by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with news that China is continuing to build out its electronic spying facilities in Cuba, which will likely further exacerbate tensions with the US. We next review several other international and US developments with the potential to affect the financial markets today, including a further slowdown in consumer price inflation in the eurozone and a discussion of yesterday’s rout in the US bond market.

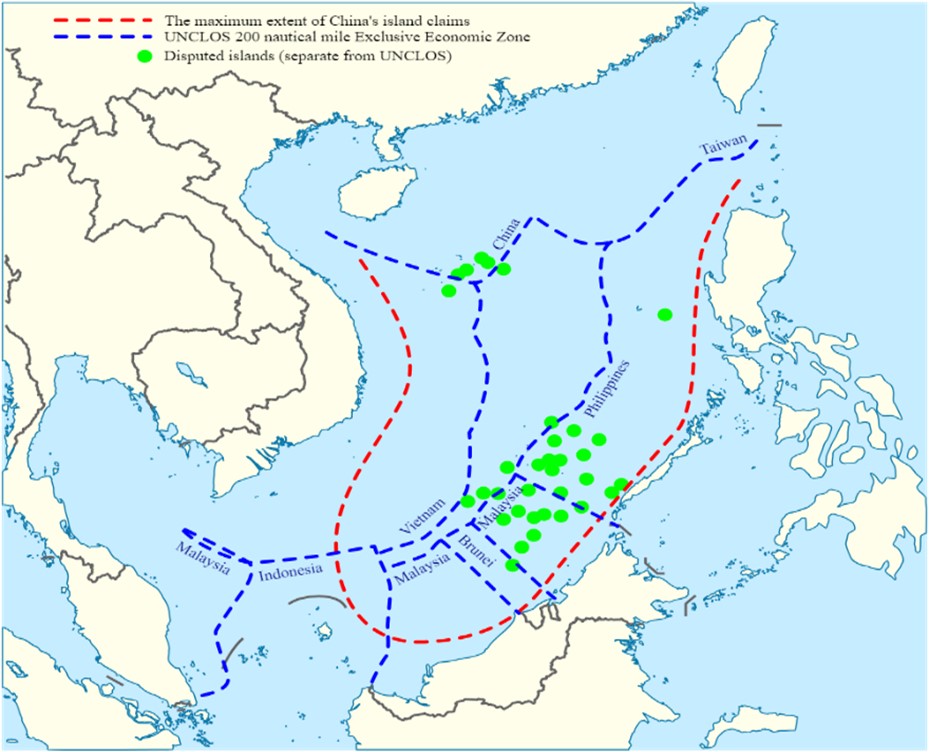

China-Cuba-United States: Commercial satellite imagery analyzed by the Center for Strategic and International Studies shows China is continuing to expand its electronic eavesdropping facilities in Cuba, including a newly discovered site just 70 miles from the US military base at Guantanamo Bay. The facilities appear to be aimed mainly at spying on the US. The report is likely to add to the many geopolitical and economic tensions between the US and China, which continue to present risks for investors.

Russia: Reports say former Deputy Defense Minister Tatyana Shevtsova has defected to France, just weeks after she resigned her position as chief of the Defense Ministry’s financial directorate. Shevtsova reportedly helped investigate corruption among high-level generals after Andrei Belousov took over as defense minister in May, but it appears she also came under suspicion because of some extremely expensive real estate she owns. As the wife of Russia’s energy minister, she also reportedly owns interests in at least two coal companies.

- If Shevtsova has really defected, she will likely be interrogated by France and other NATO countries for insights into how the Kremlin is financing its invasion against Ukraine.

- If Shevtsova reveals or confirms that China is providing more direct support to Russia than previously known, tensions between the West and Beijing could worsen further.

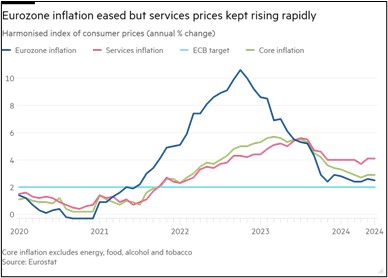

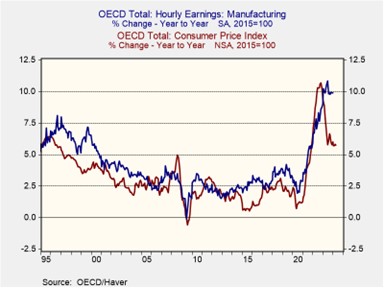

Eurozone: The June consumer price index was up just 2.5% from June 2023, matching expectations and decelerating from the 2.6% rise in the year to May. However, the core CPI inflation (excluding food, energy, and tobacco) was unchanged at 2.9%, largely reflecting sticky service prices. The elevated core inflation and likely price pressures from this month’s Paris Olympic Games are expected to discourage the European Central Bank from matching last month’s interest-rate cut with another in July. The next cut is now expected late in the summer.

Germany: According to an article in today’s Financial Times, many German companies are abandoning their long-held reluctance to produce military goods as they see growing defense orders across Europe. At least some of the firms have seen a big jump in their stock price after announcing a shift to military production.

- That’s consistent to our often-stated view that rising defense budgets in the West will likely benefit not only traditional military contractors, but also technology firms and other producers of dual-use goods and services.

- The expansion into defense production may be especially pronounced in Europe, where sluggish economic activity, weak demographics, and cooling exports mean defense is one of the relatively few growth opportunities.

France: As far-left parties and President Macron’s centrists continue trying to coordinate to head off a far-right win in Sunday’s run-off parliamentary elections, Marine Le Pen of the far-right National Rally (RN) today said her party would try to form a coalition government if it fails to win an outright majority. Previously, the party’s candidate for prime minister, Jordan Bardella, had insisted he would not rely on allies to govern. RN’s new openness to leading a coalition government likely increases the chance that it will take power in the Sunday vote.

- In last Sunday’s first-round voting for the 577 seats in parliament, RN came in first with 33% of the vote. The far-left New Popular Front (NFP) came in second with 28% and Macron’s centrist alliance came in third with 20%.

- But RN only achieved an outright majority in a relatively small number of constituencies. This coming Sunday, it will have to slug it out in a run-off against another party in hundreds of constituencies.

- In constituencies where French election rules would have sent three parties to a run-off (usually RN, NFP, and Macron’s centrists), NFP and Macron aim to drop their weakest candidate, increasing the odds that their remaining candidate could beat RN and lock it out of a majority.

Netherlands: In another example of increased far-right power in Europe, a coalition government that includes Geert Wilders’ nationalist, anti-Islam Freedom Party took office today. The government will be headed by Prime Minister Dick Schoof, a political novice and former intelligence agency chief. The far-right Freedom Party will head five of the 15 ministries, including the ministries for migration and trade.

US Bond Market: Investors yesterday dumped government bonds, pushing the yield on the benchmark 10-Year Treasury up to 4.479% by market close, versus only about 4.325% late last week. The action reportedly reflected investor reactions to last week’s debate and yesterday’s Supreme Court decision granting broad immunity to former President Trump for his official acts while in office.

- Those developments have increased the probability that Trump will be re-elected and have the chance to implement inflationary economic policies. The inflationary policies expected from Trump include big, across-the-board tariffs on imports, extension of the 2017 tax cuts, and populist spending programs.

- More generally, investors have become more concerned that Republicans will gain control of both the White House and Congress. Investors fear that having one party in control of both the executive and the legislative branches of government will lead to higher budget deficits.

US Technology Regulation: Also among the Supreme Court’s end-of-session decisions, the justices yesterday refused to rule on the validity of state laws in Texas and Florida that attempt to police social-media firms’ content moderation policies. The action suggests those policies can be protected by the First Amendment, but the justices sent the challenges back to lower courts for further argument and analysis.