by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EDT] | PDF

We begin today’s Comment with an update on the Russia-Ukraine War. There are hints of compromise on each side, even as the Ukrainians are apparently launching a major counterattack. That alone would probably be enough to give a boost to global stock markets, but we also note the Chinese government has said it will take steps to boost its private businesses. Together, the developments are driving stocks sharply higher so far today. Beyond those stories, we also review a range of other international and U.S. news stories that have the potential to affect financial markets today. We wrap up with the latest news on the coronavirus pandemic.

Russia-Ukraine: As of this writing, there still appears to be little change in the military situation in Ukraine. Russian forces continue trying to encircle key cities such as the capital Kyiv, but Ukrainian forces continue to thwart them. In response, the Russian military continues to attack civilian targets with missiles, long-range artillery, and aerial bombing. The major development is that Ukrainian forces are reportedly launching a counterattack against the Russians around Kyiv and other cities. If true, it would likely be a wise move given that the Russians are now in a vulnerable position, having stalled out and needing to regroup, even as their supply lines are dangerously extended.

- Despite the continuing military operations, Russian and Ukrainian officials are still discussing a way out of the conflict. Importantly, both sides have made more conciliatory statements over the last day. For example, Russian Foreign Minister Lavrov signaled Moscow might be satisfied if Ukraine had its own military but was neutral. Ukrainian President Zelensky said the talks were beginning to “sound more realistic.” In a video conference with European leaders in London, Zelensky also said that he accepted Ukraine would not be admitted to NATO.

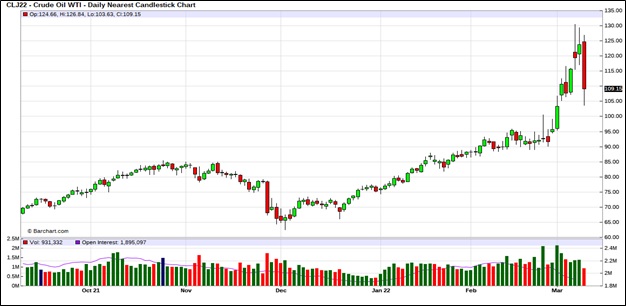

- Coupled with signs that Beijing will take steps to support its private businesses, the hints of a diplomatic breakthrough in Ukraine have helped spark a major rally for equities around the world so far today. In contrast, safe-haven assets such as government bonds, precious metals, oil, and gas are all in retreat.

- Like anyone else, we are hopeful that the Russia-Ukraine conflict can end soon, and that durable peace can be established, but we would caution that nothing is set in stone yet. In particular, the Russian side could be playing for time while it continues to regroup and resupply its forces to prepare for a push into Ukraine’s major cities. We think it’s still too early to break out the champagne.

- Separately, Russia is due to pay $117 million in interest on two dollar-denominated foreign bonds today. President Putin has suggested paying the interest in rubles, but the major bond-rating companies say that would constitute a default. If the payment is made in dollars, and within the 30-day grace period that starts today, it would probably signal that Russia is on the road to compromise and is trying to clear a path back into the good graces of its previous economic partners.

- More broadly, the war also threatens further supply-chain disruptions across multiple industries. For example, the conflict has idled some Western European auto plants because they can’t get critical cable harnesses made in Ukraine.

- By exacerbating the current shortage of autos, that could further boost prices for new and used vehicles and help keep central banks thinking about interest-rate hikes.

- Meanwhile, the U.S. and its NATO allies continue to show a united front as they seek to counter Russia’s aggression. The White House said President Biden plans to go to Brussels on March 24 for meetings with the other NATO leaders. They will discuss how to intensify pressure on Moscow without sparking a direct military conflict with Russia.

- Yesterday, President Biden signed the just-passed government spending bill that includes $13.6 billion in security, humanitarian, and economic aid for Ukraine. As early as today, Biden is expected to announce about $800 million in new military assistance to Ukraine to be funded from the new bill. The announcement will follow President Zelensky’s video speech to a joint session of Congress this morning, in which he is expected to plead for more assistance to help Ukraine push out the Russians.

Global Nickel Market: The London Metal Exchange today was forced to suspend electronic trading in nickel just moments after the market reopened for business following a week-long shutdown partly related to the Russia-Ukraine war. Even though the exchange had imposed a new 5% limit-down, prices tumbled so rapidly at the open that some trades happened below that level, forcing the exchange to stop trading and launch an investigation.

- The exchange said it would allow in-person trading later in the day.

- Nevertheless, the fiasco is another black eye for the LME and will likely undermine some traders’ confidence in using the market. If enough traders try to exit the market, it could spark increased price volatility for several commodities in the near term.

Iran Nuclear Deal: Russia has apparently walked back recent demands that Washington should offer broad sanction exemptions related to the Iran nuclear deal. It now appears Russia has settled for language ensuring that the U.S. will not sanction Russian participation in nuclear projects that are part of returning the agreement to its full implementation.

- It now looks as if the way is clear for Tehran and Washington to revive the 2015 deal.

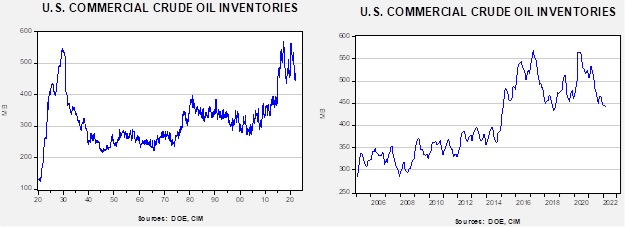

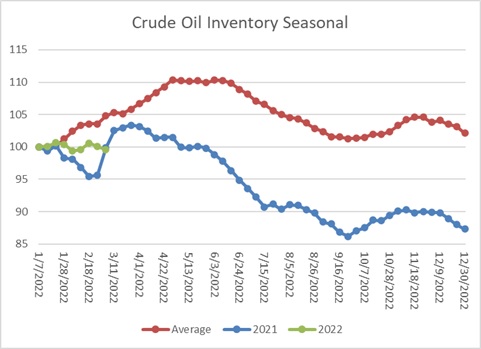

- If the agreement is revived, Iranian oil could return to the global marketplace and help push prices down, even beyond their recent drop, which helped drive yesterday’s strong rally in global equity prices.

China: At a special meeting of the State Council’s Financial Stability and Development Committee today, top economic advisor Liu He said Beijing would take measures to support the economy and financial markets after a sharp sell-off stemming from the government’s crackdown on private businesses, “zero-COVID” strategy, and risky support for Russia in its invasion of Ukraine.

- According to Liu, the government will take steps to boost the economy in the first quarter and introduce “policies that are favorable to the market,” although he didn’t elaborate on what specific measures would be taken.

- In any case, investors are cheering the show of support. The announcement is a major reason for the jump in global equity markets so far today, even if there are still no details on the support to be given.

China-Saudi Arabia: Reports yesterday said Beijing and Riyadh have recently accelerated their six-year-old talks on pricing some Saudi oil exports to China in renminbi instead of dollars. The intensifying talks will probably spark renewed concern about the dollar’s status as the world’s primary reserve currency, especially after the U.S. actions to essentially freeze a huge share of Russia’s dollar-based foreign reserves.

- However, even though the Saudis and the Chinese both have reasons to step away from the dollar, such a move would be costly for the Saudis.

- Therefore, it’s not entirely clear the Saudis would sell a significant portion of their oil for the Chinese currency.

U.S. Monetary Policy: Top officials at the Federal Reserve will finish their latest monetary policy meeting today. Last month, Chair Powell signaled the officials would use the meeting to boost the benchmark fed funds interest rate by 0.25%. The increase is expected to be just the first in a series of rate hikes. Powell has hinted that a series of shocks, including the Russian invasion, could keep inflation uncomfortably high and potentially call for larger rate rises this summer. The officials today will also release their latest economic projections, which will likely show they expect a long series of rate hikes. Nevertheless, we continue to believe that financial fragilities and/or an economic slowdown will probably limit how far the Fed can really go.

- Separately, President Biden’s nominee to serve as the Feb’s vice chair for regulation, Sarah Bloom Raskin, withdrew her candidacy after Democratic Senator Joe Manchin of West Virginia said he wouldn’t support her. As we reported here yesterday, Manchin opposed Raskin because of her past calls for regulations that would limit funding to companies that produce fossil fuels.

- The failed Raskin nomination highlights the bind Biden has gotten himself into by trying to please the Democratic party’s more progressive wing. As he tries to come up with an alternative to Raskin, a major question is whether he will again try to find someone to satisfy that wing with little or no Republican help or whether he will tap someone centrist enough to garner some Republican support.

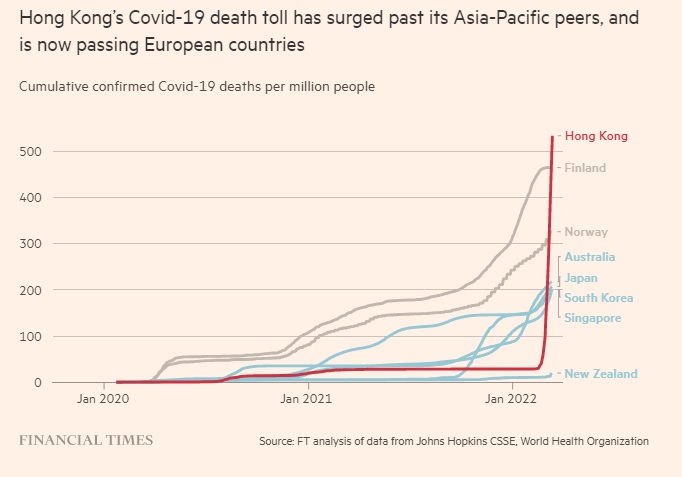

COVID-19: Official data show confirmed cases have risen to 461,817,791 worldwide, with 6,052,539 deaths. In the U.S., confirmed cases rose to 79,587,004, with 966,470 deaths. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) Meanwhile, in data on the U.S. vaccination program, the number of people considered fully vaccinated now totals 216,767,955, equal to 65.3% of the total population.

- In the U.S., the seven-day average of people hospitalized with a confirmed or suspected COVID-19 fell to 26,436 yesterday, down 44% from two weeks earlier.

- Days after Congress rejected a $15 billion appropriation for the pandemic, the Biden administration has warned that the federal government is running out of money to pay for vaccines, tests, and treatments, leaving it unprepared for any future rise in cases.