by Patrick Fearon-Hernandez, CFA, and Thomas Wash

[Posted: 9:30 AM EST] | PDF

Our Comment today focuses on international news, including a U.S. victory in its dairy trade dispute with Canada and the latest OPEC+ decision on oil supplies. We also cover several developments related to China’s real estate and technology sectors and a new treaty between Japan and Australia to enhance their defense against potential Chinese aggression. We wrap up with the latest news on the coronavirus pandemic.

United States-Canada: In the first-ever use of a new dispute resolution panel established by the U.S.-Mexico-Canada Agreement of 2020, the Canadian government will be forced to end tariffs on U.S. dairy products worth hundreds of millions of dollars. If Canada doesn’t come into compliance by the deadline of February 3, the U.S. could begin the process of initiating tariffs or other countermeasures.

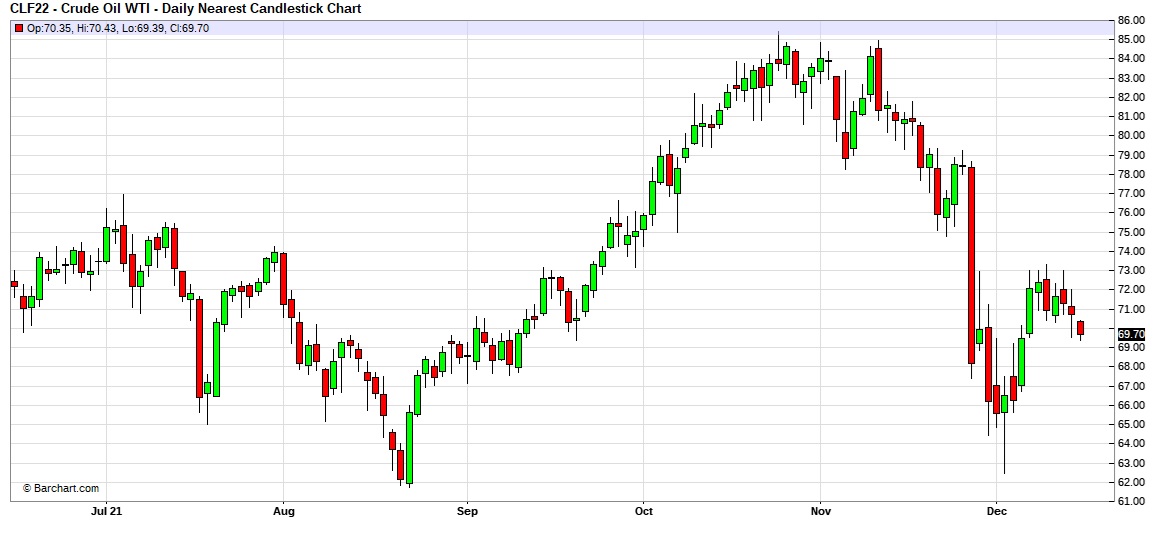

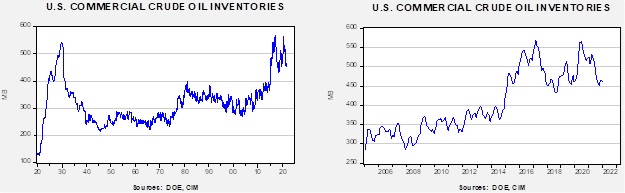

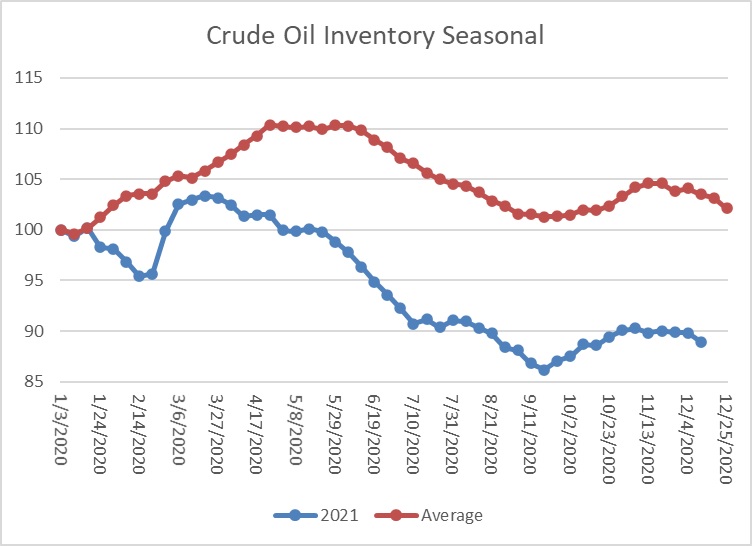

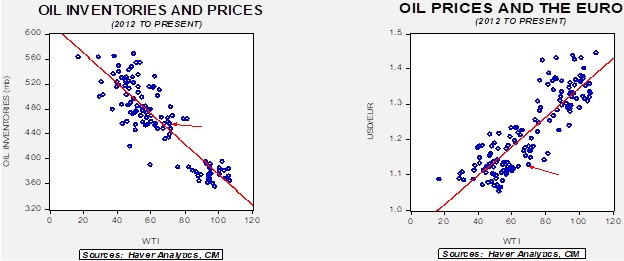

OPEC+: After a meeting yesterday in Vienna, the Organization of the Petroleum Exporting Countries and its Russian-led allies (OPEC+) said they will continue with their plan to boost global oil sales by 400,000 per day. The group is betting the surge of coronavirus infections from the Omicron mutation will have only a limited impact on rebounding energy demand.

- Oil prices surged in response to the sign of confidence in demand, after initially shrugging off the news.

- In London, Brent crude jumped almost 2.0% to approximately $80.50 a barrel, while U.S. crude surpassed $77.50, almost a six-week closing high.

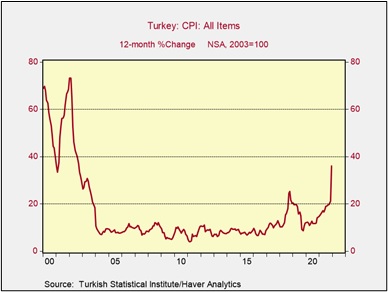

Kazakhstan: President Kassym-Jomart Tokayev accepted the resignation of his prime minister and the rest of his government after protestors took to the streets in major cities demanding action against rising prices for energy and other basic commodities.

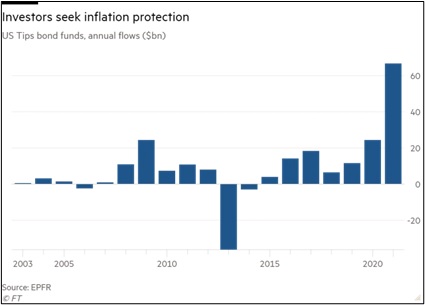

- As we have warned, periods of rising commodity prices often lead to political unrest in less developed countries.

- The unrest in Kazakhstan is notable because the Central Asian country has been tightly controlled by its government since it was a member of the Soviet Union. Reports indicate mass protests are continuing even after the government’s resignation.

- In response to the situation, the country’s bond values have declined significantly so far today, illustrating what could be in store for other emerging markets that might face similar inflation-inspired unrest.

China Real Estate Sector: Heavily indebted real estate developer Evergrande (EGRNY, USD, 4.97) said it would meet January 7-10 with holders of one of its onshore bonds to negotiate payment delays. The meeting may provide additional clues about how the government will manage the firm’s massive debt default.

- The government’s clampdown on heavily indebted developers remains a major threat to China’s economic growth in 2022, especially with some big players already defaulted and facing difficulties completing current projects. Home sales have also been falling.

- Reflecting the likelihood of a slowing economy, new data shows banks trying to meet their annual lending quotas in late December focused much more on buying bankers’ acceptances than putting their money at greater risk by issuing loans.

China Technology Sector: Internet giant Tencent (TCEHY, USD, 57.37) has cut its stake in a highly valued Southeast Asian internet company, shedding an ownership position worth about $3 billion. Coming on the heels of other such divestments by Chinese technology firms, the move has sparked concerns that the Chinese government is pressuring them to shrink. In response, Chinese tech stocks trading in Hong Kong have fallen sharply today, with Tencent itself down approximately 4.3%. As with the real estate sector, Beijing’s tightening regulatory noose continues to present growing risks for investors.

Japan-Australia: Japanese Prime Minister Kishida and Australian Prime Minister Morrison will hold a virtual summit tomorrow to sign a historic defense and security treaty. The reciprocal access agreement will provide a framework for enhanced interoperability and cooperation between the two countries’ militaries.

- The agreement will be only the second such treaty for Japan, after the longstanding agreement that governs its hosting of U.S. troops and cooperation with the U.S. military.

- More broadly, it illustrates the growing defense cooperation among many key U.S. allies in the Indo-Pacific region as they face China’s growing geopolitical assertiveness.

North Korea: According to Japanese and South Korean officials, North Korea fired a suspected ballistic missile into waters off its east coast early today, continuing a series of tests it has conducted while rebuffing Biden administration offers to reopen arms control talks.

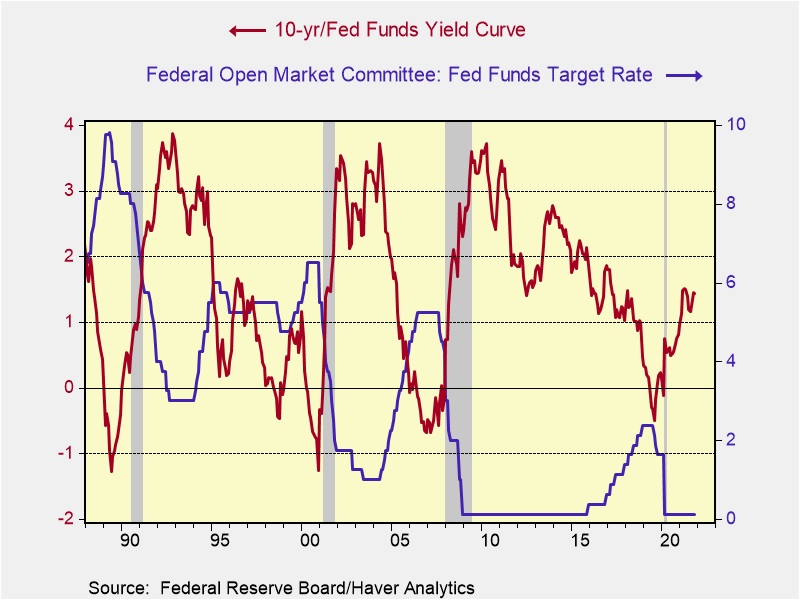

Italy: Parliament has formally launched its process for electing the country’s next president, with voting set to begin on January 24. Prime Minister Draghi, the former ECB chief, has announced that he would be willing to serve as president, but that would raise the prospect of renewed Italian political instability by ending the current unity government and forcing new elections.

Autonomous Vehicles: Deere & Co. (DE, USD, 371.29) announced that it has developed a fully autonomous tractor designed for large-scale farming. The tractor, a version of the company’s 410-horsepower 8R machine, will be available for sale later this year.

COVID-19: Official data show confirmed cases have risen to 295,242,378 worldwide, with 5,455,889 deaths. In the U.S., confirmed cases rose to 57,041,530, with 828,436 deaths. (For an interactive chart that allows you to compare cases and deaths among countries, scaled by population, click here.) Meanwhile, in data on the U.S. vaccination program, the number of people who have received at least their first shot totals 244,947,293. The data show that 73.8% of the U.S. population has now received at least one dose of a vaccine, and 62.2% of the population is fully vaccinated.

- The CDC issued updated quarantine guidance. Now, if an infected person has access to testing and wants to get tested, the best method would be to use an antigen test (also known as a rapid test) toward the end of their five-day isolation period. The person should continue to isolate until day 10 if the test is positive but can end isolation after five days if the result is negative, as long as the individual wears a well-fitting mask around others.

- A panel of outside experts advising the CDC today will consider whether the vaccine from Pfizer (PFE, USD, 54.53) and BioNTech (BNTX, USD, 224.09) should be authorized as a booster for adolescents aged 12 to 15.

- Walmart (WMT, USD, 142.00) and Kroger (KR, USD, 46.17) said they are raising their prices for BinaxNOW at-home, rapid COVID-19 tests, after the December 31 expiration of a deal with the White House to sell the test kits at cost, $14. Walmart is increasing the price to $19.98 a box, and Kroger now sells them for $23.99.

- In France, President Macron is being criticized for saying in an interview that he is deliberately trying to “p*** off” the unvaccinated by depriving them of restaurants, cinemas, and social activities as a way to pressure them to get inoculated. Ahead of the elections coming up in a few months, the king (oops! I mean president) is being criticized by his political opponents not only for his vulgar language but also for his lack of empathy toward those who are afraid or can’t get vaccinated.

- In Hong Kong, the arrival of the city’s first Omicron cases has prompted the government to impose a two-week ban on incoming flights from eight countries, including the U.S. The government is also banning nighttime dining and closing bars for the period.