by Bill O’Grady, Thomas Wash, and Patrick Fearon-Hernandez, CFA

[Posted: 9:30 AM EST] | PDF

Good morning! Today’s report begins with a discussion about Starbucks (SBUX, USD,115.35). We then turn to U.S. economic and policy news, followed by China-related stories. International news is next, and we end with our pandemic coverage.

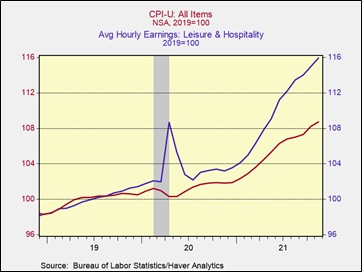

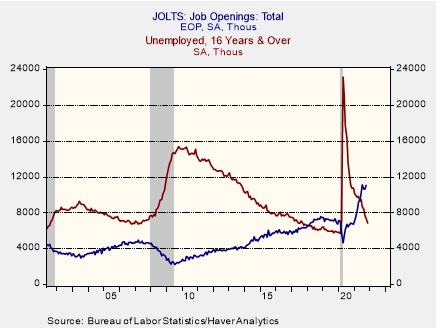

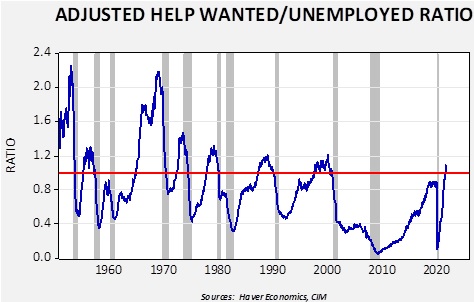

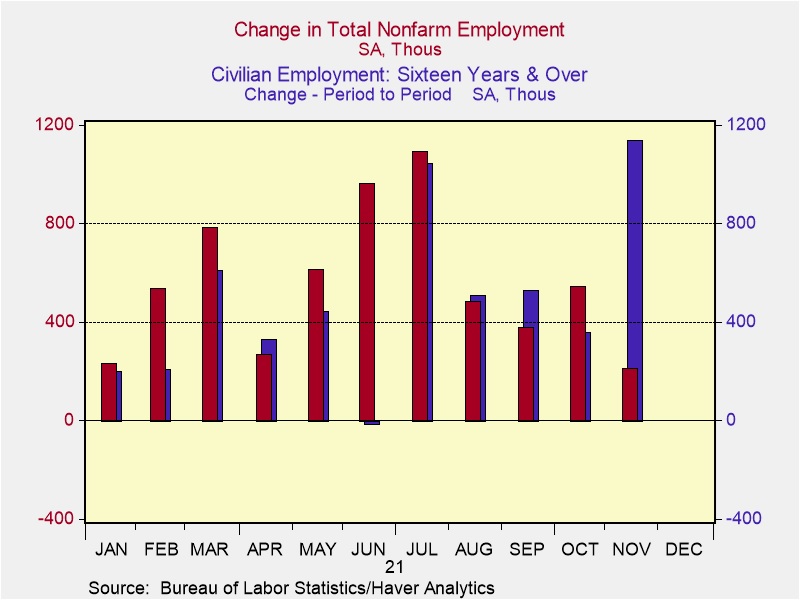

Baristas in a Starbucks store in Buffalo voted to form a union on Thursday. The vote reflects how a tight labor market can give workers the confidence to push for concessions from their employers. Since the pandemic began, restaurant workers, who are grouped as Leisure and Hospitality by the BLS, have seen their wages accelerate faster than inflation.

In fact, there is some evidence suggesting the pickup in wages may have leaked into the inflation data.

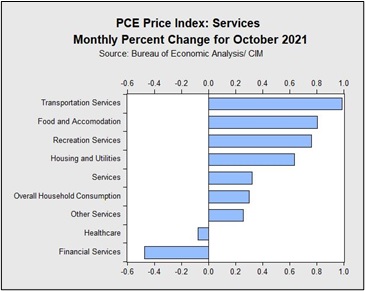

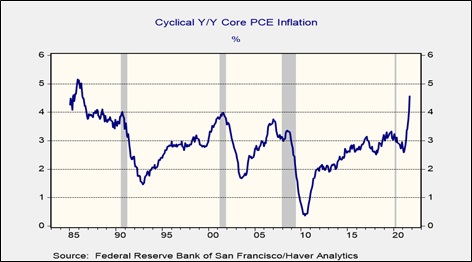

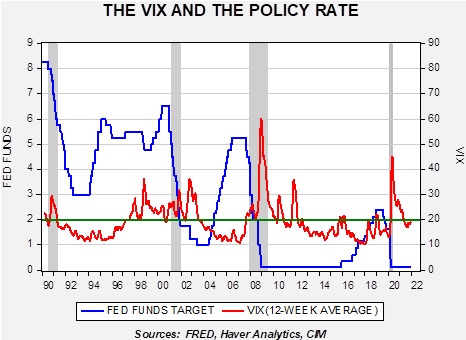

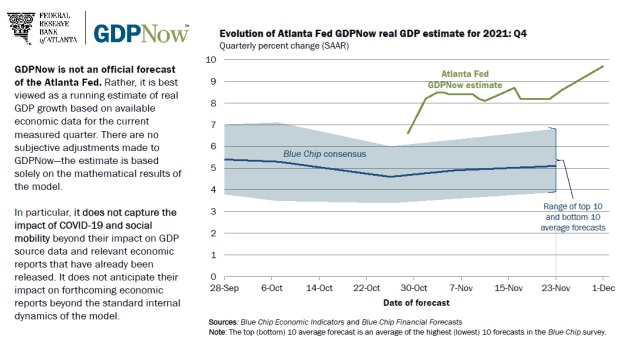

The chart above shows that in October, the rise in service inflation for Food and Accommodation and Recreation Services were only exceeded by Transportation Services. Hence, the PCE Price Index, the Federal Reserve’s preferred inflation gauge, may already show signs that the labor tightness is pushing up prices. It is worth noting that the jump in inflation for Food and Accommodation can also be attributed to an increase in food and drink prices. Meanwhile, price increases for Recreational Services were likely boosted by a surge in demand due to the lifting of pandemic restrictions and will eventually fade away. That being said, if more workers start to unionize, especially in low-skill and critical industries like food processing, we could see sustained inflationary pressure, margin contractions, or possibly both in the upcoming year. In this event, we think the Fed may decide to respond by enacting more hawkish policy that could slow GDP growth. It could be beneficial for industries with relatively low overhead and stable revenue (i.e., tech).

Economics and policy:

- The Senate passed a measure that would make it easier for Democrats to raise the debt limit without Republican support. The move would allow the debt ceiling to be raised with a simple majority as opposed to 60 votes.

- The U.S. military has ended its combat mission with ISIS in Iraq and will now focus on advising and assisting the local government.

- The Biden administration is looking to develop an economic framework with Asian countries hoping to resolve supply chain issues, export controls, and standards for artificial intelligence. Because the administration doesn’t feel confident it can push a trade deal through Congress, the administration is looking to secure a deal that falls just short of the definition of a trade agreement.

- News about supply chain relief may have been exaggerated. Recently, the reduction in the number of container ships waiting to dock at the ports of Los Angeles has been attributed to ships floating out of range from which the vessels were being counted. Additionally, the resurgence of the Omicron variant has led to increased concerns that the new supply-chain disruptions are on the horizon.

- The labor crunch could affect your commute to work this winter. States are finding it difficult to find snowplow drivers due to the lack of qualified applicants.

China:

- At the behest of Beijing, Nicaragua cut off diplomatic ties with Taiwan. The move comes after Nicaragua faces international scrutiny over its handling of the country’s presidential election last month. By ending its relationship with Taiwan, Nicaragua appears to be positioning itself to build closer ties with China.

- Fitch Ratings declared that property development companies Evergrande (EGRNF, USD, 0.23) and Kaisa (1638 HK, HKD, 0.92) were in default because both companies missed U.S. dollar-denominated payments earlier this week. Chairman of the Evergrande Group, Hui Ka Yan was forced to sell shares following the news of his company’s default. In light of the slowdown of its property market, China has imposed additional measures designed to prevent further contagion. China has forced banks to hold on to more foreign currency to prevent an appreciation of the yuan due to speculation. The PBOC Governor Yi Gang has stated that there will be no bailout of Evergrande.

International news:

- President Biden held a meeting with NATO leaders of Eastern Europe on Thursday. The discussion focused on whether Washington was willing to compromise with Moscow’s request to draw down NATO deployment in Eastern European states along Russia’s border and to end its recruitment of Ukraine to join NATO. Eastern European countries fear accepting terms laid out by Moscow could set a dangerous precedent that could lead to more confrontation with Russia in the future. During the meeting, President Biden reaffirmed the U.S.’s allegiance to NATO and stated that it was fully committed to ensuring Ukraine’s sovereignty. The growing angst about a possible Russian invasion of Ukraine has made Eastern European countries wary of the U.S.’s willingness to protect fellow NATO members from a Russian attack. At this time, it is unclear what concession Biden plans, but we suspect that at a minimum, it will include a reassurance that Ukraine does not join NATO.

- Discussion over a new cease-fire agreement between Ukraine and Russia broke down on Thursday after Kyiv accused Moscow of not taking the negotiations seriously.

- Turkish President Recep Erdogan is struggling to maintain his popularity as the country’s economy continues to struggle. President Erdogan’s refusal to listen to experts and advisors has led many people to question his leadership. With elections 18 months away, President Erdogan has a lot of ground to make up if he wants to win re-election.

COVID-19: The number of reported cases is 268,663,978, with 5,290,569 fatalities. In the U.S., there are 49,664,506 confirmed cases with 794,648 deaths. For illustration purposes, the FT has created an interactive chart that allows one to compare cases across nations using similar scaling metrics. The FT has also issued an economic tracker that looks across countries with high-frequency data on various factors. The CDC reports that 588,422,575 doses of the vaccine have been distributed with 477,433,765 doses injected. The number receiving at least one dose is 237,468,725, the number of second doses is 200,717,387, and the number of the third dose, the highest level of immunity, is 49,900,089. The FT has a page on global vaccine distribution.

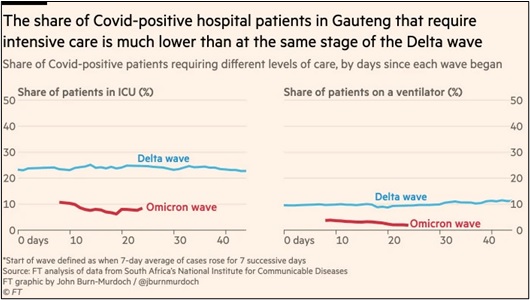

- The Omicron variant is four times more transmissible than the Delta variant, according to a recent study. There is still no evidence that suggests the Omicron variant is more dangerous than the Delta variant.

- The pandemic led to the biggest rise in the payout of death benefits since the 1918 Spanish Flu.

- New restrictions to curb the spread of COVID-19 went into effect in the U.K. on Friday.

- South Korea is in the midst of its worst wave of COVID-19 infections since the start of the pandemic.