by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with some notes on the rising power of far-right political parties in Europe and the implications for European economic policy. We next review several other international and US developments with the potential to affect the financial markets today, including the UK Labour Party’s vow not to substantially raise taxes after Britain’s July 4 elections and today’s move to T+1 trade settlement in the US financial markets.

European Union: Ahead of the European Parliament elections to be held June 6 to 9, French far-right leader Marine Le Pen has proposed that her Identity and Democracy (ID) group of national conservative parties cooperate with Italian Prime Minister Meloni’s European Conservatives and Reformists (ECR) to form the second-largest grouping in the legislature and force EU policy to the right. Meloni has expressed interest in the idea, even though she had been negotiating to support European Commission President von der Leyen’s center-right group.

- Political parties in the various EU member countries typically ally themselves with like-minded parties from other countries to boost their power in the European Parliament.

- President von der Leyen’s European People’s Party (EPP) is currently the legislature’s biggest cross-national group, with 176 of the 703 seats. The leftist Progressive Alliance of Socialists and Democrats is the second-largest group, with 144 seats. The far right is fractured between four different parties, the largest of which are the ECR, with 66 seats, and the ID, with 62 seats.

- Current opinion polls suggest the far-right parties will make significant gains in the elections. If so, a combination of the ECR and ID likely would make it the second-most powerful group in the parliament and force the EPP to adopt more conservative positions in key issues such as immigration and environmental policy.

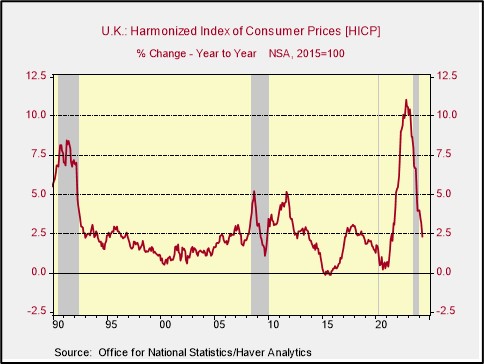

Eurozone: In an interview with the Financial Times, European Central Bank Chief Economist Philip Lane strongly hinted that the institution will start cutting interest rates at its next policy meeting on June 6. Describing the central bank’s read on the eurozone’s current output and price data, Lane said, “Barring major surprises, at this point in time there is enough in what we see to remove the top level of restriction.”

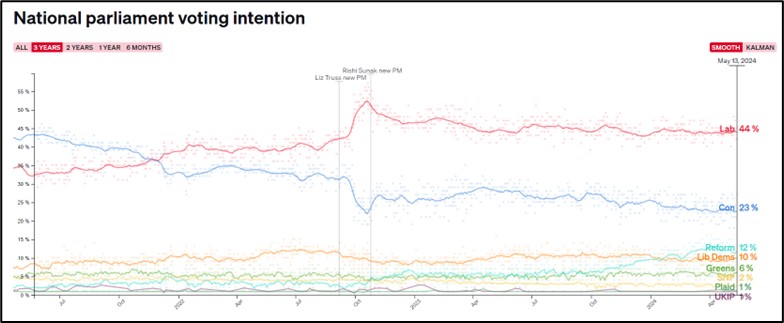

United Kingdom: Shadow Chancellor Rachel Reeves of the opposition Labour Party has promised that if Labour wins the July 4 elections, it will not raise taxes beyond the handful of modest measures it has already proposed (i.e., extending the windfall tax on energy company profits, applying the value-added tax to private school fees, and ensuring private equity bonuses are “taxed appropriately”). The statements by Reeves appear to be aimed at maintaining Labour’s current lead of 20+ percentage points in public opinion polls.

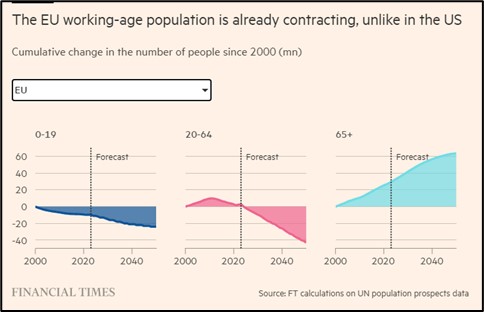

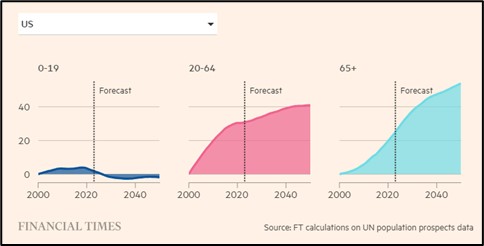

China: Ma Jiantang, the former Communist Party secretary at the State Council’s Development Research Center, warned that China is facing severe economic problems because of its low birth rate and falling population. Ma argued China must adopt an “urgent” response, but policies are still focused on family planning rather than encouraging births. Ma called for new initiatives such as promoting assisted reproductive technology, registering children born out of wedlock, improving birth insurance, extending maternity leave, and building more childcare centers.

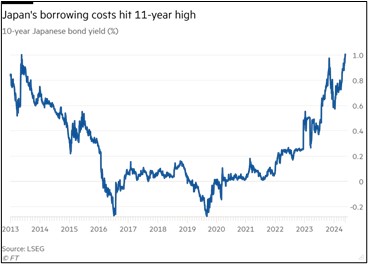

Japan: Bank of Japan Governor Ueda said at a central banking conference that his institution will continue raising interest rates toward a “neutral” level, but because it’s hard to know what that level is for the Japanese economy, the central bank will move cautiously. The statement confirms expectations that the BOJ will likely hike interest rates only slowly in the coming months and quarters. With the Federal Reserve likely to hold US interest rates higher for longer, the BOJ’s approach is likely to continue weighing on the value of the yen (JPY).

New Zealand: The Reserve Bank of New Zealand said it will impose new restrictions on mortgage lending to preserve financial stability in the face of rising home prices and increasing consumer debt. The new rules will cap the amount of new loans going to borrowers with high debt-to-income and loan-to-value ratios. Since rising home prices and worsening debt burdens are now a problem in many countries, the New Zealand moves could potentially portend similar moves in other countries.

Israel-Hamas Conflict: An Israeli airstrike in Gaza on Sunday night killed two senior Hamas military commanders, but it also killed some 45 Palestinian civilians. The high level of civilian casualties to take out just two Hamas leaders has further stirred world anger at Israel and deepened Prime Minister Netanyahu’s isolation. It also promises to further undermine support for President Biden ahead of the US elections in November.

- Separately, Israeli forces got into a shootout with Egyptian troops as they took control of a border crossing between Gaza and Egypt, killing an Egyptian officer.

- The incident once again likely raises the risk of the conflict broadening into a regional war that could disrupt key energy supplies.

US Financial Markets: As of today, trades in equities, corporate bonds, exchange traded funds, mutual funds, and options will all settle the day after the trade, i.e., T+1 versus the previous standard of T+2. The move aims to cut brokers’ collateral requirements and reduce price volatility in time of market stress. Several other countries also shifted to T+1 this week, and similar moves are being considered in the UK, Switzerland, and the European Union.

US Commercial Real Estate Market: New data shows that the vacancy rate for retail properties has fallen to a near-record low of 4.1%, versus 5.0% during the coronavirus pandemic and 7.1% shortly after the Great Financial Crisis of 2007-2008. The low vacancy rate reflects strong economic growth and more disciplined construction in recent years. Although financial difficulties for office properties continue to scare investors out of real estate funds, the retail data serves as a reminder that other areas of commercial real estate are in a strong position.