by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is closely watching for the Federal Reserve’s latest rate decision. In sports, Real Madrid’s Vinícius Júnior has been awarded FIFA’s The Best player, a moment many see as restoring balance to the football world. In today’s Comment, we’ll preview the Fed’s decision, analyze the Dow Jones’ recent slump, and provide an update on Brazil. As always, we’ll conclude with a roundup of key domestic and international data releases.

Fed Decision: While the Fed is expected to cut rates today, markets will focus on the accompanying economic projections.

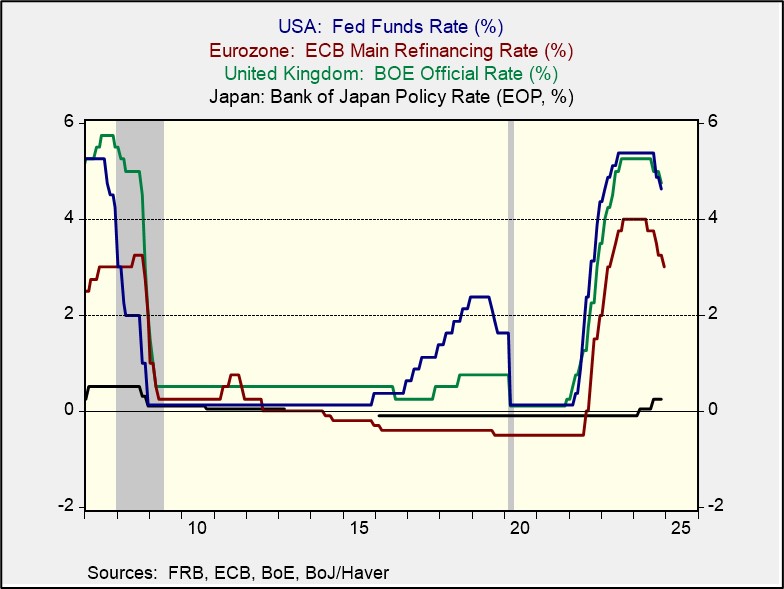

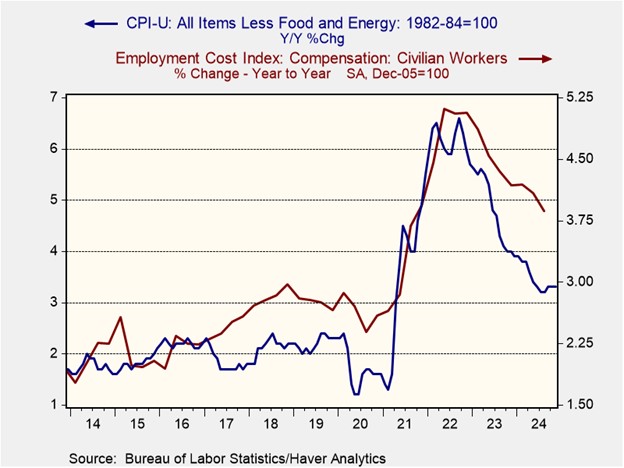

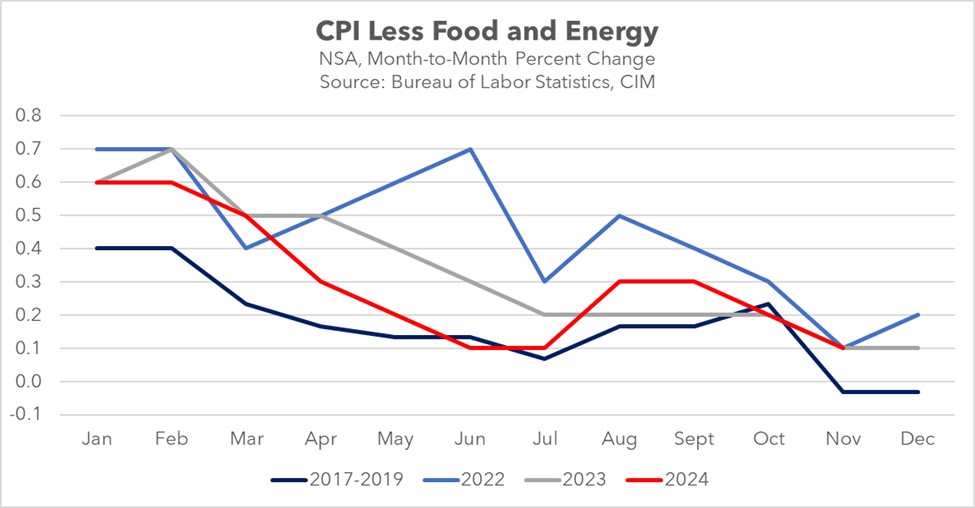

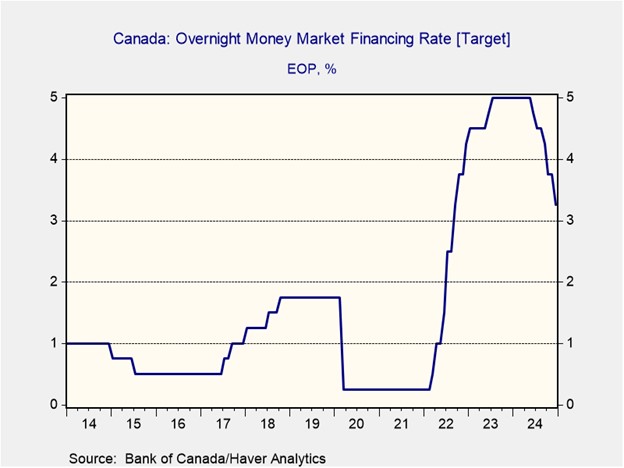

- The latest CME Group FedWatch Tool indicates a near-certainty of a 25 basis point rate cut today, with a 95% probability priced in. This confidence stems from reassurances from Fed officials and signs that the economic risks have become more balanced between inflation and unemployment. Earlier this month, Fed Governor Christopher Waller and Atlanta Fed President Raphael Bostic both signaled openness to a rate cut. Additionally, the November CPI inflation report, while up year-over-year, largely aligned with market expectations. At the same time, the unemployment rate has risen back to its 2024 peak level.

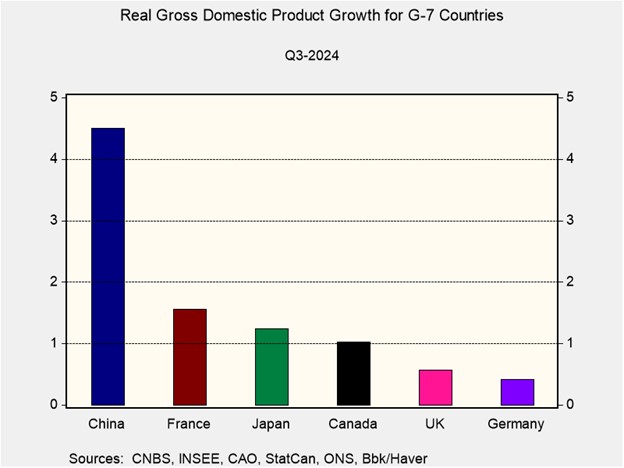

- While the rate cut at this meeting is widely anticipated, the market will be closely watching the number of rate cuts projected for 2025 in the updated dot plot. The September dot plot indicated that Fed officials expected to cut the federal funds rate target by a total of 100 basis points in 2025 to a range of 3.25%-3.50%. However, stronger-than-expected economic growth and inflation’s failure to reach new lows have prompted officials to call for a slower pace of rate cuts heading into the new year. As a result, the market now projects that the Fed could cut rates by 75 bps next year.

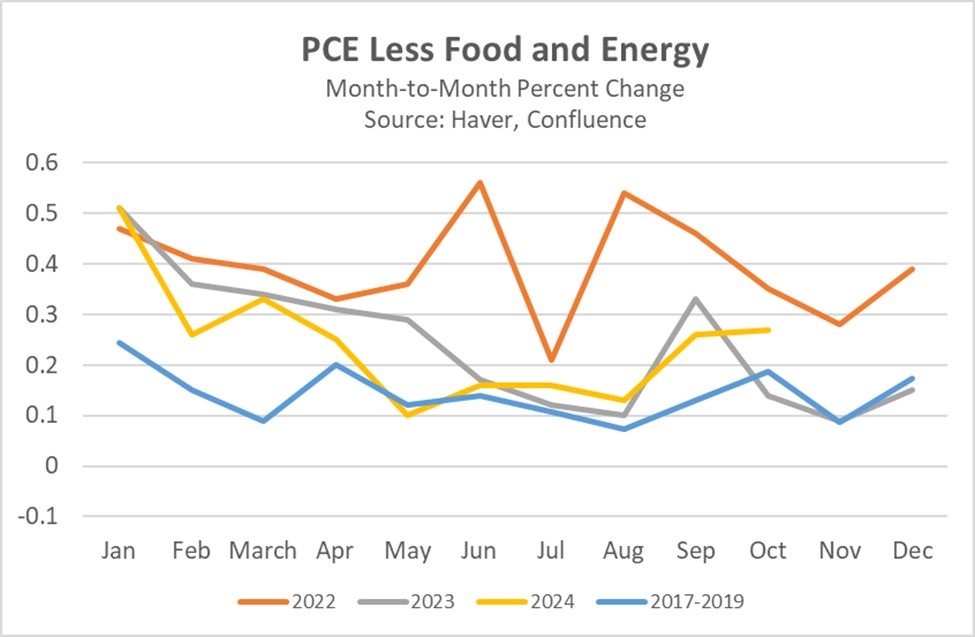

- In our view, the Fed’s ability to cut rates will be determined by inflation’s progress in the first three months of the year. As the chart above illustrates, the start of this year saw the widest gap between monthly PCE price inflation increases and its three-year pre-pandemic average. This divergence led several officials to question the need for rate cuts in 2025. Consequently, if inflation remains stubbornly high at the beginning of next year, the central bank may be less inclined to implement the projected rate cuts. This could mean that the Fed may end up cutting less than what the market currently expects.

Dow Jones Trouble: Recent S&P 500 and NASDAQ gains contrast the declining Dow Jones, highlighting the increasing influence of tech giants.

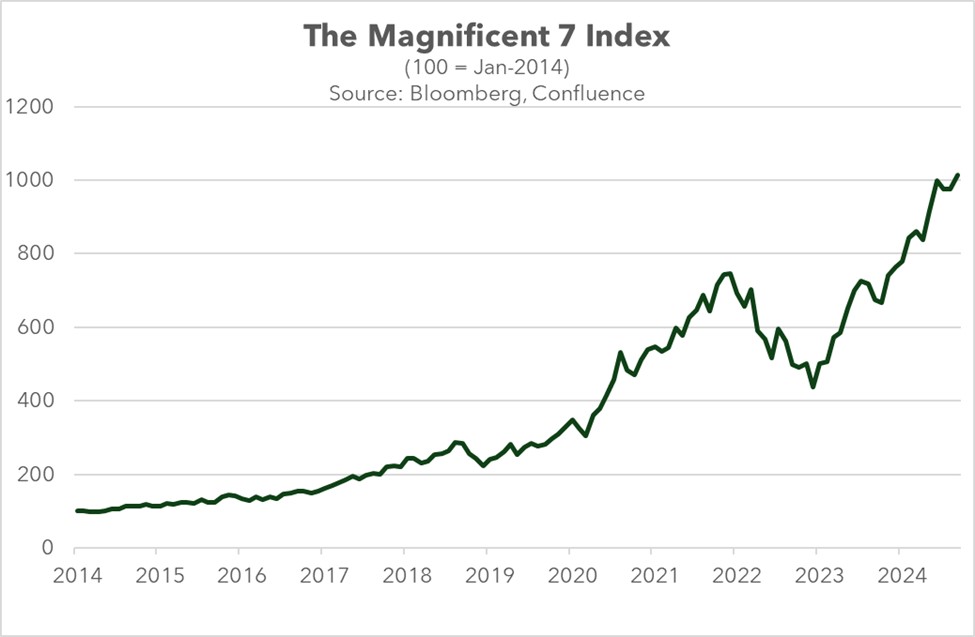

- The Dow Jones Industrial Average Index extended its losing streak to nine consecutive days on Tuesday, marking its longest downturn since the Jimmy Carter administration. The Dow Jones Index has not benefited from the rally in tech stocks, as only four of the Magnificent 7 companies (Amazon, Microsoft, Apple, and Nvidia) are included. Additionally, the index has been significantly impacted by the struggles of healthcare services following the tragic killing of the UnitedHealth CEO and the incoming administration’s plans to regulate pharmacy benefit managers.

- The poor performance of the Dow Jones is another example of how concentrated equity markets have become in recent years. Tech stocks have been the primary drivers of the S&P 500’s performance this year, with the Magnificent 7 accounting for nearly 60% of the gains, which allowed them to increased their combined share of the S&P 500 to nearly 35% in the first six months of the year. This increased concentration means the overall index performance is highly sensitive to changes in sentiment toward the tech sector.

- Going into next year, we expect momentum to continue playing a major role in equity performance. As a result, we anticipate that mega cap tech companies will thrive as long as market expectations remain relatively unchanged. We believe that in 2025 many investors will flock to familiar names in search of safety amid concerns about elevated inflation and uncertainty regarding fiscal and monetary policy. However, the increased concentration of the S&P 500 suggests that the index is highly susceptible to exogenous shocks, which we will be monitoring closely in the coming months.

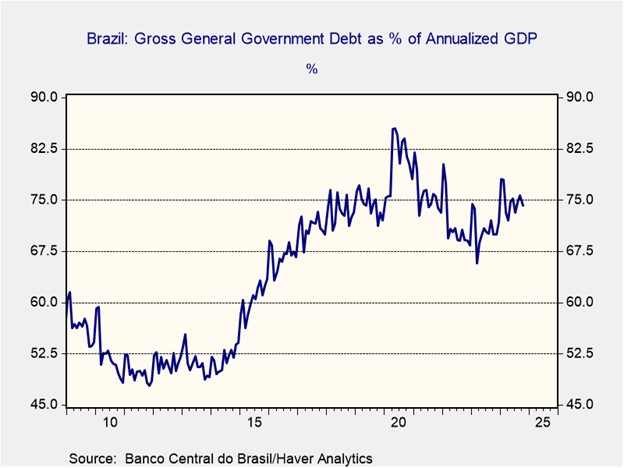

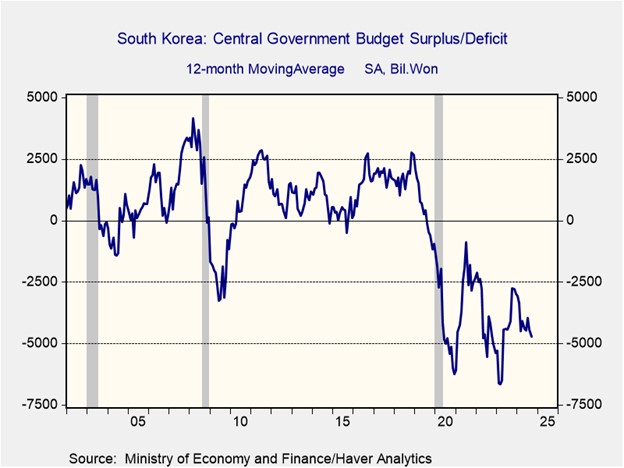

Brazil’s Problems Deepen: Brazilian markets have plummeted as investors have sought to reduce their exposure to Latin America’s largest economy due to concerns over its widening deficit.

- On Tuesday, the Brazilian real (BRL) plummeted to a record low, prompting investors to reduce their exposure to the country’s debt and equities. The market turmoil was triggered by the lower house’s approval of a spending package that included weakened measures to curb spending if revenue falls short of expectations. While the central bank intervened to stabilize the currency, serious concerns persist about Brazil’s fiscal situation, which is likely to continue weighing on investor sentiment, especially as lawmakers prepare to pass three additional proposals.

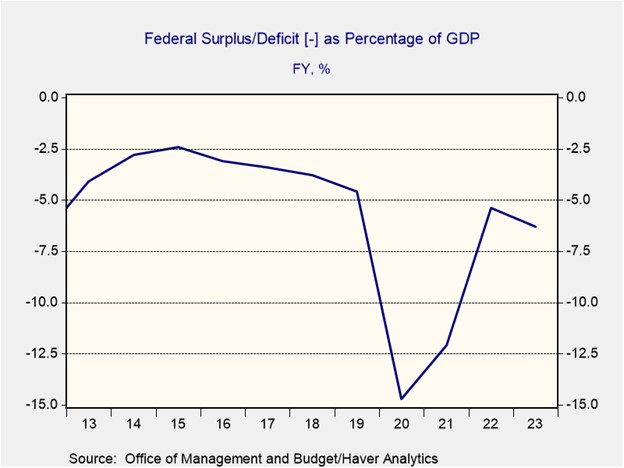

- The country’s budget deficit has reached 10% of GDP, exceeding the levels recorded during President Luiz Inácio Lula da Silva’s first term. In response, Lula proposed a plan to cut annual spending by 70 billion BRL ($11.5 billion). However, the inclusion of income tax breaks in the bill have raised concerns over the budgets’ ability to rein in the deficit. Compounding the issue is the speculation that lawmakers may weaken provisions affecting social spending. Additionally, a key measure to rein in military pension expenses has been delayed until next year, further casting doubt on the plan’s timely implementation.

- Brazil’s reluctance to make tough decisions to curb spending suggests that the central bank will likely bear the brunt of the burden. To prevent the country’s widening deficit from exacerbating inflationary pressures, the Central Bank of Brazil may need to tighten financial conditions. This policy could eventually weigh on the country’s GDP growth potential and negatively impact equities. However, if lawmakers adopt a stricter stance on the budget or if government revenues exceed expectations, investors may reconsider their outlook on Brazil.

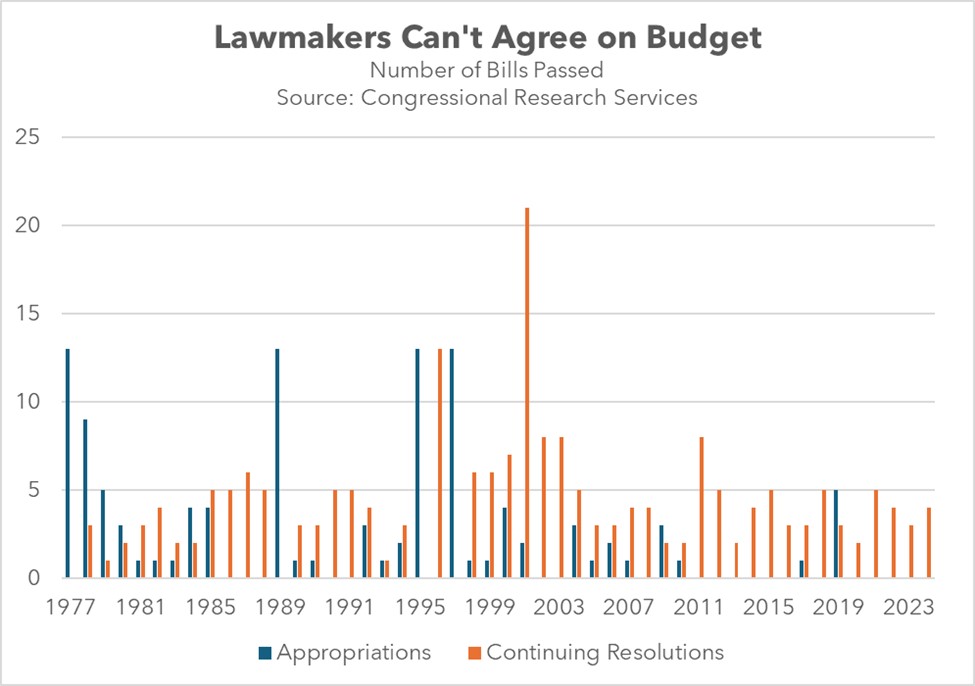

In Other News: Nissan and Honda are reportedly discussing a potential merger as a strategy to increase their size and competitiveness in the automotive industry. Meanwhile, congressional lawmakers have reached an agreement to avert a government shutdown, which is expected to alleviate market uncertainty.