by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are taking a tumble early in the trading session as Meta’s earnings outlook dampens investor optimism. On the sports front, the Miami Heat have tied the series against the Boston Celtics. Today’s Comment explores why Treasury yields might face continued pressure despite recent strength. We also examine the role of US shale production in tempering oil price surges and analyze the escalating rivalry between the EU and China. As always, we’ll wrap up with a summary of important domestic and international data releases.

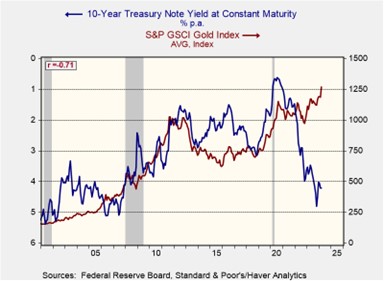

Appetite for Treasurys? Treasury allure persists despite oversupply fears and Fed unknowns, but its longevity is in question.

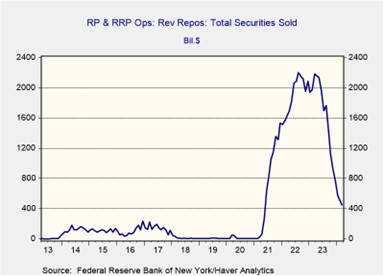

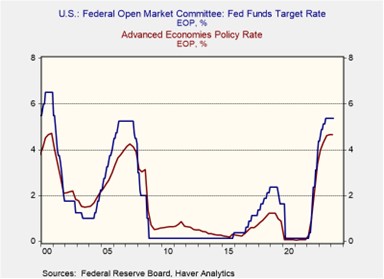

- Demand for U.S. Treasurys held steady even as the government sold a hefty $70 billion in 5-year notes on Wednesday. The auction yield came in at 4.659%, 4 basis points higher than anticipated. This follows strong investor interest in the previous day’s record $68 billion auction of 2-year notes, which yielded 4.898%, slightly below pre-auction yields, easing concerns of the yield topping 5.0%. The upcoming auction of 7-year notes on Thursday will be closely watched as a gauge of investor appetite for longer-term Treasurys given the uncertain outlook on interest rates.

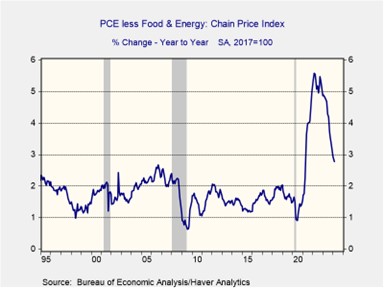

- Investor appetite for Treasurys could face headwinds on Friday following the release of the personal consumption expenditure (PCE) price index. This inflation gauge is being closely watched by the Federal Reserve as it guides its interest rate decisions this year. Consensus forecasts predict a deceleration in the core index, from a year-over-year increase of 2.78% in February to 2.66% in the following month. A reading at or below expectations is unlikely to have a strong impact on rate cut expectations, which now show a terminal Fed Funds rate at a target range of 4.50% to 4.75%; however, a higher reading could boost expectations of no rate cuts at all this year.

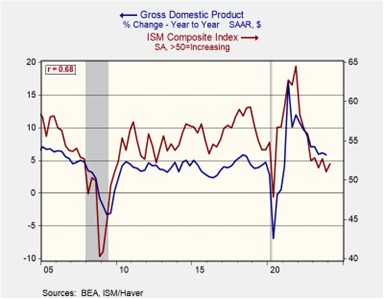

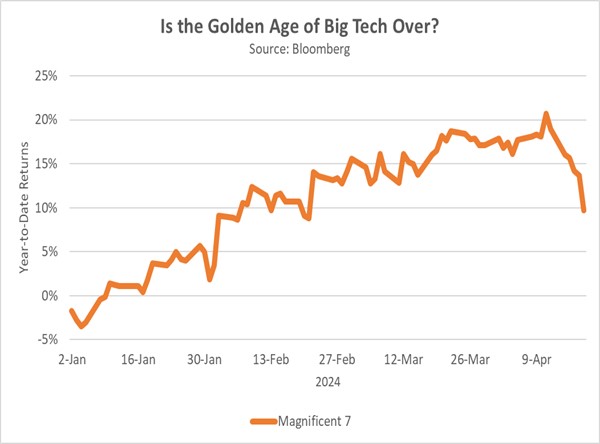

- Fixed-income securities, particularly those with longer maturities, face heightened volatility for the remainder of the year. Investor uncertainty surrounding factors like policy rate changes, geopolitical conflicts, and widening budget deficits is driving this increased volatility. Intermediate-term bonds offer a potential hedge, balancing interest rate risk and price risk more effectively than bonds on either extreme of the yield curve. However, a hawkish shift in Fed policy expectations could lead to broad-based rate hikes across all maturities. Rising rates could dampen the momentum of already expensive equities, potentially benefiting previously overlooked stocks, especially if corporate earnings disappoint investors.

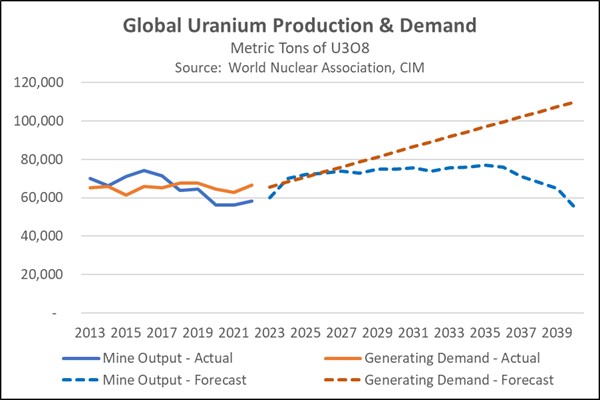

Swing Producer? US oil production has helped moderate oil prices in the face of geopolitical turmoil, but concerns linger about its long-term ability to continue doing so.

- Fears of a wider Middle Eastern conflict sent Brent crude prices surging past $90 a barrel. However, the oil market quickly rebounded as tensions eased, suggesting short-term resilience. This relative calm has alleviated concerns about supply disruptions, as previously delayed shipments are now reaching their destinations, thus reducing some of the market tightness. Iran’s reluctance to close the Strait of Hormuz coupled with U.S. hesitancy to enforce Iranian oil sanctions, suggests that supply will continue to make its way to global markets and could therefore limit the rise in oil prices.

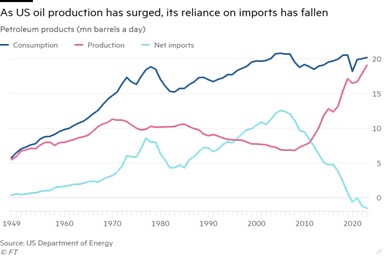

- Soaring 16% this year, Brent crude prices face uncertainty due to continued robust market supply. However, the emergence of US shale production has been a key stabilizing force. This domestic resource has mitigated the impact of rising geopolitical tensions and OPEC production cuts, allowing American consumers to rely more on homegrown oil and reduce dependence on foreign imports. In 2023, the US shattered oil production records thanks to surging shale output, a feat unlikely to be surpassed anytime soon. Meanwhile, US oil consumption has remained relatively flat for the past two decades.

- The recent surge in shale production, though positive, might not be sustainable throughout the decade. A key constraint could be the declining number of operational rigs. Baker Hughes data shows a significant drop of 134 active rigs compared to April of last year, suggesting a potential plateau in production over the next few years. The world may need to turn to other suppliers like Brazil and Guyana to manage oil prices if there is a lull in production. That said, barring major geopolitical disruptions, Brent crude could face resistance around $90 per barrel and potentially dip below $80 by year’s end.

EU-China Rivalry: EU regulators are tightening scrutiny of Chinese firms, potentially aligning with the US approach of strategic competition with China.

- EU regulators raided the offices of Chinese security equipment company Nuctech in the Netherlands and Poland on Wednesday. They suspect Nuctech may have benefited from unfair foreign subsidies that distort competition in the market. Nuctech’s production of cargo, baggage, and body scanners used at airports and border points also raises concerns about potential national security risks, as the company could conceivably gain access to sensitive data on shipments. This raid follows the EU’s recent actions against Chinese companies, including accusations of unfair support for domestic medical device suppliers and an ongoing investigation into electric vehicle exports.

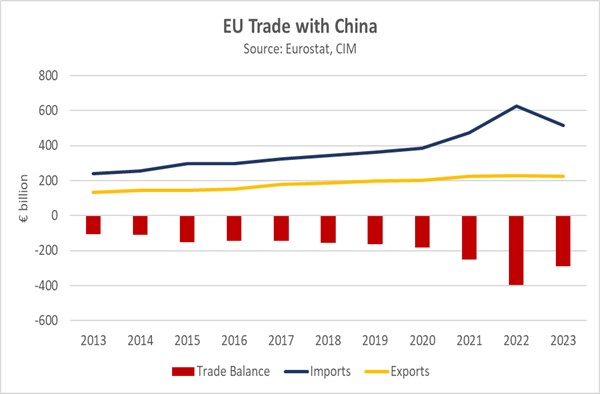

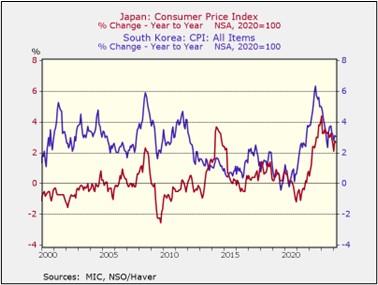

- Brussels’ recent assertiveness toward Chinese firms signals a strategic shift in response to the evolving dynamics with the world’s second-largest economy. Western concerns about recalibrating the relationship with China fuel heightened vigilance against potential market saturation by Chinese goods, particularly as Beijing seeks an export-driven escape from its economic slowdown. This hawkish shift is further reinforced by the EU’s strategic use of trade laws to address security risks posed by some Chinese companies. In 2023, the EU remained the largest importer of Chinese goods, accounting for 20.5% of all imports, while China only accounted for 8.8% of the EU’s exports.

- The escalating tensions between the EU and China highlight Western efforts to counter China’s excessive production capacity, aiming to safeguard their domestic manufacturing industries. This trend is likely to persist in the near future, with both upcoming EU parliamentary elections and the US presidential contest potentially favoring candidates who advocate for a firm stance on China. The new protectionist stance will likely complicate efforts of Beijing to bolster its economy and will make deflationary pressure within the country worse. Furthermore, it could potentially complicate efforts to stabilize the yuan (CNY), which has weakened significantly against the dollar.

In Other News: White-collar job growth has stalled in the US recently, with companies focusing on streamlining operations. French President Emmanuel Macron has called for a monetary policy overhaul to allow countries more flexibility to spend on defense. The Scottish government collapsed after a power-sharing agreement crumbled due to ideological differences.