by the Asset Allocation Committee | PDF

- Our three-year forecast includes balanced economic growth, albeit at a slower pace than recent experience, and inflation settling above the Fed’s target rate.

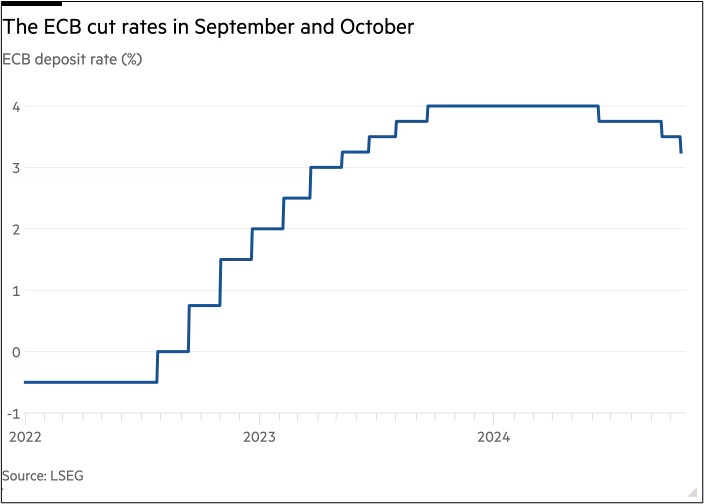

- The Fed is expected to continue easing at a measured pace over the next year.

- We initiated a position in long-duration, zero-coupon Treasurys as a stabilizer amid potential global policy uncertainty and default risks.

- We continue to favor small and mid-cap domestic equities which offer appealing valuations and growth prospects relative to large caps.

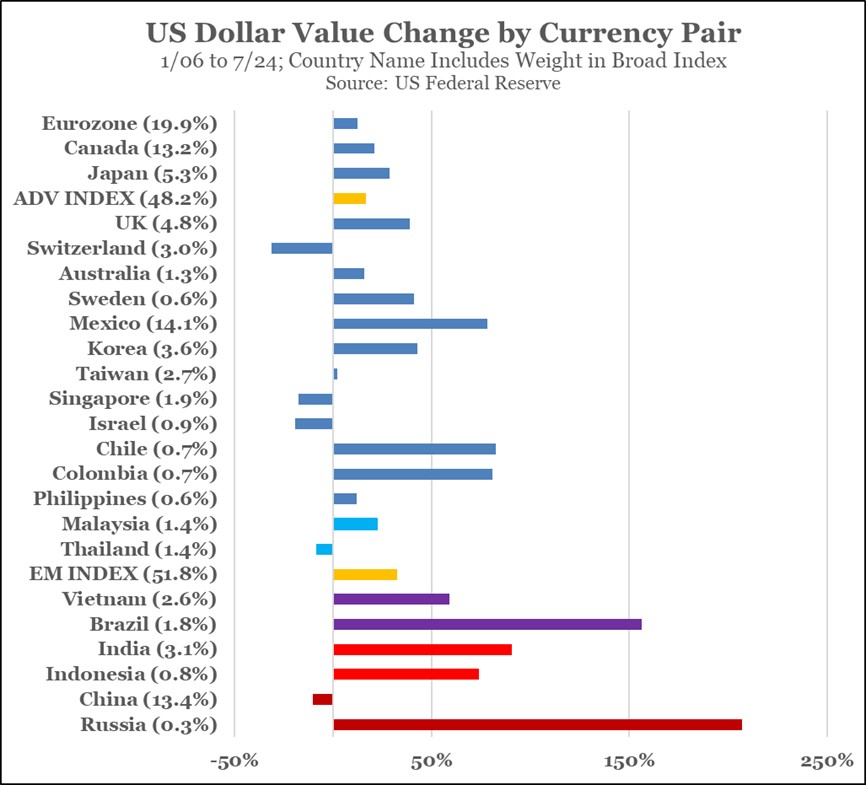

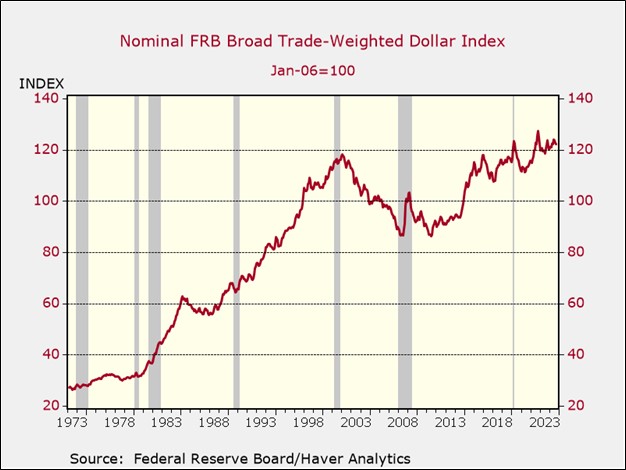

- International developed equities remain in the portfolios, but we avoid emerging markets due to heightened risks.

- We preserve an allocation to gold as a hedge against geopolitical risks, with an allocation to silver where risk appropriate.

ECONOMIC VIEWPOINTS

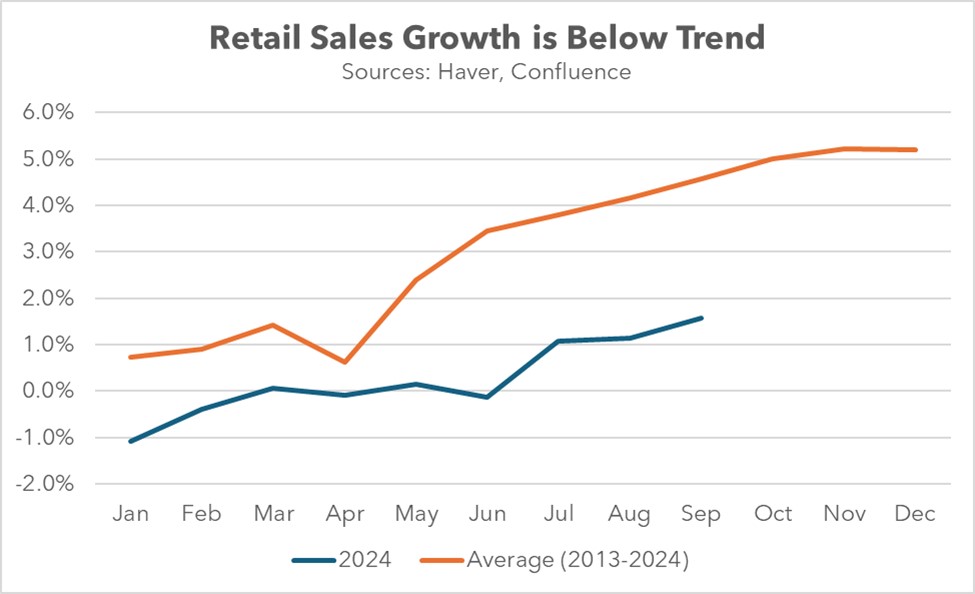

Recent economic growth has been bolstered by a strong labor market, fiscal stimulus, and resilient personal consumption. We expect fiscal spending and continued strong labor markets to sustain growth during the beginning of the forecast period, both of which would support the consumer. While the overall business spending and personal consumption sentiment has been generally optimistic, momentum is slowing at the margin. The latest GDP report highlights that a part of the recent expansion stems from drivers that may be short-term in nature, such as inventory build-up ahead of a potential port strike. As we look ahead, we expect the labor market and consumption to be supported by easing monetary policy and lower inflation. The heightened uncertainty surrounding immigration policy could lead to a scenario where labor markets remain tight, which would continue to bolster household incomes. However, toward the end of the forecast period, consumption could moderate and potentially lead to increased uncertainty in the labor markets.

This first chart shows that while civilian unemployment, shown in red, has remained subdued at 4.1%, we are seeing some weakness with part-time work for economic reasons, shown in blue, ticking higher. Wage growth momentum has moderated but remains elevated compared to the pre-pandemic decade. It is worth noting that job openings have fallen as companies anticipate slower expansion, and a notable increase occurred in the long-term unemployed (27 weeks or more), which we anticipate will also be a drag on the labor markets.

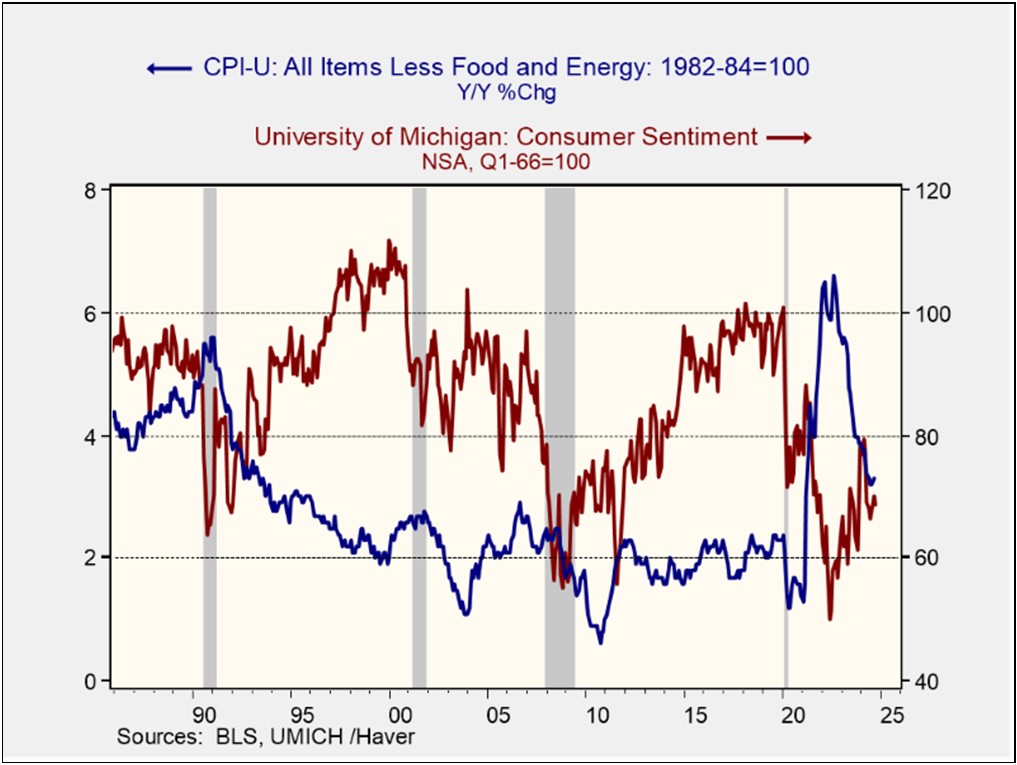

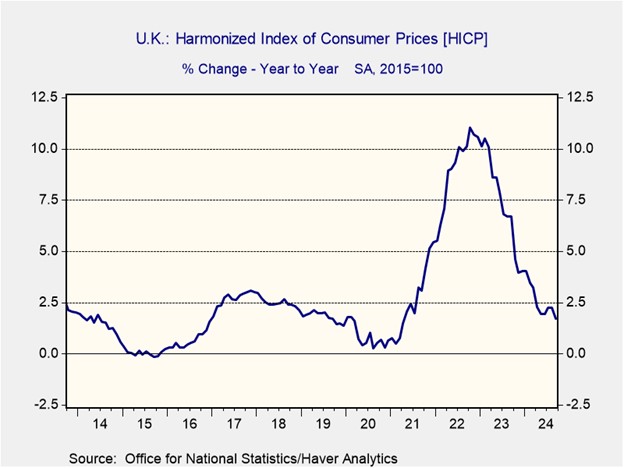

While the Fed’s 50 bps rate cut and expectations for further easing support the expansion, high prices and relatively low rates of savings have made consumers more frugal. Such economic uncertainty has the potential to lead firms to delay investment and households to postpone buying big-ticket items, actions which we have already seen to a degree. Consumer sentiment, shown in red on the second chart, has improved since inflation, in blue, receded from its cyclical peak in 2022. We expect consumption to moderate as households have depleted their stimulus-driven savings and have grown more concerned about future job prospects.

Additionally, the favorable tax treatments for individuals in the Tax Cuts and Jobs Act of 2017 are due to sunset at the end of 2025. While each of the presidential candidates has shown support for extending at least some part of the tax act for individuals, tax policy cannot be unilaterally controlled by the president. To extend these tax cuts, both houses of Congress must pass legislation. While individual tax breaks are set to expire, most of the favorable corporate tax treatments, including the reduction of corporate tax rates from 35% to 21%, do not sunset.

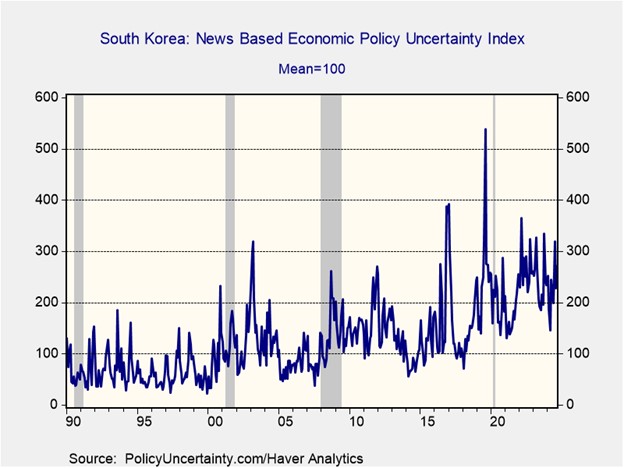

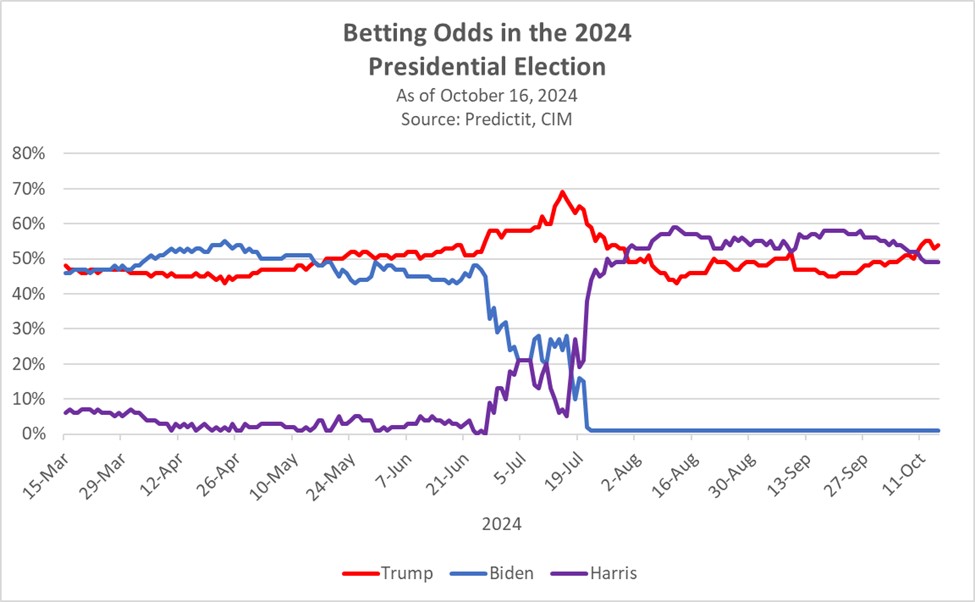

The US presidential election will take place this quarter, and while highly publicized, these elections generally have a limited long-term impact on financial markets. However, given the current political climate, we are taking precautionary measures. We maintain a position in gold as a hedge and have increased our exposure to long-dated Treasurys to mitigate potential risks. Either candidate is expected to govern alongside a divided Congress, which reduces the likelihood of abrupt policy changes.

STOCK MARKET OUTLOOK

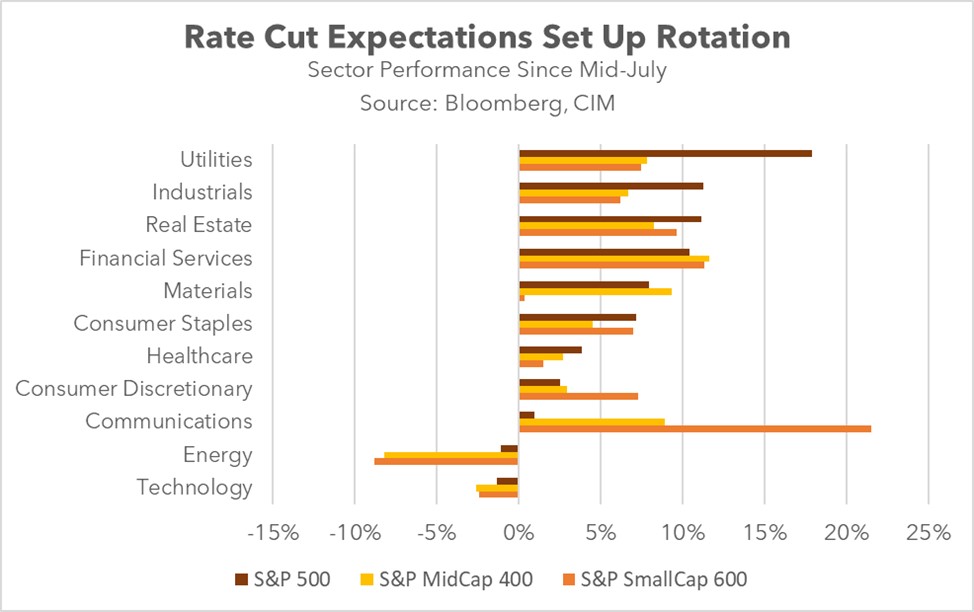

We expect corporate profit margins to remain healthy during the forecast period but we’re closely monitoring earnings quality for signs of potential weakness. With moderate economic growth and stable margins, we are maintaining an even-weight position in equity risk. The record level of cash on the sidelines continues to support valuations as we’ve seen these funds flow into risk assets during market pullbacks. This suggests that investors remain generally comfortable with equity exposure but are mindful of valuation levels. Furthermore, as the Fed continues to ease, lower money market rates may drive more capital into equities.

We are even-weight on the growth versus value style bias. While we recognize the concentration risk in a few prominent growth stocks, we believe current economic conditions will support equities across the board. We’re overweight mid-cap equities due to attractive valuations. While small cap stocks also offer appealing valuations, many small caps face higher sensitivity to debt refinancing. To manage risk and focus on earnings quality, we hold a small cap quality factor position, screening for profitability, leverage, and free cash flow.

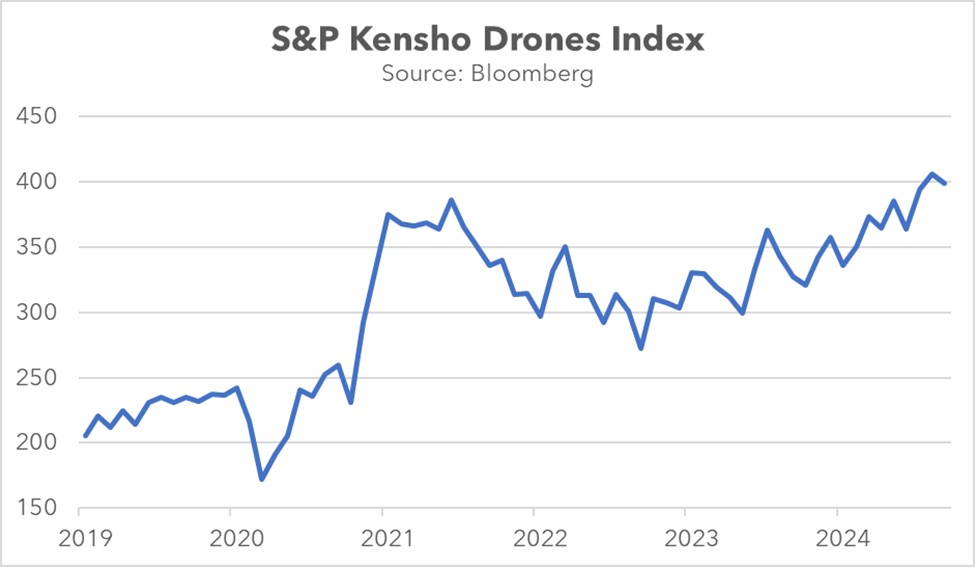

We also maintain an overweight in the Energy sector and uranium miners, driven by Middle Eastern geopolitical tensions and the global energy transition. Our exposure to military hardware and cyber-defense remains a strategic portfolio component.

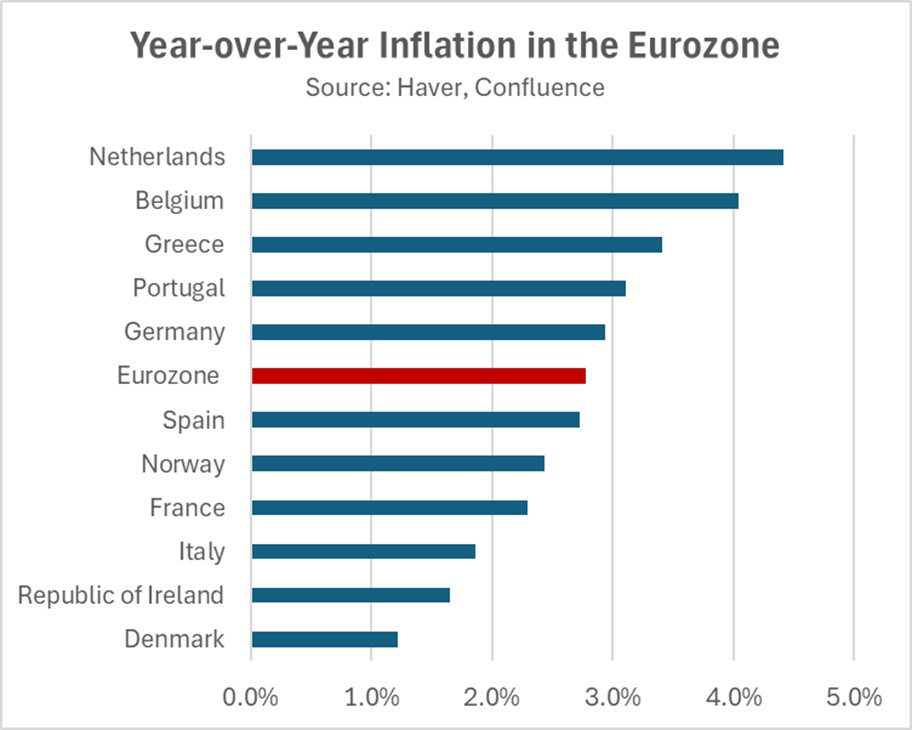

International developed equities remain attractive due to valuation discounts. Many global market leaders in the developed world ETFs are trading at lower valuations compared to US large caps. However, due to concerns about European economic growth, we have reduced developed market exposure in some portfolios. We maintain targeted exposure to Japan, where ongoing shareholder-friendly reforms and continued capital inflows may drive multiple expansion. We continue to exclude emerging market equities despite steep valuation discounts as we believe the risks surrounding Chinese growth outweigh the potential returns.

BOND MARKET OUTLOOK

Expectations for fixed income markets largely depend on inflation trends. While we expect volatility of inflation to remain elevated, the likelihood of a spike to levels experienced in 2022-2023 is slim. Rather, we expect inflation to decline gradually but unevenly from those highs, though we find it unlikely that the Fed will achieve its 2% target level within our three-year forecast period. While this became the target during the period of zero rates of the past decade, we find that a level around 3% is much more likely.

Against the backdrop of inflation expectations, the Fed’s data dependency heralds the prospect for three-month rates to remain relatively elevated compared to two-year rates. This implies that, absent a significant economic shock or a deep recession, the yield curve is more than a year away from returning to a normal, positive slope across all maturities. Accordingly, we find a mix of maturities to be the appropriate exposures in the strategies as the process unwinds. Within sectors, we are underweight investment-grade corporates due to their historical tight spreads. However, we are overweight mortgage-backed securities (MBS), where low refinancing activity has created attractive pricing. Contrasted with investment-grade corporates, speculative grade corporates maintain an attractive spread of nearly +300 basis points. Nevertheless, some caution encourages our preference for the higher BB-rated bonds in this asset class.

Although the majority of the bond exposure in the strategies is in the short to intermediate section of the curve, the combination of heightened geopolitical risk, uncertainty surrounding the US legislative and presidential election outcomes, and resulting potential policy changes leads to the introduction of a modest exposure to long-term, zero-coupon Treasurys in most strategies, the intention of which is to act as a hedge against these risks. A long-duration bond may serve as a ballast against market volatility due to its inverse relationship with interest rates and its role as a stabilizing asset in a diversified portfolio.

OTHER MARKETS

We continue to hold a position in gold across all portfolios. Despite gold spot prices reaching record highs this year, we believe additional Fed interest rate cuts and continued central bank purchases could push gold prices higher. The gold position also offers a strategic layer of protection against volatility, given its historical role as a safe-haven asset during periods of geopolitical instability. In portfolios with higher risk tolerance, silver is retained as a complementary precious metal holding. While REIT valuations have improved and the prospect of lower interest rates should generally benefit the sector, we have ongoing concerns around debt refinancing challenges and property valuations that lead us to avoid this sector this quarter.