Author: Amanda Ahne

Asset Allocation Bi-Weekly – Who Wants US Treasurys? (February 20, 2024)

by the Asset Allocation Committee | PDF

Before August 2023, the Treasury’s quarterly refunding rarely raised eyebrows. Investors readily snapped up US debt, and announcements were largely ignored by markets. However, Fitch Ratings’ surprise downgrade of the US credit rating from AAA to AA that month, just days after a $6 billion increase in the planned quarterly debt issuance, sparked investor concerns. Now, the question looms: Will there be enough demand to absorb the growing supply of US debt?

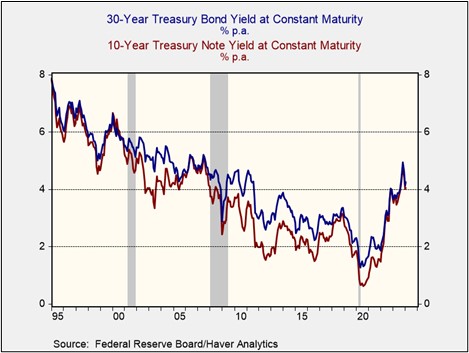

The downgrade by Fitch triggered a sharp rise in Treasury yields, especially long-term yields, which hit their highest levels since 2007. The 10-year and 30-year benchmarks spiked to multi-decade highs, reflecting lukewarm participation at Treasury auctions. Higher borrowing costs and weak auction participation sent the S&P 500 Index tumbling. In response to the market’s negative reaction, the Federal Reserve signaled an end to its hiking cycle and a potential cut in policy rates for the coming year, and the Treasury Department tilted its borrowing toward shorter-term maturities.

While the coordinated efforts of the Fed and Treasury successfully reduced borrowing costs and improved overall risk appetites, investors remained uncertain about the government’s plans to finance its burgeoning debt. This year, $8.9 billion of US Treasury bonds will mature, while the budget deficit is expected to be $1.4 trillion, meaning there will be $10 trillion of bonds coming to the market. Additionally, the Congressional Budget Office projects that the deficit could expand to $2.6 trillion by 2025. This leaves a gaping hole in financing, and without a significant change in market conditions, it is unclear who will step up to buy these bonds.

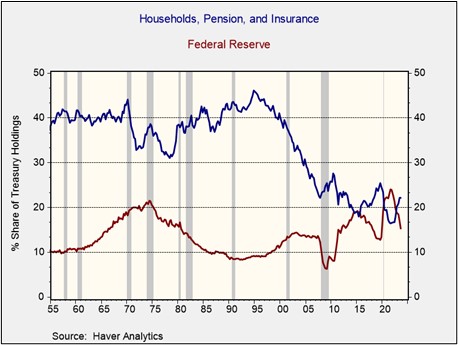

The US Treasury market boasts a unique blend of buyers, each with distinct goals. Central banks, the guardians of global monetary systems, buy Treasurys to secure their reserves and stabilize currencies. Similarly, pension funds prioritize stable, long-term income to fulfill their liability obligations. For the Fed, Treasurys become instruments of monetary policy, influencing interest rates and economic activity. Asset managers diversify their portfolios with these secure assets, reducing risk and volatility. Even households directly participate in holding a portion of the national debt, seeking a safe place for their investments.

The Fed’s shift toward tighter monetary policy in 2022 and 2023 reshaped the allocation of Treasurys. By not rolling over its maturing Treasury holdings, the Fed is now absorbing less of any new supply. Simultaneously, interest rate hikes have incentivized some corporations and foreign central banks to moderate their holdings, creating a demand gap. Households, pension funds, and insurance companies have stepped in to fill this gap, becoming the primary buyers of Treasurys. However, the central bank’s recent suggestion that it will phase in monetary easing later this year introduces uncertainty about who will buy debt going forward.

The high concentration of interest-sensitive investors like households, pension funds, and insurance companies in the bond market raises concerns about the potential impact of future interest rate cuts. Lower short-term rates typically decrease the appeal of risk-free assets like long-term bonds, potentially dampening demand. Households seeking higher returns in an accommodative monetary policy environment may consider diversifying into riskier assets. However, while pensions and insurance companies hold a significant portion of Treasurys, their demand for longer-term bonds is limited by their need to match their obligations.

Historically, broker-dealers have played a key role in stabilizing markets by absorbing available assets, but they face constraints that limit their ability to act as the buyer of last resort when the Fed doesn’t step in and provide liquidity. Broker-dealers, unlike central banks, hold limited inventory as they are primarily focused on facilitating client transactions rather than large-scale asset purchases. This limited capacity restricts their ability to absorb significant volumes of assets during periods of stress. To compensate for the inherent liquidity risk involved in holding large inventories, broker-dealers would require higher premiums, therefore pushing up yields on Treasurys.

With limited demand from traditional buyers putting pressure on long-term Treasury yields, concerns have risen that the Fed may need to intervene to prevent higher borrowing costs for businesses and consumers. Yet, policymakers remain reluctant to increase the balance sheet due to inflation concerns. Chair Powell reiterated during the January FOMC press conference that the committee will discuss slowing QT at their March meeting, suggesting that the committee is not ready to stop reducing its balance sheet.

While potential rate cuts and future reductions could increase demand for Treasurys, limited impact on yields is expected due to persistent inflation concerns and lukewarm investor sentiment. Given the continued supply-demand imbalance, we believe short-to-intermediate-term securities offer a more attractive risk-reward profile compared to long-duration bonds due to their lower interest rate sensitivity and potentially higher returns.

Daily Comment (February 16, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with more news of distorting, state-led policies in China and how they are affecting investors. We next review a range of other international and US developments with the potential to affect the financial markets today, including new moves by Australia to subsidize its nickel miners, indications the European Union is set to subsidize its defense companies, and new research showing US companies still aren’t hiring many more applicants without college degrees, despite today’s labor shortages.

China: After years of excess investment and debt financing for housing construction, the Chinese Communist Party is reportedly developing a plan for the government to take over swaths of China’s residential real estate and convert it to subsidized low-income housing. Such a plan would be in sync with General Secretary Xi’s desire for the Communist Party and the government to have more control over the economy, but it’s not clear how those entities would get control over the assets currently owned by private developers.

- Separately, investors continue to step back from Chinese assets as they increasingly realize the economic and financial market headwinds arising from Xi’s statist policies and other structural challenges.

- All the same, some investors are looking for ways to keep some indirect exposure to China so they can take advantage of any rebound in its economy. New research suggests that one way investors are trying to do that is by buying shares in European luxury goods companies, which get more than one-quarter of their profits from China on average.

India: Despite government efforts to stop them, thousands of farmers continue to march on the capital of New Delhi to demand minimum crop prices and debt service moratoria. The continued protests are increasing the political risk for Prime Minister Modi, who currently leads the opinion polls ahead of the national elections scheduled in the coming weeks.

Australia: The government has formally designated nickel as a “critical” commodity, making the nickel industry eligible for support from a $3.9-billion stimulus fund and for other steps to protect it from the current glut of low-cost Indonesian nickel. Australian nickel miners have also been struggling with the price-deflating impact of softening demand for electric vehicles since nickel is a key component of many EV batteries.

United Kingdom: The Conservative Party of Prime Minister Sunak yesterday lost two parliamentary by-elections. Adding to the pain for the Conservatives, both seats had been considered safe. The results highlight the continuing unpopularity of the Conservatives, who continue to trail the resurgent Labour Party ahead of elections expected this autumn.

European Union: In an interview with the Financial Times yesterday, European Commission President von der Leyen threw her support behind the idea of having Brussels subsidize European defense companies to help them boost their productive capacity in the face of rising threats from Russia and beyond. As we’ve been arguing, increasing geopolitical tensions look set to spark a long-lasting rise in Western defense budgets, creating greater opportunities in Western defense-industry firms, as well as tech or other firms with a lot of defense business.

Russia: Officials today said anticorruption campaigner and opposition leader Alexei Navalny died in the Siberian prison where the government of President Putin had been holding him. The authorities claim the cause of death hasn’t yet been determined. However, given the convenient timing of Navalny’s death, right before Putin faces the next presidential election in mid-March, it would not be surprising if Putin finally decided he couldn’t accept the risk of having a gadfly like Navalny around. Navalny’s death will likely exacerbate Russian tensions with the West.

United States-Russia: The White House confirmed yesterday that it has “troubling” intelligence showing that Russia is developing an advanced anti-satellite weapon, as flagged a day earlier in a message to Congress from the chair of the House Intelligence Committee. As we reported in our Comment yesterday, the weapon appears to be nuclear in nature, so it could signal that Russia is preparing to break out of an international treaty banning the deployment of nuclear weapons in space. In any case, the new weapon will further raise US-Russian tensions.

US Labor Market: Despite today’s labor shortages and companies’ insistence that they are trying to loosen hiring requirements for college degrees, new research shows that even when those requirements are lifted, companies don’t hire many more non-degreed workers. The research suggests several factors are limiting the progress, from automated screening tools that favor college graduates to the difficulty of changing hiring managers’ beliefs about the value of a degree.

Daily Comment (February 15, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with a mysterious warning from Congress about a new, destabilizing military capability in Russia. We next review a range of other international and US developments with the potential to affect the financial markets today, including multiple economic reports related to key economies in Asia and Europe and notes on US fiscal policy and the economic impact of immigration.

United States-Russia: Republican Representative Mike Turner, chair of the House Intelligence Committee, issued a cryptic call for all lawmakers to visit a secure facility in the Capitol so they could review new classified intelligence regarding what he called “a destabilizing foreign military capability.” Administration officials speaking on condition of anonymity said the intelligence relates to a new Russian nuclear capability that could be used against US satellites in space. The officials said the weapon is still in development and has not yet been deployed.

- Reports say Turner’s committee has had the referenced intelligence for about a week, and National Security Advisor Jake Sullivan was already scheduled to brief Congressional leaders on the intelligence on Thursday. It is therefore not clear why Turner issued his unusual call yesterday.

- It’s possible that Turner is simply trying to whip up anti-Russian sentiment as Congress battles over military aid to Ukraine to help it fight off Russia’s invasion.

- Nevertheless, Russia is far ahead of the US in modernizing its nuclear force, and it has made progress in developing exotic new technologies, such as hypersonic missiles. As we discussed in our recent Bi-Weekly Geopolitical Report, space has also become a high-priority warfighting domain for today’s top militaries. It would not be surprising if Russia really has leapfrogged the US in some new, destabilizing capability.

- In any case, such a development would be more evidence that the world is becoming more chaotic and risky, as we have long expected. However, while the evolving world will create headwinds for many investments, it will also likely create some investment opportunities. Here at Confluence, we continue to focus heavily on managing investments with a keen eye on both the risks and the opportunities.

Israel-Hamas Conflict: After Iran-backed Hezbollah militants apparently fired missiles from southern Lebanon into Israel yesterday, killing one Israeli soldier and wounding several others, Israel unleashed artillery and air strikes against southern Lebanon, killing and wounding both Hezbollah members and civilians. The attacks are a reminder that Israel’s retaliatory war against the Hamas government in Gaza could still spread into a regional conflict, which would threaten energy and commercial supply chains critical to the global economy.

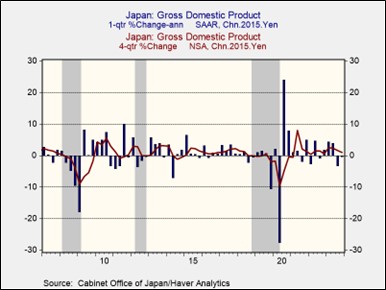

Japan: New data shows gross domestic product unexpectedly fell for a second straight quarter at the end of 2023, putting the Japanese economy in a technical recession. After stripping out price changes and seasonal effects, fourth-quarter GDP fell at an annualized rate of 0.4%, after dropping at a rate of 3.3% in the third quarter. Nevertheless, good growth earlier in 2023 meant that Japanese GDP in the full year was up 1.9%, accelerating from its growth of 1.0% in 2022 and helping confirm positive trends that have recently boosted Japan’s stock market.

South Korea: The Financial Services Commission has launched a public-private partnership to provide the equivalent of $57 billion in low-cost loans to boost investment in targeted sectors, such as advanced semiconductors, batteries, and smaller companies. Including two state-owned lenders and five major commercial banks, the program is part of a global trend in which governments are embracing subsidies, trade barriers, and other forms of industrial policy to promote favored sectors.

- These modern industrial policies largely aim to improve economic resilience, shield the country from external supply shocks, and promote better-paid jobs at home.

- The downside is that this could further fracture and balkanize global supply chains over time, making the global economy less efficient and leaving inflation and interest rates higher than they otherwise would be.

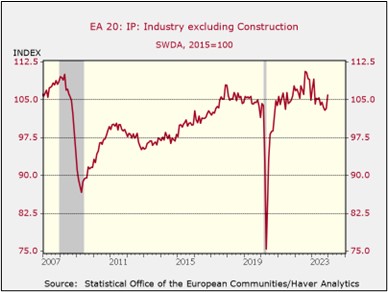

European Union: The European Commission today cut its economic growth forecasts for the overall EU and the eurozone. The Commission now expects gross domestic product in the EU to grow a modest 0.9% in 2024, while it expects eurozone growth to come in at just 0.8%. Previously, the Commission had forecast growth of 1.3% and 1.2%, respectively. Despite recent data suggesting Europe’s industrial recession could be bottoming out, the region continues to struggle with high energy prices, elevated interest rates, and weak domestic and foreign demand.

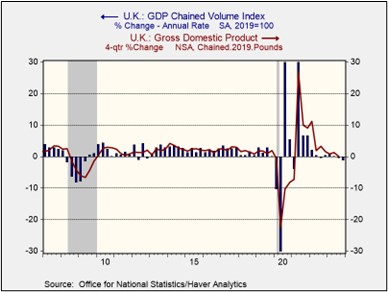

United Kingdom: Similar to the Japanese experience, British gross domestic product fell for a second straight quarter at the end of 2023, putting the country in a technical recession. After stripping out price changes and seasonal effects, fourth-quarter GDP fell at an annualized rate of 1.4%, worse than expected and far more than the 0.5% rate of decline in the third quarter. The British economy continues to struggle against a range of headwinds, including high prices, elevated interest rates, and weak demand.

United States-China: Volkswagen is reportedly holding thousands of imported Porsche, Bentley, and Audi autos on US docks after the company was informed by one of its downstream suppliers that the cars were equipped with a small electronic component from western China that might have been made with banned forced labor. Volkswagen is replacing the components at dockside, which is likely to delay US delivery of many of the autos for months.

US Fiscal Policy: In an interview yesterday, Lael Brainard, director of the White House National Economic Council, argued that the ability of the US economy to keep growing despite the Federal Reserve’s high interest rates and slowing inflation can be largely ascribed to the administration’s stimulative fiscal policies, including its big infrastructure rebuilding law and subsidies for investments in advanced technologies.

- Those programs probably have started to pump cash into the economy, but we don’t think that’s necessarily the main fiscal stimulus that’s boosting economic growth.

- Our recent work suggests much of the stimulus comes from expanding Social Security and Medicare outlays now that so many baby boomers retired during the COVID-19 pandemic, along with a drop in personal income tax revenues because of big, inflation-generated adjustments to tax brackets last year.

US Labor Market: Congressional researchers have estimated that the huge influx of migrants coming across the southern border in recent years will expand the labor force beyond what they previously predicted, thereby boosting future economic growth and government revenues. However, the researchers also believe the new immigrants are less educated than previous waves, meaning they could be less productive and therefore hold down wages for less-skilled job categories.

Back to the Future: The Advantages of Dividend Income Over Interest Income (February 2024)

Insights from the Value Equities Investment Committee | PDF

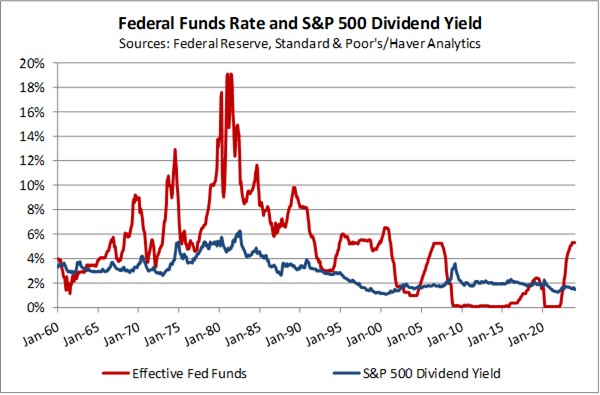

Over the past 15 years, dividend income has often exceeded what could be earned in a money market account. But as seen in the chart below, with the fed funds rate now at 5.5%, the relationship between dividend income and interest income has gone back to what was common before 2008 — where the S&P 500 dividend yield (the blue line) is 2-3% below what could be earned in a money market account invested in U.S. Treasury bills (the red line).

This begs the question:

Why should an income-oriented client still invest in a dividend income-focused stock portfolio yielding 3% when they can now earn 5% in a low-risk money market account?

Higher inflation is causing interest rates to rise on short-term fixed income and money market instruments, and now investors have more choices in generating income returns. While current yields are appealing, we believe it would be short-sighted for long-term investors to abandon the compounding benefits of a growing income stream that can protect purchasing power while also providing for growth of principal.

In this Value Equity Insights report, we highlight some of the potential advantages of growing dividend income through a portfolio of quality, growing businesses — factors which might be underappreciated in the current environment.

Daily Comment (February 14, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with new forecasts showing continued growth in the demand for liquified natural gas and how populist politics in the West could nix the resulting export opportunities. We next review a range of other international and US developments with the potential to affect the financial markets today, including surprisingly good industrial production figures out of Europe and a few words on yesterday’s market rout in the US.

Global Energy Market: In a report yesterday, oil-and-gas giant Shell said global demand for liquified natural gas will keep rising through at least 2040, when it will be more than 50% higher than it is today. According to the report, the continued rise in LNG demand will come largely from China, as that country’s industrial sector transitions from coal to gas, and from fast-growing countries in southern and southeastern Asia.

- Despite the projected demand growth, however, populist policies in the developed countries could limit the West’s export potential. One example of that is the Biden administration’s recent decision to pause approvals for new LNG export terminals. Besides appeasing the members of his political base who are against fossil fuels, Biden’s decision probably also aimed at bottling up gas supplies and keeping down energy prices in the US. A populist Republican administration could be tempted to do the same.

- In such a world, the natural gas and other key commodity markets could become fractured, with radically different prices between regions. The result would probably be a less efficient global economy and slower economic growth.

Eurozone: December industrial production rose by a seasonally adjusted 2.6%, beating expectations for a small decline and accelerating from the revised 0.4% gain in November. Output was up 1.2% from December 2022, marking its first year-over-year rise since last February. Along with surprisingly good purchasing managers’ index numbers recently, the production figures suggest the eurozone economy may be starting to bottom out, even if it is still struggling with issues such as high energy costs, elevated interest rates, and poor demand.

United Kingdom: Just a day after data showed continued strong wage growth that could discourage the Bank of England from cutting interest rates soon, a separate report showed the January consumer price index was up 4.0% year-over-year, matching its increase in the year to December instead of accelerating to the expected annual rise of 4.2%. The report will likely rekindle hopes of a near-term cut in interest rates despite yesterday’s data on wage increases.

India: With national elections coming up in just a few weeks, Prime Minister Modi’s government is scrambling to defuse mass protests by farmers demanding guaranteed crop prices and loan waivers. Negotiations yesterday between officials and protest organizers were unsuccessful, and thousands of farmers from across the country are marching on New Delhi, where the government is setting up roadblocks. To preserve his frontrunner status, Modi could well offer concessions that would expand the budget deficit and weigh on Indian asset prices.

Indonesia: In an election today, preliminary results show a big lead for controversial Defense Minister Prabowo Subianto, who commanded special operations forces when the country was a dictatorship decades ago and was accused of kidnapping democracy activists. Subianto has vowed that, if elected, he will continue the current government’s nonaligned foreign policy, as well as its economic policy focused on boosting nickel production to leverage the global shift toward electric vehicles.

Russia-Ukraine War: Kyiv today said it sank another large Russian navy ship in the Black Sea, this time using Ukrainian-made Magura V5 sea attack drones. Besides demonstrating Ukraine’s increasingly capable and sophisticated domestic defense industry capabilities, the sinking also illustrates how Kyiv’s most successful military efforts these days are in the maritime domain. Nevertheless, Ukraine’s military is increasingly on the defensive as it loses Western aid, and the Russians ramp up their military resources.

United States-China: In another piece of evidence that the Pentagon is preparing for a potential conflict with China in the Indo-Pacific region, the US Army has established its first overseas watercraft unit in decades. Based at Yokohama, Japan, the 5th Transportation Company will have 13 vessels (including landing craft, support vessels, and tugboats) and 285 Army mariners. While the Army remains focused on land warfare, the move shows how it is preparing to also fight in an Indo-Pacific maritime environment if needed.

US Stock Market: Following yesterday’s report that the January Consumer Price Index was up a stronger-than-expected 3.1% from one year earlier, and the core CPI was up 3.9%, a range of US assets sold off strongly yesterday. The S&P 500 stock price index dropped 1.4%, while the NASDAQ index fell 1.8% and the small-cap Russell 2000 price index plunged 4.0%. Bond prices also fell sharply, driving the yield on the benchmark 10-year Treasury note up to 4.32%. Most key commodity prices weakened, and the dollar surged.

- The selloffs reflected concern that sticky inflation will prompt the Federal Reserve to delay cutting interest rates. Indeed, market indicators showed that investors now expect policymakers to implement their first rate cut in June rather than May.

- The inflation data and the shifting expectations for rate cuts are consistent with our oft-stated view that investors have probably gotten ahead of themselves in expecting rate cuts in the near term. With egg on their faces for letting inflation get too high in 2021 and 2022, the Fed policymakers now want to be absolutely certain that price pressures have eased before they cut interest rates. As that continues to sink in with investors, the market could face further bouts of volatility.

US Politics: In a special election yesterday, voters in New York elected Democrat Tom Suozzi to replace ousted Republican Representative George Santos. Once Suozzi takes his oath, the Republicans in the House will be left with an even slimmer majority of 219 to 213 (three vacancies will remain). Suozzi’s healthy victory margin of 54% to 46% has also left Democrats optimistic that they can win despite being on the back foot on immigration issues as migrants continue to flow into the US across the border from Mexico.

Confluence of Ideas – #35 “Reviewing the Asset Allocation Rebalance: Q1 2024” (Posted 2/13/24)

Daily Comment (February 13, 2024)

by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with several notes related to China, including changes to a key index of Chinese stocks. We next review a wide range of other international and US developments with the potential to affect the financial markets today, including a hotter-than-expected reading on British wage growth and a discussion of how artificial intelligence is affecting the US labor market.

China-Hong Kong: With the Hong Kong municipal government preparing a new national security law that would hew closer to mainland China’s tough rules, US law firm Latham & Watkins said its attorneys in the city will no longer have automatic access to the firm’s international databases. The lawyers will still be able to access mainland Chinese documents, but they will need special permission to see foreign information.

- The Latham & Watkins announcement helps confirm that cross-border information flows between China and the US geopolitical bloc will be a new arena of decoupling.

- The restrictions on Chinese-Western information flows follow years of increased barriers to trade, capital, technology, and even travel and tourism flows in each direction.

- As we have long argued, this fracturing of global markets is likely to reduce global economic efficiency and lead to higher costs, increased inflation, and elevated interest rates going forward, with particularly negative impacts on fixed-income assets.

Chinese Stock Market: Stock index compiler MSCI announced today that it will add five new names to its benchmark MSCI China Index, but it will delete 66 names that now fail to meet its standards because of China’s long stock slump. The 66 deletions, which stem from MSCI’s regular quarterly review, are more than in its last four quarterly adjustments combined. With the deletions, the index will now have slightly more than 700 names in total.

- Since many investors seeking to match the MSCI China Index will now have to sell out of the deleted names, those stocks are now likely to come under increased selling pressure. The deleted stocks include the likes of Weibo and China Southern Airlines.

- Currently, the MSCI China Index is down more than 7% for the year-to-date and about 27% over the last year.

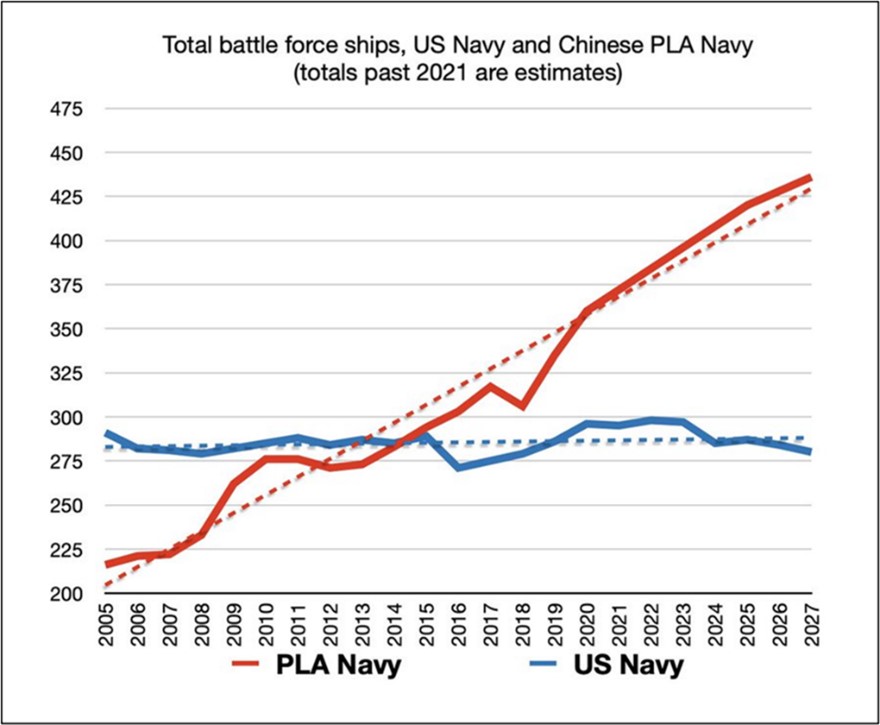

Chinese Shipbuilding Industry: Based on our expectation of ever more intense Great Power competition between China and the US, we pay a lot of attention to each side’s military power and defense industrial capacity. The Wall Street Journal today carries a good article showing how China’s shipbuilding industry has surged to become the world’s largest and richest, with many times more capacity to build commercial and naval ships than the US and the West.

- As we often note, China now has the world’s largest navy, with more than 350 combat ships. Moreover, the Chinese navy continues to grow rapidly, while the US is basically stagnant at about 295 combat ships.

- While we continue to believe that the US and the West will keep ramping up their defense budgets in the face of increased aggressiveness by the China/Russia geopolitical bloc, the lack of shipyard capacity (including a big shortage of workers) is holding back the US military’s rebuilding so far.

(Source: TheSoundingLine.com)

(Source: TheSoundingLine.com)

Russia-Estonia: The Russian government has put Estonian Prime Minister Kaja Kallas on its wanted list, along with dozens of other Baltic politicians critical of the Kremlin and its war against Ukraine. Although the move could be mere grandstanding by the Kremlin, it comes amid a surge of extraterritorial law enforcement and intelligence operations by authoritarian or authoritarian-leaning states ranging from China to India. The risks for Baltic politicians on Russia’s wanted list are therefore elevated.

- Separately, the Estonian foreign intelligence service has issued a warning that the Kremlin plans to double the number of troops it has along its border with Finland and the Baltic states in preparation for a possible war in the coming years. According to the report, Russian leaders are reluctant to attack any NATO territory right now, but they calculate that they could be in a position to do so within a decade.

- Despite Russia’s poor military performance early in its invasion of Ukraine, it has now ramped up its defense industrial capacity and improved its troop mobilization, leaving it in a stronger military position than many expected. With Russian President Putin intent on re-establishing the Soviet/Russian empire, further weakening of the US commitment to defending European territory would risk inviting a Russian invasion.

United Kingdom: Today, just as data indicated that US consumer price inflation slowed less than expected in January, a report showed UK wage growth slowed less than anticipated in October through December. The British data revealed that average weekly earnings in the period were up 5.8% from one year earlier, moderating from the annual increase of 8.5% during the summer, but the sticky wage growth will still likely discourage the Bank of England from aggressive rate cuts in the near future.

US Labor Market: New data suggests that generative artificial intelligence (AI) has already resulted in thousands of layoffs across the US economy, while more than half of all white collar “knowledge workers” report they are using the technology at least on a weekly basis. The report will likely boost concerns that generative AI will render the jobs of many affluent, college-educated knowledge workers obsolete, although we suspect it will also create many new jobs for those with skills in the technology.

US Weather: A strong nor’easter storm is lashing the Mid-Atlantic and Northeastern states today, leading to many cancelled airline flights in New York City and other major metropolitan areas. The storm won’t necessarily have a noticeable impact on national economic or financial market performance, but it could certainly be disruptive for travelers today.