by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! Equity futures have moderated as investors await a reaction to the May inflation data from Federal Reserve officials. In sports news, the Florida Panthers have taken a commanding 3-0 lead against the Edmonton Oilers in the NHL Finals. Today’s Comment will delve into the potential impact of letting the Saudi Arabia-US petrodollar agreement lapse, discuss what the latest PPI data tells us about consumer inflation, and examine why investors are reluctant to hold the Mexican peso. As usual, the report concludes with a summary of international and domestic economic releases.

End of the Petrodollar?: Saudi Arabia allowed the agreement with the US to price its oil exclusively in dollars lapse last Friday as the two sides work on a new defense pact.

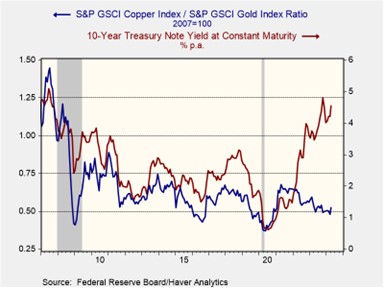

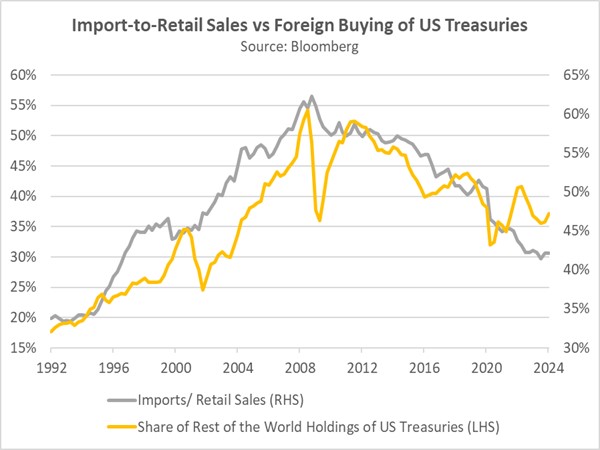

- The decline of the petrodollar system likely signals a shift away from the dollar-based global financial regime. The agreement was the result of then President Richard Nixon’s controversial decision to suspend the gold window in 1971. Upset by this move, Saudi Arabia considered pegging the price of oil to a basket of currencies, effectively severing the link to the dollar. In 1974, the US agreed to provide Saudi Arabia with military aid and weapon sales, in exchange for Riyadh’s commitment to recycling its excess dollars back into the US Treasury market.

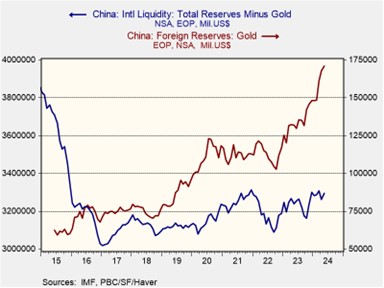

- Saudi Arabia’s recent move regarding the petrodollar system can be seen as another sign of a shifting global landscape. By avoiding a definitive stance on ending the dollar’s dominance in the oil trade, the kingdom appears to be strategically navigating the growing tensions between the US and China. China’s rise as a major oil importer for Saudi Arabia, coupled with the US shale industry’s emergence as a competitor in Europe, suggests that economic realities are driving Saudi Arabia’s cautious approach. After all, China is now Saudi Arabia’s second-largest customer after Russia and has shown a preference for diversifying away from holding excessive US dollars and toward holding more gold.

- The potential end of the petrodollar system may be more calculated than it initially appeared. Earlier this year, Saudi Arabia delayed its BRICS membership bid while negotiating a potentially transformative security pact with the US. This pact, if finalized, would be more comprehensive than the previous agreement and reportedly could include a stronger US commitment to Saudi Arabia’s defense. While progress has been made, details remain under discussion, but it does feel as if both sides are close to an agreement. This strategic maneuvering suggests the petrodollar’s demise might be premature, as the US-Saudi relationship remains a key factor.

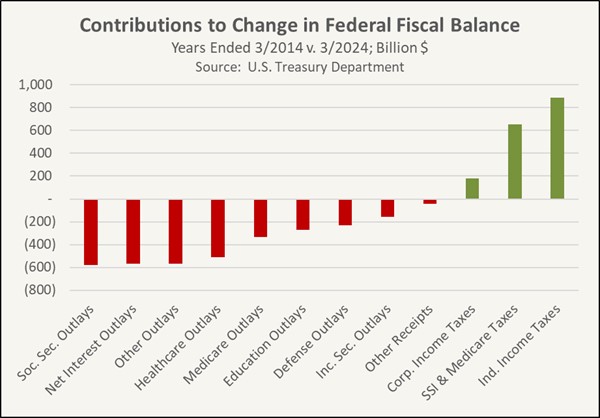

Another Inflation Surprise: Wholesale price inflation gave investors another reason to be optimistic that the Fed will cut more than once this year.

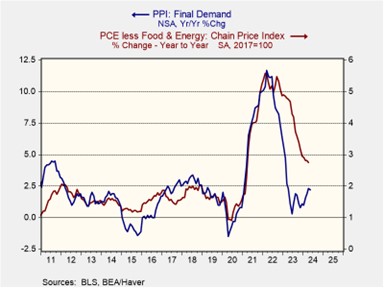

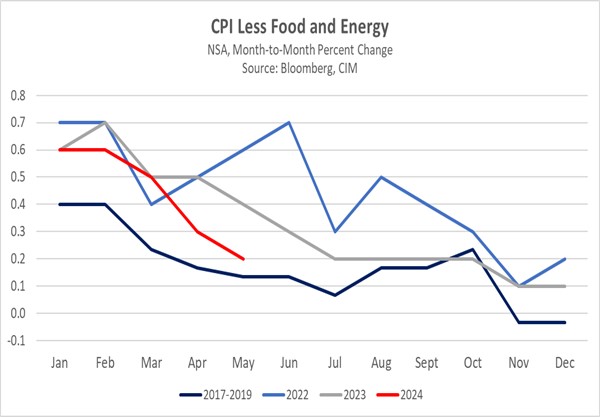

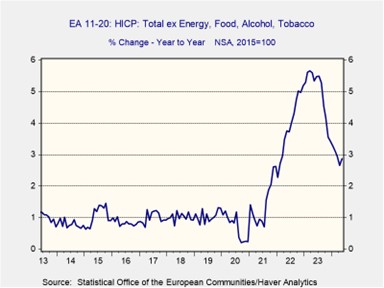

- Producer prices unexpectedly declined in May, marking their largest monthly drop since October 2023. The Bureau of Labor Statistics reported that the overall producer price index (PPI) fell by 0.2%, significantly lower than consensus estimates of a 0.1% increase. This decline was widespread, with core PPI, which excludes volatile food and energy prices, holding steady compared to the previous month. Additionally, the cost of processed goods used in production, a measure of input costs, dropped 1.5%, suggesting that businesses are seeing lower costs to build their inventory.

- Following the release of the report, the 10-year Treasury yield dropped below 4.3%, as investors believe a September cut is still possible. The report provided confidence that factors within the PPI index that contribute to the Personal Consumption Expenditures (PCE) price index, the Fed’s preferred inflation gauge, were relatively tame. This evidence suggests that core inflation may not reaccelerate this year as members of the Fed expect. In April, the PCE price index rose by 2.75% compared to the previous year, which was below the Fed’s year-end expectation of 2.8%.

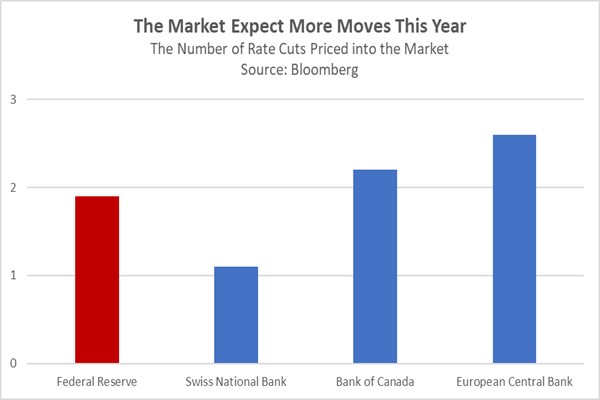

- The latest CPI and PPI reports provide evidence that inflation is on the right track. However, investors may want to wait for the latest Fed speeches before pricing in bets for additional rate cuts. The latest Fed dot plot showed that the range of rate expectations narrowed significantly from March to June, with no policymakers supporting more than three rate cuts before the end of the year, despite that being the median estimate in the previous two meetings. Any signal that current voters on the Federal Open Market Committee have become more dovish will likely be viewed favorably by markets.

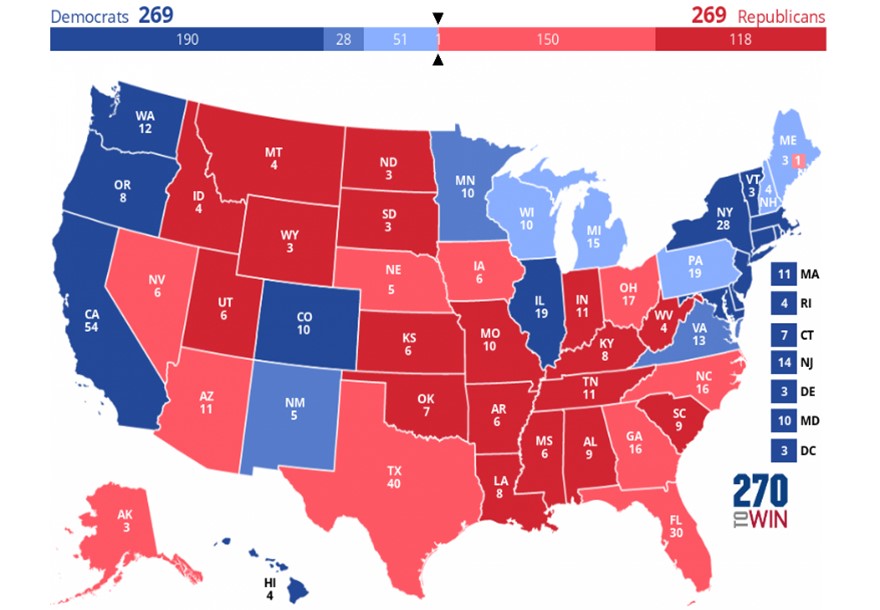

Demise of the Super Peso: Mexico’s currency plunged after a surprise landslide election victory, raising investor concerns about the country’s economic future.

- The weakness in the currency arises from concerns that the next administration will pursue judicial reforms aimed at removing checks on the ruling Morena party. Following her victory earlier this month, President-elect Claudia Sheinbaum stated that the government should focus on reforms that would replace appointed Supreme Court judges with popularly elected ones, a move likely to undermine potential challenges to the party’s agenda. While Sheinbaum mentioned that the matter should be discussed with law schools and judiciary workers, her predecessor President Andrés Manuel López Obrador (AMLO), who still holds significant influence in the party, doubled down on the necessity of this change.

- Investor uneasiness reflects concerns that the Morena party is trying to circumvent the judicial system to pass controversial legislation. Most recently, Mexico’s Supreme Court struck down a proposal that would have given the state-owned electric company an unfair advantage over private competitors. The court ruled that the proposal violated constitutional guarantees of fair competition in the power sector. Additionally, the High Court clashed with AMLO by overriding legislation that aimed to restrict the power of the National Electoral Institute. This independent body safeguards elections by enforcing rules on political campaigning by public officials.

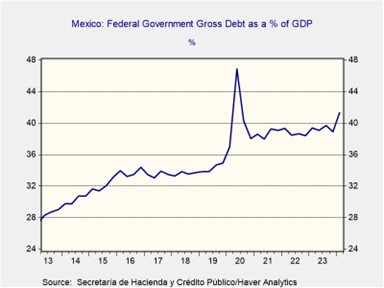

- The recent drop in the peso (MXN) suggests investors are losing faith in Mexico’s ability to maintain stability. During his six-year term, AMLO did well at keeping spending in check, even as many countries were ramping up debt during the pandemic. Nevertheless, reforms favoring state-owned firms over foreign competition could create new tensions with their Western counterparts, especially if the government pursues the nationalization of key parts of its energy sector, which is a growing concern. That said, the country will likely remain a good investment opportunity as long as the High Court remains independent of the ruling party’s influence.

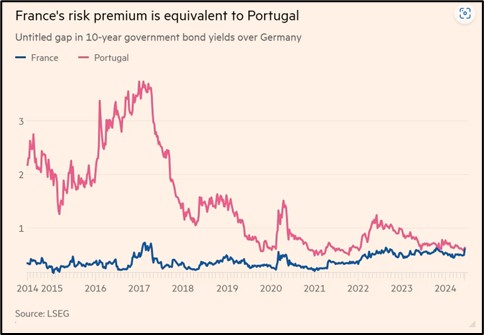

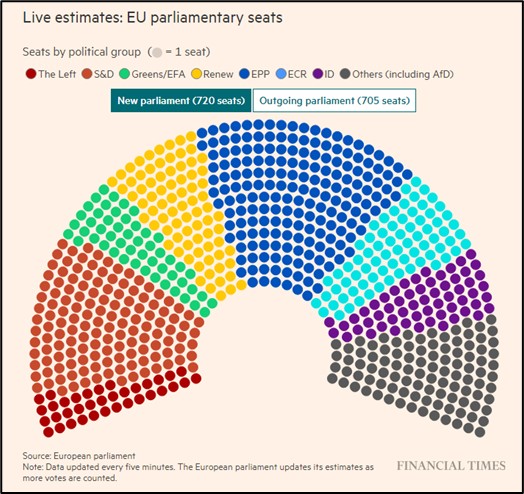

In Other News: The Bank of Japan maintained policy rates at its latest meeting but stated that it will reduce the amount of its bond purchases in a sign that the central bank is moving closer to policy normalization. Concerns over snap elections in France continue to weigh on stocks, as investors remain nervous about a potential victory for far-right candidates. Russian President Vladimir Putin proposed conditions for a possible truce, but they were rejected because they included demands for Ukrainian territory Russia doesn’t currently control. Nevertheless, this proposal shows a beginning to discussions about ending the conflict.