by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Our Comment opens with an analysis of the president’s latest home affordability initiatives. We also examine the escalating political infighting over presidential powers, today’s critical tariff ruling, and Meta’s strategic decision to invest in nuclear energy. Additionally, we address the implications of Russia’s recent use of hypersonic missiles in Ukraine. The report also includes a comprehensive roundup of key domestic and international data releases.

Housing Affordability: President Trump has directed Fannie Mae and Freddie Mac to purchase $200 billion in mortgage-backed securities (MBS) in an aggressive bid to lower mortgage rates and improve home affordability. This directive follows his Wednesday announcement of a proposed ban on large institutional investors purchasing single-family homes, a move aimed at reducing corporate competition for prospective homebuyers. Collectively, these actions represent a dual-track strategy to build populist support ahead of the 2026 midterm elections.

- This move is expected to stimulate lending activity, providing a timely boost to a housing market that has recently shown signs of softening. Following the announcement, mortgage-backed securities rallied sharply, while lenders saw their outlook improve on expectations of higher origination volume. The spread between mortgage-backed securities and 10-year Treasury yields also tightened, reflecting anticipated growth in demand.

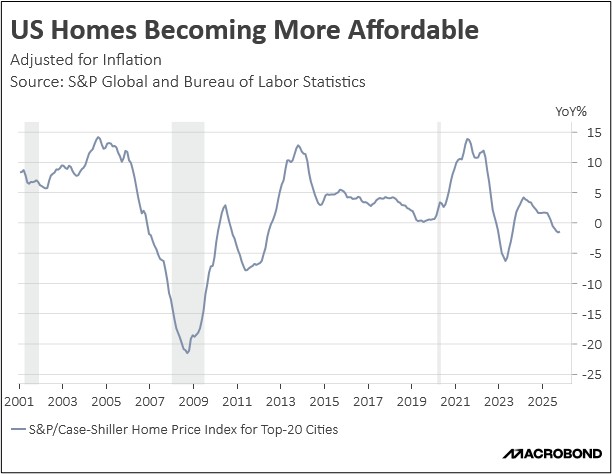

- That said, the impact of this change on the housing market is more nuanced than it appears. Prior to the president’s announcement, Fannie Mae and Freddie Mac had already begun increasing their purchases of MBS. While this successfully narrowed the spread between mortgage rates and the benchmark 10-year Treasury yield, it has yet to spark significant demand. Consequently, nominal home prices are continuing to rise at their slowest pace since 2015.

- The current disconnect in the housing market stems from the fact that recent interest rate declines have yet to reach a critical “tipping point.” As living costs rise and home prices continue to set new records, buyers have grown less sensitive to modest improvements in borrowing costs. To genuinely reinvigorate housing demand, a more substantial correction may be required, whether through a meaningful decrease in property values or a targeted stimulus to help buyers manage steep entry barriers.

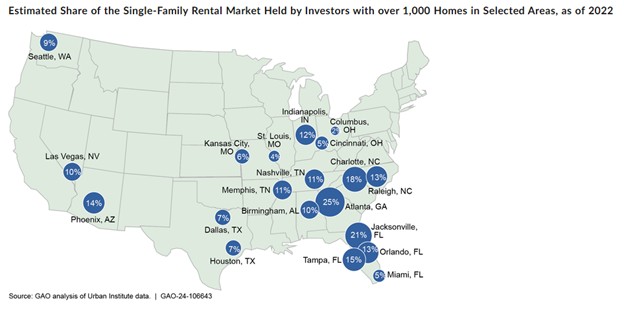

- This context helps explain why the president’s proposed restrictions on institutional home buying could carry significant weight in addressing affordability. Although institutional investors represent a small segment of the national market, their influence has been concentrated in Sun Belt states. By focusing on these high-impact regions, the policy seeks to stabilize housing costs for residents in key swing states and core supporter areas, where home prices remain out of reach for many prospective buyers.

- Forcing these investors to sell their holdings could exert downward pressure on home prices. If coordinated with increased MBS purchases by Fannie Mae and Freddie Mac, this two-part approach could meaningfully improve housing affordability for many voters. While we anticipate that an order to ban institutional investors from the housing market would likely face legal challenges, we believe the administration may still prioritize it.

Presidential Pushback: As the midterms approach, the president is encountering significantly greater resistance from within his own party than he has in the past. This tension was on clear display Thursday when several Republican senators joined with Democrats to pass legislation curtailing the president’s authority to escalate military action in Venezuela. This growing rift is likely to fuel greater political uncertainty, particularly on foreign policy, as the president adopts an increasingly assertive stance toward Latin America and the broader Western Hemisphere.

- In a 52-47 vote on Thursday, the Senate passed an act to restrict the president’s ability to escalate military action in Venezuela without congressional approval. While unlikely to become law (it would need to pass the Republican-controlled House and survive a near-certain veto), the vote represents a direct rebuke from within his own party. In response, the president attacked the senators involved and suggested they should be voted out of office.

- This congressional pushback complicates the president’s efforts to pursue an expansive foreign policy agenda. In addition to Venezuela, administration rhetoric has suggested a willingness to use force in other nations — particularly those linked to drug trafficking — and possibly as a means to acquire Greenland. A public vote that questions his authority could now turn the scope of presidential power into a contentious political issue ahead of the midterms, a scenario the White House would prefer to avoid.

- Furthermore, the Senate’s vote threatens to undermine the administration’s primary source of leverage as it seeks to project greater authority across Latin America. Without the credible threat of continued US military intervention, acting Venezuelan officials may find the space to push back against American demands. This shift could weaken the president’s ability to influence neighboring countries and consolidate regional support for his broader agenda.

- This growing resistance from the president’s own party provides a moderating influence on his foreign policy. By asserting its role in war-making decisions, Congress is effectively lowering the ceiling for military escalation in Latin America. This move toward greater oversight is likely to soothe commodity markets, reducing the uncertainty and volatility that often accompany unilateral military actions.

Tariff Ruling: The Supreme Court is set to rule on the scope of President Trump’s authority to unilaterally implement tariffs. The decision, due today, is likely to clarify the extent of presidential power to impose tariffs without congressional approval and could raise questions about how to handle revenue already collected from these duties. While market expectations suggest the justices will place some limits on this executive authority, we suspect the president may seek alternative legal pathways to maintain the tariffs if constrained by the ruling.

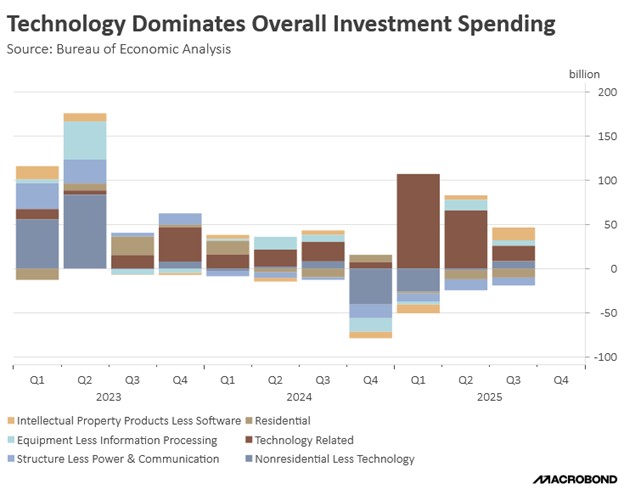

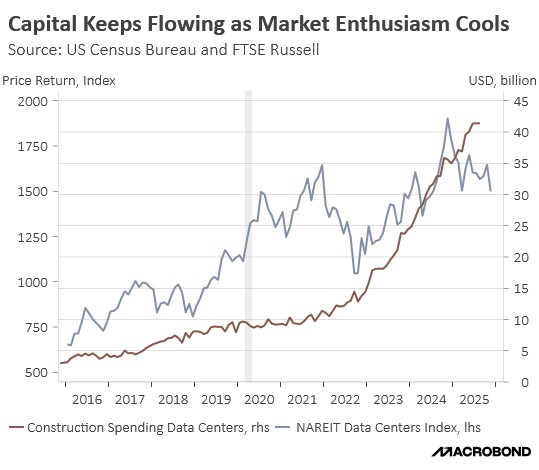

Meta Goes Nuclear: Facebook’s parent company is aggressively securing nuclear power to fuel its AI ambitions, as it has recently announced a major partnerships with Vistra and SMR innovators like Oklo. These agreements underscore the critical role of energy infrastructure in the AI race. As data center density increases, the demand for 24/7 power will benefit a wide array of energy sources, positioning nuclear and natural gas as indispensable partners to solar and wind in meeting the tech industry’s soaring electricity needs.

Russia Ramps Up: Thursday’s Russian strike involving the Oreshnik hypersonic missile represents a dangerous new phase in the war. Impacting a strategic facility near Poland, the attack highlights Vladimir Putin’s willingness to leverage nuclear-capable hardware to influence ongoing peace talks. Although the conflict appears to be moving toward a resolution, Russia’s reliance on high-end weaponry suggests it fully intends to dictate the terms of regional security long after the fighting stops.