Author: Amanda Ahne

Daily Comment (May 8, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with some notes on the stock market winners of the pandemic years and fundamentals in the silver market. We next review several other international and US developments with the potential to affect the financial markets today, including notes on Japanese and Swedish monetary policy and prospects for inflation in the US.

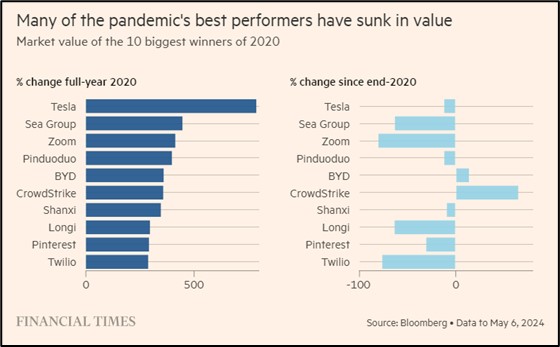

Global Stock Markets: The Financial Times today carries an interesting report noting that the 50 large-cap stocks that appreciated the most in 2020, amid coronavirus pandemic, have lost about one-third of their value, or $1.5 trillion, since then. The data shows just how short-lived many of the changes and disruptions of the pandemic actually were. Importantly, we’ve noted similar snap-backs in some key economic data series.

- Without a doubt, the pandemic also caused many longer-lasting stock market winners and economic changes.

- Nevertheless, the dramatic short-term disruptions in the finance and economic data will make it harder for economists and investment strategist to use pandemic-era figures for their models in the future.

Global Silver Market: Data from the International Energy Agency shows China and other countries around the world are boosting their investment in photovoltaic cell factories. Since solar cells use a lot of silver because of its high electrical conductivity and other features, the new investment is driving increased silver demand and higher silver prices. The data helps explain why we have recently added silver to our more aggressive asset allocation strategies.

Japan: At an economic conference today, Bank of Japan Governor Ueda said he would be willing to hike interest rates earlier than planned if consumer price inflation looks set to worsen again. He specifically cited a risk that the weak yen (JPY) could feed into broad price increases. The statement adds to the evidence that many major central banks are pulling back from their previous predisposition to cut interest rates.

Sweden: Despite the “higher for longer” approach to interest rates taken by the Federal Reserve, the Bank of Japan, and other major central banks, other institutions are proceeding with cautious rate cuts. The Riksbank today cut its benchmark short-term interest rate from 4.00% to 3.75%, as widely expected. That makes Sweden only the second rich, industrialized country to cut rates this cycle, following Switzerland’s cut in March. Both central banks are responding to Europe’s recent soft economic growth and falling inflation.

United Kingdom: In a fresh sign of chaos and falling political fortunes, two members of parliament for the ruling Conservative Party have defected to the main opposition Labour Party in the last two weeks. In an especially dramatic move yesterday, Dover MP Natalie Elphicke “crossed the floor” just moments before the start of Prime Minister’s Questions, the weekly debate in the parliament chamber between Prime Minister Sunak and Labour Leader Starmer. The developments add to the sense that the Conservatives will lose big in this autumn’s elections.

Argentina: Faced with persistently high inflation that has eroded the purchasing power of the peso (ARS) and forced consumers to pay for purchases with huge wads of bills, the central bank for the first time has begun printing 10,000-peso notes. The new notes are five times more valuable than the largest previous denomination, consisting of 2,000-peso notes.

United States-China: The US Commerce Department has revoked export licenses that until now allowed Intel and Qualcomm to supply semiconductors to Chinese telecom technology giant Huawei for its laptop computers and mobile phones. The move signals that the Biden administration intends to keep up its effort to weaken China’s geopolitical threat by impeding the country’s technological development. The change is also likely to spur Chinese retaliation, further advancing the spiral of tensions between Washington and Beijing.

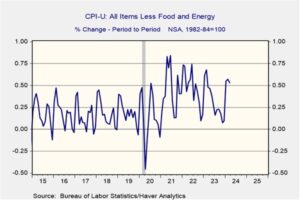

US Consumer Price Inflation: While President Biden contends with the political fallout from the high inflation of 2022 and 2023, new analysis from Axios warns that if former President Trump is re-elected in November, key planks of his agenda could boost inflation again. Specifically, the analysis says Trump’s goals such as increasing import tariffs, cutting taxes, clamping down on immigration, and pressuring the Fed to keep interest rates low would all be potentially inflationary.

- We take no position on who should win the election, as it remains too close to call.

- Rather, we think the significance of the Axios analysis is that broader geopolitical forces and domestic political realities in the US are likely to make the economic environment more inflationary going forward, no matter who wins the election.

Daily Comment (May 7, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with projections that global exports and imports are set to grow faster again in 2024 and 2025. We next review several other international and US developments with the potential to affect the financial markets today, including a readout on Chinese General Secretary Xi’s visit to Paris, weak factory orders in Germany, and the latest financial projections for the US social security system.

Global Trade: The International Monetary Fund, the World Trade Organization, and the Organization for Economic Cooperation and Development are all predicting that growth in international trade will accelerate in 2024 and 2025. Overall, the organizations are calling for trade growth to accelerate from about 1% in 2023 to almost 3% in 2024 and even more in 2025.

- The expected acceleration in trade largely reflects the booming US economy, which is benefiting from higher wage growth, increased productivity, reindustrialization, and fiscal stimulus.

- Higher US demand is likely to draw in increased imports, which will likely help stimulate many foreign economies and give a boost to their financial markets.

European Union-China: In his visit to Paris yesterday, Chinese General Secretary Xi called for a global ceasefire during this summer’s Olympic Games and offered a few minor concessions on China-EU trade. Nevertheless, European Commission President von der Leyen and French President Macron warned Xi that the EU would defend its domestic industries if China keeps dumping excess production on the Continent at unfairly low prices. The warnings suggest trade tensions between the two economies will continue to worsen, perhaps eventually to a trade war.

Eurozone: As Europeans mull how to fund stronger armed forces to deter Russian aggression, top eurozone leaders have proposed re-purposing the European Stability Mechanism (ESM) to make low-interest defense loans to member countries. The ESM was established in 2012 to help struggling countries that had lost access to global debt markets, such as Greece. The fund now has about 422 billion euros ($454 billion) and no new economic need, so some officials think it could be a relatively painless way for eurozone nations to hike their defense spending.

- Nevertheless, re-purposing the ESM for defense loans would likely require a major political and bureaucratic effort.

- The fact that officials are considering such a move serves as more evidence that the Europeans are genuinely worried about possible Russian aggression against them.

Germany: March factory orders fell by a seasonally adjusted 0.4%, far weaker than expected. In addition, February orders were revised down to show a fall of 0.8%. Orders over the three months ended in March were down a whopping 4.3%, largely reflecting weaker demand for aircraft, ships, and train cars. The figures underscore that German economic growth remains quite tepid, which is likely to pull down activity and profits throughout the EU.

Australia: The Reserve Bank of Australia today held its benchmark short-term interest rate unchanged at 4.35%. The policymakers noted that consumer price inflation continues to moderate, but much slower than previously anticipated. They also raised their inflation forecasts and warned that interest rates may not change until mid-2025. That adds to the evidence that major developed-country central banks are increasingly likely to hold interest rates “higher for longer,” dashing investor hopes for rate cuts that would boost stock and bond prices.

Israel-Hamas Conflict: As it had warned, Israel last night began striking Hamas targets in the southern Gaza city of Rafah, shortly after the Israelis said a truce deal accepted by Hamas was insufficient. The Israelis have sent tanks into the area this morning and seized a key border crossing into Egypt. As we noted in our Comment yesterday, the new Israeli attacks will likely rekindle worries that the conflict could broaden and further isolate Israel politically.

Russia: After winning re-election in March, President Putin today was inaugurated for yet another six-year term. In his inaugural address, Putin signaled he will double down on his effort to maintain close ties with China and help it build a “multi-polar” world that would no longer be dominated by the US.

Russia-United States: Russian police in the far eastern city of Vladivostok have arrested a visiting US Army soldier on charges of stealing from a local woman. The arrest of the soldier, who had just finished a tour of duty at a US military base in South Korea, gives the Kremlin another prisoner that it will likely try to use as leverage against the US in various bilateral disputes.

US Social Security System: The trustees of the Social Security system yesterday said the fund for retirees should be able to pay all scheduled benefits until 2033, unchanged from last year’s projection. Due to the increasing number of retirees and slower growth in the cohort of younger workers paying into the system, benefits would then have to be cut some 17% unless Congress took steps to transfer general tax revenues into the system.

US Artificial Intelligence Industry: The Wall Street Journal today carries an article saying Apple has been working to develop a specialized processing chip for running AI programs in the company’s data center servers. The chip would not be used for training AI models, but for implementing AI applications that Apple will offer its customers. The project illustrates the evolving division of labor among different firms looking for a competitive advantage in the evolving AI industry.

Bi-Weekly Geopolitical Podcast – #47 “Middle East: Land of Fault Lines” (Posted 5/6/24)

Bi-Weekly Geopolitical Report – Middle East: Land of Fault Lines (May 6, 2024)

by Daniel Ortwerth, CFA | PDF

Conflict in the Middle East is one of the most persistent themes in current events. Not only is this true today, but Middle Eastern discord has dominated the news flow throughout most of our lives. At Confluence, we recognize that this enduring pattern of strife reveals the presence of many major fault lines that run through Middle Eastern society, politics, economics, and relations with the rest of the world.

A fault line is defined as a “divisive issue or difference of opinion that is likely to have serious consequences.” A major fault line is one in which the competing forces have both deeply embedded positions and the resources to support those positions. Many issues of this type characterize those in the Middle East, which explains why conflict in the region is so common despite repeated attempts at resolution. Investors must be prepared for this trend to endure for the foreseeable future, which will continue to meaningfully impact global affairs.

This report briefly reviews the main fault lines that define the Middle East from a geopolitical standpoint. This is not a complete list, but rather it is a selection of those we consider most enduring and impactful. Confluence does not take positions on these issues, but we will summarize and show how they produce complexity. We arrange these prominent fault lines in three layers: the ancient fault lines, the more modern ones, and the present-day issues that are currently causing “geopolitical earthquakes.” While these earthquakes do raise the risk of escalation into a broader regional war, we remind readers that the region has often witnessed this increased level of risk before without necessarily leading to further escalation. Rather than trying to predict the outcome, we recommend that investors pay attention to key implications, which we will highlight at the end of the report.

Don’t miss our accompanying podcasts, available on our website and most podcast platforms: Apple | Spotify

Daily Comment (May 2, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equity futures are up today as investors embrace a less hawkish Fed. In sports news, Borussia Dortmund edged out PSG with a narrow 1-0 aggregate lead in the Champions League. In today’s Comment, we delve into the FOMC’s decision to keep rate cuts on the table, examine the disappointing trend in economic data, and discuss the impact of a possible security pact between the US and Saudi Arabia. As usual, our report concludes with a round-up of international and domestic data releases.

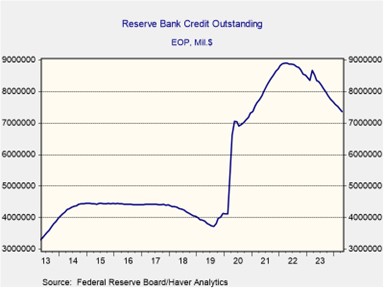

Less Hawkish: The Federal Reserve failed to deliver the hawkish shift markets had feared in a sign that rate cuts are likely to remain on the table for the foreseeable future.

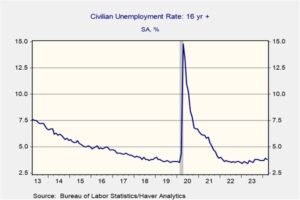

- The Federal Open Market Committee (FOMC) decided to maintain the target range for its federal funds rate at 5.25% to 5.5%. In a separate move, the FOMC announced it will slow the pace of its securities holdings runoff with a reduction in its monthly redemption cap on Treasury securities, decreasing from $60 billion to $25 billion beginning in June. At the press conference, Fed Chair Jerome Powell downplayed the prospect of an immediate rate hike aimed at further curbing inflation. However, he emphasized policymakers’ heightened focus on labor market developments, suggesting their preparedness to cut rates if unemployment were to deteriorate substantially.

- Markets seem to be taking comfort in Chair Powell’s cautious approach to interest rates, effectively dodging the scenario of a renewed tightening cycle. Before the decision, anxieties were mounting over whether persistent inflation would force the Fed’s hand back to rate hikes in order to fully extinguish inflationary pressures. The slowdown in balance sheet reduction further underscores the committee’s preference for a pause in tightening rather than new restrictions. The Fed’s dovish tone has sparked investor optimism, leading to revised rate cut expectations of two reductions starting in September. We would caution, however, that this optimism may be short-lived.

- Powell’s comments suggesting a dovish stance might not represent the entire committee’s view, echoing a pattern from previous meetings. Notably, he sidestepped a question on whether further rate hikes were discussed if inflation worsens. This underscores the importance of studying the Fed’s speeches for clues on committee sentiment before the FOMC minutes are released. That said, Powell did reiterate that the committee is ready to act if the labor market cools unexpectedly. Consequently, a payroll figure below 125,000 and an unemployment rate exceeding 4.2%, while unlikely, could keep rate cuts on the table despite high inflation.

Negative Economic Surprises: Despite headlines touting strong economic data, a recent disappointing string of data points indicates that momentum may be shifting in the wrong direction.

- Disappointing economic data emerged on Wednesday, raising concerns about a potential slowdown. Job openings reported by the BLS JOLTS survey plummeted to a three-year low in March. The decline was particularly notable in construction, which also coincided with an unexpected drop in spending for the sector in the same month. The weakness in construction activity may signal that companies are potentially facing margin pressure due to rising costs. The ISM price index surged to its highest level since June 2022, highlighting ongoing inflationary pressures despite the weakness in the manufacturing sector overall, suggesting that firms might be trying to force costs onto consumers.

- Wednesday was hardly an anomaly. Consumer confidence, as measured by the Conference Board’s index, plummeted from 103.1 to 97.0 in April, defying expectations of a rise to 104.0. This unexpected decline was primarily driven by a steep drop in consumer expectations, the steepest in nearly two years. Further fueling concerns is a broader trend of emerging economic weakness. Citigroup’s Economic Surprise Index has been on a downward trajectory since February, dropping from a peak of 44.1 to 15.1. While it hasn’t dipped below zero yet, the sharp decline indicates a potential slowdown on the horizon.

- Despite signs of a strong economy, recent data weaknesses suggest the expansion might be more fragile than previously thought. A key question remains, one that has not yet been fully addressed by the markets, regarding consumer tolerance for ongoing price increases. While businesses initially attempted to pass on these costs in early 2023, a closer look at non-seasonal data reveals they weren’t able to sustain this pace throughout the year, leading to a slowdown in price hikes, particularly in the summer months. If this trend persists, as the recent data suggests, companies may be forced to address cost pressures through workforce adjustments.

Saudi Defense Pact: The US and Saudi Arabia are nearing a security guarantee agreement, potentially opening the door to normalized relations between Saudi Arabia and Israel.

- The proposed security agreement builds on discussions held before the October 7 Hamas attack on Israel. It could grant Saudi Arabia access to offensive weapons after a three-year freeze, allowing it to replenish missile stocks and potentially pursue uranium enrichment. Additionally, Riyadh would limit its purchases of Chinese technology in its key network exchange for US investment in Artificial Intelligence (AI). However, a major hurdle remains — the deal hinges on an Israeli withdrawal from Gaza and commitment to a Palestinian state, a difficult condition for Israel to accept after the recent conflict.

- The proposed US-Saudi defense agreement could reshape the security balance of the Middle East, but it faces hurdles from both Israel and the US Senate. The Biden administration hopes economic incentives and a security guarantee will win over Israel, while assuring senators that Saudi Arabia won’t misuse weapons nor manipulate its oil production to harm US interests. However, navigating these challenges is difficult, especially given Israel’s strengthened right wing and waning trust in US security commitments. The deal’s prospects seem slim, but a potential path forward might still exist.

- The ability to provide a counterweight to Iran in the Middle East may play a significant factor in garnering support from all parties. There is strong suspicion that Iran provided some level of support to Hamas during its conflict with Israel. Additionally, Iran’s actions since the conflict began have increased the likelihood of a broader military conflict in the region. The prospect of Iranian deterrence could incentivize Israeli Prime Minister Benjamin Netanyahu to engage in negotiations. However, a lasting agreement might necessitate strategic ambiguity from all parties regarding the Palestinian state issue, allowing for concessions without jeopardizing domestic support.

In Other News: The US is considering refilling its strategic reserves in a sign that oil prices may receive some support in the coming days. Strong speculation surrounds Japan’s potential intervention in the foreign exchange market to bolster the yen. This raises the possibility of the Bank of Japan tightening monetary policy to defend its currency.

Daily Comment (May 1, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are down as investors await the Federal Reserve’s policy decision. In sports news, Real Madrid showed their fighting spirit again, securing a draw against Bayern Munich in a thrilling Champions League match. Today’s Comment examines our views on monetary policy, where we believe the market should be less focused on rate cuts and more on balance sheet reduction. We also discuss how investors are paying closer attention to earnings and whether China may look to stimulate its economy over the next few months. The report concludes with a summary of domestic and international data releases.

No Cut, No Problem: The market anticipates a hawkish stance from the Federal Open Market Committee (FOMC) after its meeting, but the Fed’s balance sheet plans shouldn’t be overlooked.

- Strong economic data has cast doubts on the Federal Reserve’s plan to cut rates three times this year, as initially outlined in their economic projections. The CME FedWatch Tool now reflects a more cautious approach, suggesting one or two cuts are more likely. This shift aligns with the Fed’s wait for clearer signs of inflation subsiding. Tuesday’s employment cost index, showing a jump in wages and benefits from 0.9% to 1.2% in Q1, is a prime example. The data highlights persistent wage pressures, particularly for unionized workers whose compensation rose 6.3% compared to 4.1% for non-union workers.

- Despite the economic data, the Fed might prioritize easing financial conditions through other means. Minutes from the March FOMC meeting showed that a majority of policymakers favored a measured slowdown in quantitative tightening (QT), specifically by reducing the pace of US Treasury drawdown while maintaining the current pace of runoff of mortgage-backed securities. The FOMC minutes didn’t provide a specific timeframe, but policymakers expressed a preference for a “fairly soon” implementation, likely indicating this summer or even this month. This move could help anchor Treasury yields and alleviate the risk of funding pressures in the repo market.

- While a rate cut delivers a more direct economic boost, slowing the pace of QT could still offer some market relief. Unlike rate cuts, a measured slowdown in balance sheet reduction is unlikely to significantly impact consumer spending. This signals the Fed’s consideration of a less restrictive policy stance. However, we don’t expect it to completely rule out rate cuts in 2024. Instead, it will likely signal less confidence in its ability to lower rates moving forward. Given persistent inflation, our current forecast is for a maximum of two rate cuts this year, with a strong possibility of none at all.

Investors Not Deterred: Investors have shifted their focus to corporate earnings, scrutinizing the ability of companies to maintain profitability amidst tightening financial conditions.

- Early signs from earnings season are positive. Over 80% of the nearly 300 companies that have reported have exceeded analyst expectations, defying concerns as the country continues to experience strong consumer spending growth. The S&P 500 has seen earnings growth of 5.6%, handily surpassing Bloomberg’s estimate of 3.8%. This strong performance is broad-based, with some companies reporting positive surprises exceeding 8% in earnings growth. This robust corporate performance appears to be a bright spot in the market as investors adjust to the possibility of fewer rate cuts from the Fed.

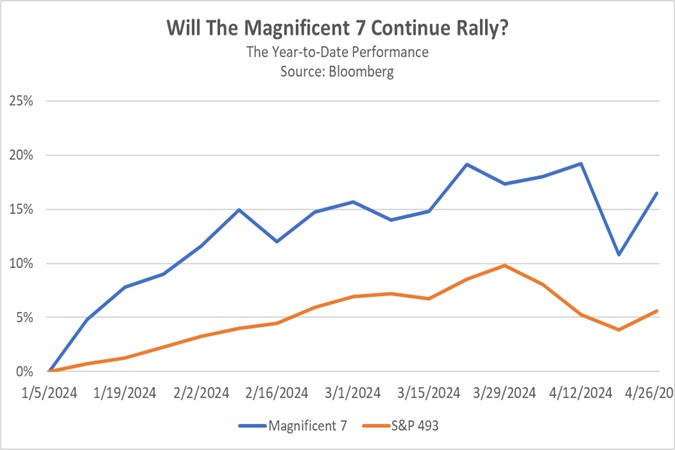

- The focus of tech earnings this week shifts to the “Magnificent Seven,” a group of high-valuation tech companies. Investors are eager to see if these companies can justify their lofty stock prices. So far, the tech sector has shown mixed results. Disappointing outlooks from Meta and weak sales from Apple have dampened investor enthusiasm. However, a surprise dividend from Alphabet and robust cloud performances by Amazon and Microsoft have offered some relief. A strong earnings report from Nvidia later this month could give the Magnificent Seven a much-needed boost. However, considering the recent reports from fellow chipmakers AMD and Supermicro, such a performance might be unlikely.

- Maintaining their stellar start to the year is proving difficult for major tech companies, suggesting much of their potential for growth is already reflected in their stock prices. This could explain the recent dividend announcements from companies like Meta and Alphabet, potentially aimed at appeasing investors seeking returns to offset the higher risks associated with tech stocks. However, such payouts are unlikely to become the norm, as tech companies prioritize reinvesting most of their earnings into research for the competitive AI landscape. This shift in focus could benefit less-favored sectors, particularly mid and small caps, which often boast stronger fundamentals.

China on the Move: Beijing is expected to announce new measures to help improve the country’s economic situation, while it struggles to deal with a struggling currency and slow growth.

- The Politburo met on Tuesday and set a date in July 2024 for the long-delayed Third Plenum. The postponement of the meeting, originally expected in late 2023 (a year after President Xi Jinping secured an unprecedented third term), has sparked speculation about internal discussions within the party leadership regarding China’s economic challenges. The focus of the July Plenum is expected to be economic reforms aimed at modernizing the country. Additionally, the Politburo indicated a willingness to support the struggling economy through measures such as bolstering the property market and potentially reducing interest rates.

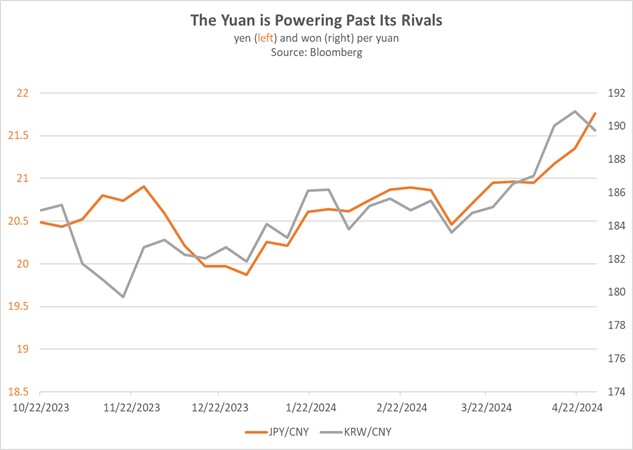

- China’s rising yuan (CNY) is raising concerns about export competitiveness. While the yuan is loosely pegged to the dollar, it has appreciated against other Asian currencies — 6% against the Japanese yen (JPY) and nearly 3% against the Korean won (KRW) — sparking speculation of a devaluation. Although a weaker yuan might boost exports, it could also trigger capital flight, similar to what happened after the 2015 devaluation. This could harm financial assets and erode investor confidence. Despite these drawbacks, the People’s Bank of China’s ongoing warnings against speculators suggest currency intervention remains a possibility.

- The delay of China’s Third Plenum sparks questions, but it could also indicate that the government believes there is a modestly improved economic situation when compared to a few months ago. The lead-up to the meeting may buoy Chinese stock markets as the government highlights the country’s growth prospects. While a currency devaluation is a lingering concern, it’s unlikely unless China faces significant economic pressure. However, despite tentative signs of progress, investors should remain cautious due to persistent geopolitical and regulatory risks.

In Other News: The Department of Justice’s plan to reclassify marijuana as a less dangerous drug has led to a surge in the WEED ETF. The US Senate passed legislation banning the import of enriched uranium from Russia in another sign that the ties between the country remain severed.

Daily Comment (April 30, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with growing concern among top Israeli officials that they could be indicted for war crimes over their conduct of the war against Hamas. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including several key economic statistics and a preview of the Federal Reserve’s latest policy meeting, which starts today.

Israel-Hamas Conflict: New reporting says Israeli Prime Minister Netanyahu has become increasingly concerned that he and other top Israeli officials could be indicted for war crimes by the International Criminal Court, which has been investigating Israeli and Palestinian conduct against each other over the last decade. The reports say Netanyahu is so concerned that he asked President Biden over the weekend to intervene to make sure the ICC doesn’t issue arrest warrants against him or his national security officials.

- A spokesman for the US National Security Council issued a statement saying that the ICC has no jurisdiction over the Israel-Hamas conflict and that the White House does not support its investigations.

- In any case, Netanyahu’s concern illustrates the risk that Israel is becoming increasingly isolated and is suffering significant reputational damage over its battle against Hamas in the Gaza Strip. As a result, the Israeli stock market, which had become an investor darling in recent years, could face years of headwinds.

Eurozone: Excluding price changes and seasonal effects, first-quarter gross domestic product rose 0.3%, beating expectations and easily reversing the revised 0.1% decline in the fourth quarter of 2023. The growth rate in January through March was the region’s strongest since the third quarter of 2022. Much of the growth reflected a renewed expansion in the German economy, which benefited from stronger investment and exports. Excluding the volatile food and energy categories, the core GDP price index was up just 2.7% year-over-year.

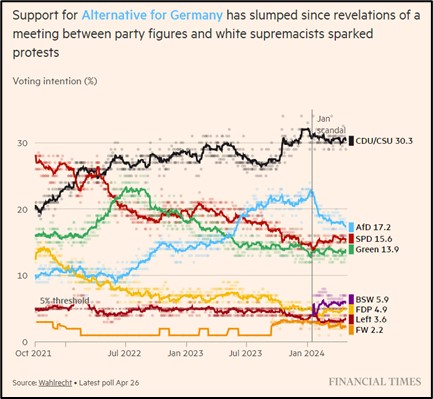

Germany: Little more than a month ahead of the elections for the European Parliament, new polling shows the once-surging, right-wing populist Alternative for Germany (AfD) party is rapidly losing support following revelations that Chinese and Russian spies have been working in its ranks. The reports suggest Chinese and Russian agents have infiltrated populist, anti-establishment political parties and media outlets throughout the West. In turn, any further revelations of the type could slow populist gains in other countries as well.

Japan: Masato Kanda, the vice minister of finance in charge of currency policy, declined today to confirm reports that the government had intervened in the market yesterday to prop up the yen (JPY). Nevertheless, he noted that the recent depreciation in the currency was hurting vulnerable people by raising the prices of imported goods. He stressed that the government would therefore respond firmly to excessive movements in the currency market, in what amounts to a virtual admission of the intervention yesterday.

- Taken together, Kanda’s statement and the intervention yesterday suggest the government’s red line on the yen’s value is now about 160 per dollar ($0.00625). If the currency looks set to depreciate below that level going forward, the government is likely to intervene again.

- So far this morning, the yen is trading at approximately 156.92 per dollar ($0.00637).

Australia: March retail sales unexpectedly fell by a seasonally adjusted 0.4%, wiping out the revised 0.2% gain in February. The culprit? In part, it was Taylor Swift, whose multiple sold-out concerts in February had boosted ticket sales, travel, and other types of consumer spending. Now that the Swifties have gotten back to normal life, the data shows that Australian consumers are in a funk, with retail sales in March up just 1.3% year-over-year.

China: The official purchasing managers’ index for manufacturing fell in April to a seasonally adjusted 50.4, beating expectations but still down from 50.8 in March. The nonmanufacturing PMI fell to 51.2 from 53.0. Like most major PMIs, these are designed so that readings over 50 indicate expanding activity. The April data therefore suggests the Chinese economy is still growing again after a period of weakness, but because of challenges such as the continued decline in real estate development, the recovery remains modest and could fizzle out.

- Faced with the risk of the current recovery petering out, the Communist Party Politburo today issued a statement hinting at new economic stimulus measures.

- The statement suggests the People’s Bank of China could soon launch a new set of interest-rate cuts, while the government provides new support for the housing market.

China-Solomon Islands-United States: The Solomon Islands’ pro-China prime minister, Manasseh Sogavare, yesterday said he would not stand for a new term when lawmakers vote this week for a new prime minister. Rather, ex-Foreign Minister Jeremiah Manele will represent his party. By stepping down, Sogavare insists his party will cobble together 28 of the 50 seats in parliament to retain power, but a coalition of key opposition parties has 20 seats locked up and could convince enough smaller parties and independents to join it and take power.

- If Sogavare’s party loses the parliament vote, it could reflect popular dissatisfaction over his 2022 security deal with Beijing, which has brought Chinese police to the Solomon Islands and drawn the Solomons away from the US.

- Parliament’s vote for the prime minister is due to be held on Thursday.

US Monetary Policy: The Fed begins its latest policy meeting today, with its decision due at 2:00 PM EDT tomorrow. Given the continued momentum in US economic growth and persistent price pressures, the policymakers are widely expected to hold the benchmark fed funds interest-rate target unchanged at a range of 5.25% to 5.50%. Based on interest-rate futures trading, it now appears investors expect the first rate cut — perhaps the only rate cut this year — to come around the end of summer.

- As we’ve noted before, continued high interest rates will likely put stress on certain banks, commercial real estate owners, and other players in the financial markets.

- Despite the economy’s current positive momentum, high interest rates probably remain a risk for the economy and financial markets.

Daily Comment (April 29, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with a discussion of the latest US bank to be seized and sold by regulators as a result of today’s high interest rates. We next review a range of other international and US developments with the potential to affect the financial markets today, including a UK proposal to cut long-term disability benefits due to their spiraling fiscal costs and a proposed tax increase on the wealthy in Russia to help fund its invasion of Ukraine. We also include a preview of this week’s Federal Reserve policy meeting.

US Banking System: On Friday afternoon, state and federal regulators seized Philadelphia-based Republic First Bancorp and sold it to fellow regional lender Fulton Financial. Reports say the bank faced challenges similar to Silicon Valley Bank and the two other lenders that had to be seized last year: a steep drop in the value of its bond holdings as interest rates rose, along with a wave of withdrawals as large depositors sought greater security and higher yields elsewhere. Nevertheless, the seizure hasn’t seemed to spark too much investor concern so far.

- The muted market reaction probably reflects the fact that Republic First had total assets of only about $6 billion at the end of 2023 and a stock-market capitalization that was closer to zero than anything else. The bank’s small size, well understood problems, and orderly seizure could minimize the risk of contagion to other financial institutions.

- Nevertheless, the development underscores how continued high interest rates in the US are stressing particular firms in the financial sector and related industries, such as commercial real estate.

- Despite the economy’s current positive momentum, an unexpected crisis for a big firm could still undermine confidence, spark financial contagion, and potentially put the economy into reverse. We therefore think high interest rates remain a risk for the economy and financial markets.

Japan: Continued high rates in the US also keep buoying the dollar, especially as foreign central banks hesitate to hike their rates or prepare to cut. Exemplifying the trend, the Japanese yen (JPY) today continued to depreciate, almost reaching 160 per dollar ($0.00625), a new multi-decade low. Reports indicate that the government then intervened in the market to lift the currency. As of this writing, the yen is trading at 156.26 per dollar ($0.00640).

United Kingdom: Faced with surging payments for long-term disability benefits, largely driven by mental health issues, the UK government will release proposed rules today to tighten eligibility and cut costs. The proposed rules mark a rare instance in which a Western government has been willing to suggest benefit cuts to a politically popular program as its costs increase in the face of population aging and worsening mental health conditions.

Russia: In a speech last week, President Putin said his government is exploring options for hiking taxes on wealthy companies and individuals. According to Putin, the aim is to make the tax system more progressive, with richer taxpayers obliged to pay a higher rate to fund social programs and channel more resources to the poor. Such a move would also disproportionately hit taxpayers in the rich, vibrant, liberal-leaning cities of Moscow and St. Petersburg, basically forcing them to pay more to support Russia’s expensive invasion of Ukraine.

- Sources say the government is considering hiking the top corporate income-tax rate to 25% from its current rate of 20%.

- For the individual income tax, the government is mulling a boost in the top rate to 20%, versus 15% today, for those with incomes over about $54,300 per year and an increase to 15% from 13% for those with incomes over about $10,860. Individuals with incomes below that level would continue to enjoy the flat 13% rate put into place early in Putin’s reign.

China-European Union: As China continues to boost its electric vehicle industry, leading to excess capacity and surging exports of ultra-low cost Chinese EVs, new research from the Rhodium Group suggests the EU would have to impose tariffs of about 50% to stem the tide and protect domestic EU producers. The report comes as Brussels continues its formal investigation into possible unfair dumping by Chinese EV firms.

- The dumping probe is widely expected to confirm that Chinese EV makers are exporting to the EU at subsidized, unfairly low prices. According to Rhodium, EU policymakers are likely to respond by imposing anti-dumping tariffs of 15% to 30%, despite the risk of angering Beijing and potentially prompting it to retaliate against European exports.

- Nevertheless, the Rhodium analysts believe many Chinese EV makers would still earn a comfortable profit at the EU’s contemplated tariffs. The analysis suggests it would take tariffs of 50% or even more to make the EU market unattractive to Chinese producers.

- Of course, tariffs that high would be even more likely to anger Beijing and prompt retaliation against the EU. All the same, now that EU leaders have joined US leaders in realizing that Chinese dumping could be a mortal threat to their domestic industries, the EU is becoming increasingly aggressive in erecting barriers to Chinese trade.

China-United States: Admiral John Aquilino, the outgoing commander of all US military forces in the Indo-Pacific, has warned that China is pursuing a “boiling frog” strategy in the region. In Aquilino’s analysis, Beijing is actively boosting its military strength and adopting more aggressive military behavior in the Indo-Pacific, but it is doing it so gradually that the US and its allies may not see the danger until it’s too late to reverse it.

- Aquilino’s analysis, which is consistent with our view of Chinese strategy, points to even more tensions or a potential crisis in the region in the future.

- As we often warn, the spiral of tensions and the potential for a future crisis will produce continued risks for investors going forward.

US Monetary Policy: The Fed holds its latest policy meeting starting tomorrow, with its decision due at 2:00 PM EDT on Wednesday. Given the continued momentum in US economic growth and persistent price pressures, the policymakers are widely expected to hold the benchmark fed funds interest-rate target unchanged at a range of 5.25% to 5.50%. Indeed, interest-rate futures trading suggests investors now expect the first rate cut — and potentially the only rate cut this year — to come around the end of summer.

- As noted above, continued high interest rates will likely put stress on certain banks, commercial real estate owners, and other players in the financial markets.

- Despite the economy’s current positive momentum, high interest rates probably remain a risk for the economy and financial markets.

US Electric Vehicle Industry: Tesla has reportedly won Beijing’s tentative approval to release its “full self-driving” software in vehicles sold in China. The company’s FSD software is considered key to reigniting its sales growth in major markets, so the news has boosted Tesla’s stock price by approximately 11% in pre-market trading. Nevertheless, given the Chinese government’s massive support for domestic EV makers, we suspect that excess capacity and falling prices will remain a big challenge for Tesla.