by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today opens with new data showing slowing wage growth in major developed countries, which should eventually allow the major central banks to start cutting interest rates (though probably not as soon as many investors expect). We next review a range of other international and U.S. developments with the potential to affect the financial markets today, including the latest signs that the Middle East conflicts could broaden and worsen and increased regulatory action in the U.S. as the Biden administration gears up for the November election.

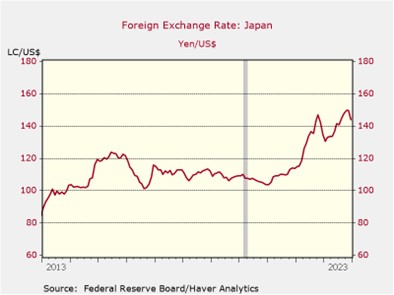

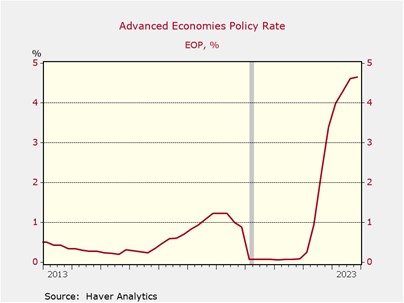

Global Labor Markets: New cross-country figures from recruiting site Indeed show average wage growth slowed markedly in major developed countries over the last six months. In the U.S., for example, the report shows advertised wages and salaries in December were up just 3.8% year-over-year, down from a peak of 9.5% year-over-year in late 2021. Advertised wages and salaries in the eurozone were also up 3.8% on the year, compared with a peak of 5.2% in 2022. Pay increases also moderated in the U.K.

- The figures from Indeed help confirm that consumer price pressure is likely to keep moderating in the near term.

- In turn, that should help encourage the major central banks to eventually start cutting interest rates, although policymakers continue to caution that any rate cuts will likely come later than investors currently seem to expect (see the latest statements in this regard in our discussions below).

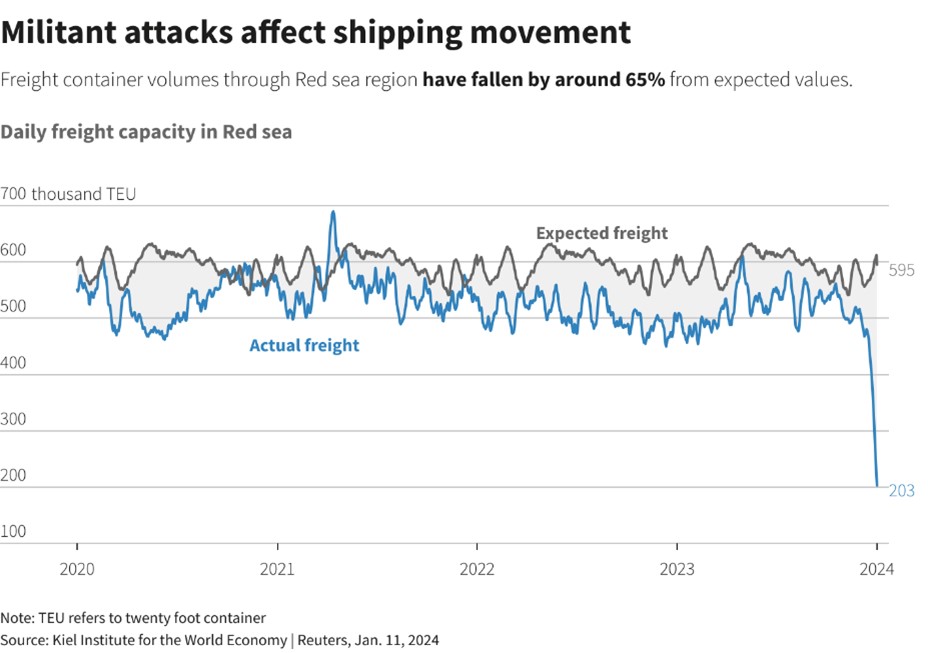

Middle East Conflicts: One day after launching missile strikes against regime opponents in Syria and Iraq (including an alleged Israeli “intelligence center”), Iran’s Shiite-led government said yesterday that it launched missiles and drones against a Sunni jihadist group in Pakistan. Separately, the U.S. launched a strike against Iran-backed Houthi rebels in Yemen for the third time in the last week, preemptively destroying four anti-ship ballistic missiles the rebels were preparing to launch against commercial and military ships in the Red Sea.

- The latest attacks come on top of Israel’s continuing ground invasion against Hamas militants in the Gaza Strip, its effort to control rising unrest among Palestinians in the West Bank, and sympathy attacks against Israel by Iran-backed militants in Lebanon, Syria, and Iraq.

- Outside of Gaza, it appears that all these entities are trying to calibrate their attacks to sufficiently weaken or dissuade their targets without sparking an even stronger response. With so many different countries and groups launching weapons, we see an increasing risk that one of them will miscalculate and spark an even broader, more intense, and more dangerous escalation.

- It’s true that even safe-haven assets such as gold and crude oil sold off today (probably on concern that interest rates won’t be cut as aggressively as investors had hoped), but the growing risk of a broader conflict in the Middle East will likely keep them relatively well bid in the near term.

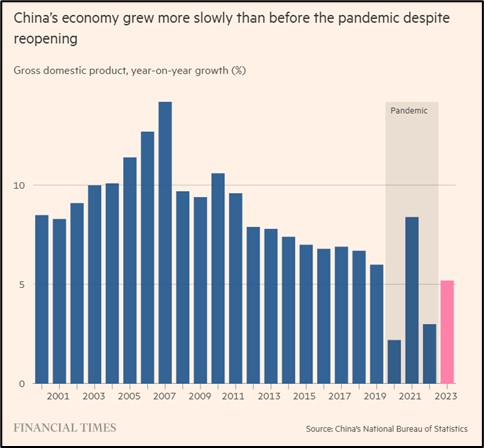

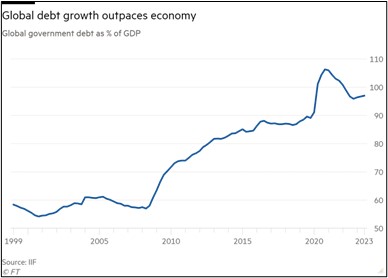

Chinese Economic Growth: As flagged by Premier Li Qiang in a speech yesterday, the government issued official data today showing Chinese gross domestic product rose by an inflation-adjusted 5.2% in 2023. That was slightly better than the government’s target of 5.0% for the year, but excluding the extraordinary swings during the COVID-19 pandemic, it was the slowest official growth rate since 1990.

- Going forward, we expect Chinese economic growth to remain challenged by what we call the “Five Ds”: Weak consumer demand, high corporate and local government debt, poor demographics, economic disincentives from the Communist Party’s increasing intrusion into the economy, and decoupling as foreign countries shift their trade, investment, and technology flows away from China.

- Since China accounts for so much of the global economy and world trade, its continued weakness is likely to weigh on output in countries around the world, retarding profit growth and presenting headwinds for financial markets.

Chinese Demographics: Highlighting China’s demographic challenges, data today shows births in the country fell to slightly more than 9 million in 2023, down from more than 9.5 million in 2022 and less than half the nearly 19 million as recently as 2016 (see graph below). That means China’s fertility rate — the number of children a woman has over her lifetime — has fallen to just above 1.0, far below the “replacement rate” of more than 2.0. The figures therefore portend further population declines and increasing average ages in the future.

Eurozone: At the World Economic Forum in Davos, Switzerland today, European Central Bank chief Lagarde said her institution would probably wait until summer before cutting interest rates, rather than cutting in the spring as some officials and observers expect. Coupled with a surprise acceleration in U.K. consumer price inflation announced today, Lagarde’s statement is further evidence that bond investors around the world have gotten ahead of themselves in expecting near-term rate cuts. Global stock and bond prices have therefore fallen so far today.

France: In an effort to undercut the rising popularity of right-wing populists, President Macron has announced that his new cabinet will focus on law and order, easier regulations for businesses and workers, and reduced budget deficits. In theory, the pro-business policies should be attractive to investors, but it is important to remember that Macron’s centrist alliance no longer has a majority in parliament, so getting the program into law will be challenging.

U.S. Monetary Policy: In a speech yesterday, Fed Governor Christopher Waller warned that the monetary policymakers want to be sure consumer price inflation has indeed been subdued, so they would “take [their] time” before cutting interest rates. With the statement, Waller appeared to be taking back the dovish views he shared last November, which helped spark the recent rally in bonds and drove yields back down to what we consider excessively low levels. In response, investors dumped bonds, and the yield on the 10-year Treasury note jumped to 4.0660%.

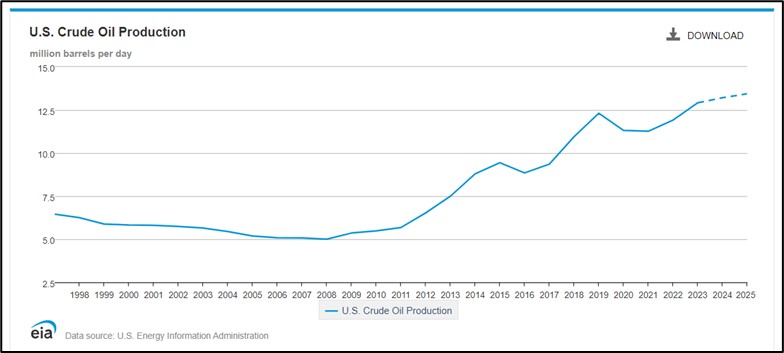

U.S. Energy Regulation: Under pressure from climate-change activists, the Biden administration is reportedly considering whether to review the government process for approving export terminals for liquified natural gas. Since the U.S. opened its prolific shale patch in recent years, the country has become the world’s top exporter of LNG. Any eventual new regulations could throttle the growth of the industry and boost energy prices abroad, although bottling up gas in the U.S. market could bring down prices — and profits — here at home.

U.S. Financial Services Regulation: Stepping up the Biden administration’s attack against “junk fees,” the Consumer Financial Protection Bureau today is expected to propose a cap on overdraft fees at banks with $10 billion or more in assets. Reports indicate the proposed cap could be as low as $3 per instance, compared with as much as $39 today. If implemented, the cap could greatly reduce the $9 billion or so of overdraft fees that major banks pull in annually.

U.S. Artificial Intelligence Industry: Microsoft (MSFT, $390.27) announced today that it will offer new subscription-based AI tools for individuals and small businesses that would include the ability to develop custom chatbots. The move is consistent with our previously expressed view that AI would likely evolve from enormous, broad-based generative AI systems to more highly focused, customized AI tools for specific purposes or which could perhaps be trained on an organization’s specific data. In any case, the announcement points to continued rapid innovation in AI.

(Source: Wall Street Journal)

(Source: Wall Street Journal)

(Source: The Economist)

(Source: The Economist)