by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Our Comment today opens with an update on the Russia-Ukraine war, focusing on the two sides’ artillery attacks even as they remain generally in an operational pause. We next review a wide range of other international and U.S. developments with the potential to affect the financial markets today, including an important warning from a Federal Reserve official that the central bank may be tightening policy too rapidly.

Russia-Ukraine: Russian and Ukrainian forces both remain in a relative operational pause, with both sides engaging in only limited, sporadic ground attacks. However, both sides also continue to stage more substantial long-range artillery attacks on each other. According to Kyiv, the Ukrainian military used advanced artillery systems recently delivered from the West to destroy at least one Russian command post and ammunition depot near the occupied southern city of Kherson, killing a dozen Russian officers. Other reporting suggests the Ukrainians may have destroyed as many as 20 ammunition depots with the new weapons, producing increasingly severe shortages for the Russian forces. Meanwhile, the U.S. announced last week that it will send four more HIMARS long-range artillery systems to Ukraine, bringing the total sent to 12. Finally, in a welcome sign that Ukraine could eventually resume some food exports despite the war, officials said the recent liberation of the strategically located Snake Island off Ukraine’s southern coast has allowed eight foreign ships to access Ukrainian ports.

- S. National Security Advisor Sullivan said intelligence indicates Iran is preparing to provide Russia several hundred drones, including weapons-capable versions, to help on the Ukrainian battlefield. Under the deal, Iran will also train Russian troops to use the drones, beginning as early as this month.

- In a sign that at least France hasn’t yet lost its urgency to rebuild its armed forces in response to Russian aggression, Defense Minister Lecornu proposed a €44-billion military budget for 2023, up €3 billion from the 2022 budget. If enacted, the defense budget increase would be nearly twice as large as any in the last two years.

- In part, the higher defense spending is needed to replenish munitions and equipment that have been sent to Ukraine.

- The government is also looking to fund major modernization efforts, support ongoing efforts to combat terrorism, and boost its defense industrial base.

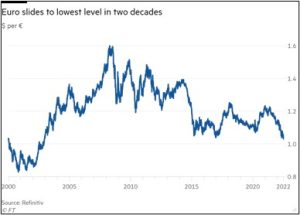

Eurozone: Reflecting Europe’s wartime energy crisis, record-high inflation, and lagging monetary policy, the euro continues to lose value and almost fell to parity with the dollar earlier today. At its lowest point, the euro could be bought for just $1.0002, its lowest level since 2002.

- Despite the inopportune timing, EU finance ministers this morning will give their final thumbs up to Croatia’s adoption of the euro from January 1. According to studies of how the euro transition in other countries worked out, we would look for a modest increase in Croatian inflation early next year as shopkeepers take advantage of the opportunity to round up their new euro prices.

- We also note that with its adoption of the euro, Croatia will gain a seat on the ECB’s policy board.

European Travel Industry: London’s Heathrow Airport said it would cap the number of departing passengers from the facility at 100,000 a day until September and has asked airlines to stop selling new tickets from the airport for the summer season. The move follows similar caps imposed at London’s Gatwick Airport and Amsterdam’s Schiphol Airport as rebounding travel demand collides with post-pandemic labor shortages.

United Kingdom: Former Chancellor Rishi Sunak has emerged as the front-runner in the race to replace Boris Johnson as Conservative Party leader and prime minister. Sunak currently has more publicly declared support from other members of parliament than any of the other remaining nine candidates, including several high-profile supporters. However, his challenge is to head off opposition from the right of the party, notably from other contenders with more aggressive tax-cutting platforms.

Argentina: In her first official press conference yesterday, newly appointed Finance Minister Batakis said she is committed to the IMF-Argentina financing deal struck earlier this year. She also promised that Argentina “is not going to spend more than we have.” Meanwhile, IMF Managing Director Georgieva said she felt positive after her first meeting with Batakis last week. Despite the good vibes, however, we think the Peronist government in Buenos Aires will have a hard time regaining investor confidence after its long string of debt defaults.

South Pacific: After months of controversy over China’s move to build security ties among the island nations of the South Pacific, both Kiribati and the Marshall Islands have abruptly pulled out of a Pacific Islands Forum summit meeting. The news has stoked concern that Chinese meddling was behind the rupture, as it tries to weaken the region’s most important diplomatic body and assert its own leadership instead.

Global Personal Computer Market: Data firm Gartner (IT, $244.37) said global PC shipments in the second quarter were down 12.6% year-over-year, marking their steepest annual decline in nine years. The decline reflects several challenges for PC makers, including geopolitical uncertainty sparked by the Russia-Ukraine war, spending shifts as consumers adjust to higher inflation, a reversal of pandemic-driven electronics demand, and ongoing supply chain issues. The report could be a further headwind for technology stocks in the near term.

United States – Saudi Arabia: As President Biden embarks on a trip to the Middle East tomorrow, his administration is reportedly considering reversing its policy of only selling defensive weapons to Saudi Arabia. As Biden seeks to repair U.S.-Saudi relations and secure a boost in OPEC oil production, the reports suggest that the Saudis will demand renewed U.S. commitments to the defense of the kingdom in return, probably in conjunction with warmer rhetoric on Biden’s part.

U.S. Monetary Policy: Kansas City FRB President Esther George, who has traditionally been one of the strongest inflation hawks on the Fed’s policymaking board, said in a speech that the Fed may be hiking interest rates and pulling back its balance sheet too rapidly for the economy and financial markets to absorb.

- The statement supports the view that the Fed’s rapid policy tightening will produce a recession in the coming months and force it to reverse course much earlier than planned.

- Coupled with other recent signs suggesting that the economy may be losing momentum, George’s statement about economic problems spurred by monetary policy is probably one reason for the further downdraft in risk assets so far today.

U.S. Labor Market: According to new data from the National Labor Relations Board, the number of workplaces where employees have started trying to organize unions jumped to 1,411 in the first half of 2022, up 69% from the same period in 2021.

- In large part, the rise probably reflects the increased bargaining power that workers feel after so many people dropped out of the labor force during the coronavirus pandemic. In addition, greater unionization efforts may reflect improved sentiment toward unions among the broader public.

- All the same, we note that the unionization efforts in the first half of the year were no higher than in 2015. The long-term trend has been for decreased unionization in the U.S., which has contributed to economic inequality but probably supported corporate profit margins. We suspect that new unionization efforts would need to expand much further to reverse those trends.

U.S. Energy Market: Yesterday, the Electric Reliability Council of Texas asked residents to conserve electricity as extreme heat blanketed much of the state and threatened the power grid’s capacity. If electricity supplies get stretched too thin, the organization can order large customers or transmission companies to turn off their power. In extreme circumstances, it can also begin rolling blackouts, which could meaningfully disrupt economic activity in the state.