by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war. Today is Ukraine’s national Independence Day and marks six months since the start of the war. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including the European drought, tension in Brazil, and the latest student loan forgiveness program.

Russia-Ukraine: Russian and Ukrainian forces continue to make only limited attacks and territorial gains against each other, but momentum continues to shift gradually toward the Ukrainians. One piece of evidence in that regard is that Russia has reportedly been forced to transfer more national guard forces to the Russia-supporting province of Luhansk in eastern Ukraine to maintain order as more citizens there begin to oppose the war. Separately, reports indicate that Russian President Putin has lost so much trust in Defense Minister Shoigu that he has taken direct control over many of the Russian units fighting in Ukraine.

- In an address today to mark Ukraine’s Independence Day, President Zelensky said the country had been reborn because of Russia’s invasion, and he defiantly vowed that Russian forces would be pushed out of all Ukrainian territory. As if to emphasize the point, Ukrainian forces destroyed another Russian ammunition dump in occupied territory in the country’s east.

European Drought: A new report by an EU research center says about 47% of the EU is under drought warning conditions and 17% in drought “alert,” meaning vegetation and crops are being affected. The report also warns that the drought is having a severe impact on hydroelectric production and is threatening the cooling systems of other energy facilities. The report projects that the drought will persist until November, prolonging the risk of food production disruptions, high energy prices, and the associated economic headwinds.

United Kingdom: As Foreign Minister Liz Truss and Former Chancellor Rishi Sunak continue to battle it out to succeed Boris Johnson as Conservative Party leader and prime minister, the prolonged mudslinging is starting to erode popular support for the party. The latest polling shows support for the opposition Labor Party is currently 12 percentage points higher than the support for the Conservatives. However, although there is still some chance that the Conservatives could recover once their leadership race ends in a couple of weeks.

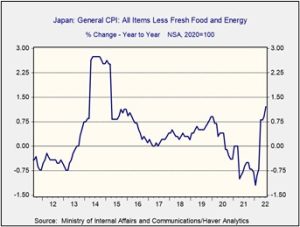

Japan: Prime Minister Kishida reportedly plans to announce that Japan will not only restart several nuclear power plants shuttered after the 2011 meltdown at Fukushima but will also start studying the construction of new, modern plants. The move would mark a major policy shift in Japan, which had virtually shut down its nuclear sector after the Fukushima disaster. The move could also be a harbinger of a broader re-embrace of nuclear power globally.

China-Vietnam: Sources say Apple (AAPL, $167.23) is in talks to produce its Apple Watches and MacBooks in Vietnam as it expands its effort to diversify production away from China. Even though Apple is still reluctant to stray too far from China, its effort to move more production to Vietnam illustrates how Western countries are increasingly wary of putting all their eggs in the Chinese basket as U.S.-China tensions worsen.

Brazil: In a major escalation of political tensions, Brazil’s electoral court ordered searches of the homes of several prominent businessmen over their alleged support for an undemocratic seizure of power if President Bolsonaro loses his re-election bid this autumn, as anticipated.

United States-Iran: In the negotiations to restart the 2015 deal limiting Iran’s nuclear program, U.S. diplomats said “gaps” remain in Iran’s response to the EU’s “final draft” of a new deal, despite some progress being made. Given that Iran evidently continues to make progress on its nuclear development, which would reduce the benefit of a new deal, it is looking increasingly unlikely that a substantive new agreement will be reached.

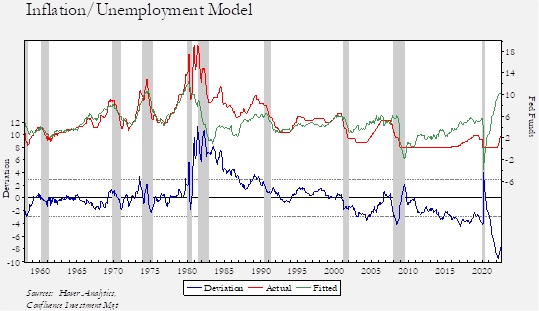

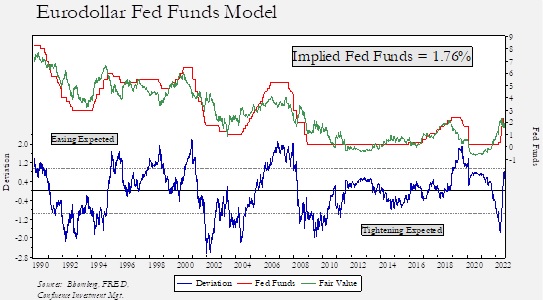

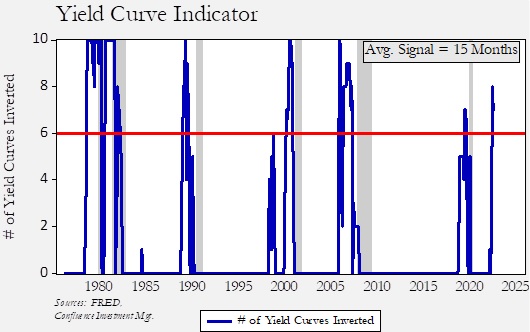

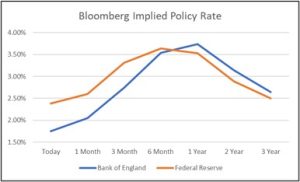

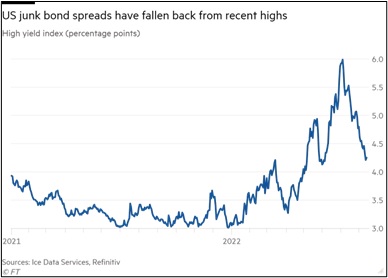

U.S. Monetary Policy: At an event yesterday, Minneapolis FRB President Kashkari said that when consumer price inflation is as high as it is now, the Fed should err on the side of tighter monetary policy and not worry too much about putting the economy into recession. Even though Kashkari isn’t a voting member of the Fed’s policymaking committee this year, his statement may reflect the sentiment of other policymakers. His statement, therefore, adds to concerns that investors may be placing too much hope on a near-term Fed pivot toward lower interest rates.

- Meanwhile, the Kansas City FRB kicks off its conference in Jackson Hole, Wyoming, today, with Fed Chair Powell set to deliver his keynote address on Friday morning. Investors remain concerned that Powell will also push back on recent market expectations (hopes?) that the policymakers will soon pause their aggressive interest-rate hikes or even pivot to cuts.

- One important impact of the Fed’s rate hikes is that they’ve helped boost borrowing costs worldwide, including in less developed countries. Those countries are now burning through their foreign currency reserves as they deal with higher interest rates and higher prices for food and energy imports, potentially setting up more emerging market debt defaults.

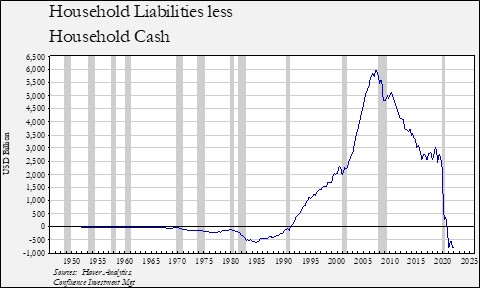

U.S. Fiscal Policy: President Biden today reportedly plans to announce a student loan forgiveness program that would cancel up to $10,000 of student debt for people making less than $125,000 per year or married couples making up to $250,000 per year. The action is expected to eliminate student debt for about 15 million people, although the program is also likely to generate legal and political pushback, in part because of its impact on the federal budget deficit.

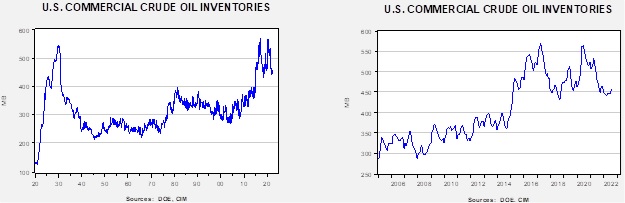

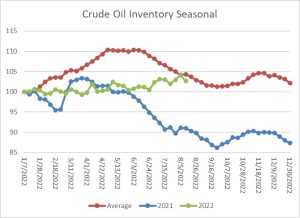

U.S. Energy Markets: When we wrote our Comment early yesterday morning, we mentioned that natural gas prices at the time were surging on concern about another cutoff of Russian gas supplies to Europe. Later yesterday, however, Freeport LNG announced that it would delay the restart of its LNG export facility in Texas, which has been shut down for repairs after a fire several months ago. With U.S. gas exports now expected to be impeded for longer than previously thought, gas has fallen back below $10.00 per BTU and is currently trading at approximately $9.37.