by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Equities are off to a so-so start as investors brace for next week’s FOMC meeting. In sports news, the Champions League matchups are set, with a highly anticipated clash between Real Madrid and Manchester City in the quarterfinals. Today’s Comment delves into our analysis of the recent inflation reports, examines the potential impact of overnight reverse repo rates on the FOMC’s policy deliberations, and provides an overview of the upcoming Russian elections scheduled for the weekend. We also include, as always, a roundup of domestic and international data.

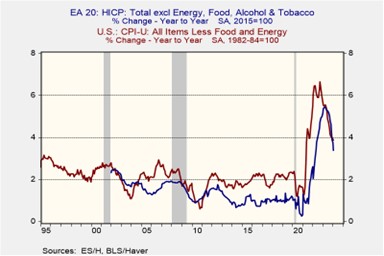

Double Dose of Inflation Trouble: Despite a negative market reaction to the latest inflation report, a closer look at the data reveals a more nuanced picture.

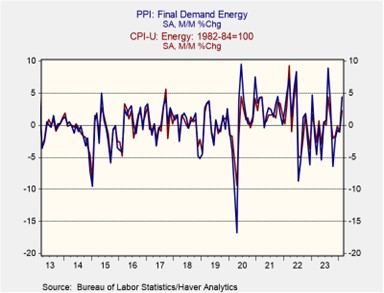

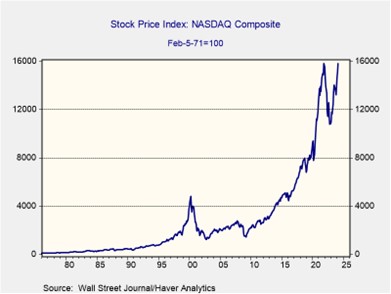

- February’s faster-than-expected rise in wholesale prices is another indication that inflationary pressures remain stubbornly persistent. The producer price index (PPI) in February increased more than expected, jumping from 0.3% to 0.6%, according to the Bureau of Labor Statistics. This aligns with concerns about inflation after the consumer price index (CPI) also rose faster than anticipated earlier this week. Similar to the PPI, the CPI climbed from 0.3% in January to 0.4% in February. Following the PPI report, the 10-year Treasury yield rose 10 bps, while the stock market dipped with the S&P 500 and NASDAQ both falling about 0.7%.

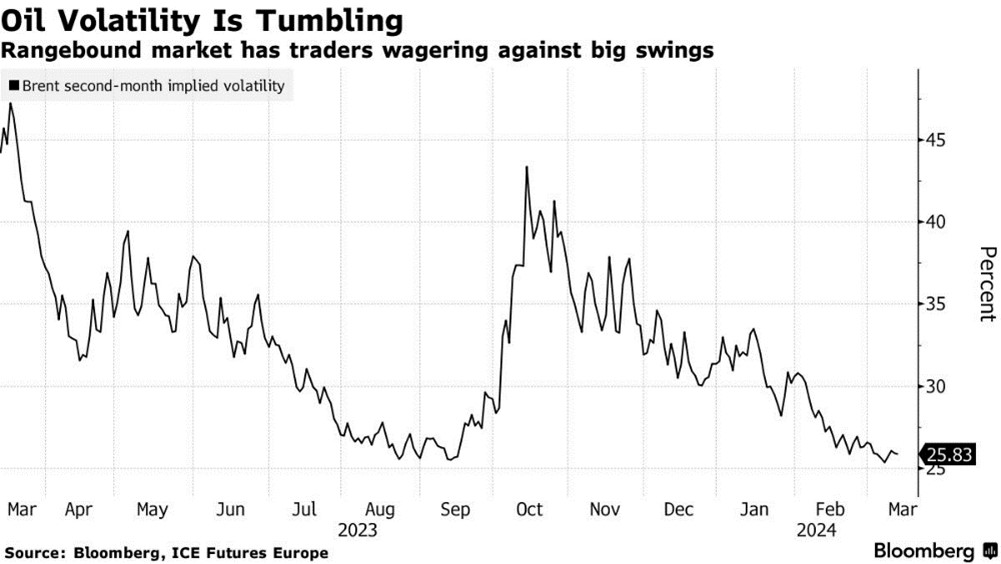

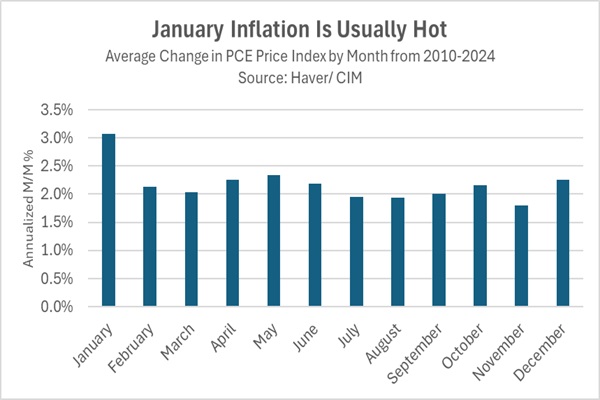

- Concerns in the market about resurgent inflation might be exaggerated. Recent data suggests that inflationary pressures are mainly driven by temporary factors, most notably the significant increase in energy prices. In February, the PPI witnessed a 4.4% surge in energy prices while the CPI reported a 2.3% rise, highlighting the importance of this trend. Additionally, the rise in fuel prices also resulted in higher transportation costs, which further contributed to the unusual increase in both price indexes. In essence, the factors that inflated prices were largely one-time events and may not signal sustained price pressures.

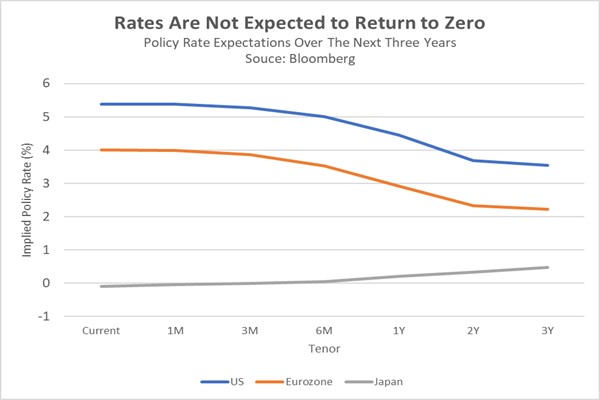

- The hotter-than-expected inflation report likely strengthens the case for the Fed to delay a rate cut. Futures markets currently predict rate cuts in either June or July, which aligns somewhat with Atlanta Fed President Raphael Bostic’s recent comments. The upcoming FOMC meeting in April, with its updated economic projections, will provide a clearer picture of the committee’s policy path for the rest of the year. We expect them to either maintain their current forecast of three rate cuts this year or potentially revise it down to two.

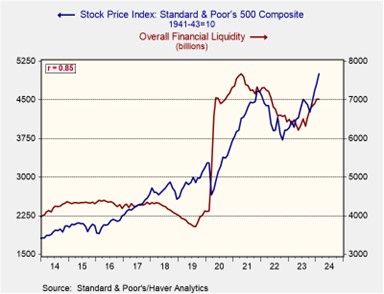

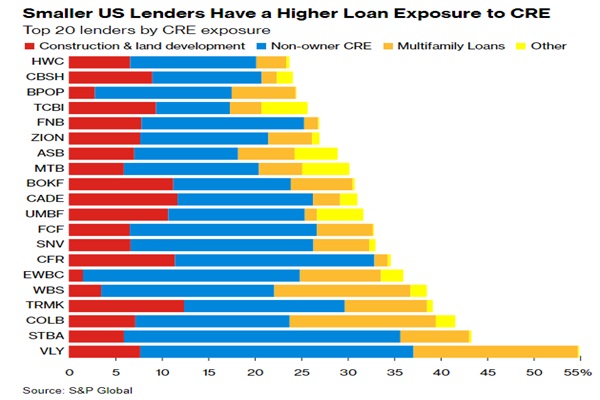

Liquidity and the Stock Market: While a recent cash injection will bolster the financial system, it’s unlikely to prevent a potential liquidity crisis later in the year.

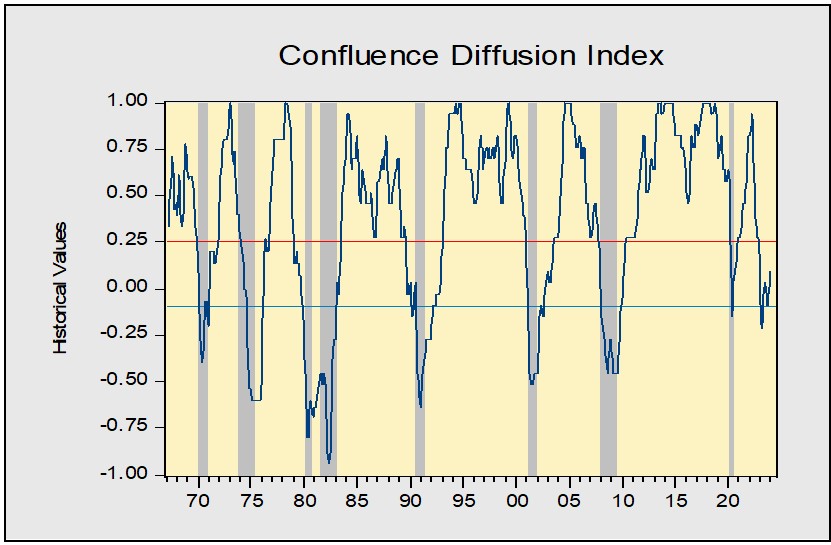

- The Federal Reserve’s overnight reverse repo (ON RRP) facility balance has surged to $521.7 billion. This increase is likely temporary, but it gives policymakers some breathing room to decide when to slow down quantitative tightening (QT). The surge reflects investors who are seeking safe, short-term parking for their cash due to a temporary pause in Treasury settlements. However, with more attractive options now available in other investments like money market fund repos, banks have been diverting funds away from the facility. At the current pace, it is expected that ON RRP will run out of cash by midyear.

- Overnight funding levels are a critical gauge of excess reserves in the banking system. A significant drop can signal potential market stress. As the chart below illustrates, the recent liquidity surge has likely buoyed risk assets. However, the FOMC is grappling with the optimal level of reserves, as it directly impacts the timing of QT unwinding. Governor Christopher Waller downplayed concerns about the zero-balance ON RRP, while Dallas Fed President Lorie Logan expressed anxieties about potential future liquidity issues.

- The Federal Reserve is expected to discuss winding down its QT program at its upcoming meeting, even before the ON RRP facility is drained completely. However, the specific details of this shift remain unclear. While the expectation is for rate hikes to end before QT stops altogether, there’s a possibility the meeting could lead to a slowdown in the pace of tightening from the current maximum of $60 billion in Treasuries and $35 billion in mortgage-backed securities per month. This slowdown could alleviate some market liquidity concerns and potentially boost stock prices.

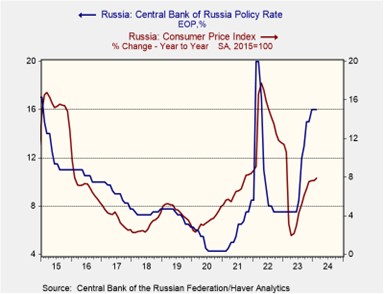

Russian Elections: While Russia’s upcoming presidential election is likely a formality, the outcome could reveal the true impact of the war in Ukraine on Putin’s domestic standing.

- Russian President Vladimir Putin is poised to secure a fifth consecutive term without encountering significant challenges to his leadership, prompting the Kremlin to anticipate a resounding victory. Recent polls indicate a remarkable 86% approval rating for Putin, marking the highest level since 2016. However, despite his widespread popularity, there are concerns that some segments of the populace may seek to express discontent with the Russian leader. A common strategy among voters is to converge at the polls on Sunday and collectively support opposition candidates by casting their ballots simultaneously, aiming solely to spotlight their opposition stance.

- These elections occur amidst a critical juncture in the war in Ukraine. With potential territorial gains, Putin seems intent on exploiting his perceived advantage to solidify his position. Earlier this week, Putin hinted at a willingness to negotiate an end to the conflict in Ukraine in return for security assurances. Russia’s resilient economy is nonetheless being strained by the war’s escalating costs, particularly with declining oil revenues. This fiscal pressure likely explains the Kremlin’s consideration of tax hikes, in a move that could face pushback given the country’s already high borrowing costs and elevated inflation.

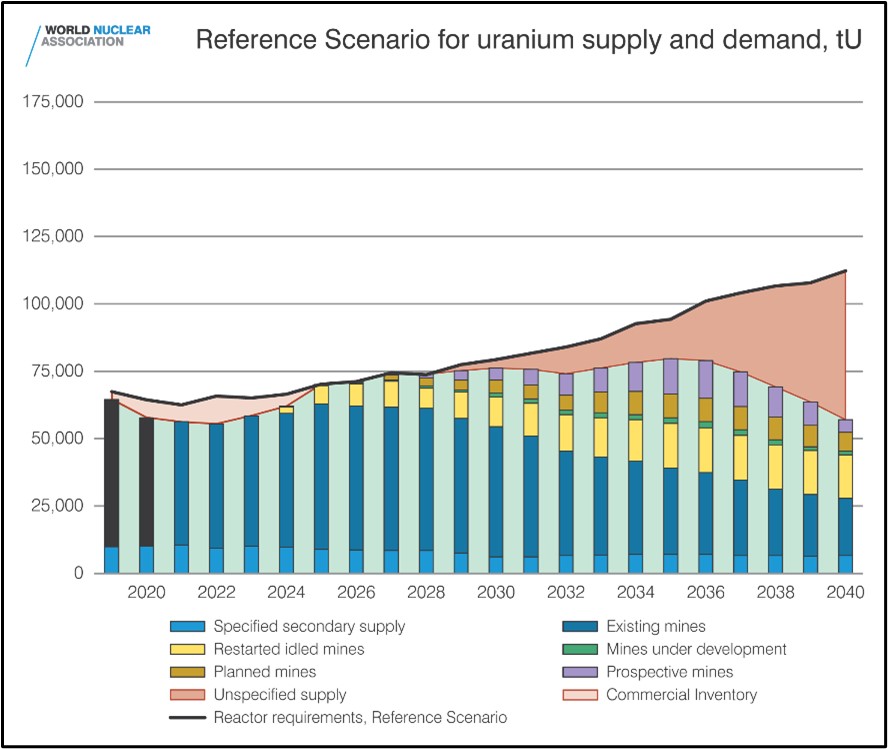

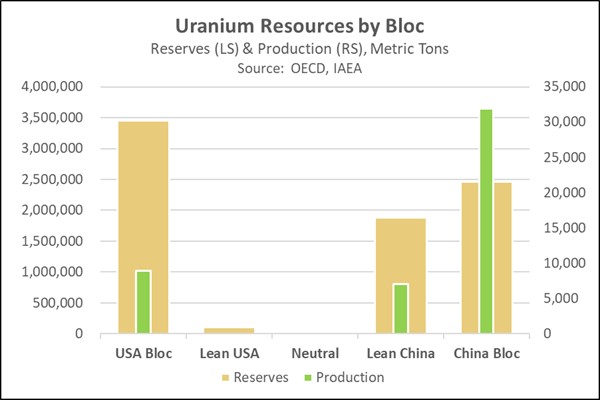

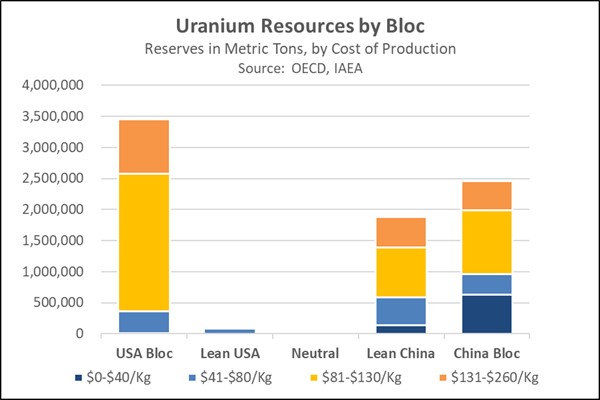

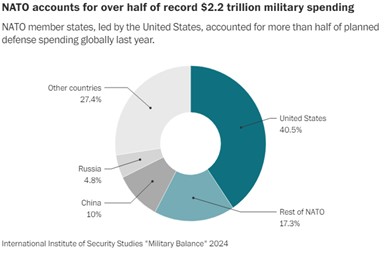

- Another electoral victory for Putin may not startle the markets, but his post-election decisions are expected to draw significant attention. In remarks made on Wednesday, Putin stated that while he currently views the deployment of tactical nuclear weapons as unnecessary, Russia maintains readiness to employ them if it senses a threat to its sovereignty. This highlights the growing importance of nuclear deterrence in national security, especially with recent calls for a stronger European defense in response to Russia. Consequently, we expect continued high demand for uranium and related materials in the coming years.

Other News: China is looking to stimulate its economy by boosting its tourism sector. This move suggests the country may be seeking to improve relations with the West as it grapples with an economic slowdown. Supporters of free-market principles have backed Nippon Steel’s acquisition of US Steel, but the controversy surrounding the deal highlights growing populist sentiment in the United States. Senate Majority Leader Chuck Schumer (D-NY) has pushed for new elections in Israel, signaling mounting impatience in the US with Israeli President Benjamin Netanyahu’s management of the conflict.