by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with new projections of global interest rates from the Organization for Economic Cooperation and Development. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including potential territorial aggression by Venezuela against its neighbor Guyana and an important case being heard today by the U.S. Supreme Court that could potentially dismantle much of the modern U.S. regulatory system.

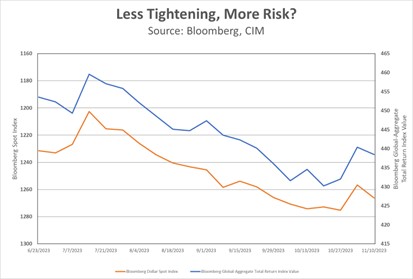

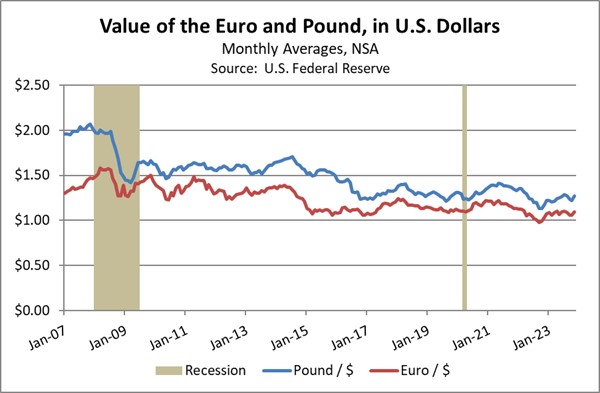

Global Monetary Policy: In its latest economic outlook, published today, the OECD warned that both the European Central Bank and the Bank of England may need to keep interest rates high until early 2025—much longer than investors are expecting—to guard against stubborn inflation pressures. In contrast, the OECD projected the Federal Reserve will start cutting U.S. interest rates by the second half of 2024.

- The prospect of earlier rate cuts in the U.S. is probably a key reason why the euro (EUR) and pound (GBP) have appreciated so far this quarter, while the dollar has declined. As of early this morning, the EUR is valued at a nearly four-month high of $1.0984, up 3.9% from the end of September. The GBP is trading at $1.2696, up 4.1% for the quarter.

- If the dollar continues to weaken, it could provide a boost to foreign stocks and some commodities.

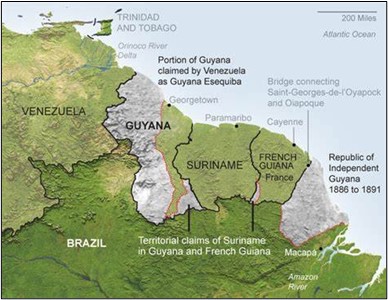

Venezuela-Guyana-Brazil: Venezuela’s National Assembly, dominated by the ruling party, has recently approved a national referendum on the status of the Essequibo territory—the western two-thirds of oil-rich Guyana that Venezuela has claimed for more than a century. The planned referendum may simply be a ploy to help the government of Nicolas Maduro in Venezuela’s coming elections, but it could also be an example of Chinese- and Russian-style “lawfare” ahead of an attempt to seize Essequibo. Since Venezuelan forces would likely have to traverse Brazilian territory for any such invasion, the Brazilian military has reportedly been put on alert and is massing troops along its border with Venezuela.

- Over the last decade, dozens of new oil fields have been discovered in Guyana, setting it up to be a key source of new energy in the coming decades. The country is currently estimated to have the equivalent of more than 11 billion barrels of oil deposits, similar to the number of deposits in Kuwait and the United Arab Emirates.

- If Venezuela did try to invade Guyana, the potential damage to its oil fields and the risk that they would fall into Venezuela’s hands could spark a significant jump in global oil prices.

- If Venezuelan forces traversed Brazilian territory to reach Essequibo, such an invasion could also spark a broader conflict, potentially drawing in more South American countries or even the U.S.

(Source: New York Times)

(Source: New York Times)

China-Lithuania: In another sign that Beijing is trying to ease tensions with the West, at least temporarily, Lithuanian Foreign Minister Gabrielius Landsbergis said China has now lifted most of the economic sanctions it imposed on the Baltic country in 2021 in retaliation for its approval of a de facto Taiwanese embassy in Vilnius. Separate data from Beijing shows Lithuanian exports to China in the first 10 months of 2023 were up 54% from the same period one year earlier.

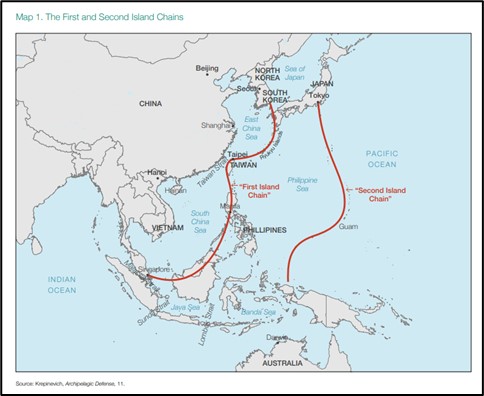

India: Despite Beijing’s recent efforts to ease its international relations and rekindle stronger economic growth, its ongoing military buildup continues to spur reactions in neighboring countries. According to recent reports, Indian officials on Friday plan to formally approve the construction of their country’s second indigenous aircraft carrier. Along with India’s first indigenous carrier and a Russian-built vessel, that would lift New Delhi’s total carrier force to three, enough to eventually ensure a continuous power projection capability throughout the Indian Ocean.

Vietnam: The government announced it will raise its income tax on multinational firms to 15%, in line with an OECD-led effort to set a minimum rate on companies to avoid tax evasion and tax-rate shopping. The move threatens to slow the recent surge of foreign direct investment into Vietnam as more multinational firms look to diversify their production out of China.

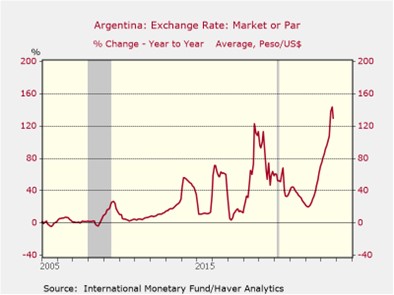

United States-Argentina: The newly elected president of Argentina, populist libertarian Javier Milei, has announced that he held fruitful meetings with U.S. officials in Washington yesterday, as he tries to set the groundwork for restructuring his country’s troubled $43-billion loan from the International Monetary Fund. In addition, Luis Caputo, a former Argentine finance minister considered the frontrunner to lead Milei’s economy ministry, met U.S. Treasury and IMF officials.

- Milei has said he will postpone his controversial reform, which would replace the Argentine peso (ARS) with the U.S. dollar.

- On the other hand, he plans to send a package of “shock therapy” reforms to Argentina’s congress on December 11, including spending cuts to balance the budget in 2024.

U.S. Regulatory Policy: In a case that could undermine administrative courts in multiple sectors, the Supreme Court today will hear a challenge to the Security and Exchange Commission’s use of such panels. The courts, which are presided over by administrative law judges, are being challenged on grounds that the judges aren’t impartial and that the courts rob defendants of their right to a trial by jury. A decision is expected by next July.

U.S. Investing Pantheon: Investing legend Charlie Munger, vice chairman of Berkshire Hathaway (BRK-B, $360.05) and key lieutenant of Warren Buffett, died yesterday in a California hospital at the age of 99. Munger is often credited with convincing Buffett to abandon his early-career focus on cheap “cigar butt” investments and instead focus on buying great businesses at reasonable prices, an approach we largely share here at Confluence!

(Source: Hudson Institute, 2023)

(Source: Hudson Institute, 2023)