by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with President-elect Trump’s latest vow to impose steep import tariffs on key trade partners once he is inaugurated to his new term. We next review several other international and US developments with the potential to affect the financial markets today, including signs that Germany may be ready to relax its government debt rules to spur economic growth and a few observations on the recent surge in US small cap stock prices.

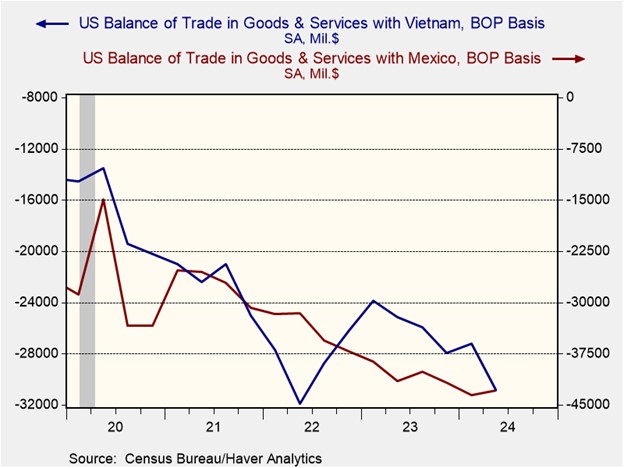

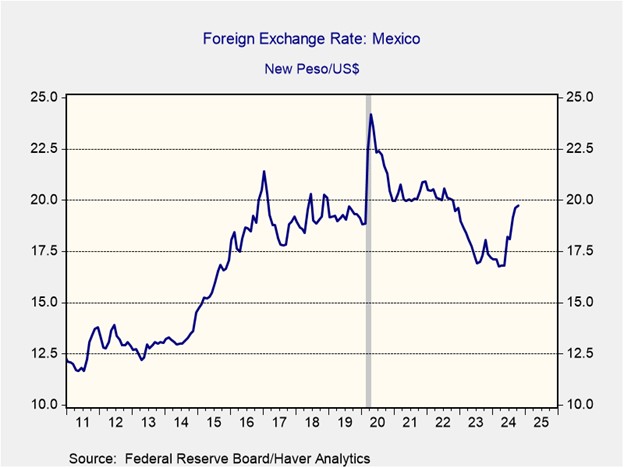

United States-Canada-Mexico-China: President-elect Trump yesterday said he’ll impose 25% tariffs on all imports from Canada and Mexico on his first day in office to push them to crack down on illegal immigrants and drugs crossing their borders into the US. He also said he would impose an additional 10% tariff on imports from China, on top of existing levies. The threats are likely to deepen concerns that foreign countries, including key US allies, could face devastating tariffs once Trump is inaugurated, and not just for economic or protectionist reasons.

- In response, both the Canadian dollar (CAD) and the Mexican peso (MXN) are trading down about 0.8% versus the greenback so far today.

- Canadian and Mexican stock price indexes are also lower today. In addition, stock values for major foreign exporters to the US are also trading down, including Japanese automakers.

China: New reports based on satellite imagery and public documents suggest the Chinese military has built a prototype nuclear reactor to power its upcoming aircraft carriers. That means the country’s fourth carrier, under development now, could be its first to have the advantages of nuclear propulsion, including global range, faster speeds, greater capacity for carrying aircraft and munitions, and faster aircraft launch tempos — all of which would help make the Chinese navy an even greater challenge for Western naval forces.

China-United States: Apple CEO Tim Cook is in China today for the third time this year as he seeks government approval to add artificial-intelligence to the iPhone offerings in the country. However, a high-ranking government official has warned that Apple and other foreign firms wanting to bring AI to China would face long and complex approval processes if they don’t partner with a local company. The statement suggests China is turning back to a technology-transfer tactic it previously used to steal innovations from foreign firms.

Russia-North Korea: South Korean security officials say Russia has delivered advanced air defense systems to North Korea in return for the 10,000 or more troops and other military aid that Pyongyang has sent to Russia for its war against Ukraine. The air defense systems and potentially other military goods are on top of the energy and food deliveries that Russia has also reportedly sent to North Korea to pay for its aid. North Korea is also expanding a key factory that produces missiles for itself and Russia, possibly with Russian financing.

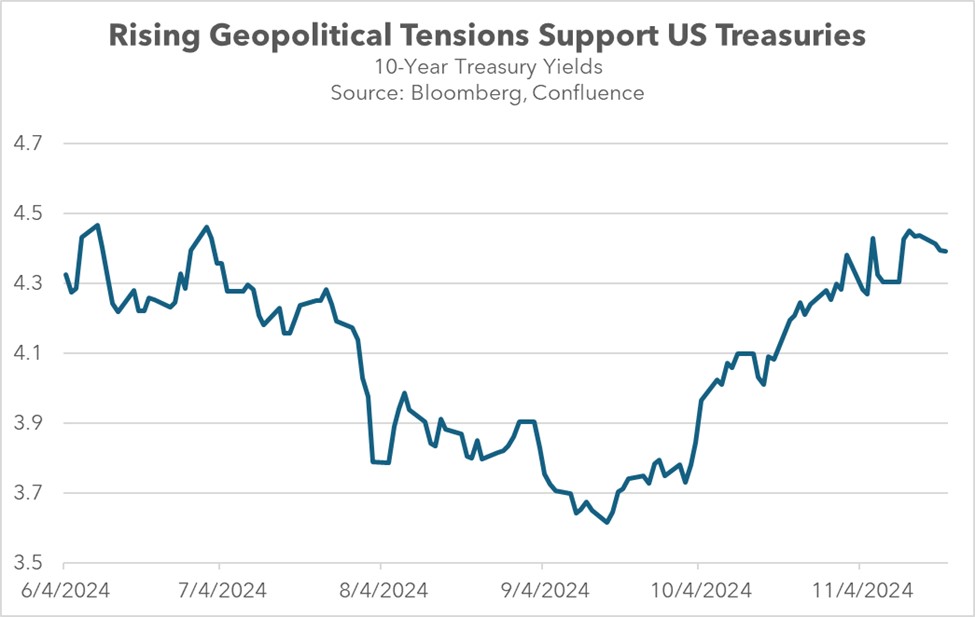

- The air-defense transfers illustrate the growing internationalization of the Russia-Ukraine conflict. They also reflect the increasing cooperation and coordination among the major countries in the China-led geopolitical and economic bloc, including China itself, Russia, Iran, and North Korea.

- As we’ve noted before, we think the trend of growing cooperation and coordination in the China-led bloc will become increasingly evident in 2025. Indeed, the commander of US forces in the Indo-Pacific region last week warned that Russia is likely to transfer critical submarine technology to China, helping make its naval forces an even bigger threat. The trend will likely strengthen the China-led bloc, sharpening tensions with the US-led bloc.

Germany: Former Chancellor Angela Merkel, who helped introduce the country’s controversial “debt brake” into the constitution in 2009, has written in her memoir that she now thinks it should be relaxed. The news comes just days after Friedrich Merz, now the leader of Merkel’s center-right Christian Democratic Union, said he could support making the rule more flexible. Since the CDU is currently in the pole position to win February’s parliamentary elections, the statements suggest the politics are moving toward a change in the brake in 2025.

- The debt brake caps new borrowing by the federal government at 0.35% of GDP, adjusted for the economic cycle. It also bars Germany’s 16 individual states from taking on any new debt at all.

- The debt brake has come to be seen as shackling the German economy. For example, some economists believe it has inhibited needed investment in high-return public goods such as infrastructure. Amending the rule could help reinvigorate German economic growth, which in turn would likely give a boost to the broader European Union economy.

Italy: Banking giant UniCredit yesterday launched an all-stock, 10.1 billion EUR ($10.6 billion) takeover bid for domestic rival Banco BPM. If successful, the takeover would create Europe’s third-largest lender by market capitalization. It could also potentially spark a wave of much needed consolidation and efficiency gains in the sector. The takeover bid comes as UniCredit’s effort to buy German lender Commerzbank has gotten a frosty reception.

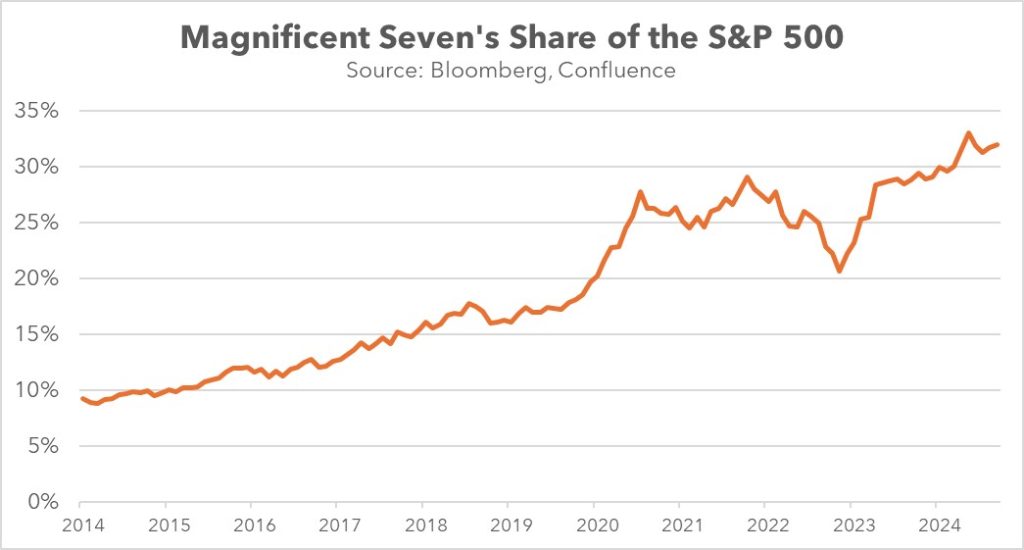

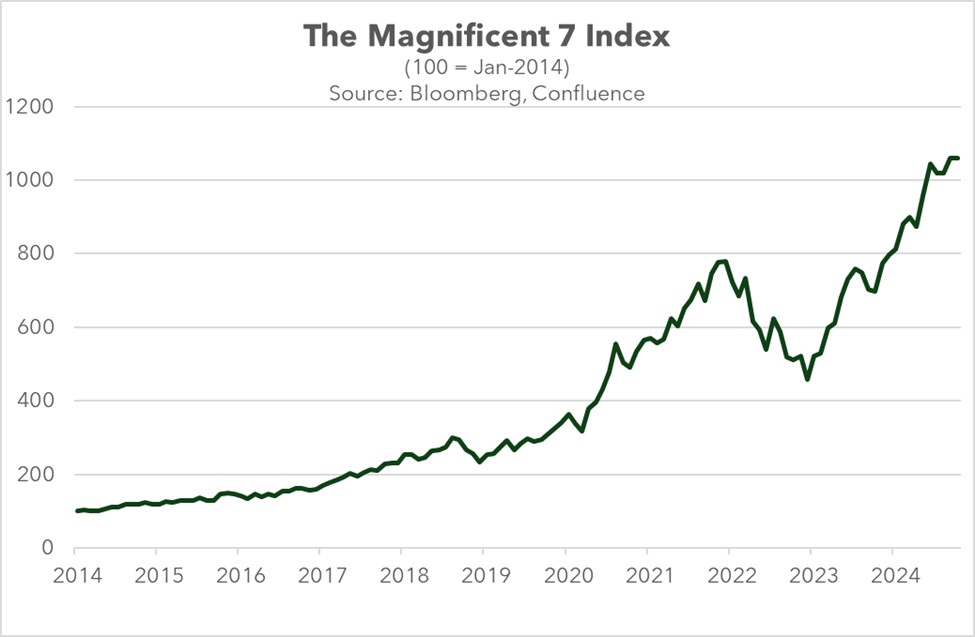

US Stock Market: The Russell 2000 price index of small capitalization stocks yesterday jumped to a new record for the first time in three years, closing at 2,442.03. The index is now up 10.1% since election day and 20.5% for the year-to-date. The recent jump largely reflects optimism over the future impact of President-elect Trump’s likely economic policies. As we have argued in the past, we also think small caps are benefiting as the world fractures into relatively separate geopolitical and economic blocs — a trend that is fostering US re-industrialization.

US Economy: The American Farm Bureau has released its annual estimate of the cost of a Thanksgiving dinner for 10 people, and the figure comes to just $58.08, down 5% from last year. Adjusted for inflation, that’s one of the cheapest Thanksgiving dinners since 1982. The estimate assumes a dinner of turkey, cranberries, sweet potatoes, pumpkin pie mix, and more. Apparently, the estimate doesn’t include the nice wine, like a Zinfandel or German Riesling, that this author will be sipping alongside his turkey and stuffing!

Global Health: New research shows global rates of HIV infections and deaths related to the virus dropped sharply between 2010 and 2021. New infections fell almost 22% globally in the period, to 1.65 million, and HIV-related deaths decreased nearly 40%, to 718,000. The declines are largely attributable to new drugs and better prevention methods against the disease, which has killed some 40 million people since 1980 and was once seen as a virtual death sentence.

The Daily Comment will go on hiatus beginning Wednesday, November 27, and will return on Monday, December 2. Confluence wishes everyone a Happy Thanksgiving!