by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

Good morning! Today’s report will continue with our focus on the Russian invasion of Ukraine. Afterward, we discuss non-Ukraine-related news and close with our pandemic coverage.

President Biden plans to meet with NATO and EU leaders on Thursday to discuss imposing tougher sanctions on Russia. The new sanctions are expected to be more targeted but will likely not result in the banning of Russian oil and gas in Europe. The push to tighten sanctions comes amid growing speculation that Russia will look to use nuclear or chemical weapons in Ukraine. NATO Secretary-General Jens Stoltenberg has stated that using such weapons would likely signal an escalation of the conflict, but he failed to call it a red line. On Wednesday, NATO countries sent additional resources to Ukraine to help defend itself from such an attack.

From our perspective, the use of nuclear weapons by Russia likely carries more risk than the country is willing to bear. As mentioned in a previous report, Chinese President Xi Jinping signed a pledge to protect Ukraine from a nuclear attack; thus, Beijing may be forced to respond to Russia if such weapons are used in the conflict. How China may respond is unclear because the pledge does not go beyond an agreement to defend Ukraine. However, it will most likely come in the form of a reduction in sanctions relief for Russia. Note that China has publicly come out in support of Russia by spreading many of the talking points promoted by the Kremlin. There isn’t much evidence that China has tried to evade the sanctions, suggesting that Beijing is still not ready to put all of its eggs into one basket by supporting Russia. There is even some speculation that China may be trying to distance itself from Russia as the conflict with Ukraine escalates. That being said, the lack of support from China does not mean that there is no possibility of a nuclear or chemical attack from Russia but suggests the costs would likely exceed the benefits. As a result, we suspect the uncertainty in markets because of the Russian invasion will likely persist for the foreseeable future as there doesn’t appear to be an off-ramp for either Russia or Ukraine at this point.

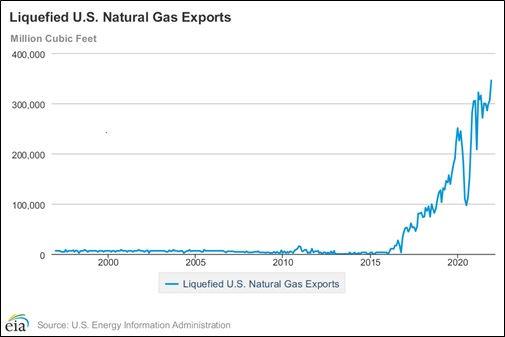

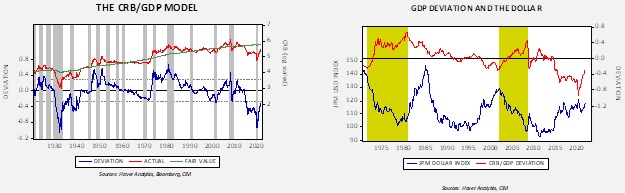

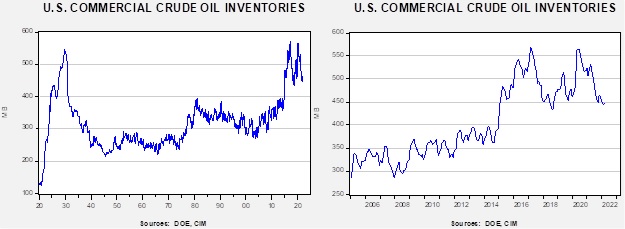

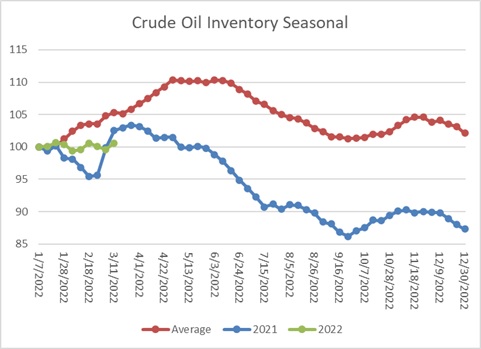

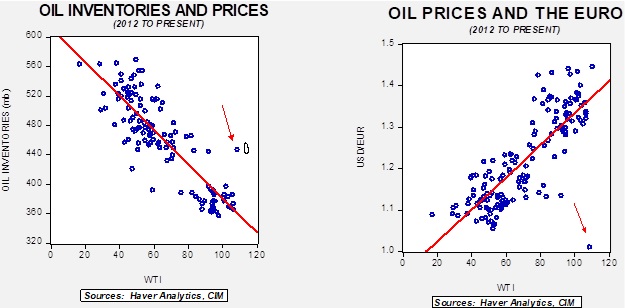

- In other news, Russian President Vladimir Putin has asked countries to pay for their oil and gas using rubles. The move comes as the country continues to struggle to deal with the economic ramifications of the sanctions. An article from the WSJ details the impact of sanctions on Russia’s oil and gas industry despite the fact that Russian energy companies, for the most part, have not been targeted. Although in the short run, the demand for rubles will lead to an appreciation of the currency against the dollar. The sudden change in form of payment is almost certainly a breach of contract and will most likely be challenged in court. So far, Putin has given no indication that he is preparing to cut Europe off. However, this suggests Russia is considering weaning itself off Western currencies in general as it positions itself toward autarky. Putin’s announcement has led to an increase in commodity prices and the ruble.

- The Russian stock market partially reopened on Thursday after being closed for a month following the country’s invasion of Ukraine. On its opening, the stock market rose as high as 12 percent before paring back much of its gains. The rise should not come as a surprise, as western investors, who own up to 80% of the free-floating market, were prevented from selling. Additionally, short selling was banned. The move comes as Russia attempts to rebuild trust in its equity markets and avert a financial crisis. To support its stock market, the Kremlin plans to inject over one trillion rubles ($10.3 billion) into the market from the country’s National Wealth Fund.

- In Ukraine, officials announced it struck a Russian-occupied port facility, suggesting the country is still finding some success in holding off Russian forces. The port was an important logistic hub for Russian forces, and the act provides further evidence the war is not close to ending.

- The Biden administration is expected to ask for $813.3 billion in national security spending in the federal budget for the next fiscal year.

Non-Ukraine news:

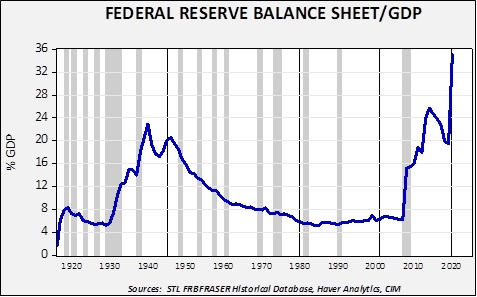

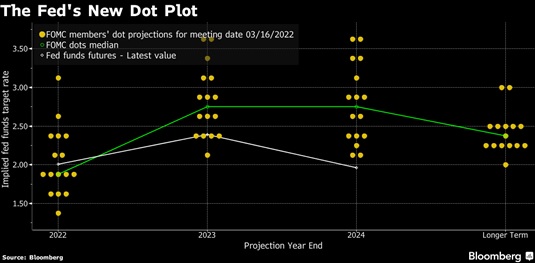

- San Francisco Fed President Mary Daly has indicated that the Federal Reserve could raise rates 50 bps in addition to a reduction of its balance sheet at its next meeting. Her comments provide more evidence that the Fed is becoming more hawkish as it attempts to contain inflation.

- A new metric designed by French bank BNP Paribas suggested that the U.K. is the second most unsustainable, behind Latvia, of the 36 economies that it tracks. The ranking comes as the country struggles with rising inflation and wealth inequality. Additionally, uncertainty regarding the Northern Ireland Protocol is the most visible sign of future unrest within the country.

- Germany will announce a package designed to ease the burden of soaring energy costs on households. The package includes subsidies for low-income households, an increase in the allowance for commuters, and a cut in fuel taxes.

- North Korea launched what is considered its first intercontinental ballistic missile in four years. The missile was the country’s most successful launch so far.

COVID-19: The number of reported cases is 475,935,572, with 6,105,530 fatalities. In the U.S., there are 79,844,751 confirmed cases with 974,833 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The CDC reports that 699,566,225 doses of the vaccine have been distributed, with 558,918,245 doses injected. The number receiving at least one dose is 255,001,325, while the number of second doses is 217,184,868, and the number of the third dose, granting the highest level of immunity, is 96,874,549. The FT has a page on global vaccine distribution.

- There is a global push to reduce COVID-19 restrictions, even as some countries struggle with the current wave of cases. Singapore expects to lift most of its restrictions for vaccinated travelers. Meanwhile, airlines have urged Biden to lift mask mandates for flights and COVID-19 testing for foreign travelers.