by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! S&P 500 futures are off to a modest start. In sports news, Caitlin Clark broke the WNBA assist record. Today’s Comment will discuss the recent massive tech outage, the overperformance of small caps relative to large caps, and our thoughts on China’s Third Plenum. As usual, our report ends with a roundup of international and domestic economic releases.

Cybersecurity Concerns: A seemingly innocuous software update exposed serious vulnerabilities in our critical infrastructure.

- On Thursday, a massive tech outage caused IT systems around the world to shut down. The system failure impacted companies across many industries, including airlines, banks, and emergency services. The source of the disruption appears to be related to a system update by cybersecurity software company CrowdStrike. The company has since found a fix for the problem, and users of macOS and Linux were not affected. However, it is unclear when all systems will return to normal following the outage.

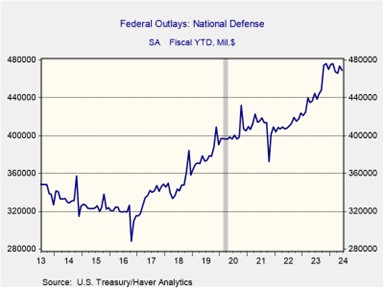

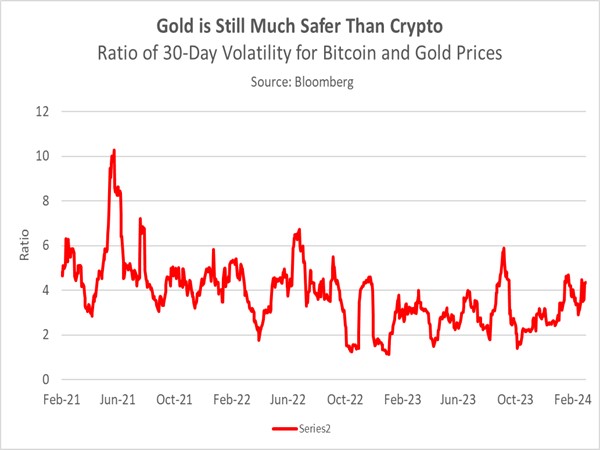

- Despite CrowdStrike’s assurances that the outage wasn’t caused by cyberwarfare, the event highlights vulnerabilities to cyberattacks. The recent surge in attacks, which picked up around 2020, has shown no signs of slowing down. The hacking of auto software provider CDK Global serves as a stark example of this growing threat. The global cost of cybercrime is expected to surge from $8.15 trillion in 2023 to over $13.8 trillion by 2028. The increase is likely to be shared by governments as they look to prepare for the new form of war that relies less on direct combat and more on sabotage.

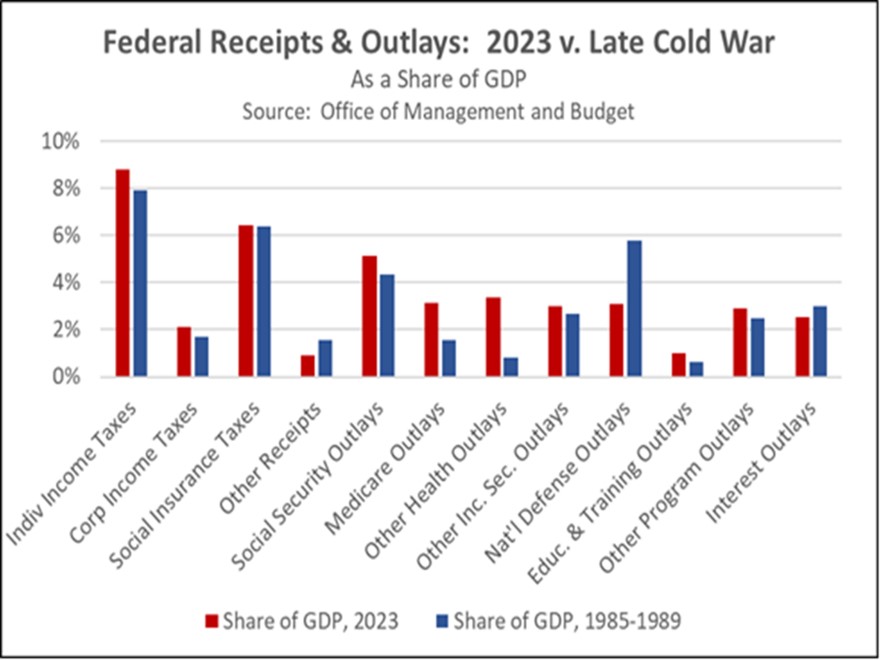

- Building on our previous analysis, we expect US government spending to increase regardless of the outcome of the 2024 election. Although Republican presidential candidate Donald Trump has mentioned cuts to foreign aid if he wins, he has consistently advocated for improving US defense spending. We anticipate that his administration could reallocate funds to provide more support for the US Department of Homeland Security. Consequently, defense companies, particularly those specializing in cybersecurity, may have significant upside potential in the coming years.

Shifting Gears: Investors are moving into small caps as the market continues to price in the possibility of a rate cut in September.

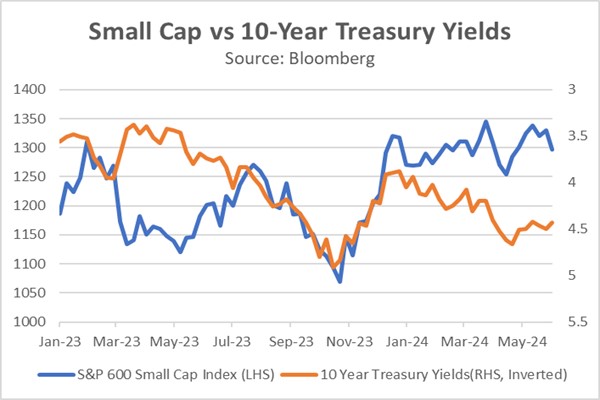

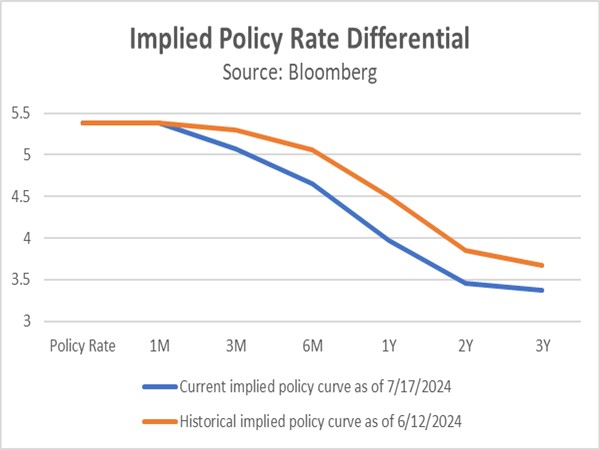

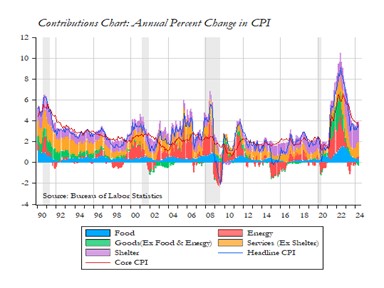

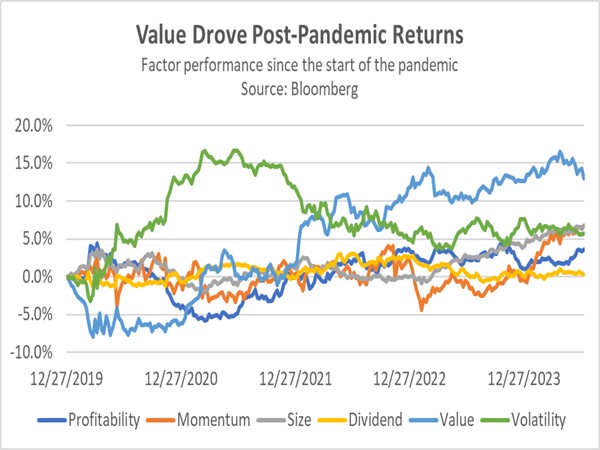

- While the S&P 500 has declined 1.0% over the last five days, the S&P SmallCap 600 Index has risen nearly 3.0%. This shift into small-cap stocks reflects investors favoring smaller companies amid expectations of a Fed pivot. Since the Fed started hiking interest rates in March 2022, investors have sought refuge in large companies because of their profitability, pricing power, and ability to absorb large changes in interest rates. Now that it appears that those rates may be moving downwards, investors are ready to go bargain hunting.

- While our views on small caps are bearing out, our concerns now rest with the longevity of the rally. The strong correlation between the S&P 600 and 10-year Treasury rates in the second half of 2023 demonstrates that even though stocks rallied during the period of lower rates, they were unable to maintain momentum when rates reversed course. Therefore, while recent economic data has drawn investors back to small caps, their optimism likely hinges on the Fed maintaining a dovish stance on future rate policy in the form of multiple rate cuts this year.

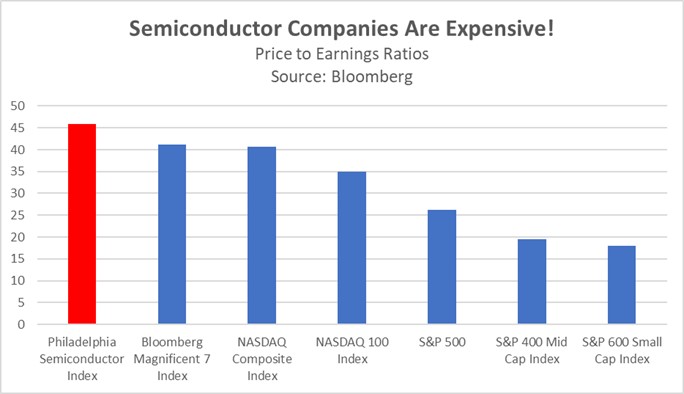

- While monetary policy uncertainty due to high inflation presents challenges, small-cap stocks still offer attractive opportunities for investors. Our research consistently shows that value investing remains a long-term driver of performance. Since small caps boast lower P/E ratios compared to their mid- and large-cap counterparts, they possess significant upside potential relative to their peers. However, to mitigate risks, we recommend screening for quality factors like profitability, leverage, and solvency.

China’s New Way: The final day of the widely expected meeting ended with a thud as the final statement failed to reassure investors that the worst was behind.

- In short, Beijing plans to continue with its state-driven economic model that focuses on balancing economic development with domestic security. Notably, the statement maintains its ambitious 5% growth target and preference toward long-term investments in technology as it looks to make itself less dependent on the West for resources. There was also a mention of the need to ensure the long-term growth by addressing potential risks associated with the property sector, local government debt, and small and mid-sized financial institutions.

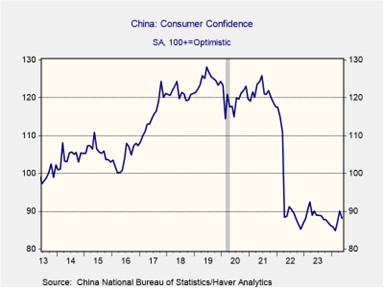

- The market’s reaction to the readout was negative, interpreting it as a sign of the government’s reluctance to intervene and stimulate growth. While China’s economy did manage a 4.7% year-over-year growth rate, this masks a concerning slowdown in domestic consumption. Retail sales have dipped modestly over the past few months and are on course to contract 1% by year-end. At the same time, consumer confidence remains near its pandemic lows, with ongoing market volatility leading households to prioritize saving over making discretionary purchases.

- China’s recent remarks solidify our belief that the nation will continue to grapple with several challenges, often referred to as the five D’s: weak consumer demand, excess capacity and high debt, poor demographics, economic disincentives from the Communist Party’s intervention in the markets, and Western decoupling from trade, technology, and capital flows. These factors will likely make it difficult to identify investment opportunities in China; however, a focus on companies that cater primarily to the domestic market and align with China’s strategic goal could have long-term benefits.

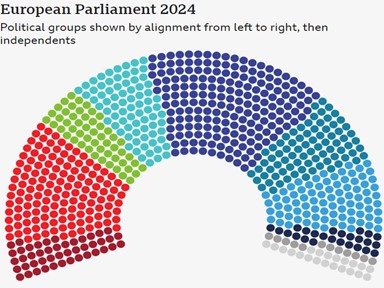

In Other News: Israel is considering transferring control of the Rafah border to the EU, in a sign that the conflict is close to coming to an end. An ECB survey suggests that investors are growing confident that rate setters could lower rates again in September. Also, Ursula von der Leyen easily secured a second term as president of the European Commission, further cementing centrist party control over European affairs[1].

[1] Yesterday’s Comment mistakenly stated that von der Leyen was the president of the European Parliament.