by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! S&P 500 futures are higher as investors remain optimistic about a Fed pivot. The USWNT boosted spirits with a crucial victory over Zambia, keeping their Olympic quest for gold alive. Today’s Comment will dissect the latest GDP data and its potential impact on Fed policy, explore why mega-cap stocks are offsetting gains from other companies within the S&P 500, and assess rising trade tensions between the US and Mexico. We’ll conclude with a snapshot of key economic indicators.

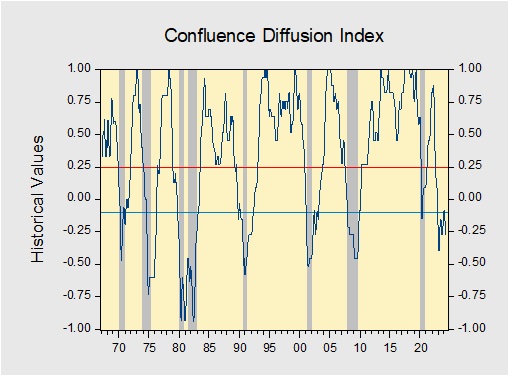

Soft Landing? The US economy is proving remarkably resilient in the face of elevated interest rates.

- In Q2, US Gross Domestic Product (GDP) expanded at an annualized pace of 2.8%, significantly outpacing the prior period’s 1.4% growth and surpassing the projection of 2.0%. This acceleration was fueled by a sharp increase in consumer spending, jumping from an annual pace of 1.5% to 2.3%. Specifically, households capitalized on declining prices by boosting purchases of automobiles and household furnishings. To address weakening demand over the past year, retailers have implemented price cuts on major appliances and motor vehicles.

- While the robust growth figures may temporarily alleviate recession concerns, they do not guarantee sustained expansion. Consumption, driven largely by big-ticket purchases, has propelled growth, but this may mask the underlying economic weaknesses faced by most households. A recent report from the Philadelphia Fed showed that credit card delinquencies have risen to their highest level in nearly 12 years. Moreover, despite a pickup in spending during the second quarter, consumption lagged the 3.0% annual pace recorded in the same period last year.

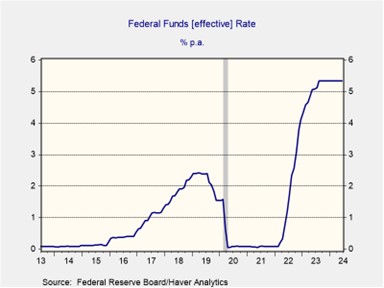

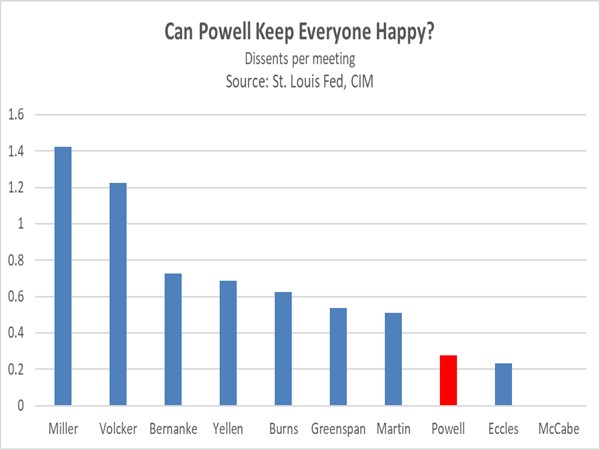

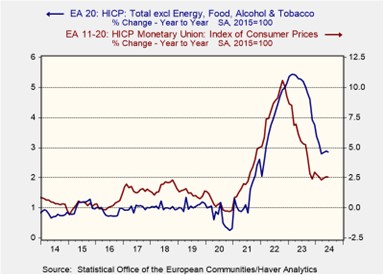

- The robust GDP figures suggest the US economy may be operating in a Goldilocks zone, balancing growth with price stability. This could embolden Fed officials to maintain their current interest rate stance to avoid the risk of prematurely loosening policy only to reverse course later. While inflationary pressures have remained surprisingly subdued in recent months, concerns persist about a potential resurgence similar to the first quarter’s spike. Although a July rate cut cannot be entirely ruled out, a pause until the Fall meetings seems more probable.

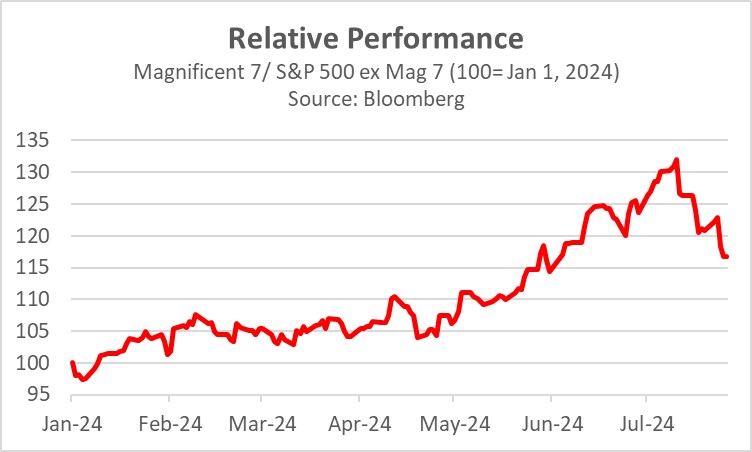

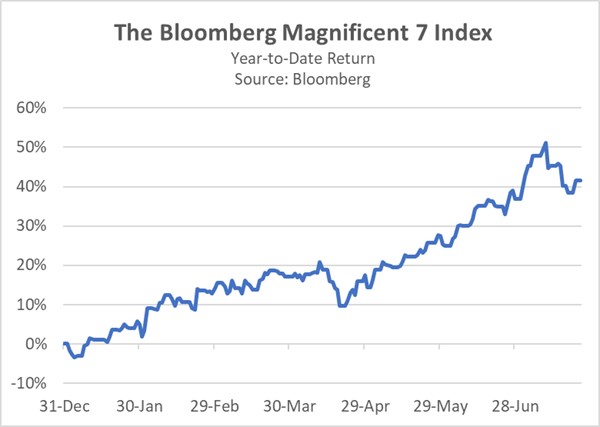

The S&P 493: While the S&P 500 has declined sharply this month, most of the losses have been concentrated among the Magnificent 7 (M7).

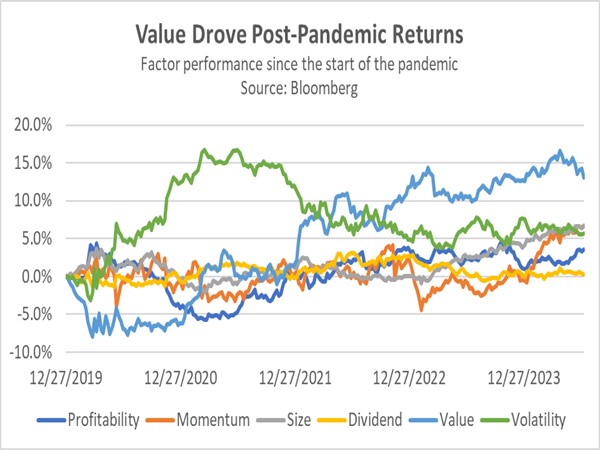

- In July, the stock price index for the Magnificent 7 declined by 6.5%, while the remaining 493 within the S&P 500 increased by 1.2%. This divergence began in mid-July following the CPI report, which indicated that month-to-month inflation turned negative for the first time since 2020. The gap expanded over the past two weeks as investor skepticism intensified regarding the pricing of large-cap tech firms and the profitability of AI initiatives.

- The recent pullback is benefiting the broader market, which has become heavily concentrated over the past two years. Despite a decline in the index, nearly 300 S&P 500 companies have advanced, with industrial and financial services leading the way. These companies’ performances were overshadowed by the dominance of the Magnificent 7, which collectively account for nearly a third of the index. The relative performance of the M7 and the other 493 companies shows that mega-cap companies have lost a lot of ground to their smaller, large-cap peers.

- While the recent rotation away from big tech has gained popularity, it has been anything but smooth sailing. The VIX Index, a measure of market volatility, has surged to its highest level in three months and currently hovers just below 20, indicating heightened investor anxiety. The index may begin to cool over the coming months as investors gain greater certainty about the path of interest rates and the likely winner of the presidential election. As a result, investors should be careful not to overreact to sudden changes in the market.

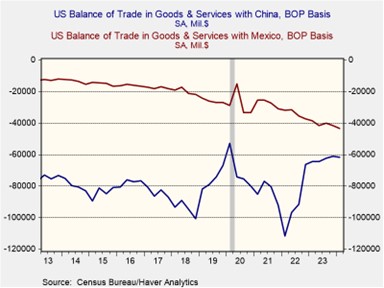

US vs Mexico: Concerns about a potential trade war with the US have cast doubts on Mexico’s ability to capitalize on nearshoring opportunities.

- Earlier this week, Mexican President Andrés Manuel López Obrador (AMLO) dismissed threats stating that the US would consider banning cars made in Mexico. His comments followed remarks made by Tesla CEO Elon Musk, who said that his company is putting plans to build a factory in the country on hold until after the US election due to political uncertainty. Musk was referring to former President Trump’s pledge to impose tariffs on Mexican-made cars due to concerns that Mexico was aiding China’s efforts to evade tariffs by building factories there.

- The dispute over tariffs unfolds amid a deepening economic interdependence between the United States and Mexico. In recent years, the US has dramatically increased its reliance on Mexican goods, surpassing China as its top import source in 2022. Concurrently, Mexico has experienced a surge in foreign direct investment (FDI), including from China, as businesses seek to establish supply chains closer to the US market to mitigate geopolitical risks. According to the United Nations Conference on Trade and Development (UNCTAD), Mexico ranked as the world’s ninth largest FDI recipient.

- It is important to note that Trump had a relatively good relationship with AMLO during his first term in office. Despite his initial skepticism about Mexico, Trump ultimately bridged his differences in order to play a pivotal role in renegotiating NAFTA, now known as USMCA. This collaboration suggests that there may be some validity to AMLO’s claims that concerns about tariffs on Mexican cars are being overblown. Nevertheless, the dispute over China is likely to remain a significant source of tension between the US and Mexico, regardless of the November election outcome.

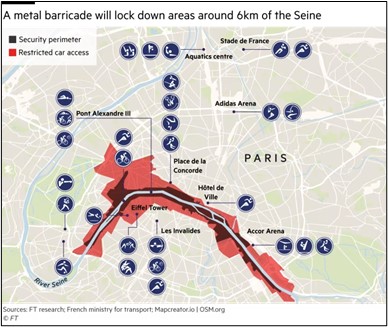

In Other News: North Korean hackers are intensifying cyberattacks targeting US military secrets amid renewed nuclear ambitions. This escalating digital threat underscores a growing risk to US national security. Separately, a cyberattack crippled France’s railway system just hours before the opening ceremony of the Olympics. The attack raises concerns about other possible disruptions during the event. Barack and Michelle Obama endorsed Kamala Harris as the Democratic nominee for president, which is a further sign that the party has rallied around a candidate.