by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM ET] | PDF

Good morning! The market is on hold as investors await the release of US PMI data, which will provide insight into the strength of the economy. In sports news, Canada secured a victory over the US in the 4 Nations Face-Off. Today’s Comment will cover key highlights, including our analysis of Scott Bessent’s recent interview with Bloomberg, an overview of the upcoming German elections this weekend, and discussions of other important market developments. As always, the report will also feature a summary of the latest international and domestic data releases.

Scott Bessent Speaks: The US Treasury Secretary spoke with Bloomberg, outlining the Trump administration’s key objectives as it advances its policy agenda. The interview occurred just one day before his scheduled meeting with China’s top financial official, where the two were set to discuss the evolving dynamics of US-China relations.

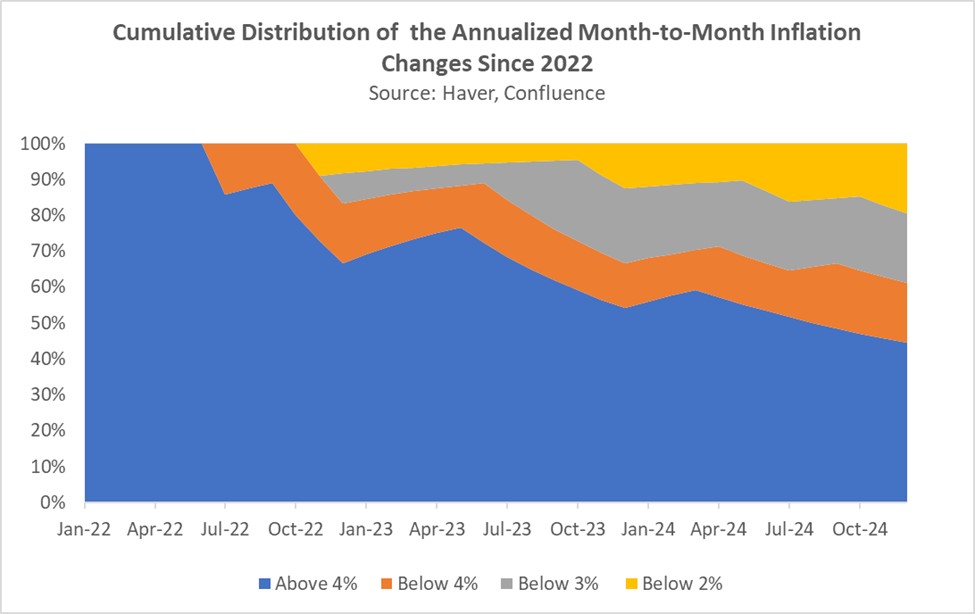

- During the discussion, Bessent reaffirmed the US’s commitment to maintaining a strong dollar policy and upholding Federal Reserve independence, though not without a few pointed remarks. He noted that while the US prefers a strong currency, it also wants other countries to avoid currency manipulation, specifically calling out China and the European Union. He also criticized the Fed for suggesting that tariffs could contribute to inflation, implying that even if such an effect occurred, it would likely be transitory.

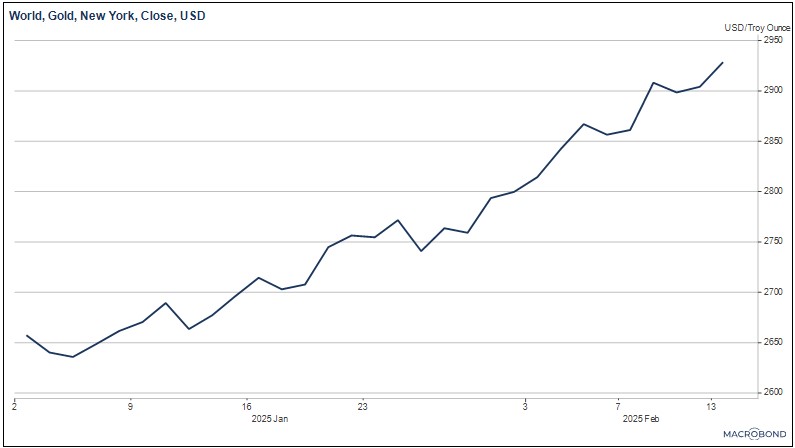

- Bessent also addressed and dispelled rumors surrounding gold. He emphasized that the US holds all the gold reported on its balance sheet and noted that these reserves are subject to regular audits. Additionally, he dismissed speculation that the US might revalue its gold holdings as part of its efforts to establish a sovereign wealth fund, saying that it was not something he had considered.

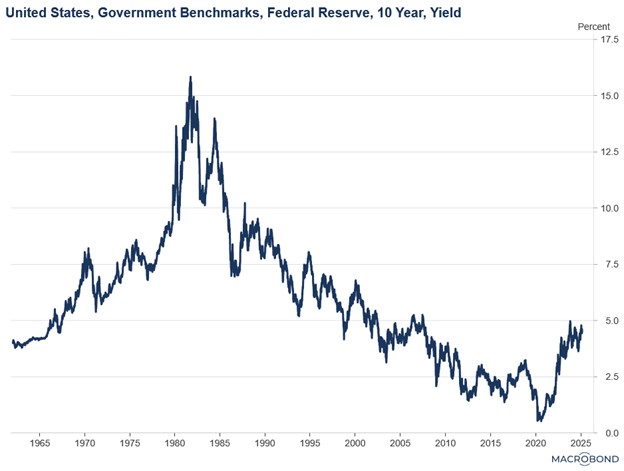

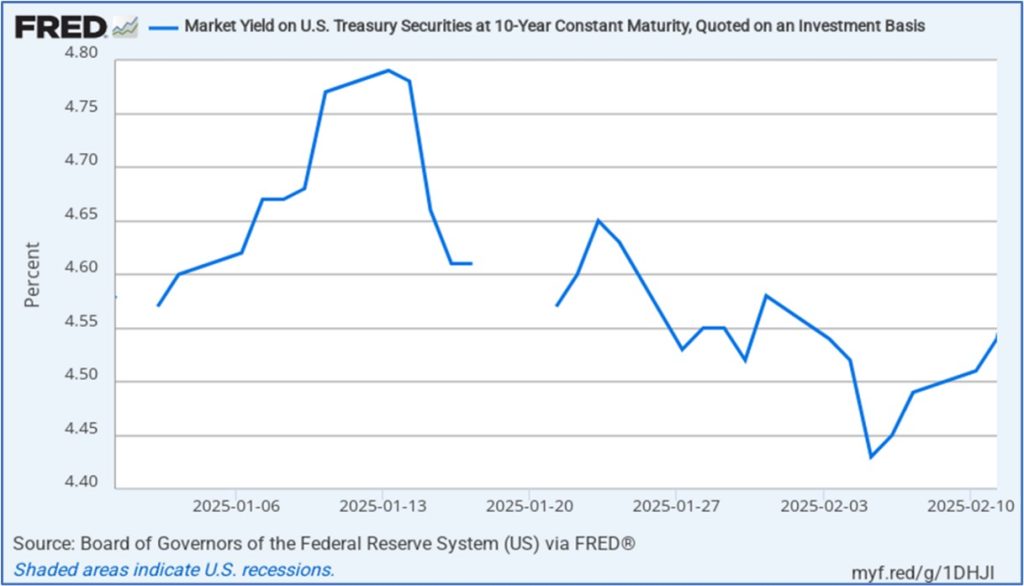

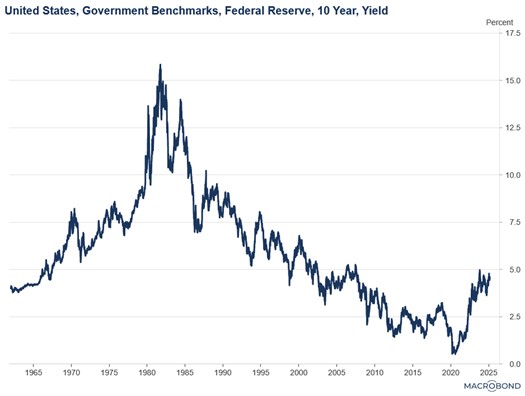

- Additionally, he discussed the Trump administration’s efforts to reduce long-term bond yields. Bessent indicated that the Treasury might maintain the current duration of bond issuances until the Federal Reserve halts its quantitative tightening program. He also suggested that cost-cutting measures could play a role in helping to bring yields down further.

- Although the interview did not provide significant new insights, it did highlight the Trump administration’s preference in avoiding extreme measures while pursuing its agenda. Despite the provocative rhetoric often seen in headlines, the administration has shown a reluctance to adopt interventionist policies, such as devaluing the dollar or revaluing gold, that could severely destabilize financial markets. This suggests a more cautious approach than the bold claims might imply.

German elections: The country is holding parliamentary elections on Sunday, with the two leading parties, the Union parties (CDU/CSU) and the far-right Alternative for Germany (AfD), expected to secure the most votes. However, neither is projected to win a majority.

- Recent polls suggest that CDU/CSU is likely to secure around 30% of the vote, while AfD is expected to garner 21%. Although the combined support for both parties would be enough to form a government, CDU/CSU has categorically ruled out entering into a coalition with AfD. That said, the race remains highly unpredictable, with roughly a fifth of the electorate still undecided.

- The battle for control of the government is expected to be highly contentious. While the CDU/CSU holds an advantage, a strong performance by AfD could significantly undermine their leverage. Meanwhile, the other two parties likely to gain seats — the Social Democratic Party (SPD) and The Greens — are polling at 16% and 13%, respectively. However, neither party is close to securing the number of seats required to form a coalition.

- If the polls are accurate, CDU/CSU may have to rely on smaller parties to form a government. These include the left-wing Sahra Wagenknecht Alliance (BSW), The Left party, and the fiscally conservative Free Democratic Party (FDP). While FDP is ideologically closer to CDU/CSU, polls suggest the party is trending below the 5% threshold required to secure parliamentary seats. As a result, CDU/CSU may be forced to make concessions to one of the left-wing parties to achieve a governing majority.

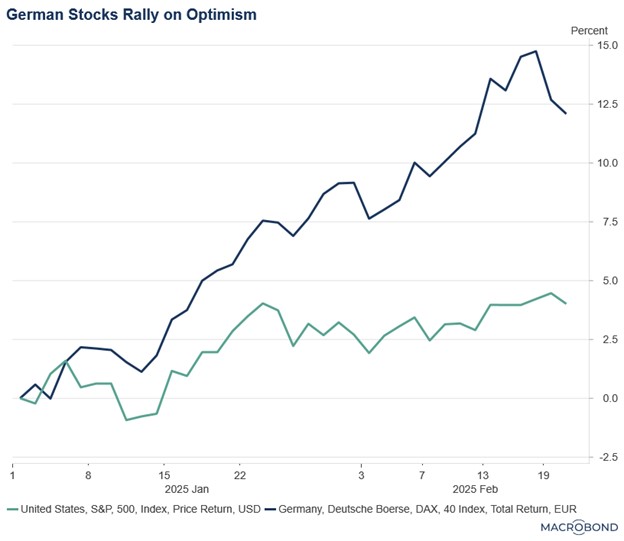

- Year-to-date, the German equity market has been one of the world’s best-performing markets, rising nearly 12%. This growth has been fueled by optimism surrounding a potential economic rebound, expectations of increased fiscal spending following the election, and the possibility of an end to the war in Ukraine. We suspect this trend could continue as long as there are no surprises in the election.

The Great Rebalance: US and Chinese officials are set to discuss measures aimed at addressing trade imbalances, particularly by encouraging China to reduce its reliance on exports for growth and boost its domestic consumption.

- Ahead of the talks, Chinese Premier Li Qiang emphasized the need for the country to expand its services sector, particularly in areas such as healthcare, sports, and entertainment. His comments come as the country struggles to deal with crippling deflation due to the lack of domestic demand for goods and services.

- While Li’s remarks suggest a willingness to engage in dialogue, China is unlikely to change its course of action without sustained pressure from the US. China has a history of making promises and not delivering on them.

- We believe a crucial step for the government to reduce its reliance on export growth and stimulate domestic consumption is the creation of a comprehensive social safety net. This would empower households to spend more freely on discretionary items.

- The US effort to improve its savings and trade balance may rely on convincing China to boost welfare spending. While Chinese leaders have discussed strengthening the social safety net, little action has been taken. If reforms materialize, increased consumer confidence could make China a more attractive investment destination by driving domestic consumption and reducing export reliance.

Zelensky-Trump Rivalry: Ukrainian President Volodymyr Zelensky and US President Donald Trump have been embroiled in a heated exchange over Ukraine’s valuable mineral resources. The tension arose after Zelensky reportedly refused to cede more than 50% of the rights to these resources without firm guarantees of security and stability for Ukraine.

- The Trump administration has argued that the proposed deal would strengthen bilateral ties by aligning the interests of both countries. It believes that such an arrangement would foster mutual benefits and long-term cooperation. However, President Zelensky has emphasized that any agreement must include concrete commitments and guarantees from the US administration to ensure Ukraine’s sovereignty and security are safeguarded in exchange for access to its valuable resources.

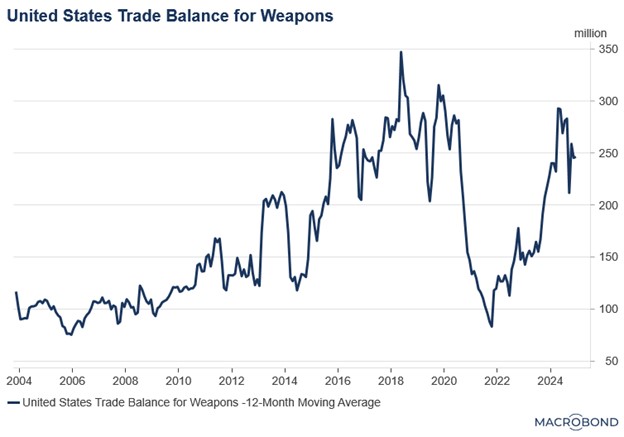

- The dispute over Ukraine’s mineral resources is particularly significant, as many of these valuable materials, which include rare earth elements and titanium that are critical for weapons development and advanced technologies like semiconductors, are located in regions currently occupied by Russia.

- While the friction between Zelensky and Trump is unlikely to cause a complete breakdown in relations, it could strain their partnership and complicate efforts as peace talks move forward.