by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Today’s Comment opens with an update on the Russia-Ukraine crisis, in which the U.S. and its European allies are apparently coalescing around a set of sanctions and other actions to deter Russia from attacking. We next preview today’s Federal Reserve decision on monetary policy and highlight a range of other U.S. and international issues that have the potential to move the markets today. We end with an update on the coronavirus pandemic.

Russia-Ukraine: White House officials said that if Russia attacks Ukraine as feared, they want the allied economic sanctions imposed on Moscow to include export controls on sensitive technologies needed by key Russian industries. The export controls would be similar to those imposed by the Trump administration on Chinese telecom giant Huawei. Analysts believe such controls could weigh heavily on Russia, despite government efforts to make the economy more sanctions-proof in recent years. The officials said the moves would exacerbate the selloff in Russian markets, increase the country’s cost of borrowing, and hurt the value of Russia’s currency, which would raise the domestic political costs for Mr. Putin of moving on Ukraine. The U.S. and the U.K. have also warned that they have not ruled out implementing sanctions directly on President Putin if Russia invades Ukraine.

- After weeks of calls and meetings in European cities, U.S. officials yesterday said they were seeing convergence on prospective sanctions among the U.S. and European nations, in part because of assurances that the U.S. is working to secure energy supplies should Russia invade Ukraine and cut off exports of energy westward.

- U.S. officials said they are seeking energy stockpiles in North Africa, the Middle East, Asia, and inside the U.S. that could fill Europe’s energy supply gap should the Kremlin cut the flow of gas.

- However, the task remains daunting. In mid-winter and with energy prices already high, Europe would need to find alternatives for the 40% of its gas supply that comes from Russia.

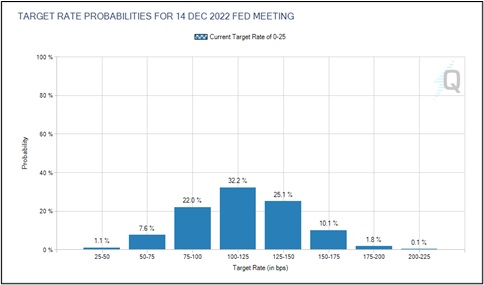

U.S. Monetary Policy: Fed officials today end a two-day policy meeting, after which Chair Powell is expected to confirm that the central bank’s asset purchase program will end by March and set the stage for a new round of interest rate hikes. Some policymakers’ statements have recently sounded almost panicky about inflation, creating uncertainty about how fast or how far they will hike rates and driving high volatility in financial markets in recent days. The uncertainty is exacerbated by the way the Fed has abandoned decision-making based on models and systematic analytical frameworks that are transparent to all; in their place, the policymakers are relying much more on personal judgment.

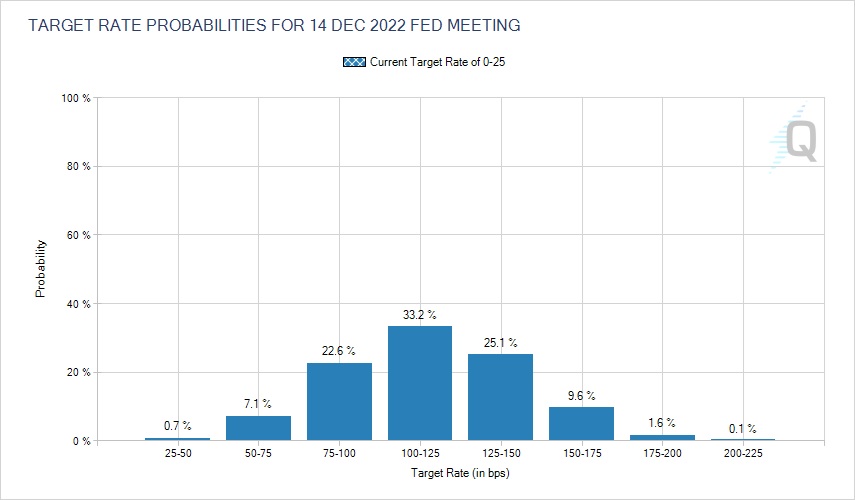

- Futures markets currently suggest expectations for four or more quarter-point rate hikes by December (see chart below).

- Markets could remain volatile at least until the results of today’s meeting are released.

(Source: CME Group)

U.S. Banking Sector: While cash-rich companies and households have been slow to take loans over the last year, new data show banks have enjoyed a big increase in their auto lending. U.S. banks increased their auto-loan balances by 12% over the course of 2021, even though their total loan books increased only marginally.

Global Supply Chain Disruptions: Preliminary data show imports unloaded in December at the ports of Long Beach and Los Angeles were down approximately 14% from the same month one year earlier, marking the fourth straight month of year-over-year declines. The queue of vessels waiting to enter the port complex rose past 100 during December and reached a record 109 ships in early January.

- The reasons for the backups are complex: ships can’t unload quickly because terminals are full of containers. Truckers can’t pick up loads due to a shortage of drivers and the steel trailers used to pull boxes. Warehouses near the ports and at nearby logistics hubs are short workers and don’t have space for more deliveries.

- The backups are exacerbating supply-chain delays and driving up shipping costs, which in turn are contributing to inflation reaching its highest level in decades.

- In updated forecasts, the International Monetary Fund said global supply chain disruptions, high inflation, and the latest wave of the coronavirus pandemic will weigh more heavily on global economic growth this year than previously thought. The organization now projects that global economic output growth will slow to 4.4% in 2022, compared with 5.9% in 2021 and a previous estimate of 4.9% last October.

European Union: The EU’s General Court in Luxembourg struck down a $1.2 billion antitrust fine levied by the European Commission against U.S. semiconductor giant Intel (INTC, 51.00). The ruling, which called the commission’s analytical methods incomplete and insufficient to establish damages, may make it more difficult for EU antitrust officials to rein in big U.S. technology companies based on antitrust issues.

Portugal: New polling shows the far-right Chega Party led by firebrand television commentator André Ventura is now the country’s third-most popular political group.

- With parliamentary elections due on Sunday, and with the poll gap between the ruling Socialist Party and the opposition center-right Social Democratic Party narrowing, Chega’s support could now be vital to the formation of a right-of-center government.

- In any case, the surge in Chega’s support shows that Portugal isn’t as immune to far-right populism as many in the country thought.

El Salvador: International Monetary Fund officials reviewing El Salvador’s economic prospects ahead of a potential $1 billion financing have urged the government to stop recognizing bitcoin as a legal tender in the country and expressed concern over its plan to issue bonds linked to the cryptocurrency. The IMF concerns centered on the risks involved in the cryptocurrency, underlined by the government’s money-losing purchases of it in recent months.

COVID-19: Official data show confirmed cases have risen to 359,140,962 worldwide, with 5,618,197 deaths. In the U.S., confirmed cases rose to 72,178,003, with 872,126 deaths. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) Meanwhile, in data on the U.S. vaccination program, the number of people who have received at least their first shot totals 251,289,667. The data show that 75.7% of the U.S. population has now received at least one dose of a vaccine, and 63.5% of the population is fully vaccinated.

- Even though data continue to show new infections and hospitalizations related to the omicron mutation are falling back rapidly, deaths (a lagging indicator) are still on the rise. The seven-day average for newly reported COVID-19 deaths reached 2,258 per day on Tuesday, up about 1,000 from daily death counts two months ago. The current daily death toll is now at its highest level since February 2021.

- Despite the omicron retreat in some countries, others are still seeing rapid increases in new infections and hospitalizations. In Japan, the seven-day average of new cases now stands at 62,613, exceeding 60,000 for the first time. Hospitalizations, hospital bed occupancy rates, and new deaths are also at or near record highs.