by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Good morning! Today’s report begins with a discussion about the recent remarks made by FOMC members. This is followed by U.S. economic and policy news a China-related story. International news is next, and we end with our pandemic coverage.

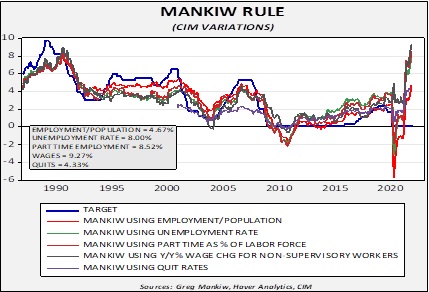

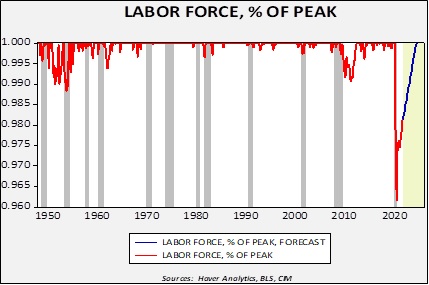

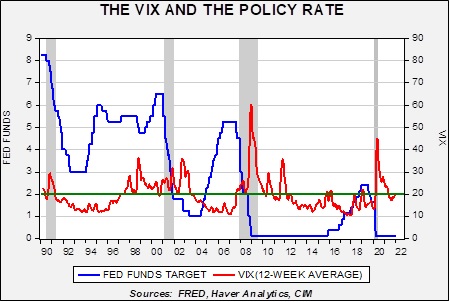

More Hikes? The Federal Reserve appears to be getting more hawkish by the week. Philadelphia Fed President Patrick Harker and San Francisco Fed President Mary Daly both signaled support for interest rate hikes starting in March. While Harker, a voting member, stated he would support “at least three” rate hikes, Daly, a non-voting member, has not been open about the number of increases she supports. Meanwhile, St. Louis Fed President James Bullard told the WSJ he expects to support as many four rate hikes to combat rising inflation.

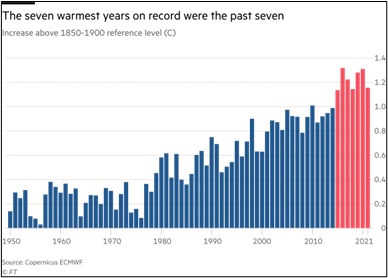

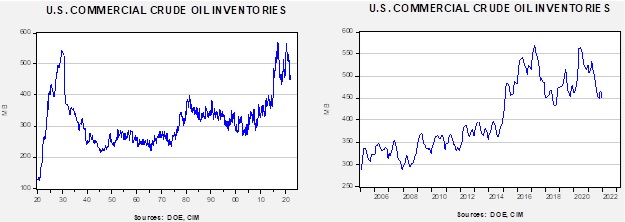

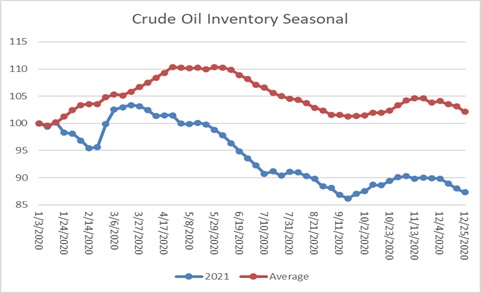

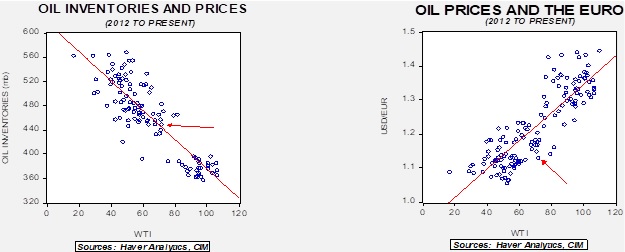

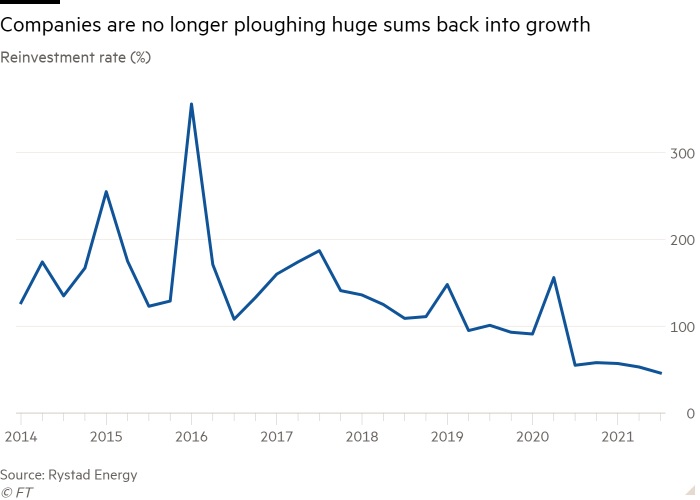

In addition to the rate hikes, more members of the Fed have expressed a willingness to return inflation to its 2% target. During her testimony before the Senate Committee, Federal Reserve Governor Lael Brainard, who we view as a dove, mentioned a desire to get inflation back to its pre-pandemic norm. However, this may be easier said than done. In 2021, inflation was driven primarily by motor and energy prices. Although both product groups saw a jump in price due to stronger demand, they were constrained by a reduction in output. Retail inventories for motor vehicles are still well below their pre-pandemic levels, while the lack of investment in fossil fuels has reduced production capacity for commodities worldwide. Moreover, supply chain disruptions due to continued outbreaks of COVID-19 continue to be an issue. So, it may take a while for inflation to return to 2% even with Fed action. The hawkish comments from the Fed have made us less optimistic that it will back away from raising rates more than once this year.

Economics and policy:

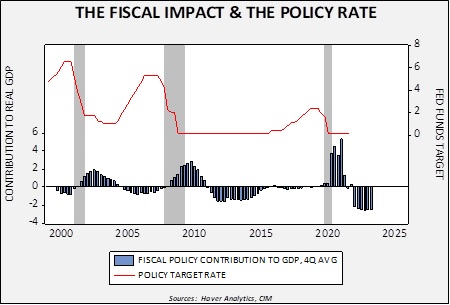

- The U.S. budget deficit narrowed to its lowest level in two years in December. The deficit shrank to $21.3 billion as the rise in income and corporate profits boosted tax receipts.

- Congress expects to move forward with a bill designed to help the country’s competitiveness with China. The legislation would authorize funding to bolster research and development as well as aid to the domestic semiconductor industry. Although the bill has bipartisan support, it has a narrow pathway to success. There is resistance on both sides of the aisle due to concerns that the bill may be too harsh on China.

- Senator Joe Manchin (D-WV) has expressed an openness to supporting the Build Back Better Act. Manchin, whose vote is critical to getting the bill passed, stated he would like the tax credit given to nuclear plants under the bill to expand from six years to 10 years. Extending the credit would mean the bill would have to cut costs elsewhere in order for it to meet its $2 trillion price tag.

China:

- Chinese banks have become more selective about financing real estate projects from local governments. The reluctance appears to be related to banks wanting to limit their risk exposure to the real estate sector amidst a decline in property values.

International news:

- The head of the International Energy Agency, Fatih Birol, implied that the gas crisis in Europe was deliberately caused by Russia. Birol stated Russia was holding back a third of the gas that it could send to Europe and depleted its storage facilities to give the impression of tightened supply. Additionally, Birol theorized that the gas shortage was related to Russia’s ongoing tension with Ukraine. In December, Russia sent troops along the Ukraine border in what is perceived as an act of intimidation.

- Moscow and Washington are set for additional talks. So far, discussions appear to be at a standstill after Moscow and NATO allies refused to accept each other’s demands. Moscow wants guarantees that Eastern European countries will not join NATO, while Washington would like a withdrawal of troops from along the Ukraine border.

- In the Senate, Republicans are looking to impose more sanctions on Russia over the Gazprom Nord Stream 2 gas pipeline. A vote in favor of the bill could hinder efforts of the Biden administration to come to an agreement with Moscow over the Ukraine border issue.

- U.K. Prime Minister Boris Johnson has apologized for attending a party during the first pandemic lockdown. The Prime Minister has come under pressure to resign following the release of the story.

- Taiwan Semiconductor Manufacturing Company (TSMC, $132.23) plans to spend at least $40 billion to upgrade and expand its production capacity beyond its borders. The firm is looking to establish new fabs in Japan and the U.S.

- Borrowers in Europe have rushed to debt markets in anticipation of higher rates in the future. There was $107 billion in bonds sales in the lead up to Christmas, a new record.

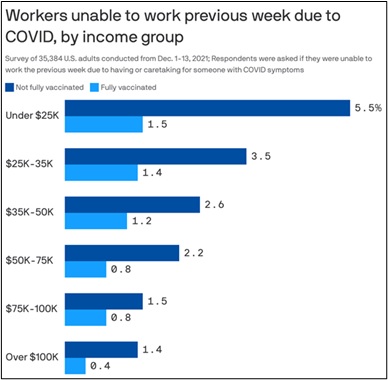

COVID-19: The number of reported cases is 317,289,446, with 5,515,204 fatalities. In the U.S., there are 63,203,866 confirmed cases with 844,562 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 644,652,095 doses of the vaccine have been distributed, with 522,482,674 doses injected. The number receiving at least one dose is 247,695,845, the number of second doses is 208,182,657, and the number of the third dose, the highest level of immunity, is 77,101,175. The FT has a page on global vaccine distribution.

- An Omicron outbreak has been detected in another major port city in China. On Thursday, Chinese officials reported there were cases in Dalian. So far, the city is undergoing mass testing but could go into lockdown if it is discovered the virus is spreading. Dalian would be the second port city to be lockdown due to cases of COVID-19, the first being Tianjin. The spread of COVID-19 in China has already led to growing port congestion and could add to global supply chain pressures.

- AstraZeneca Plc (AZN, $58.40) has data supporting the use of its vaccine as a booster. The new research suggests that the vaccine generated antibodies against Omicron. Last year, the vaccine was sidelined by the U.S. and Europe due to a rare side effect that caused blood clots.

- The Biden Administration is set to distribute free COVID-19 tests for schools across the country. The effort is designed to keep schools open after a rise in cases has forced some schools to close due to a staff shortage.

- France expects to lift travel restrictions on the U.K. by the end of the week. The report comes after data that suggests that Omicron may have peaked in the U.K.