by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is reacting to the latest jobs data. In sports news, Real Madrid triumphed over Mallorca to advance to the final of the Spanish Super Cup. Today’s Comment will delve into the recent rise in UK gilt yields, explore the potential factors behind a prolonged conflict in Ukraine, and discuss other relevant market developments. As always, the report will include a summary of key international and domestic economic data releases.

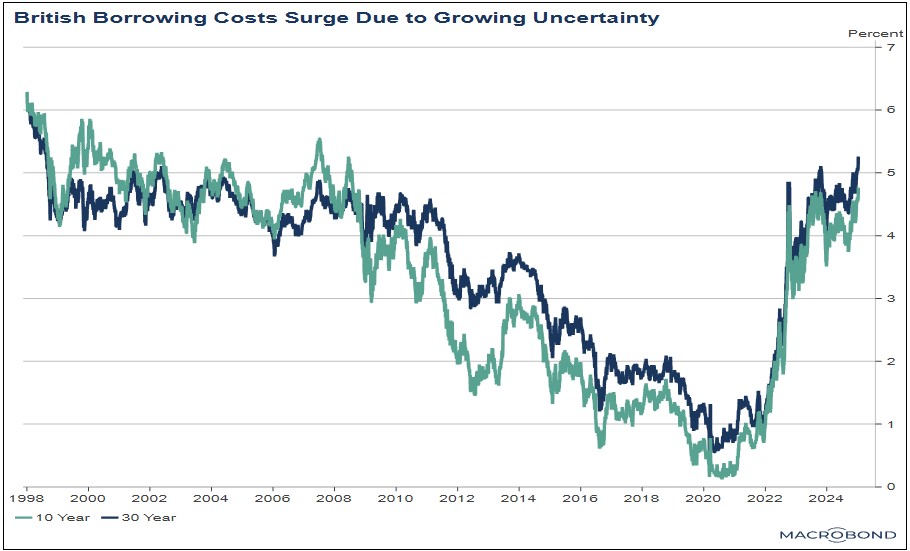

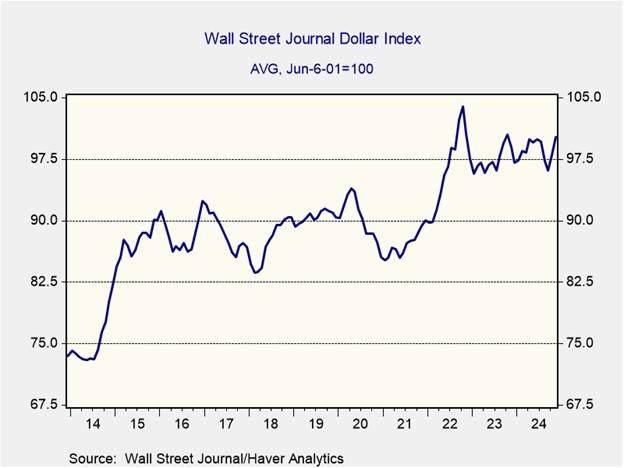

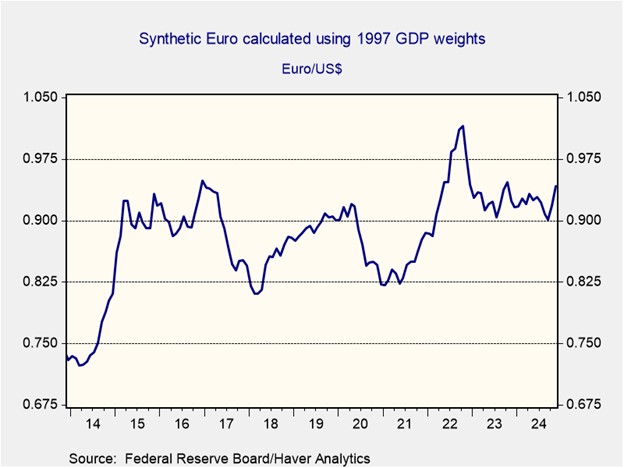

Another Truss Moment? UK long-term bond yields soared to multi-decade peaks on Thursday, driven by escalating concerns about the nation’s ability to manage its burgeoning debt. The 10-year gilt yield reached 4.82%, its highest level since 2008, while the 30-year gilt yield climbed to 5.38%, its most elevated point since 1998. This surge in interest rates exerted downward pressure on the pound sterling (GBP), causing it to depreciate by 0.6% on the day.

- The cause of the market sell-off remains uncertain, but a potential contributing factor could be the growing tensions between London and Washington. It has been reported that Elon Musk, a prominent figure within the Trump administration, is rumored to be trying to oust UK Prime Minister Keir Starmer before the next election.

- Despite President-elect Donald Trump not having expressed any specific criticism of the UK, concerns linger regarding potential tariffs that could impede the nation’s economic growth. This anxiety emerges at a critical moment when the UK government depends on a strong economy to stave off the severe budget cuts needed to tackle the growing national debt.

- Since the United Kingdom voted to leave the European Union in 2016, it has had six prime ministers and has seen its general government debt surpass the total of GDP for the first time in at least 50 years. Hence, the rise in yields may be driven by the possibility of growing political instability and an increase in the government deficit.

- While the recent rise in yields is concerning, its moderate pace is unlikely to trigger a market rout similar to the one that occurred in 2022 following the release of the controversial mini budget under UK PM Liz Truss. However, the increase in borrowing costs could weigh on the economic growth of the country.

Another Lifeline? President-elect Donald Trump has extended the timeline for ending the conflict in Ukraine from 24 hours after taking office to six months. This shift in strategy appears to stem from concerns within the administration that a hasty resolution could be perceived as a rushed or poorly executed decision, potentially impacting the president’s public image.

- The reported U-turn also appears to be an olive branch to Europe, aimed at persuading the administration to sustain its support for Ukraine. Although the president campaigned on ending US funding for the war, he has been notably quieter on the issue since winning the election.

- In fact, just days after winning the election, Trump reportedly warned Russian President Vladimir Putin against escalating the war and reminded the Russian leader that the US “has weapons, too.”

- Despite President-elect Trump’s initial reluctance to end the war, discussions between the US and Russia appear to be taking shape. Trump is reportedly open to a peace deal that would allow Russia to retain control over several captured regions. However, Russian delegates have expressed dissatisfaction with the initial proposal.

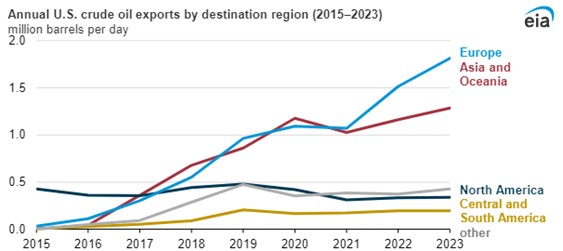

- Although the end of the conflict is a positive development, investors should remain mindful that Russia remains a strong competitor to the US in the global energy market. A key takeaway from the conflict is that sanctions on Russia created new opportunities for US energy producers to capture market share in Europe. The administration’s desire for Europe to increase its reliance on US energy will likely lead to heightened scrutiny by the US administration regarding any resurgence of Russian energy exports.

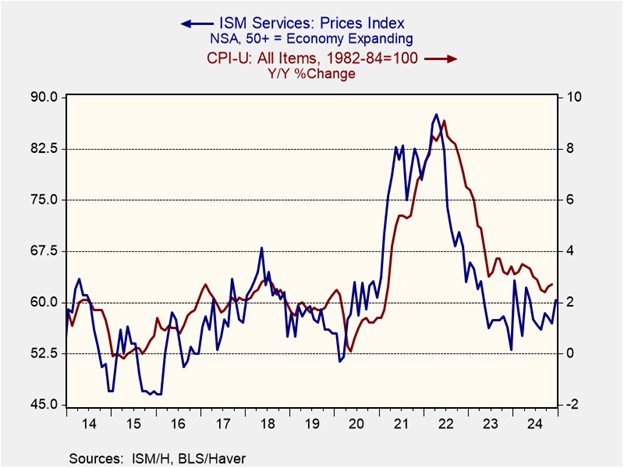

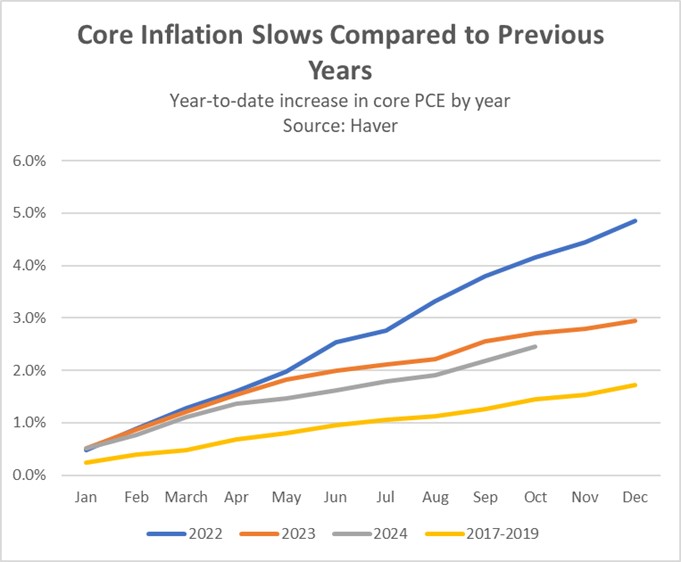

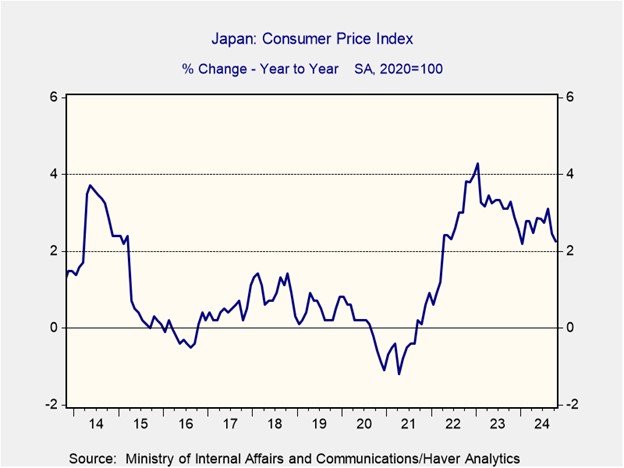

Japan Inflation Optimism: There are growing signs that the country may have finally escaped its deflationary spiral. The Bank of Japan is expected to upwardly revise its inflation outlook. While the recent revisions have been attributed to an increase in rice prices and the depreciation of the currency, there are also increasing signs that wages have started to pick up.

- The central bank’s decision to raise its inflation forecast signals a stronger commitment to tightening monetary policy to counteract persistent price pressures and safeguard economic stability. This is likely to result in higher Japanese bond yields and a stronger yen (JPY). However, given the prevailing economic slowdown, the impact on equities may be mixed.

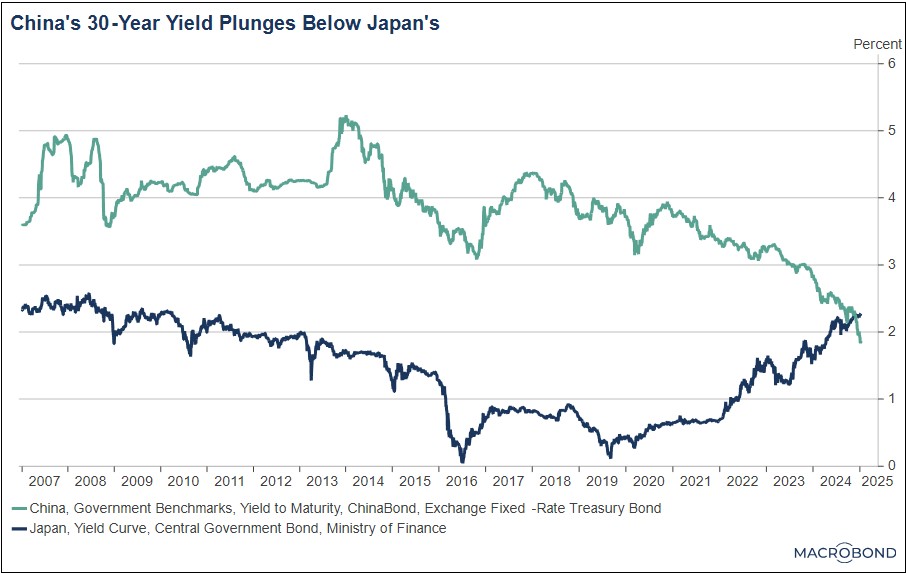

China’s Troubles Deepen: The People’s Bank of China has halted purchases of government bonds, a move widely interpreted as an attempt to dampen speculation about the country’s economic growth prospects. This action could further fuel fears of a deflationary spiral in the world’s second-largest economy.

- At the same time, the MSCI China Index seems poised to enter a bear market in the next few days as investors brace for escalating trade tensions between China and the US. On Friday, the index dropped by as much as 1.1%, bringing its total decline closer to 20% since its peak on October 7, 2024.

- Earlier this week, it was reported that outgoing President Joe Biden plans to announce new restrictions on AI chips as the US seeks to maintain its competitive edge over China in the sector.

- As noted in our previous reports, China is likely to face challenges stemming from the five Ds: weak consumer demand, overcapacity coupled with high debt, unfavorable demographics, economic disincentives due to the Communist Party’s market interventions, and the impact of Western decoupling in trade, technology, and capital flows.

DOGE’s Setback: Tesla CEO Elon Musk acknowledged on Wednesday that his newly formed Department of Government Efficiency may fall short of its ambitious goal of reducing the federal deficit by $2 trillion, potentially achieving only half of that target.

- While this news is disappointing amid the market’s strong preference for fiscal restraint, investor skepticism about the feasibility of Musk’s ambitious deficit reduction target was evident from the start.

- That said, we still believe that efforts to reduce government spending are likely to be bullish for bond prices.

Labor Talks: US dockworkers have reached a tentative agreement with their employers, averting a potential shutdown of East and Gulf Coast ports next week. This new deal includes provisions for a framework to address the impact of automation on the workforce, aiming to protect workers’ jobs as technology advances. If ratified, this agreement will have a six-year term.