by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment today opens with several additional observations on the US seizure of Venezuelan President Maduro, with a focus on potential next steps. We next review several other international and US developments that could affect the financial markets today, including the announcement of a more powerful artificial intelligence chip from semiconductor giant Nvidia and a modified international tax treaty that should help shield US multinationals from big tax hikes.

United States-Venezuela: The Wall Street Journal yesterday issued a report showing the Central Intelligence Agency’s role in the US seizure of President Maduro was even wider than previously known. Early reports said the CIA’s clandestine service inserted agents into Venezuela last August to secretly keep track of Maduro, while also cultivating a source within Maduro’s inner circle. According to the new WSJ report, the CIA’s analysis directorate was also instrumental in recommending that Vice President Delcy Rodriguez be left in charge after Maduro’s seizure.

- The CIA’s pivotal role in the Venezuelan action suggests it is already well on its way toward rebuilding its traditional clandestine skillset and analytical prowess, stepping back from the military-operational focus it took on during the War on Terror. That suggests the CIA is well positioned to be a key instrument of US power as the country moves back toward shadowy, rough-and-tumble, “hard power” foreign relations.

- In fact, it would not be a surprise if the Agency already has similar teams in places such as Bogota, Managua, Mexico City, and Havana.

United States-Mexico-Venezuela: It would be no surprise if the US now tries to force the remaining Venezuelan government to stop providing low-cost oil to Cuba, with the aim of destabilizing its Communist government and forcing regime change there. However, new data from Kpler shows that Mexico became Cuba’s top oil supplier in 2025, representing 44% of its total imports, while Venezuela only provided about 34%. That implies that any US effort to change the government in Havana will require putting economic or other pressure on Mexico.

- Because of Mexico’s sizable stock market, many US investors have exposure to it and have already had to deal with major trade-policy changes and US tariff hikes over the last year. If the US now imposes economic or financial pressure on Mexico to end its oil exports to Cuba, investors might have to deal with a new round of uncertainty.

- Nevertheless, we think that Washington’s new focus on dominating Latin America and bringing its economic policies more in line with the US could ultimately be good for many stocks in the region. In the interim, however, the shift in US policy could spark additional volatility in Latin American equities.

Venezuela: Within Venezuela itself, reports today say the remaining Chavista government has launched a crackdown to stifle any social support for Maduro’s seizure. The government declared a state of emergency yesterday, and the reports today say armed Chavista paramilitaries known as colectivos are patrolling the streets of Caracas. Several journalists have already been arrested. The crackdown could prevent social unrest and maintain order, but it could also help solidify the continued rule of the Chavistas and make them more resistant to US demands.

China-Japan: Beijing today issued a global ban on companies providing goods with both civilian and military uses to the Japanese armed forces. According to the announcement, the ban applies to any company anywhere in the world, raising the stakes for any firm that sells to both the Japanese military and has operations in China. The move marks the latest Chinese retaliation for Prime Minister Takaichi’s statement late last year that a Chinese blockade of Taiwan would require Japan to intervene militarily.

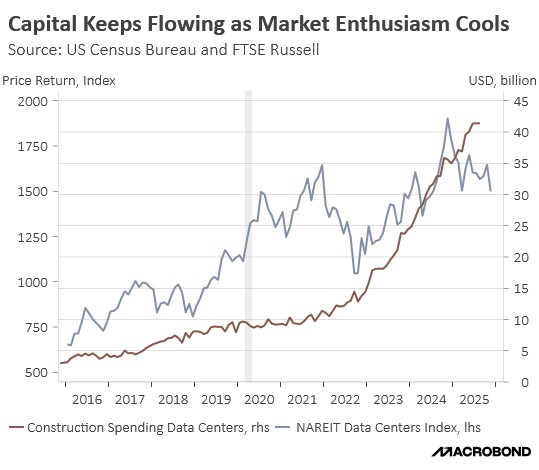

US Semiconductor Industry: Semiconductor giant Nvidia yesterday unveiled its newest chips for artificial intelligence, known as Vera Rubin, months earlier than expected. According to CEO Jensen Huang, the earlier-than-expected release was necessary because of the hugely complex computing required by AI and the immense demand for advanced processors to train and operate AI models. If investors take the news to mean that Nvidia remains well positioned to keep growing as the AI market evolves, it could lead to further gains in Nvidia’s stock price.

US Energy Industry: In an interview yesterday, President Trump suggested he might have the federal government subsidize US oil companies that help rebuild Venezuela’s energy infrastructure. Recent studies show that rebuilding the country’s energy facilities and boosting their capacity again could take up to $90 billion over the next six or seven years. The hint at possible subsidies is a further illustration of how the new US administration is increasingly comfortable with greater government involvement to steer economic activity.

US Industrial Metals Market: US copper prices closed at a new record high yesterday, with contracts for January delivery closing at $5.9245 per pound. They have jumped another 1.1% so far today to $6.0400 per pound. After rising 41% last year, US copper prices have now added another 6.3% so far in 2026. The rise in price largely reflects expectations of limited supply growth while demand surges due to electrification and AI — factors which help explain why copper miners currently make up a large portion of our Global Hard Assets portfolio.

Global Corporate Taxation: The Organization for Economic Cooperation and Development’s 2021 deal on minimum corporate taxes was amended yesterday to give special exemptions to US companies. The deal agreed by 145 countries still sets the minimum corporate income tax rate at 15% to avoid a “race to the bottom,” but there will now be safe harbors for multinationals whose parent company is located in a jurisdiction judged to meet “minimum taxation requirements.” The deal also includes new simplification measures, further cutting the costs for US firms.