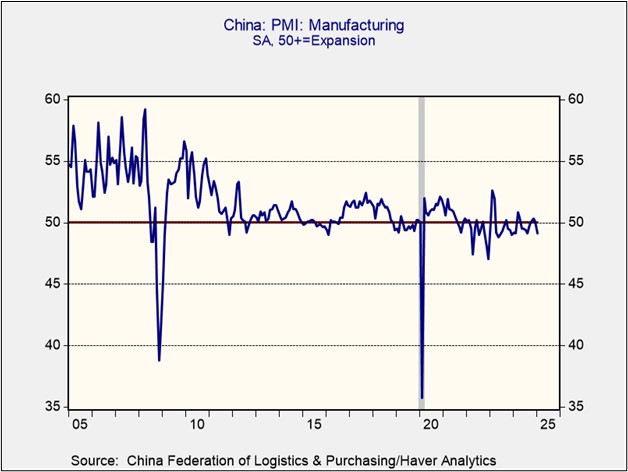

China: Yesterday, major property developer Vanke, until now considered the most stable of China’s major housing firms, reported a massive fourth-quarter loss of approximately $6.2 billion and announced the resignation of several top officials. Company figures showed the firm suffered a massive drop in new residential sales and falling margins — data that suggests China’s housing crisis has now spread to even its strongest developers. A key question going forward is whether the government will step in to help Vanke stay in business.

United States-India: According to the White House, President Trump has told Indian Prime Minister Modi that he wants New Delhi to buy more US weapons to help rebalance trade between the two countries. The request comes as India, the world’s biggest arms importer, is trying to diversify its buying away from Russia. That creates a potential opportunity for US defense contractors. However, it’s important to note that New Delhi is also trying to expand its own defense industrial base so that it is less reliant on foreign suppliers.

- As we’ve noted previously, President Trump has reportedly told newly confirmed Defense Secretary Hegseth to prepare for smaller defense budgets, potentially presenting a risk for US defense firms.

- However, Trump’s conversation with Modi suggests he may be looking to offset lower US arms orders with increased orders from abroad. That is likely also a reason why Trump is pushing other US allies to spend more for their own defense, since a lot of that new spending could well be channeled to US suppliers.

- We note, however, that many US allies are still resisting increased defense budgets and/or purchases from the US. In Germany, for example, the namesake leader of the radical left-wing Sahra Wagenknecht Alliance has vowed to block any increase in military spending if her party gains representation in the Bundestag in next month’s election. According to opinion polls, the party currently has about 5% support, just enough to enter parliament.

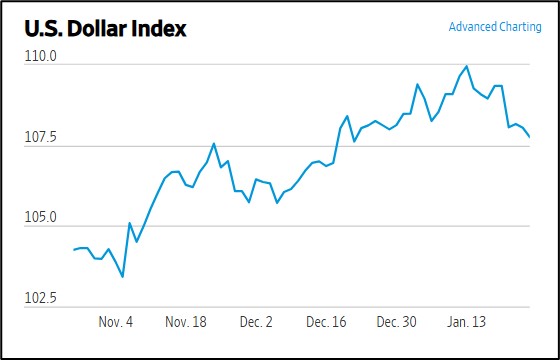

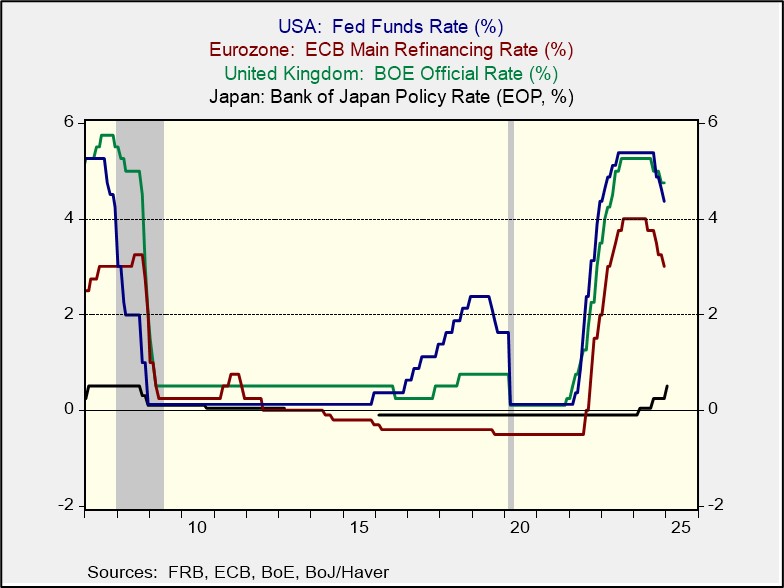

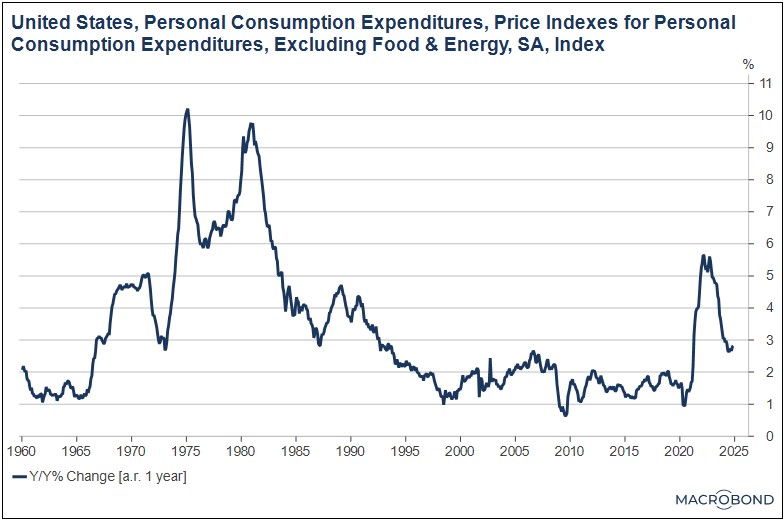

US Monetary Policy: The Fed begins its latest policy meeting today, with the decision due out tomorrow at 2:00 PM ET. The policymakers are widely expected to hold the benchmark fed funds interest rate unchanged at its current range of 4.25% to 4.50%, but surprises are possible given that the annual rotation of committee members will bring new officials to the panel. Chair Powell’s post-meeting news conference will be especially important, as investors will be looking for more guidance on the future path of rates.

US Fiscal Policy: The White House’s Office of Management and Budget last night ordered executive departments and agencies to pause federal grants, loans and other financial-aid programs pending a review by the new administration. Because of the broad nature of the order, departments and agencies are reportedly confused about what disbursements must be stopped and how long they will be frozen.

- Footnotes to the memo exempted Social Security, Medicare, and other payments made directly to individuals.

- However, that would still leave a vast array of federal payments that could potentially be frozen, from small-business loans to highway funding. A disbursement freeze of that magnitude could be disruptive to the economy and undermine business confidence.

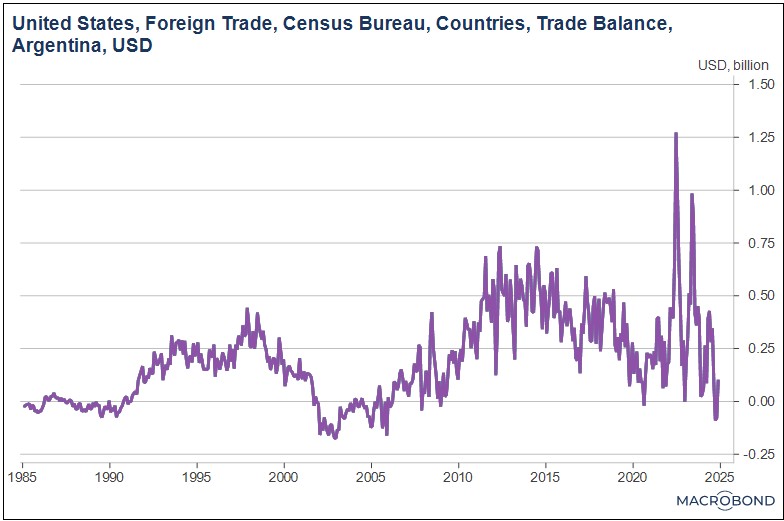

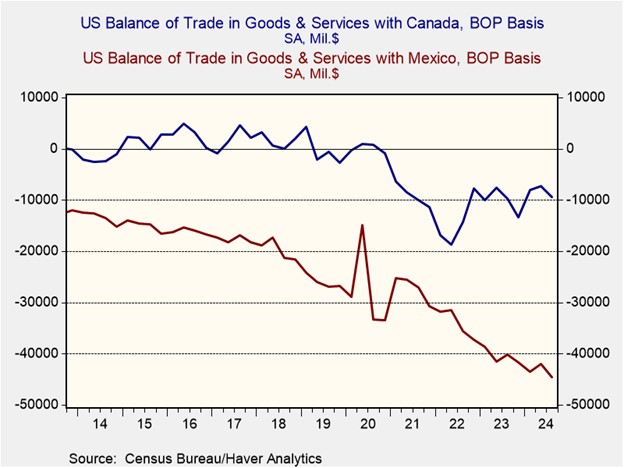

US Trade Policy: According to a Financial Times article yesterday, Treasury Secretary Bessent is pushing the Trump administration to back a gradual increase in US import tariffs. Under Bessent’s plan, the universal tariffs would rise 2.5% per month until they reach 20.0%, giving firms more time to adjust and creating the opportunity for the US to strike trade deals with foreign countries. Our latest Bi-Weekly Geopolitical Report discusses how Bessent’s trade policies fit into the overall Trump program of shifting security and prosperity costs to US allies.

US Health Policy: New reports say Robert Kennedy Jr. is struggling to convince senators to confirm him as Secretary of Health and Human Services because of his controversial stand against vaccines and his support for abortion rights. If Kennedy fails to win confirmation in a vote later this week, healthcare stocks would likely rally, at least until a new nominee is named.

US Commercial Real Estate Industry: According to data providers such as MSCI, sales of US office buildings jumped approximately 20% in 2024 to a total of $63.6 billion. Sales are still much weaker than the annual average of $142.9 billion from 2015 to 2019, but the rebound last year provides further evidence that investors have started trying to take advantage of the distressed industry.

- As we’ve noted over the last few months, we are seeing increased evidence that buyers are scooping up properties burdened by excessive debt, high interest rates, and low occupancy rates.

- As companies impose more back-to-the-office policies, the new sales could bode well for office-sector real estate investment trusts (REITs) going forward.