by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Happy Halloween! Markets are currently digesting the latest inflation data as investors gauge the Federal Reserve’s next move. In sports news, the Los Angeles Dodgers clinched a World Series victory over the New York Yankees. Today’s Comment will delve into a detailed analysis of the recent GDP data, explore the challenges faced by Big Tech companies in scaling data center infrastructure to meet AI demands, and provide a brief overview of the UK’s recent budget. As always, the report will conclude with a roundup of international and domestic data releases.

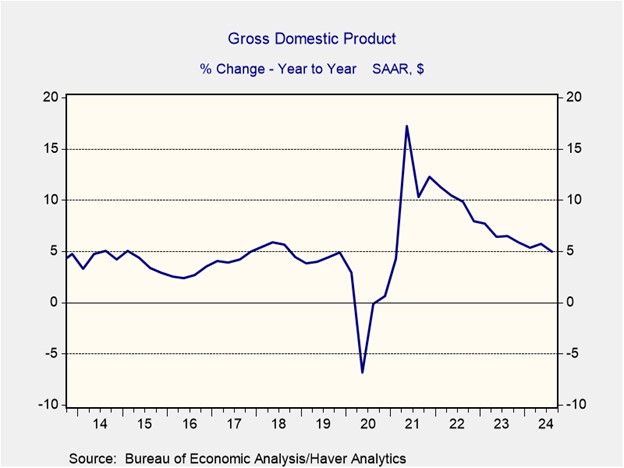

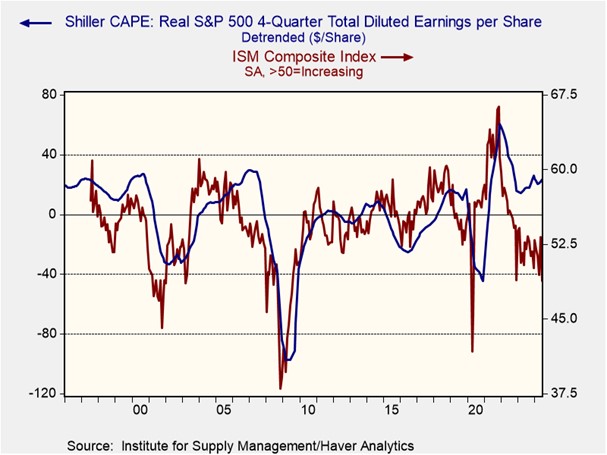

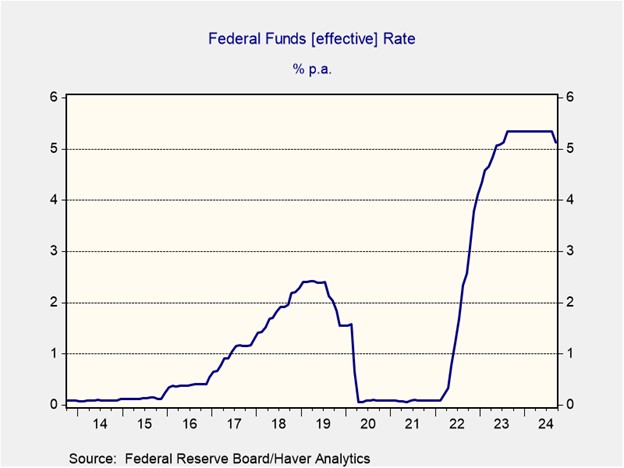

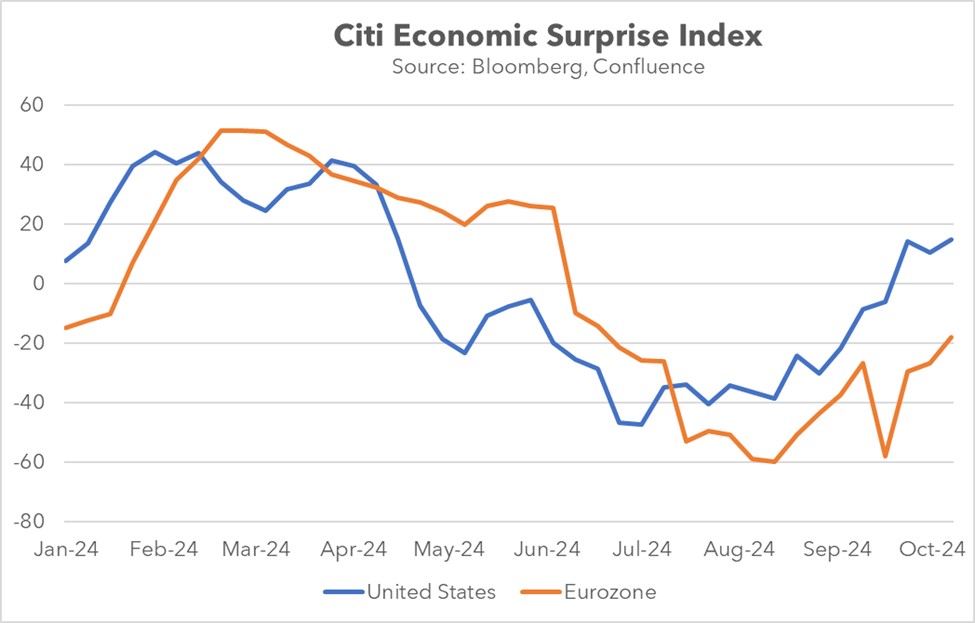

GDP Resilience: The robust economic growth observed in the third quarter has complicated the Federal Reserve’s decision-making process regarding potential interest rate cuts.

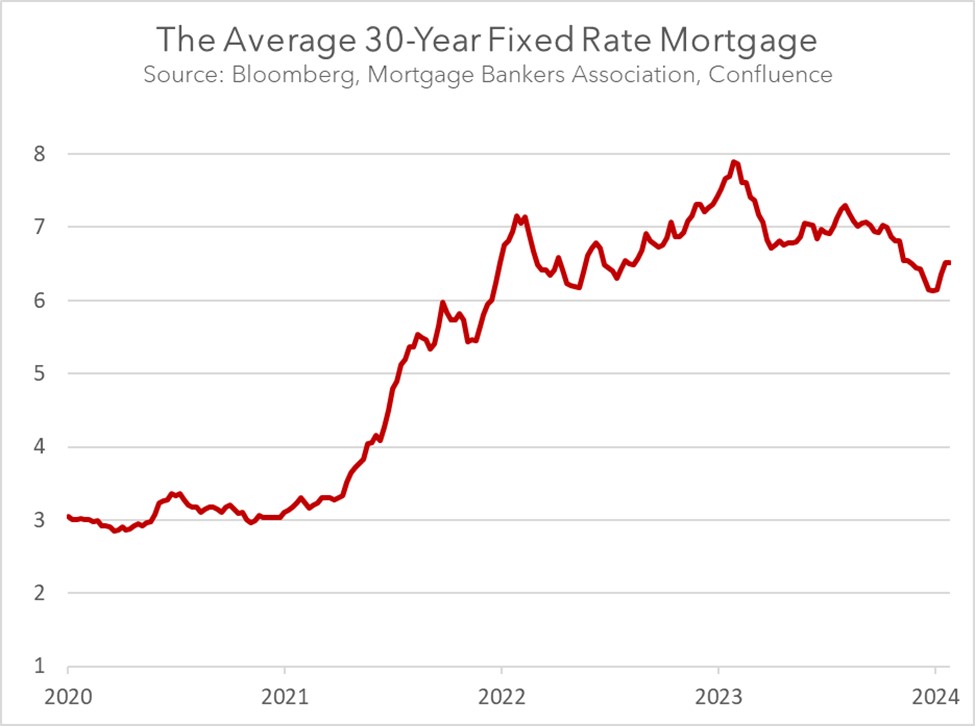

- US GDP expanded at an annualized rate of 2.8% in the third quarter, marginally missing the projected 3.0%. Strong consumer spending and government expenditures were the primary growth drivers. Consumer spending accelerated from 2.8% to 3.7% annualized, led by a surge in nondurable goods purchases. Additionally, increased defense spending contributed nearly 20% to overall growth. However, investment, particularly residential spending, contracted from the previous quarter as elevated interest rates continue to act as a drag to economic output.

- While third-quarter growth was robust, its sustainability remains uncertain. Precautionary spending, likely driven by concerns over a potentially prolonged port worker strike on the East and Gulf Coasts, may have pulled forward much of the anticipated consumption for the coming quarter. Additionally, the surge in defense spending, largely driven by escalating tensions in Ukraine and the Middle East, may be a one-time event. Consequently, the latest report may still provide a complicated picture for the Fed when it is deciding whether it is appropriate to adjust policy rates.

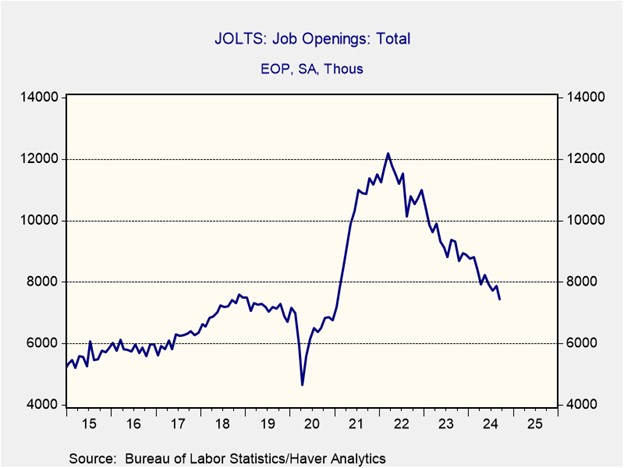

- The Federal Reserve’s decision on whether to cut rates will likely hinge on Friday’s jobs report. In its previous meeting, the Fed revised its year-end unemployment rate expectation upward from 4.1% to 4.4%. Given that the unemployment rate has since declined from its 2024 peak of 4.3% to 4.1%, a significant rate cut this month is highly improbable. However, a pause in rate hikes remains a distinct possibility, especially if the unemployment rate continues its downward trend, given the recent strength of economic data.

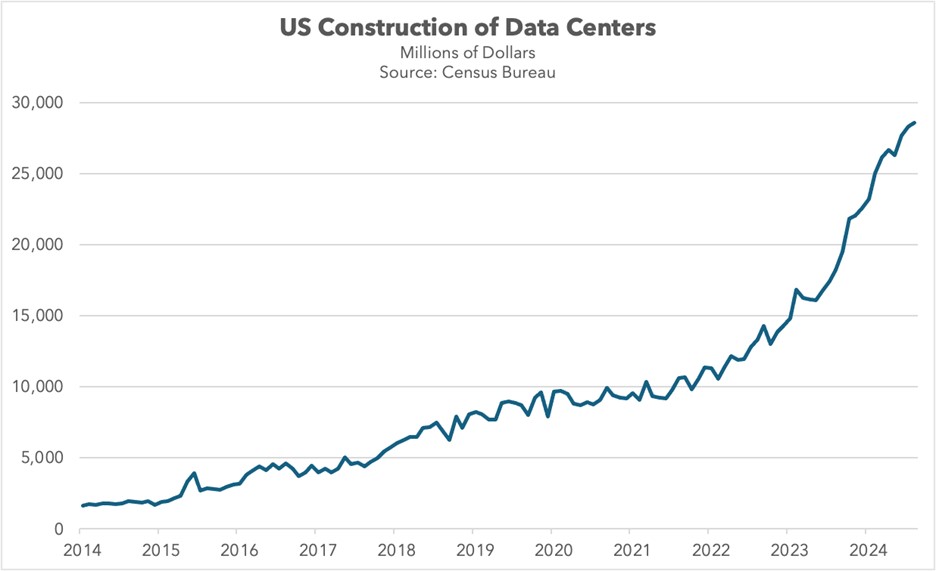

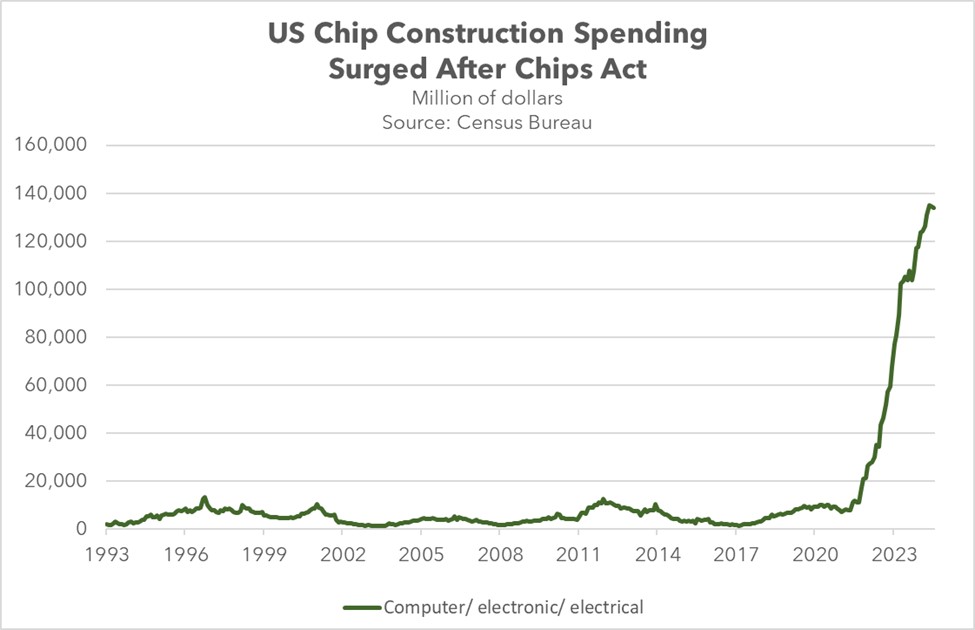

Data Centers on the Rise: The limited supply of data centers is preventing tech companies from being able to capitalize on the rising demand for AI.

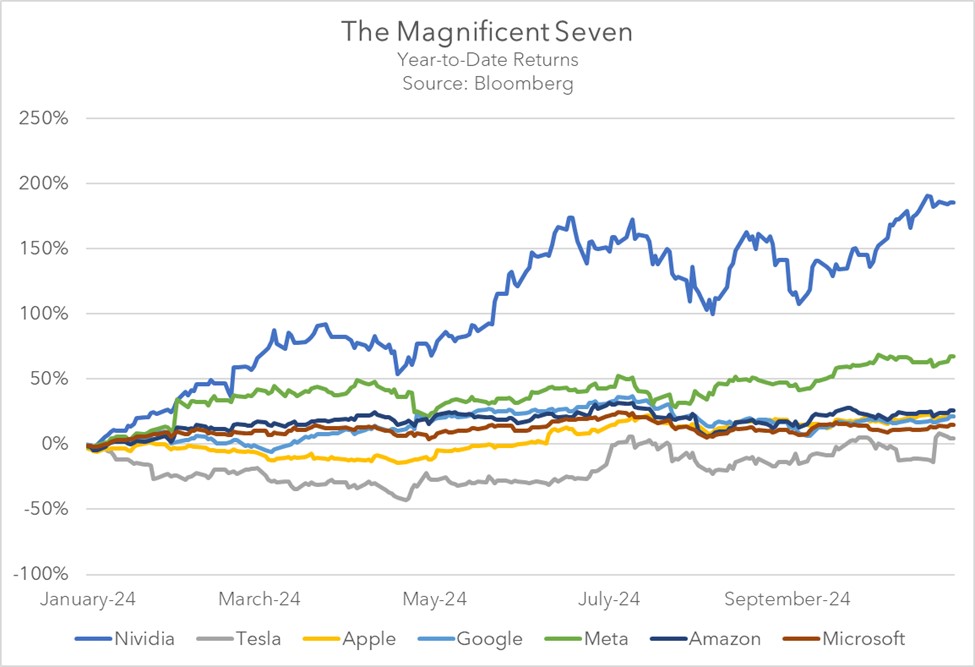

- Microsoft and Meta have recently warned that their limited data center capacity could hinder revenue growth in their cloud businesses. This outlook has dampened investor sentiment towards both companies, as it implies a need for increased capital expenditures to expand their infrastructure. Consequently, both companies experienced a decline in their share prices, despite reporting relatively strong revenue growth in the third quarter. Investors are concerned about the long-term profitability of these companies, given their consistently upward revised spending forecasts that have outpaced revenue guidance.

- Building out data center capacity has proven challenging, as construction projects have faced significant pushback from local communities. These communities often cite concerns about noise pollution, land use, and limited job creation. Many towns across the country have been reluctant to approve data center construction projects. Additionally, the energy intensity of these facilities has become a concern, as utility companies struggle to build out the necessary infrastructure to meet the demand. These challenges will limit tech companies’ ability to expand their data center capacity.

- While the demand for data centers continues to grow, the ability to build them at scale is facing significant challenges. This could hinder the growth of major tech companies as they seek to expand their infrastructure. Although this may not entirely derail revenue growth, it suggests that the path to profitability may be more arduous than many investors anticipate. Given that the future profitability of large tech companies is already largely priced into their stock prices, we believe investors may find more attractive opportunities in other sectors, particularly those with limited exposure to AI.

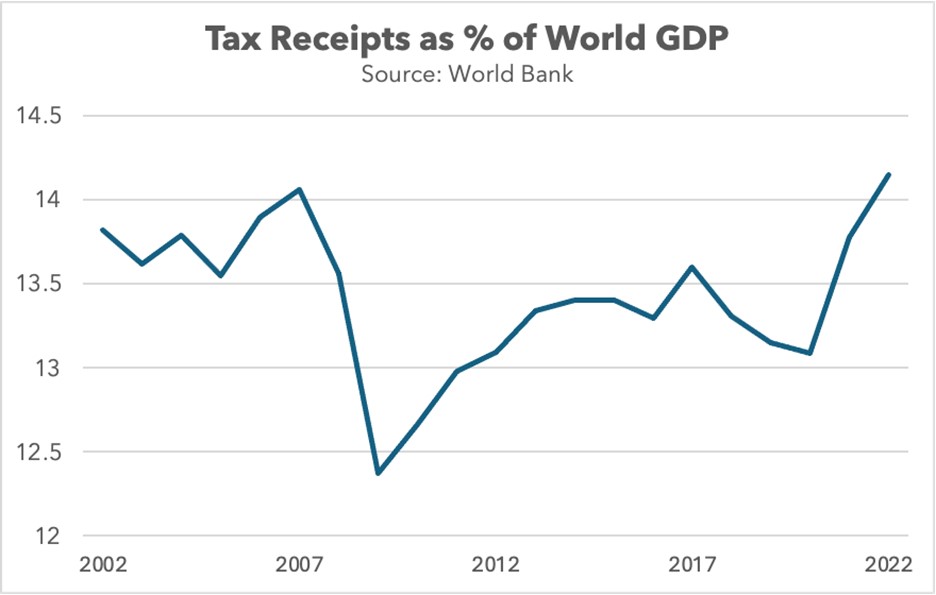

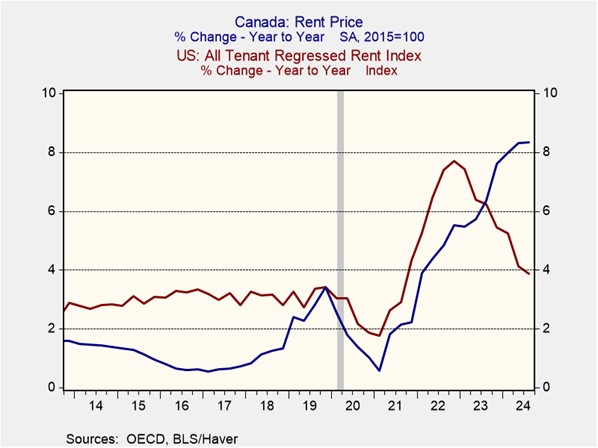

UK Budget: The Labour Party delivered its budget proposal to mixed fanfare.

- The new budget proposal aims to generate nearly $52 billion in additional tax revenue by the end of the decade. Over half of this revenue would come from an increase in the National Insurance payroll tax, with additional taxes levied on inheritance and capital gains. The budget also seeks to boost long-term growth through increased spending on infrastructure and research and development. While the market’s initial reaction was negative, it was far from a panic. On Wednesday, the 10-year UK gilt yield rose 18 basis points, and the pound sterling (GBP) modestly weakened by 0.4% against the US dollar.

- While the recent budget averted another “Liz Truss Moment,” it has raised concerns about the UK’s economic growth outlook for the coming quarters. The National Insurance payroll tax levy, in particular, has drawn significant criticism. A left-leaning think tank estimates that this tax increase will limit the real weekly wage to approximately $17 higher by the end of 2028, compared to two decades ago. However, this projection assumes that businesses will pass on the tax burden to consumers and workers to protect their profit margins.

- Governments worldwide are increasingly recognizing the need to generate additional tax revenue to offset pandemic-related spending. While some countries may be able to increase funding through robust economic growth, others, like the UK, may need to rely on higher taxes to balance their budgets. The recent UK budget proposal indicates that the government does not believe that growth alone will suffice to close the fiscal gap. While we expect the new proposal to have long-term benefits, we believe that long-term bonds could present an attractive investment opportunity if the plan is successful.

In Other News: Factory activity in China strengthened for the first time in six months, in a sign that the economy is starting to show signs of life. Volkswagen is demanding that its workers take a 10% pay cut as it looks to avoid having to make layoffs. North Korea conducted its longest ever ballistic missile test flight time in a sign that the country is looking to assert itself no matter who wins the US election in November.