by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is currently digesting the latest inflation data as it tries to gauge the Fed’s next move. In sports news, the New York Yankees clinched the AL East title for the second time in three years. Today’s Comment will dive into why chip companies are regaining popularity. We also give our thoughts on why interest rate benchmarks are important to the Fed and explain the impact that China’s stimulus will have on its economy. As usual, the report will end with a roundup of international and domestic data releases.

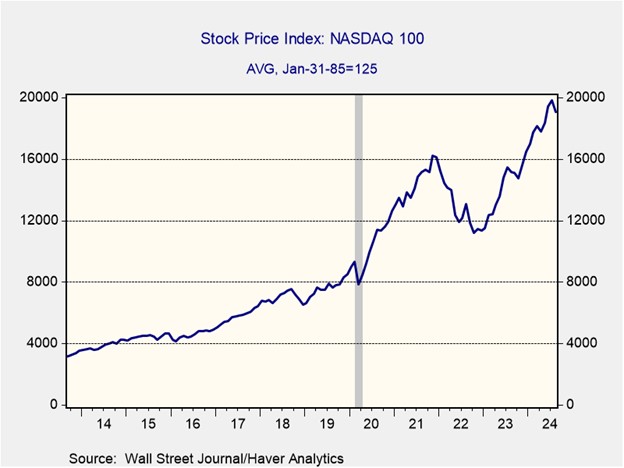

Chips Are Back: Chipmakers received a boost after Micron Technology’s results challenged the notion that the AI rally was fading.

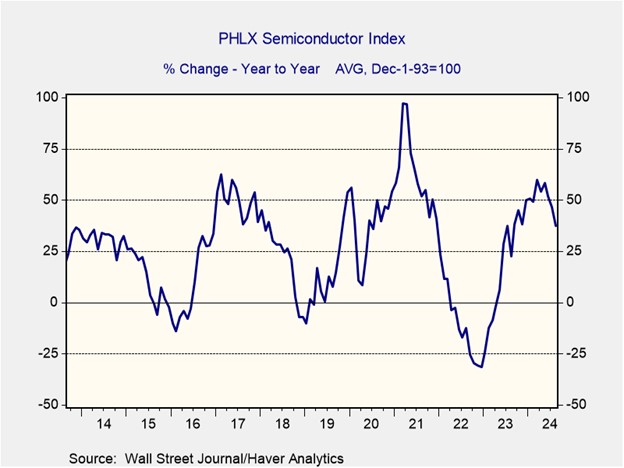

- The US chipmaker announced a 93% year-over-year increase in its earnings for the fiscal year ending August 29. Moreover, the company revised its outlook for future revenue upward, indicating growing optimism about its growth potential in the AI sector. Following the results, the CEO credited the company’s strong performance to high demand for AI-related products. The impressive earnings and guidance sparked a post-earnings rally — the company’s largest since 2011. This positive news also boosted chipmakers broadly, pushing the PHLX Semiconductor Index up 3.5% on Thursday.

- Despite ongoing concerns about valuations in the AI sector, there is clear evidence of continued strong demand for AI technology. Major tech companies like Google, Meta, and Amazon are investing heavily in AI to establish a dominant position in the market. Meanwhile, demand for related products, such as smartphones and personal computers, has led to concerns about a possible chip shortage. Research from Bain Capital suggests that a modest 20% increase in demand could potentially disrupt supply.

- Despite the potential for a decline in current AI hype, we foresee that the underlying demand for AI products will ultimately benefit tech companies. While long-term concerns may emerge, they are unlikely to eclipse the inflated expectations surrounding the technology’s future applications. One of the primary concerns within the AI sector is valuation, as chip and other AI-related stocks still appear overvalued compared to other sectors. Consequently, we anticipate that some of the larger, highly valued companies in the space may experience continued growth, but the momentum is likely to moderate.

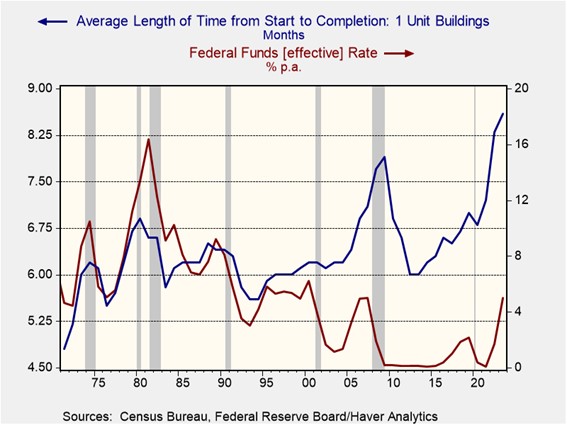

After LIBOR: Despite it being over a year since the shift from London Interbank Overnight Rate (LIBOR) to Secured Overnight Financing Rate (SOFR), Federal Reserve officials remain concerned about potential oversights.

- New York Fed President John Williams announced the establishment of a group of private market participants to oversee the use of interest rate benchmarks across financial markets. The decision comes amid ongoing concerns about the transition from LIBOR to SOFR and its potential impact on interbank lending. Although SOFR has served as a viable replacement for LIBOR, its lack of a component measuring bank funding costs has hindered the central bank’s ability to identify risks within the financial market and compromised its capacity to ensure financial stability.

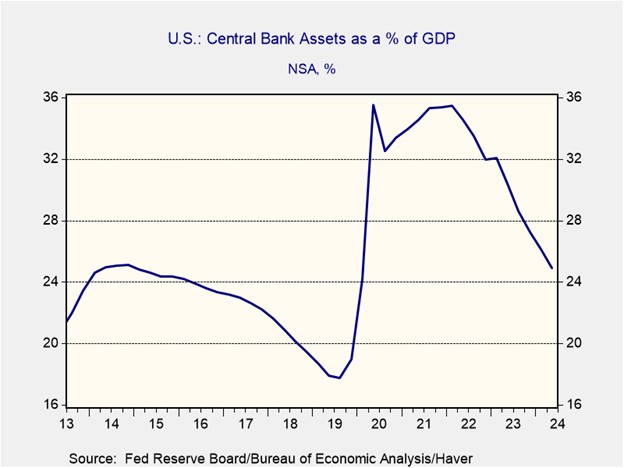

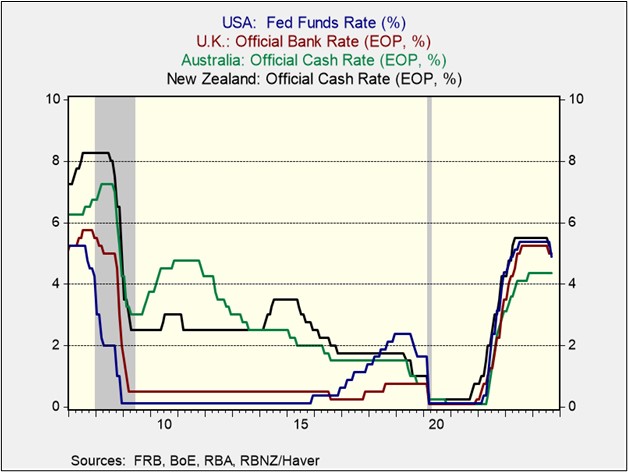

- Increased oversight of reference rates is crucial as the central bank navigates its quantitative tightening program, which aims to shift the central bank’s balance sheet from “abundant” to “ample” reserves. Despite the lack of a definitive benchmark for optimal reserve levels, a previous attempt to reduce reserves resulted in a repo market crisis in 2019. Overnight repo rates skyrocketed due to an excess of Treasury securities and insufficient cash, forcing the central bank to prematurely halt its balance sheet reduction and lower policy rates.

- The establishment of a reference-rate-use committee might indicate that the Federal Reserve is nearing the conclusion of its quantitative tightening policy. The central bank began decelerating its balance sheet reduction in June, aiming to prolong this process for as long as feasible. While a complete cessation of tightening this year seems improbable, 2025 could offer a potential timeline. The end of quantitative tightening may place downward pressure on long-term bond yields, as the Fed would then be able to reinvest some of its holdings and absorb more of the Treasury market supply.

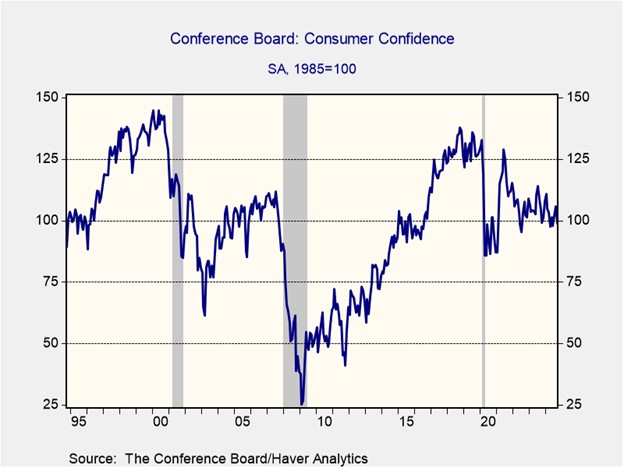

China Brings Out the Bazooka: To counter speculation about its willingness to employ all available economic tools, Beijing announced a new round of stimulus measures.

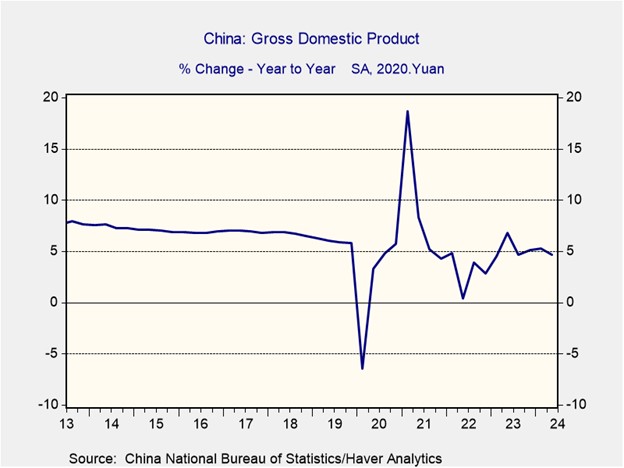

- On Thursday, the Politburo announced its intention to employ fiscal measures to revitalize the economy and bolster the struggling property sector. Although no official figure was disclosed, Reuters reported a planned issuance of $284 billion in sovereign debt. To complement increased spending, Beijing also expressed support for measured risk-taking. Under its “three E” policy, the country would grant immunity to individuals who make mistakes due to inexperience, experimentation, or unintentional errors while striving to promote development.

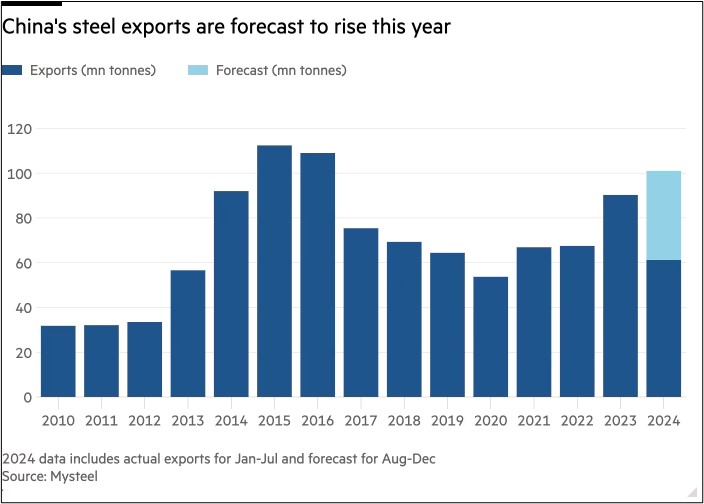

- The shift in policy may be attributed to concerns that the economy was on track to fall short of its growth target. Earlier this month, several investment banks lowered their growth projections for China following the weaker-than-expected second-quarter GDP growth of 4.7% year-over-year. More recent data also reinforces the view that the economy is in trouble. China’s National Bureau of Statistics reported that industrial profits experienced the most significant decline this year, accompanied by a slowdown in overall earnings. The cited cause of this weakness was insufficient market demand.

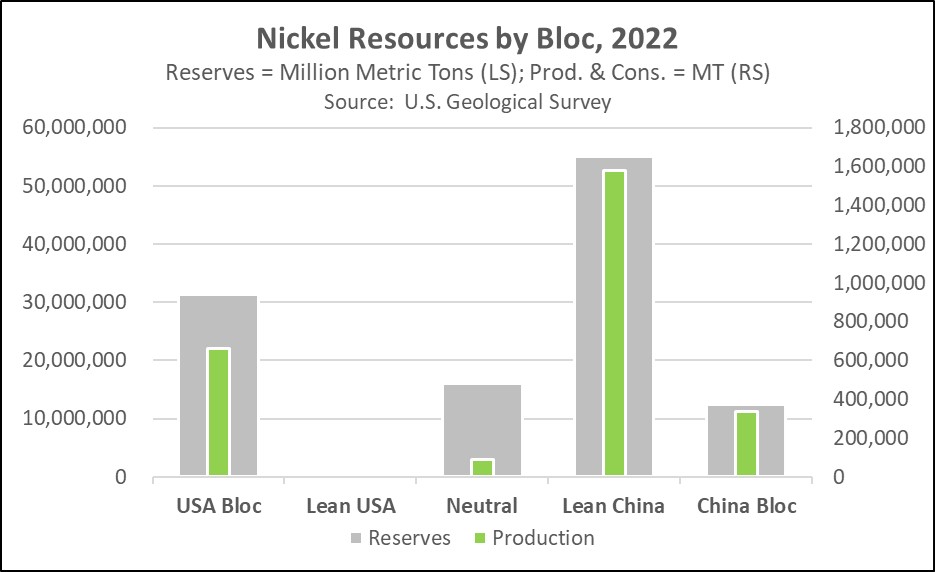

- The additional stimulus should provide investors with confidence that China is willing to pull out all the stops to revive the economy. However, it is unclear whether this will be enough to overcome the challenges known as the five Ds: weak consumer demand, excess capacity and high debt, poor demographics, economic disincentives from the Communist Party’s intervention in the markets, and Western decoupling from trade, technology and capital flows. Although we anticipate short-term improvements in Chinese and European equities, we will closely monitor their long-term performance.

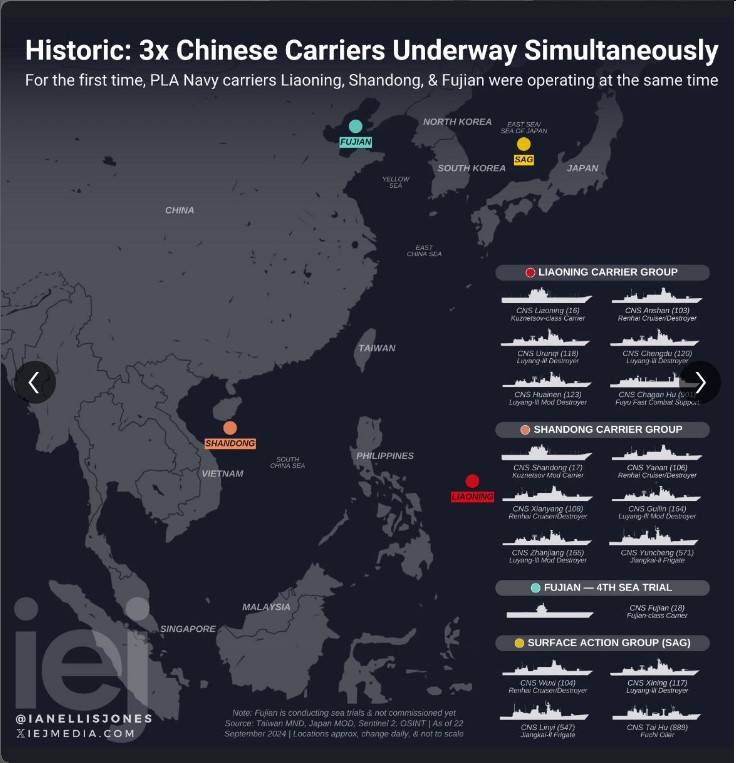

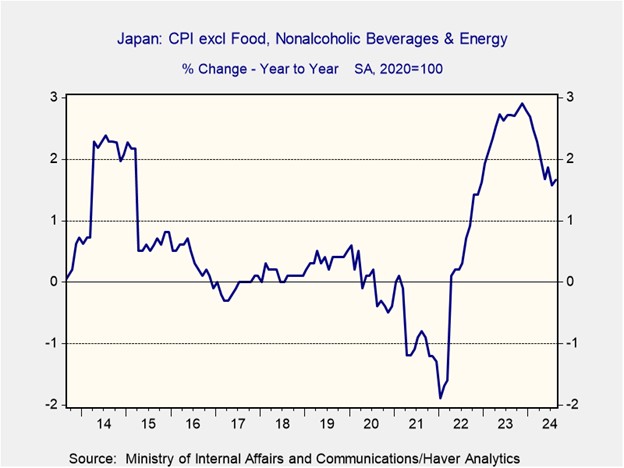

In Other News: President Trump has announced that he is meeting with Ukrainian president Volodymyr Zelensky. The meeting will likely go over how Zelensky plans to end the conflict. China’s nuclear-powered submarine sank, which will likely foster doubts about the country’s military advancements. Shigeru Ishiba will become Japan’s next prime minister after winning the presidency of the ruling Liberal Democratic Party.