by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! The overnight news was relatively tame, but we are following several stories. Today’s report begins with recent developments regarding the Ukraine situation. Up next, we discuss U.S. economic and policy news with an update on President Biden’s pick to fill the vacant seats on the FOMC. International news follows, and we conclude with our pandemic coverage.

Ukraine update: The White House has announced that it will taper down its rhetoric regarding the Russia-Ukraine conflict. At the insistence of Ukraine, the Biden administration stated it would stop describing a Russian invasion as being imminent. The change in rhetoric comes after Ukraine President Volodymyr Zelensky complained that calling an invasion imminent was causing unnecessary panic and having a negative impact on his country’s economy. That being said, the administration is still looking into ways to deter Russia from sending its troops into Ukraine. The White House announced on Wednesday that it would cut Russia off from receiving semiconductors if its troops enter Ukraine. Although unprecedented, the government could use regulation to restrict U.S. companies and pressure foreign companies that rely on U.S. equipment from selling chips to Russia. If the U.S. were to follow through on this threat, it would have a severe impact on the Russian economy. Additionally, the U.S. has decided to enhance its presence in Europe. On Wednesday, the Pentagon announced that 2,000 more troops were deployed to Eastern Europe to bolster NATO defenses.

In light of growing pressure from the West, Russian President Vladimir Putin is trying to form closer ties with China. He will meet with Chinese President Xi Jinping on Thursday to discuss ways China could help Russia counter U.S. sanctions. Recently, China has become more outspoken in its support for Russia’s position concerning Ukraine. Last week, Chinese Foreign Minister Wang Yi stated that Russia’s security concerns were legitimate. China’s strong demand for commodities and its vast market will be critical for Russia if it plans to wean itself from its dependence on the U.S. However, it will likely come at a steep cost. In exchange for helping Russia, China will probably demand a substantial discount for Russian commodities. China, which also has ambitions to expand its reach into Eastern Europe, could also use Russia’s dependency as leverage in future disputes. Thus, forming closer ties with China may not be that attractive of an option for Putin.

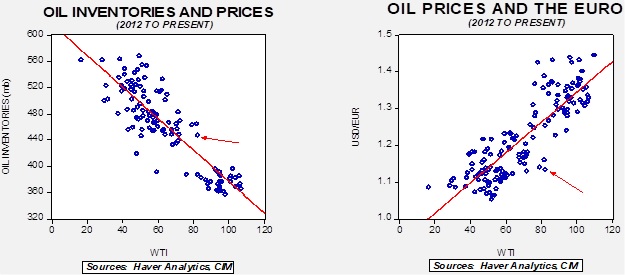

At the moment, we suspect that the primary path to de-escalation will be through peace talks. Last week, French President Emmanuel Macron and Vladimir Putin met to discuss reviving the Minsk-2 agreement. Originally brokered in 2015, the agreement gave Russia more influence in Ukraine in exchange for peace. In the absence of an outright commitment from the U.S. to not allow Ukraine to join NATO, Russia could look to have a greater say in Ukraine government as a consolation prize. Reports suggest Ukraine may be receptive to increased Russian influence if it prevents an invasion. The revival of talks between Ukraine and Russia could possibly be the reason both sides have been keen to talk down the possibility of an imminent attack, with Russia going as far as implying the U.S. is the only aggressor in this conflict. We are still far away from a resolution, but conditions increasingly favor a peaceful outcome. If we are correct, it would be favorable to risk assets and bearish to commodity prices.

Economics and policy:

- The Biden administration has moved to limit the security risks posed by foreign-owned apps such as TikTok. The Commerce Department announced a rule change that could force foreign apps to submit to third-party auditing, source-code examination, and monitoring of the logs that show user data. Violations of security rules could lead to an app being banned from use in the U.S.

- President Biden’s pick to serve on the Federal Reserve Board, Lisa Cook, has met resistance to her confirmation. Cook’s research has been criticized for being too focused on race. Additionally, her misgiving regarding the Paycheck Protection Program being too small and biased toward large companies has received some blowback from politicians. In related news, Sarah Bloom Raskin, who has served on the Federal Reserve Board previously, is also expected to face scrutiny regarding her positions related to climate change, crypto, and bank mergers. The President’s three picks to fill the vacant seats on the Federal Reserve Board will have their Senate hearings today.

- The Pentagon announced that U.S. troops killed Islamic State leader Abu Ibrahim al-Hashimi al-Qurayshi in a raid.

International news:

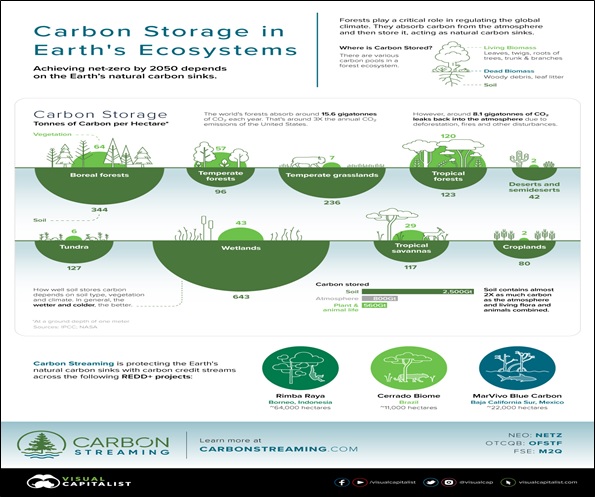

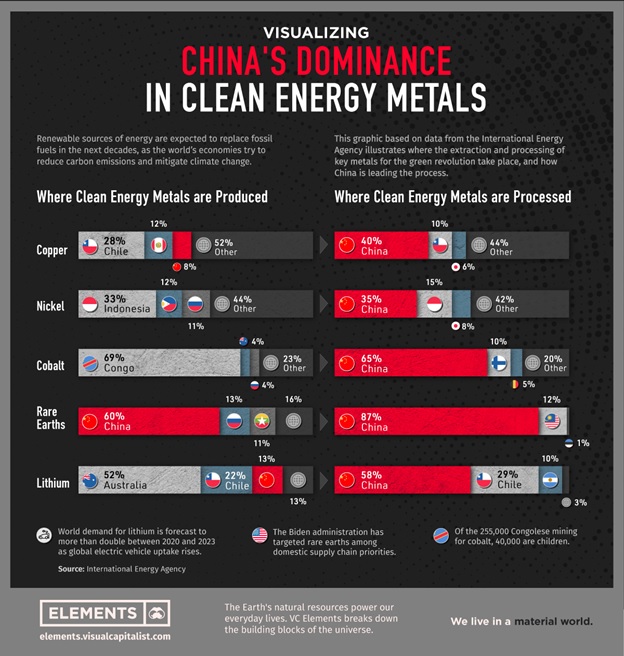

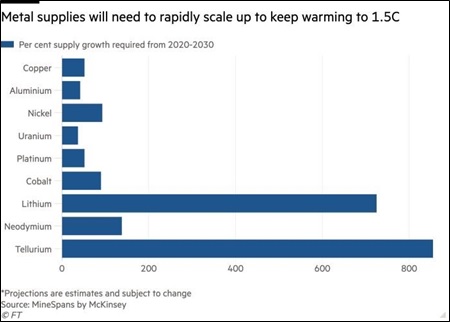

- Mexican President Andres Manuel Lopez Obrador announced his desire to form a state lithium company. On Wednesday, he told reporters in Mexico City that lithium is a strategic material that belongs to the people, signaling that private investment wasn’t welcome. As the demand for electric vehicles has increased in recent years, lithium has emerged as a possible competitor to oil. Thus, it is likely that lithium-producing companies will become more critical to the global economy as the world moves to cut down on carbon emissions.

- OPEC and its allies have agreed to increase production by an additional 400,000 barrels a day at its latest meeting. Despite the agreement to increase production, certain countries within the group have struggled to fulfill their respective supply pledge. Countries such as Nigeria and Libya have struggled to ramp up production due to the lack of investment and militia unrest.

- The U.K. is planning to resume free-trade talks with the U.S. after the midterm elections.

- The NATO chief raised concerns about a Russian military buildup along the Belarus border with Ukraine. The troop movements come amidst joint military exercises with Belarus and Russia. Moscow has held that having troops along the Ukraine border is consistent with military training and not a prelude to an invasion; however, NATO is not convinced. We suspect the buildup could be related to the U.S. decision to send additional troops into Eastern Europe. Therefore, we still believe that conflict in Ukraine remains a possibility.

COVID-19: The number of reported cases is 385,424,523, with 5,702,683 fatalities. In the U.S., there are 75,681,309 confirmed cases with 894,316 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The CDC reports that 668,308,025 doses of the vaccine have been distributed with 540,630,198 doses injected. The number receiving at least one dose is 250,378,993, the number of second doses is 212,130,684, and the number of the third dose, the highest level of immunity, is 88,614,084. The FT has a page on global vaccine distribution.

- Germany will allow up to 10,000 people to attend large outdoor events as long as the spectators wear masks and have proof of vaccinations.

- The World Health Organization has expressed optimism regarding the pandemic in Europe. The organizations stated the region is entering a “plausible endgame” as COVID deaths start to slow down.