by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment begins with the recent shift in US foreign policy toward increased interventionism, with a focus on Cuba. We also examine the finalization of the TikTok deal, the cooling of trade tensions between the EU and US, and the progress of the ongoing Ukraine-Russia peace talks. As always, we include a comprehensive roundup of essential economic data from the US and global markets.

Regime Intervention: Recent indicators suggest that the US government is poised to deepen its involvement in the Western Hemisphere over the coming months. A recent Wall Street Journal article highlights that the Trump administration is specifically targeting the Cuban government for removal before year’s end, as it has been emboldened by recent regional shifts. This policy is part of a larger effort to dismantle China’s growing presence in the Americas, marking a decisive pivot from traditional diplomatic engagement to a more transactional and assertive foreign policy.

- According to the report, Cuba’s political and economic situation has reached its most fragile point since Maduro was taken to the US. It has been speculated that the economy may be on the brink of collapse and is struggling to provide basic goods and medicine amid constant blackouts. Analysts believe this crisis could force the government into a political deal that would require moving away from its communist system toward a more democratic model.

- The initiative to dismantle the Cuban government appears to be the cornerstone of a long-term strategy to reshape the Western Hemisphere. The White House views the recent ouster of Nicolás Maduro as a solid proof of concept, demonstrating that the US can effectively engineer the transition of adversarial foreign governments. The objective is to force a new government to distance itself from Chinese influence while opening the island’s markets to American investors for the first time in decades.

- The White House’s new approach marks a definitive end to the era of the “benevolent hegemon.” In its place is a more assertive and transaction-based foreign policy. The US appears to be moving away from the soft-power goals of collaboration and regional stability, signaling to the world that future alliances will primarily be quid pro quo, with diplomatic moves measured by their direct benefit to US interests.

- This trend is exemplified by the recent establishment of the Board of Peace (BoP), a US-led international organization that serves as an alternative to the United Nations. Under its draft charter, countries can secure a permanent seat by contributing $1 billion to fund the charter. The board is structured with an Executive Board of US officials and is chaired for life by Donald Trump, granting him sweeping authority over its agenda and membership even after his presidency concludes.

- Market volatility has so far remained relatively low, as US actions have provoked more rhetoric than concrete retaliation. The absence of military confrontation and only a few isolated economic challenges have allowed markets to largely look past geopolitical tensions. The critical risk for investors is a change in this status quo. The formation of a coalition capable of mounting a serious economic or strategic challenge could trigger a sharp and prolonged rise in market instability.

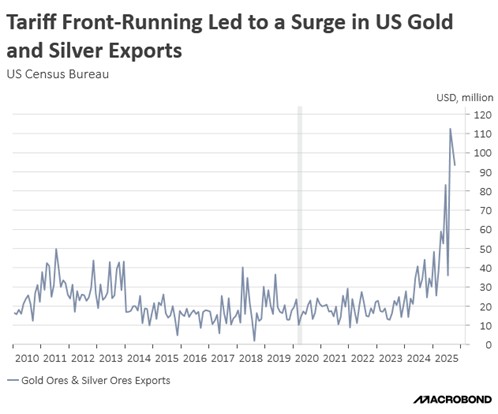

- This environment is likely to favor commodities, as escalating tensions prompt nations to accelerate resource accumulation and stockpile precious metals like gold. Furthermore, the outlook for the aerospace and defense sectors remains highly favorable; global powers are expected to ramp up military expenditures significantly to safeguard their interests and deter emerging foreign threats.

TikTok Deal Done: The White House has finalized a deal to transfer key parts of TikTok’s US operations to a consortium of American investors. The agreement concludes a protracted saga that began with a proposed ban of the app over national security concerns. While its Chinese parent company, ByteDance, will retain ownership, the deal leases TikTok’s core content algorithm to the US entity, allowing it to be retrained and managed domestically. This arrangement signals a de-escalation in tensions between the US and China over tech concerns.

Bank of Japan: The Japanese central bank held its key rate steady at 0.75% in its latest meeting as it takes its time with tightening monetary policy. The bank’s outlook showed that policymakers expect growth and inflation to pick up over the coming months, suggesting it still plans to normalize policy after years of an accommodative stance. However, central bank officials indicated that next moves will be dependent on changes in the global economy, with the possibility of a slowdown leading the bank to moderate its pace of tightening.

EU-US Trade Resumes: EU lawmakers are expected to continue ratifying the US trade deal after having put it on hold following tensions over Greenland. The decision comes after the bloc expressed satisfaction with the White House’s reversal on its tariff threats. As a result, the European Parliament is expected to vote on the agreement in the coming days. This suggests that tensions between the two sides are starting to de-escalate as they look to finalize the arrangement.

Intel Slips: Concerns about a potential wafer supply crunch led to a sharp sell-off in Intel stock. While the company reported strong earnings, its outlook was bleak as the chipmaker claimed it may be unable to secure the memory chips needed to complete its orders. These concerns mirror those of Samsung, which noted weeks ago that competition for chips has led to an increase in costs that are being passed on to consumers. We are now seeing signs that AI-driven demand is beginning to drive up the prices of consumer discretionary goods.

Ukraine-Russia Deal: The White House is meeting with Russian and Ukrainian negotiators to help work out the final details of a peace deal. The focus appears on the Donbas region, where Russia controls about 90% of the territory, as Ukraine remains unwilling to cede land that Russia does not yet have in its control. These final talks suggest an agreement is within reach, potentially setting the stage for a post-war recovery. This deal could mean that these resource-rich regions will begin to boost exports, which would place downward pressure on grain and oil prices.