by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

In today’s Comment, we would love to only focus on happy news like the Super Bowl or Valentine’s Day, but the world is much too tense for that. Therefore, we open with the latest developments on the Russia-Ukraine crisis. We then turn to a range of international news and U.S. developments that have the potential to affect the financial markets today. We close with a short recap of the latest news on the coronavirus pandemic.

Russia-Ukraine: Among the key developments over the last few days, President Biden had remote meetings with a large group of allied leaders on Friday, with Russian President Putin on Saturday, and with Ukrainian President Zelensky on Sunday. The most important recent development in the meetings was that Biden reportedly told the meeting with allied leaders that the U.S. has intelligence suggesting Putin has ordered his troops to prepare to launch an attack this Wednesday, February 16. Meanwhile, German Chancellor Scholz will meet with Zelensky today in Kyiv and with Putin tomorrow in Moscow. Since Scholz would be the last major NATO leader to have a direct or video conference with Putin, that meeting could well be the last best chance to convince Putin to take an off-ramp and diffuse the crisis.

- We continue to believe that it is somewhat more likely that Putin will back down, and the crisis will be resolved. In large part, that’s because of the surprising extent to which NATO countries and the U.S. political establishment have coalesced behind a strong response to the Russian threat. In turn, that response reflects an innovative U.S. strategy to blunt Russia’s “grey zone” attacks using “information warfare.”

- Russian grey-zone tactics have involved cyberattacks and other activities that fall short of traditional, violent warfare and are hard to clearly attribute to the Russian military. Western leaders have, therefore, had their hands tied in taking strong action against those attacks.

- In the current crisis, the administration is aggressively releasing U.S. intelligence on Russian preparations and grey-zone activities in order to characterize them as military aggression before they’re launched. There are risks in the approach. For example, there’s a chance that the U.S. releases will lead to the loss of important intelligence sources and methods. The intelligence may also be fragmentary or otherwise unreliable, in which case it may later prove to be false.

- Here’s one example: During my days as a CIA analyst in the 1980s and 1990s, my computer search profile would typically send me 200 to 300 intelligence reports to review each day. They would include everything from raw satellite imagery and communications intercepts to “finished” intelligence reports from organizations like the State Department’s intelligence group or foreign intelligence services.

- Out of those 200 to 300 reports that would come across my computer screen, only three or four might seem reliable or connected to my “account” (Soviet/Russian military budgeting and defense industry). I would only do a deeper dive into those reports and ignore the rest.

- Of those three or four intelligence reports that I would examine closely, many would ultimately prove meaningless. In the current crisis, the U.S. may be releasing these kinds of reports. They may merely be semi-reliable hints of what the Russians are doing or planning. While it may sound bad for the U.S. to talk up such reports, it’s probably reasonable for the administration to be using a relatively low hurdle for reliability if the release of the information closes off a potential Russian avenue for attack.

- Despite the likelihood (or hopes) that the U.S. information strategy will force Putin to back down, signs continue to accumulate that sober professionals in many industries around the world are taking seriously the possibility of a major war.

- On Sunday, one of Ukraine’s main air carriers, SkyUp Airlines, said it suspended sales for flights this week after its insurers stopped covering aircraft in Ukrainian airspace because of an increased threat of a Russian invasion.

- A day earlier, Dutch national flag carrier KLM said it had suspended its flights to Kyiv and wouldn’t operate flights in Ukrainian airspace.

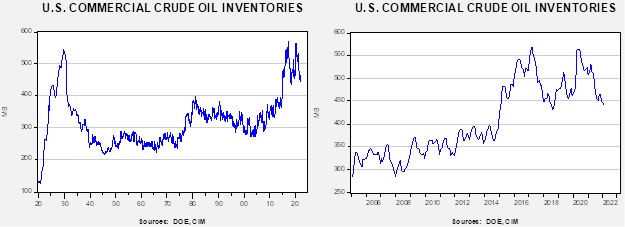

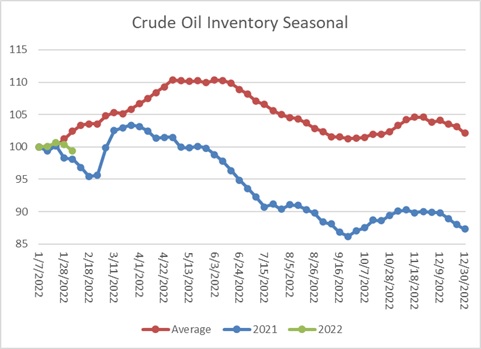

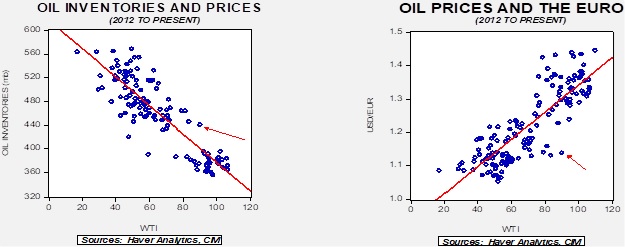

- Meanwhile, energy traders are starting to price in a higher risk that a Russian invasion will lead to sanctions that curtail its oil exports. Oil prices are now approaching $100 per barrel for the first time since 2014.

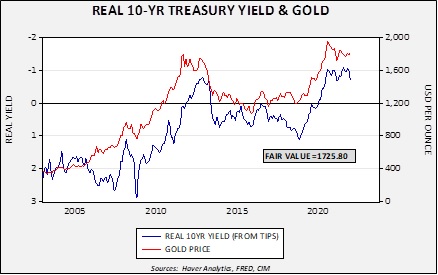

- Financial assets are also reflecting the risks. Gold and safe-haven U.S. Treasury obligations continue to appreciate. Bond yields are edging lower. Stock markets continue to weaken, especially in Europe, although we’ve noted relative strength in defense stocks. For the time being, we expect these trends to continue.

- Allied NATO military moves are also screaming, “This is not a drill.” Among the key developments are the following:

- The U.S. has now evacuated nearly all of its diplomatic personnel in Ukraine. It has also removed the 160 or so Florida National Guard troops who had been in the country training Ukrainian soldiers. The soldiers assigned to the 53rd Infantry Brigade Combat Team have been ordered to reposition elsewhere in Europe.

- In recent weeks, four U.S. Navy destroyers normally assigned to the East Coast were deployed to the US. 6th Fleet in the Mediterranean. Notably, the destroyers are all configured for ballistic missile defense.

- Late last week, a task force consisting of four U.S. Air Force B-52s was sent from Minot Air Force Base in North Dakota to RAF Fairford, U.K., for a notional three-week stay, during which they will exercise with NATO allies and partner nations.

- Also, late last week, U.S. Air Force fighter jets were deployed to Poland and Romania to support enhanced air policing and to reassure NATO eastern flank allies. Eight F-16s from the 52nd Fighter Squadron at Spangdahlem Air Base, Germany, deployed to Fetesti Air Base, Romania, while eight F-15s from the 48th Fighter Squadron at RAF Lakenheath, U.K., landed in Lask, Poland.

- On Saturday, U.S. F-22 fighter jets were deployed to the United Arab Emirates, ostensibly to help the UAE thwart a recent spate of air attacks by Houthi rebels in Yemen. However, we note those fighters would also be close enough to the Black Sea region to assist in any hostilities there.

Global Commodity Markets: The Russia-Ukraine crisis is happening amid low inventories for a wide range of commodities beyond just energy.

- The problems are particularly acute in metals, where spot prices of several contracts on the London Metal Exchange are trading higher than those for later delivery, as traders pay large premiums to secure immediate supply.

- Even cocoa prices are rising, driven by dry weather in Africa weighing on production and cutting into inventories. Most-actively traded cocoa futures have risen about 12% this year—and 11% in February alone—to $2,811 a metric ton, on pace for the highest monthly level since April 2018.

Canada: Police in Windsor, Ontario, yesterday arrested anti-vaccine protesters and towed vehicles to clear access to the Ambassador Bridge linking the city to Detroit. It’s not entirely clear when traffic on the bridge will be back to normal, but if the flow of trucks normalizes soon, it will help ease the production stoppages that the protests caused to auto manufacturing on both sides of the border.

- The truckers’ protests primarily aimed to reverse Canada’s stringent pandemic rules, but we’ve been watching them closely for any sign that the truckers, coordinating on social media, might be tempted to use such traffic blockages as leverage to pursue other goals.

- Even as a separate truckers’ protest continues in Canada’s capital city of Ottawa, the dismantling of the Ambassador Bridge blockage may reflect the limits of the truckers’ ability to wage economic warfare. All the same, the current labor shortage and stretched supply lines probably point to continued disruptions in other areas. In the U.S., the most important thing to watch may be the West Coast ports, where the longshoremen’s contract expires this summer, possibly setting up a major strike.

European Central Bank: In an interview with the Financial Times, Irish central bank governor Gabriel Makhlouf pushed back against investors expecting the ECB to start hiking interest rates as early as June. According to Makhlouf, the ECB could stop its net bond purchases in June or a few months later and would only raise rates after that. His statement is consistent with efforts by ECB Chief Lagarde to walk back her recent hints of an early rate hike, which had unsettled European markets and gave a boost to the Euro.

Spain: In a regional election over the weekend, the far-right Vox party secured 18% of the vote in Castile-León, likely putting it into position to join a regional government for the first time. It also suggests that any center-right national government of the future might need to rely on the populists to govern.

U.S. Tax Policy: As Democrats in Congress try to resurrect a version of President Biden’s “Build Back Better” program of social policy and climate stabilization measures, they’re finding that a key stumbling block is that Senator Joe Manchin of West Virginia is pushing for increased corporate and individual income tax rates, while Senator Kyrsten Sinema of Arizona opposes them. With the Senate deadlocked 50-50 between Democrats and Republicans, both senators would need to agree for the measure to pass.

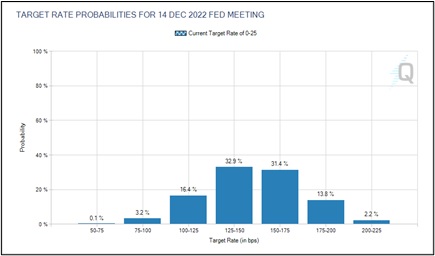

U.S. Monetary Policy: In an interview with the Wall Street Journal, Kansas City FRB President Esther George said the Fed should consider selling bonds from its $9 trillion asset portfolio to address high inflation and guard against harmful effects that can result from short-term rates rising above long-term rates.

- George’s suggestion that the Fed shouldn’t just stop growing its balance sheet, but should actively reduce it, is yet more evidence that monetary policymakers are panicking about inflation and the need to tighten policy.

- We have little doubt the Fed will start to tighten policy next month. However, we still suspect that the policymakers won’t be able to hike interest rates as far as the market currently suggests before hitting economic or financial potholes that will force it to curtail the tightening.

- For now, the prospect of tightening monetary policy will continue to foster financial market volatility. If the Fed does curtail its tightening earlier than investors expect, however, it would likely cause a sharp rebound in bond prices.

COVID-19: Official data show confirmed cases have risen to 412,134,811 worldwide, with 5,817,819 deaths. In the U.S., confirmed cases rose to 77,740,175, with 919,697 deaths. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) Meanwhile, in data on the U.S. vaccination program, the number of people who are considered fully vaccinated now totals 213,869,678, equal to 64.4% of the total population.

- In the U.S., data continue to suggest that the highly transmissible Omicron mutation is in retreat. The seven-day average of people hospitalized with a confirmed or suspected COVID-19 infection fell to 92,896 over the weekend, down some 35% from just two weeks ago.